Author: Lars, Director of Research at The Block

Translation: Jordan, PANews

Although the stablecoin market performed well in April, the majority of cryptocurrency market indicators have declined. This article will use 11 charts to analyze the cryptocurrency market over the past month.

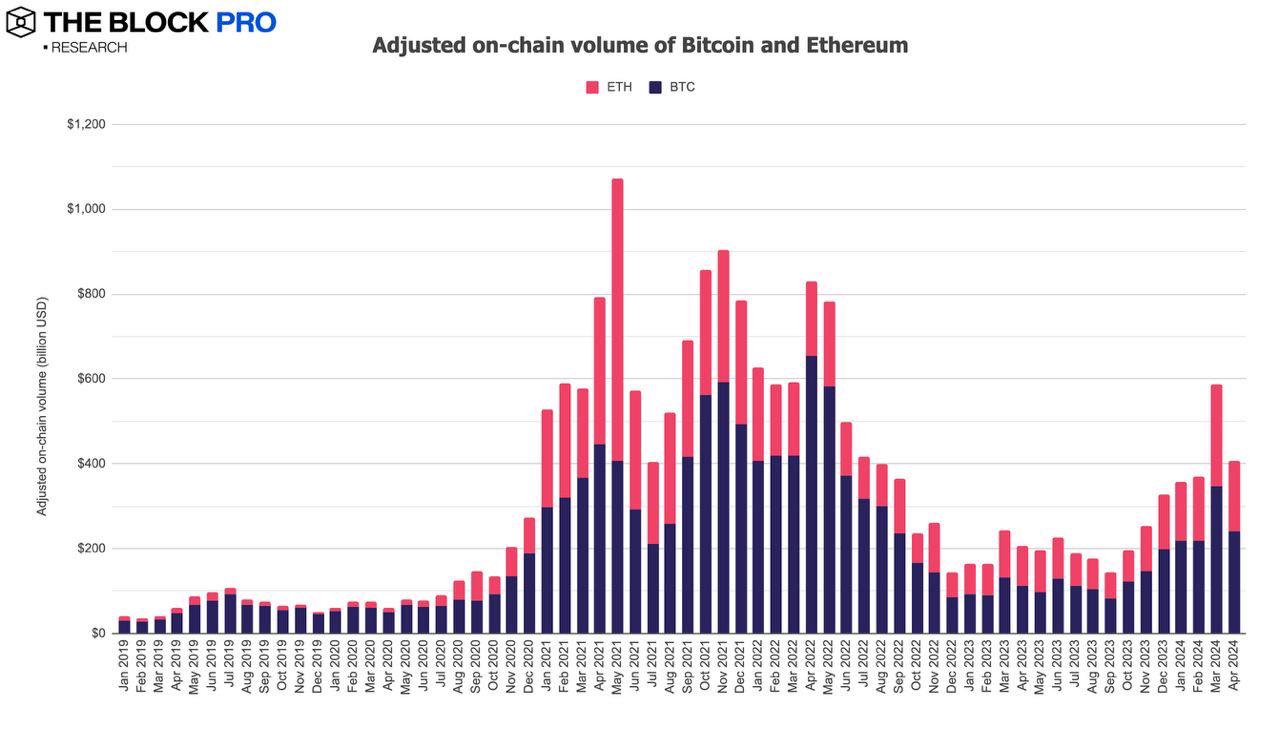

- In April, the overall on-chain transaction volume of Bitcoin and Ethereum decreased by 30.5% to $408 billion after adjustment. The on-chain transaction volume of Bitcoin decreased by 30.85%, and that of Ethereum decreased by 30.2%.

