Writing: Jaleel, BlockBeats

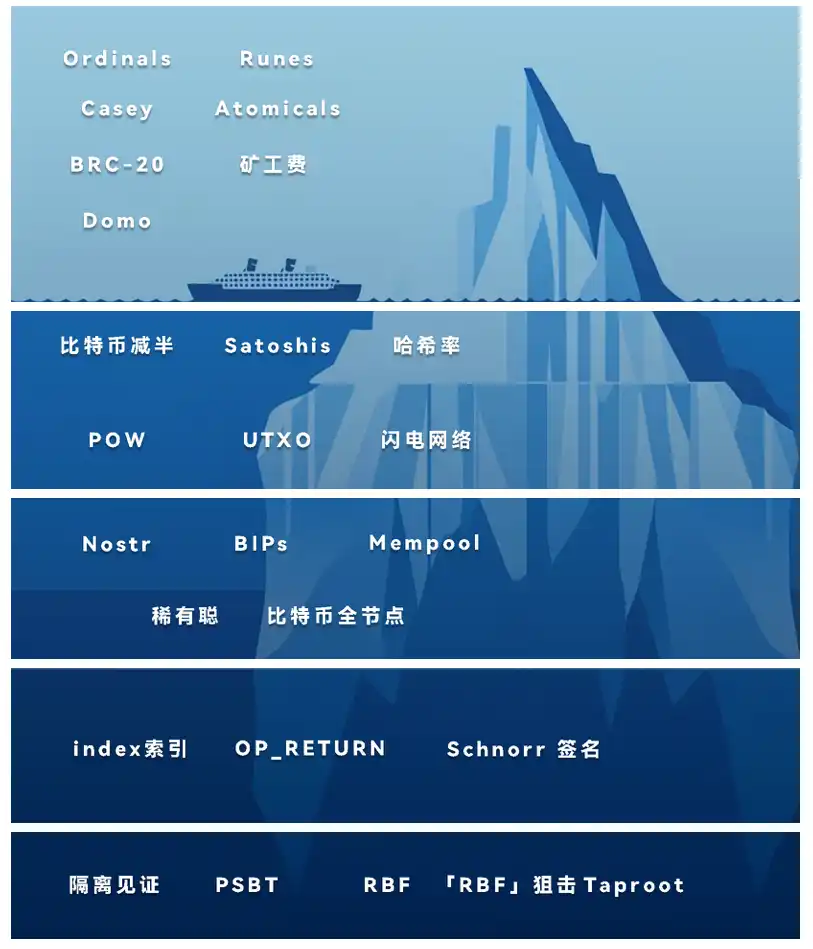

With the birth of the Runes protocol and the explosion of the third round of the Bitcoin ecosystem, more and more communities are paying attention to the Bitcoin ecosystem. However, the biggest confusion for most novices is still "the threshold of the Bitcoin ecosystem is too high". Because BlockBeats has sorted out various terms of the Bitcoin ecosystem into five knowledge levels, peeling off the veil of the Bitcoin ecosystem layer by layer.

Entry-level: Topics familiar to most novices in the Bitcoin ecosystem

1. Ordinals

The Ordinals protocol focuses on minting NFTs on the smallest unit of Bitcoin—satoshi, using the Taproot upgrade of Bitcoin, allowing each satoshi to represent a unique digital asset. Ordinals utilizes the inherent characteristics of the Bitcoin blockchain, allowing each satoshi to uniquely represent a digital asset, bringing NFT-like functionality to the Bitcoin network without the need for any additional layers or tokens.

2. Casey Rodarmor

Casey Rodarmor (@rodarmor) is a programmer and Bitcoin developer, as well as the creator of the Ordinals protocol and the Runes protocol. Through the development of the Ordinals protocol, Casey has provided a new way to directly store and transmit non-monetary data (such as digital artwork) on the Bitcoin blockchain, and it can be said that without Casey, there would be no Bitcoin ecosystem.

Image source: Ordinals summit 2023

3. BRC-20

BRC-20 is an experimental standard for creating and transmitting fungible tokens on the Bitcoin network. It was introduced by the anonymous developer Domo in March 2023, aiming to mimic the ERC-20 standard of Ethereum. Unlike ERC-20, which uses smart contracts, BRC-20 tokens are created by engraving JSON data on satoshis (the smallest unit) of the Bitcoin network.

4. Domo

Domo (@domodata) is the creator of the BRC-20 protocol. Domo has remained anonymous since developing BRC-20 and has also created a fund called Layer 1 Foundation to assist in the governance of BRC20.

