MakerDAO: Strong Performance in Bear and Bull Markets Due to Solid Fundamentals or Successful Narrative?

By: IOSG Ventures

TL, DR:

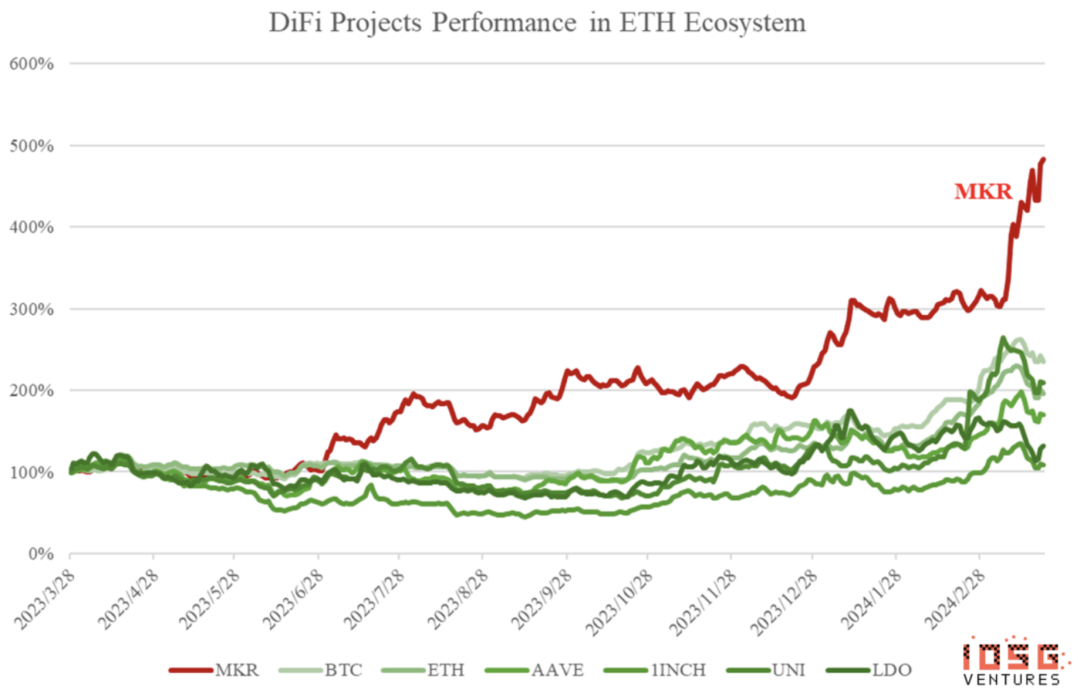

In the past year, MakerDAO has outperformed BTC, ETH, and other DeFi protocols, with MKR's price increasing by about 500% while most DeFi participants' tokens saw a 200% increase.

MakerDAO's success stems from its solid fundamentals and diversified business model, performing well in both RWA and the cryptocurrency market. In the current uncertain macroeconomic conditions of traditional finance and the DeFi race, we believe that MKR's business layout in both areas can help it withstand risks and achieve substantial returns.

Positive market sentiment and the release of the MakerDAO Endgame: Launch Season roadmap indicate future growth. The release of Endgame has further boosted market sentiment.

Challenges faced by Endgame include striking a balance between innovation and risk, ensuring stakeholders understand its purpose. It introduces a new token economic model, governance framework, and clear development roadmap to improve its growth potential, risk resilience, and public acceptance.

While simplifying operations, its core business focus remains largely unchanged. The benefits from the revenue side may not be particularly significant in the short term, but it may reduce internal communication costs and enhance the professionalism and operational efficiency of each business.

We believe that the effective execution of Endgame is crucial for MakerDAO to continue leading the future DeFi landscape. The impact of the roadmap and MakerDAO's commitment to innovation will determine its future success.

Background

In the previous bear market, few cryptocurrencies showed strong performance, and Maker (MKR) was undoubtedly one of them. While other blue-chip assets fluctuated in price, Maker not only maintained its value but also achieved remarkable growth, doubling from March 2023 to October. This outstanding resilience demonstrates its ability not only to survive in adversity but also to thrive under difficult conditions.