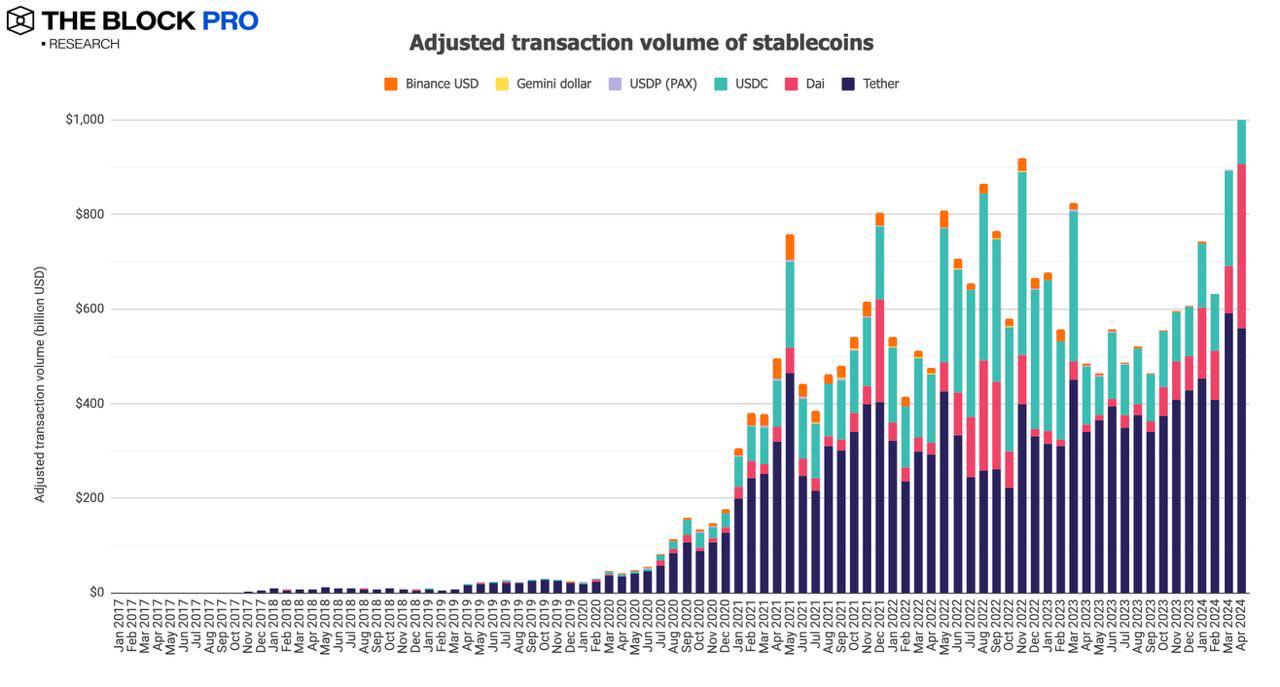

- The adjusted on-chain transaction volume of stablecoins in April increased by 23.7% to $1.1 trillion, reaching a historical high. The supply of issued stablecoins increased by 2.8% to $141.2 billion. Among them, the market share of the US dollar stablecoin USDT increased to 77.83%, while the market share of USDC slightly decreased to 18.1%.

