Preface

This month, the BTC halving market did not arrive as expected. Instead, it has been showing a trend of oscillation and decline since the beginning of the month. At the same time, due to the delay in the expected interest rate cut in the United States and the continuous outflow of BTC spot ETF, people have shown more negative sentiment towards the future market. The market value and trading volume of cryptocurrencies have both shown a significant decline. Meanwhile, the impact of the decrease in BTC miner income began to show at the end of the month, with the stock prices of listed mining companies showing varying degrees of decline. Some mining machines are approaching the shutdown price, further weakening the momentum for a rebound in the subsequent market, with the expected time being postponed.

1. Macro Perspective

1.1 Delay in Expected Interest Rate Cut in the United States Affects Cryptocurrency Market

On April 10, 2024, the US CPI data was released, showing that the US core CPI, whether year-on-year or month-on-month, has exceeded expectations for three consecutive months:

- The March seasonally adjusted CPI year-on-year rate was 3.5% (previous value 3.2%, forecast value 3.4%), and the March seasonally adjusted CPI month-on-month rate was 0.4% (previous value 0.4%, forecast value 0.3%);

- The March seasonally adjusted core CPI year-on-year rate was 3.8% (previous value 3.8%, forecast value 3.7%), and the March core CPI month-on-month rate was 0.4% (previous value 0.4%, forecast value 0.3%).

After the data was released, the futures of the three major US stock indexes fell, and the US dollar index rose in the short term. CPI data is an important reference for the timing of the Fed's interest rate cuts this year. From the end of last year to the beginning of this year, the market has been optimistic about the Fed's early interest rate cuts. However, the continued stability and strength of the US economy have repeatedly thwarted analysts' interest rate cut predictions.

At the beginning of the year, some opinions believed that with BTC halving for the fourth time, coupled with BTC spot ETF and the expectation of the Fed's interest rate cut, it would probably create a new bull market cycle in the cryptocurrency market. However, the "stubbornness" of US economic inflation has to some extent cooled the entire market. With the release of the April CPI data in the US, the cryptocurrency market has no expectations for an interest rate cut in May, which has become an indirect factor for the continued oscillation and decline in the market in April.

1.2 Approval of ETF in Hong Kong, Physical Subscription and Redemption May Become a Competitive Advantage

On April 15, Huaxia Fund (Hong Kong), Boshi Fund (International) Co., Ltd., and Jiashi Investment announced that they have obtained conditional approval from the Securities and Futures Commission (SFC) of Hong Kong to issue Bitcoin and Ethereum spot ETFs. With this, Hong Kong became the second region after the United States to pass a Bitcoin spot ETF, and also the first region to pass an Ethereum spot ETF.

The clear regulatory framework in Hong Kong has made it a reality to quickly pass BTC and ETH ETFs, which is an advantage of Hong Kong over the US in terms of regulatory policies. More importantly, the attitude and actions of the Hong Kong Securities and Futures Commission demonstrate its determination and initiative in the field of cryptocurrency markets, providing important support for Hong Kong to regain the confidence of global capital.

Although the data on the first day of listing of the 6 ETFs in Hong Kong shows a significant difference compared to the trading volume of the first day of the Bitcoin spot ETF in the US, the market remains optimistic. It is believed that ETFs, as a new channel for traditional institutional investors to enter the market, will attract more traditional institutional investors. At the same time, the support for physical subscription and redemption of Bitcoin and Ethereum spot ETFs in Hong Kong will also drive the overall growth of the market, possibly achieving unexpected overtaking on the curve.

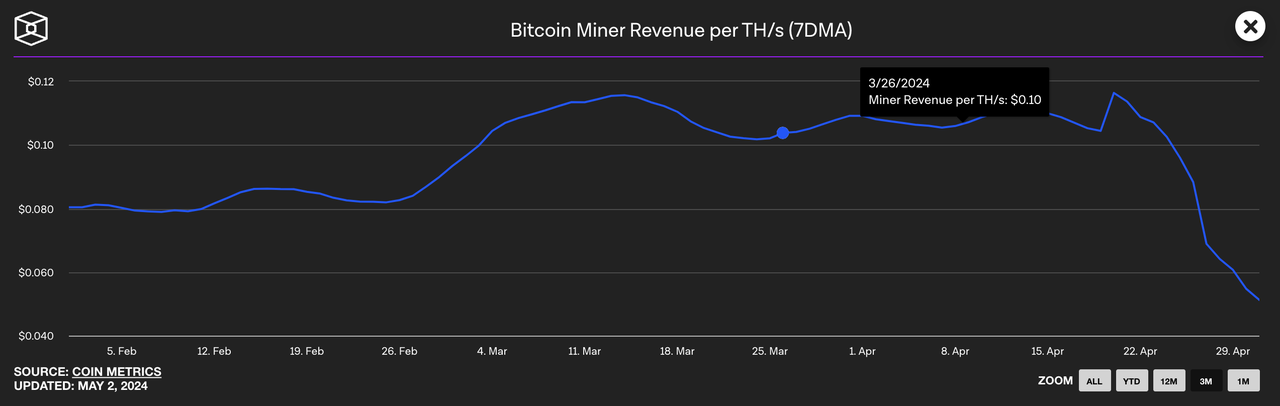

1.3 Significant Decrease in BTC Miner Income, Indirect Impact Begins to Show

According to the latest report from CoinShares: After the BTC halving, miners are facing a significant increase in costs, with electricity and overall costs almost doubling. Calculated at $0.06 per kWh, after the halving, Antminer S19, T19, Whatsminer M33S+, M30S+, and even less energy-efficient miners are approaching the shutdown price, with the average production cost of BTC estimated to be around $53,000.

In addition, according to Glassnode data, although after the halving, Runes transactions generated about $117 million in Bitcoin network fee income, as time passed, Bitcoin fee income has significantly declined, with Runes transaction fees on April 28 being $1.03 million. As the popularity of Runes decreases, miner income decreases, and the electricity cost of the most advanced Bitcoin miners currently exceeds 50%.

To cope with the decrease in income after the halving:

- Bitfarms announced an investment of $240 million to upgrade its Bitcoin mining equipment, aiming to remain profitable after the 2024 Bitcoin halving;

- Bitmain announced the release of Antminer L9 in May, which supports LTC, DOGE, and BEL mining, with a power consumption ratio of 0.21 J/M;

- Hut 8's new CEO, Asher Genoot, stated that Hut 8's strategic cornerstone is based on diversified sources of income and a large amount of Bitcoin holdings, and is prepared to acquire struggling miners;

- Mining companies are beginning to shift towards the field of artificial intelligence, attempting to reduce costs through optimizing energy costs and mining efficiency. Companies such as BitDigital, Hive, and Hut 8 have generated income from the AI field;

From the performance of mining companies, they still have confidence in the market and are actively responding. By controlling operating costs, using more efficient equipment, and expanding asset categories, they are improving their yield, optimizing their income structure, and consolidating their market position. Although the impact of the halving has not dissipated, it is being hedged and absorbed.

