Author: Nancy, PANews

Recently, the news about the upcoming issuance of zkSync and predictions about airdrop rules have sparked market discussions. This article from PANews reviews the data of zkSync this year and finds that although zkSync still maintains a leading market size, the willingness of its users to participate is decreasing, and the profit capture capability is also significantly reduced. This is closely related to its continuous years of airdrop PUA, the poor quality of ecological projects, and the neglect of user rights.

Few high TVL ecological projects with a single type, on-chain profits rely on Ga income but have significantly shrunk

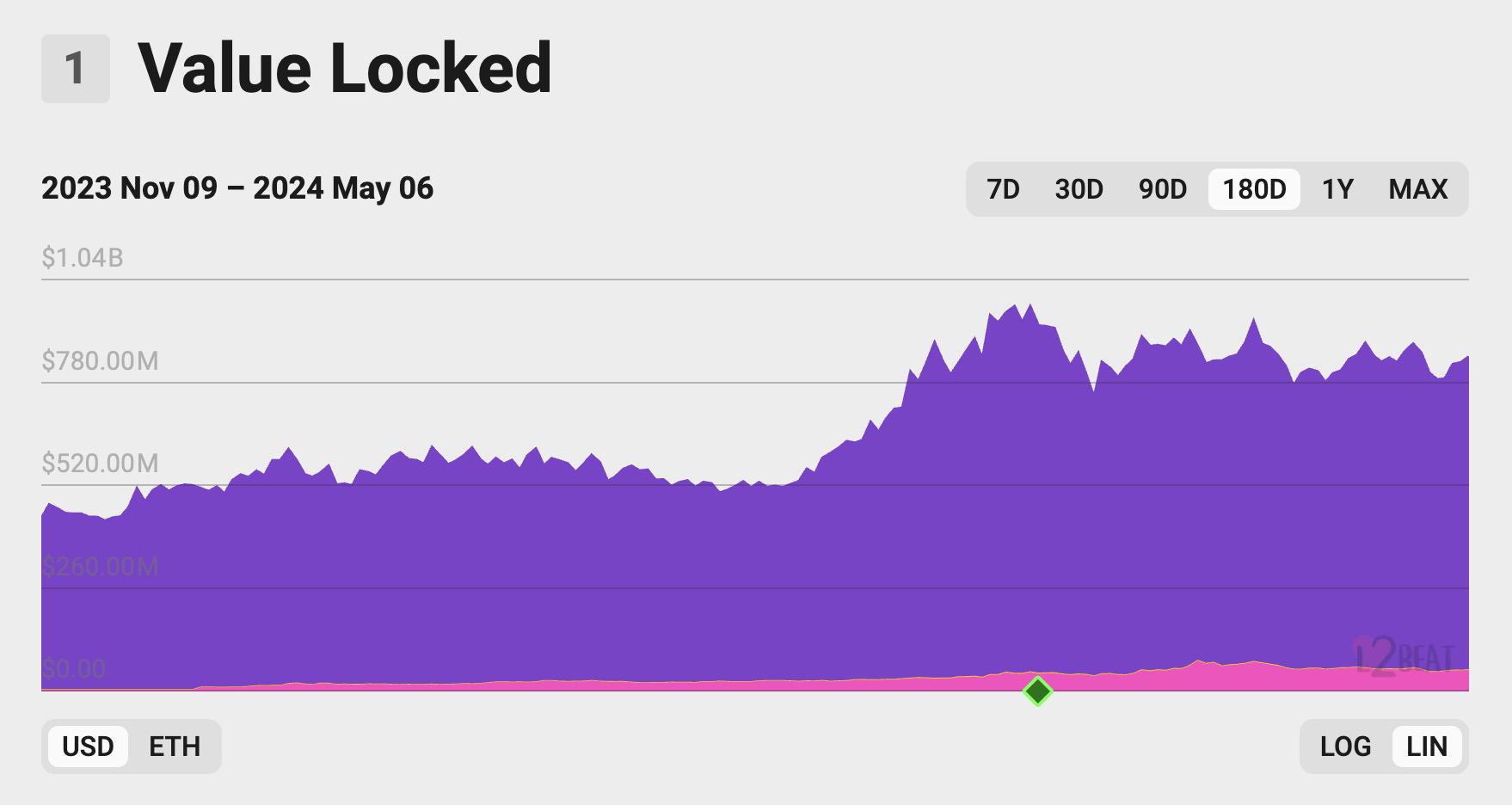

Up to now, according to L2BEAT data, as of May 6, the total locked value (TVL) of zkSync Era has reached nearly 850 million US dollars, an increase of about 44.1% since the beginning of the year, ranking eighth among L2 projects.

However, the zkSync ecological projects with high TVL are relatively single and few in number. According to the zkSync official website, as of May 6, although its ecological projects have reached 243, covering DeFi, games, trading markets, NFT, social, wallets, and DEX, DeFiLlama's data also shows that only 4 zkSync projects have a TVL of over 10 million US dollars, accounting for nearly 66% of the overall locked value. Meanwhile, among the top 10 TVL projects, they mainly come from the DEX and lending tracks. Its ecological dilemma also significantly affects the level of user participation.

In terms of the number of users and the scale of funds, zkSync Era has achieved good growth this year. According to Dune data, as of May 6, the number of zkSync Era users has reached nearly 3.13 million, an increase of 16.3% since the beginning of the year; the total amount of ETH bridged has exceeded 3.22 million, an increase of 38.8% since the beginning of the year. However, the average amount of ETH bridged per user is only 1.37, with over 80% of users bridging less than 1 ETH, and only 1.3% of addresses have a balance of over 10 ETH. Therefore, although the airdrop expectation of zkSync still has some appeal, users tend to prefer low-cost investments.

