To determine whether Restaking is a panacea or a stopgap measure, one must thoroughly understand it in order to draw an objective conclusion.

Authors: Baiding & Jomosis, Geek Web3

Editor: Faust

Preface: Restaking and Layer2 are important narratives in the current cycle of the Ethereum ecosystem. Both aim to address existing issues within Ethereum, but their specific paths differ. Compared to complex technical means such as ZK and fraud proofs, Restaking is more about empowering downstream projects economically. It may seem like simply staking assets and earning rewards, but its principles are far from being as simple as imagined.

It can be said that Restaking is a double-edged sword. While empowering the Ethereum ecosystem, it also brings significant risks. Currently, opinions on Restaking vary. Some say it brings innovation and liquidity to Ethereum, while others argue that it is too utilitarian and accelerates the collapse of the crypto market.

Undoubtedly, to determine whether Restaking is a panacea or a stopgap measure, one must understand what it is doing, why it is being done, and how it is being done in order to draw an objective and clear conclusion. This is also of great significance in determining the value of its token.

When it comes to Restaking, Eigenlayer is an inevitable case. Understanding what Eigenlayer is doing is understanding what Restaking is doing. This article will use Eigenlayer as an example to introduce the business logic and technical implementation of Eigenlayer in the clearest and most understandable language, analyze the impact of Restaking on the technical and economic aspects of the Ethereum ecosystem, and its significance for the entire Web3.

Explanation of Restaking and related terms

Everyone knows that Restaking refers to "restaking," and it originally took root in the Ethereum ecosystem and gained popularity after Ethereum's transition to POS in 2022. What is "restaking"? Let's first introduce the background of Restaking, namely POS, LSD, and Restaking, so that we can have a clearer understanding of Restaking.

1. POS (Proof of Stake)

Proof of Stake, also known as "POS," is a mechanism that probabilistically allocates the right to record transactions based on the amount of assets staked. Unlike POW, which allocates the right to record transactions based on the participants' computing power, it is generally believed that POW is more decentralized and closer to permissionless than POS.

On September 15, 2022, with the Paris upgrade, Ethereum officially transitioned from POW to POS, completing the merge of the mainnet and the beacon chain. The Shanghai upgrade in April 2023 allowed POS stakers to redeem their assets, solidifying the maturity of the Staking model.

2. LSD (Liquid Staking Derivatives Protocol)

As we all know, the interest rate for Ethereum PoS staking is quite attractive, but retail investors find it difficult to access this part of the income. Apart from the requirement for hardware equipment, there are two reasons:

First, the staked asset amount of a Validator must be 32 ETH or a multiple thereof, making it unattainable for retail investors.

Second, before the Shanghai upgrade in April 2023, users could not withdraw their staked assets, resulting in low capital utilization efficiency.

To address these two issues, Lido emerged. It adopts a staking model called collective staking, where "staking together, sharing profits," allowing users to deposit their ETH on the Lido platform, which aggregates them as assets staked when running Ethereum Validators, thus solving the pain point of insufficient funds for retail investors.

Furthermore, when users stake their ETH on Lido, they will receive stETH tokens anchored to ETH at a 1:1 ratio. stETH can be exchanged back to ETH at any time and can also be used as a token equivalent to ETH, participating in various financial activities on mainstream DeFi platforms such as Uniswap and Compound. This solves the problem of low capital utilization efficiency in the POS Ethereum.

Since POS involves staking highly liquid assets, products led by Lido are called "Liquid Staking Derivatives" (LSD), which is what we commonly refer to as "LSD." As mentioned earlier, stETH, known as a liquid staking token (LST), is a derivative token of ETH, and it is referred to as "LST" in English.

It is easy to see that the ETH staked in the POS protocol is a genuine native asset, while tokens like stETH, which are LST, are created out of thin air. This can be understood as creating a "financial leverage" in economics. The role of financial leverage in the entire economic ecosystem is not simply good or bad and needs to be analyzed in specific contexts and environments. It is important to remember that LSD adds the first layer of leverage to the ETH ecosystem.

3. Restaking (Re-staking / Restaking)

Restaking, as the name suggests, involves staking LST tokens as staked assets to participate in more POS networks/chains' staking activities to earn rewards and help enhance the security of more POS networks.

