Author: Liu Zhengyao, Senior Lawyer at Shanghai Mankun Law Firm

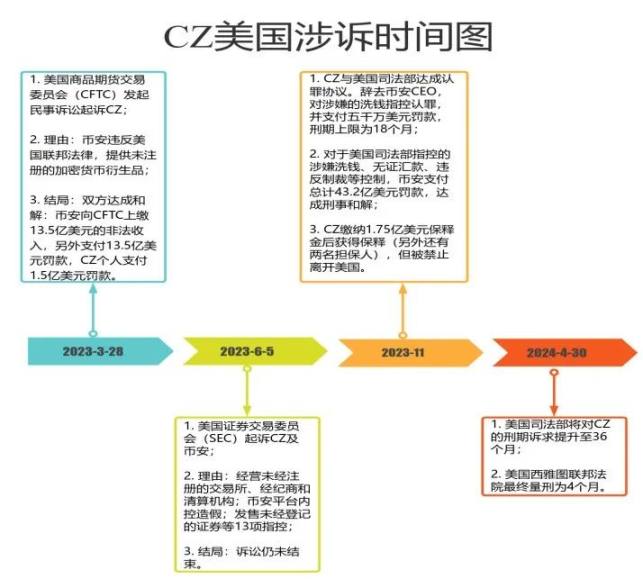

The United States Federal Court in Seattle issued a judgment on April 30 local time for Binance founder Zhao Changpeng (CZ). Unlike the 36-month sentence pursued by the Department of Justice (DOJ), the presiding judge, Richard A. Jones, sentenced him to 4 months in prison for CZ's (or Binance's) violation of the United States Bank Secrecy Act's anti-money laundering provisions.

Subsequently, CZ stated on social media that he would serve his sentence and then focus on the education sector. At the same time, he emphasized the importance of compliance for virtual currency exchanges and the close attention paid to Binance and the safeguarding of user funds during the (DOJ's prosecution) process, which was crucial for CZ to receive a lenient sentence. Finally, CZ reiterated his commitment to protecting users.

The last sentence "Protect users!" inevitably brings to mind the sentencing of FTX founder SBF (Sam Bankman-Fried) to 25 years on March 28 this year for fraud and misappropriation of client funds, resulting in losses of over $8 billion.

In this light, CZ's ordeal seems relatively mild. However, the story is not over. Lawyer Liu has outlined the different demands of various law enforcement agencies in the United States against CZ or Binance, which may help us better understand the legal dilemmas that cryptocurrency exchanges may face:

Some may feel that CZ's ordeal resembles being subjected to a "slaughter," and some articles are filled with a sense of schadenfreude. However, Liu believes that these views are somewhat superficial (of course, this does not necessarily represent my own opinion). The essence of Binance's or CZ's ordeal is fundamentally a reactive response of centralized government institutions to the application of decentralized technology in the financial, especially monetary, field.

When faced with conservative authoritarian governments, cryptocurrency exchanges have no choice but to compromise. However, the awkwardness lies in the fact that cryptocurrency exchanges themselves are typical centralized institutions, which runs counter to the original intention of decentralization in virtual currencies. Although their existence currently has its rationale, such as providing great convenience for virtual currency transactions between users, they inherently cannot escape the drawbacks of centralization. CZ is not always blameless, and Binance is not the "protector" of the crypto circle; CZ just did not cross as many red lines as SBF did.

From the perspective of regulators, whether it is the DOJ, SEC, CFTC in the United States, or territorial jurisdiction, personal jurisdiction, protective jurisdiction, and universal jurisdiction in Chinese criminal law, the country's legislators and law enforcers can always find a basis to justify their actions. In other words, at least in the eyes of many politicians, politics is the law, and the law is a tool of politics (but Lawyer Liu still firmly believes in the law!).

The United States accuses Binance of violating its Bank Secrecy Act's anti-money laundering provisions, such as failing to report nearly 100,000 transactions conducted through Binance by organizations including Hamas, "ISIS," and terrorist groups, and not restricting $8.9 billion in transactions between U.S. users and Iranian users. Additionally, Binance earned substantial fees from millions of transactions between users from "Cuba, Syria, and the Crimea, Donetsk, and Luhansk regions of Ukraine" (quoted from "Judging Zhao Changpeng | Prism" by author Wen Shijun).

According to some American lawyers, the application of the Bank Secrecy Act in the CZ case is not common in U.S. jurisprudence. Therefore, it cannot be ruled out that the CZ case was fabricated.

However, as mentioned earlier, the author's speculation is not primarily to blame a specific government, as we cannot guarantee that CZ would necessarily receive a lighter sentence in other countries; he might even face heavier punishment. What the author wants to convey is that it is still difficult for decentralized virtual currencies and the cryptocurrency exchanges representing them to be accepted by all governments in a short period of time. However, some people express optimism—since the United States, as the global financial hegemon, does not seem to have taken strong action against the "hegemony" of the virtual currency world, does this mean that the possibility of virtual currencies being accepted by the "mainstream world" is increasing?

But for true believers in decentralization, what does the "mainstream world" think—Who cares?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。