Author: Teahouse Waiter

1. Project Introduction

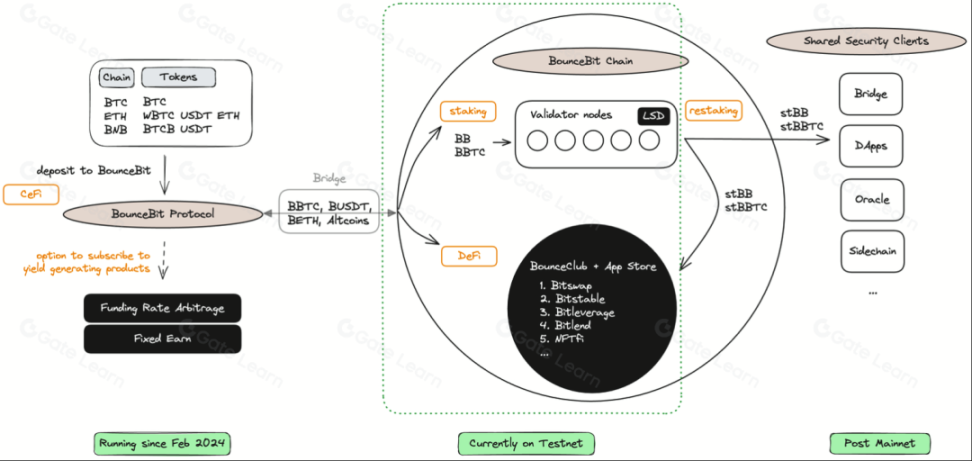

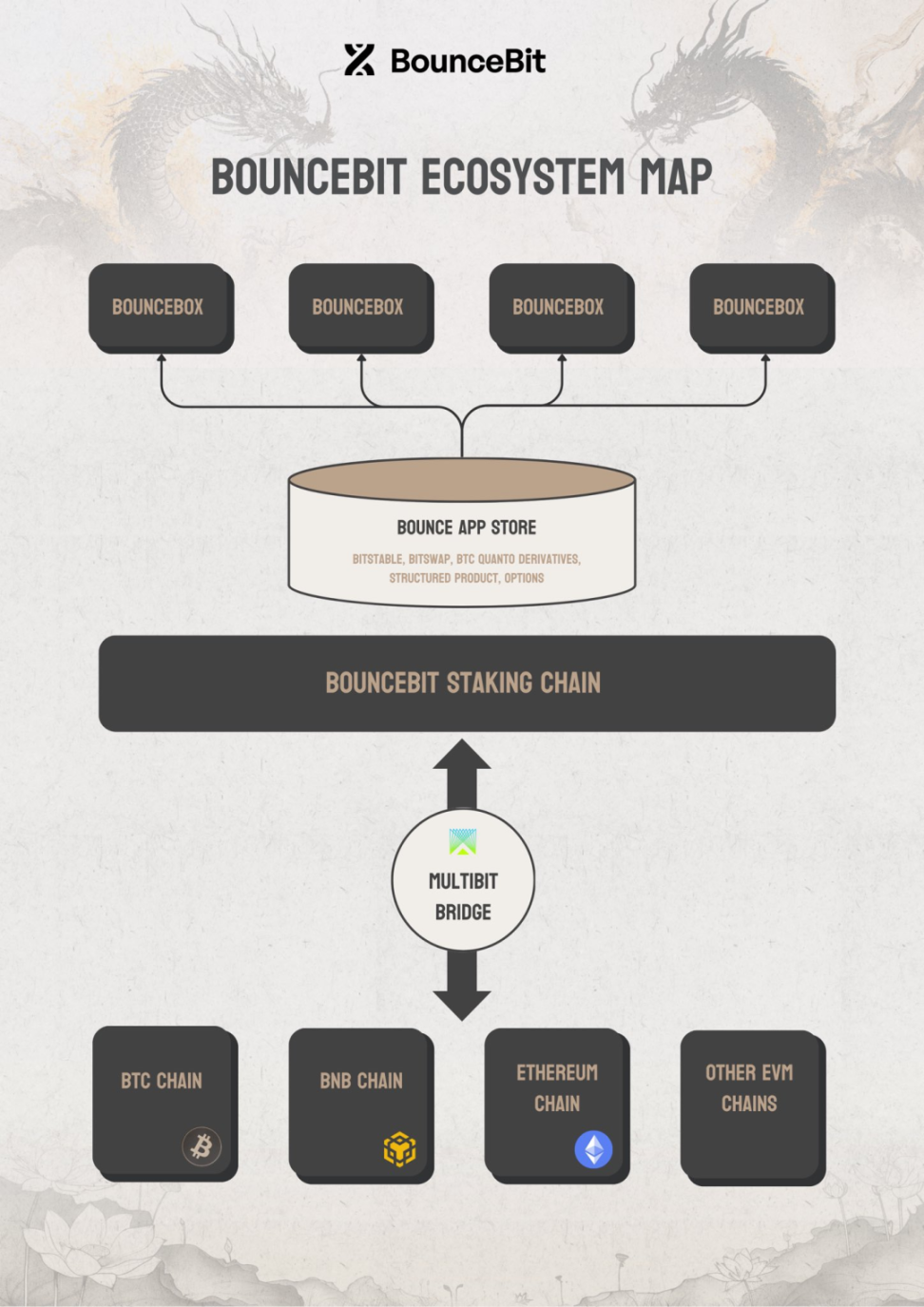

BounceBit is a re-staking project built on the Bitcoin ecosystem, aiming to create a new ecosystem - BounceBit Chain, allowing BTC to generate organic staking rewards.

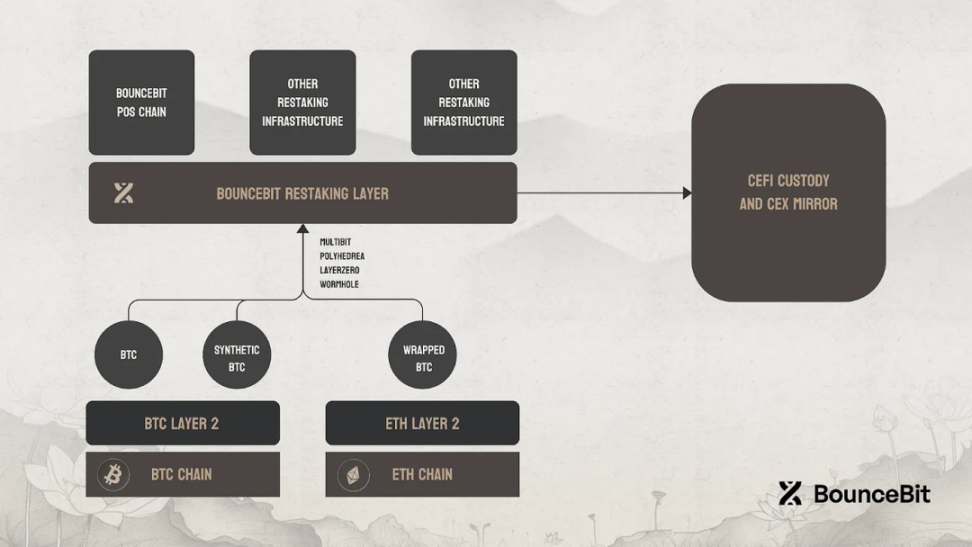

The core innovation of BounceBit comes from the BTC re-staking mechanism, which is a key driver of the project. BounceBit will build a series of infrastructures to explore the use of re-staking on various types of bitcoins, which can take the form of sidechains, oracles, bridges, virtual machines, data availability layers, etc. The goal is to support the entire framework through re-staking and aggregated shared security.

By integrating Bitcoin into a proof-of-stake (PoS) first-layer network, BounceBit redefines the role of Bitcoin in the blockchain ecosystem. BounceBit not only extends the utility of the world's first cryptocurrency, but also pioneers a token economic model committed to scalability, security, and inclusivity.