However, Maker's appeal is not limited to bear markets. As the cryptocurrency market looked bullish in early 2024, Maker's price rose from 1400 to 2000. This momentum did not stop; after the announcement of the highly anticipated Endgame plan on March 13, the price soared to 3000. Such a surge means that holding MKR may have brought returns of up to 5 times in the past year!

So, what is the secret behind MakerDAO's strong performance in bear and bull markets? Is it due to its solid fundamentals or the success brought by its changing narrative? Most interestingly, what is MakerDAO Endgame, and what should we expect for the future? This article aims to address these questions and reveal the driving force that has made MakerDAO stand out in the unpredictable cryptocurrency market.

MakerDAO: Highly Adaptive DeFi Pioneer, Bridge Between Cryptocurrency and Real-World Assets

In the rapidly evolving DeFi space, MakerDAO has cleverly addressed two key trends: integrating real-world assets (RWA) and staking Ethereum (stETH), successfully highlighting its unique position. This strategy not only strengthens its position in the decentralized finance sector but also showcases its resilience and adaptability.

Staked Ethereum (stETH) Integration

In the crypto space, MakerDAO has locked approximately 600,000 wrapped staked ETH (wstETH) through its core protocol and subsidiary, Spark. This significant integration has made MakerDAO the third-largest total value locked (TVL) entity, reaching $116.7 billion (with Maker locking $86.7 billion and Spark locking $30 billion), second only to Lido's $340 billion and Eigenlayer's $118.01 billion. Unlike Lido and Eigenlayer, which focus on staking and restaking services, MakerDAO's DeFi business model goes beyond simple asset collateralization.

By locking stETH, MakerDAO effectively uses these assets as collateral to mint its native stablecoin, DAI. This process allows MakerDAO to generate income through stable fees (interest rates) charged on loans issued against stETH collateral. As Ethereum yields fluctuate, MakerDAO adjusts its risk parameters and interest rates to ensure stable system operation while generating income. This approach converts Ethereum's volatility and yields into stable income streams, consolidating its position as an industry leader.

RWA Strategy

In June 2023, MakerDAO integrated US Treasury bonds into its investment portfolio, indicating its diversification of income sources through the use of RWA. Essentially, when there is a high-yielding and risk-free alternative, Maker's governors are unwilling to hold inefficient and "risky" USDC on its balance sheet. This decision not only positions MakerDAO as a leader in the RWA field within the cryptocurrency industry but also significantly enhances its income.