Image source: Ordinals summit 2023

5. Runes

Runes is a new Bitcoin protocol developed by the creator of Bitcoin Ordinals, Casey Rodarmor. Unlike Ordinals, which is used for issuing NFTs on the Bitcoin network, Runes is used to issue fungible tokens. It allows users to directly create, mint, and transfer tokens in the UTXO model of Bitcoin, without relying on any centralized service or intermediary. Runes has optimized the BRC-20 protocol by combining the original minting and listing into a single transaction.

6. Atomicals

The Atomicals protocol allows the creation and management of digital assets called ARC-20 on the Bitcoin blockchain. These assets use the UTXO model and can store multiple files, making them suitable for more complex applications. Unlike BRC-20 and Ordinals, the AVM design of Atomicals is intended to provide greater flexibility and scalability, achieving similar smart contract functionality and supporting more complex digital asset management. Compared to Casey and Domo, the author of the Atomicals protocol, Arthur, remains more anonymous, rarely appearing in offline activities and only participating in a few audio "appearances" interviews.

7. Mining Fee

The fee paid by users when conducting Bitcoin transactions to miners in order to include their transactions in a block. The mining fee is the transaction fee of the Bitcoin network, ensuring the economic incentive for miners to support the operation and security of the network.

Second level: Topics familiar to most players in the Bitcoin ecosystem

1. Bitcoin Halving

Bitcoin halving refers to the event of halving the Bitcoin mining reward, occurring approximately every four years after the production of 210,000 blocks. The halving is primarily aimed at controlling the issuance of Bitcoin, which is part of Bitcoin's design to simulate the gradually decreasing mining speed of scarce resources (such as gold). The halving directly affects the incentive structure of miners and is considered to have a significant impact on the price of Bitcoin. The most recent halving occurred on April 20, 2024, and the next halving is expected to take place in February 2028, when the block height will reach 1,050,000.

2. Satoshis

Translated as "聪" in Chinese, satoshi is the smallest unit of Bitcoin, where 1 Bitcoin equals 100,000,000 satoshis. As the value of Bitcoin can be very high, satoshi provides a smaller unit of currency, making microtransactions possible.

3. Hash Rate

Hash Rate refers to the number of attempts per second by all mining devices in the network to solve block hashes, usually expressed in hashes per second (H/s). Hash Rate is a key indicator of measuring the security of the Bitcoin network, where a higher hash rate means higher computational difficulty and security.

4. POW

Short for Proof of Work, it is a cryptographic algorithm used to prevent abuse of network services (such as spam or distributed denial-of-service attacks). Bitcoin's proof of work requires miners to solve a complex mathematical problem, the difficulty of which is automatically adjusted to ensure the generation of a new block approximately every 10 minutes. Miners who successfully solve the problem can add new blocks to the blockchain and receive new Bitcoins as a reward. This process not only protects the network from attacks but also serves as the mechanism for Bitcoin currency issuance and circulation.

5. UTXO

Short for Unspent Transaction Outputs, it refers to the unspent transaction outputs in the Bitcoin network, representing the Bitcoin amounts that can be used as new transaction inputs. Bitcoin's transaction model is based on UTXO, where each transaction begins with referencing previous transaction outputs as its inputs and ends with creating new UTXOs that can be used in future transactions.

6. Lightning Network

The Lightning Network is a "second layer" payment protocol built on top of the Bitcoin blockchain, aiming to achieve instant, high-throughput micropayments. The Lightning Network reduces transaction congestion and fees on the blockchain by creating a network of payment channels, making small-value payments economical and fast.

Third level: Topics familiar only to experienced Bitcoin ecosystem OGs

1. Nostr

Nostr is a simple decentralized social networking protocol that allows users to create and manage their own identities using key pairs and communicate through events such as posts, contact information, and other social interactions. The founder, Fiatjaf (@fiatjaf), although this protocol is not directly related to Bitcoin, it has received widespread attention from Bitcoin supporters because it represents a decentralized and censorship-resistant communication method. In April 2023, there was a Lightning Network "custodial solution" called the Nostr Assets Protocol, which also adopted the name Nostr.

2. BIPs

Bitcoin Improvement Proposals, or BIPs, are design documents driven by the Bitcoin community, proposing improvements to new features, information, or environmental changes for review by the Bitcoin community. BIPs are an important part of the Bitcoin development process, providing a formal pathway for how to improve the Bitcoin network.