2. Core Operating Mechanism

2.1 Re-staking Mechanism

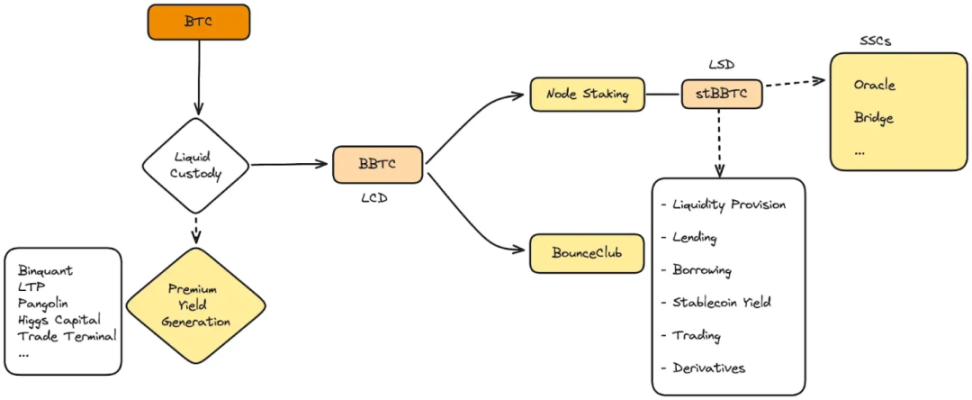

One of the core innovations of BounceBit is its BTC re-staking mechanism. Users can convert their bitcoins into BBTC and then stake them on the BounceBit platform to earn rewards. This mechanism not only increases the liquidity of Bitcoin but also enhances its application in the DeFi ecosystem.

Here is a detailed introduction to BounceBit's re-staking mechanism:

2.1.1 Basic Concept

The re-staking mechanism is based on converting traditional cryptocurrencies such as Bitcoin into a new form that can be used on the BounceBit platform, commonly referred to as BBTC. This conversion allows Bitcoin, which originally did not have staking functionality, to participate in staking and consensus processes, thereby increasing additional income while maintaining its value.

2.1.2 Steps and Process

- Convert to BBTC: Users first convert their held bitcoins into BBTC. This process can be completed through BounceBit's cross-chain bridge or directly on its platform. The converted BBTC represents the value of the user's bitcoins on the original chain.

- Stake BBTC: Once bitcoins are converted into BBTC, users can stake them on the BounceBit platform. By staking BBTC, users participate in the platform's security, help maintain network stability, and verify transactions.

- Earn Rewards: Users participating in staking can earn rewards, which can be in the form of BBTC or another native token of the platform, BB. These rewards come from network transaction fees, rewards for generating new blocks, or other economic activities.

2.2 Dual-Token System

BounceBit's dual-token system is a key design feature that effectively enhances network security, provides flexible staking mechanisms, and promotes user participation in its governance structure. This system consists of two tokens with different functions: BB and BBTC. Below is a detailed introduction to these two tokens and how they operate on the BounceBit platform:

2.2.1 BB Token

BB is the native governance token of BounceBit.

- 2.2.1.1 Main Uses

- Network Governance: BB token holders can participate in platform governance decisions, including proposals and voting. This governance model allows community members to directly influence the platform's development direction and adjustments to key parameters.

- Staking Rewards: BB tokens can be staked in the network to support its operation, and stakers can receive transaction fees and other incentives as rewards.

- Security Assurance: By staking BB tokens, users help maintain network security, prevent double spending, and other types of attacks.

The design of BB tokens aims to incentivize holders to actively participate in the platform's maintenance and governance, ensuring the healthy development and long-term success of the network.

- 2.2.1.2 Token Allocation

The total supply of BounceBit tokens is 21 billion, allocated as follows:

- Staking Rewards: 35%, used to reward users providing staking services to the BounceBit network.

- Market: 3%, used to incentivize liquidity providers to provide liquidity for BounceBit trading pairs.

- Binance Megadrop: 8%, used to airdrop BB tokens to the public through Binance Launchpad.

- Testnet Incentives: 4%, used to reward testnet participants.

- Advisors: 5%, used to reward advisors of the BounceBit project.

- Team: 10%, used to reward team members of the BounceBit project.

- BounceClub and Ecosystem Reserve: 14%, used to support the development and growth of the BounceBit ecosystem.

- Investors: 21%, used to reward early investors.

2.2.1.3 BounceBit Token Release Schedule

BounceBit tokens will be gradually unlocked over four years, with the specific schedule as follows:

2.2.2 BBTC Token

BBTC is a token pegged to the value of Bitcoin, mainly used to achieve broader applications of Bitcoin on the BounceBit platform. Its main features and uses include:

Increasing the liquidity and availability of Bitcoin: Users can convert their bitcoins into BBTC and then use them on the BounceBit platform to participate in various staking and investment opportunities, such as DeFi projects.

Cross-chain functionality: BBTC can freely transfer between different blockchains, allowing Bitcoin to circulate and be used in a wider blockchain ecosystem.

Participating in staking and earning income: By converting bitcoins into BBTC, users not only maintain the value of Bitcoin but also earn additional income through staking BBTC.

The design of BBTC aims to address the low liquidity and limited use cases of Bitcoin on its native chain. Through BBTC, Bitcoin can more flexibly participate in various blockchain activities.