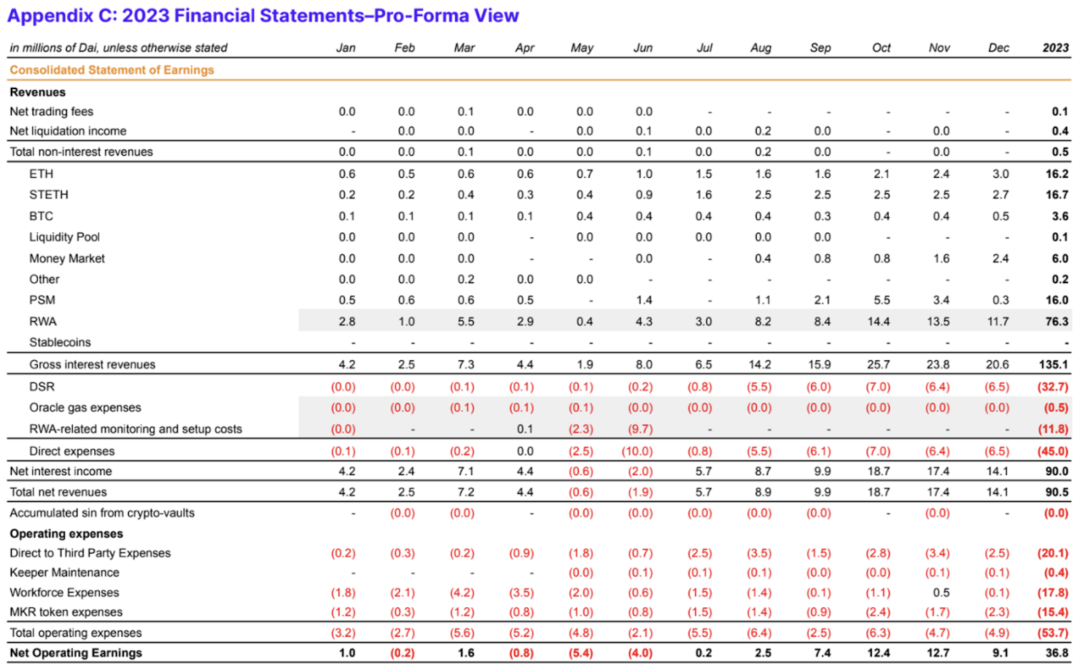

RWAs, including real estate and bonds, have become an important part of MakerDAO's income, contributing approximately 60% of its fee income. The inclusion of US Treasury bonds has proven to be a successful strategy, enhancing the stability of MakerDAO's income and resulting in annual income exceeding $100 million.

According to a report from Steakhouse (https://www.steakhouse.financial/projects/makerdao-financial-report-2023), in 2023, approximately 56% of income, totaling 76.3 million DAI, came from real-world assets (RWA). Further analysis shows that 83% of real-world asset income was concentrated in the latter half of the year, coinciding with a period of continuous growth in the ten-year federal interest rate.

Source: Steakhouse

MKR: All-Weather Cryptocurrency Asset

Due to its strategic allocation in RWA and cryptocurrency market lending, MKR has performed well in different market environments. In a high-interest rate environment, MKR demonstrates strong adaptability, benefiting from its RWA investments, unlike other cryptocurrencies that may suffer losses under such macroeconomic pressures. As interest rates decline, market liquidity increases, and the cryptocurrency market enters a bull market, MakerDAO's strategy is expected to shift towards its advantages in native cryptocurrency operations, especially cryptocurrency lending.

Therefore, MakerDAO adeptly navigates market cycles, focusing on cryptocurrency lending in bull markets and optimizing RWA income in bear markets, ensuring its position as a strong all-weather cryptocurrency asset.

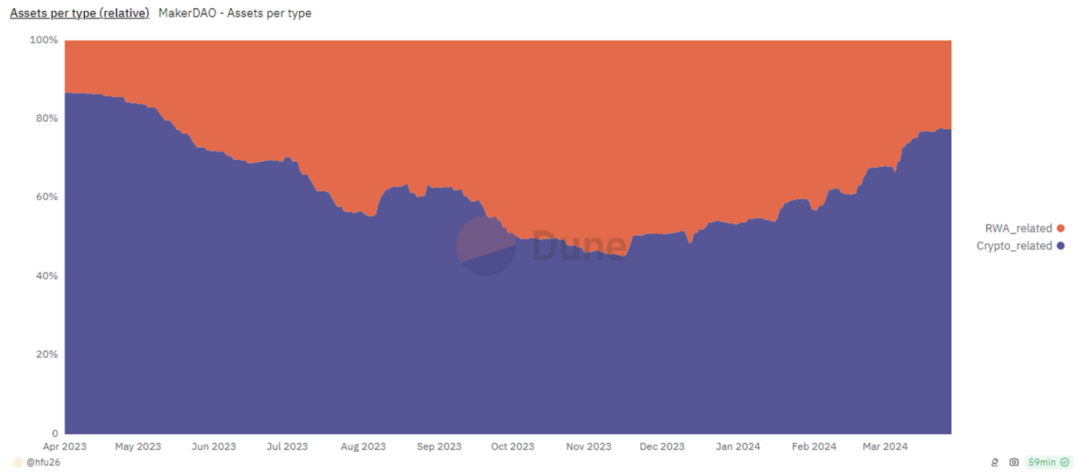

The following chart reaffirms Maker's asset allocation strategy. When the Federal Reserve interest rate peaked at approximately 5% in October 2023, Maker allocated most of its assets to RWA-related assets, earning income from government bonds and other credit-related products.

As the confidence of the Federal Reserve in controlling inflation increased and interest rates began to decline, Maker strategically shifted towards cryptocurrency-related areas.