2. Industry Data

2.1 Market Cap & Ranking Data

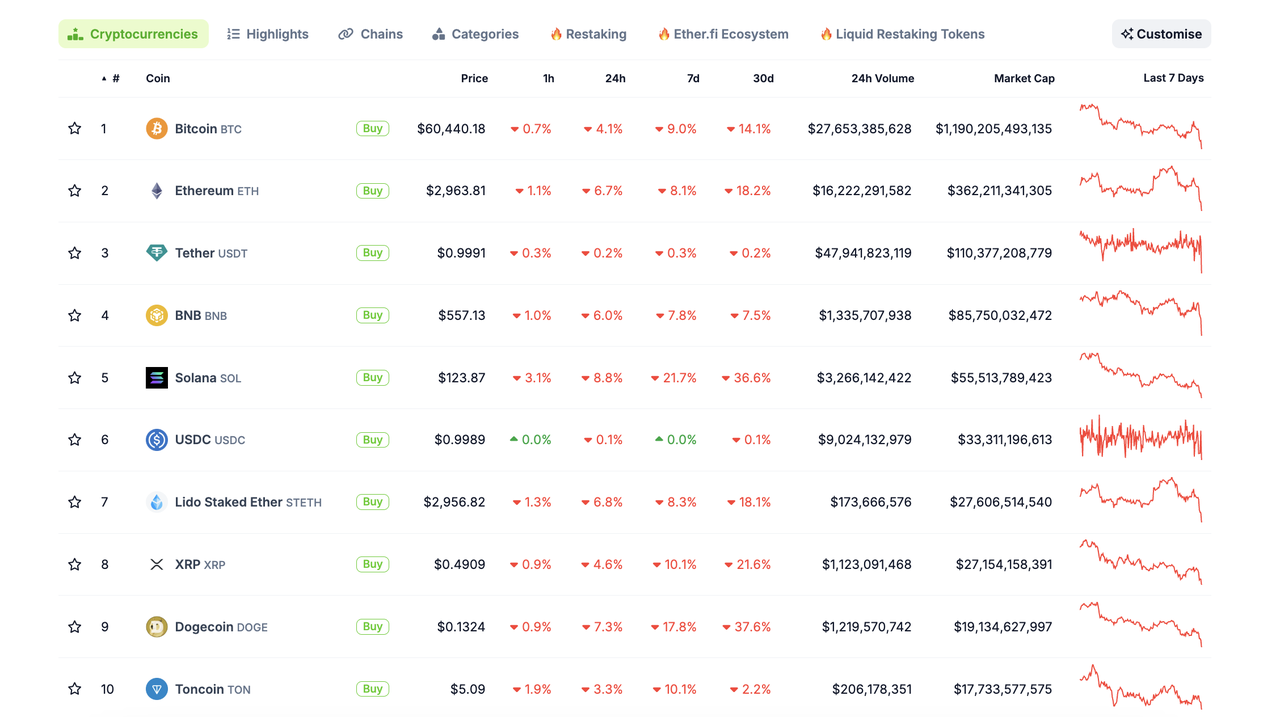

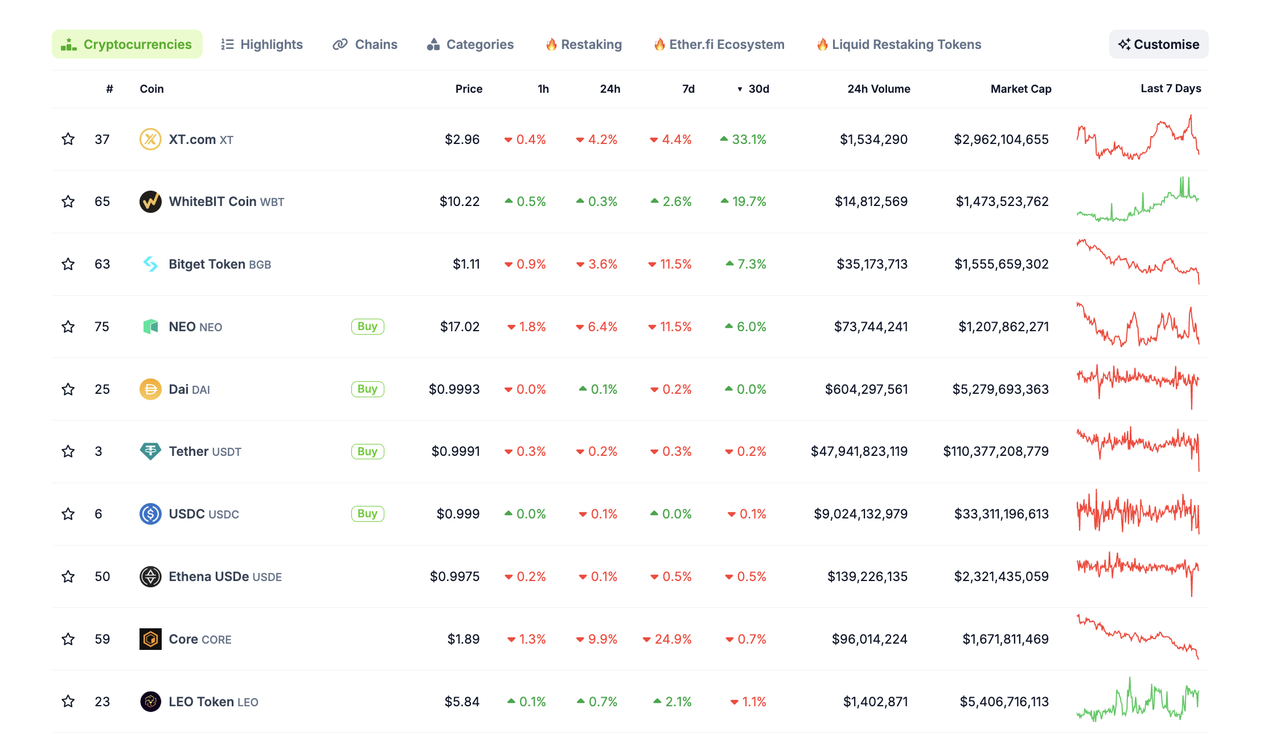

In the fluctuating market this month, the market cap of the top 10 tokens has all experienced varying degrees of decline, and there have been some changes in rankings. USDC has surpassed STETH and XRP to rise to the 6th position, while TON has risen to the 10th position. In terms of the 30-day change, DOGE has experienced the largest decline at 37.6%, followed by SOL at 36.6% and XRP at 21.6%. BTC ranks 6th with a 14.1% decline.

The decline in the market this month started at the beginning of the month, with occasional rebounds (about a 5-day cycle). It is mainly the overall market decline driven by BTC, especially after the news of the delayed expectation of an interest rate cut in the United States, which has led to a noticeable increase in the slope and speed of the decline. Although TON has experienced some decline, with the frequent actions in the TON ecosystem, it is the best-performing token among the top 10 tokens, except for USDT and USDC, and is highly regarded by the market.

Among the top 100 tokens by market cap, the tokens with the highest increase in March are XT (+33.1%), WBT (+19.7%), and BGB (+7.3%). ZT, WBT, and BGB are all platform tokens of CEX, and currently, ZT and WBT are still maintaining an upward trend, with WBT showing particularly strong momentum, while BGB is showing a downward trend. It is expected that its increase and trend in May will be close to the overall market situation.

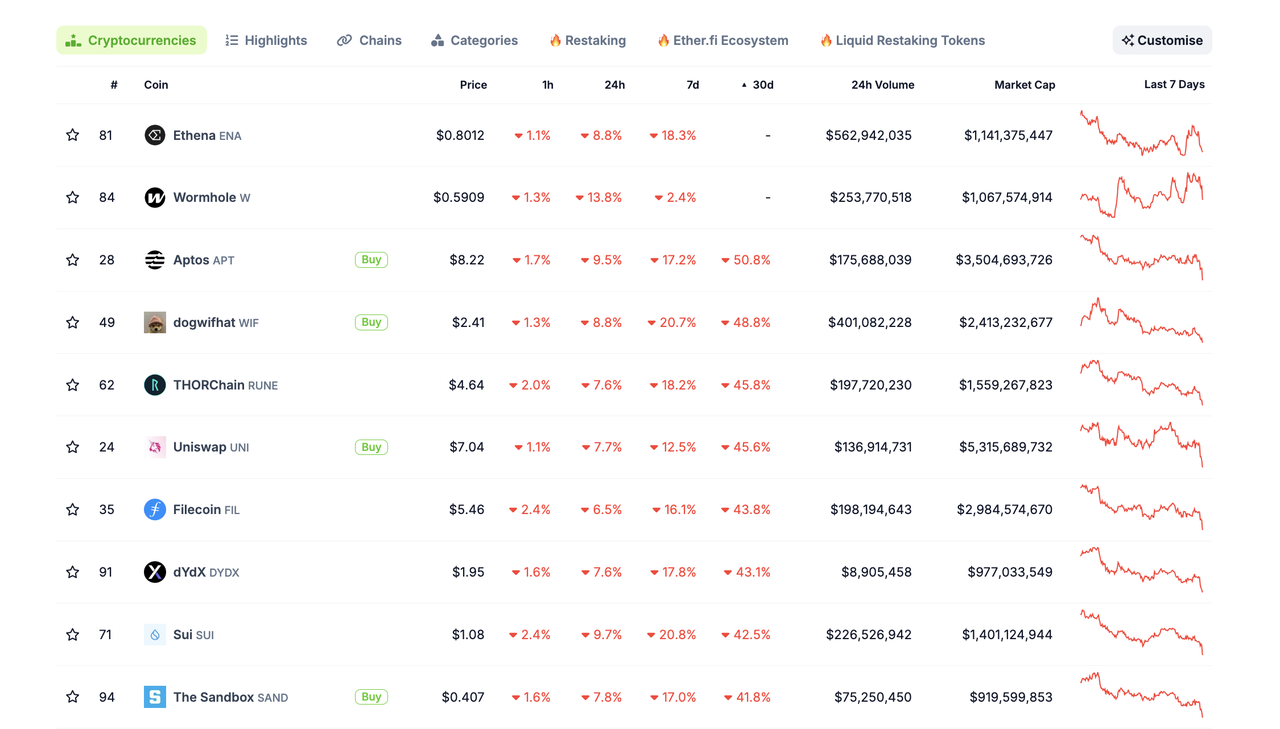

Looking at the overall change in market cap rankings of the top 100 tokens, APT with a 50.8% decline tops the list of declining tokens. The main reason is that APT welcomed a large token unlock of about $330 million this month. In the context of the fluctuating and declining market, coupled with the expectation of a large number of tokens entering the market, the price and TVL have been declining since the beginning of the month, with a quoted price of $8.22 as of April 30, and the rebound strength is almost non-existent. Investors are advised to pay close attention to the dynamics of token unlocking. In the fluctuating and declining market, a large-scale unlock may lead to short-term significant losses, and caution is especially needed.

