Author: Binance

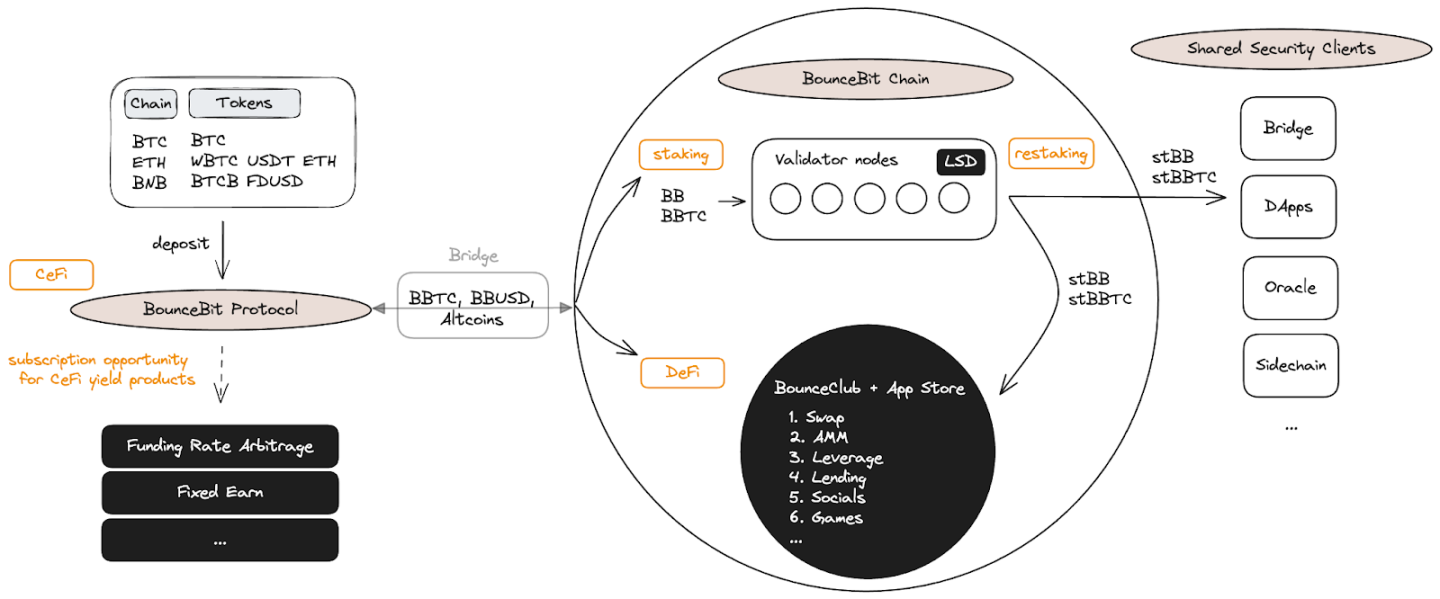

BounceBit has built a BTC re-staking infrastructure to provide a base layer for various re-staking products. Through the CeFi + DeFi framework, BounceBit enables BTC holders to earn income from multiple sources.

The BB token has various uses on the BounceBit platform:

- Staking: Stake BB to participate in Bounce Bit PoS's dual-token staking mechanism.

- Protocol incentives: Tokens are paid as staking rewards to validators ensuring network security.

- Gas fees: BB is used to pay for transaction and smart contract execution gas fees.

- Governance: Use BB to participate in on-chain governance, such as voting for protocol upgrades.

- Currency: BB can be used as a currency on the BounceBit platform. It can be used for various applications and infrastructure as a medium of exchange or value storage.