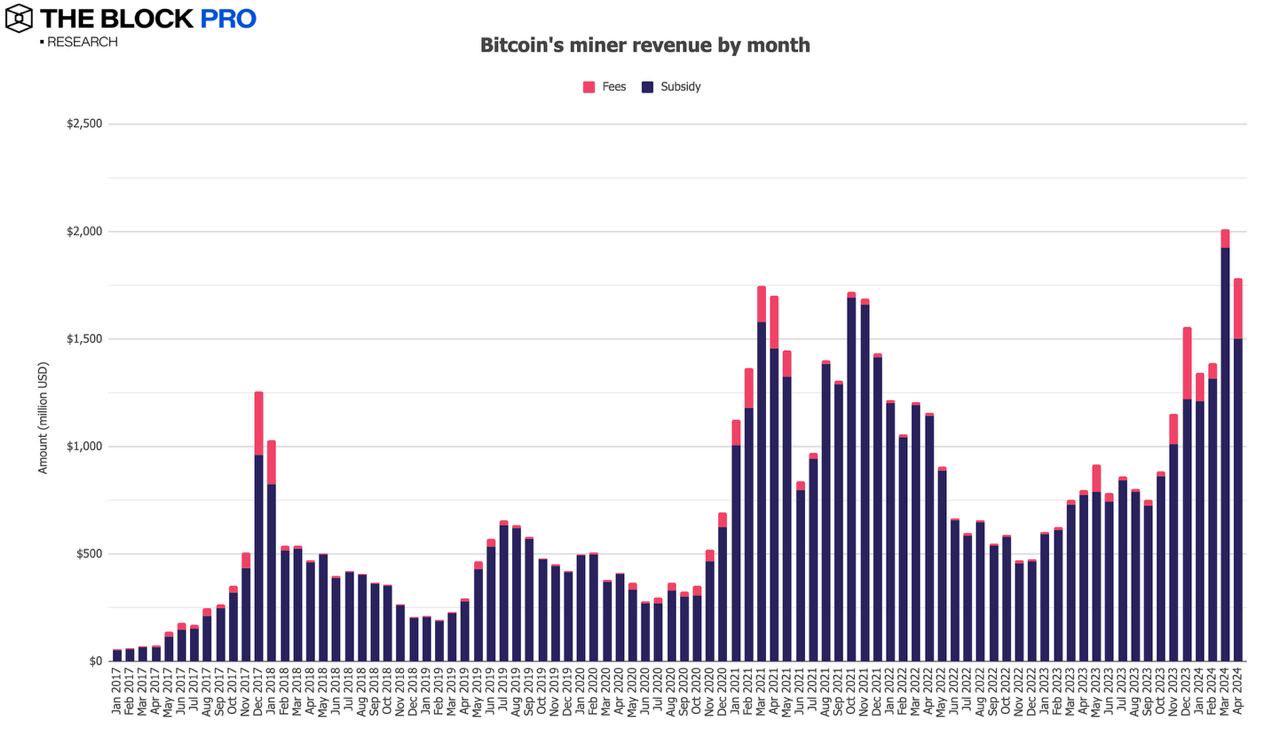

- Bitcoin miner revenue decreased by 11.3% to $1.78 billion in April. In addition, Ethereum staking income further decreased by 16.9% to $257 million.

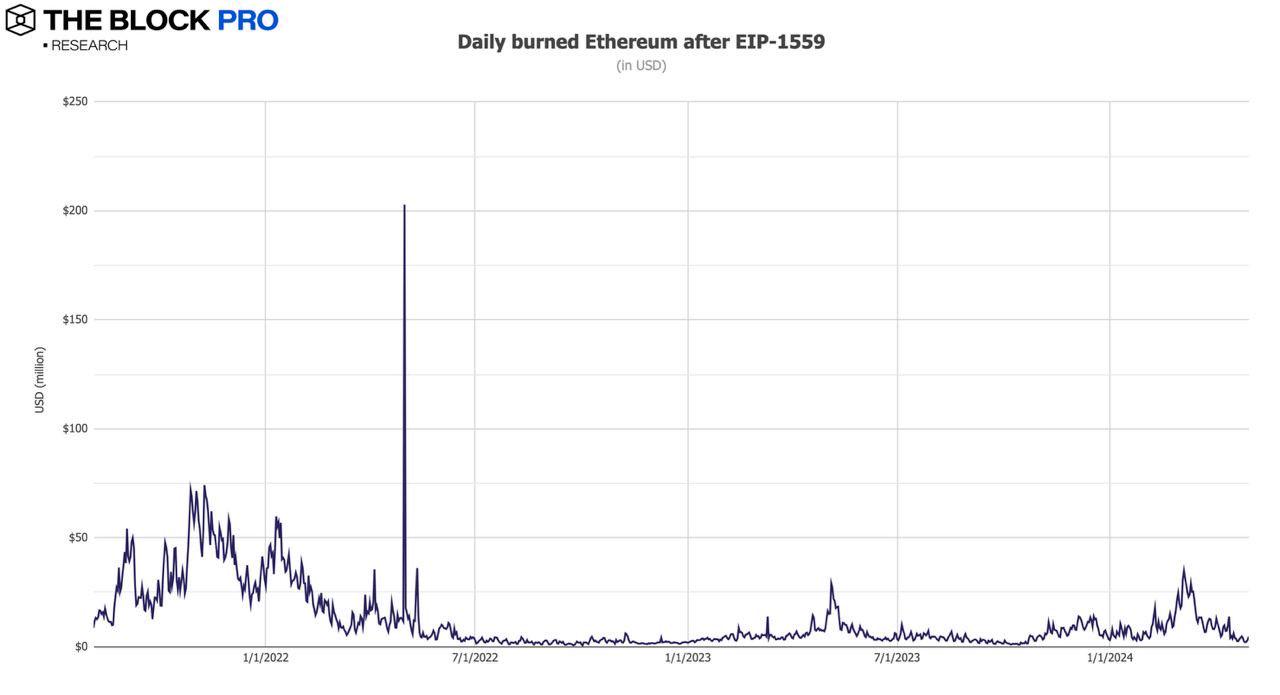

- In April, the Ethereum network burned a total of 54,640 ETH, equivalent to $179 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has burned approximately 4.78 million ETH, worth about $12.02 billion.

