Author: flowie, ChainCatcher

Editor: Marco, ChainCatcher

Around April 20th, during the Bitcoin halving, the mainnet of the Runes protocol will go live, and the first genesis rune will officially start. (Countdown to Runes launch)

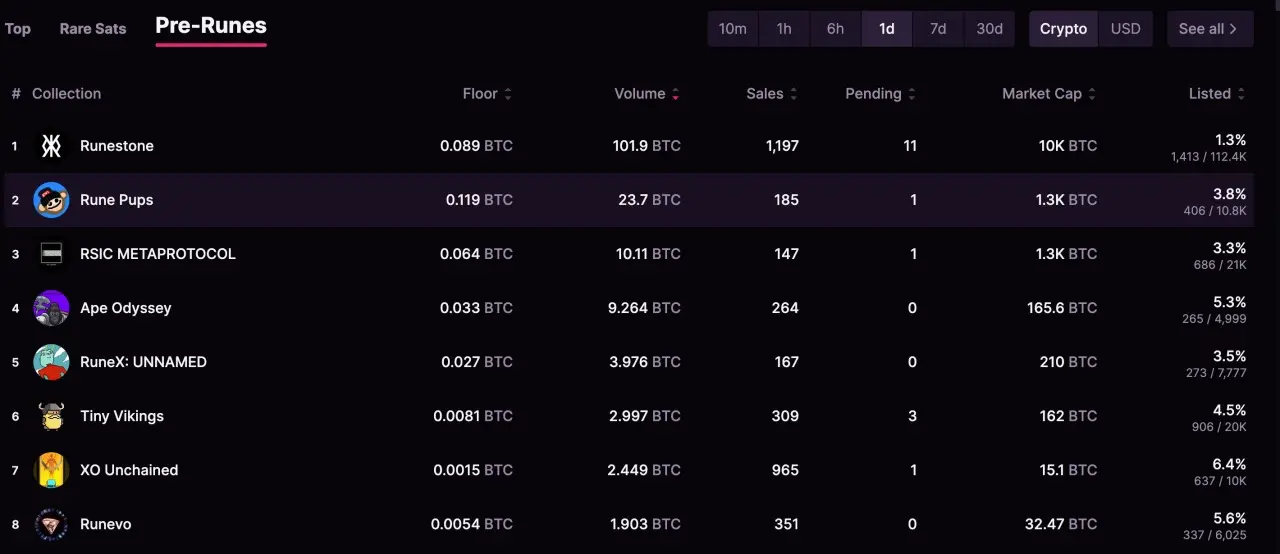

With another large-scale fair launch opportunity in the Bitcoin ecosystem, although the first rune has not yet been born, the market has long been restless. Pre-rune projects such as Runestone have taken off in advance. According to Magic Eden market data, on April 18th, the floor price of Runestone had reached 0.089 BTC, and the floor price of Pune Pups had reached as high as 0.119 BTC.

Taking the lessons from the inscription frenzy, the infrastructure related to rune casting and trading has been prepared in advance. Multiple wallets or trading platforms such as OKX Wallet, Unisat Wallet, and Magic Eden have announced their support for the Runes protocol, with some platforms already launching testnets for user practice. There have also been specialized trading bots for runes appearing in the market.

The wealth myth brought by the inscriptions is still vivid, and with the arrival of the runes, many users in the crypto community are gearing up for a big move.

But there has been a lot of narrative consumption in the early stage. With the unveiling of the runes, will the speculation reach a new climax, or will it quickly cool down?

Can Runes surpass BRC20?

Casey, the founder of Ordinals, is also the proposer of the Runes protocol. Recently, Casey expressed extreme confidence on the X platform, stating, "If the market value of the Runes protocol does not exceed 1 billion USD in the first month after the mainnet launch, I will commit seppuku." The total market value of BRC20 tokens is currently around 24 billion USD.

Although BRC20 did dominate the Bitcoin ecosystem's trading after the release of Ordinals, Casey has always been dissatisfied with it. In September 2023, Casey published the concept of Runes through a blog post, in which he pointed out various issues with existing protocols such as BRC20, RGB, and Taproot Assets.