BounceBit's Layer 1 consists of the following parts:

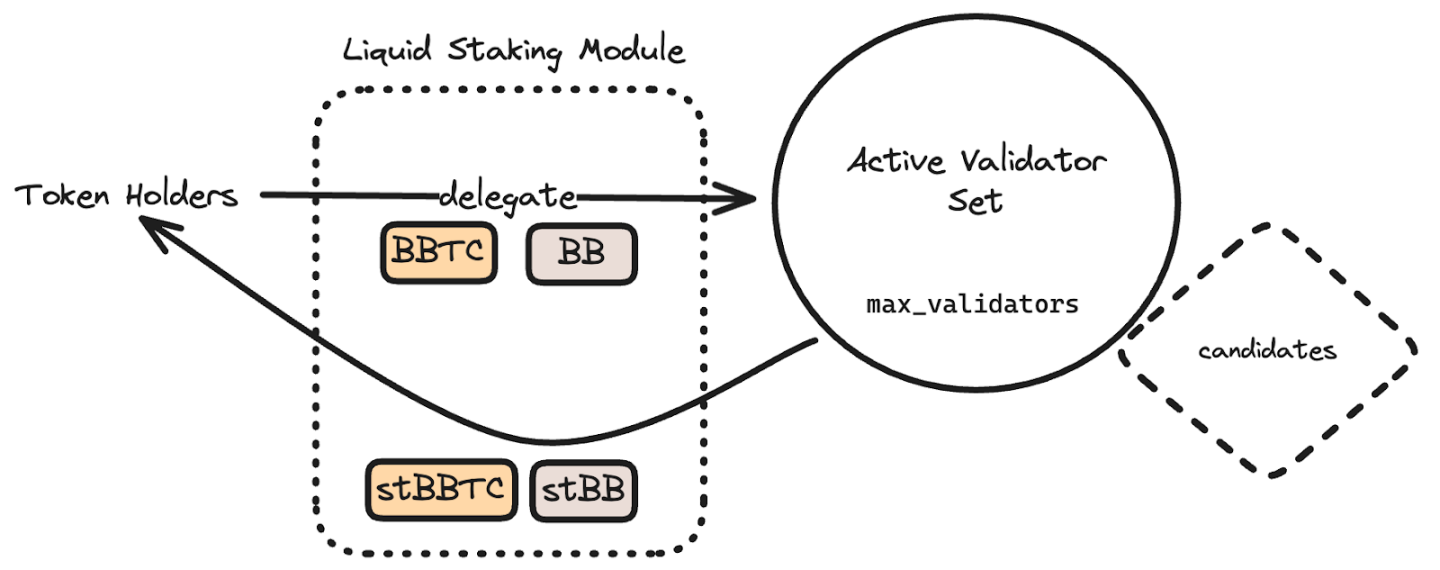

- Dual-token PoS: A hybrid consensus mechanism where each validator can accept BBTC and/or BB tokens.

- Native LSD module: This module allows staking delegation to validators and receiving LST tokens as a reward.