After staking LST assets, a 1:1 staking certificate is obtained for circulation, known as LRT (Liquid Restaking Token), such as staking stETH to obtain rstETH, which can also be used to participate in DeFi and other on-chain activities.

In other words, the LST tokens created out of thin air in LSD are staked again, creating a new asset out of thin air through Restaking, namely the LRT asset, adding a second layer of leverage to the ETH ecosystem.

The above is the background of the Restaking track. At this point, there is certainly a question: the more leverage there is, the more unstable the economic system becomes. The first layer of leverage in LSD can be understood, as it solves the problems of retail investors' inability to participate in POS and improves capital utilization efficiency. However, what is the necessity of the second layer of leverage introduced by Restaking? Why stake the already created LST tokens again?

This involves both technical and economic aspects. In response to this question, the following text will briefly outline the technical structure of Eigenlayer's products, analyze the economic impact of the Restaking track, and finally provide a comprehensive evaluation of it from both technical and economic perspectives.

(Up to this point, many English abbreviations have appeared in this article, among which LSD, LST, and LRT are core concepts, and they will be mentioned multiple times later. Let's reinforce our memory: the ETH staked in the POS is a native asset, and the stETH anchored to the staked ETH is LST. The rstETH obtained by staking stETH on the Restaking platform is LRT.)

Product features of Eigenlayer

We must first clarify the core problem that EigenLayer's product features aim to solve: providing economic security for some underlying POS-based platforms from Ethereum.

Ethereum has high security due to its substantial amount of asset staking. However, for services that are executed off-chain, such as Rollup sequencers or Rollup verification services, their off-chain execution is not directly controlled by Ethereum and cannot directly benefit from Ethereum's security.

To obtain sufficient security, they need to build their own AVS (Actively Validated Services). AVS is a "middleware" that provides data or verification services for terminal products such as DeFi, games, and wallets. Typical examples include "oracles" that provide data quoting services and "data availability layers" that can provide users with stable access to the latest data status.

However, building a new AVS is quite difficult because:

- The cost of building a new AVS is very high and takes a long time.

- The staking of a new AVS often uses the project's own native token, which has much weaker consensus than ETH.

- Participating in staking for a new network's AVS will cause stakers to miss out on the stable returns from staking on the Ethereum chain, resulting in opportunity costs.

- The security of a new AVS is much lower than that of the Ethereum network, and the economic cost of attacks is very low.

If there were a platform that allowed early-stage projects to directly lease economic security from Ethereum, the above problems could be solved.

Eigenlayer is such a platform. The whitepaper of Eigenlayer is titled "The Restaking Collective," with the characteristics of "Pooled Security" and "free market."

In addition to ETH staking, EigenLayer collects Ethereum's staking certificates to form a security leasing pool, attracting stakers who want to earn additional income to restake. It then leases the economic security provided by these staked funds to some POS network projects, which is the "Pooled Security."

Compared to the unstable and potentially fluctuating APY in traditional DeFi systems, Eigenlayer clearly specifies the staking returns and penalty rules through smart contracts, allowing stakers to freely choose and earn returns in a transparent and open market, turning the process of earning returns from an uncertain gamble into a transparent market transaction, which is the "free market."

In this process, projects can lease security from Ethereum, avoiding the need to build their own AVS, while stakers receive stable APY. In other words, while Eigenlayer enhances ecosystem security, it also provides returns to users in the ecosystem.

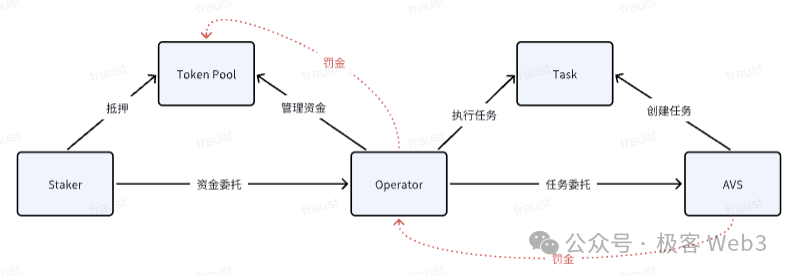

Eigenlayer provides security through a process involving three roles:

- Secure Lender - Staker (Staker). Stakers stake funds to provide security.