2.2 Stablecoin Inflows and Outflows

In April, the total supply of stablecoins approached $160 billion, increasing by approximately $10 billion compared to March. The growth rate is gradually slowing down, and considering the current level of market trading activity, it appears to be lacking momentum in the short to medium term. Without specific positive news, the trend of weak growth is expected to continue, and the possibility of negative growth in May cannot be ruled out.

Among the top 10 stablecoins by market cap, the fastest-growing stablecoin this month is FDUSD, with a 73.00% increase, followed by USDe with a 51.87% increase. After a slight decline last month, FDUSD reclaimed the top spot in terms of growth this month, while USDe continued its strong performance from last month, showing a robust trend in the stablecoin race. Additionally, PYUSD, a stablecoin launched by traditional payment institution PayPal, currently ranks 12th. With the support and empowerment from PayPal in cross-border remittance services, the issuance of PYUSD has been steadily increasing and is expected to enter the top 10 stablecoin market cap rankings in May.

According to the official PayPal website, its cross-border remittance service Xoom Financial now allows U.S. Xoom users to convert their PayPal stablecoin PYUSD into dollars and use it as a source of funds to remit to recipients in approximately 160 countries/regions worldwide.

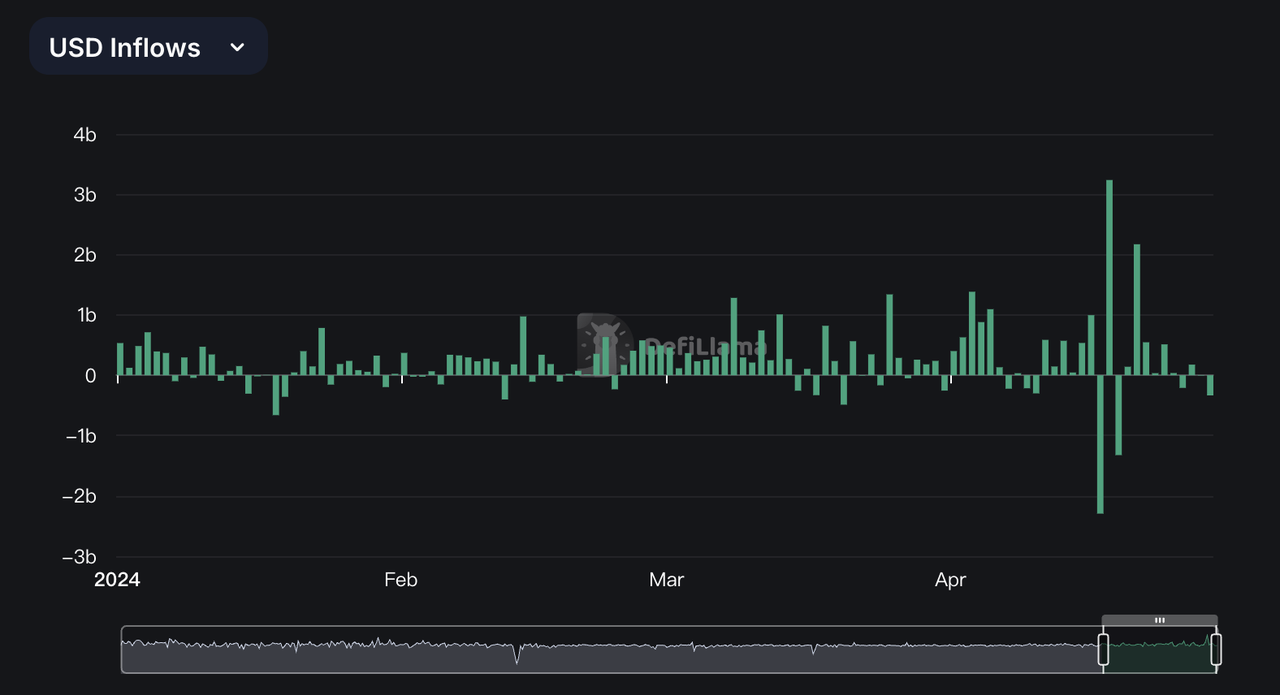

In terms of USD inflows, the net inflow reached its highest point on April 18th at $3.24 billion. The period from April 17th to 21st saw extremely noticeable changes in inflows and outflows, which coincided with the fourth BTC halving, reflecting the turnover and game between long and short positions in the market. However, the net outflow amount and frequency remained lower than the net inflow. Additionally, from a news perspective, the continuous outflow of the U.S. BTC spot ETF is having a related impact on USD inflows, and there is a possibility of a reversal in the flow and strength of USD.

