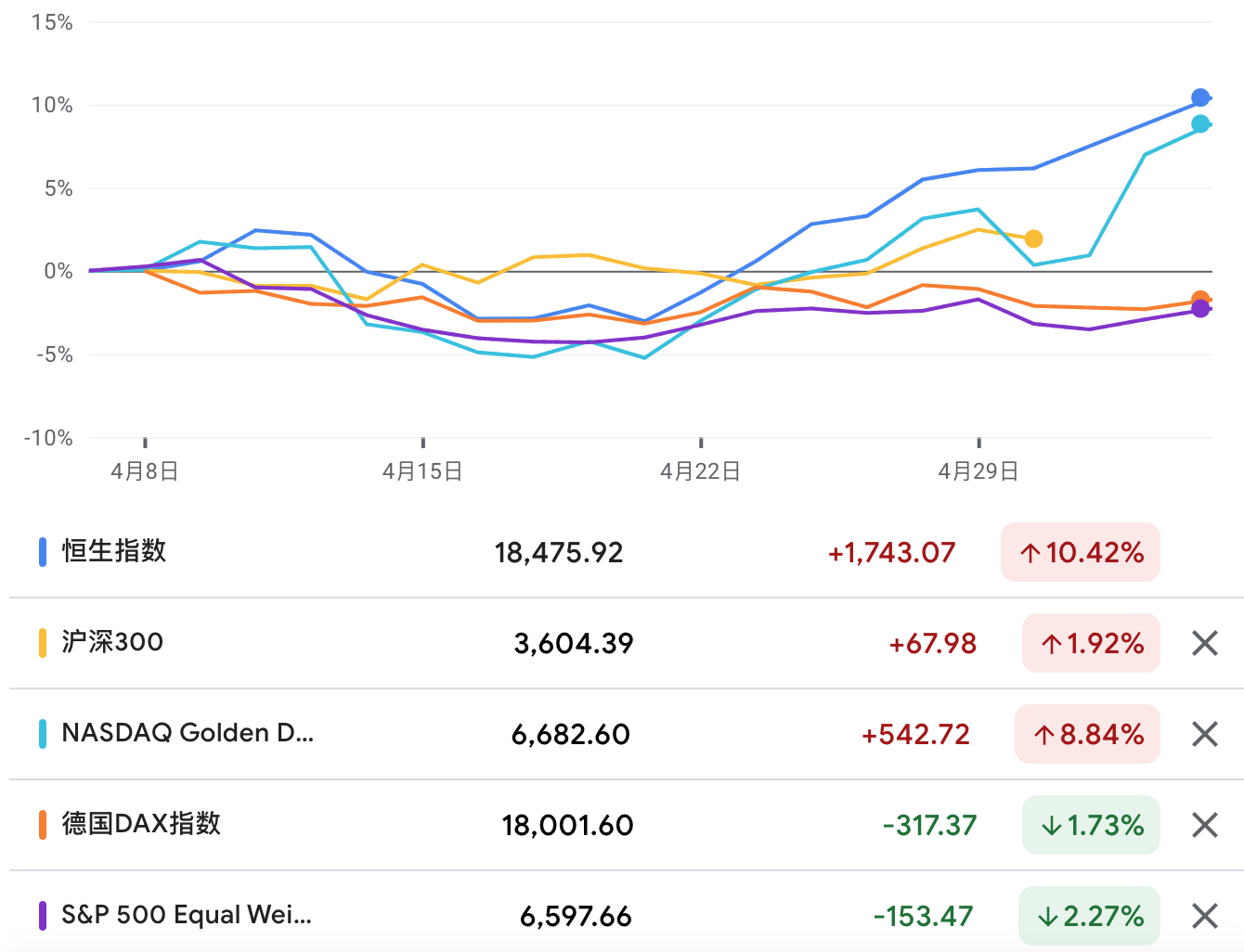

Last week, global risk assets markets rose across the board, with the SP500 up 0.5%, Nas100 up 1%, Hang Seng Index and CSI 300 up 4.7% and 0.6% respectively, and the Nikkei 225 and Korea Composite Index both up 0.8%. Most major government bond yields fell, with the 10-year US Treasury yield falling sharply by 17 basis points to 4.50%. The release of several key data and policies has temporarily settled market uncertainty about interest rates, enhancing market expectations of a possible slowdown in inflation, providing the Federal Reserve with room for rate cuts, and thus entering a round of valuation repair/oversold rebound market.

Reassuring factors for the market include lower-than-expected US non-farm payroll reports, ISM manufacturing PMI, and service sector indices, dovish signals from the FOMC and Powell, Apple and Amazon's billion-dollar buybacks and strong financial reports, and talks between Hamas and Israel under the mediation of major powers. Slightly unsettling factors include the ECI labor cost and the Treasury Department's quarterly debt issuance exceeding expectations.

First of all, contrary to Wall Street's expectations, the US Treasury not only did not cut, but instead significantly raised the expected size of this quarter's borrowing by 20% to $243 billion, and raised the cash balance at the end of the third quarter from $750 billion to $850 billion. These pieces of information all indicate that the volume of future bond issuance will increase, further draining market liquidity, and there is also a risk of further upward pressure on bond yields. Regarding this new borrowing plan, the Treasury clarified that it did not take into account the Fed's balance sheet adjustment and still assumed that the Fed would continue to shrink its balance sheet at a rate of $60 billion per month for the next two quarters. Secondly, the Employment Cost Index (ECI) showed a 1.2% increase in the cost index for the first quarter, significantly higher than the expected 0.9%. The annual increase was 4.2%, also higher than the expected 4.0%, and consistent with the previous quarter. The limited downward trend in wages suggests that the Fed needs this figure to be between 3% and 3.5% to meet the 2% inflation target, which has led the market to anticipate a higher possibility of a hawkish stance from Powell on Wednesday, which may have been the background for the market's sharp decline in the first half of this week. (The good news is that long-term bonds will not have a particularly large adjustment, and a small-scale high-cost bond buyback plan has been announced.)

However, unexpectedly, both the FOMC statement and Powell's Q&A were dovish. First, the Fed's statement made no hint about the future trend of inflation, even though the data showed stubborn inflation. The dovish aspect was also in the Fed's decision to slow down the balance sheet reduction. This time, the Fed decided to start slowing down the balance sheet in June, reducing it from the original $60 billion to $25 billion, which is more than the market's expectations. Previously, the Fed had expressed that most officials were inclined to halve it, which is $30 billion. Although the additional $5 billion has little impact, it can easily be interpreted as a dovish signal. Secondly, at the press conference, Powell first denied the idea of future rate hikes, emphasized that policy is already sufficiently tight, and pointed out that the labor market has loosened, among other things, which are the current officials' inclinations. Powell also mentioned the lag in housing inflation, indicating that as long as housing inflation remains low, it will eventually come down, but it is unclear when. So the press conference was also dovish and did not hedge the dovish statement as it sometimes does.

In terms of data, the US non-farm payroll report for April increased by 175,000, lower than the market's expected 240,000, and the unemployment rate rose slightly to 3.9%, while average hourly earnings growth was lower than expected, with a monthly growth rate of 0.20%, lower than the expected 0.3%. Finally, the market saw a situation where all three core sub-items weakened, combined with JOLTS job vacancies falling to a three-year low, indicating that the tight labor market situation may be easing. Combined with the dual decline in April ISM PMI and the dovish Fed the day before, the market confirmed a reversal in sentiment. We saw stocks, cryptocurrencies, and bonds surge, while the US dollar, gold, and oil weakened.

