Preface

As the first and largest blockchain by market capitalization, Bitcoin has not only paved the way for digital assets but also continues to dominate the market in terms of capitalization. Throughout its history, Bitcoin has been regarded as "digital gold," primarily due to its role as a store of value rather than for use in decentralized applications.

However, recent developments indicate that the potential of Bitcoin's active DeFi ecosystem is greater than previously anticipated. This shift is occurring at a time when Bitcoin's interests and technological capabilities are aligning as never before.

Source: X

The coming years could be crucial for Bitcoin as it may transition from a passive store of value to an active ecosystem full of innovation and investment opportunities.

We believe this represents an opportunity worth exploring, especially as most people have not yet invested in this ecosystem due to its novelty, and functionalities like Runes are about to be released.

This article aims to highlight the potential opportunities for the future of Bitcoin and provide in-depth analysis.

Bitcoin Ecosystem

The core code of the Bitcoin protocol has remained largely unchanged over the years, primarily serving as a medium of exchange.

In 2017, the Bitcoin protocol adopted the SegWit upgrade, which separated digital signatures ("witnesses") from transaction data. This separation effectively freed up space, allowing more transactions to be included in the blockchain.

Subsequently, the Taproot upgrade was introduced in 2021. This enhancement allows for the aggregation of multiple signatures and transactions, facilitating the aggregation of signatures. Essentially, this means that multiple signatures can be grouped for verification. Despite these upgrades, Bitcoin still faces challenges in scalability, slow transaction speeds, and high costs.

Currently, the Bitcoin network consists of miners, nodes, stakeholders, developers, as well as various Layer2 solutions, sidechains, and DApps. Miners and nodes maintain the network by validating transactions and ensuring consensus through a proof-of-work mechanism. The developer community contributes by expanding the local ecosystem and occasionally updating the core protocol, although reaching consensus on these upgrades may be challenging, resulting in infrequent substantive changes.

