In recent days, the biggest hot topic is undoubtedly Renzo's listing on Binance, which has attracted a lot of attention and has had a dramatic storyline.

As a dragon in the LRT track, Renzo is a liquidity re-staking protocol based on EigenLayer. It effectively releases the liquidity of re-staked ETH by introducing the derivative token ezETH, while using algorithms to balance real-time returns and risks, automatically making the optimal configuration choices for users, ensuring stable and substantial investment returns.

Renzo went live on the mainnet in October last year, with a current TVL of over $3 billion. Two rounds of financing are known:

- In January of this year, Renzo completed a $3.2 million seed round financing at a valuation of $25 million, with Maven11 leading the investment and OKX, IOSG, SevenX, and others participating.

- In February of this year, Binance Labs announced an investment in Renzo, with the specific amount undisclosed.

The total supply of the official token $REZ is 10 billion, with an initial circulation of 1.05 billion. 2.5% of this is allocated to Binance Launchpool, allowing users to mine by staking BNB or FDUSD, continuing until April 30th. Link: https://launchpad.binance.com/zh-CN/

Renzo's valuation can be directly compared to ether.fi, as both have similar TVL and initial circulation, and both were launched on Binance Launchpool.

According to calculations by Star Daily, based on the real-time price of ETHFI at $3.9, the corresponding price of $REZ calculated with the same FDV is $0.39, with a weighted FDV difference of $0.34. The corresponding price of $REZ calculated with the same MC is $0.43, with a weighted FDV difference of $0.37.

Before Renzo's listing on Binance, let's take stock of the 6 "most" belonging to Renzo.

1. The fastest-growing LRT protocol

Renzo officially launched its product on December 18 last year and within 13 weeks, it gained a TVL of over $20 billion, becoming the fastest-growing liquidity re-staking protocol and a top EigenLayer ecosystem project.

According to Defillama statistics, Renzo's current TVL is $3.25 billion, ranking second in the LST track, second only to ether.fi (current TVL $3.845 billion).

Based on TVL alone, Renzo's listing on Binance is indeed backed by solid strength.

2. The most easily guessed Binance-backed project

With Binance's investment in Renzo, the first launch on Launchpool was a high probability event. This speculation was almost 100% confirmed when Binance announced the listing of $ETHI.

The reason is simple: ether.fi is the leader in the LRT track. The fact that it did not receive investment from Binance but can still be listed on Binance conveys an important signal: Binance is bullish on this track and has initiated a wave of listing top LRT projects.

In terms of TVL, following closely behind ether.fi is Renzo and Puffer. Both of these projects have received investment from Binance, so their listing on Binance is only a matter of time.

3. The fastest token code modification

Renzo's original token code was $EZ, but there was another project in the market using EZ as the token code, causing confusion in the community.

A few hours after the Binance mining announcement, Renzo's team decided to change Renzo's token code from "EZ" to "REZ" after negotiation.

This incident inevitably makes us worry about @zksync: both $ZK and $ZKS have been taken by others, what will your token be called?

4. The most dramatic unpegging

On April 24, Renzo announced the token model, which sparked dissatisfaction in the community. The reason was that the distribution plan was too centralized and the airdrop claim time was later than the opening of Binance.

This move not only led to community attacks but also caused a large amount of selling pressure on ezETH, causing a short-term unpegging to $688. During this period, a whale bought 2,499 ezETH with 2,400 ETH, making a net profit of 99 ETH.

5. The team that listens to the community's opinions the most

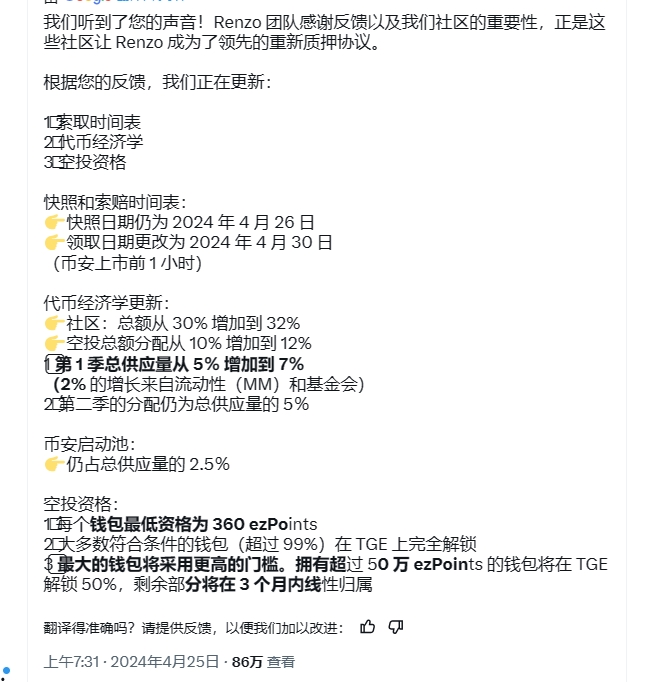

On April 25, after extensively listening to community opinions, Renzo's team modified the token economics, increasing the total amount of community token distribution from 30% to 32% and increasing the airdrop share from 10% to 12% (the total supply for the first quarter increased from 5% to 7%, with the additional 2% borne by liquidity and the foundation), and changed the claim date to 1 hour before Binance's opening.

In addition, the minimum qualification for airdrops for each wallet is 360 ezPoints, and most airdrop addresses can be fully unlocked after TGE. Wallets with over 500,000 ezPoints will unlock 50% at TGE, and the remaining portion will be linearly unlocked within 3 months.

Soon, the community's evaluation of Renzo underwent a two-level reversal. It must be said that the Renzo team is a model of listening to advice, compared to some projects that act stubbornly and ignore the voices of the community, their vision is many times greater.

6. The project most worth lurking after Renzo

Renzo has been listed, and bouncebit has also been officially announced. It's still early for Babylon, so the Binance-backed staking projects that can be heavily invested in now are Puffer and StakeStone.

I have participated in both of these projects, but Puffer is too volatile, and I have stopped adding positions. It seems that the listing is not far off. For new users without large funds, it is not recommended to enter at this time.

As for StakeStone, with a TVL of just over $600 million, it may have the highest cost-effectiveness. I have recently been adding to multiple wallets, starting at 0.25E per wallet, which can cover multiple aspects, and also took advantage of the unreleased big boss Scroll and L0.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。