Author: Wen Shijun

Editor: Wang Weikai

Produced by: Prism·Tencent Xiaoman Studio

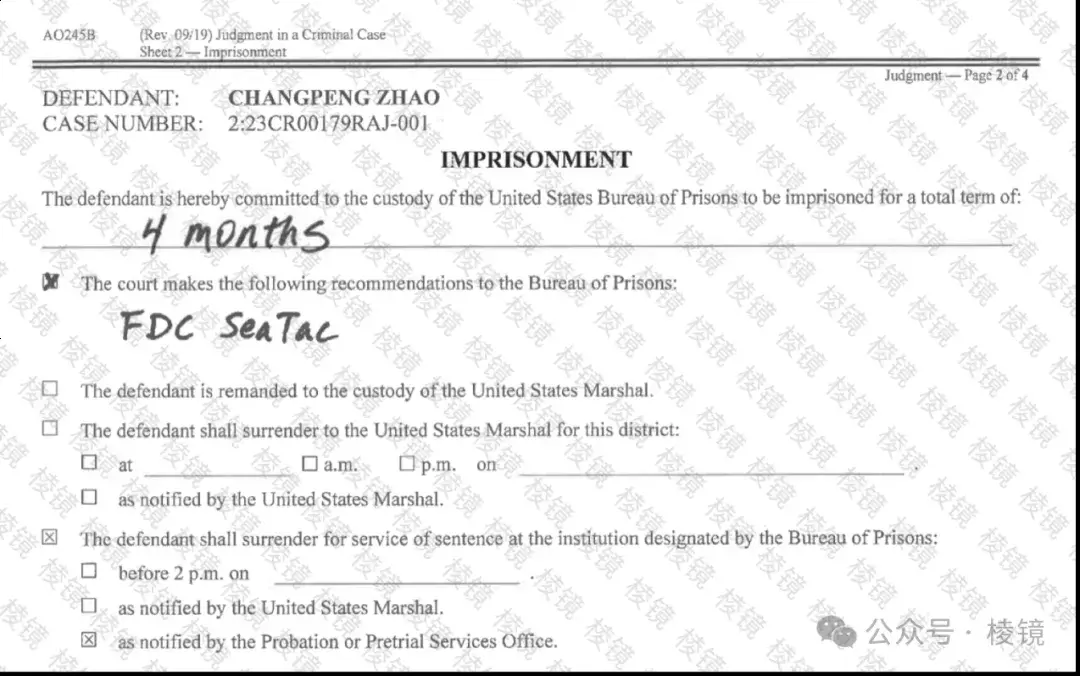

On the morning of April 30th local time, former "richest Chinese" Zhao Changpeng was sentenced to four months in a federal prison in Seattle, USA for failing to comply with anti-money laundering regulations.

Before the verdict was announced, Zhao Changpeng, dressed in a blue suit and light blue tie, was very nervous. The media on the scene described him as "on pins and needles." After all, in November last year, the maximum sentence he agreed to in a plea agreement with the Department of Justice was 18 months. Shortly before the trial on April 23, the Department of Justice raised the sentence request to three years.

The court did not immediately detain Zhao Changpeng. After the verdict, Zhao Changpeng posted on social media thanking everyone for their support, stating that he would "focus on the next chapter of life: education."

United States v. Changpeng Zhao: A Classic American "Government Sues Citizen" Lawsuit

Zhao Changpeng, 47, is the founder and former CEO of Binance.

Born in Jiangsu, China, he is a citizen of Canada and the United Arab Emirates. In 2021, Zhao Changpeng, with a wealth of $94.1 billion (approximately 681.3 billion RMB), surpassed many renowned old-time tycoons to become the richest Chinese in the world. This was just four years after he founded Binance.

After experiencing market fluctuations and heavy regulatory pressure in the cryptocurrency industry, Zhao Changpeng's current wealth is $39.7 billion—still the richest person in Canada and ranked 38th on the global rich list. This level of wealth is on par with that of Stephen A. Schwarzman, a senior figure on Wall Street and the founder of Blackstone.

Binance is the world's largest cryptocurrency exchange, with a market share that once exceeded two-thirds and still remains over 50%. In the first quarter of 2024, the total spot trading volume of global cryptocurrency exchanges was $4.29 trillion. In addition to trading services, Binance also issues its own cryptocurrency, BNB (Binance Coin), which currently fluctuates around a total market value of $90 billion.