For example, the BRC20 token standard would lead to excessive "garbage" clogging the Bitcoin network. This was also the most criticized aspect of BRC20 by Bitcoin core developers last year.

Casey believes that a better Bitcoin token protocol should be simple, not rely on off-chain services, and be based on UTXO. The goal of Runes is to replace and surpass existing Bitcoin ecosystem token protocols such as BRC20, and to build a new standard for homogeneous tokens on Bitcoin.

After half a year of code adjustments, compared to BRC20 tokens, Runes theoretically has many improvements, such as simpler operations, more developer-friendly, stronger compatibility and scalability, and more flexible token issuance. Recommended reading "A Comparison of Runes and BRC20 Homogeneous Token Protocols in One Article"

Redphone, the originator of the BRC-20 concept, also shared his views on Runes, stating, "Unless BRC-20 continues to evolve, Runes is likely to become the mainstream token standard for Bitcoin."

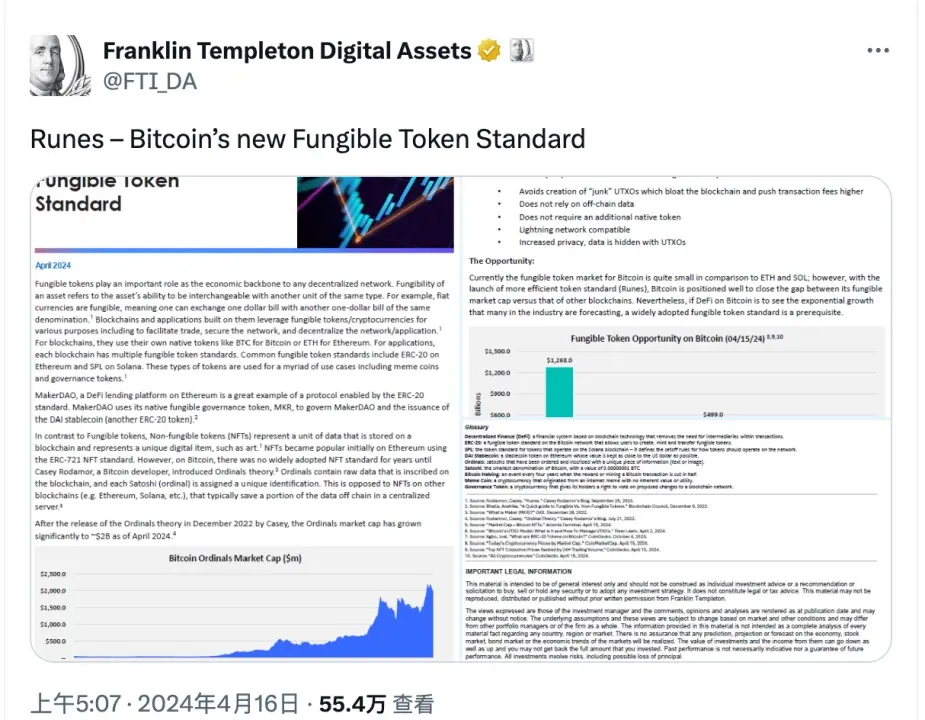

A report recently released by the asset management giant FTI indicated that "Runes" will narrow the gap between Bitcoin and Ethereum, Solana in the market for interchangeable tokens.

However, according to technical blogger Shi Si Jun, Runes also has limitations. For example, the rules are complex, the issuance management rules are complicated, and the rune names require 13 characters and special punctuation marks, which indirectly increases the risk of phishing for users.

In addition, by choosing to launch synchronously during the BTC halving period and without a prior testnet, fewer and fewer institutions in the market are able to access the Runes protocol in a timely manner, which means that the protocol ecosystem will need more time to ferment.

Furthermore, there are compatibility issues in the future for Runes. Protocols like atomical have allowed inscriptions to move beyond the simple token speculation stage and enter the narrative of BTC L2, and the rune project is still only a play at the issuance level.

