Front note: It has been a long time since I posted on "X" after mainly posting on "X". If you wish to receive timely updates, please go to X: @web3thinking.

Today is the 4th halving of BTC, which has attracted widespread attention. Equally noteworthy is the launch of the Runes protocol, which once launched BRC20, and assets such as ORDI and SATS created myths of thousandfold and ten-thousandfold wealth, causing regret for those who missed out. As an asset issuance protocol on the BTC layer, Runes is an improved version of the BRC20 by the creator of the Ordinals protocol. So, will the launch of Runes once again bring about a huge wealth effect?

Image source: @0xSea Grandpa, why don't we have any $BTC at home? Child, I used them all to charge runes on April 20, 2024

We once again feel the FOMO of the entire network, and this emotion has been constantly appearing and spreading in the crypto industry since the bear market, often making people excited and restless, but not getting to the point. So, in addition to FOMO, taking advantage of this halving and the issuance of new assets, let's try to explore some underlying logic.

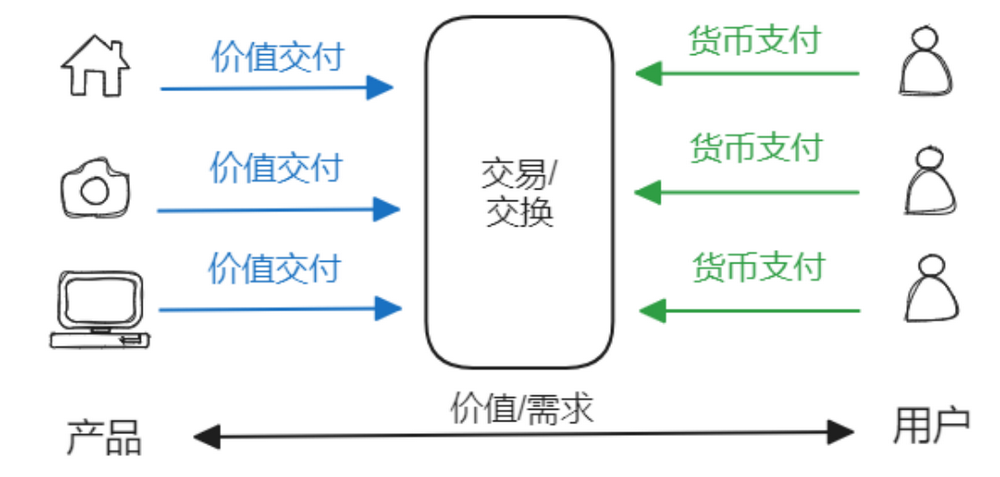

In order to facilitate the understanding of the crypto industry later on, let's start with the traditional economy and abstract the traditional physical economy and the Web2 internet economy model:

Value/demand model with trading as the core of traditional products

There are several aspects that need to be understood:

l Value and value delivery: The value here refers to the object of interaction with users through the product, which is the utility of the product, satisfying the needs of users' sight, hearing, smell, taste, touch, and mind, such as seeing, hearing, smelling, eating, wearing, living, and playing, etc. So, from innovation, production to the sale of products, it is actually the process of creating value and delivering value. On the product side, this is application-oriented, because applications correspond to user needs.

l Value and price: With value, price is generated based on value and demand, but fundamentally, it is the development context from value to price. With a price, transactions are made based on demand, leading to circulation (liquidity).

l Completing transactions (exchanges): Usually, money is a medium to efficiently complete value delivery (product circulation) and monetary payment (monetary circulation), building a complete transaction loop. It can be seen that "transactions" are the core, countless transactions build various types of economies.

The above model involves several basic elements and their relationships, constructing a simple and efficient economic model that is ubiquitous and permeates everyone's daily life and behavior.

However, the emergence of blockchain, especially the continuous innovation and development of Crypto, seems to have subverted this traditional model, bringing strong impacts to people, making it difficult to understand amidst the complex appearances.

But in fact, no matter how chaotic the Crypto field may seem, it still does not escape the definition of "economy", but the nature and relationships of several elements have changed, thus bringing about different development orders and paths.

Here, a brief introduction to the background is needed. The crypto industry has developed for many years and has always been criticized within the industry for being self-indulgent—other than speculation, what else is there? So, builders always hope to find practical applications, achieve scalable applications, and break out of the industry. Under this "trapped thinking" logic, the inertia of "application-oriented" was still maintained, and there was once hope of finding a "killer application" to break through the bottleneck and achieve vigorous development.