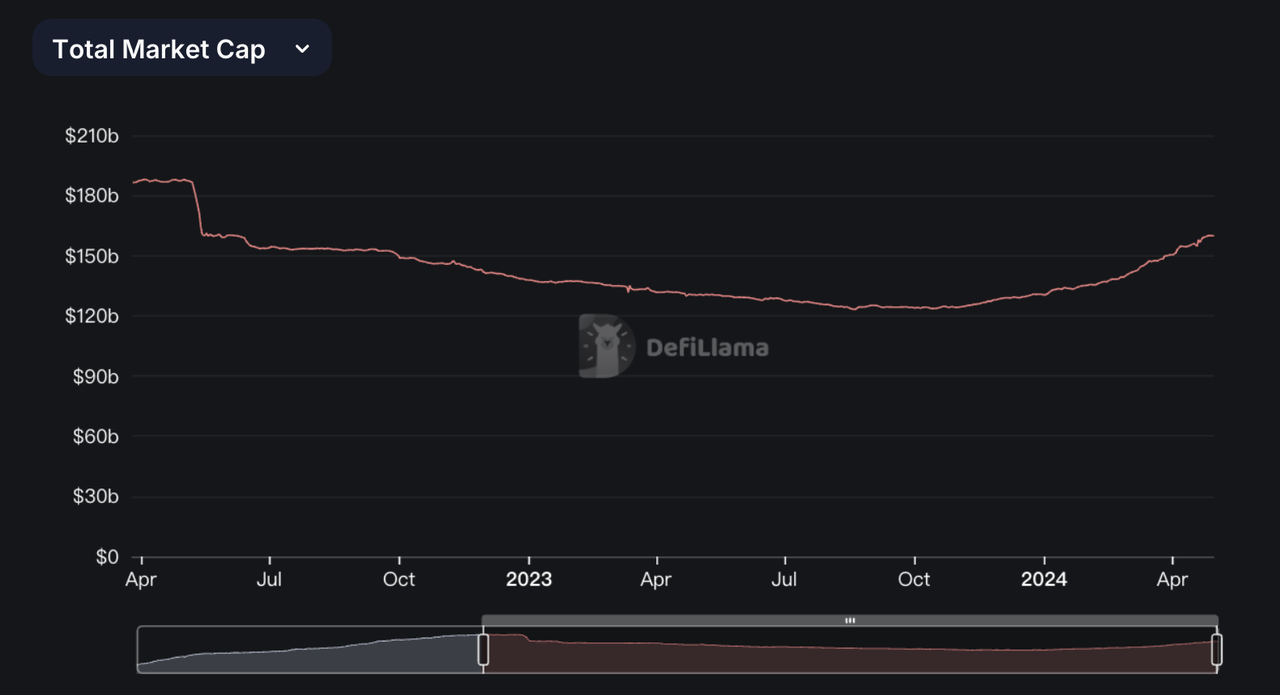

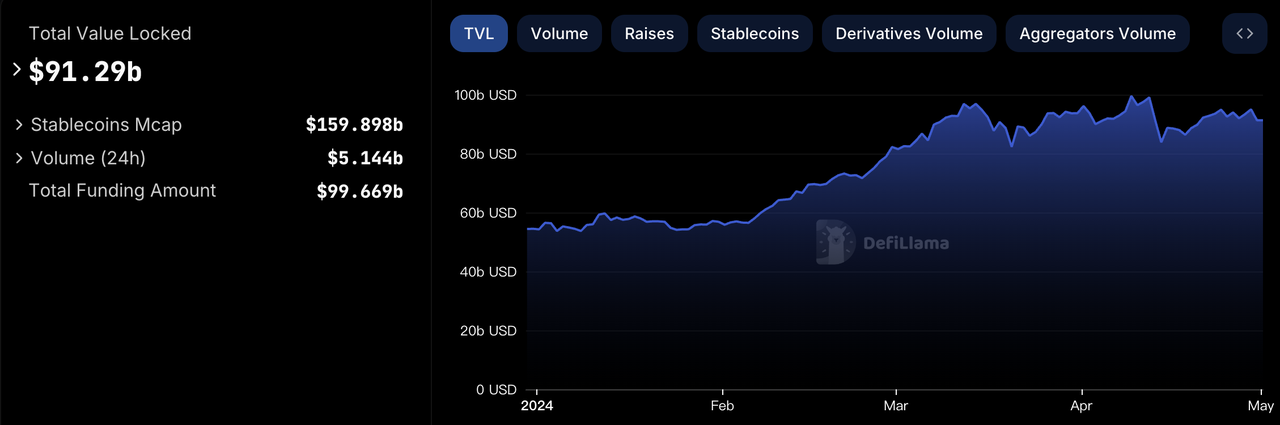

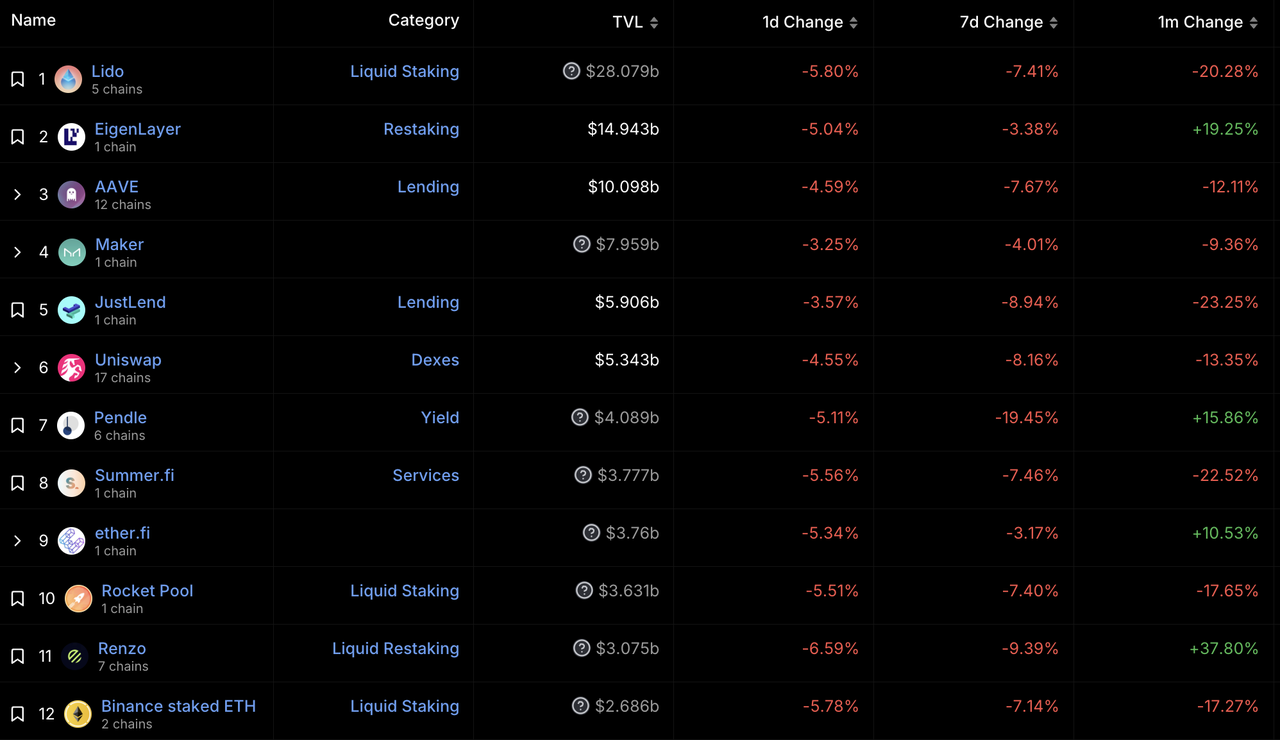

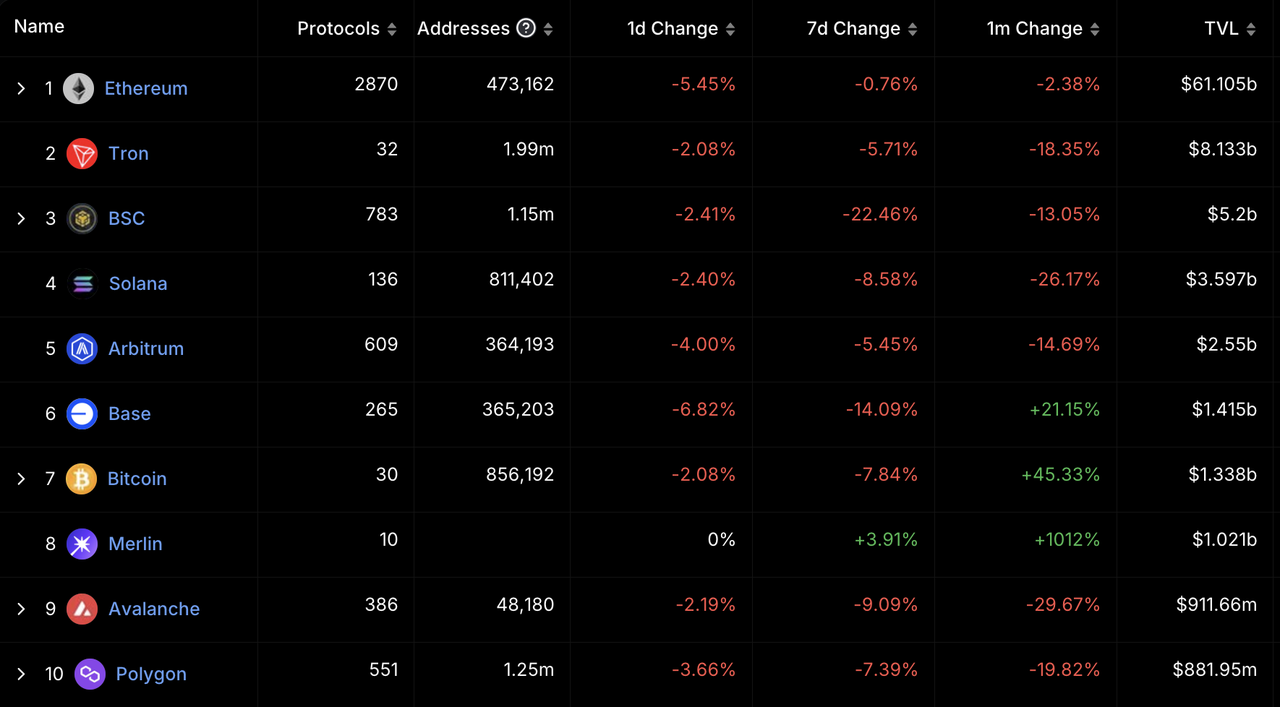

2.3 On-chain TVL Rankings

The overall on-chain TVL experienced significant fluctuations in April, especially with a sharp decline from April 12th to 14th, followed by a slow increase. The third week saw a slow recovery, but the oscillating trend was evident, and the recovery momentum was insufficient. In the current fluctuating market, on-chain activity has noticeably decreased compared to last month, and the development of various ecosystems has also been affected. It is expected that the trend of on-chain TVL in May will be strongly correlated with the market trend, but the growth trend in terms of the native currency will slowly rise with the development of the ecosystem.