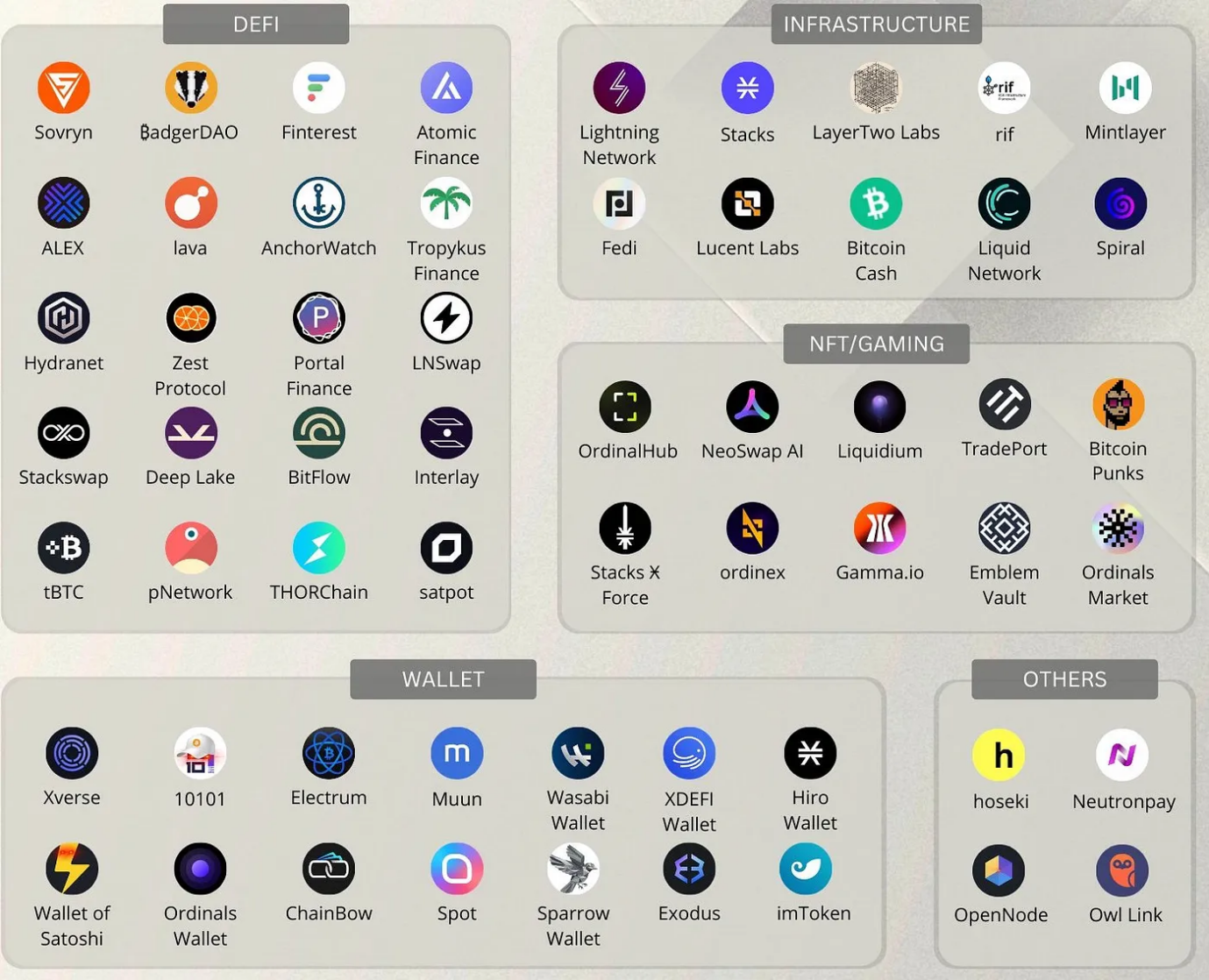

Here's a brief overview of the ecosystem:

Layer-2 Solutions

Several solutions have been proposed to address Bitcoin's scalability issues, but the majority of Bitcoin users consider the proof-of-work system as a fundamental part of Bitcoin's identity and are generally reluctant to support significant protocol changes.

Nevertheless, Layer2 solutions present a more practical approach and seem to be gaining attention as they do not involve any major modifications to the core blockchain. These operate as independent blockchains running on top of the main Bitcoin network, making them easier to implement and more realistically effective in addressing scalability issues.

Here are three prominent players making strides:

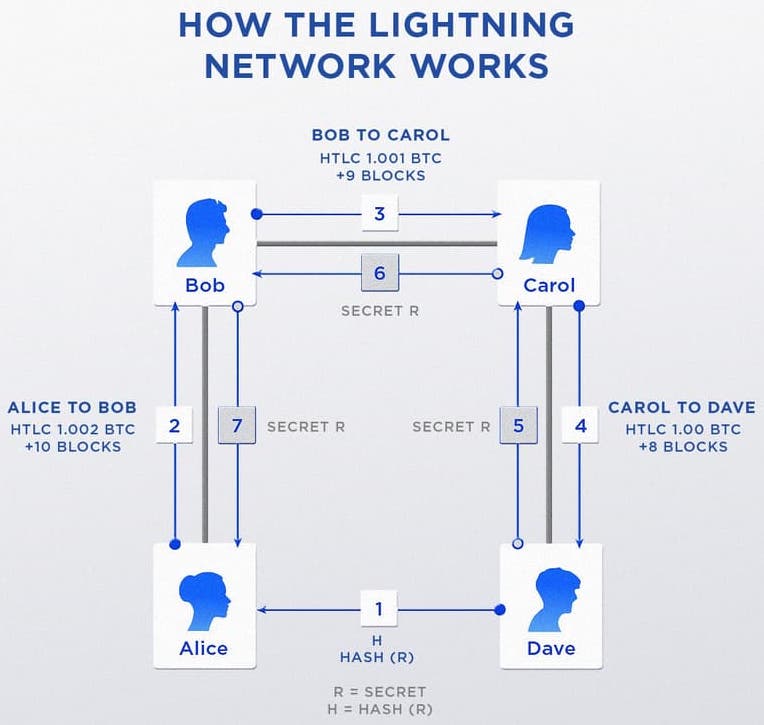

Introduced in 2016, it was the first Layer2 payment protocol developed on the Bitcoin blockchain. Aimed at improving transaction speeds and reducing costs, it utilizes Bitcoin's smart contract functionality to enable near-instant payments. While the Lightning Network has successfully improved transaction efficiency, attracting over $287 million in total locked value (TVL), it has not provided the advanced smart contract capabilities necessary for developing a diverse DApps ecosystem. Instead, it focuses on its peer-to-peer network's payment capabilities.

Source: The Lighting Network

Is the current market leader, set to undergo the Nakamoto upgrade, which will bring significant improvements in security and speed. Founded by computer scientist Muneeb Ali at Princeton University in 2013, this technology has been four years in the making. Stacks enables smart contracts and decentralized applications to use Bitcoin as an asset and settle transactions on the Bitcoin blockchain. All transactions on the Stacks layer are automatically hashed and settled on Bitcoin. It boasts a highly qualified team, and its technology has been peer-reviewed by experts from Stanford and Princeton.

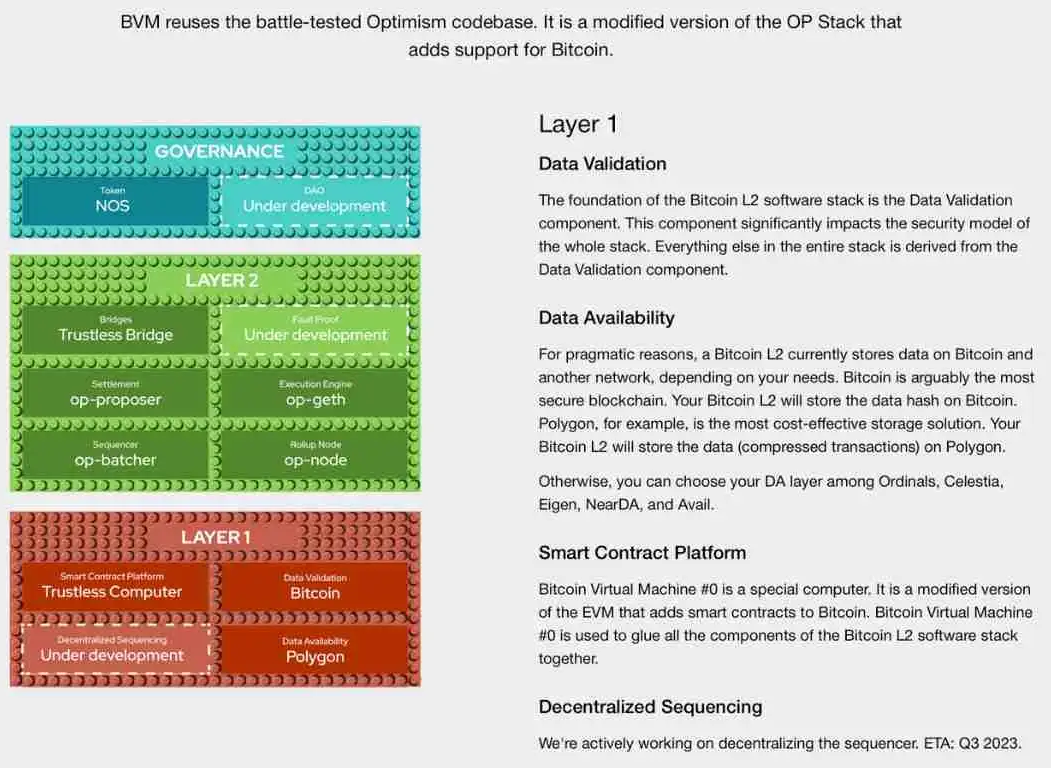

The BVM Network

Is addressing Bitcoin's smart contract and scalability limitations through its Layer2 meta-protocol. BVM makes it possible to create DApps and smart contracts, and facilitates the expansion of the Bitcoin L2 blockchain. Currently, BVM is making a name for itself on-chain, especially during the recent market downturn. Its relatively strong performance demonstrates potential growth, particularly as interest in BTC L2 solutions continues to increase. As a Rollup-as-a-Service (RaaS) protocol, BVM allows users to easily launch new Bitcoin L2 blockchains, with all value flowing back to BVM token holders as new L2s continuously pay for their $BVM tokens. Notable developments include ecosystems launched using the BVM SDK, such as Tuna Chain and Naka Chain. Additionally, plans to integrate Runes functionalities indicate further growth for BVM.