Countries such as Singapore and the United Arab Emirates have a relatively open and even welcoming attitude towards cryptocurrencies.

However, for the superpower United States, it is difficult to make a clear-cut decision quickly. Whether it is the political tradition from Washington or the intricate interests of Wall Street and Silicon Valley, the US attitude towards cryptocurrencies is both contentious and ambiguous.

With Zhao Changpeng's conviction, the attitude has become clearer: not to ban, but to require stricter regulation.

The United States is the most important market for cryptocurrencies, with a number of heavyweight players active in the country. As early as 2012, the world's second-largest cryptocurrency exchange, Coinbase, was established in the United States. In April 2021, it went public on the Nasdaq, considered a milestone for the "legalization" of cryptocurrency trading in the United States.

Initially, Binance provided services to US users through its global platform. However, as the US continued to tighten cryptocurrency regulations, Binance launched an independent platform, Binance.US, in 2019, specifically for US customers.

Binance.US sought to develop in compliance with the US regulatory system. In May 2021, shortly after Coinbase's IPO, Binance invited former Acting Comptroller of the Currency at the Office of the Comptroller of the Currency (OCC), Brian P. Brooks, to serve as CEO of Binance.US. However, after only three months in office, Brooks resigned due to conflicts with Zhao Changpeng.

The crux of the matter lies in the decentralized nature of cryptocurrencies.

For many of Binance's US customers, anonymous trading and avoiding regulation are the reasons they "believe in" and use cryptocurrencies. In March 2023, in response to an investigation by three US senators, Binance officially admitted that "the removal and restriction of US users was implemented gradually, and this measure was not perfect in the first few years of implementation."

In fact, for a long time, Binance's US users used two platforms: Binance.US, which operated above ground, and Binance, which operated outside the US regulatory system.

The prosecution in Zhao Changpeng's criminal case was led by three departments under the US Department of Justice: the Criminal Division's Money Laundering and Asset Recovery Section (MLARS), the National Security Division's Counterintelligence and Export Control Section (CES), and the US Attorney's Office for the Western District of Washington.

The US Department of Justice alleges that Zhao Changpeng was aware of and even encouraged "Binance employees to call US VIP customers and encourage them to provide their information while outside the US." During the trial on April 30, the presiding African-American federal judge, Richard A. Jones, also mentioned that the prosecution often cited a statement by Zhao Changpeng to Binance team members: "It's better to ask for forgiveness than permission."

It is worth noting that the Department of Justice carries significant weight in the US political system. In the cabinet, the Secretary of State, Secretary of Defense, Attorney General, and Secretary of the Treasury are collectively known as the "Big Four," responsible for the core policies of the president and the ruling party.

It can be said that the trial of Zhao Changpeng is actually a trial of the decentralization of cryptocurrencies by the United States. After all, the most "terrifying" aspect of cryptocurrencies is their impact on the US dollar system—many cryptocurrency supporters believe that they are reshaping the world's monetary system and establishing a decentralized new world order.

All of this makes the lawsuit "United States v. Changpeng Zhao" even more significant.

According to the judgment, Zhao Changpeng will serve four months in the federal prison in Seattle, USA. Source: Court judgment document