3. Mempool

Mempool, short for Memory Pool, refers to the collection of all unconfirmed transactions stored on a Bitcoin network node. When a transaction is sent to the Bitcoin network but has not been included (confirmed) in any block, the transaction is in the Mempool. Miners select transactions from the Mempool to create new blocks, typically prioritizing transactions with higher fees.

4. Rare Satoshis

Rare Satoshis is not an official term of the Bitcoin network, but it emerged after the birth of Ordinals and refers to unique satoshis related to specific block times with collectible value. Bitcoin is composed of satoshis, with each Bitcoin consisting of one hundred million satoshis. The scarcity and uniqueness of satoshis can be determined by ordinal theorists, giving satoshis special significance, whether they are Bitcoins mined by Satoshi Nakamoto, the first satoshi of a block, or satoshis used to buy pizza.

5. Bitcoin Full Node

A Bitcoin full node is a complete client running the Bitcoin protocol, maintaining a full copy of the blockchain data. Full nodes validate all transactions and blocks to ensure they comply with Bitcoin's rules. Bitcoin full nodes are crucial for the health and decentralization of the network. They help distribute power in the network, ensuring that no single entity can control or tamper with the transaction history of Bitcoin. Full nodes also enhance the security of the network, as the more nodes validate transactions, the more difficult it is to manipulate the entire system.

Fourth level: Delving into the Rabbit Hole

1. Indexing

In the context of Bitcoin, "index" or "索引" usually refers to the data structure used in the blockchain database for quick data retrieval. For example, the transaction index (txindex) is an optional feature that allows nodes to create an additional database to store metadata for each transaction, including their location in the blockchain. With the transaction index enabled, nodes can access information about any transaction more quickly, which is useful for developing applications and services, especially those that require extensive blockchain data queries.

2. OP_RETURN

OPRETURN is an opcode in the Bitcoin script language that allows embedding a small piece of data (currently up to 80 bytes) into a Bitcoin transaction. This data itself is unspendable and therefore not used as part of the input. OPRETURN is primarily used to add metadata to transactions, which can be used for various applications such as proving the existence of data at a certain point in time (timestamp service), adding simple messages, or implementing more complex blockchain layer applications. Since this data is permanently recorded on the Bitcoin blockchain, it provides developers with an immutable data storage option.

3. Schnorr Signatures

Schnorr signatures are a digital signature algorithm proposed by the mathematician Claus Schnorr. In Bitcoin, Schnorr signatures were introduced through the Taproot upgrade, aiming to replace or coexist with the existing ECDSA (Elliptic Curve Digital Signature Algorithm) signature scheme. Schnorr signatures offer several advantages, including simpler signature aggregation, enhanced privacy, and greater efficiency. Signature aggregation allows multiple signatures to be merged into one, reducing data volume and lowering transaction fees. Additionally, it improves support for multi-signature transactions, making transactions involving multiple parties indistinguishable from regular transactions, thereby enhancing privacy.

Fifth level: The Most Profound Bitcoin Ecosystem Knowledge

1. Segregated Witness (SegWit)

Segregated Witness, or SegWit, is an upgrade to the Bitcoin protocol designed to address transaction scalability and malleability issues. SegWit increases the effective capacity of blocks by segregating signature data from transaction data and to some extent reduces the size of each transaction, thereby improving network throughput.

2. PSBT (Partially Signed Bitcoin Transactions)

Partially Signed Bitcoin Transactions, or PSBT, is a standard format used to transfer incomplete transactions between different participants for signing. It enables multiple parties to collaborate in creating, signing, and sending transactions without exposing private keys to other participants.

3. RBF (Replace-by-Fee)

Replace-by-Fee, or RBF, is a mechanism that allows the sender to replace a transaction by increasing the fee before it is confirmed on the blockchain. This mechanism is commonly used to expedite transaction confirmation or to correct unconfirmed transactions with insufficient fees.

4. "RBF" Sniper Attack

RBF has given rise to the "RBF" attack, a strategy to earn profits. Users monitor unconfirmed low-fee transactions and attempt to replace the original transaction with the same transaction at a higher fee using the RBF mechanism. This is often used by mining pools or individual miners seeking to increase revenue by extracting higher transaction fees.

5. Taproot

Taproot is a significant upgrade to the Bitcoin network, primarily enhancing privacy and scalability through a combination of Merkelized Abstract Syntax Trees (MAST) and Schnorr signatures. Taproot makes complex transactions on the blockchain indistinguishable from regular transactions, thereby enhancing privacy. Additionally, it improves the network's scalability and efficiency. It can be said that it is because of the Taproot upgrade that the Bitcoin ecosystem has been able to begin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。