The most notable project this month is Renzo, which, despite facing community scrutiny over its token model, still occupies the top position in terms of TVL growth (37.8%), leading other projects in the top 10 TVL rankings by a significant margin and far exceeding the 19.25% increase of EigenLayer. Additionally, EigenLayer's growth is approaching stability and is beginning to see significant withdrawals of staked assets, requiring further attention to its future performance.

According to DeFiLlama data, as of April 30th, the TVL of ETH liquidity re-staking protocols reached $26.91 billion, with EigenLayer ranking first with a TVL of nearly $15 billion, followed by ether.fi with a TVL exceeding $3.7 billion, and Renzo with a TVL exceeding $3 billion.

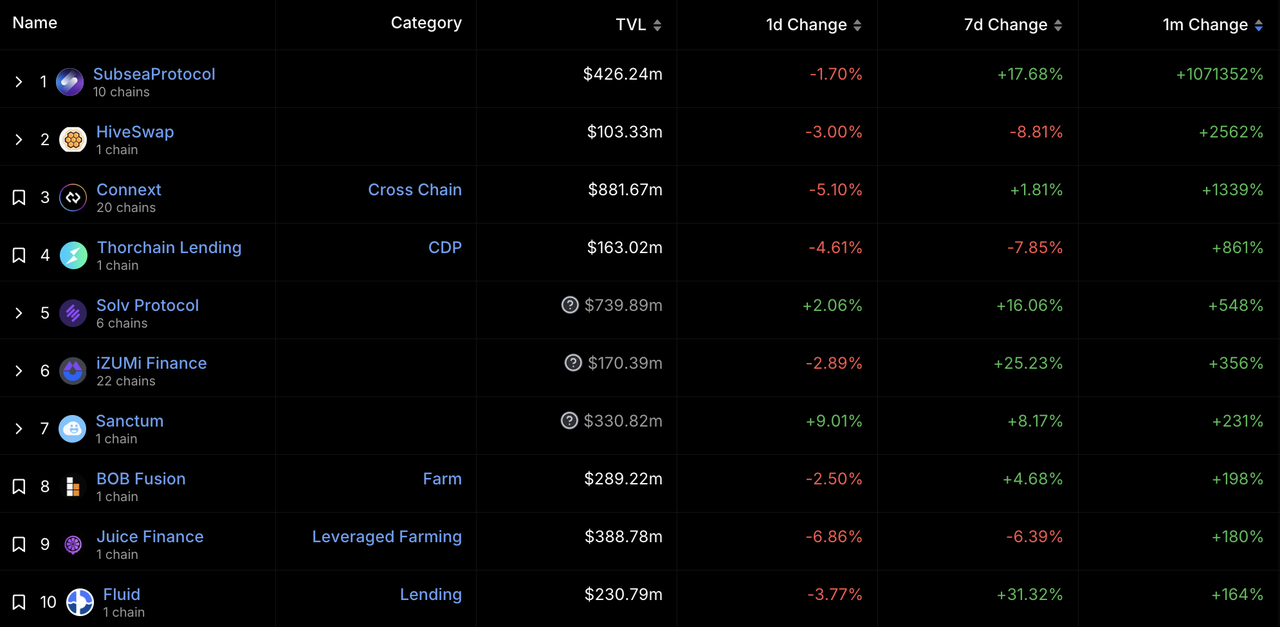

Among the 138 projects with a TVL exceeding $100 million (down from 142 last month), the project with the highest TVL growth this month is SubseaProtocol (+1071352%), followed by HiveSwap (+2562%) and Connext (+1339%). SubseaProtocol experienced a sudden surge in TVL on April 8th, and while no specific actions have been observed, it may be anomalous data that is being monitored and tracked.

Subsea is a risk management market for digital assets that has pioneered a completely automated, transparent, and fair immutable detection mechanism to protect users from digital asset risks, hacker attacks, and exploitation.

Hiveswap is a SWAP in the BTC ecosystem that provides liquidity services for assets in the Bitcoin ecosystem using the interoperable Bitcoin layer MAP protocol, including assets on BTC L1, the MAP protocol interoperability layer, and various assets on Bitcoin L2.

Connext is a trust-minimized cross-chain communication protocol that enables blockchain composability. Developers can use Connext to build cross-chain applications. Connext is a leading protocol for fast, fully non-custodial transfers and contract calls between EVM-compatible chains. Anyone can use Connext to send value transactions or call data across chains and aggregate them.

In the DeFi category, the total TVL of the top 10 tracks is still led by LSD at $453.29 billion, showing a significant decrease compared to last month ($514.4 billion). Considering the overall market downturn, it is actually a contraction in the gold standard scale, but the total amount is still increasing.

In addition, only Restaking and RWA are experiencing positive growth in other tracks, especially Restaking, which has seen an increase of approximately $35 billion. This indicates that the market is currently entering a period of calm, with Restaking being the only clear investment direction, reflecting further recognition of Restaking. However, Restaking is an emerging product with significant unknown risks, and more users are approaching it with caution.

In terms of chain categories, the BTC ecosystem's TVL growth was the most impressive in April, with Merlin's TVL increasing by 1012%, and Btcoin's TVL also increasing by 45.33%, followed by Base at 21.15% (down from 116% last month), while the remaining public chains showed negative growth (Solana's growth also failed to be sustained).

In the current market conditions, the high growth of Merlin and the sustained growth of BitCoin are mainly due to the market's attention and investment in the BTC ecosystem, especially L2, after the fourth BTC halving. With more projects being implemented, the BTC ecosystem is becoming more active. If the market and market sentiment do not significantly improve in May, the performance of the BTC ecosystem is expected to continue to outperform other public chains, while the growth momentum of Base will further weaken.

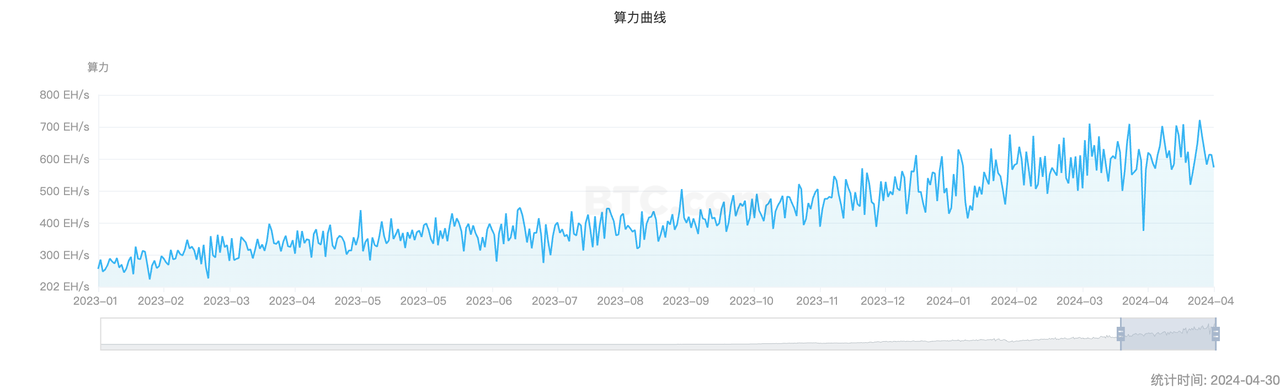

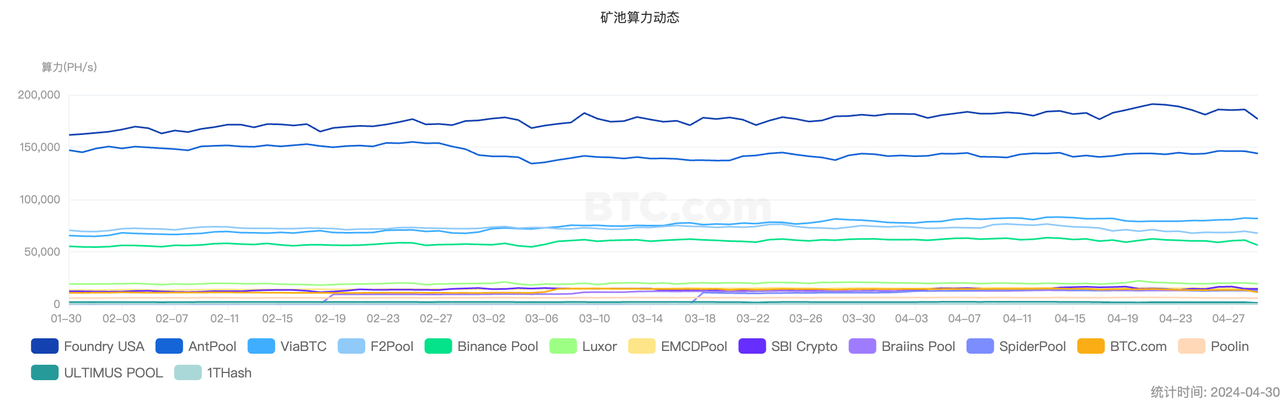

The total POW network hash rate has reached 617.86 EH/s, an increase of approximately 3.52% compared to last month's 596.81 EH/s. Although the growth rate has slightly decreased from last month's 3.78%, it is not significant. With the fourth BTC halving, miners' income per TH/s of hash rate decreased by about 50% after 10 days, consistent with the post-halving output.