It is worth noting that temporary employment services saw the largest decline of 16,000. Temporary workers are usually considered a leading indicator of the job market, as when demand begins to decline, temporary services are the first to be reduced. Over the past few months, temporary vacancies have been declining, but have been overlooked due to the overall strong employment. From first-quarter GDP to the performance of consumer companies such as McDonald's and Starbucks and management statements (consumer fatigue), to this non-farm payroll and PMI, more and more data indicate that the economy may not be as strong as it seems. In other words, we should now start paying attention to the possibility of an economic downturn, which could affect the investment logic for the entire year. (But at this stage, it is still a debate between a soft landing and re-inflation)

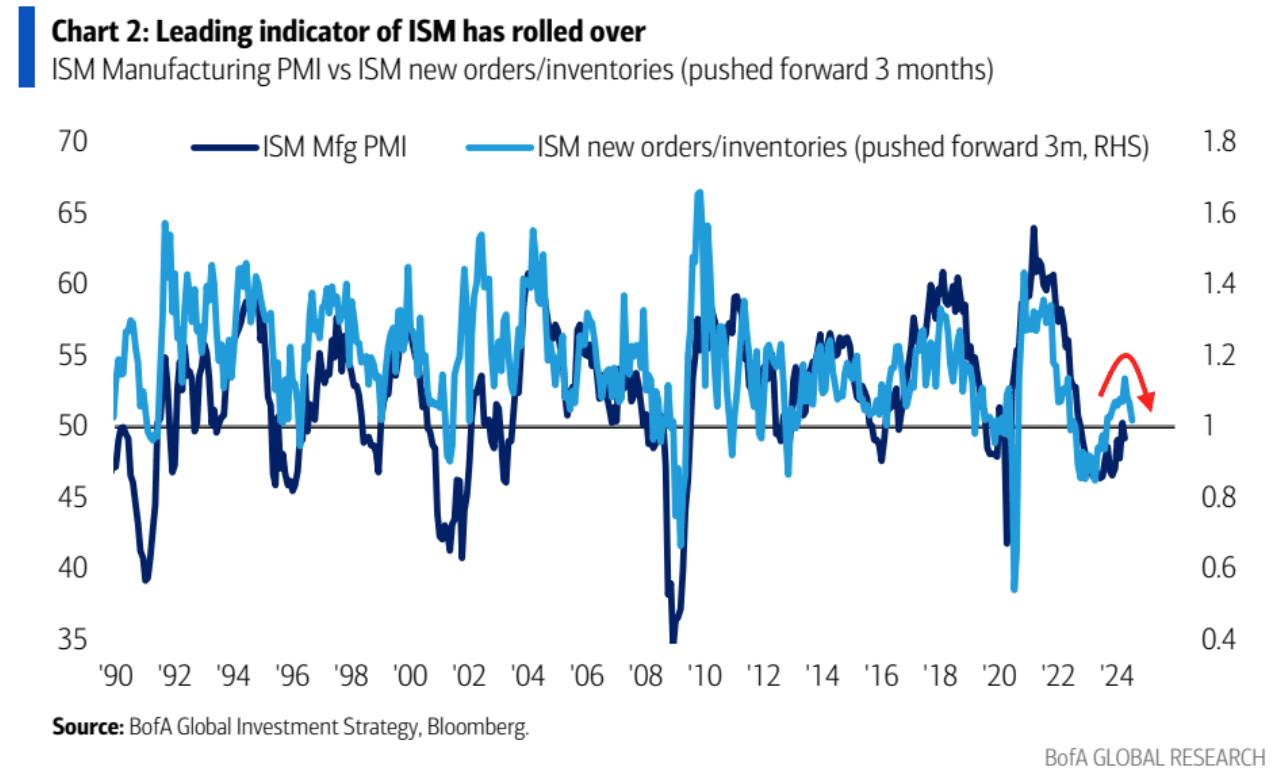

For example, the leading indicator ISM new orders index has declined for three consecutive months.

For the market, bad news has turned into good news, and the interest rate market is now fully priced in for two rate cuts by 2024 and an additional three rate cuts by 2025:

The first rate cut is expected to be confirmed in September:

In addition, due to reports of easing geopolitical tensions, a slowing US economy, and EIA crude oil inventories exceeding expectations, crude oil fell by 7%, and gold fell by 1.4% to $2301 per ounce.

Efforts to reach a ceasefire and release hostages in Gaza have made slight progress: Both sides resumed negotiations in Cairo on Saturday. However, there are still significant differences between the two sides. Hamas demands that any agreement must be conditional on ending the Gaza war, while Israel demands the release of hostages and the permanent disarmament and dissolution of Hamas.

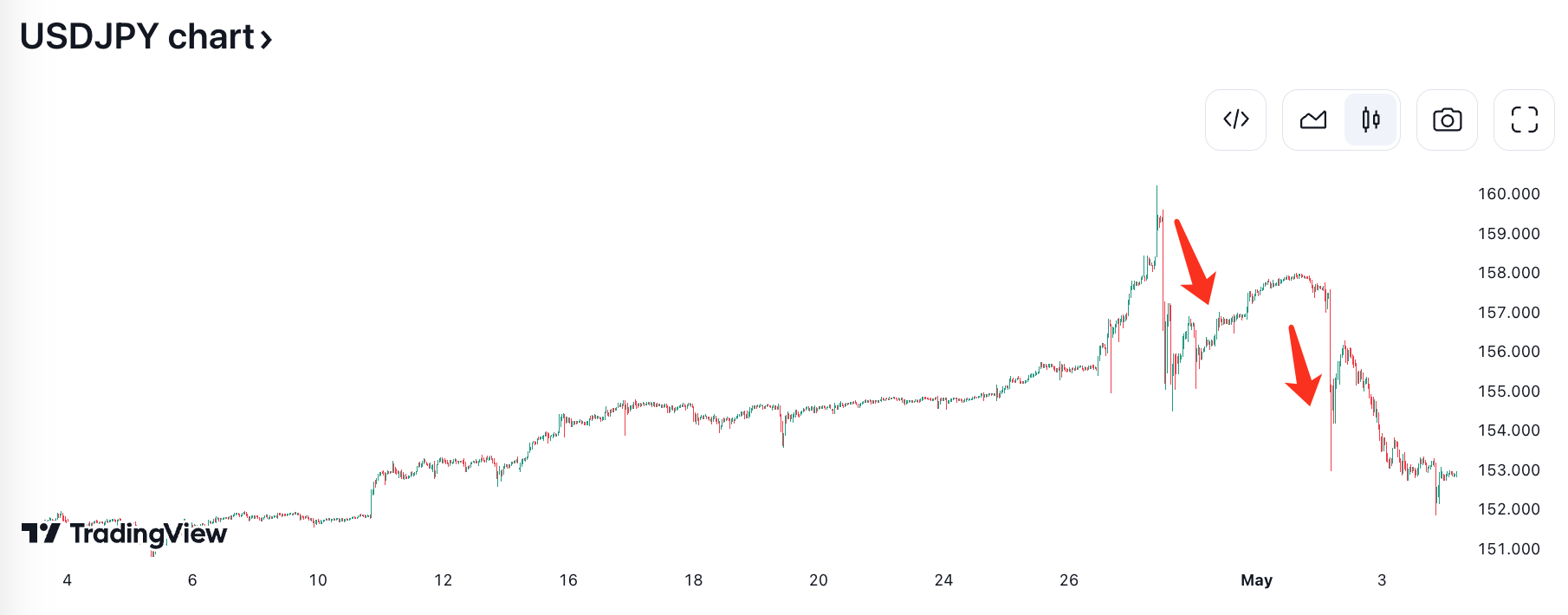

The yen fluctuated significantly, and the Bank of Japan may intervene: On April 29, the yen briefly fell below 160, then rose to around 156. On April 30, the Bank of Japan said that its current account surplus may decrease by 7.56 trillion yen, significantly higher than market expectations, indicating that the Bank of Japan may have intervened in the exchange rate by about 5.5 trillion yen.