2.2.3 Dual-Token Consensus Mechanism

The dual-token system of BounceBit not only provides diversified economic incentives but also maintains network security and stability through a unique dual-token consensus mechanism. In this mechanism:

Validators need to stake BB or BBTC to participate in the network's consensus process.

This dual-token design enhances network security by requiring participants to hold at least one of the two tokens, thereby increasing the economic cost of network attacks.

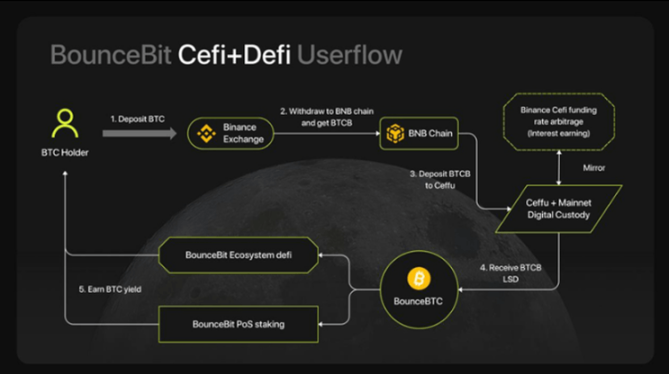

2.3 DeFi & CeFi Integration

The integration of DeFi (decentralized finance) and CeFi (centralized finance) is one of the core features of the BounceBit platform, aiming to bridge the traditional financial world with blockchain technology seamlessly. This integration not only provides users with a wider range of financial tools and services but also enhances liquidity and accessibility of funds.

Here is a detailed explanation of how BounceBit achieves the integration of DeFi and CeFi:

2.3.1 DeFi Integration

- Smart Contract Platform:

BounceBit is built on compatibility with the Ethereum Virtual Machine (EVM), allowing it to execute smart contracts. This feature enables developers to deploy and run various decentralized applications (DApps) on the BounceBit platform, including lending platforms, automated market makers (AMMs), and other financial protocols.

- Liquidity Protocols:

By providing built-in liquidity protocols, BounceBit enables users to stake and borrow their crypto assets. These protocols typically take the form of liquidity pools, where users can deposit their crypto assets in exchange for a share of transaction fees or other forms of income.

- Tokenized Assets:

BounceBit supports tokenized assets, such as BBTC, allowing traditional crypto assets like Bitcoin to be more active in the decentralized finance ecosystem, enabling users to participate in a wider range of DeFi activities.

2.3.2 CeFi Integration

- Regulated Partnerships:

BounceBit collaborates with regulated financial institutions to provide centralized financial services. These services include asset custody, fiat currency exchange, and credit services. Through this approach, BounceBit ensures that financial activities on the platform comply with relevant regulatory requirements.

- Asset Liquidity and Security:

In the realm of CeFi, BounceBit provides liquidity management and security measures for crypto assets. Collaborating centralized institutions can offer faster transaction processing speeds, higher trading volumes, and insurance and other security measures for user assets.

- User Interface and Experience:

BounceBit aims to eliminate the boundaries between DeFi and CeFi in user experience. By providing a unified interface, users can seamlessly switch between decentralized and centralized financial products, enjoying the advantages of both without the need to frequently switch platforms or wallets.

2.3.3 Bridging DeFi and CeFi

Dual-Token Mechanism and Liquidity:

BounceBit's dual-token system (BB and BBTC) serves as a liquidity bridge for the integration of DeFi and CeFi. Users can use these tokens to earn returns in DeFi protocols or trade and exchange on CeFi platforms.

Cross-Chain Technology:

BounceBit utilizes cross-chain technology to enable assets to move freely between different blockchains, enhancing its support for various financial domains and allowing users to access multi-chain assets on a single platform.

2.4 Proof of Stake (PoS)

BounceBit adopts a unique Proof of Stake (PoS) consensus mechanism, which not only enhances network security but also improves its energy efficiency and scalability. In BounceBit's PoS system, node operators need to stake tokens (such as BB or BBTC) to participate in the network's consensus process and transaction validation. Here is a detailed explanation of BounceBit's PoS consensus mechanism:

2.4.1 Basic Principles of PoS Consensus Mechanism

PoS (Proof of Stake) is a blockchain consensus mechanism that ensures network security and integrity by holding tokens, as opposed to the computational power required in Proof of Work (PoW). In PoS, the selection of validators is based on the quantity of tokens held and the duration of holding, rather than the ability to solve complex computational problems.

