Author: Chloe, PANews

Bitcoin has been fluctuating recently, and the future direction of the market has attracted much attention, with analysts' views differing widely.

Senior trader Peter Brandt's forecast released on April 29th pointed out that Bitcoin has reached its peak in the current bull market cycle and predicted that Bitcoin may fall to over $30,000 or even lower. This is in contrast to many market price models and forecasts, which believe that Bitcoin is far from the peak of this cycle and may reach a peak of $210,000 before the bull market ends. Therefore, Peter Brandt's forecast has sparked considerable debate in the market.

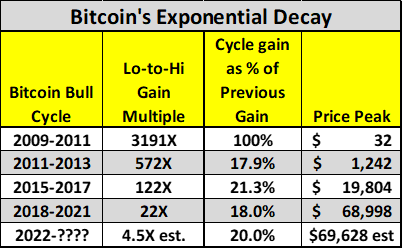

According to Peter Brandt's article, his theoretical condition is that the bull market cycle of Bitcoin presents an "exponential decay" pattern, which is the conclusion he drew from observing four Bitcoin bull market cycles.

That is, when the peak price of each consecutive cycle is only about 20% higher than the peak of the previous cycle, it meets the condition of "exponential decay." Data also shows that this situation has occurred in the past three Bitcoin market cycles.

>> The scale of 2011-2013 is about 20% of 2009-2011

>> The scale of 2015-2017 is about 20% of 2011-2013

>> The scale of 2018-2021 is about 20% of 2015-2017

According to this decay rate, Brandt estimates that this bull market round, if calculated from the low point, will only rise by about 4.5 times, reaching around $70,000. In March, the price of Bitcoin did indeed reach $73,000. However, Brandt is not very certain about his theory, as he believes there is only a 25% chance that Bitcoin has already peaked.

Assuming that Bitcoin has indeed peaked, Peter Brandt believes that the price may fall to around $30,000 by 2021; however, from a technical analysis perspective, such a significant decline would be the most advantageous development for the long-term market.

Based on long-term power law behavior, is Brandt's theory completely wrong?

Regarding Brandt's forecast, Giovanni Santostasi, CEO and research director of Quantonomy, has put forward a theory that is completely opposite to Brandt's, based on long-term power law behavior.

Santostasi believes that Brandt's theory only used three historical data points, and it is necessary to exclude one before the halving, as Brandt's analysis includes the bubble before the first halving, which occurred within 4 years of Bitcoin's birth. Santostasi believes that this irregular bubble behavior should be excluded from the analysis and only focus on the cycles related to halving.

The remaining two data points are simply not enough for reliable statistical analysis. Santostasi calculated the percentage deviation of Bitcoin's historical highs from the long-term power law trend and derived another exponential decay pattern. (The fact that Bitcoin prices follow a power law distribution means that its growth is nonlinear, has scale invariance, and is somewhat predictable.)

According to this pattern, the fourth bull market may peak around December 2025, with a maximum price of around $210,000, and then fall to around $83,000. Santostasi's analysis takes into account various data such as the power law trend of Bitcoin prices, the halving cycle every four years, and the exponential decay of historical highs.

In addition, many experts have given predictions for the peak of this Bitcoin bull market:

- Pav Hundal, an analyst at Swyftx, believes that by the next halving in 2028, the price of Bitcoin will at least double to around $120,000.

- Laurent Benayoun, CEO and quantitative trading strategy expert at Acheron Trading, expects the peak of this bull market to be around $180,000.

- Fidelity Digital Assets adjusted its mid-term outlook for Bitcoin from "positive" to "neutral" on April 22, revealing that from a mid-term perspective, Bitcoin is "no longer cheap."

In conclusion, many analysts in the market have different views on when this bull market will peak and how high it can rise. However, most people still believe that Bitcoin is far from its peak, and around $70,000 should not be the end of the bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。