However, the actual development is not like this. After going round and round, everyone is now increasingly clear that the fundamental core of the crypto field is "Token", and the biggest application around Token is "speculation". "Token" is "gold", that is, encrypted digital assets, and "speculation" is "finance", that is, the flow and circulation of assets, which is precisely the core logic of finance.

Understanding this logic, one can understand that the essence of the crypto field is finance, establishing the financial logic of Crypto, understanding things thoroughly, and its mission may be accomplished. But precisely because it grasped this fundamental aspect, "establishing the foundation and giving birth to the way", it broke out of the industry, expanding into a broad development space. Currently, there has been considerable development in fields such as gaming and social, which, although also starting from Token, due to the innovation and breakthrough of asset categories, have more intersections with traditional Web2, and the development trajectory tends to merge, which will not be detailed here.

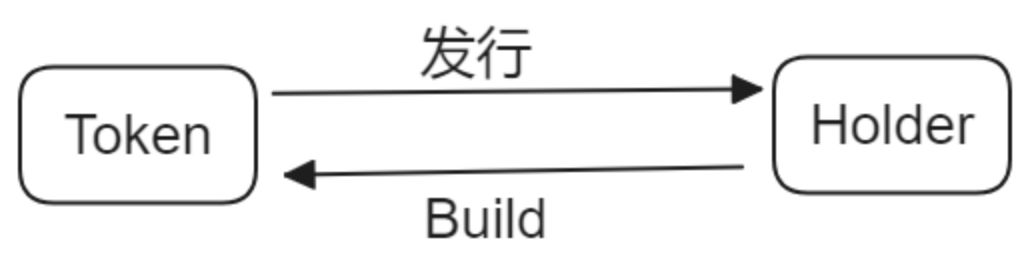

In order to further sort out the different development contexts of Crypto, consider the initial stage of an innovative Crypto asset, and establish the following abstract model:

Model of the relationship between Token and Holder in Crypto

When a Token is just deployed and created, it definitely needs to be distributed to users in various ways, including reservation, investment and financing, mining, auctions, minting, whitelisting, airdrops, etc.; the recipients of distribution include developers, investors, miners, bidders, community contributors, etc. These people will become the initial holders, the stakeholders of the Token, and become the builders of the Token's value.

In other words, from the beginning, there exists a co-creation, symbiotic, and consistent relationship between Token and Holder. In the traditional model, the relationship between products and users is often loose and fragmented.

Why does such a relationship exist between Token and Holder? In this model, there are some universal and basic underlying logics.

l Initially, Token has no value, it is just an empty shell, but it may become a carrier of value. In the traditional economy, products already carry actual usable value when they are launched. However, Token is useless from the beginning, without value. But it may carry expectations, which are given by the creators, whitepapers, or evangelists. So, how to turn possibilities and expectations into reality? Therefore, Token needs to be empowered with value, and empowerment starts from distribution.

l Distribution of Token is the beginning of empowerment, and innovative distribution methods are particularly important, involving fairness, decentralization, consensus formation, and many other aspects. There are various distribution methods, and adopting various distribution methods, one of the very important purposes is to reach holders with Token as a link, aggregate resources, consolidate consensus, leverage their respective strengths, become builders, and empower Token together. It can be said that the distribution method of Token will directly affect the effect and efficiency of empowerment.

l Initially, Token has no value, but it can have a price, which is very important. And this price has a certain arbitrariness, "precision" is not so important at this time, it can even be arbitrarily set, as long as it can trigger transactions. At this point, the price is a triggering factor to attract traders with demand to execute transactions. So, the early price of Token is basically only related to transaction demand, an arbitrary initial price, which will achieve subsequent price discovery as demand changes. This is completely different from the traditional path, where the path of traditional products is from value to price, and value and demand jointly determine the price, and the price fluctuates around the value.

l The price triggers transactions, and transactions bring liquidity. Usually, for a nascent Token, other than trading, it is not very useful, and trading is its greatest utility. Whether it is order books, AMM, Token-bound smart contracts, or graph-based duality, all liquidity methods essentially achieve the liquidity of Token through external or internal trading. The liquidity here refers to the ability and efficiency of an encrypted digital asset to be exchanged for another encrypted digital asset.

l Liquidity injects value into Token, becoming the source of Token's value. Once Token gains liquidity, it can provide continuous support for its price. The so-called support means that a highly liquid Token can always achieve smooth transactions without drastic fluctuations, maintaining price balance. The so-called support means that in liquidity provision, Token will achieve price discovery and may even provide price language.

l Most importantly, from this point on, Tokens with liquidity will expand into other values. Based on liquidity, with liquidity providing support and support for prices, the value of Token is derived. Token will transform from a valueless shell, merely carrying value expectations, into a truly meaningful encrypted digital asset with sustained prices, rather than the much-maligned "air coins".

