Author: Tracer, Crypto KOL

Translation: Felix, PANews

How do market makers "manipulate" the market and profit from it? What are the benefits of traders paying close attention to market makers? Crypto KOL Tracer stated that he made over $130,000 in profit last month by paying attention to market makers. Understanding market psychology and not being influenced by market makers' manipulation is crucial in the current market.

Market makers' behavior typically leads to significant token fluctuations. Learning to understand market makers' actions can lead to greater profits. Below are the "manipulation" methods of market makers shared by Tracer.

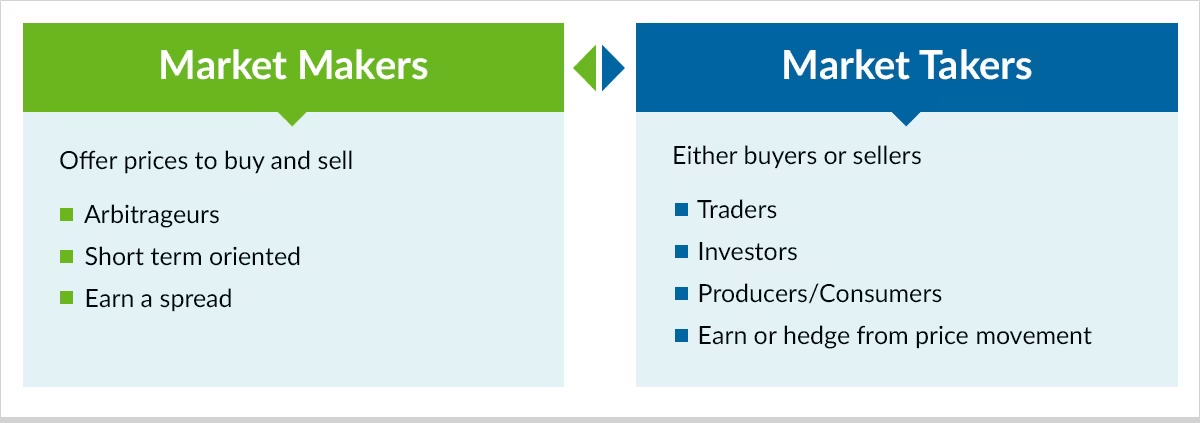

Market makers are companies that enhance market liquidity and depth, with their main task being to create demand and supply. Market makers hold a large amount of tokens and can "manipulate" the market to profit from price differences. Among all market makers, they are usually divided into two types:

- Market makers as project advisors

- Traditional market makers

The ultimate results of the two types are the same, but their tasks are slightly different.

Market makers as project advisors fully assist in project launches. With the help of market makers, projects have achieved success in several key areas:

- Sound token economics and TGE construction

- Successful token listing

- Fundraising from fund institutions

Traditional market makers never get involved in low-market value projects and do not handle a range of tasks:

- Supporting market liquidity

- Narrowing the supply-demand gap

- Promoting efficient trading

The significant market downturn is the "masterpiece" of these market makers.