However, government intervention has once again proven to be ineffective, costing $35 billion to pull the exchange rate back from 160 to 156, and the subsequent further upward movement of the yen exchange rate was still driven by the aforementioned factors.

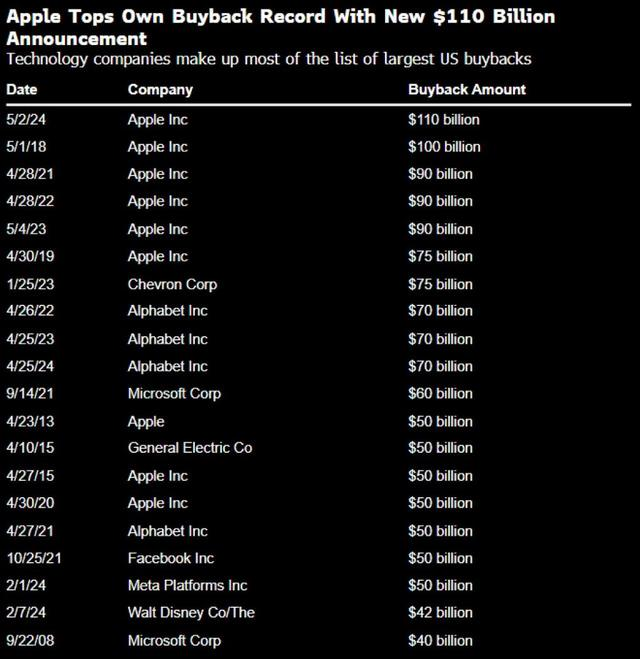

[Apple: $110 billion buyback, 4% dividend yield]

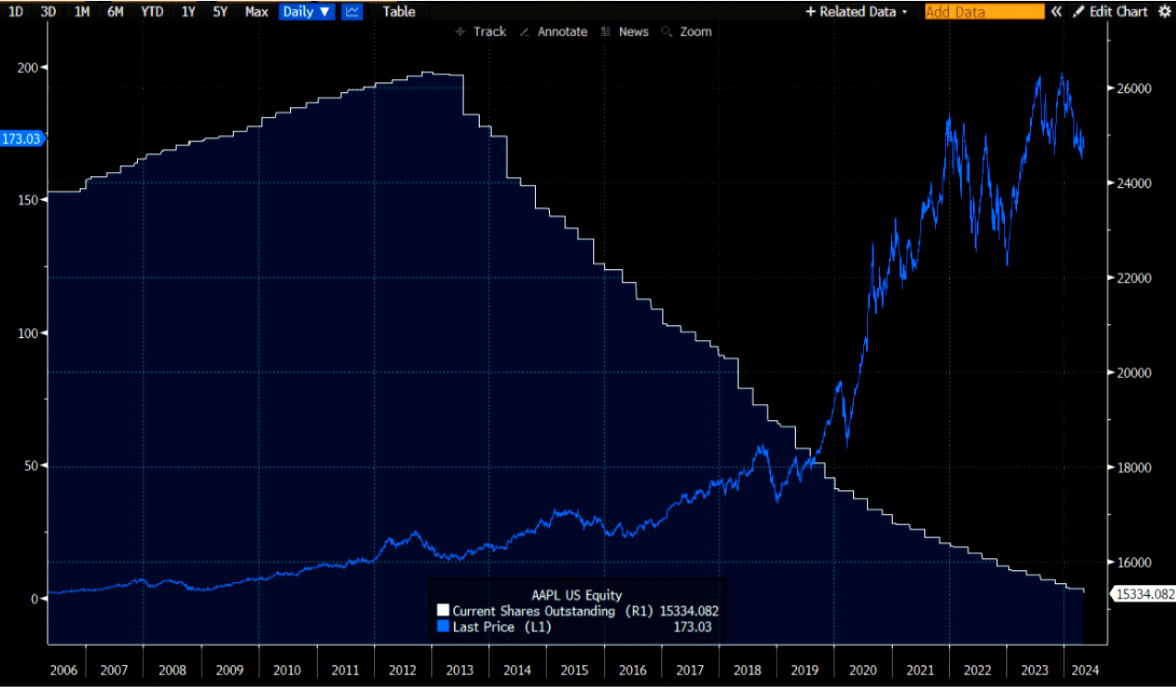

Apple announced better-than-expected second-quarter results (market expectations were pessimistic due to weak iPhone revenue) and announced the largest stock buyback plan in US history of $110 billion, while also increasing the dividend by 4% to $0.25 per share. Apple's stock price jumped 6%. Apple broke its previous record for the largest buyback and achieved 12 consecutive quarters of dividend increases. Analysts believe that this move may indicate that Apple is becoming a value stock that returns capital to shareholders, rather than a high-growth stock that needs cash for research and expansion. (By the way, there are plenty of A-share dividend yields higher than 4%, and many have fallen below net assets)

As of the release of the financial report, Apple's stock price had fallen by more than 8%, far less than the 6% increase in the S&P 500 index:

On the 7th of this week, Apple plans to launch a new iPad, which may help boost future iPad sales. The company has not released a new model since 2022, which may be why iPad revenue has been relatively weak. Next month is Apple's developer conference, where investors will be very interested in Apple's AI strategy, and whether this new strategy can help Apple find new growth points is worth paying attention to.

[Tesla failed to continue the strong rebound from the previous week, falling 3.7% last week]

The focus before was that China gave Tesla the green light for its Full Self-Driving (FSD) feature, although the specific details are still unknown. After returning to the US from Beijing, Musk suddenly disbanded the entire company's Supercharger team and decided not to push forward with the next-generation integrated casting GIGCASTING plan, casting uncertainty over the company's prospects.

Currently, purchasing FSD in China requires 64,000 RMB, approximately $8,840, which is relatively high. In addition, according to an article from 36Kr, Tesla's FSD is mainly trained using overseas data, and it may not perform well in China. The initial novelty may help boost Tesla's revenue, but the sustainability of this performance will depend on FSD's performance on Chinese roads. The article also mentioned that Chinese roads are much more complex than those in the US, requiring much more training, but Tesla's Shanghai data center cannot connect to US supercomputers, and Nvidia's GPUs are also restricted, so there is no way to fully unleash its potential. On the other hand, Chinese domestic training data is much higher, so although Tesla is indeed ahead in technology, it may not necessarily have a decisive advantage.