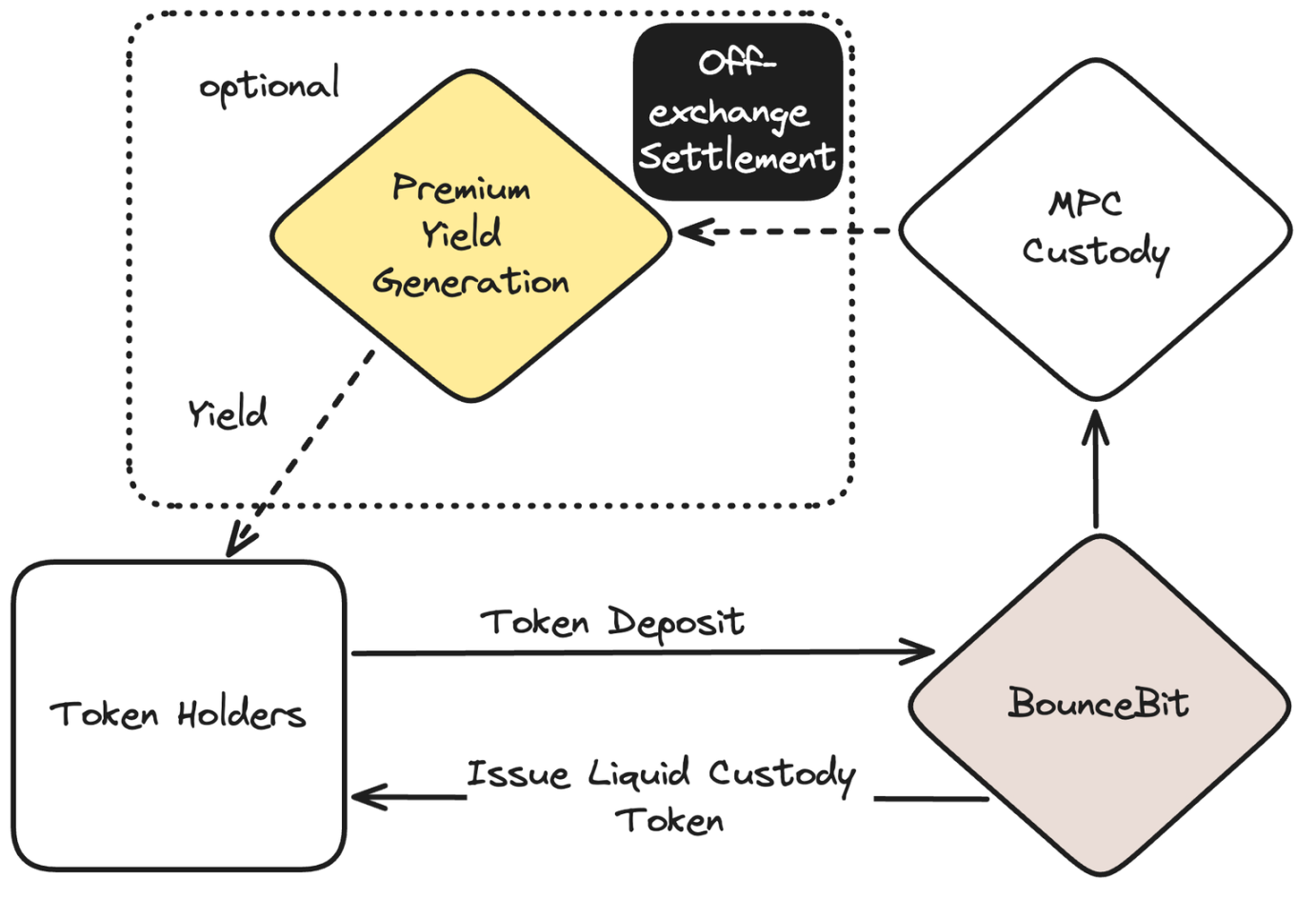

BounceBit's basic CeFi layer consists of the following components:

- Compliance custody: All user funds are stored in secure custody solutions through MPC wallets.

- OTC settlement: OES can safely utilize CEX liquidity, while trades are settled off-chain.

The project has raised $7.98 million from previous financing.

