The author believes that the current failure of the cryptocurrency investment cycle is due to the market model depriving retail investors of unlimited profit opportunities and promoting the decoupling between venture capital and retail.

Author: @reganbozman

Plain Blockchain Translation

Why is this cryptocurrency cycle considered a failure? Why is everyone feeling the pain?

We can attribute all the problems to one fact: Retail investors (individual investors) cannot truly profit in the current market structure.

Here are some thoughts from @reganbozman on returning to the origin and improving the current cycle:

The reason for the absence of retail investors in this cycle is very straightforward. It is because in the traditional cryptocurrency market, such as infrastructure tokens, there are no longer returns of 500 times. Now, a more interesting casino and a better meme culture are waiting for them nearby.

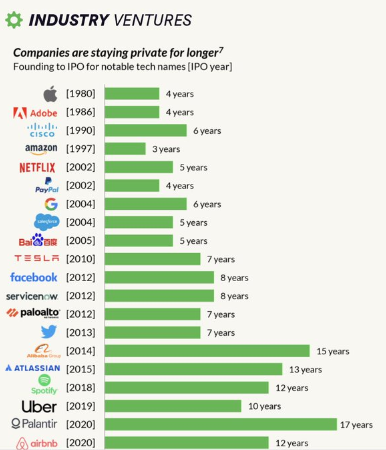

We are essentially repeating what happens in the venture capital/IPO market, the longer a company stays private, the more upside potential is reserved in the "private" (e.g., venture capital funds) domain, which cannot be accessed by retail investors.

Cryptocurrencies have been reversing this trend, democratizing access to asymmetric upside potential. But now it's no longer the case: the amount of funding from venture capital firms for primary and secondary chains has greatly increased; there are no public token sales; venture capital firms make money; retail investors are being neglected; perhaps it's not surprising that retail investors are disillusioned with this cycle.

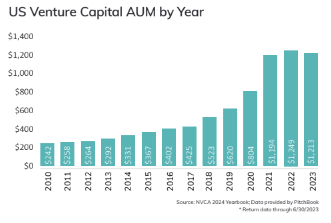

One significant reason companies choose to stay private for longer is that venture capital firms now have five times more funds than ten years ago. Companies can now raise $1 billion or more in the private market without the additional burden of the public market.

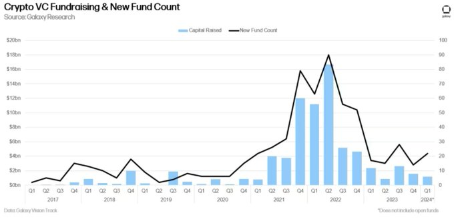

Unsurprisingly, the cryptocurrency venture capital field has also seen a similar trend—compared to five years ago, the size of cryptocurrency venture capital funds has significantly increased.

Cryptocurrencies were supposed to solve this problem! The goal of ICOs (Initial Coin Offerings) was to democratize capital formation and provide opportunities for venture capital returns to be extended. They have indeed been successful in this regard, provided you have a U.S. passport, otherwise you won't be able to share in this success.

During the ICO period in 2014, the price of Ethereum (ETH) was 30 cents per token, and today the price has reached $3,000. This means that investing in Ethereum over 10 years would yield a return of 10,000 times, which absolutely exceeds any venture capital return during the same period. Anyone on Earth could participate, which is truly amazing.

Now, the industry has clearly grown, so the entry prices have naturally risen, but these opportunities have not disappeared. The launch price of SOL (Solana) in 2020 was $0.22, and now the price is $140, which means a return of 636 times in 4 years. This is likely to exceed almost all venture capital returns in the past five years.

In this cycle, we have moved away from this market structure. Now, retail investors have almost no chance to buy tokens before the token sale, nor can they buy tokens at a lower price on the public market.

Airdrops are definitely an improvement on the existing venture capital paradigm, as early users can receive some financial returns. But compared to token sales, airdrops are not as advantageous in financial transactions—by definition, the returns you can get from airdrops are limited.

We have transitioned from a market with no limits to one with limits—this is a huge change. Investing $1,000 in the SOL ICO has now turned into $636,000.

Investing $1,000 in Eigen may only yield a return of $1,030… even if it grows tenfold, it would only be $1,300.

In the previous cycle, you could control your own destiny. In this cycle, you can only wait for Eigen's charity.

Financial nihilism means acknowledging that these markets are always about money. Yes, this funding supports technological development, but it is money that drives the entire process.

If we weaken the role of money, the whole system will collapse. We can take some measures to improve the current project release structure. Ultimately, the key is to create unlimited returns for early users and the community.

That being said, there are larger structural issues in the market. Some primary and secondary chains have raised huge amounts of funding before listing, resulting in valuations of tens of billions of dollars. This brings two problems:

(A) A large amount of selling pressure

(B) Setting a bottom valuation for the project's listing

In my view, the structural problem most token replacements face in this cycle is that the selling pressure from venture capital has not been offset by retail inflows. If $500 million is raised before the project is listed, it will eventually face $500 million in selling pressure (if the token price rises, this number could be even higher).

Raising funds privately at a high valuation means you will try to enter the market at a higher valuation. This may lead to a situation where only a decline is faced. The relationship between venture capital and retail investors does not need to be adversarial, everyone can make money on SOL.

However, if you try to inject too much venture capital into the market and the market's liquidity is not sufficient, this will become even more difficult. It's almost impossible if the unlimited returns for the most important market participants are canceled.

We can blame and argue about the issues with MemeCoins, but this completely ignores the root of the problem. MemeCoins are not the problem, our current market structure is the problem.

Source: https://twitter.com/reganbozman/status/1786436532825645523

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。