The current macro situation is not as clear as we might think: with the inflation figures announced by the US Bureau of Labor Statistics not meeting analysts' expectations (CPI in March 2024 was 0.4%, expected to be 0.3%), expectations for a Fed rate cut continue to be delayed or even suppressed. Jamie Dimon, CEO of JPMorgan, even mentioned the risk of interest rates rising to over 8%. The high-interest rate environment provides more profit opportunities for RWA projects. Maker is very likely to profit again from the RWA aspect.

Source: https://dune.com/queries/3569610/6008265

Valuation Expansion: Market Recovery and Narrative Evolution After Endgame Release

The previous section emphasized MKR's solid business model and impressive profitability, laying the foundation for understanding its valuation. However, the significant increase in MKR's price is not solely attributed to its financial performance, as profit estimates increased from $500 million in April 2023 to $1.5 billion in March 2024, but the price increased by more than 5 times.

A closer look at data from Makerburn reveals another important part of the story: valuation expansion. From June 2023 to August 2023, MKR's price-to-earnings ratio (P/E) hovered between 10 and 15. By September 2023, this number began to rise, reaching around 20 in February 2024, and then sharply jumping to over 30 by the end of March 2024.

So, what drove this remarkable valuation expansion?

Source: https://makerburn.com/#/charts/revenue

Market Environment Recovery

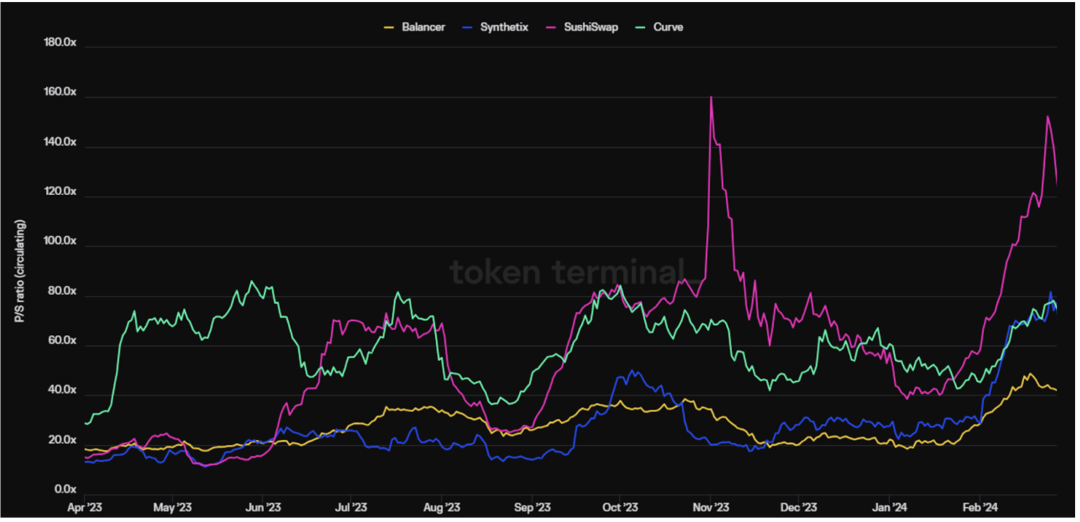

In our article in December 2023, we emphasized the start of the sixth cryptocurrency bull market, which has now been ongoing for over a year. For details, please refer to our analysis. This phase has promoted the activity of various DeFi projects, driven by market activity enhancement and growth expectations. This interactive and increased trading volume in the expectations is not only speculative; it can be observed throughout the DeFi space. Projects like Balancer, Synthetix, Sushiswap, and Curve Finance are experiencing significant expansion, a trend confirmed by Token Terminal data.

However, MKR's extraordinary journey of valuation expansion is not solely a product of market dynamics, especially with its price-to-earnings estimate soaring to over 30 by March 2024. The full launch of MKR Endgame in early March 2024 marked a key moment, propelling its valuation to new highs and distinguishing its growth trajectory from broader market trends.

This prompts us to delve deeper: what exactly is Endgame, why can it spark such high expectations, and support the significant increase in MKR's valuation?