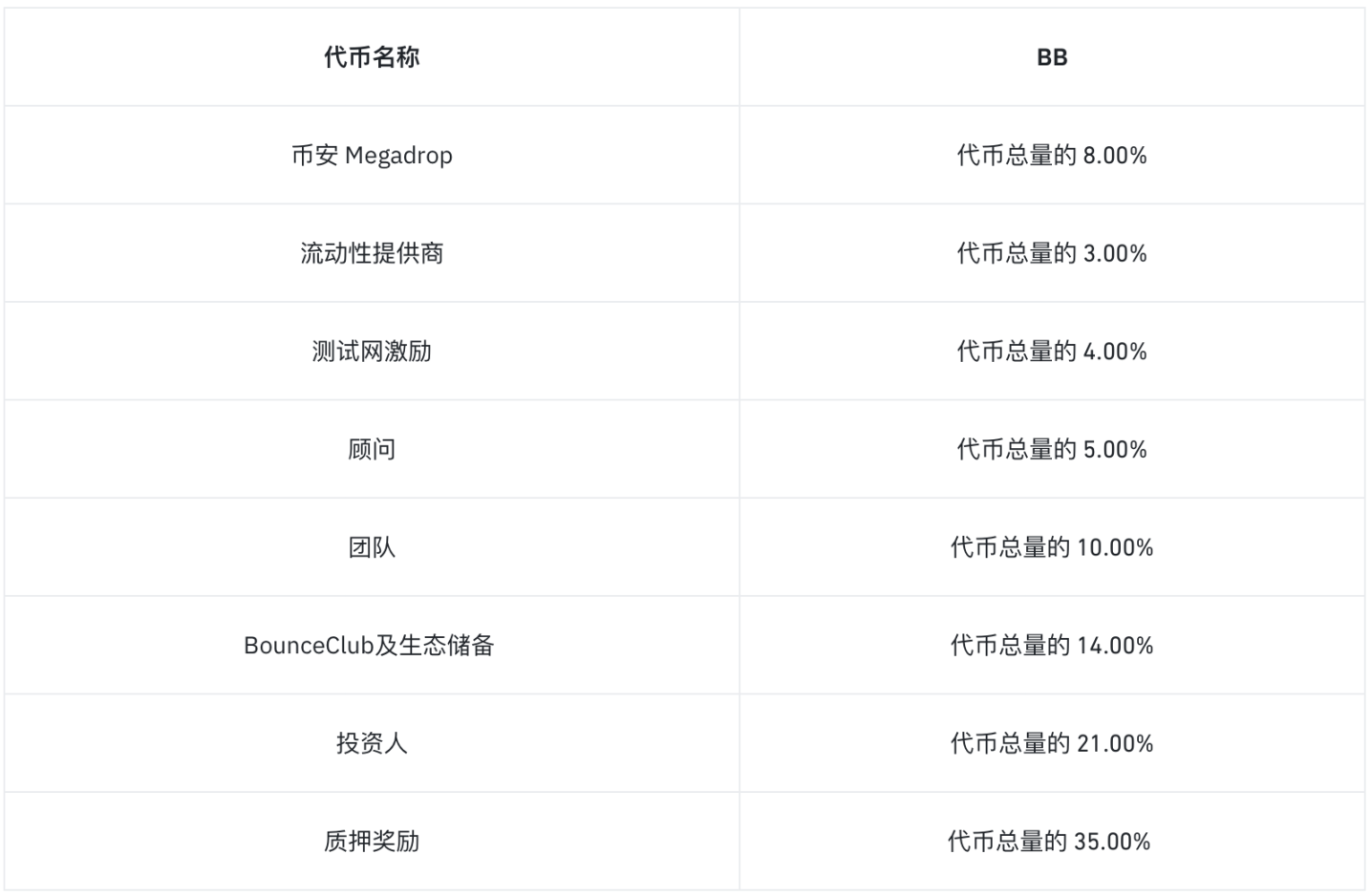

The total supply of BB is 2,100,000,000 tokens, with a circulating supply of 409,500,000 tokens (19.50% of the total token supply) after listing.