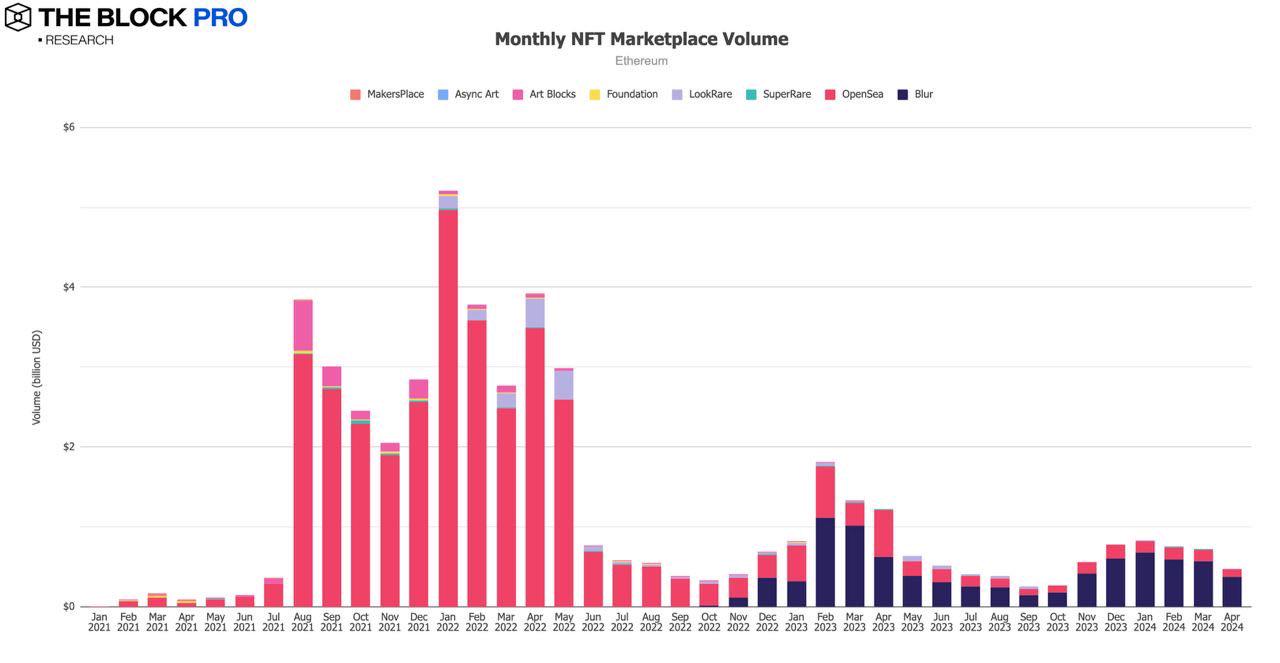

- The on-chain NFT market transaction volume on the Ethereum network in April decreased significantly by 34.5% to approximately $476 million.