2.4.2 Characteristics of BounceBit's PoS

Dual-Token Staking: BounceBit allows users to stake two types of tokens—BB and BBTC—to participate in staking and network validation, increasing participant diversity and providing more staking flexibility.

Validator Election: In BounceBit's PoS system, token holders can elect trusted nodes as network validators through voting. This process promotes decentralization of power and increases the network's decentralization.

Reward Mechanism: Validators participating in PoS staking can receive transaction fees and newly generated tokens as rewards. This reward mechanism incentivizes more users to join staking, enhancing network security.

Security and Stability: By requiring validators to stake a significant amount of tokens, BounceBit's PoS system increases the cost of launching attacks, thereby enhancing network security.

Energy Efficiency: Compared to PoW, the PoS mechanism is more energy-efficient. BounceBit's adoption of PoS not only reduces environmental impact but also improves transaction processing speed and network scalability.

2.4.3 Roles and Responsibilities of Validators

In BounceBit's PoS system, validators are responsible for critical network operations, including:

Transaction Validation: Validators are responsible for checking and confirming transactions on the network to ensure their legitimacy and accuracy.

Block Generation: Validators participate in generating new blocks that record all transactions occurring on the network since the previous block.

Network Security Maintenance: Validators help prevent double spending and other types of network attacks through continuous network participation and monitoring.

2.5 Liquidity and Cross-Chain Operations

Liquidity and cross-chain operations are essential components of the BounceBit platform's functionality, aiming to improve the efficiency and accessibility of crypto assets and connect different blockchain networks. These features are crucial for building an open, interconnected blockchain ecosystem, allowing assets to move freely and users to seamlessly trade and engage in financial activities across multiple platforms. Here is a detailed explanation of BounceBit's functionality and implementation in these two aspects:

2.5.1 Liquidity Management

On the BounceBit platform, liquidity management is achieved through various mechanisms and tools to ensure users can trade and use their assets efficiently and conveniently.

Key liquidity features include:

- Liquidity Pools:

BounceBit utilizes liquidity pools to increase the liquidity of assets on the platform. These pools are typically provided by users, who can receive a portion of transaction fees as a reward.

Liquidity pools support various transactions, including token swaps, lending operations, and other complex financial instruments.

- Automated Market Makers (AMMs):

BounceBit can integrate the AMM model, allowing decentralized trading without the need for traditional order books. Users can interact directly with smart contracts to buy and sell assets using preset algorithms, improving trading efficiency and predictability.

- Staking and Reward Mechanism:

To further increase the platform's liquidity, BounceBit encourages users to stake their tokens (such as BB or BBTC) to support network operations and provide liquidity. In return, users can receive staking rewards, including a portion of newly issued tokens or transaction fees.

2.5.2 Cross-Chain Operations

Cross-chain technology enables BounceBit to connect multiple different blockchain networks, allowing assets to move freely between different chains. This is a key technology for achieving widespread blockchain adoption and functionality expansion.

Implementation of Cross-Chain Functionality

- Cross-Chain Bridges:

BounceBit develops and maintains cross-chain bridges that allow assets like BBTC to move from one blockchain to another. This transfer is secured and transparent through smart contracts.

Bridge operations can be one-way or two-way, depending on the specific assets and the requirements of the target chain.

- Compatibility and Interoperability:

BounceBit ensures its platform is technically compatible with other major blockchain protocols (such as Ethereum, Binance Smart Chain, etc.). This includes support for standardized token protocols (such as ERC-20), allowing these tokens to be issued and traded on different chains.

- Decentralized Identity Verification and Security:

Cross-chain operations require high levels of security. BounceBit ensures the security and tamper resistance of cross-chain transactions through multi-signature, smart contract verification, and other encryption technologies.

2.6 Tripartite Ecosystem

BounceBit's tripartite ecosystem is a key component of its platform structure, designed to facilitate interaction and cooperation among multiple participants, thereby driving the healthy development and innovation of the entire network. This ecosystem includes three main roles: users (network participants), BB holders, and node operators.

Here is a detailed explanation of these three roles and their functions and roles in the BounceBit ecosystem:

2.6.1 Users (Network Participants)

Users are the foundation of the BounceBit ecosystem, interacting with the platform in various ways:

Transaction Initiators: Users can initiate and execute transactions, such as transfers, purchases, and sales.