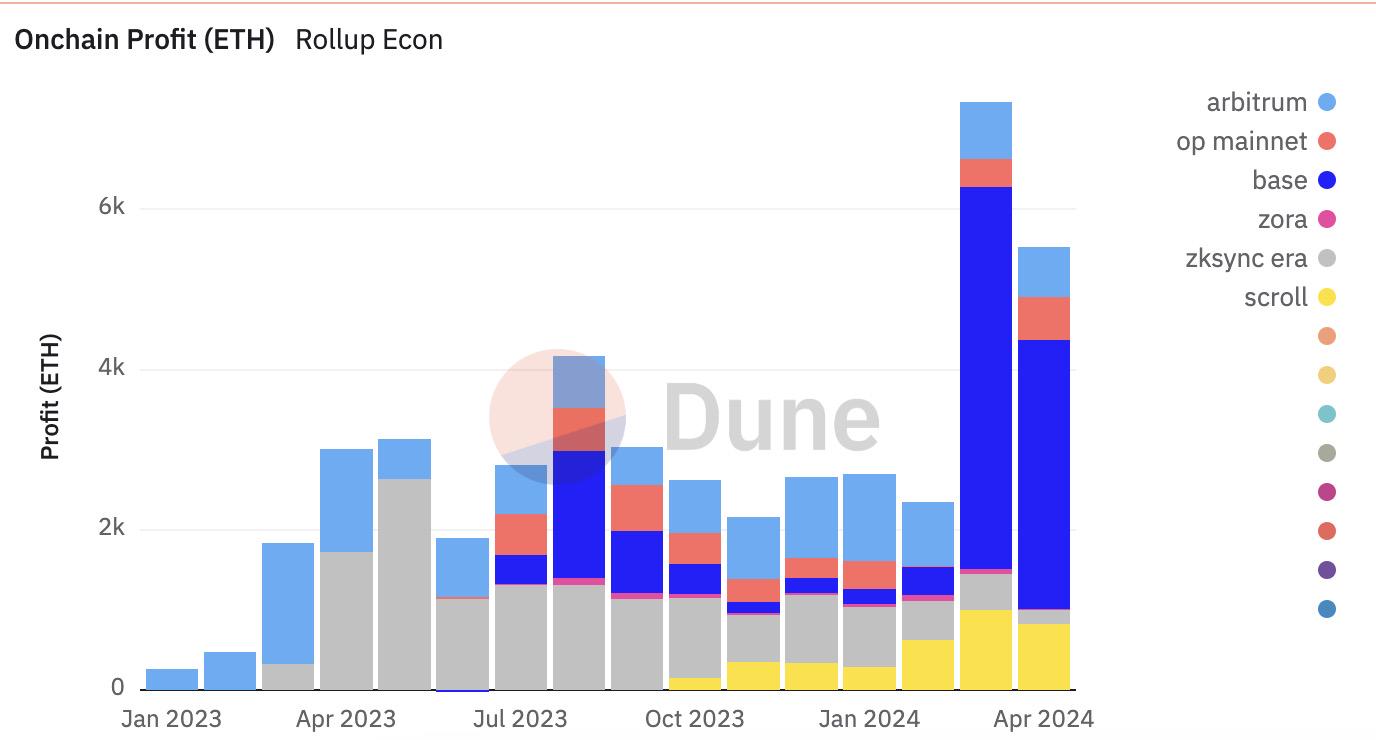

The participation of a large number of yield farmers has also brought huge profits to zkSync Era. The latest data from Dune shows that as of May 1, after deducting the cost of publishing data to L1 and the cost of verifying proofs on L1, zkSync Era has generated profits of about 1848 ETH in the past four months due to Gas, accounting for 10.3% of the total profits of the Rollup chain. However, it still lags behind competitors such as Base, Arbitrum, and Scroll, and the monthly profits have shown a significant decline.