Tesla's business scope is actually very wide, including automobiles, energy, batteries, autonomous driving, and robotics, all of which require continuous investment. From the last financial report, it can be seen that Tesla's free cash flow is negative, with AI capital expenditures consuming $1 billion, overall cash position decreasing by $2.2 billion, and the company currently has $26.9 billion in cash. Although it is not yet a problem, this trend is not good. Furthermore, the company's largest automotive business growth is weak, with a significant decline in profits, and it seems difficult to improve in the near future. With expenses continuing while income decreases significantly, it is necessary to re-prioritize each business.

S&P 500 +568%, Berkshire Hathaway +554%

[Coinbase's first-quarter report exceeds expectations, ETF drives institutional trading volume to a record high]

Thanks to the rebound in Bitcoin prices and the listing of spot ETFs, the largest cryptocurrency exchange in the US saw its first-quarter performance double year-on-year, with net profit turning from a loss to a profit, far exceeding expectations.

After the US stock market closed on Thursday, May 2, Coinbase released its first-quarter financial report for the 2024 fiscal year. The report showed that the company achieved first-quarter revenue of $1.64 billion, exceeding the expected $1.34 billion, a year-on-year increase of 113%. With the support of $737 million in unrealized gains from holding cryptocurrency assets, Coinbase achieved a net profit of $1.18 billion in the first quarter, marking the second consecutive quarter of profitability, a year-on-year turnaround from a loss of $78.9 million in the same period last year.

After the financial report was released, Coinbase saw a small increase, but still fell 2.8% for the entire week. The company's stock price has risen by over 45% since the beginning of the year.

Cryptocurrency Market Overview

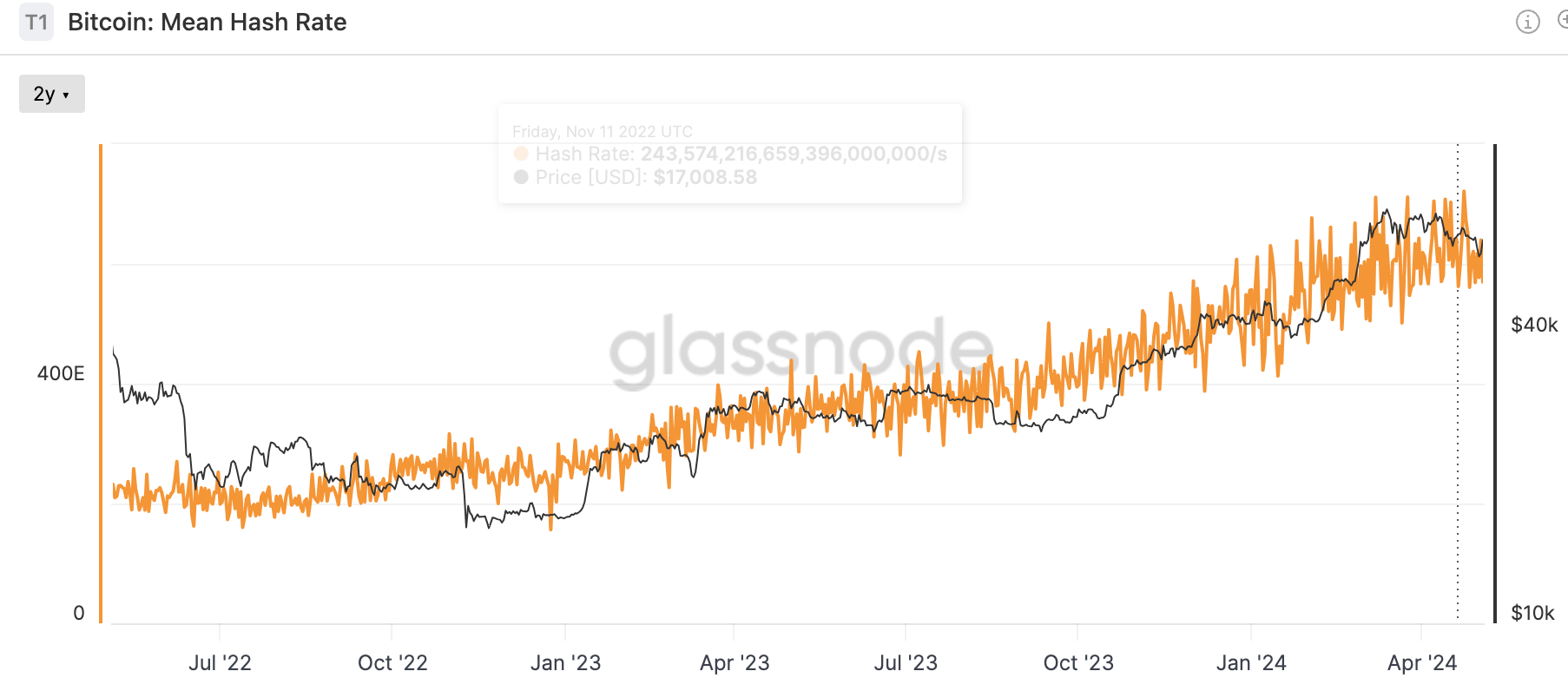

Bitcoin's hash rate continues to remain high:

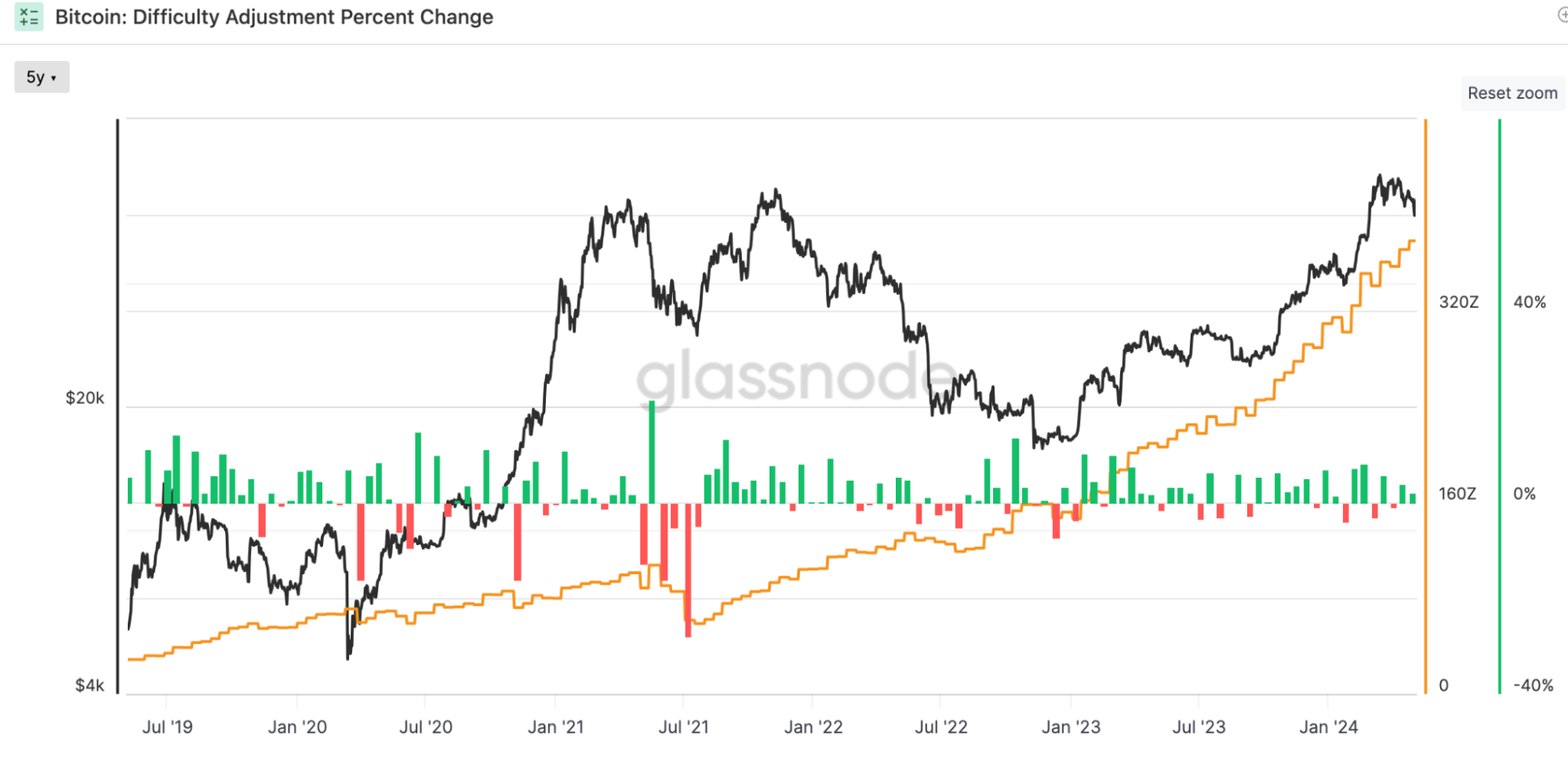

Mining difficulty has been raised twice after the halving:

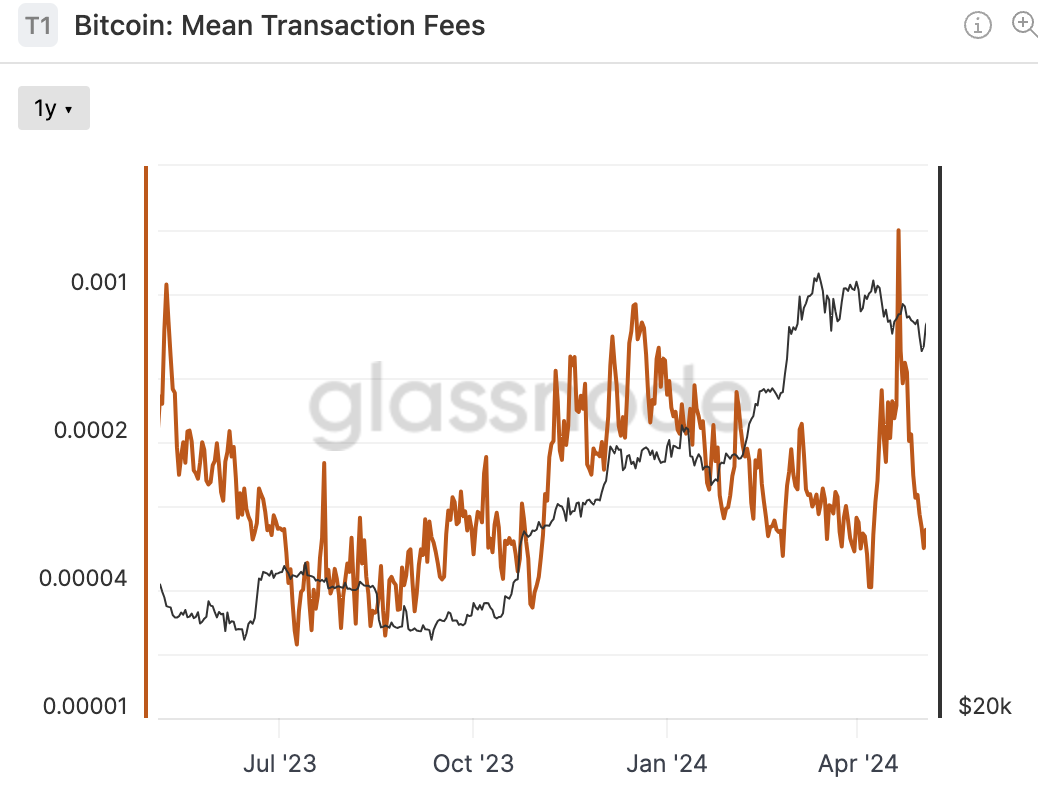

NFTs have had a brief moment of popularity:

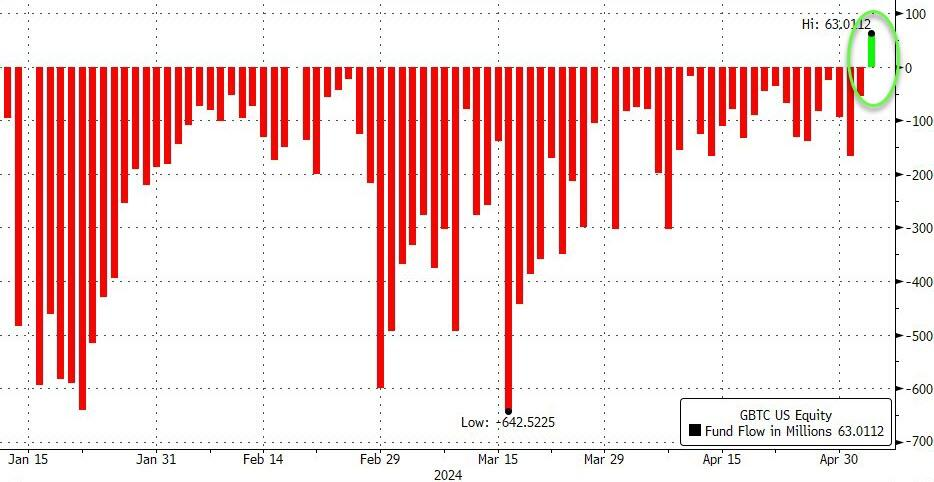

GBTC is the main source of selling pressure for all spot Bitcoin ETFs, but the trend unexpectedly changed: since the launch of spot Bitcoin ETFs, GBTC saw net inflows of $63 million (1020 BTC) for the first time on Friday.

Although there was a net outflow overall last week, net inflows jumped to $380 million on Friday, the largest since March 26. On Wednesday, investors sold US spot Bitcoin ETFs at the fastest pace ever. These 11 ETFs saw a total net outflow of $563.7 million.