DApp Users: Users can utilize decentralized applications (DApps) deployed on the BounceBit platform, such as lending platforms, exchanges, games, etc.

Staking Participants: Users can participate in network security maintenance by staking BB or BBTC and potentially earn rewards.

The activity of these participants directly impacts the vitality and sustainable development of the network. Their transaction behavior and staking decisions are important drivers of network demand and expansion.

2.6.2 BB Holders

BB holders play a crucial governance role in the BounceBit ecosystem:

Governance Voting: Users holding BB tokens can participate in network governance decisions, including voting on protocol updates, fee structure adjustments, and other key decisions.

Staking and Rewards: BB holders can stake their tokens in the network to support secure operations and earn staking rewards.

Community Building: BB holders are often more invested in the long-term success of the platform and may participate in community building and promotional activities to increase BounceBit's visibility and attract new users.

The decisions of this group are crucial for the platform's future direction and development, ensuring that BounceBit progresses in the common interest of its holders.

2.6.3 Node Operators

Node operators are technical participants responsible for maintaining the security and efficient operation of the BounceBit network:

Transaction Validation and Block Generation: Node operators are responsible for validating transactions on the network and participating in block generation, which is crucial for maintaining blockchain integrity and continuity.

Network Security Maintenance: By running full nodes, node operators help the network defend against potential attacks and failures.

Technical Support and Innovation: Node operators are often pioneers in technology and may develop new tools and features to improve network performance and user experience.

The stability and reliability of node operators directly impact the overall health of the network. They play a role as infrastructure providers in the entire ecosystem, serving as an important bridge between users and holders.

2.7 LSD (Liquid Staking Derivative)

BounceBit's LSD (Liquid Staking Derivative) flexible staking mechanism is an innovative feature of the platform, allowing users to stake cryptocurrencies without sacrificing asset liquidity. This mechanism is particularly suitable for users who want to earn returns from their held crypto assets while maintaining their liquidity. LSD solves the liquidity issue in traditional staking methods by creating a derivative representing the staked assets. Here is a detailed explanation of BounceBit's flexible staking with LSD:

2.7.1 Working Principle of LSD

- Asset Staking:

Users first select the assets they want to stake, such as BB or BBTC. These assets are typically locked in a smart contract to support network security or participate in the consensus mechanism.

- Issuance of LSD:

Once the assets are locked, users receive corresponding liquidity staking derivative tokens (LSD), such as stBB or stBBTC. These derivative tokens can be freely traded on the market, allowing users to use them for other investments or trades without compromising the security of the original staked assets.

- Earnings and Rewards:

While the original assets are locked, users can still earn staking rewards by holding LSD. These rewards are typically related to network security, transaction fee sharing, or new block generation.

2.7.2 Advantages of LSD

Enhanced Liquidity:

The greatest advantage of LSD is that it allows users to maintain the liquidity of their assets. Even while participating in staking, users can freely use or trade their LSD tokens.

Risk Diversification:

Users do not need to lock all their assets in a single activity or investment. Through LSD, they can participate in multiple staking pools or DeFi projects simultaneously, diversifying their risks.

Market Adaptability:

LSD enables users to adjust their investment portfolios based on market conditions. For example, in the event of a token price drop, they may decide to sell some LSD to minimize losses without needing to unstake the assets themselves.

2.7.3 Use Cases

DeFi Integration:

LSD can be used in various DeFi protocols, such as lending platforms, liquidity pools, and automated market makers (AMMs). Users can use LSD as proof of liquidity to participate in these protocols and earn additional returns.

Financial Management:

Investors can use LSD for more complex financial planning, such as using LSD as collateral for borrowing or as part of their trading strategies.

Maximizing Returns:

By leveraging staking rewards and market activities with LSD, users can maximize the overall returns on their assets.

3. Team / Partners / Funding

3.1 Team

Most members of the BounceBit team remain anonymous. The founder of the project is named Jack Lu. In 2020, Jack Lu became a co-founder of Bounce Finance and exited the project. BounceBit currently has 15 employees and plans to recruit more talent.