- Secure Intermediary - Operator (Node Operator). Responsible for helping stakers manage funds and assisting AVS in executing tasks.

- Secure Recipient - AVS, such as oracles and other middleware.

(Image source: Twitter @punk2898)

Someone has made an analogy for Eigenlayer: comparing it to a shared bicycle service for upstream and downstream. The shared bicycle company is equivalent to Eigenlayer, providing market services for LSD and LRT assets, similar to how a shared bicycle company manages bicycles. The bicycle is equivalent to LSD assets, as they are both assets that can be leased. The rider is equivalent to middleware requiring additional verification (AVS), just as a rider rents a bicycle, AVS rents LSD and other assets to obtain network verification services to ensure their own security.

In the shared bicycle model, deposits and default responsibilities are used to constrain users to pay deposits to prevent malicious damage to the bicycles. Similarly, Eigenlayer prevents malicious behavior by participants in verification through staking and penalty mechanisms.

Smart Contract Interaction Process of EigenLayer

The core idea of Eigenlayer's security is based on two principles: staking and slashing. Staking provides basic security for AVS, while slashing increases the cost of malicious behavior for any party.

The interaction process of staking is shown in the following diagram.

In Eigenlayer, the main interaction with stakers is through the TokenPool contract. Stakers can perform two operations through TokenPool:

Staking - Stakers can stake assets in the TokenPool contract and specify a specific Operator to manage the staked funds.

Redemption - Stakers can redeem assets from the TokenPool.

Staker's redemption of funds involves three steps:

1) The Staker adds the redemption request to the request queue, requiring a call to the queueWithdrawal method.

2) The Strategy Manager checks if the Operator specified by the Staker is in a frozen state.

3) If the Operator is not frozen (detailed description follows), the Staker can initiate the complete withdrawal process.

It is important to note that EigenLayer gives Stakers full freedom. Stakers can liquidate their staked funds back to their own accounts or convert them into staking shares for re-staking.

Based on whether the Staker can personally run node facilities to participate in the AVS network, Stakers can be divided into regular stakers and Operators. Regular stakers provide POS assets for each AVS network, while Operators are responsible for managing the staked assets in the TokenPool and participating in different AVS networks to ensure the security of each AVS. This is somewhat similar to Lido's approach.

The relationship between Stakers and AVS is like a fragmented security supply and demand relationship. Stakers often do not understand the products of AVS project parties, cannot trust them, or do not have the resources to directly operate equipment to participate in the AVS network. Similarly, AVS project parties often cannot directly reach Stakers. Although they have a supply and demand relationship, they lack an intermediary to connect with each other. This is where the role of the Operator comes in.

On one hand, the Operator helps stakers manage funds, and stakers often have a trust assumption about the Operator. EigenLayer officially explains that this trust is similar to staking on the LSD platform or Binance staking. On the other hand, the Operator helps AVS project parties operate nodes. If the Operator violates the restrictions, malicious behavior will be slashed, making the cost of malicious behavior far exceed the benefits, thereby building trust between AVS and the Operator. In this way, the Operator becomes a trusted intermediary between stakers and AVS.