Source: https://tokenterminal.com/terminal/metrics/ps-circulating

MakerDAO Endgame: Ultimate Plan for Operational Efficiency, Clarity, and Risk Isolation

4.1 Background: Challenges Faced by MakerDAO

Inefficient operations: Despite widespread adoption of DAOs in crypto projects, operational efficiency remains an issue. MakerDAO has faced significant challenges, including rejected proposals aimed at improving efficiency through centralized operations, which have also clouded members' understanding of voting and activities.

Intensified competition: Competition within the decentralized finance (DeFi) ecosystem is increasingly fierce, as highlighted by the public conflict between MakerDAO and Aave. Faced with Aave's launch of its stablecoin GHO, MakerDAO responded by supporting Spark's development and collaborating with Morpho to establish a new lending pool. These actions underscore the intense competitive landscape in DeFi and have gradually raised questions about the solidity of MakerDAO's competitive barriers in a rapidly changing market.

Changes in risk control: Recently, MakerDAO's Dai Savings Rate (DSR) has experienced significant fluctuations, rapidly increasing from 5% to 16%, retracting to 13%, and ultimately adjusting to 10% by the end of April. This challenged the community's expectations for stable and predictable interest rate policies. Additionally, they significantly expanded the limit of D3M to 25 billion DAI and collaborated with Morpho to establish the USDe pool, reflecting a strategic shift towards higher risk tolerance. These measures, closer to hedge fund strategies than traditional central banks, demonstrate MakerDAO's efforts to address external DeFi competitors while potentially sacrificing foundational stability.

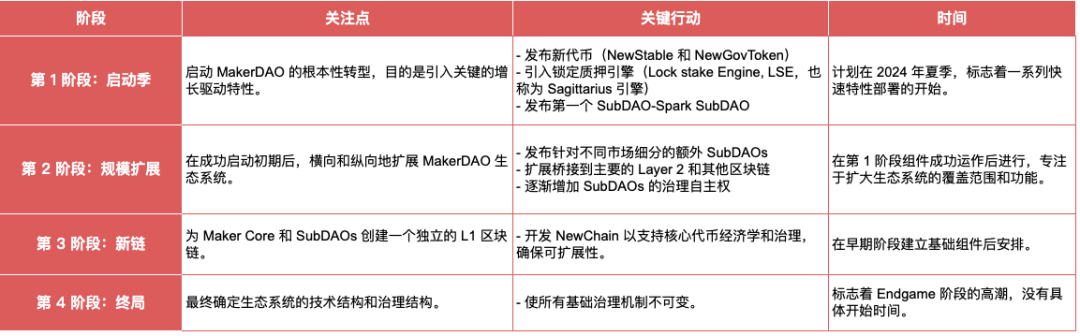

To address these challenges while maintaining its decentralized nature, MakerDAO introduced the Endgame framework in the third quarter of 2022, with its initial phase launched in the first quarter of 2024. The framework aims to enhance MakerDAO's scalability, risk resilience, and user engagement.

4.2 Contents in the Roadmap

Key changes:

Maker Core will have no direct relationship with its business, and even Dai lending will be done through Spark (a SubDAO).