What values will be expanded? This is based on innovative financial applications of highly liquid encrypted assets, such as:

l Means of payment: Token can be used as a means of payment, enabling currency exchange in the crypto world and consumption in the virtual world;

l Collateral interest and lending: As an encrypted digital asset with price and value, Token can be used for collateral interest and collateral lending;

l Derivative creation and combination: Token, as an underlying value asset, can be used for creating and combining derivatives to meet the needs of different risk and return preferences;

l …

In short, once there is sustained pricing, many Crypto financial applications can be innovated, attracting new users and bringing prosperity.

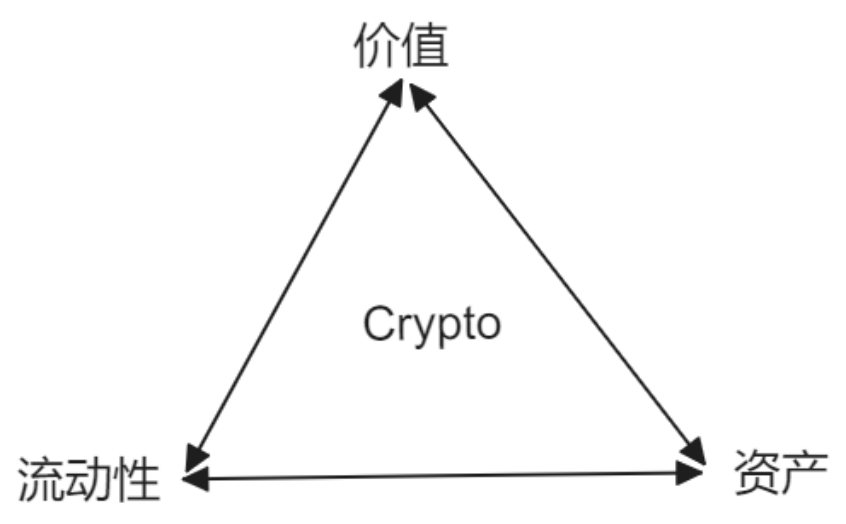

So far, we have explored the traditional value/demand model with trading as the core, and discussed the mutual relationship between value, price, and liquidity in the traditional context. Based on the model of the relationship between Token and Holder, we have focused on the source of Token's value, and the important conclusion is that liquidity is the source of Token's value, and from this, other values of Token are derived.

To deepen the understanding, let's further summarize the previous content into what I call the value triangle of Crypto:

Value triangle of Crypto

l Assets are the foundation: Focusing on the innovation of asset categories and issuance methods. Different asset categories have their own capability boundaries, focusing on different innovative financial applications, such as BTC for P2P encrypted digital asset transfer, ERC20 for DeFi, ERC721 for digital collectibles, Ordinals & BRC20 for engraved assets. And the asset issuance method involves profit distribution, related to operational principles and development patterns such as decentralization, fairness, and liquidity, and will have a profound impact on Token consensus formation.

l Liquidity is the source of Token's value: As mentioned earlier, unlike the traditional development path from actual value to price, this is the logic of developing the physical economy. Crypto is financial logic, Token has a price first, and then liquidity is brought about through transactions. Once liquidity is established, it will in turn support the price, provide support for the price, and further expand into other values of Token.

l Financial application innovation is the value derivation of Token: As analyzed earlier, Token's application innovation, such as payment, collateral interest, lending, derivative innovation, and trading, etc. And as Token asset categories continue to innovate, application boundaries will continue to expand, and financial innovation will continue to emerge.

Currently, we are witnessing explosive growth in the BTC ecosystem. At this stage, innovation in asset categories and issuance methods is becoming the biggest narrative, such as BRC20, RUNES, ARC20, RGB++, and various Fairlanch issuance protocol innovations; and with the listing and trading volume growth on CEX, DEX, the establishment of other liquidity methods, the liquidity of tokens is gradually being established. Next, token characteristics such as data engraving, one coin one satoshi, L1/L2 asset duality, etc., will inevitably give birth to various complex application innovations and L2 gameplay. These development contexts are basically within the framework of the model described in this article. Understanding these basic logics will help grasp the key points and promote the development path, avoiding getting lost, and even achieving unexpected success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。