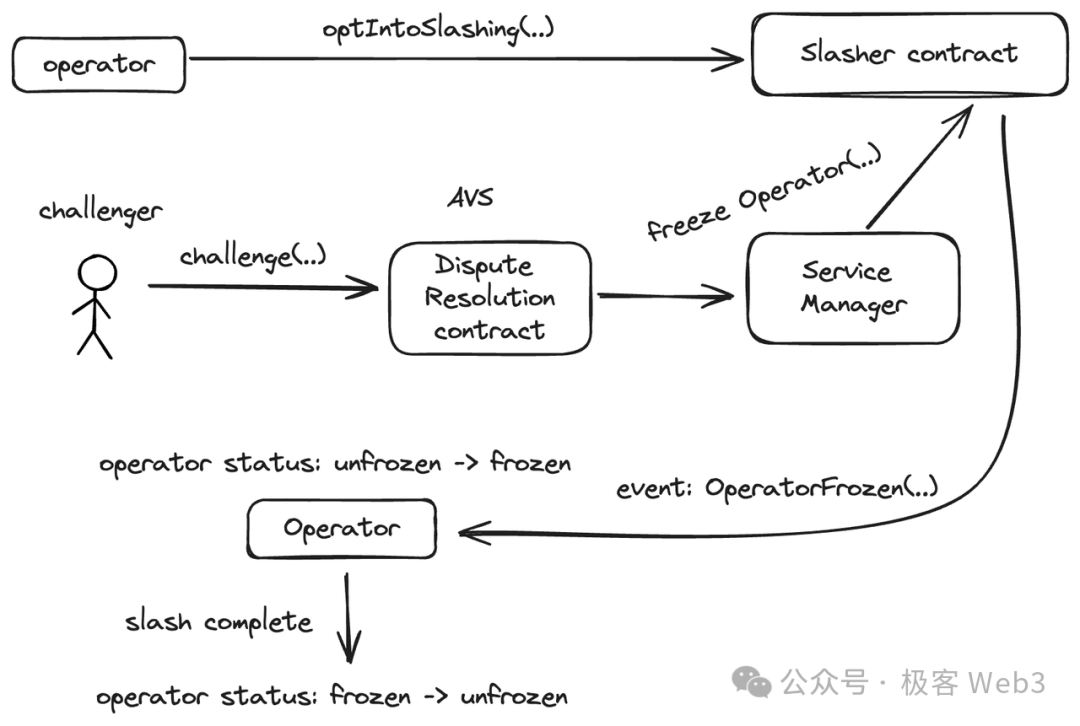

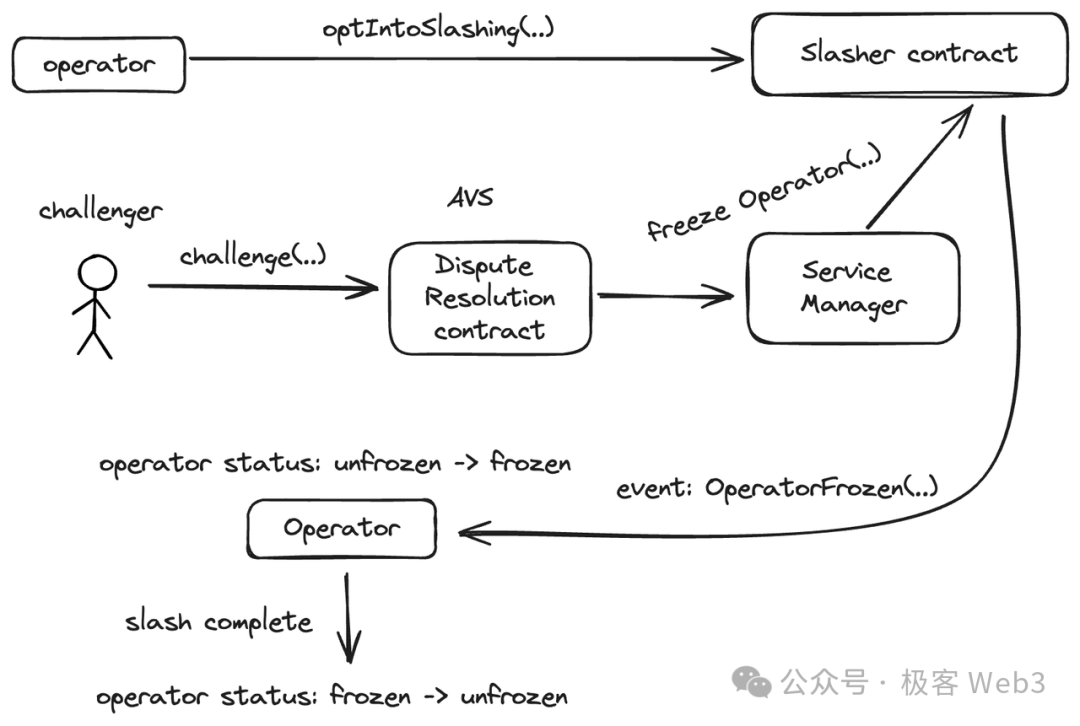

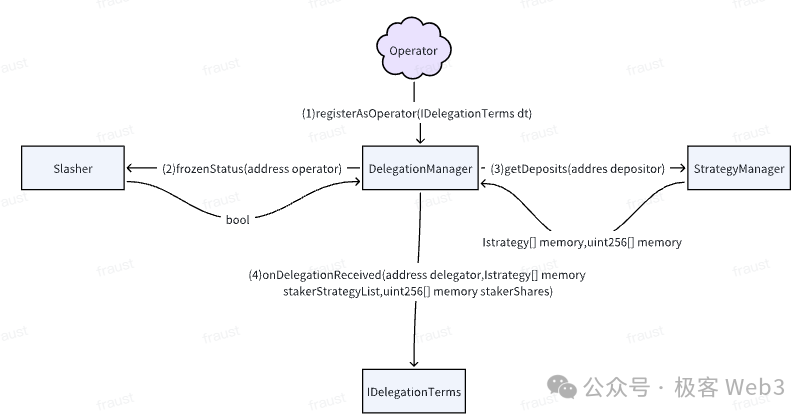

To join the Eigenlayer platform, an Operator must first call the optIntoSlashing function of the Slasher contract, allowing the Slasher contract to constrain/punish the Operator.

Subsequently, the Operator must register through the Registry contract. The Registry contract will call the relevant functions of the Service Manager to record the Operator's initial registration behavior and then transmit the message back to the Slasher contract. Only then will the Operator's initial registration be completed.

Now let's look at the contract design related to slashing. In Restaker, Operator, and AVS, only the Operator will be the direct subject of slashing. As mentioned earlier, for an Operator to join the Eigenlayer platform, they must register in the Slasher contract to authorize the Slasher to carry out slashing operations against the Operator.

Of course, in addition to the Operator, the slashing process also involves several other roles:

1. AVS: While the Operator accepts the commission from the AVS for operation, they also have to accept the triggering conditions and standards for slashing proposed by the AVS. Two important contract components to emphasize here are the dispute resolution contract and the Slasher contract.

The dispute resolution contract is established to resolve challenges from challengers, and the Slasher contract will freeze the Operator and carry out slashing operations after the challenge window ends.

2. Challenger: Anyone who joins the Eigenlayer platform can become a challenger. If they believe that an Operator's behavior has triggered the conditions for slashing, they will initiate a fraud proof process similar to an OP.

3. Staker: Slashing of the Operator will also result in corresponding losses for the Staker.

The process for executing slashing against the Operator is as follows:

1) The challenger calls the challenge function in the Dispute Resolution contract established by the AVS to initiate a challenge.

2) If the challenge is successful, the Dispute Resolution contract will call the freezeOperator function of the Service Manager, causing the Slasher Contract to trigger the OperatorFrozen event, changing the status of the specified Operator from unfrozen to frozen, and then entering the slashing process. If the challenge fails, the challenger will receive a certain penalty, to prevent malicious challenges against the Operator.