Source: BVM

Several other expansion solutions have been developed to enable smart contracts on Bitcoin:

- RGB: A layer-2 solution that uses Bitcoin's UTXOs to create digital assets such as tokens and NFTs, fully compatible with the Lightning Network.

- Counterparty: Allows token creation and crowdfunding; reinvigorated through innovations like Ordinals.

- Rootstock (RSK): A merge-mined sidechain with EVM-compatible smart contracts, using a token pegged to Bitcoin, RBTC.

- Liquid Network: A sidechain by Blockstream, supporting decentralized trading and asset issuance, including NFTs and stablecoins.

- Omni Layer: Supports token issuance and decentralized exchanges; enhanced through Omni Bolt for faster transactions via the Lightning Network.

- Mintlayer: Combines proof of stake with Bitcoin's proof of work on a sidechain, supporting smart contracts and cross-blockchain transfers.

DeFi on Bitcoin

Ethereum has been the primary Layer1 blockchain for DeFi. However, recent developments may position Bitcoin as a significant part of mainstream DeFi adoption. With regulatory changes in the US, anticipation of Bitcoin halving, and the introduction of Bitcoin ordinals, Bitcoin is gaining momentum.

The Bitcoin network is evolving beyond basic transactions, leading the development of a rich DeFi ecosystem. This has led to projects supporting more complex financial applications, challenging Ethereum's dominance.

For example, Sovryn provides a non-custodial, permissionless environment on RSK, a second-layer EVM smart contract blockchain based on Bitcoin, for trading, borrowing, and lending Bitcoin and selected assets.

Additionally, platforms like Zest Protocol, backed by Primal Capital, are pioneering peer-to-peer decentralized lending backed by Bitcoin. Meanwhile, Bitcoin DEXs like Bisq Network operate under decentralized autonomous organization guidance, facilitating P2P trading.

Ordinals and Runes

Especially with the development of the Bitcoin network, the Runes protocol has gained widespread recognition. However, many are still unfamiliar with how Runes simplifies transactions on Bitcoin by leveraging UTXO-based accounting, which is more cost-effective than traditional methods, such as on the Unisat market. Previously, Bitcoin transactions were primarily managed through an account model and required specific transaction amounts, making it less user-friendly compared to trading tokens on Ethereum.

Created by the innovators at Ordinals, Runes aims to be the Bitcoin equivalent of Ethereum's ERC20, facilitating fungible tokens. This protocol was released after the Bitcoin halving on April 19, resulting in a significant increase in transactions fees on the Bitcoin first layer in the short term. Greythorn is further monitoring its impact on Bitcoin second-layer solutions.

Unlike Ordinals, which stores data in transaction witnesses and attaches information to individual satoshis, Runes embeds token records into Bitcoin's unspent transaction outputs (UTXOs). This approach seamlessly integrates with Bitcoin's existing system, enhancing functionality and blockchain integrity. It is specifically designed for easy implementation on various L2 platforms, such as Stacks.

Here are some key projects related to the Runes protocol:

- PUPS / Rune Pups: An NFT collection with post-Runes activation, 23% of the PUPS supply will be distributed to participants through airdrops.

- WZRD: This cultural token is an early participant in the Ordinals ecosystem and has rapidly gained popularity.

- Runestones: This project will transition to the Runes token after the Bitcoin halving. It has been airdropped to various ordinal collections, including Bitcoin Puppets.

As the ecosystem launches, there will be more to come, so stay tuned.