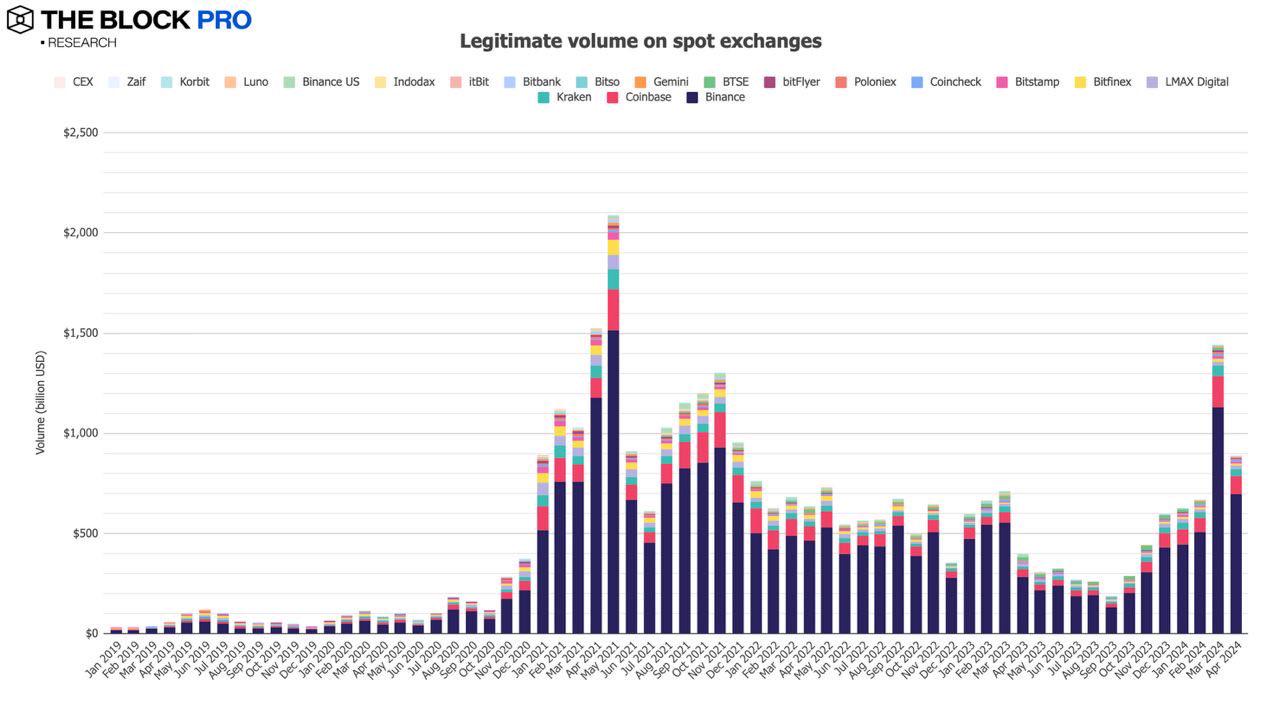

- The spot trading volume of compliant centralized exchanges (CEX) decreased by 38.4% in April, dropping to $888 billion.

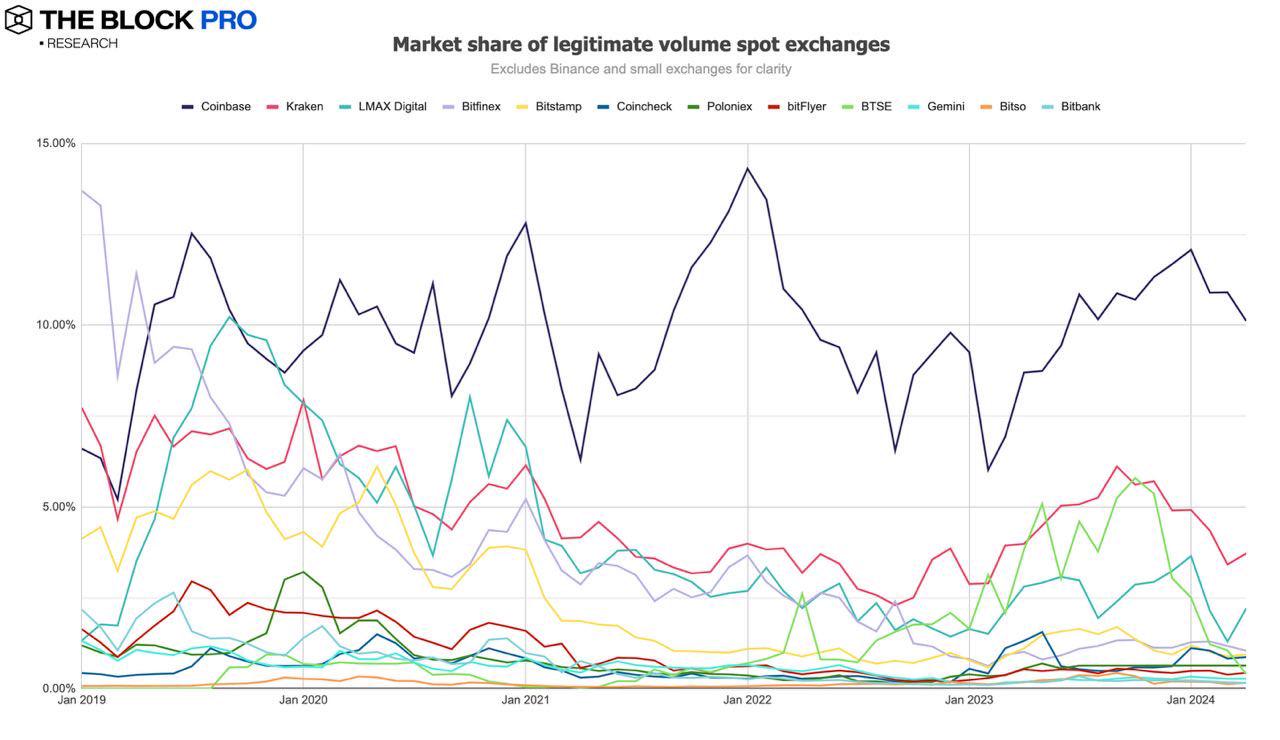

- The market share rankings of major cryptocurrency exchanges in the spot market in April are as follows: Binance at 78.4% (an increase from January, February, and March), Coinbase at 10.1%, Kraken at 3.7%, and LMAX Digital at 2.2%.