3) After the slashing process is completed, the Operator's status will be reset to unfrozen and continue to operate.

Throughout the process of executing slashing, the Operator's status is always in a frozen "inactive state." In this state, the Operator cannot manage the funds staked by the staker, and stakers who have staked funds with this Operator cannot withdraw them. This is similar to being under suspicion and unable to escape punishment. Only when the current penalty or conflict is resolved and the Operator is not frozen by the Slasher, can they engage in new interactions.

All contracts in Eigenlayer adhere to the above freezing principle. When a staker stakes funds with an operator, the isFrozen() function is used to check the Operator's status. When a staker initiates a request to redeem their staked funds, the isFrozen function of the Slasher contract is still used to check the Operator's status. This is Eigenlayer's comprehensive protection of AVS security and staker interests.

Finally, it should be noted that within Eigenlayer, AVS does not unconditionally obtain the security of Ethereum. Although the process for projects to obtain security on Eigenlayer is much simpler than building their own AVS, attracting Operators on Eigenlayer to provide services and attracting more stakers to provide assets for their POS systems is still a challenge, which may require a lot of effort in terms of APY.

Economic Impact of Restaking on the Crypto Market

There is no doubt that Restaking is currently one of the hottest narratives in the Ethereum ecosystem, and Ethereum occupies a significant position in Web3. In addition, various Restaking projects have gathered a very high TVL, which has a significant impact on the crypto market and may continue throughout the entire cycle. We can analyze this impact from both micro and macro perspectives.

Micro Impact

It is important to recognize that the impact of Restaking on various roles in the Ethereum ecosystem is not singular and brings both benefits and risks. The benefits can be summarized as follows:

(1) Restaking does enhance the underlying security of downstream projects in the Ethereum ecosystem, which is beneficial for their long-term development.

