The most important factors for the success of liquidity staking tokens are liquidity, DeFi integration/partnerships, and expanding support for multiple chains.

Author: Tom Wan, On-chain Data Analyst

Translator: 1912212.eth, Foresight News

The liquidity staking in the Ethereum ecosystem once sparked a staking craze, and even the progress of re-staking protocols is currently in full swing. However, an interesting phenomenon is that this trend seems not to have affected other chains. In addition to Ethereum's significant market value advantage, what other underlying factors are at play? When we shift our focus to Solana and compare the liquidity staking protocols on Ethereum, what is the current development trend of LST on Solana? This article will reveal the full picture for you.

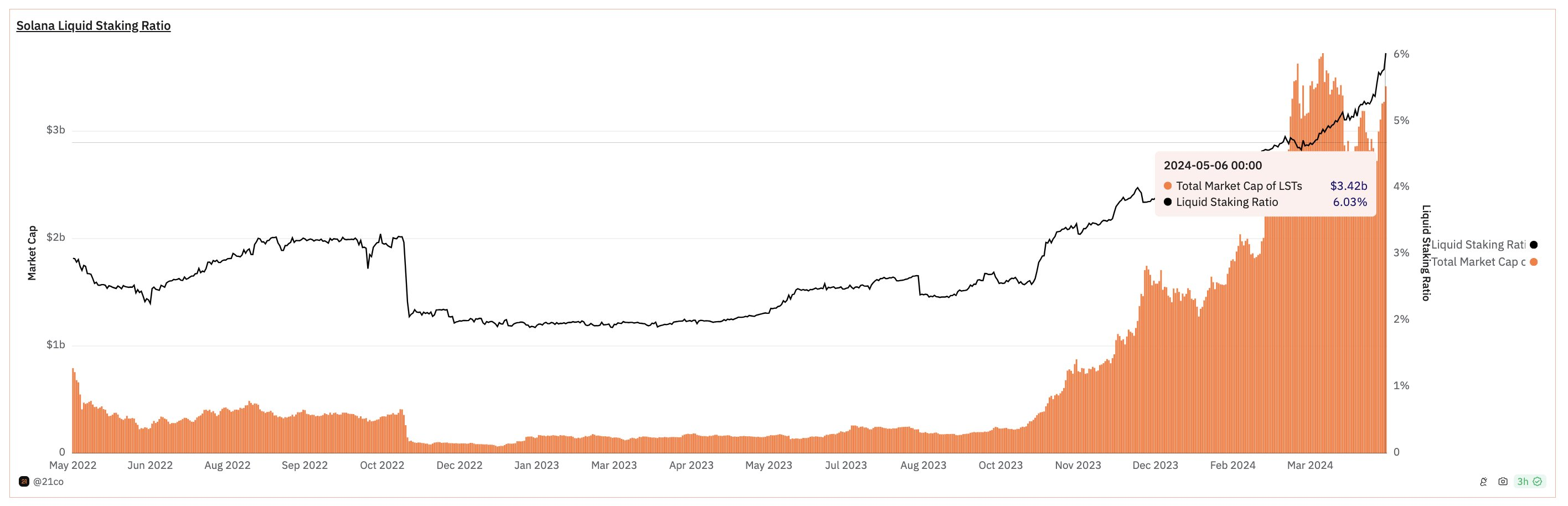

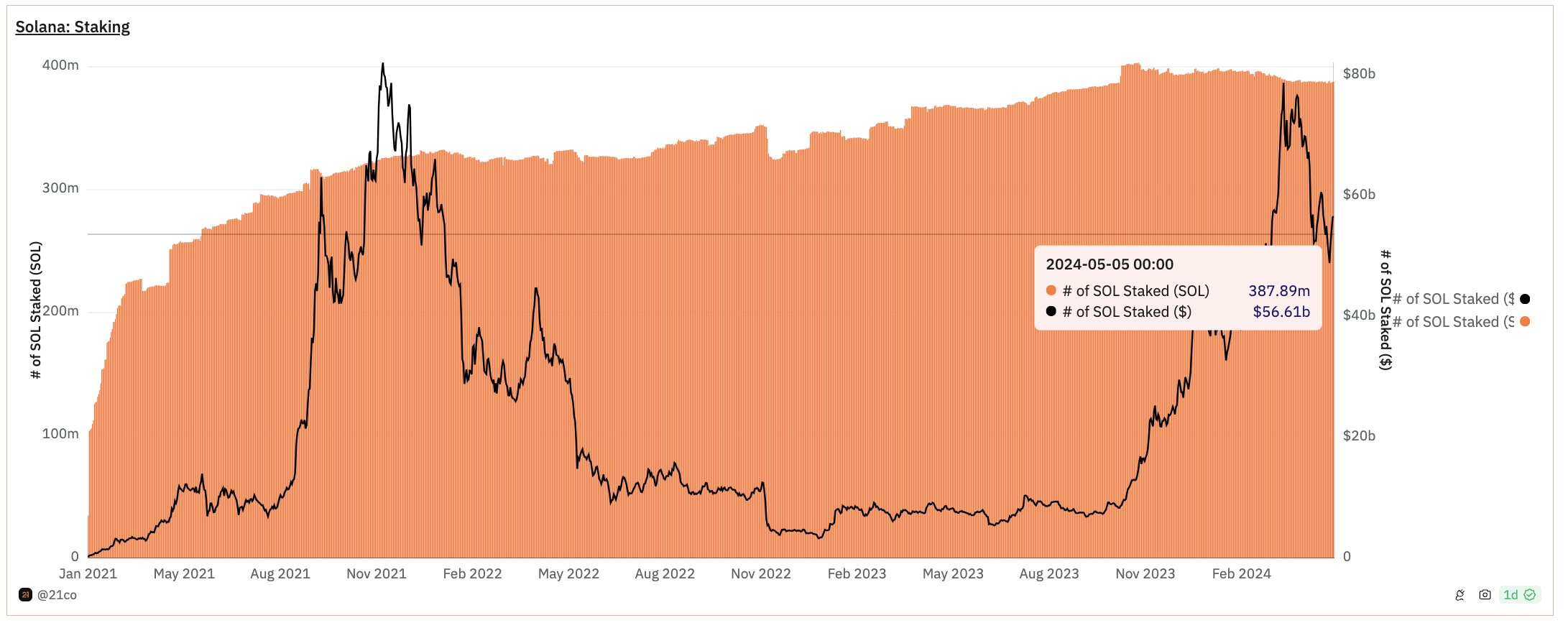

1. Although the staking rate exceeds 60%, only 6% (34 billion USD) of the staked SOL comes from liquidity staking.

In contrast, 32% of the staking volume on Ethereum comes from liquidity staking. In my opinion, the reason for this difference lies in the existence of "protocol internal delegation."

Solana provides a simple way for SOL stakers to delegate their SOL, while Lido is one of the early channels for delegating ETH to earn staking rewards.