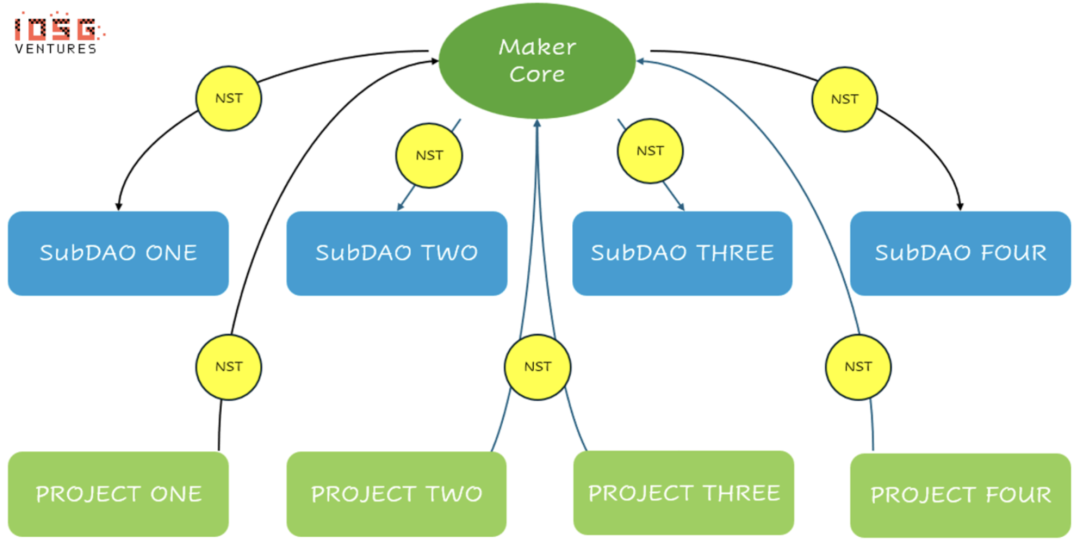

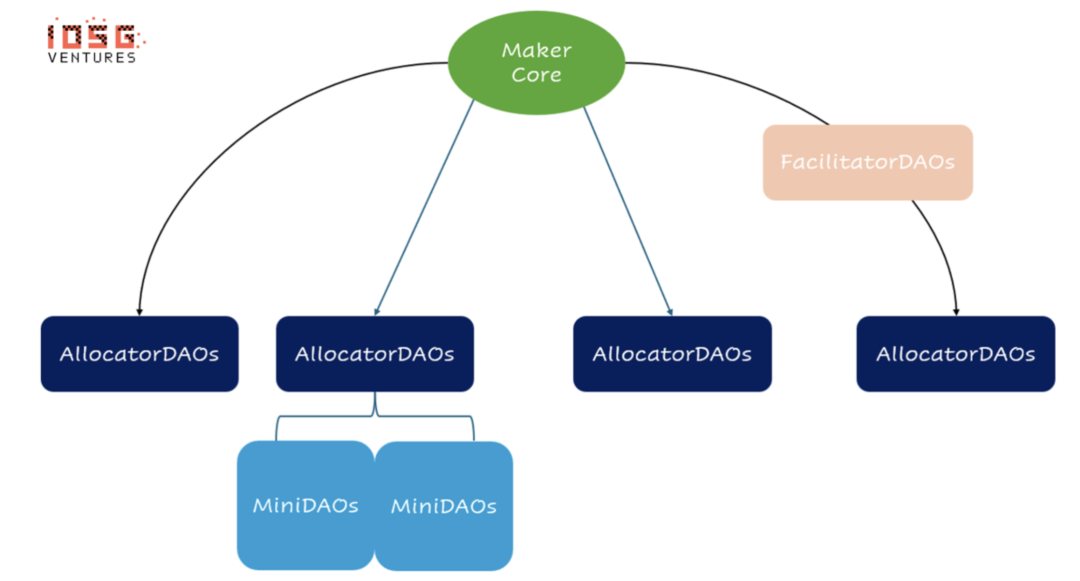

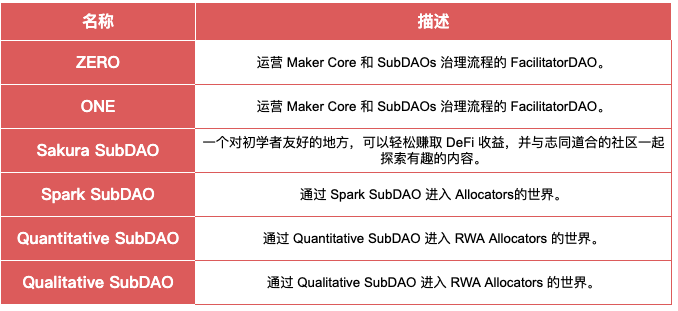

Two types of SubDAO will be introduced in Maker's Endgame: primary SubDAO, including AllocatorDAO and FacilitatorDAO, and secondary SubDAO called MiniDAOs. The primary SubDAO has a large token supply, primarily allocated through Genesis farming and used for employee bonuses, with ongoing allocations based on later proposals. MiniDAOs also follow the Genesis farming model, but with different specific allocation strategies across various farming channels.