(2) Restaking frees up the liquidity of ETH and LST, making economic circulation in the ETH ecosystem smoother and more prosperous.

(3) The high yield of Restaking attracts staking of ETH and LST, reducing the active circulation and benefiting the token price.

(4) The high yield of Restaking also attracts more funds into the Ethereum ecosystem.

At the same time, Restaking also brings significant risks:

(1) In Restaking, an IOU (financial claim) is used as collateral in multiple projects. If there is no proper coordination mechanism between these projects, it may lead to an excessive amplification of the value of the IOU, resulting in credit risk. If multiple projects simultaneously demand redemption of the same IOU, it will not be able to meet the redemption requirements of all projects. In such a situation, if one project encounters problems, it may trigger a chain reaction, affecting the economic security of other projects.

(2) A considerable amount of LST liquidity is locked in Restaking. If the price of LST fluctuates more than ETH and stakers are unable to withdraw LST in a timely manner, they may suffer economic losses. Additionally, the security of AVS also depends on TVL, and high price volatility of LST poses a risk to the security of AVS.

(3) The staked funds of Restaking projects are ultimately stored in smart contracts, and the amount is very large, leading to excessive concentration of funds. If the contract is attacked, it will result in significant losses.

Microeconomic risks can be mitigated through parameter adjustments, flexible rules, and other means, but these will not be discussed in detail here due to space limitations.

Macro Impact

First and foremost, it is important to emphasize that the essence of Restaking is a form of leverage. The impact of Restaking on the crypto market is closely related to market cycles. To understand the macro impact of Restaking on the crypto space, it is necessary to first understand the relationship between leverage and market cycles. Restaking adds two layers of leverage to the ETH ecosystem, as mentioned earlier:

First Layer: LSD doubles the value of staked ETH assets and their derivatives out of thin air.

Second Layer: Restaking does not only stake ETH, but also LST and LP Tokens. Both LST and LP Tokens are tokenized assets, not actual ETH. This means that the LRT generated by Restaking is an asset built on top of leverage, equivalent to a second layer of leverage.

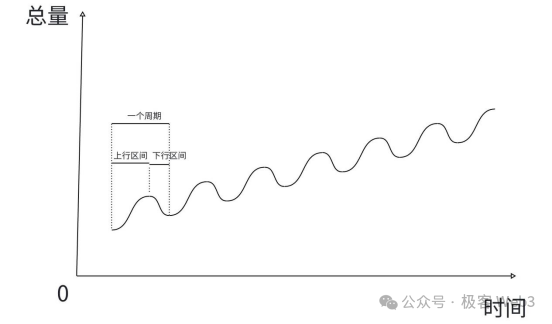

So, is leverage beneficial or harmful to an economic system? In conclusion, leverage must be discussed within the context of market cycles. In an upward phase, leverage accelerates development, while in a downward phase, leverage accelerates collapse.

The development of the social economy is as shown in the above figure, with prolonged ascents leading to descents, and prolonged descents leading to ascents. Each ascent and descent forms a cycle, and the overall economic volume spirals upward in this cyclical pattern, with each cycle's bottom higher than the previous one, and the overall volume increasing. The current crypto market cycle is very apparent, currently in the period following Bitcoin's halving, which is typically a bull market for 2-3 years followed by a bear market for 1-2 years.

However, while the Bitcoin halving cycle roughly aligns with the bull and bear cycles of the crypto economy, the former is not the fundamental cause of the latter. The true cause of the bull and bear cycles in the crypto economy is the accumulation and rupture of leverage in the market. The Bitcoin halving is simply a catalyst for capital inflows and the emergence of leverage in the crypto market.

What is the process of the accumulation and rupture of leverage that leads to the cyclical changes in the crypto market? If everyone knows that leverage will eventually rupture, why use leverage in an upward phase? In fact, the underlying laws of the crypto market are similar to those of the traditional economy. Let's first look for patterns in the development of the real economy. In the development of modern economic systems, leverage is bound to appear and must appear.