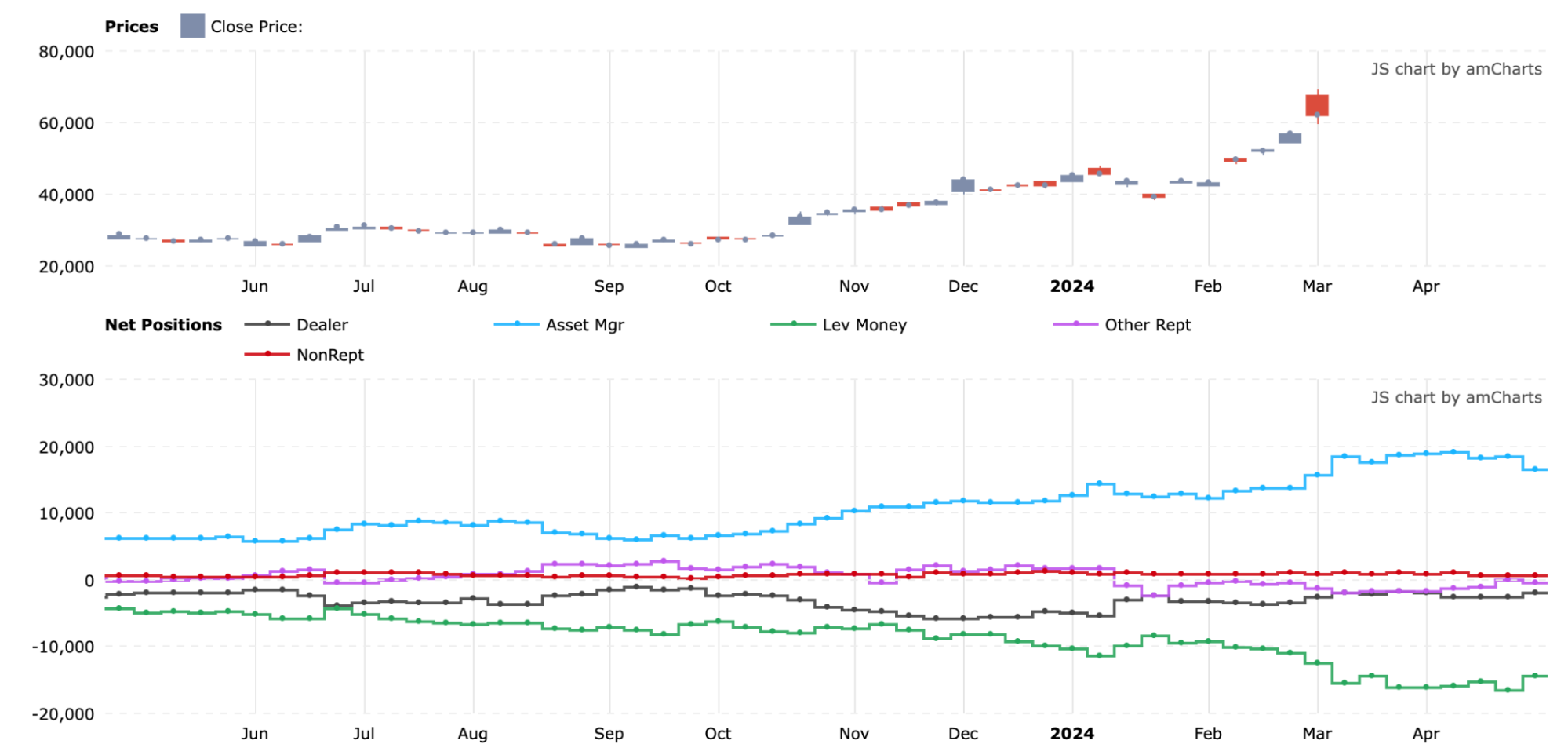

CME futures market hedge funds began to reduce their record net short positions last week, bringing the net short back to the level of 7 weeks ago:

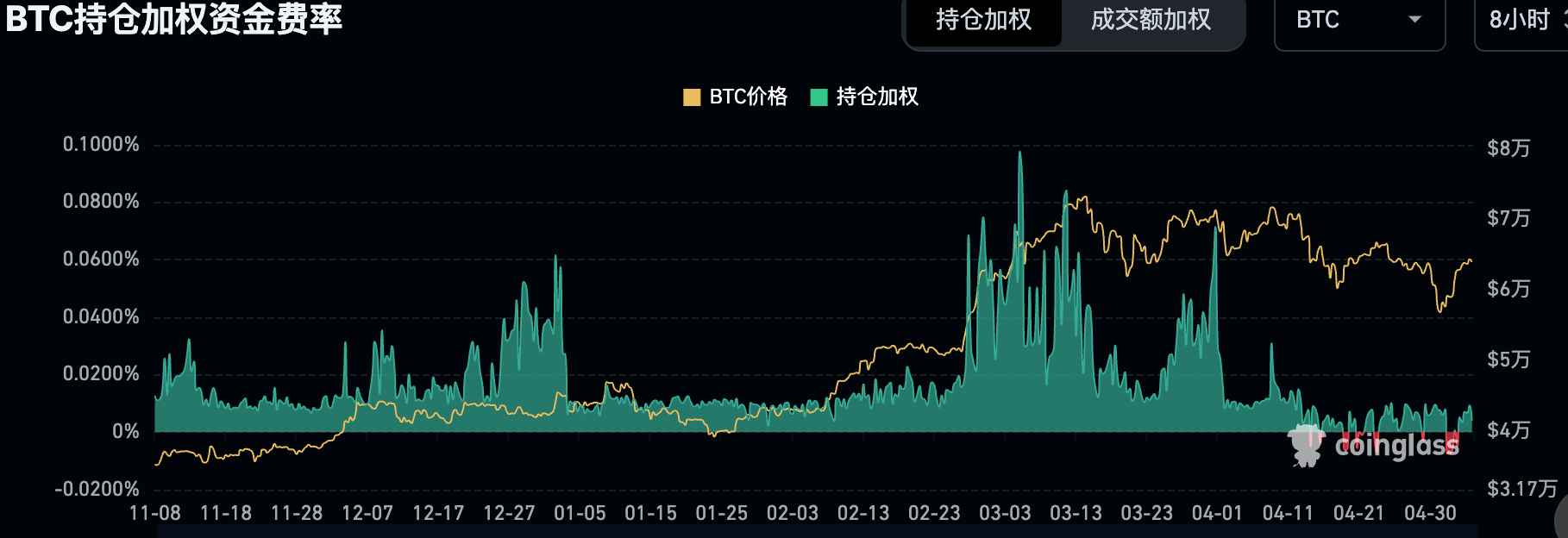

The contract market fee rate remains at a low level in this round of bull market, and last week saw the deepest negative value:

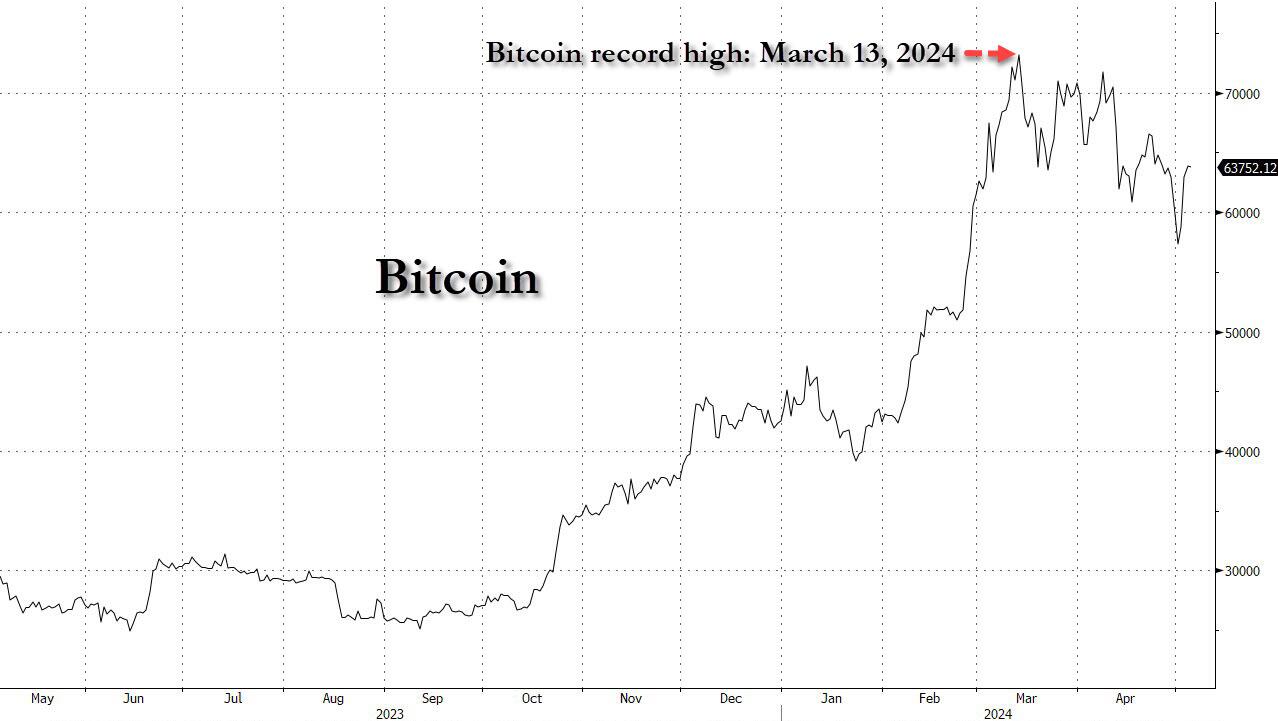

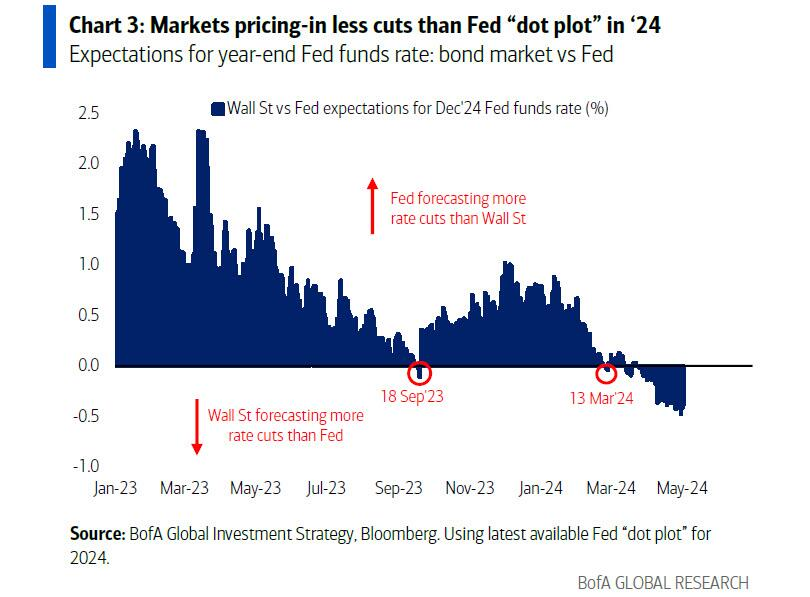

March 13 marked the shift in market pricing from more rate cuts to a lower rate cut than the "dot plot" of the Federal Reserve, and on this day, Bitcoin hit a historical high of $73,157.

Cryptocurrency News Worth Noting:

Fidelity Digital Assets Vice President Manuel Nordeste stated at an event in London that they are collaborating with pension funds interested in allocating Bitcoin.

Bitwise CEO Hunter Horseley stated, "Many traditional and reputable companies have begun to engage in Bitcoin business in unprecedented ways."

[BlackRock](https://flight.beehiiv.net/v2/clicks/eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJ1cmwiOiJodHRwczovL3d3dy5jb2luZGVzay5jb20vYnVzaW5lc3MvMjAyNC8wNS8wMi9ibGFja3JvY2stc2Vlcy1zb3ZlcmVpZ24td2VhbHRoLWZ1bmRzLXBlbnNpb25zLWNvbWluZy10by1iaXRjb2luLWV0ZnMvP3V0bV9zb3VyY2U9Zmxvd3MuaGV5YXBvbGxvLmNvbSZ1dG1fbWVkaXVtPXJlZmVycmFsJnV0bV9jYW1wYWlnbj1zYXR1cmRheS1iaXRjb2luLWZsb3dzIiwicG9zdF9pZCI6IjEwYWI4YzYwLWJkM2ItNDIxYi05N2U3LTNhZTY3ZGY4ZjNmZiIsInB1YmxpY2l0aW9uX2lkIjoiOTNkNmE4ZWItZTA4Yy00ZWUxLThiMzktYjQwZjYzNWNlZTU0IiwidmlzaXRfdG9rZW4iOiI4ZmU2ZjRhMC04YWU2LTQzZjEtYjhiMi04Y2I0MmM0MzY1N2EiLCJpYXQiOjE3MTQ5Mjc4NjksImlzcyI6Im9yY2hpZCJ9.8Jz3Z3Z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3z3

A BTC ETF whale has emerged in Hong Kong, named Ovata Capital Management. The fund is distributed across four different US stock ETFs, with a total allocation of 60 million USD. They stated that their goal is to "generate absolute returns unrelated to overall stock performance".

A well-known European institution disclosed its BTC holdings in the 13F filing: Swiss bank Lombard Odier ($209B AUM) holds 1.5 million USD of IBIT; and BNP Paribas in France bought 1030 shares of IBIT in the first quarter as tokenized shares.

[Overseas Hot Discussion 'ABC']

Recently, as the financial reporting season comes to a close and the political bureau meeting sets the tone, expectations for easing and reform are strengthening. The space for speculation in US stocks is narrowing, and global funds have a strong willingness to allocate to undervalued Chinese assets. The risk appetite in the Chinese market has significantly increased, and the ABC strategy, which was a big failure last fall and winter, is now being discussed:

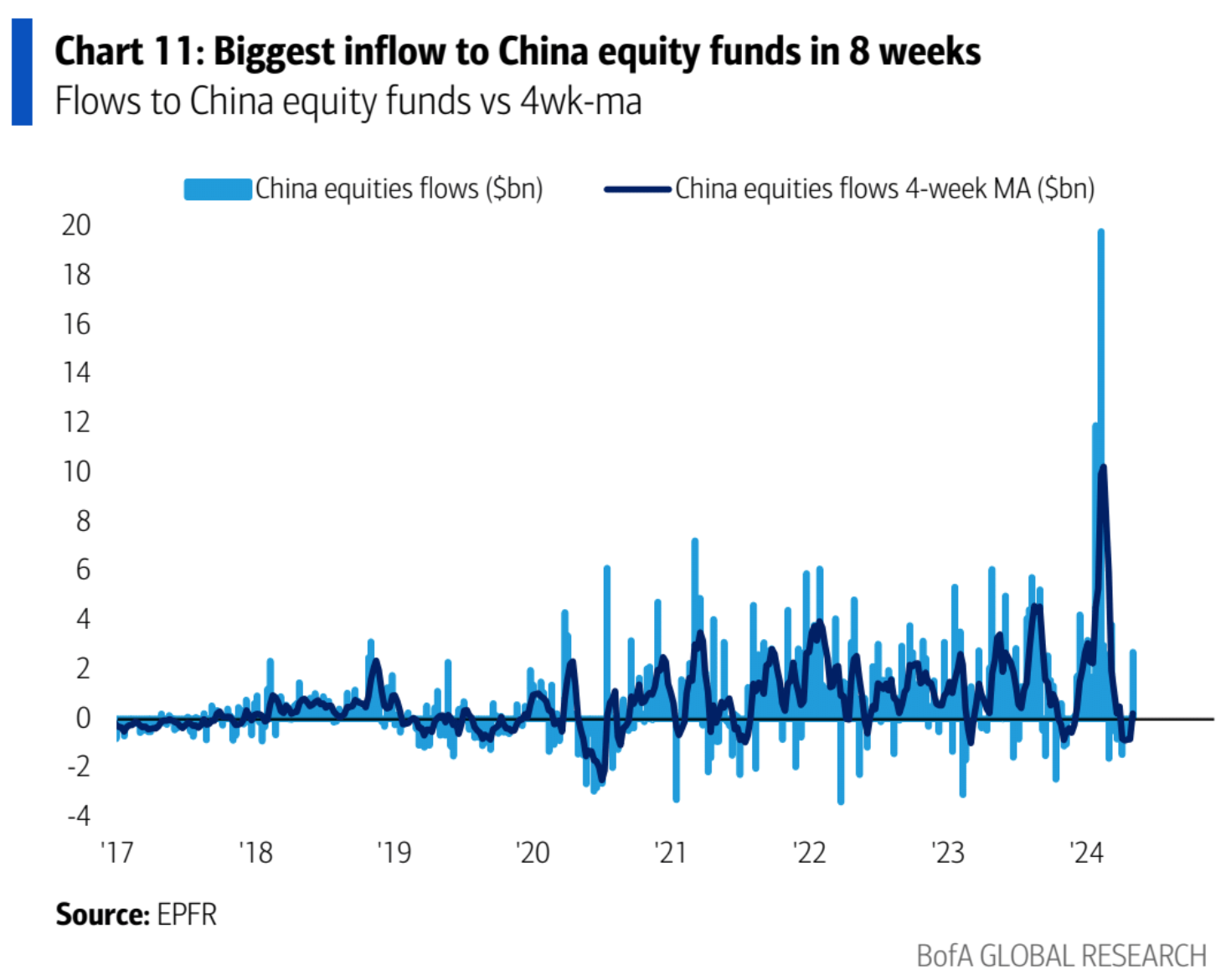

EPFR's inflow of funds into China turned positive and reached the largest net inflow in 8 weeks:

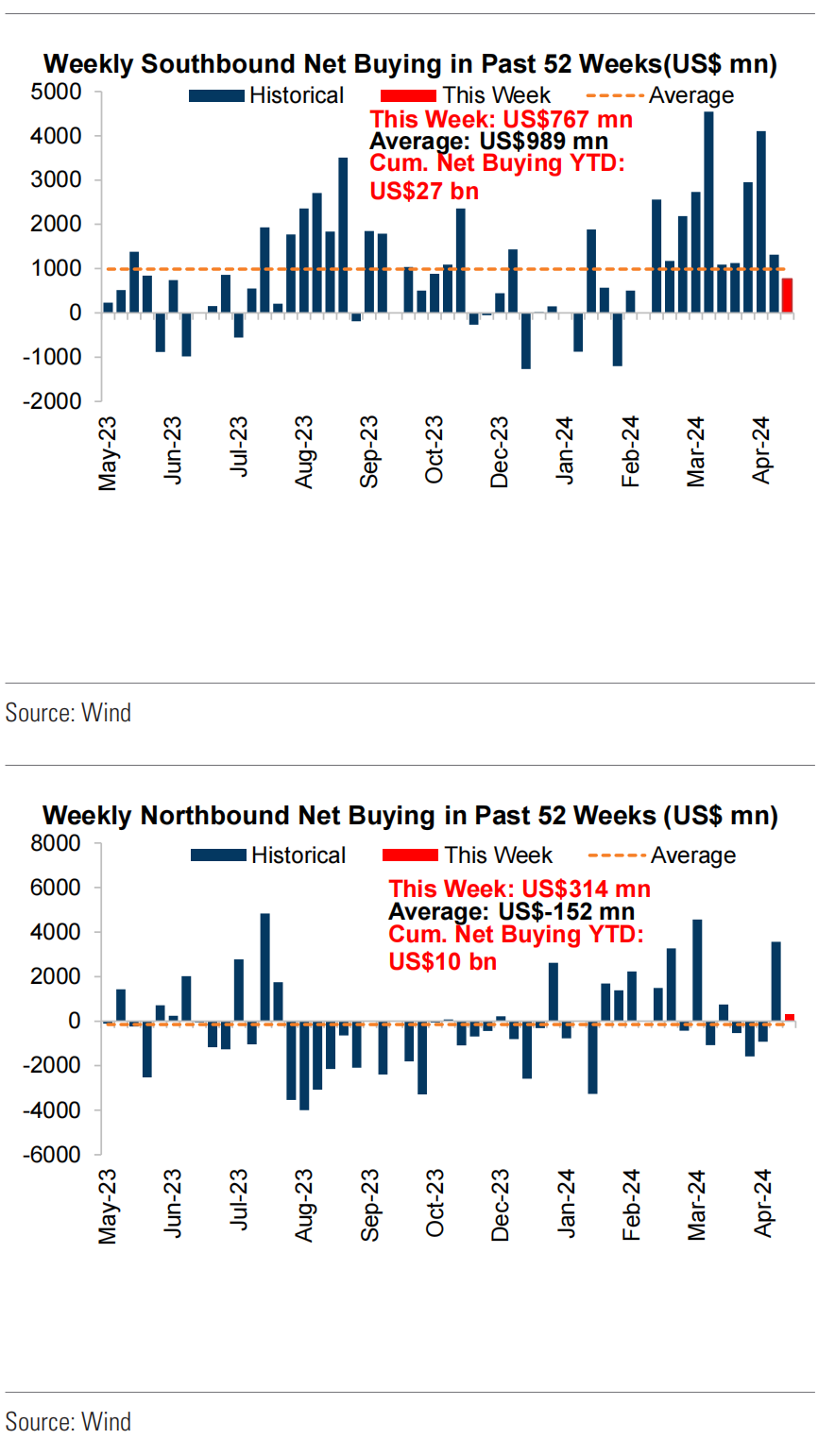

One week behind the northbound funds, there has been a 5-week hiatus:

This week is relatively quiet in terms of macro data, with a focus on speeches by several Federal Reserve officials and the progress of the Gaza ceasefire agreement. If there are no surprises, the upward trend may continue moderately.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。