The significant decrease in miner income has led to a corresponding shrinkage in daily BTC inflows into the market. The decline in BTC prices may drive more BTC from miners into the market. Once BTC reaches the shutdown price for some small and medium-sized miners (unable to bear the cost pressure), there is a possibility of mass shutdowns, triggering a chain reaction in the market and even a partial reshuffle.

Among them, the top 3 mining pools are still Foundry USA, AntPool, and ViaBTC, while F2Pool has dropped to the fourth position, with about 140 EH/s less than ViaBTC. In terms of growth, Foundry USA continues to show the most stable performance.

ETH:

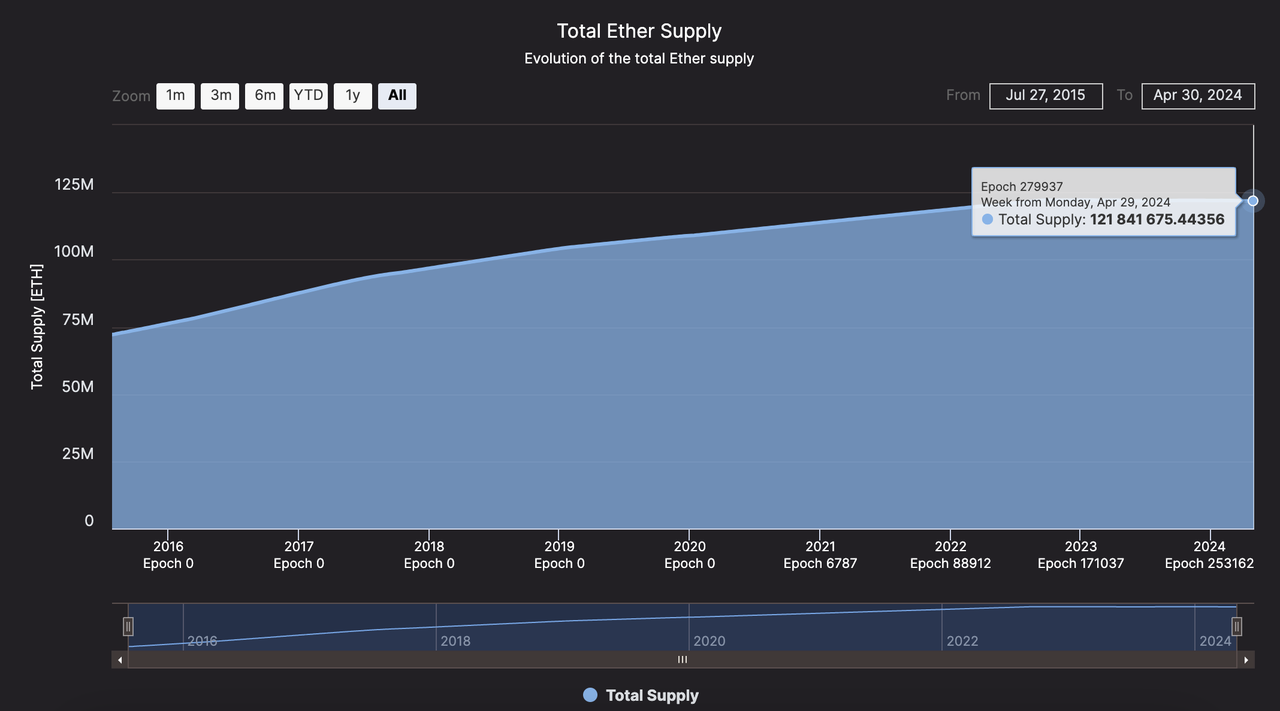

The supply trend of ETH remains stable, with no significant fluctuations since June 2022, maintaining at around 122 million. This indicates that the POS mechanism has played a very positive role in stabilizing the ETH ecosystem, and the market value of ETH is strongly correlated with its ecosystem value.

As the largest current industry ecosystem, ETH is focusing on the construction and expansion of its internal ecosystem, driving continuous exploration in underlying infrastructure and services for the entire industry. This steady progress allows its potential energy to continue to accumulate, waiting for new opportunities to emerge.

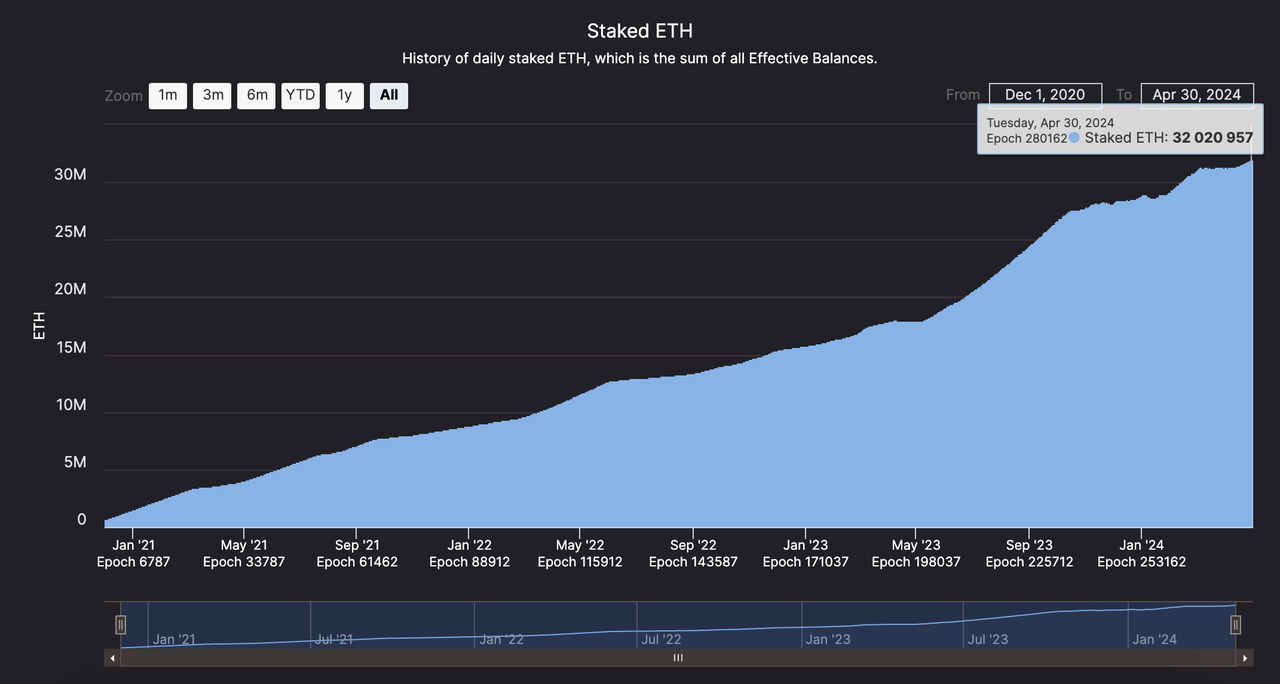

At the same time, the total staked ETH in POS continues to rise. As of April 30th, there are 1,000,766 active validators and a total staked ETH of 32,024,157, accounting for 26.28% of the total ETH supply. In April, there was an additional staking of 692,898 ETH, and the staking share of the liquidity staking protocol Lido accounted for 29.15% of the total, slightly down from 30.11% last month.

On April 27th, Lido announced the conclusion of the SSV Simple DVT testnet and the upcoming launch of the mainnet. In the next few weeks, selected participants will use SSV technology to join the mainnet Lido Simple DVT module. Although this will not make Lido's absolute share more decentralized, it will further enhance the security of stakers and encourage more service providers to participate.