The fundamental reason is that in an upward phase, the development of social productivity leads to an excessively rapid accumulation of material wealth. To ensure the circulation of the surplus products in the economic system, there must be a sufficient amount of currency. Currency can be issued, but it cannot be issued arbitrarily and infinitely, otherwise the economic order will collapse. However, if the amount of currency cannot meet the circulation needs of the surplus products, it can easily lead to stagnation in economic growth. What to do in such a situation?

Since currency cannot be issued infinitely, the utilization rate of unit funds in the economic system must be increased. The role of leverage is to increase the utilization rate of unit funds. Here's an example: Suppose $1 million can buy a house, and $100,000 can buy a car. The house can be used as collateral for a loan, with a collateralization rate of 60%, meaning the house can be used to borrow $600,000. If you have $1 million and no leverage, you can only choose to buy 1 house or 10 cars; with leverage, you can buy 1 house and 6 cars, effectively spending your $1 million as if it were $1.6 million. From the perspective of the entire economic system, without leverage, the circulation of currency is limited, consumer purchasing power is constrained, market demand cannot grow rapidly, and the supply side naturally will not have high profits, leading to slower or even regressive development of productivity; with leverage, the issue of currency quantity and consumer purchasing power is quickly resolved. Therefore, in an upward phase, leverage accelerates the development of the entire economy. Some may say, isn't this a bubble? It's not a problem. In an upward phase, a large amount of off-market funds and commodities enter the market, and there is no risk of the bubble bursting at this time. This is similar to going long with a contract; in a bull market, there is often no risk of liquidation.

What about in a downward phase? The funds within the economic system are continuously absorbed by leverage, and will eventually be exhausted, leading to a downward phase. In a downward phase, prices will fall, so the collateralized house will no longer be worth $1 million, and the collateralized property will be liquidated. From the perspective of the entire economic system, everyone's assets face liquidation, and the sudden contraction of the circulation of funds that was originally supported by leverage will lead to a rapid decline in the economic system. Using the example of contracts, if you only trade spot without using contracts, when the market is bearish, your assets will only shrink; but if you use contracts and get liquidated, it's not just a shrinkage of assets, but a direct reduction to zero. Therefore, in a downward phase, having leverage will lead to a faster collapse than not having leverage.

From a macro perspective, the appearance of leverage is inevitable, and leverage is not entirely good or entirely bad; it depends on which phase of the cycle it is in. Returning to the macro impact of Restaking, the leverage within the ETH ecosystem plays a very important role in driving the bull and bear cycles, and its appearance is inevitable. In each cycle, leverage will inevitably appear in the market in some form. The so-called DeFi Summer in the previous cycle was essentially the two-pool mining of LP Tokens, which greatly fueled the bull market in 2021. This round's catalyst for the bull market may have become Restaking, although the mechanisms may appear different, the economic essence is the same, both are for the purpose of digesting the influx of capital in the market and meeting the demand for currency circulation through leverage.

Based on the discussion of the interaction between leverage and cycles above, this multi-layered leverage of Restaking may accelerate the speed of the current bull market phase and raise the peak, while also intensifying the decline of the current cycle's bear market phase, leading to a more widespread chain reaction and greater impact.

Conclusion

Restaking is a secondary derivative of the PoS mechanism. Technically, Eigenlayer uses the value of restaking to maintain the economic security of AVS, using the mechanism of staking and slashing to achieve "easy borrowing and easy repayment." The redemption window for staked funds not only allows sufficient time for checking the reliability of Operator behavior, but also prevents a large amount of funds from being withdrawn in a short period, which could lead to market and system collapse.

In terms of its impact on the market, it needs to be analyzed from both micro and macro perspectives. From a micro perspective, Restaking provides liquidity and returns to the Ethereum ecosystem, but also brings some risks, which can be mitigated through parameter adjustments and flexible rules. From a macro perspective, Restaking is essentially a form of multi-layered leverage, exacerbating the overall economic evolution of the cryptocurrency market, creating a significant bubble, and making the upward and downward movements of cryptocurrencies more rapid and intense. There is a high likelihood that this macroeconomic impact is a key factor in the leverage rupture and transition to a bear market in this cycle, and this macroeconomic impact is in line with underlying economic laws and cannot be changed, only adapted to.

We need to understand the impact of Restaking on the entire crypto space, and utilize its dividends in the upward phase, while preparing for the rupture of leverage and market decline in the downward phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。