Endgame introduces key updates to MKR usage: it allows the purchase of liquidity pool tokens to make Maker Core more relevant to SubDAO interests, new minting every year to support SubDAO and employee incentives, and a new module where locked MKR enables governance participation and rewards, with a portion being burned upon withdrawal.

The entire proposal is quite lengthy and includes many technical details. However, the key improved features and considerations can be summarized into the following categories:

4.2.1 Business Side

- Incentivizing long-term participation

MKR as Collateral: Using MKR as collateral in the Sagittarius Engine is a significant change. It is part of the Maker Endgame, allowing MKR to be used as collateral, incentivizing long-term staking for rewards and penalties to enhance stability and governance within the Maker ecosystem.

Rewards and Penalties: Unlike the past model, the Sagittarius Engine introduces a 15% penalty for unstaking, promoting stability and aligning holders' interests with the sustainability of the ecosystem.

- Risk Management Mechanisms

Hard Liquidation Ratio: Set at 200%, the vault will be liquidated if it falls below this threshold.

Soft Liquidation Ratio: A preventative 300% threshold, with the vault being liquidated if not recovered within a week.

Risk Controls: The hard and soft liquidation triggers in Maker Endgame are designed to protect the interests of all stakeholders, such as MKR holders and DAI users, by ensuring the system maintains good collateral and resilience to market fluctuations. However, introducing native collateral brings significant risks. Price fluctuations may trigger a death spiral of MKR selling pressure, further increasing its volatility as collateral.

4.2.2 Operational Side

- SubDAO

Relationship with Maker: SubDAOs are autonomous organizations within the Maker ecosystem, each with its own governance tokens and focus areas. For example, the Spark SubDAO focuses on lending and DeFi products, operating at scale alongside Maker's infrastructure.

Relationship with MakerCore: The relationship between MakerCore and SubDAOs has changed, with MakerCore stepping back from front-end maintenance and focusing on distributing DAI through these SubDAOs. MakerDAO allocates credit lines to SubDAOs, enabling them to have sufficient liquidity. MakerCore sets risk parameters, including acceptable collateral types and over-collateralization requirements, ensuring the stability of DAI. In exchange for these services, MakerDAO earns deposit fees from DAI managed by SubDAOs, creating a symbiotic system with strong liquidity and income.

Value Distribution: Through a specified inflation mechanism, value is shared between SubDAOs and MakerDAO, with a portion of new MKR allocated to SubDAOs. These SubDAOs commit to reinvest in MKR and DAI, enhancing market liquidity and the ecosystem's monetary value. This allocation depends on the amount of MKR/DAI liquidity pool tokens staked, coordinating incentives between Maker and its SubDAOs.

Allocation of New Stablecoin (NST)

Profit Transfer and Distribution

- SubDAO Categories

AllocatorDAOs:

Able to generate DAI directly from Maker.

Authorized to distribute DAI in the DeFi ecosystem after approval by Maker Core.

Provide an entry point for new participants into the Maker ecosystem.

Capable of creating miniDAOs for increased autonomy and flexibility.

MiniDAOs:

An experimental concept with no actual examples to date.

Intended to provide a more independent structure for AllocatorDAOs when needed.

FacilitatorDAOs:

Responsible for organizing and managing internal mechanisms of different DAOs and Maker Core.

Handle various aspects including community management, product development, and legal compliance.

Structure of Different DAOs

List of SubDAOs

4.2.3 Risk Isolation:

MakerDAO's Endgame manages risk through a clearly defined operational and governance structure, maintaining consistency within the Maker ecosystem. This structure outlines the roles of MKR holders, Maker Core, and SubDAOs, focusing on managing capital flows and asset allocation. MKR holders, especially Aligned Delegates, are crucial in setting governance practices that ensure uniformity and consistency of decisions throughout the ecosystem.

Maker Core implements these governance decisions by directing capital to Allocator Vaults within established risk parameters. This process helps mitigate financial risk by ensuring capital management does not become overly concentrated and by implementing capital dispersion controls in collaboration with Arrangers.