3. Market Trends

3.1 BTC Price Oscillation Downward

https://www.binance.com/en/trade/BTC_USDT?_from=markets&type=spot

After experiencing a 16.6% increase in March, the price of BTC began to decline and showed a trend of oscillation downward in April. According to Binance data, as of 11:00 on April 30th (UTC+8), the highest price of BTC in April was $72,797.99, and the lowest price was $59,600.01, with a 10.51% decrease on the 30th.

Regarding the downward trend of BTC in April, the mainstream view in the market suggests three possible reasons:

- Profit-taking and selling pressure after BTC reached a new high. Binance trading data shows that on March 14, 2024, BTC reached a historical high of $73,777, and considering the achievement of BTC's phase target, many investors closed their profits, leading to a price decline.

- Conflict between Iran and Israel causing panic in the crypto market. On April 13th, Iran used drones to attack Israel, directly affecting the price trend of BTC. Binance trading data shows that on April 13th, the price of Bitcoin experienced a sharp drop to a low of $60,660.57. The uncertainty of regional conflicts has intensified the downward trend of crypto assets, including Bitcoin.

- The net outflow of BTC spot ETF also affected the price trend of BTC. According to sosovalue data, from April 1st to April 26th, the net outflow of BTC spot ETF was $83.61 million, also causing the price of BTC to decline.

Regarding the BTC price: Since September 1, 2023, Bitcoin has been on a 7-month winning streak. The increase in February 2024 was about 43.57%, and in March, it was about 16.6%.

In April, the most significant event was the fourth BTC halving. Based on historical experience of BTC retracement before and after halving, the overall 10.51% decline in BTC this month is within expectations.

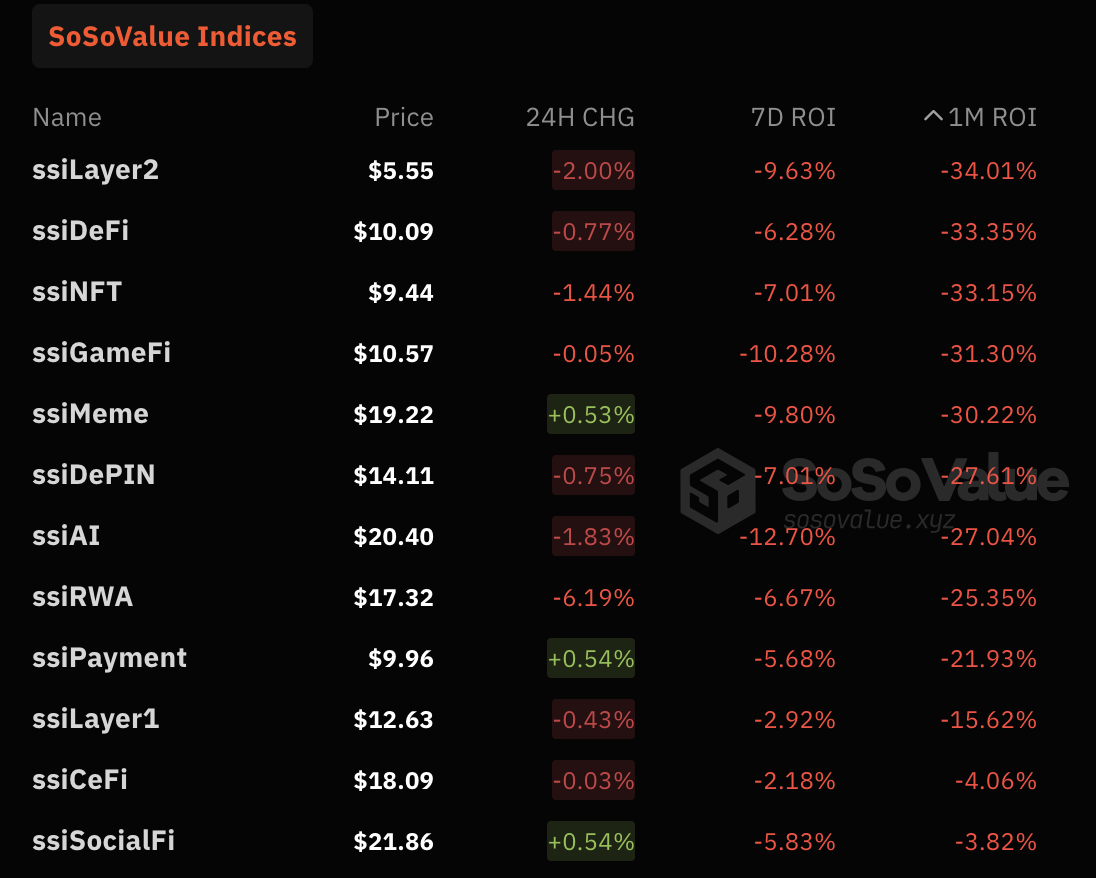

3.2 Significant Decline in Various Sectors

https://sosovalue.xyz/assets/cryptoIndex

With the oscillating downward trend of BTC prices, other sectors in the crypto industry have also shown signs of a general decline. According to sosovalue tracking data, the Layer2, DeFi, NFT, and Gamefi sectors have experienced the largest declines in ROI.

In addition to these four sectors, the recently popular MemeCoin and AI sectors have also experienced significant pullbacks:

- In the MemeCoin sector, Doge has declined by 32.71% in 30 days, and Shib has declined by 21.25% (CoinMarketCap data).

- In the AI sector, apart from Near Protocol, representative projects such as RNDR, TAO, and GRT have all experienced declines of over 20%.

Considering the previous general uptrend of crypto assets and the profit-taking of many floating chips due to the BTC halving, the current oscillating downward trend and the general decline in other sectors are likely part of a normal market adjustment.

4. Investment and Financing Observations

4.1 Investment and Financing Overview

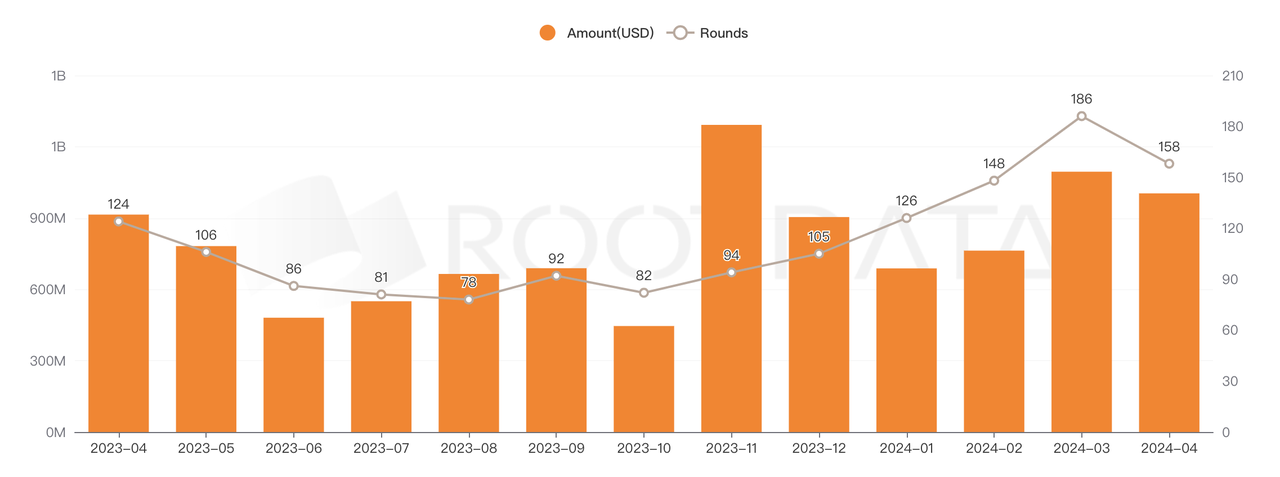

In April 2024, the total amount of completed transactions in the cryptocurrency market was $1.004 billion, a decrease of 7.55% compared to the previous month. The public data is as follows:

- 158 financing events, a decrease of 12.15% compared to the previous month.

- 4 acquisition events, an increase of 33.33% compared to the previous month.

- The average financing amount was $8.8092 million, a decrease of 8.37% compared to the previous month.

- The median financing amount was $3.35 million, a decrease of 33% compared to the previous month.

Seed round financing events are still the most common, followed by strategic financing and other types of financing. Pre-seed round financing events have seen rapid growth:

- 44 seed round events (a decrease of 6.3% compared to the previous month).

- 15 strategic financing events (a decrease of 50% compared to the previous month).

- 0 Series A events (a decrease of 100% compared to the previous month).