Key Metrics

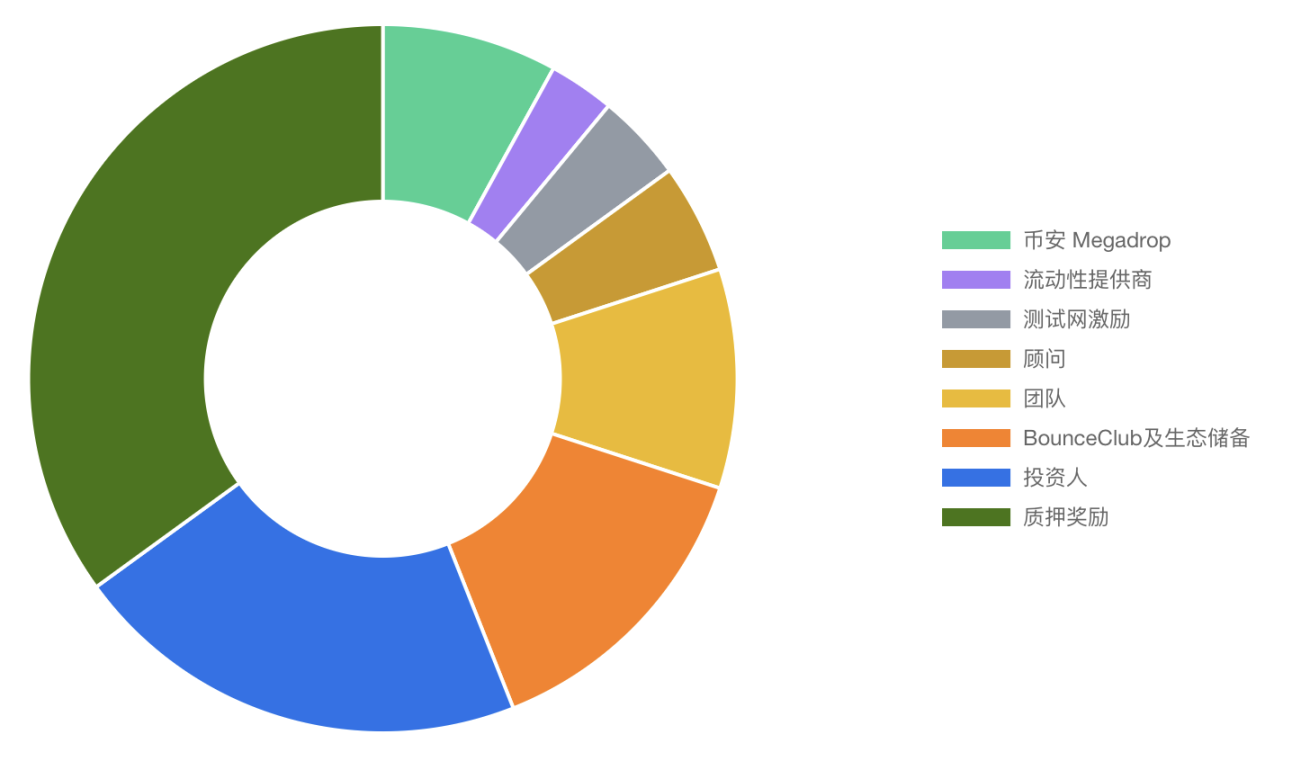

Token Distribution

1. What is BounceBit?

BounceBit empowers Bitcoin assets by actively participating in network validation and various revenue-generating activities (including CeFi, DeFi, and restaking), transforming Bitcoin from a passive asset into a positive force in the crypto ecosystem.

1.1 Project Mission

The project's mission is to enable more people to access the high-yield opportunities of Bitcoin assets typically enjoyed only by quantitative and top asset management companies. BounceBit aims to bring the transparent advantages of CeFi and DeFi to the public.

1.2 Value Proposition

BounceBit's approach to driving Bitcoin development should primarily involve using assets without changing the concept of the Bitcoin blockchain. By leveraging funding rate arbitrage and creating on-chain certificates for re-staking and mining, it effectively combines the advantages of centralized finance (CeFi) and decentralized finance (DeFi). This integration brings opportunities for Bitcoin to generate better returns and have broader applications.

1.3 Project Highlights

- BTC re-staking: BounceBit has built a BTC Restaking infrastructure, ensuring fund security through regulated custody services such as Ceffu, Mainnet Digital, and Fireblocks. When assets generate interest through arbitrage strategies managed by experienced asset management entities, users receive a BTC-pegged version called bounceBTC (BBTC), which can be delegated to node operators. The node operators return staking certificates (stBTC) to the stakers. This liquid staking derivative can then be re-staked to other shared secure client (SSC) entities, such as sidechains, bridges, and oracles.

- Dual-token PoS: The dual-token PoS is a hybrid consensus mechanism where each validator can accept BBTC and/or BB tokens. This system expands the base of stakeholders and weaves an additional layer of elasticity and security into the network consensus structure.

- BounceClub: BounceClub serves as an on-chain space where users can create DeFi experiences using a completed mini-program without code, easily integrated from the App Store.

- Liquid Custody: BounceBit introduces the concept of "Liquid Custody," which keeps staked assets liquid and provides more opportunities to earn income. When users deposit assets into BounceBit, they receive a liquid custody token (LCT) representing their assets held in a 1:1 ratio in regulated custody. These tokens can be bridged to BounceBit and further utilized.

1.4 Existing Products

Solution Design

Liquid Staking Derivative Module

This infographic introduces BounceBit's native Liquid Staking Derivative (LSD) module. Token holders can delegate their BBTC and BB to validators and receive LST (stBBTC, stBB) as proof. Validators are selected as active validators based on voting weight, otherwise, they are candidate validators. The maximum number of validators is determined by management.

Liquid Custody

This infographic explains the concept of liquid custody. When users deposit assets, BounceBit issues them a liquid custody token. Funds are stored in industry-standard custody solutions. Users can choose to participate in Delta-neutral funding rate arbitrage strategies through off-chain settlement solutions (Ceffu's MirrorX).

