Here's the complete translation:

Preface:

The name of the Entangle project is derived from "Quantum entanglement," reflecting the project's vision of building connections, associations, and interconnections. Similar to how quantum entanglement links different particles together, Entangle aims to connect different blockchain networks together through its cross-chain liquidity and synthetic derivatives solutions, creating a unified and interconnected Web3 ecosystem.

Sharding Capital invested in Entangle in July 2023, participating in both the seed and private rounds. The current return on investment is approximately 100x, with realized returns of 3-4x. Investing in Entangle is highly attractive due to its innovative solutions, robust ecosystem and partnerships, technical strength and team background, as well as market demand and potential applications, all providing a solid foundation for the project's development.

As a global market, the cryptocurrency and blockchain industry is constantly iterating and optimizing. New blockchains, projects, and technologies are rapidly increasing, fragmenting the entire crypto market into numerous isolated islands. The fragmentation between chains and projects is an undeniable fact, and the crypto space faces severe issues of fragmentation and interoperability. Cross-chain communication and seamless liquidity management are critical issues that need to be urgently addressed at the current stage of blockchain development.

Entangle, as an innovative project aimed at addressing these challenges, not only provides technical solutions but has also made significant progress in its ecosystem and product suite.

As Entangle is about to launch its mainnet at the end of this month, this article will delve into why Sharding Capital invested in Entangle.

Innovative Solutions

The cryptocurrency and blockchain ecosystem consists of multiple independent networks and chains, lacking effective interoperability and connectivity, resulting in users and assets being unable to flow between different chains. This fragmentation not only limits user choice and flexibility but also increases the complexity of cross-chain interactions, hindering the overall development and maturity of the ecosystem.

Entangle, through several innovative components, helps address the fragmentation issues in the crypto market and provides seamless cross-chain interoperability and liquidity management for users and developers.

Photon Messaging: A customizable, high-speed, and cost-effective full-chain messaging solution. Photon Messaging allows for rapid messaging between any EVM or non-EVM networks, making communication between different chains more convenient and efficient.

Universal Data Source: This is a low-latency, cost-effective data infrastructure compatible with any Web2 or Web3 data source. The universal data source simplifies data sharing and exchange between different chains, providing developers with more flexibility and choices.

Liquid Vaults and Synthetic Vaults: These provide solutions for cross-chain liquidity management and synthetic assets. Users can manage and trade assets in these Vaults without worrying about barriers between different chains, thereby enhancing asset liquidity and flexibility.

Cross-Chain Liquidity and Synthetic Derivatives

Entangle is positioned as a full-chain connector in the Web3 ecosystem, providing developers with a powerful infrastructure and tools to build in this dynamic environment.

Entangle's Liquid Vaults and Synthetic Vaults offer solutions for cross-chain liquidity management and synthetic assets, utilizing synthetic derivatives to coordinate liquidity and add value to the general Layer1 and Layer2 ecosystems.

Entangle DEX allows users to exchange between USDC and LSD, and create, trade, and manage their LSD. Entangle DEX also supports cross-chain exchanges through Entangle Oracle.

Synthetic derivatives are financial products created synthetically, with their value derived from an underlying asset or index, but without directly holding that asset. The combination of cross-chain liquidity and synthetic derivatives provides users with more investment and trading choices. Users can seamlessly transfer assets between different chains using cross-chain liquidity while tracking and trading various asset price movements on different chains using synthetic derivatives. This combination provides users with more flexibility and choices and helps improve the overall liquidity and efficiency of the entire DeFi ecosystem.

Market Demand and Potential Applications

As an innovative project dedicated to addressing key issues in the cryptocurrency and blockchain space, Entangle has broad market demand and potential applications.

- Addressing cross-chain communication and interoperability issues

- Enhancing the liquidity and efficiency of the DeFi ecosystem

- Providing more investment and trading choices

- Reducing transaction costs and risks

- Meeting the growing market demand

Through the infrastructure provided by Entangle, users and developers are offered an efficient and flexible solution. As the cryptocurrency and blockchain space continues to evolve, Entangle is poised to become a unified Web3 foundational layer.

Robust Ecosystem and Partnerships

Entangle has established strategic partnerships with industry leaders including Arbitrum, Mantle, Linea, AAVE, Polygon, Stargate, Velodrome, SushiSwap, integrating 42+ DApps and 16+ blockchains.

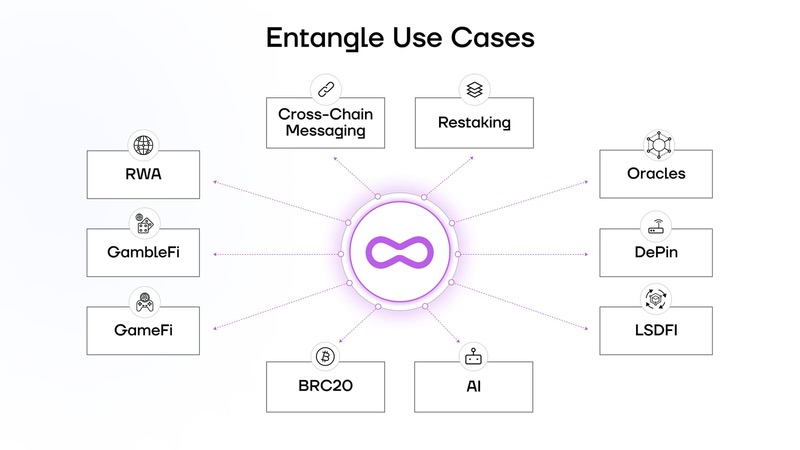

Entangle has made significant progress in establishing its position in key blockchain ecosystems. In this process, it has unlocked various use cases covering various Layer1 and Layer2 networks, DeFi protocols, real-world assets (RWA), GameFi, DEPin, AI, and more.

Invest Now, Shape the Future

In Sharding Capital's investment decision in Entangle, they see a revolutionary force that is not only driven by innovative technology but also by a profound understanding of the overall direction of the cryptocurrency and blockchain industry. As an institution dedicated to exploring and investing in innovative projects, Sharding Capital firmly believes that Entangle's full-chain liquidity infrastructure will become a crucial pillar of the future cryptocurrency and blockchain industry.

As the cryptocurrency and blockchain space rapidly develops, Entangle will continue to play its unique role, promoting cross-chain communication and seamless liquidity management, providing a unified and interconnected Web3 ecosystem for users and developers. Sharding Capital will continue to closely monitor the development of the Entangle project and take pride in its future success.

Investing in Entangle is an investment in the future, a future built on innovation, interconnection, and mutual benefit. In this vibrant and opportunistic world of cryptocurrency and blockchain, Entangle will continue to play a crucial role and lead the industry's development direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。