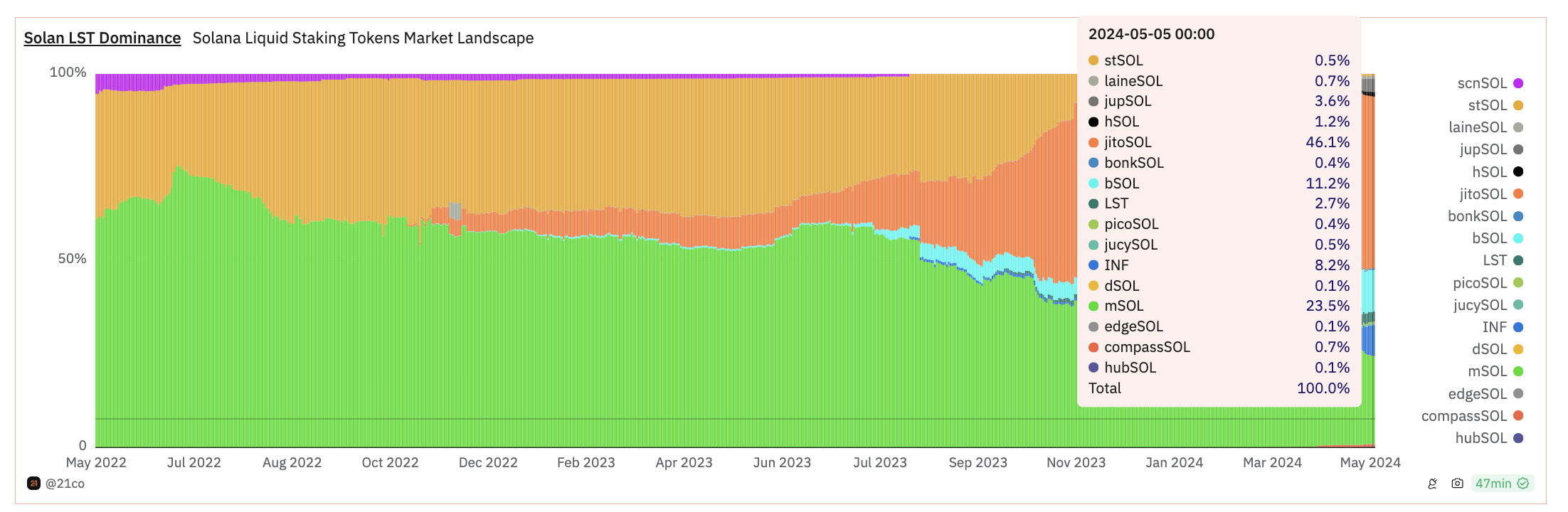

2. The market share of Solana LST (Liquidity Staking Tokens) is more balanced than Ethereum.

On Ethereum, 68% of the market share comes from Lido. In contrast, the liquidity staking tokens on Solana are in an oligopoly state.

The top 3 liquidity staking tokens on Solana occupy 80% of the market share.

3. History of liquidity staking on Solana

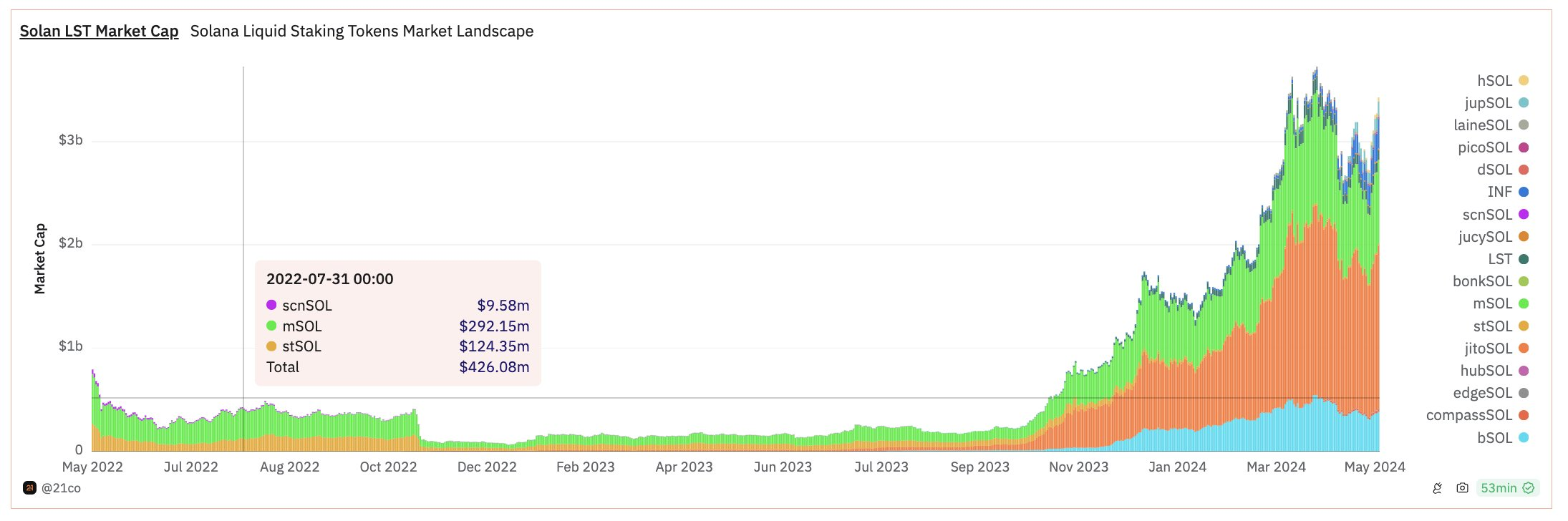

In the early market, Lido's stSOL (33%), Marinade's mSOL (60%), and Sanctum's scnSOL (7%) divided the market, and the total market value of LST on Solana was less than 1 billion USD.

This lack of adoption can be attributed to marketing and integration. At that time, there were not many high-quality DeFi protocols for LST, and the focus was not on liquidity staking.

During the FTX crash, the liquidity staking ratio decreased from 3.2% to 2%.