The Highest Fine in History, Yet Still Not Exempt from Imprisonment

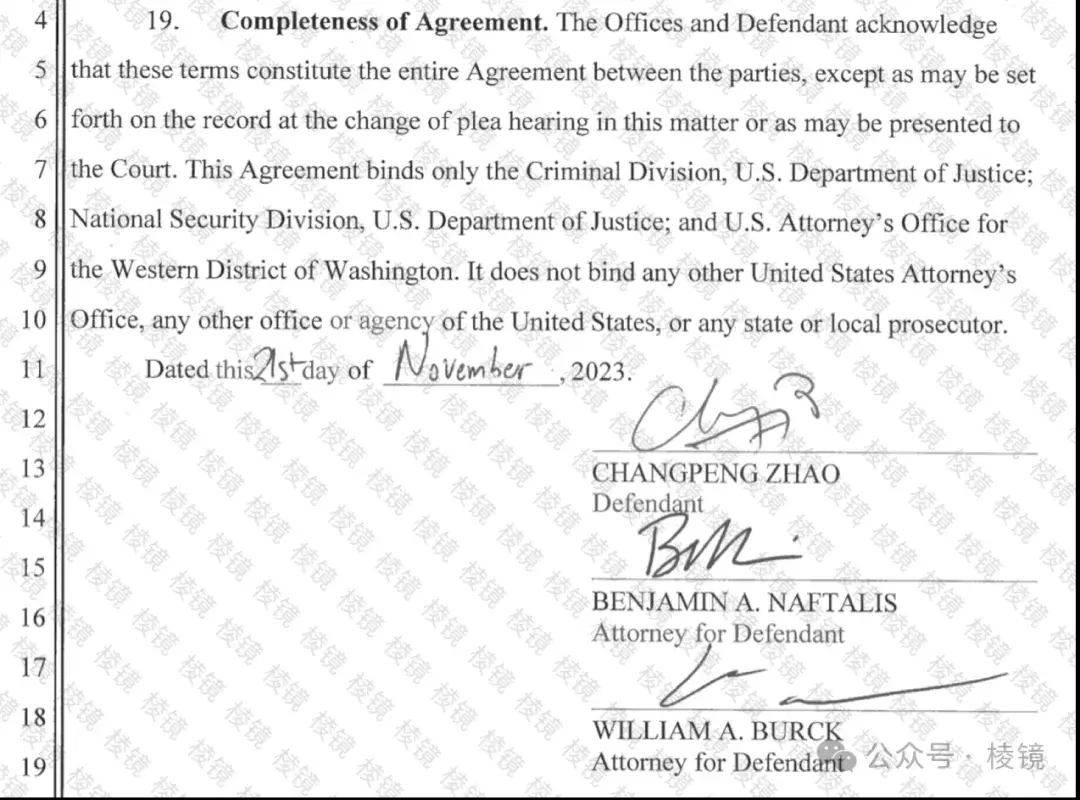

On November 21, 2023, Zhao Changpeng signed a plea agreement with the US Department of Justice. However, his "confession and cooperation," and accepting a huge fine did not completely exempt him from imprisonment.

The plea agreement obtained by the author of "Prism" shows that Zhao Changpeng acknowledged a series of criminal charges by the US Department of Justice for violating the US Bank Secrecy Act and anti-money laundering regulations.

The plea agreement mentioned that from June 2017 to 2022, Binance had over one million US users. These US users made over 20 million transactions, totaling $65 billion in deposits and withdrawals, and conducted over 900 million transactions, totaling $550 billion in cryptocurrency spot trading, helping Binance become the largest cryptocurrency exchange in the US market.

The plea agreement emphasized that as a money services business (MSB) operating in the US, Binance did not obtain a MSB license from the Financial Crimes Enforcement Network (FinCEN) of the US Department of the Treasury.

As the CEO and daily manager of Binance, Zhao Changpeng "willfully" failed to implement effective transaction monitoring for a considerable period, allowing Binance to not implement effective customer identification (KYC) and anti-money laundering (AML) measures.

"The defendant placed Binance's growth and profits above compliance and above US law," the plea agreement stated, as Zhao Changpeng believed that requiring customers to provide identity information would exclude them.

Because of this, Binance failed to effectively restrict US users from trading with users in US-sanctioned areas, such as $890 million in transactions with Iranian users, "including millions of transactions between users in Cuba, Syria, and the Ukrainian regions of Crimea, Donetsk, and Luhansk," from which Binance earned substantial fees.

As part of the plea and settlement, Zhao Changpeng is required to pay a $50 million fine in his personal capacity, resign as CEO of Binance, and refrain from participating in any activities related to Binance for three years. Prepared in advance, on the day he signed the plea agreement, Zhao Changpeng announced his successor on social media—Richard Teng, a Singaporean.

In this social media post, he wrote, "Today, I resigned as CEO of Binance. Indeed, emotionally, it is not easy to let go. But I know this is the right thing to do. I made a mistake, and I must take responsibility. This is the best for our community, for Binance, and for myself."

Richard Teng joined Binance in charge of Singapore operations in 2021 and was appointed as the head of all regions except the US for Binance in May 2023. Before joining Binance, he held important positions in the financial regulatory departments of Singapore and the United Arab Emirates. During the COVID-19 pandemic, Zhao Changpeng resided in Singapore.