By introducing SubDAO governance tokens, MKR is in a safer position, only needing intervention in cases of significant turmoil that SubDAO governance tokens themselves cannot resolve (e.g., massive dislocations). SubDAOs act as a firewall between actual operations and Maker Core.

Source: Steakhouse

4.3 Different Phases:

This narrative undoubtedly represents an unprecedented grandeur, and the process will be divided into four phases.

In short: Is it the beginning of a new era, or old wine in a new bottle?

Token Economics: The transformation of MKR token economics requires closer scrutiny. The plan to use MKR as collateral and allow governance participation through zero-rate borrowing against ETH introduces risk factors. Additionally, the proposed annual inflation rate of approximately 6% may have unforeseen consequences on the token's value.

Simpler or More Complex: While the detailed planning of MakerDAO's ultimate strategy presents a well-thought-out evolution plan, it also reveals a significant drawback. While the shift towards Maker Core is visionary, it seems to overemphasize long-term goals at the expense of immediate practical actions, leading to a gap between strategic planning and current implementation. Furthermore, the changes in governance structure introduce another layer of complexity, leaving participants questioning whether this new approach simplifies the system or makes it more complex in another way.

Business Essence Unchanged after Brand Reshaping: Despite operational structural changes, MakerDAO fundamentally adheres to its familiar domain of crypto lending, especially expanding into the Spark protocol. Similarly, its business in RWA has not changed in the short term. This raises doubts about business innovation, as the plan does not detail future projects. It leaves a significant portion of the roadmap to imagination, indicating a strategic focus on perfecting existing operations rather than exploring unknown business paths. Therefore, it is unclear whether the launch of this ultimate plan is just a brand reshaping or truly brings more value.

Higher Risk or Safer: SubDAOs act as a firewall between Maker Core and actual operations. However, Maker has taken more adventurous moves. The market's perception of MakerDAO has shifted from viewing it as a stable central bank to an entity taking on increasing risks to remain competitive. This conceptual shift reflects a reassessment of DAI's risk, leading to the repricing of MKR to align with broader market trends. This shift emphasizes the delicate balance MakerDAO faces between innovation and maintaining foundational stability.

Conclusion

MakerDAO's outstanding performance over the past year demonstrates its robust and all-weather business model, adept at navigating the volatile crypto market. Its strategic shift towards RWA during high-rate periods and focus on the crypto market during market upswings highlights its business acumen surpassing other blue-chip tokens. With unparalleled revenue-generating ability—generating approximately $230 million in revenue annually—MakerDAO stands at the pinnacle of financial efficiency in the DeFi space.

Driven by positive market sentiment, the valuation expansion of MakerDAO highlights the potential growth of its price-earnings (P/E) ratio. The proposed roadmap of MakerDAO Endgame further propels this momentum, heralding a brighter future.

However, the vision of Endgame is not without challenges. The key to success lies in finding the delicate balance between innovation and rigorous risk management, especially as MKR takes on the role of collateral. The complexity of implementing such a grand plan demands excellent communication to ensure stakeholder buy-in.

While Endgame introduces a simplified operational model, it does not deviate from the core essence of MakerDAO. Considering its undoubtedly superior business model, the business transformation may not be necessary. It aims to strengthen and expand the established business framework rather than explore new risk investments in the short term.

Looking ahead, whether MakerDAO can alleviate these concerns and demonstrate the actual benefits of Endgame will be crucial. Effective execution may further solidify its leadership position in the DeFi space, presenting a more robust, user-centric platform ready to adapt to the dynamic changes in the crypto world.

The ultimate measure of Endgame's success will be its impact—whether it can deliver on its promises, enrich stakeholder benefits, and maintain MakerDAO's position as a beacon of resilience and innovation in the decentralized finance space. At least for now, the launch of this plan seems to have no downsides, with clearer delineation of roles and increased professionalism in various areas, while also isolating some risks. Perhaps this is just the end of the prologue, and the competition between large DeFi projects will become more intense. Only time will tell us the answer, but the journey ahead is undoubtedly hopeful.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。