3.2 Investors / Partners

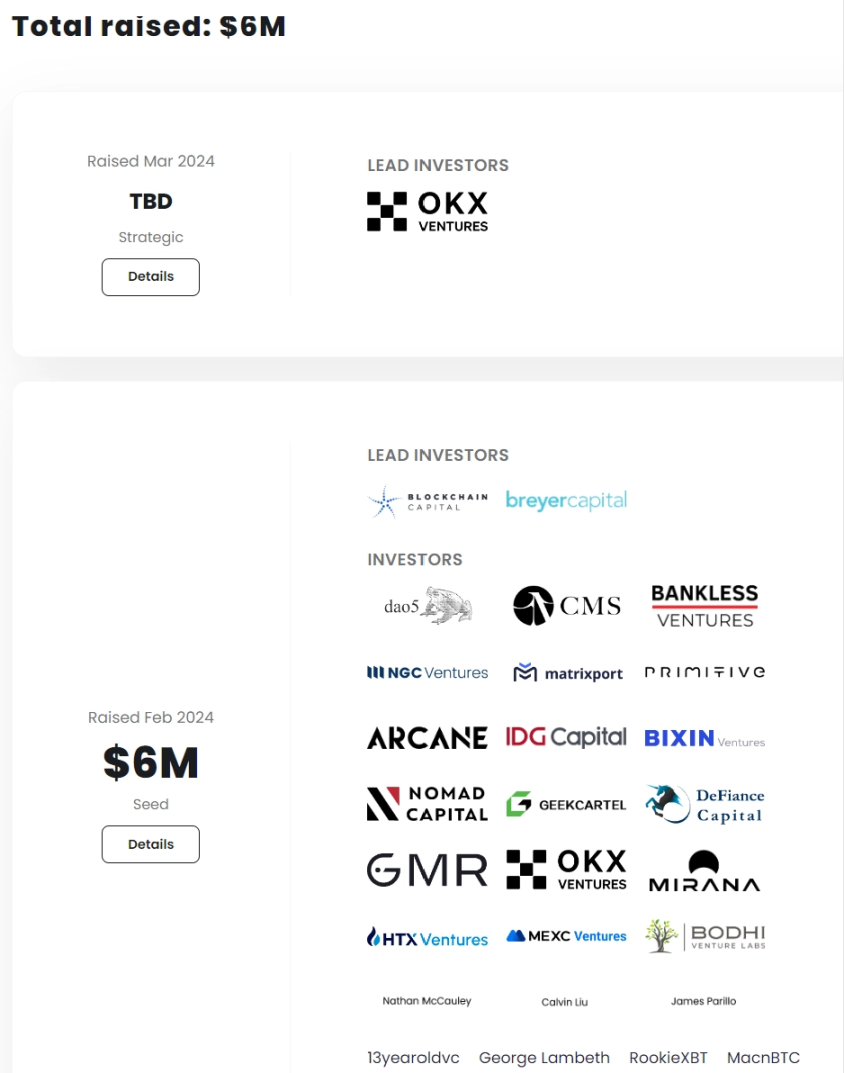

The latest investment from Binance Labs has garnered significant attention from the community for BounceBit. Although the amount of funding has not been disclosed, Binance Labs has expressed its support for the project to expand the functionality of Bitcoin and traditional value storage.

In late February, BounceBit successfully raised $6 million led by Blockchain Capital and Breyer Capital.

Some notable seed round investors include CMS Holdings, Bankless Ventures, NGC Ventures, Matrixport Ventures, DeFiance Capital, OKX Ventures, and HTX Ventures.

The project's main angel investors include Nathan McCauley, Co-founder and CEO of Anchorage Digital, Calvin Liu, Strategic Director of EigenLayer, and Ashwin Ayappan, Portfolio Director of Brevan Howard.

4. Project Evaluation

4.1 Track Analysis

The BounceBit project falls into several areas, mainly DeFi (decentralized finance), cross-chain technology, and staking services. These areas collectively form the core value proposition of BounceBit: enhancing asset liquidity and potential returns by utilizing the re-staking mechanism of assets such as Bitcoin in a multi-chain environment.

BounceBit's Business Model:

Transaction Fees: BounceBit charges a certain percentage of fees for various transactions on the platform, such as token exchanges and staking.

Staking Rewards Sharing: The platform may deduct a portion of the rewards obtained by users through staking as management fees.

Partnerships and Integrations: Collaboration with other DeFi and CeFi projects to generate revenue through providing technical support or liquidity support.

Target Audience:

Cryptocurrency Investors: Users looking to increase their asset returns through staking and other methods.

Cross-Chain Users: Users needing to move assets between different blockchains, seeking efficiency and security.

DeFi Participants: Users seeking advanced financial tools and permissionless financial services.