The following is the complete translation of the provided markdown:

April 9, 2024, Binance's current CEO, Richard Teng, delivered a speech at the Paris Blockchain Week Summit in France. Source: Visual China

As part of the overall plea agreement, Binance also admitted guilt at the company level. It involves multiple US government and regulatory agencies:

According to the US Department of the Treasury, on the same day Zhao Changpeng signed the plea agreement on November 21, 2023, Binance reached settlements with the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC) for "failure to comply with anti-money laundering and sanction obligations."

The settlement amounts were $3.4 billion and $968 million, respectively—setting not only records for fines in two departments but also the largest settlement amount in the history of the US Department of the Treasury.

The above settlement also requires the US Department of the Treasury to retain access to Binance accounts and systems for five years. Binance must undergo compliance upgrades during this period (a pre-fine of $150 million was also agreed upon, to be executed if Binance fails to fulfill compliance commitments), and "completely withdraw" from the US within five years.

In March 2023, the US Commodity Futures Trading Commission (CFTC) also filed a civil lawsuit against Binance.

According to information publicly released by the commission, also on November 21, 2023, the two parties reached a settlement agreement: Binance paid $1.35 billion in "illegally obtained income" to the commission and an equivalent $1.35 billion fine. Additionally, Zhao Changpeng personally paid an additional $150 million fine to the commission.

This comprehensive settlement agreement does not include the 13 charges brought by the US Securities and Exchange Commission (SEC) against Binance for violating US securities laws—this lawsuit is still ongoing.

For Zhao Changpeng, of course, he hopes to avoid disaster despite the financial loss. The plea agreement mentions that the highest sentence Zhao Changpeng could face is 10 years in prison. However, as an exchange term, the plea agreement also specifies that if the court's sentence does not exceed 18 months under the US Sentencing Guidelines, Zhao Changpeng will waive his right to appeal.

However, it is worth noting that the plea agreement shows that the two parties reached an agreement based on Rule 11(c)(1)(A) of the Federal Rules of Criminal Procedure in the United States. Under this provision, the defendant signs the plea, and the prosecutor promises not to add new charges beyond the agreement, but "the court may accept, reject, or defer judgment on the agreement."

As the plea agreement states, "No one promises or guarantees what the court will sentence."

The signature page of the plea agreement reached between Zhao Changpeng and the US Department of Justice, including the signatures of Zhao Changpeng and his hired top lawyers, Benjamin Naftalis and William Burck. Source: Zhao Changpeng's plea agreement

The Cat-and-Mouse Game between Crypto Tycoons and Uncle Sam

Plea agreements are common in US judicial practice. According to data from the American Bar Association, in recent years, 98% of criminal cases in federal courts have been concluded in the form of plea agreements.

However, what sets the "United States v. Zhao Changpeng" case apart is that the defendant is a crypto tycoon who rode the wave of technology and human nature to amass wealth, while the plaintiff is the political and legal machinery of the world's most powerful country, making this cat-and-mouse game far from simple.

In fact, in the months following the signing of the plea agreement, the battle between the prosecution and the defense has been ongoing:

Following the signing of the plea agreement, the first issue at hand was bail. The initial bail terms obtained by the author of "Prism" showed that Zhao Changpeng could obtain temporary freedom at the cost of a $175 million personal bail bond and two guarantors, each making commitments of $250,000 and $100,000, respectively.

Additionally, Zhao Changpeng was required to deposit $15 million in a designated trust account, which would be forfeited if he violated the bail terms. For Zhao Changpeng, who is incredibly wealthy, even with the previous billions in fines, this was just a drop in the bucket—just a little pain.

The initial bail terms did not restrict Zhao Changpeng from leaving the United States but required him to report any changes in address and phone number at any time and to return to the US within 14 days before the formal sentencing.

Zhao Changpeng "voluntarily" flew to the US to sign the plea agreement and originally intended to leave the US and return to his home in the United Arab Emirates immediately after signing. Judge Brian A. Tsuchida, of Japanese descent, agreed to his request to leave the US, but the US Department of Justice subsequently requested that African-American federal judge Richard A. Jones review this decision and asked Zhao Changpeng to stay in the US.

The core reason cited by the Department of Justice was that the US and the United Arab Emirates do not have an extradition treaty, there have been no cases of the United Arab Emirates extraditing its citizens to the US, and Zhao Changpeng's assets are all located outside the US.