2. Token Economic Model

2.1 Token Allocation

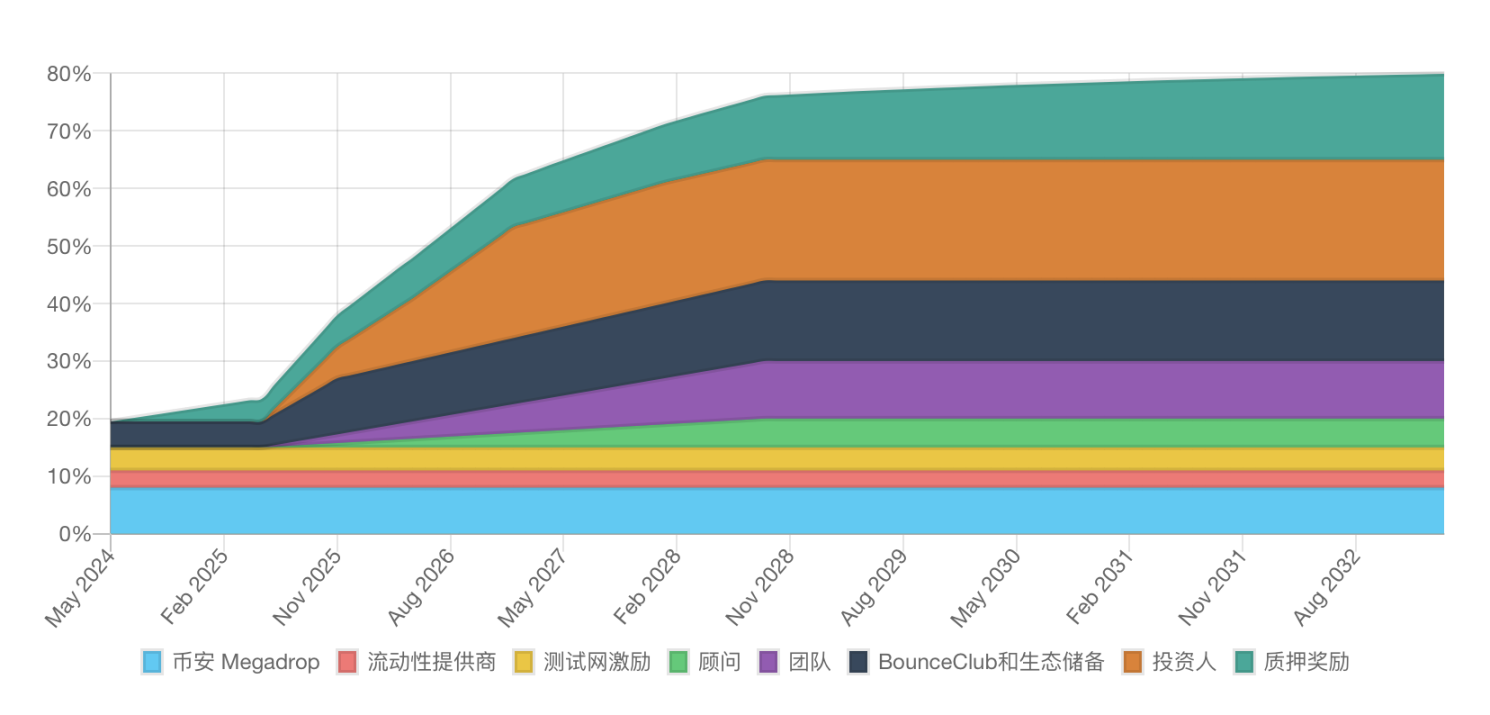

2.2 Token Issuance Schedule

Note: BB tokens will continue to unlock after March 2033.

3. Roadmap

Key Milestones

Future Roadmap

Q2 2024:

- Continuous Premium Yield product development

- BounceBit mainnet launch

- Ecosystem building

- BounceClub distribution

Q3 2024:

- More CeDeFi products

- Options and structured products

- Lending

Q4 2024:

- BounceBit re-staking platform

Q1 2025:

- Shared Secure Client (SSC) ecosystem development

Business and Operational Development Plan

- Ceffu: Centralized custody & OES solutions

- Mainnet Digital: Compliant institutional crypto asset custody

- Antalpha: Bitmain asset management and operation platform

4. Community

Appendix

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。