On-chain profits of zkSync Era Source: Dune@niftytable

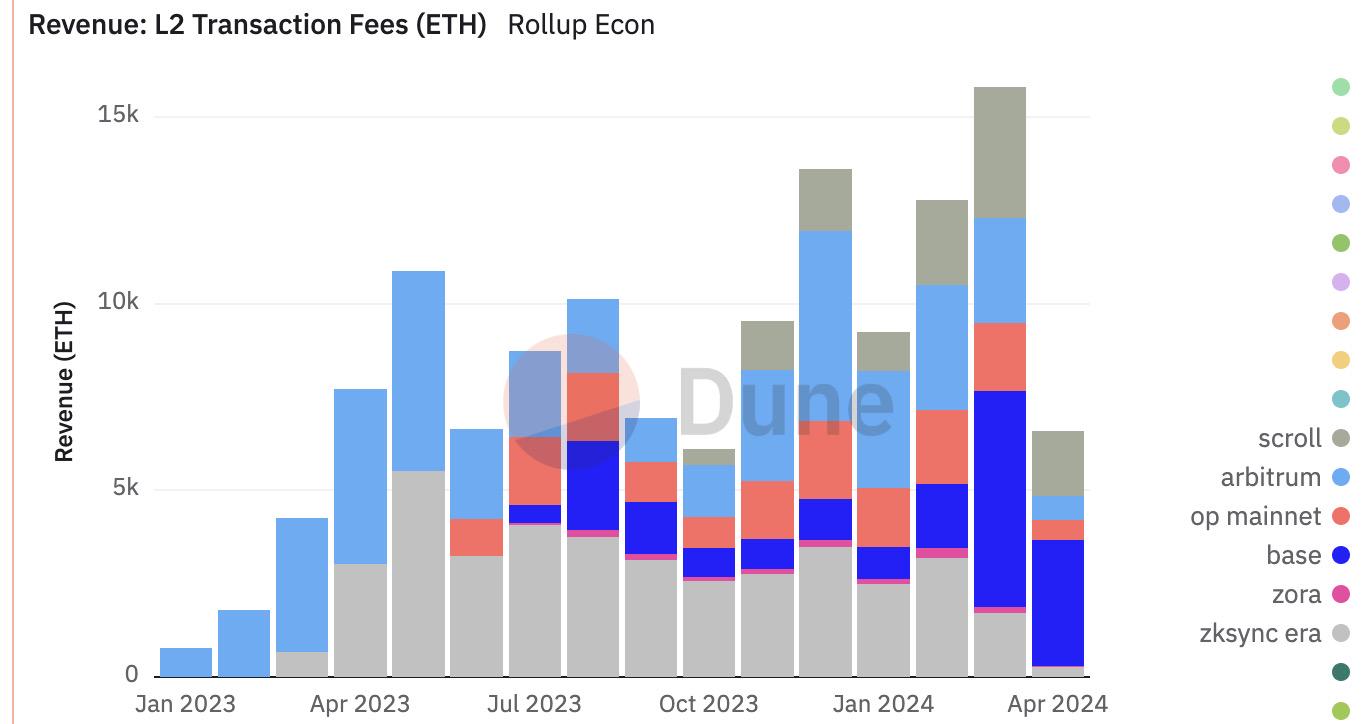

Since the beginning of this year, zkSync Era has received a total of 7678 ETH in transaction fees, accounting for only about 17.3% of the overall amount. Looking at the changes in transaction fees month by month, there has been a continuous downward trend, with the fees captured in April decreasing by about 88.9% compared to January; the cost required for sending to L1 has decreased by nearly 96.2%, which still outperforms competitors such as Arbitrum, OP Mainnet, Base, Starknet, and Linea; the cost of verifying proofs on L1 reached 1541 ETH this year, accounting for 49.7% of the total. In other words, the on-chain profits of zkSync Era mainly come from Gas income, but have significantly shrunk.

Changes in L2 monthly transaction fees Source: Dune@niftytable

Intensive rug pulls lead to neglect of user rights, community accuses the lack of official action

The inability to safeguard user rights and the lack of official action are causing zkSync to lose community trust.

Although there are numerous on-chain accidents and rug events in the crypto dark forest, the indifference of zkSync ecological projects and the official team to user rights has become one of the important reasons hindering the expansion of its market size.

For example, the previous zkSync lending protocol Eralend suffered a flash loan attack, resulting in a total loss of approximately 3.4 million US dollars. Not only did it fail to recover the stolen funds, but it also did not compensate the users accordingly; the zkSync ecological lending platform xBank Finance suffered a loss of 550,000 US dollars due to a hacker attack, and after the liquidity was close to zero, although it stated that it was contacting the attacker to recover user funds through a white hat bounty, it also did not mention the issue of compensating users; the decentralized entertainment platform ZKasino was questioned for forcibly converting over 10,000 ETH of user deposits into platform tokens and was suspected of conducting a soft rug pull. However, the official team did not respond to the unauthorized rule changes and the whereabouts of the funds, and even transferred the funds in batches. Currently, the Dutch Fiscal Investigation and Enforcement Service has arrested a suspect in the ZKasino fraud case and seized 11 million euros of assets.

Faced with the severe damage to user interests, the zkSync team has never made any relevant responses or improvement measures, which also reflects its poor management of the ecosystem. The low cost of wrongdoing has become one of the important reasons for the proliferation of chaos.

In response to this, many community members expressed dissatisfaction, stating that the zkSync team has not shouldered the heavy responsibility of ecosystem construction, including supporting high-quality projects, and has allowed various rug projects to run rampant. Although the official team has repeatedly emphasized the importance of the community, it turns a blind eye to project misconduct and user rights, showing a greater concern for Gas income than the community.

In this context, in the current situation of intensive L2 launches in the market, if zkSync does not pay attention to ecosystem construction and user interests, it will face greater challenges as the airdrop effect gradually loses its appeal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。