On November 24, 2023, Zhao Changpeng filed a motion with Judge Jones through his lawyers and played the emotional card: "Just a few months ago, he and his partner had just welcomed their third child," and "allowing Mr. Zhao to stay in the United Arab Emirates would enable him to take care of his family and prepare to return to the US for sentencing."

However, Judge Jones rejected Zhao Changpeng's request to leave the country.

The "partner" referred to is He Yi. Born in Sichuan, China in 1986, He Yi worked as a TV host at a travel TV station before entering the cryptocurrency industry and meeting Zhao Changpeng. He Yi is one of the co-founders of Binance and is known as the "Crypto Queen."

Although the working relationship between the two has always been very close, it was not publicly reported until early 2023 that they had already had two children.

The Wall Street Journal cited sources as saying, "In Zhao Changpeng's absence, his partner He Yi is the largest shareholder of Binance, with control over the company's marketing and investment departments."

On December 22, 2023, Zhao Changpeng once again petitioned the court to return to the United Arab Emirates for four Sundays to visit family members preparing for surgery. As an exchange condition, Zhao Changpeng offered to pledge all his shares in Binance.US, which are valued at approximately $4.5 billion. However, Judge Jones still did not agree.

On February 12, 2024, the court announced that the trial date originally scheduled for February 23 was postponed to April 30.

On February 23, the prosecutor once again requested the court to tighten the bail restrictions on Zhao Changpeng: he was required to surrender his Canadian passport and could not change his residence in the US without permission. Even when traveling in the US, he had to notify the prosecutor three days in advance. In reality, he did use this time to visit many places in the US, including the skiing destination of Telluride, Colorado.

Bail terms were just a minor push, and the more critical issue was the game of sentencing. Zhao Changpeng and his legal team have been trying to reduce the sentence and obtain probation.

There have been cases of probation: in May 2022, after surrendering, Arthur Hayes, a co-founder and former CEO of BitMEX, a "post-85" African-American, was charged with violating anti-money laundering regulations and ultimately received six months of home detention and two years of probation.

But things are not that simple. Another recent case undoubtedly caused Zhao Changpeng concern.

On March 28, just over a month ago, Sam Bankman-Fried, the "post-90" co-founder and CEO of FTX Exchange, known as the "Jewish king of crypto," was sentenced to 25 years in prison for large-scale fraud.

The Final Pressure from the Prosecution, Leading to 161 Plea Letters

On April 23, just before the trial, the prosecutor submitted a sentencing memorandum to the court.

The memorandum obtained by the author of "Prism" shows that the prosecutor's language was harsh, directly pointing to Zhao Changpeng's subjective intent: Binance grew in a "Wild West" mode (a time of rampant crime in the American West), and "Zhao Changpeng's business decisions were the best means of obtaining users, developing the company, and filling his wallet in violation of US law."

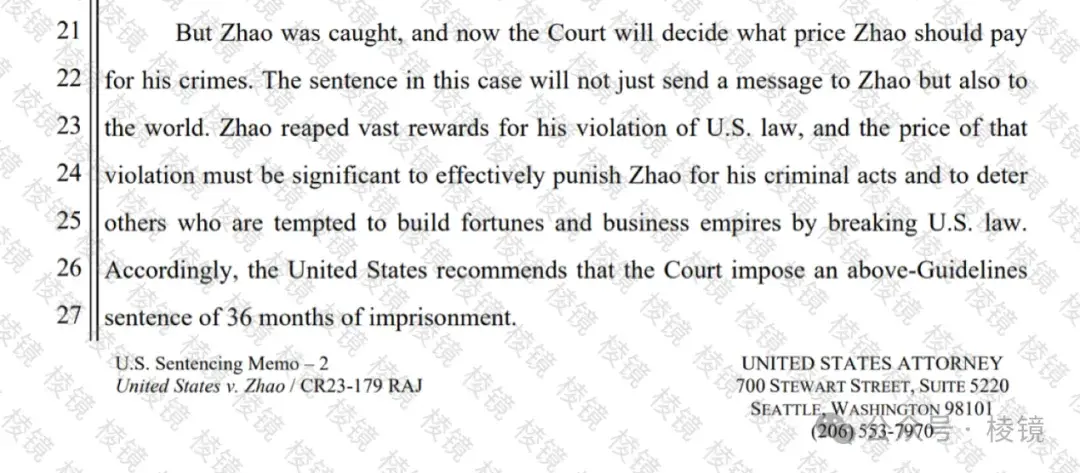

The prosecutor believes that an 18-month sentence "is not enough to reflect the seriousness of Zhao's crimes."