- 12 Pre-seed round events (an increase of 120% compared to the previous month).

- 13 other types of events (an increase of 23.5% compared to the previous month).

Although acquisition events have increased, financing events, average financing amounts, and median financing amounts have all decreased significantly. The short-term market sentiment is negative, and the influx of hot money has slowed down. This indicates that the market trends in April have had a significant impact on investment and financing. Investment institutions have started to become cautious and slow down their pace. However, acquisitions and mergers are becoming a trend in the competition, and in the future, the competition in the top sectors will become clearer.

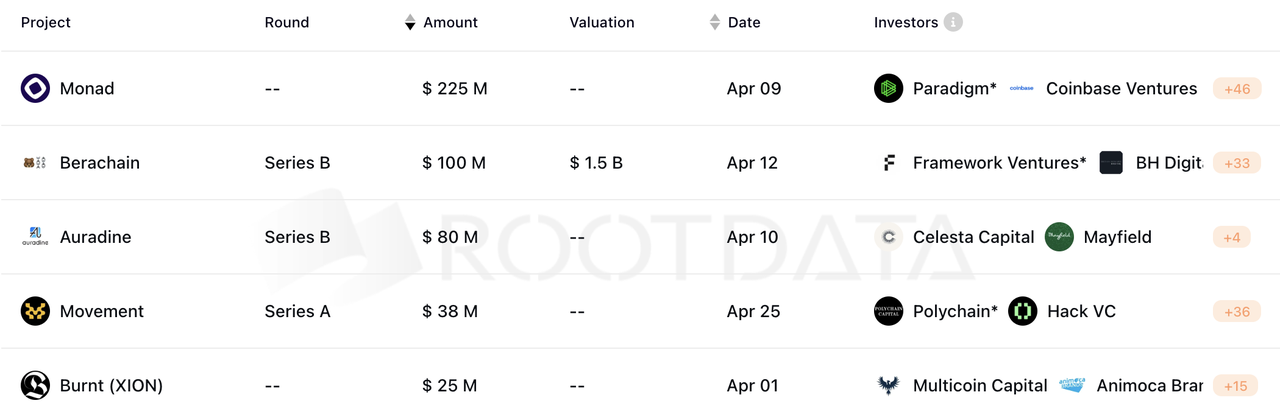

Top 5 financing rounds in April:

Monad completed a $225 million financing with undisclosed valuation.

Berachain completed a $100 million Series B financing with a $1.5 billion valuation.

Auradine completed an $80 million Series B financing with undisclosed valuation.

Movement completed a $38 million Series A financing with undisclosed valuation.

Burnt (XION) completed a $25 million financing with undisclosed valuation.

4.2 Analysis of Investment and Financing Institutions

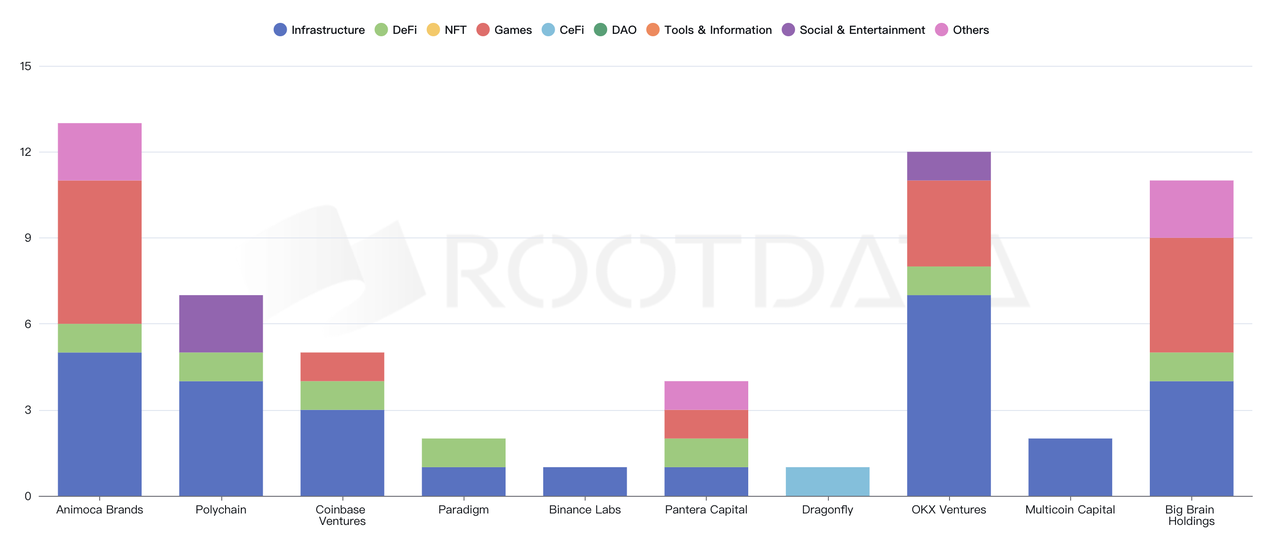

From the perspective of VC institutions: Animoca Brands has been the most active in the GameFi field, followed by OKX, Big Brain, and Polychain, with these three making a significant number of investments in infrastructure and GameFi. Other VC companies have focused their investments on infrastructure and DeFi.

This reflects the current distribution and pattern of industry construction and applications. Infrastructure remains the current focus of development, while the proportion of GameFi on the application side is becoming increasingly significant. The market is shifting its focus to GameFi as the new application focus after DeFi, and it is recommended for investors to closely monitor this trend.

4.3 Investment and Financing Trend Analysis

With the reduction in block rewards after the Bitcoin halving, miners' income and hash rate are facing greater downward pressure. In addition, the expectation of only one interest rate cut by the Federal Reserve this year has made VC institutions and TradFi funds more cautious. It is expected that investment institutions will be more cautious in their positioning in May.

However, in times of market fear, it is often best to be "greedy" and move forward. This is the best opportunity to find undervalued investments. With the continuous innovation and development of the Bitcoin ecosystem, the long-term narrative of AI, GameFi blockchain games, and parallel EVM, it is expected that the investment and financing market in May will continue to make steady progress, focusing on infrastructure and GameFi, and based on current on-chain data, the BTC ecosystem is expected to perform better.

About Movement

At the end of April, modular blockchain Movement announced the completion of a $38 million Series A financing, making it the 4th largest financing project in April. This financing was led by Polychain Capital, with participation from Hack VC, Foresight Ventures, Placeholder, Archetype, Maven 11, Robot Ventures, Figment Capital, Nomad Capital, Bankless Ventures, OKX Ventures, dao5, and Aptos Labs, among others. This funding will support Movement in bringing Facebook's Move virtual machine to Ethereum to address smart contract vulnerabilities and increase transaction throughput.

As a modular framework, Movement can be used to build and deploy Move-based infrastructure, applications, and blockchains in any distributed environment. The framework is compatible with Solidity, connects EVM and Move liquidity, and allows builders to customize modular and interoperable applications with different user bases and liquidity out of the box.

5. Conclusion

The data and market dynamics in April 2024 have revealed several important trends:

- The delay in the expected interest rate cut in the United States, combined with the cryptocurrency market reaching new highs and then experiencing a decline, is still within the expected range, and a rebound in the future is still expected.

- After the Bitcoin halving, with the decline in the popularity of Runes, miners and mining companies have begun to actively expand their business portfolios and revenue streams.

- The growth trend of stablecoins has begun to slow down, but this has not affected the buying of large whale traders. The increase in holdings by large whales has provided more expectations for the market trend.

- On-chain TVL has decreased with the market downturn, but Restaking and the BTC ecosystem continue to show growth trends. It is expected that this trend will continue in June.

- Pre-seed round investment and financing events have seen rapid growth, with GameFi accounting for a significant proportion. This indicates that although VC layouts are affected by market sentiment, they are still making steady progress.

Although the market continues to oscillate downward and the volatility is significant, the main trend in the market is still traditional capital and ETFs. In the trend of a significant decline in various sectors, Restaking and the BTC ecosystem have shown particularly strong performance, demonstrating strong contra-market capabilities and future potential. Once the market adjustment is completed and a rebound begins, Restaking and the BTC ecosystem may become the core narrative of this cycle.

Furthermore, the modular and GameFi sectors have begun to show strong momentum in investment and financing and implementation progress. This is especially evident in the advantage of GameFi in the investment and financing projects, as well as the upcoming mainnet launch of Avail, making them potential key variables that will impact the industry and market. It is important to continue to closely monitor these developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。