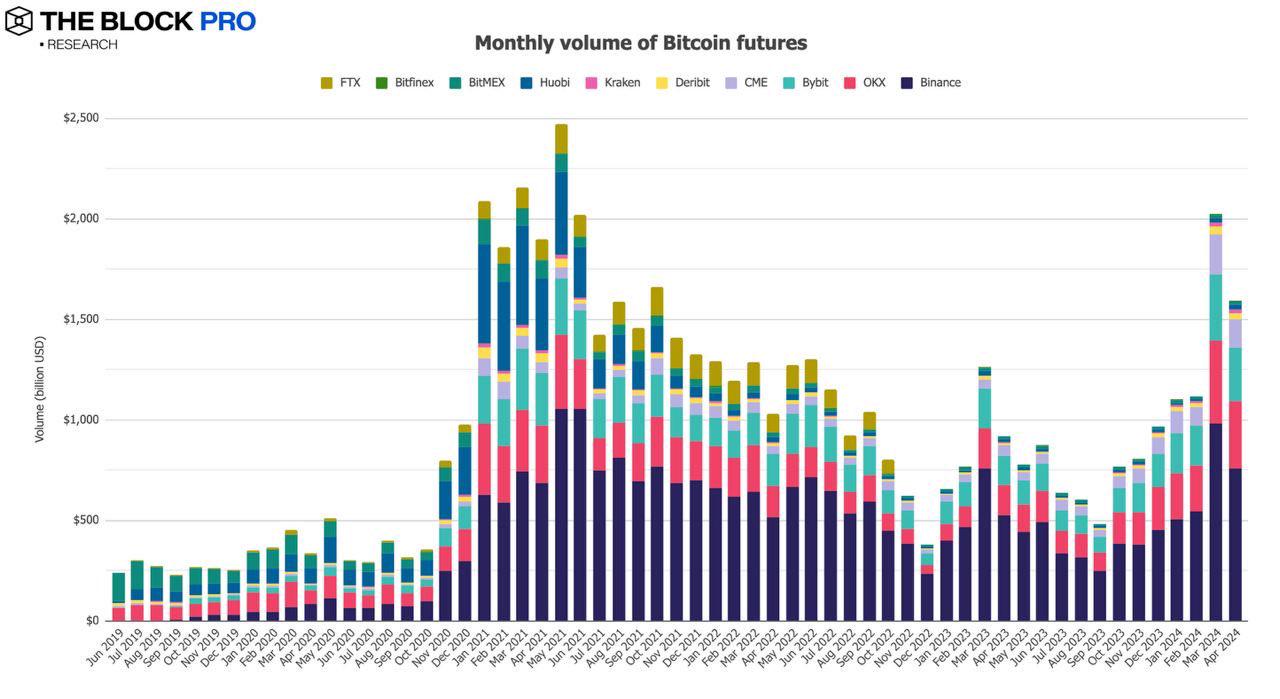

- In terms of cryptocurrency futures, the open interest of Bitcoin futures decreased by 1.6% in April, and that of Ethereum futures decreased by 17.7%. In terms of futures trading volume, the trading volume of Bitcoin futures decreased by 21.38% to $1.59 trillion in April.