The memorandum emphasizes that "Zhao obtained huge returns by violating US law, and the cost of this illegal behavior must be enormous" in order to "deter others who attempt to build wealth and business empires by violating US law."

As a national lawsuit, the US Department of Justice also recommends a stern tone: "The United States recommends a 36-month prison sentence, a sentence above the Guidelines standard."

Just before the verdict, the prosecution requested a sentence twice the standard, which, in the eyes of the public, was the final pressure.

April 23, 2024, the Department of Justice prosecutor submitted a recommendation to the court, requesting a 36-month sentence for Zhao Changpeng. Source: Sentencing Memorandum

Zhao Changpeng quickly "fought back." Shortly after the release of this memorandum, Zhao Changpeng's apology letter to Judge Chad Jones and 161 joint plea letters began to circulate on the internet. These letters were actually completed in February 2024, around the time when the prosecution may have been seeking a higher sentence.

In the letters, Zhao Changpeng expressed his hope for probation, once again expressed remorse, and took full responsibility.

Regret overflowed on paper: "Words cannot express how much regret I feel for my choices, which led to my appearance in court." At the trial on April 30, he said "I'm sorry," expressing his desire to take responsibility for his "mistakes," but he had already done everything possible to promote compliance and cooperate with the US government before stepping down as CEO.

He stated in court that he wanted to create an online education platform for underprivileged children. In his previous plea letters, he also mentioned that after leaving the crypto industry, his next goal was to enter the blockchain and biopharmaceutical industry.

The 161 joint plea letters included family members, friends, political and business leaders, colleagues, industry experts, Binance angel investors, Binance users, and more. At the forefront were family members, with He Yi's name appearing again, ranking second, and Zhao Changpeng's sister, Jessica Zhao, a former Managing Director at Morgan Stanley, ranking first.

In her plea letter, He Yi said, "As CZ's (CZ is Zhao Changpeng's nickname in the crypto industry, short for Changpeng Zhao) partner," she understands "his sense of mission and responsibility to this industry"; "As CZ's life partner," they have known each other for ten years, and she knows "he lives a simple life," "and still makes every effort to spend quality time with our three young children."

She believed Zhao Changpeng's "biggest mistake was ignorance," not intentional wrongdoing. He Yi also mentioned the "Wild West," saying, "If the cryptocurrency industry is compared to the Wild West, then CZ is the guardian in this wilderness."

Following He Yi were three plea letters from Zhao Changpeng's other two children, their mother, Zhao Changpeng's wife Yang Weiqing.

In her letter, Yang Weiqing said, "I have known Zhao Changpeng since 1999, and we got married in 2003." After marriage, she has been a full-time housewife, and Zhao Changpeng has taken great care of the children and family, "rarely missing any opportunity to personally take care of the children," "changing diapers, feeding, accompanying the children on trips, and more."

Furthermore, "Changpeng has always borne all the household expenses," "he helped my parents buy a house in Tokyo," "and also helped my nephew find a job."

In the final part of her letter, Yang Weiqing "implored the judge to give Changpeng a light sentence and give him a chance to continue taking care of his loved ones."

The plea letters from political and business leaders included Max Baucus, the US Ambassador to China during the Obama administration, members of ruling families in the United Arab Emirates, and Liang Xinjun, co-founder of Fosun Group.

In his letter, Max Baucus said that Zhao Changpeng had invited him to be an advisor to Binance, "A few months ago, my wife and I prepared dinner for CZ at our home in Montana." Max Baucus emphasized that Zhao Changpeng is different from Sam Bankman-Fried, who was recently sentenced to 25 years, "He did not use other people's funds in his own accounts, unlike Sam Bankman-Fried, who did exactly that."

Liang Xinjun, in his plea letter written in his capacity as CEO and founder of the Singapore-based Xin Family Office, specifically mentioned that at the beginning of the Russia-Ukraine war, Zhao Changpeng blocked Russia, preventing it from using cryptocurrency financing, transferring assets, and making payments on the Binance platform.

Later, Liang Xinjun said, "I am even more convinced that he is not a profit-seeking businessman; his business philosophy is to benefit humanity and the world."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。