Similar Projects

Lido Finance: Provides liquidity staking services, allowing holders of assets such as Ethereum to stake their assets without losing liquidity. The stETH provided by Lido is a liquidity staking derivative similar to the LSD offered by BounceBit.

Rocket Pool: Another DeFi project that provides Ethereum staking services and supports stakers to maintain a certain level of liquidity.

Thorchain: Focuses on providing cross-chain liquidity solutions, allowing assets on different blockchains to be freely traded and swapped, similar to BounceBit's cross-chain functionality.

4.2 Project Advantages

The BounceBit project has multiple advantages, setting it apart in the competitive cryptocurrency and blockchain market. Here is an analysis of the main advantages of BounceBit:

1. Innovative Staking Solution

BounceBit introduces the concept of LSD (Liquid Staking Derivative), allowing users to maintain asset liquidity while participating in staking and supporting network security. This model is highly attractive to users who want to earn returns from their held crypto assets without sacrificing liquidity.

2. Cross-Chain Functionality

BounceBit's cross-chain technology enables assets such as Bitcoin and other cryptocurrencies to move freely between different blockchain platforms. This not only enhances the efficiency and accessibility of assets but also strengthens the interoperability and scalability of the entire crypto market. For users and developers, this means accessing and utilizing resources from multiple blockchain networks on a unified platform.

3. EVM Compatibility

By being compatible with the Ethereum Virtual Machine (EVM), BounceBit can support a wide range of smart contracts and decentralized applications (DApps), attracting a large number of existing Ethereum developers and projects. This compatibility also means that BounceBit can quickly integrate new features and applications, maintaining a technological advantage.

4. Enhanced Security and Decentralization

BounceBit adopts a dual-token system and Proof of Stake (PoS) consensus mechanism, which not only enhances network security but also strengthens the network's resistance to censorship and decentralization through the decentralization of power. The dual-token system also incentivizes active participation in network governance and maintenance, enhancing community involvement and platform stability.

5. Integrated DeFi and CeFi Advantages

BounceBit's platform combines the advantages of decentralized and centralized finance, providing an ecosystem covering a wide range of financial services. This integration allows users to experience fast and convenient CeFi services and flexible, transparent DeFi applications on the same platform, meeting the needs of different users.

4.3 Project Disadvantages

While the BounceBit project demonstrates significant advantages in multiple aspects, like all technological and business innovations, it also faces potential challenges and disadvantages. Here are the possible drawbacks and limitations of the BounceBit project:

- Complexity and User Adaptation

BounceBit introduces multiple innovative concepts and technologies, such as LSD (Liquid Staking Derivative), cross-chain operations, and a dual-token system, which may be difficult for ordinary users to understand and adapt to. This complexity may hinder the adoption of new users, especially those unfamiliar with cryptocurrency operations.

- Security Risks

Despite implementing advanced security measures, cross-chain technology and smart contracts themselves bring new security challenges. Cross-chain bridges and smart contracts may become targets for hacker attacks, especially in the presence of code vulnerabilities. Security vulnerabilities may lead to fund theft or data tampering, damaging user trust.

- Regulatory and Compliance Risks

As BounceBit attempts to integrate DeFi and CeFi functionalities, it may face regulatory challenges in different jurisdictions. In particular, involving cross-border transactions and cross-chain asset transfers may trigger complex compliance requirements. Failure to adapt to the constantly changing regulatory environment in various countries may lead to legal risks, affecting the project's sustainable development.

- Competitive Pressure

Although BounceBit provides innovative solutions in multiple areas, it still needs to maintain its leading position in a competitive market. There are many established competitors in the market, such as Lido and Thorchain, which have built strong user bases and brand recognition. BounceBit needs to continuously innovate and improve to stand out in such an environment.

- Dependence on Technological and Market Changes

The success of BounceBit largely depends on the advancement of blockchain technology and the overall condition of the crypto market. Market fluctuations and the uncertainty of technological developments may affect the project's performance and user investment returns. Additionally, as blockchain technology evolves, new technologies may render current solutions obsolete.

5. Conclusion

BounceBit and its token economics represent a significant leap in the integration of traditional financial concepts with cutting-edge blockchain technology. By incorporating Bitcoin into its PoS network and providing innovative staking solutions, BounceBit not only enhances the utility of BTC but also sets a new standard for token economics. As the platform continues to develop, it has the potential to become the cornerstone of the next generation of blockchain infrastructure, providing a stable, secure, and scalable environment for users, holders, and validators to grow their digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。