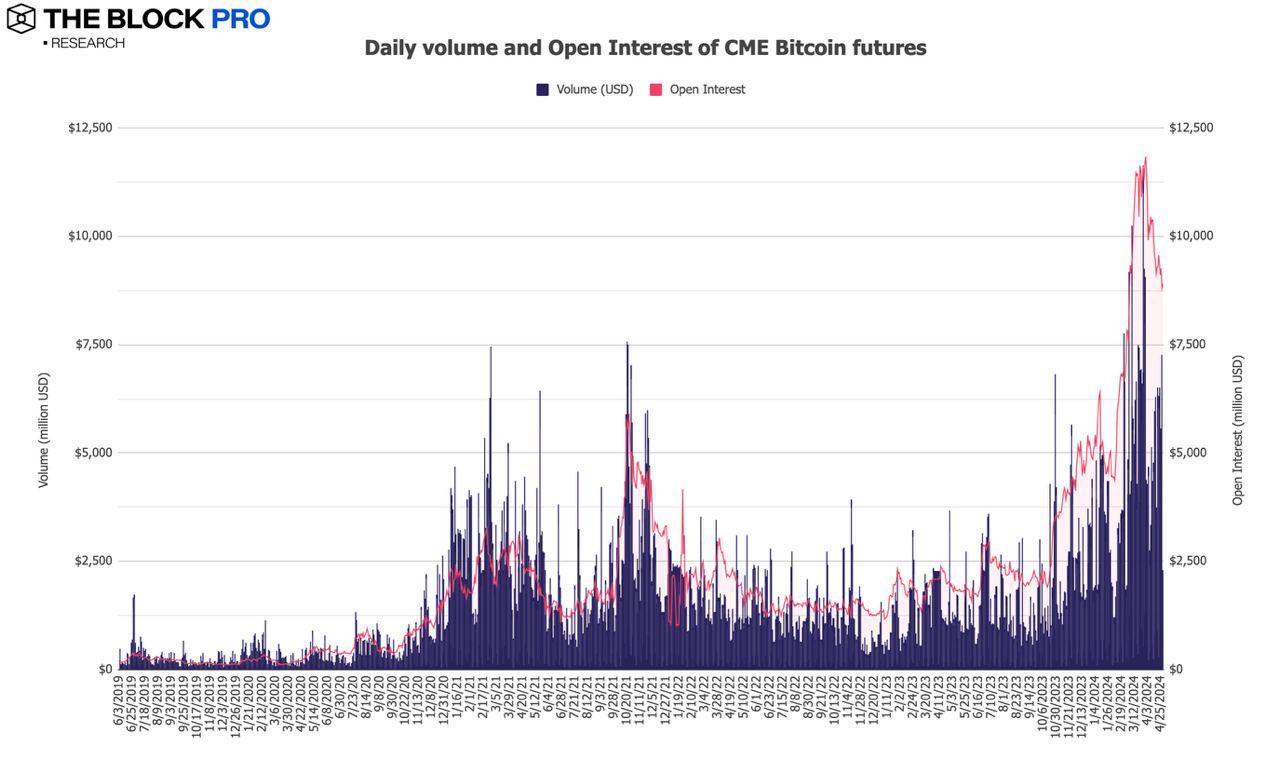

- The open interest of CME Bitcoin futures decreased by 23.7% to $8.9 billion in April, and the daily average volume decreased significantly by 30.1% to approximately $4.8 billion.