4. Leaders of LST

In November 2022, Jito launched jitoSOL, and it took them about a year to surpass stSOL and mSOL, becoming the dominant LST on Solana with a 46% market share.

2nd place: mSOL (23.5%)

3rd place: bSOL (11.2%)

4th place: INF (8.2%)

5th place: jupSOL (3.6%)

5. Success of Jito

In conclusion, the most important factors for the success of liquidity staking tokens are liquidity, DeFi integration/partnerships, and expanding support for multiple chains.

6. Liquidity staking is the untapped potential of Solana DeFi, which may increase its TVL to 15-17 billion USD.

Liquidity staking tokens have driven the growth of the Ethereum DeFi ecosystem. For example, 40% of AAVE v3's TVL comes from wstETH. It can serve as collateral generating income and unlock more potential for DeFi, such as Pendle, Eigenlayer, Ethena, etc.

Here are my expectations for the liquidity staking ratio of Solana in 1-2 years (based on current valuations):

- Base case: 10%, providing an additional 15 billion USD in liquidity to DeFi;

- Bull case: 15%, providing an additional 50 billion USD in liquidity to DeFi;

- Long-term bull market scenario: 30%, similar to Ethereum's liquidity staking ratio. Adding an additional 135 billion USD in liquidity to DeFi.

7. Many excellent DeFi teams are working together to bring more staked SOL into DeFi.

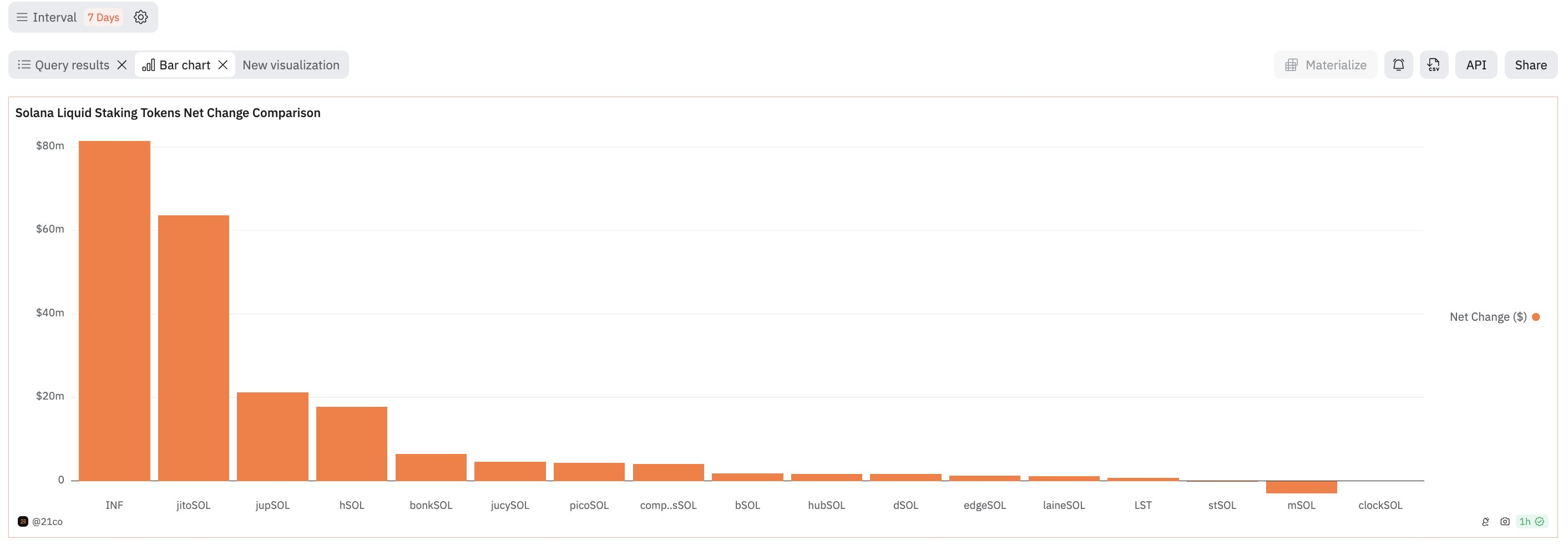

Drift Protocol, Jupiter, Marginifi, BONK, Helius labs, Sanctumso, and SolanaCompass have all launched liquidity staking tokens.

As a DeFi user, competition and innovation in the market are always better. This is why I am optimistic about the future of Solana DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。