The bullish points for Runes can be summarized as follows:

- Innovation in Bitcoin fungibility: Runes introduces a new token standard on the Bitcoin blockchain, aimed at improving the current BRC-20 fungible token standard. This innovation is considered significant enough to trigger a reassessment of the potential for decentralized applications on Bitcoin.

- Efficiency and design: The design of the Runes token standard is more efficient, adopting a UTXO-based design. This represents a shift from the account-based design of Bitcoin's BRC-20 and Ethereum's ERC-20 tokens, potentially reducing the inflation of "garbage" UTXOs and high fees generated in the current process.

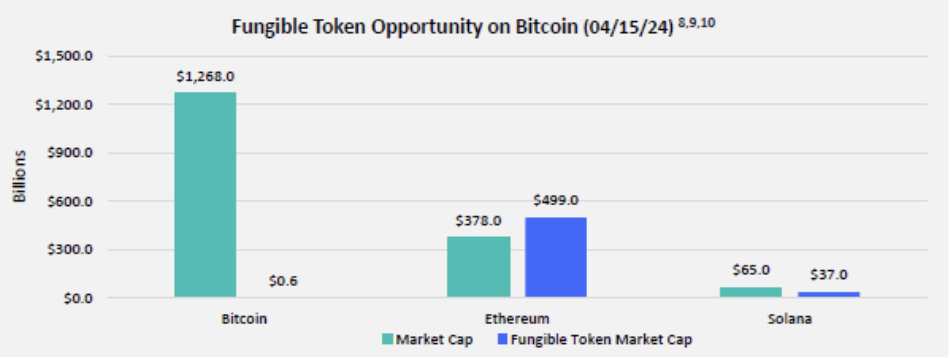

- Market positioning: Compared to Ethereum and Solana, Bitcoin's market value of fungible tokens is relatively small. However, the introduction of more efficient token standards like Runes may help Bitcoin narrow the gap.

- Compatibility and privacy: Runes is designed to be compatible with the Lightning Network and promises increased privacy as data is hidden within UTXOs. This compatibility and privacy feature can be seen as a significant improvement over existing standards, potentially making Bitcoin a more attractive platform for DeFi.

Source: Franklin Templeton

RGB++

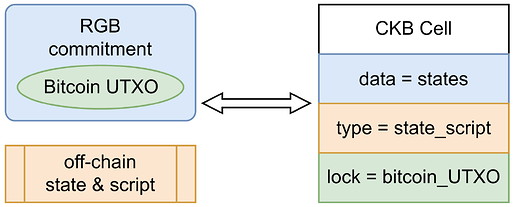

RGB++ enhances Bitcoin's capabilities by integrating smart contracts on the Nervos CKB blockchain. A notable feature of RGB++ is its homomorphic binding, synchronizing asset management between Bitcoin and the CKB Nervos blockchain. In practical terms, each Bitcoin UTXO is linked to a corresponding Cell (imagine a "transaction block") on the CKB blockchain. Therefore, when a Bitcoin transaction using a UTXO occurs, it is automatically recorded on the CKB blockchain, and the corresponding Cell on CKB is updated.

Source: Nervos

This system does not require a third-party multi-signature bridge, allowing for trustless transactions between these blockchains while ensuring accurate reflection of activities on both networks. RGB++ is considered a promising BTC second-layer solution, especially as we approach the Bitcoin halving.

In terms of investment, the token directly associated with RGB++ is $CKB, with a market value reaching $1 billion, with over 99% of tokens already in circulation. This reduces concerns about the potential market impact of new token releases.

Conclusion

Greythorn notes that the Bitcoin ecosystem is worth paying attention to, as BTC still has the highest adoption rate in the cryptocurrency space and is recognized by individual and institutional investors, potentially bringing more stability and growth potential.

Thanks to the ongoing development of the BTC ecosystem, such as the Lightning Network accelerating transactions and the Runes initiative enhancing token fungibility, we look forward to Bitcoin's continuous improvement and expansion of its applications, bringing about new transformations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。