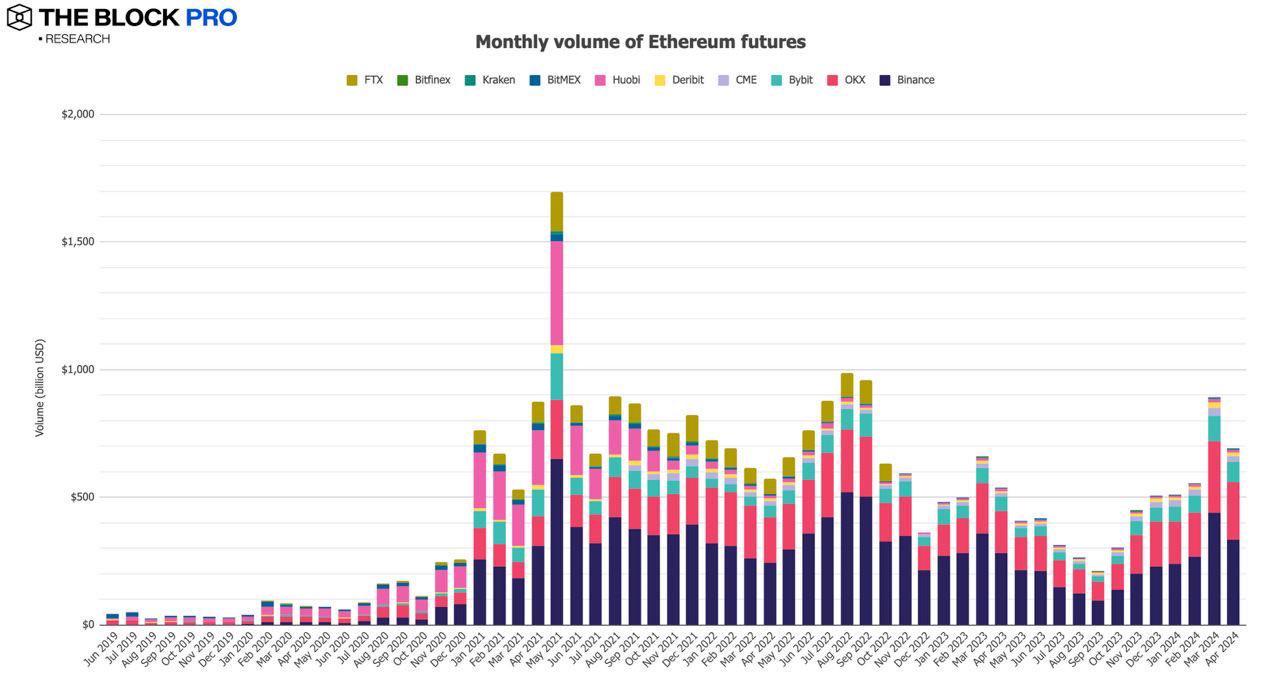

- The average monthly trading volume of Ethereum futures decreased to $691 billion in April, with a decrease of 22.6%.

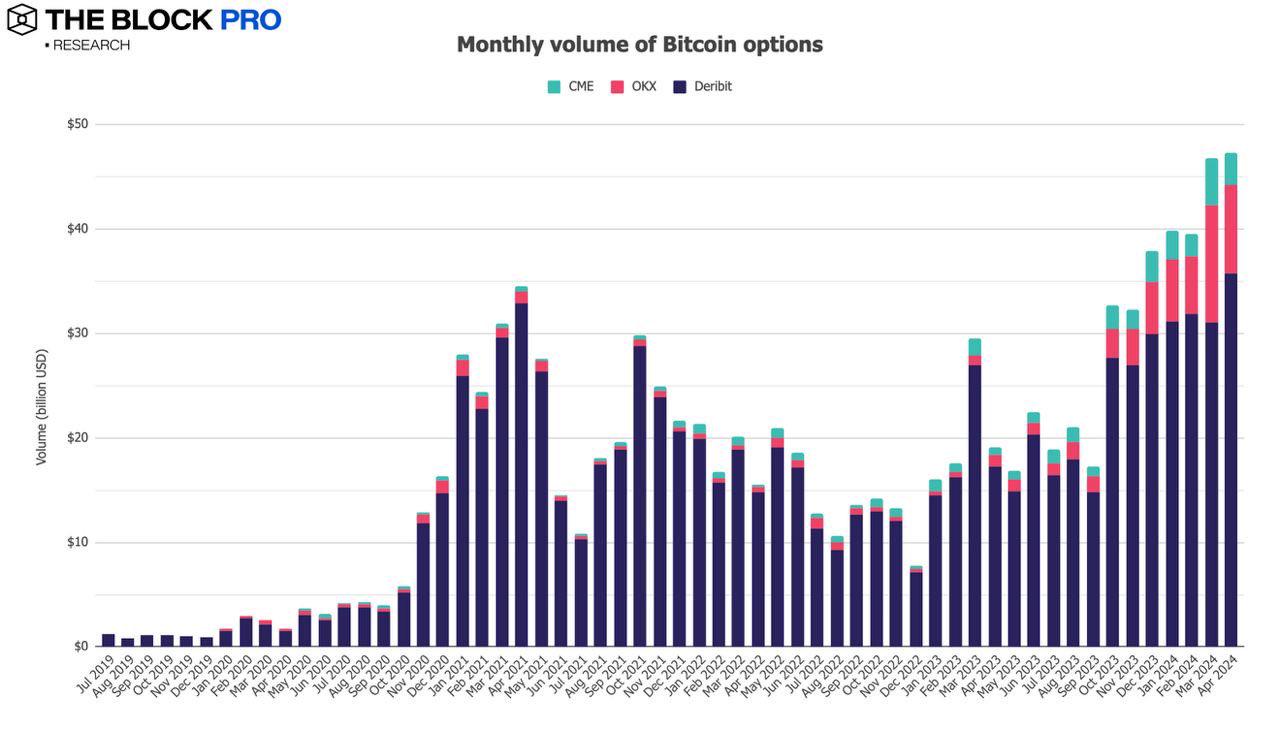

- In terms of cryptocurrency options, the open interest of Bitcoin options continued to decline by 15.5% in April, and the open interest of Ethereum options also decreased by 7.1%. In addition, both Bitcoin and Ethereum options trading volumes reached historical highs again in April, with Bitcoin options trading volume reaching a new high of $47.3 billion, an increase of 1.2%, and Ethereum options trading volume reaching a new high of $26.32 billion, an increase of 25.4%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。