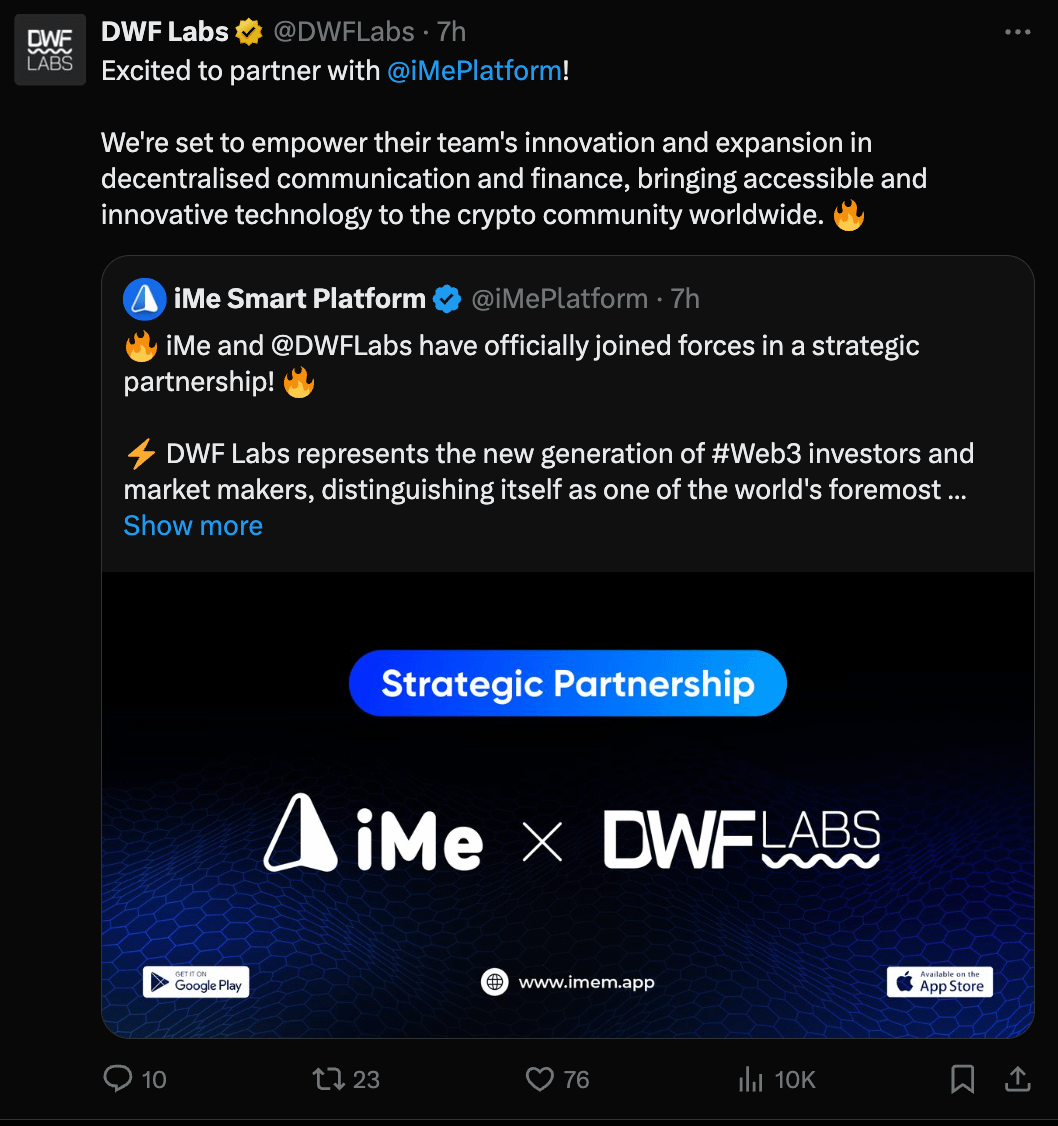

Partnerships are one of the most popular "manipulation" methods. The recent partnership between the messaging intelligence platform iMe Smart Platform and DWF Labs significantly boosted the token price of the project. The LIME token saw a short-term surge of 30%, which is also beneficial for the market makers themselves.

All market makers' strategies depend on market sentiment and trends.

During a bull market, the main task of market makers is to trigger FOMO among crypto enthusiasts and encourage them to buy tokens. Most uninformed users become victims of these manipulations.

During a bear market, market makers' strategies completely change. Their task now is to instill fear in you and make you sell your tokens to lock in their profits. Market makers buy at this time, which will generate profits in the future.

If you observe tokens experiencing abnormal movements, accompanied by sustained upward selling (pumps and dumps), make sure that market makers are involved. Be cautious with these tokens and try to understand market makers' behavior. If you can do this, you can profit calmly.

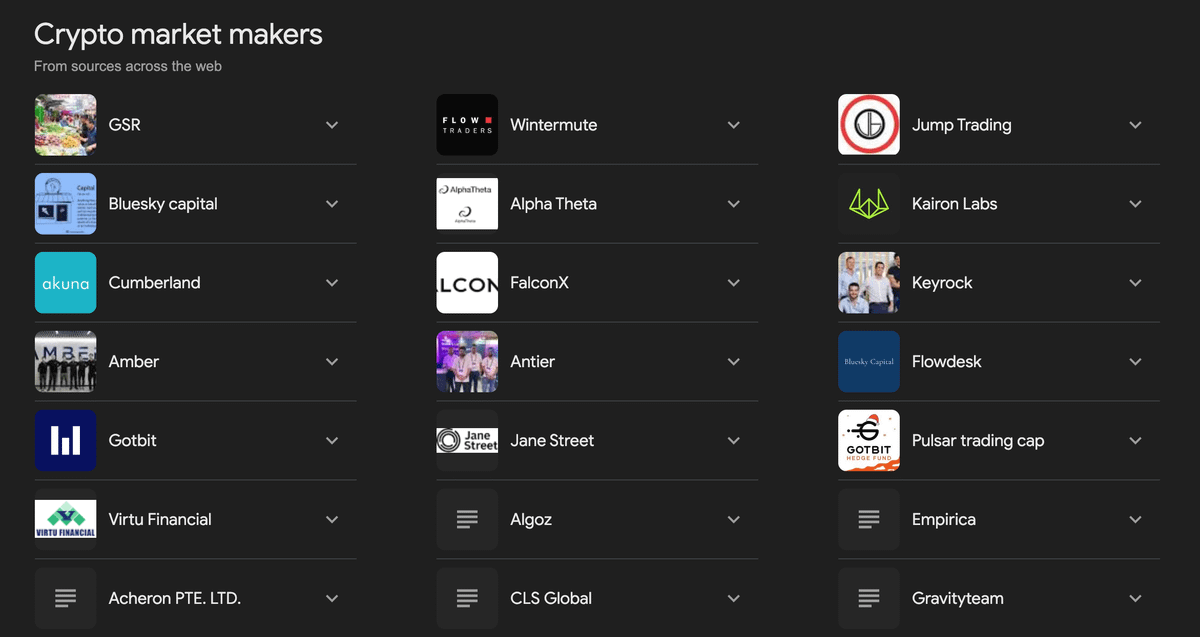

There are many market makers in the market, but here are the three most influential ones:

- Amber Group

- DWF Labs

- GSR

You need to closely monitor these market makers and understand their movements and their impact on the market.

Amber Group is a well-known market maker trusted by leading institutional and individual investors, with a large and high-quality team. Additionally, this market maker recently partnered with Pendle.

DWF Labs has integrated with over 60 leading exchanges, providing 24/7 services for the trading volume required by exchanges.

GSR is a market maker with over 10 years of experience. GSR provides deep liquidity and personalized services for crypto projects. GSR establishes reliable long-term relationships with token issuers.

Related reading: In-depth analysis of crypto market makers: driving market prosperity, hermits across bull and bear cycles

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。