There are still doubts in the market about whether Runes can bring a more user-friendly trading experience. Crypto KOL @udiWerthemer believes that there is nothing in the Runes protocol that makes it easier to exist than BRC20, and all the problems still exist.

After the first rune goes live, will the speculation continue to heat up or quickly cool down?

In September of last year, Casey also released the basic code for Runes after proposing it. Many projects were quick to take advantage of the Runes concept and lay out their plans in advance.

Most of the conceptual rune projects are currently Bitcoin NFTs. With the launch of the Runes protocol, they will be converted to runes through airdrops or 1:1 exchanges.

On the eve of the official launch of the runes, a large number of pre-rune (Pre-Runes) projects such as Runestone, Pune Pups, and RSIC have achieved substantial gains through incentive strategies such as point airdrops. Early participants in pre-mining have already obtained considerable returns. Recommended reading "Will Runestone Bring a Rune Frenzy? A Look at 14 Runes Worth Watching"

The infrastructure for rune inscription trading is also very active, with dozens of platforms actively launching tools for proxy trading. It is hard to find a protocol that has not yet officially launched but has such a lively race.

Currently, many crypto users are sharpening their tools and preparing to make a big move. For them, this will be an excellent opportunity to replicate the thousandfold returns of the inscriptions.

On one hand, the runes of the pre-rune projects have attracted a large number of users. Leonidas, the founder of Runestone, once boasted that he would create the world's top meme on the world's top blockchain. The highest market value of the BRC20's largest meme, ORDI, is around 2 billion USD, while the current market value of Runestone is 600 million USD.

On the other hand, Casey has set 10 runes as important targets. In order to prevent the first Rune from being snatched or pre-mined by VCs or project parties, Casey has hardcoded the first 10 Runes (Rune 0 - Rune 9) into the Runes protocol. The 0th genesis rune has been determined to be UNCOMMON•GOODS, while the other 9 are yet to be revealed.

Crypto KOL @wutaner calculated that with a valuation of one billion USD, the price of UNCOMMON•GOODS will reach 10 USD. The gas cost for casting a UNCOMMON•GOODS is about 2.2 USD. If the price of a UNCOMMON•GOODS is around 50-100 USD, the profit will be close to 50 times.

However, DEFI RESEARCH analyst IGNAS believes that runes are bearish in the short term. After various speculative activities in the early stage, the speculation on runes will cool down shortly after the protocol goes live, "just like the cooling down after the revelation of NFTs."

The reason is that after the runes go live, there may be overcrowding, and Bitcoin transaction fees may become excessively high, preventing many cash-strapped retail investors from actively trading. Secondly, the issuance of a large number of new rune tokens may dilute the attention of traders and the capital inflow into each token.

In addition, IGNAS believes that the genesis rune UNCOMMON•GOODS will be difficult to speculate on. This is because UNCOMMON•GOODS can be minted for free for 4 years, and only one can be minted per transaction.

Although there may be short-term cooling risks for runes, in the long run, most voices in the market seem to lean towards the idea that runes will continue to ferment, similar to the multiple outbreaks experienced by BRC20 in the past, providing more opportunities for participation in waves.

IGNAS states that the best opportunity may arise after the sell-off. Both the Bitcoin ecosystem and runes are in the very early stages, and even if one did not participate in pre-rune mining, there is still a wealth of opportunities in the subsequent rune minting and secondary market fluctuations.

Tools for Proxy Trading Are Everywhere, Are You Ready?

After the launch of the runes, participants can participate through primary minting or secondary trading.

Primary rune minting allows participants to choose to deploy a full node themselves or use a third-party platform for proxy trading. While having a Bitcoin full node may yield higher returns, setting up a full node requires participants to have a certain level of coding ability, making it a slightly higher barrier to entry. It is expected that most users will choose third-party proxy platforms such as OKX Web3 Wallet, UniSat, and others. These proxy platforms also tend to provide one-stop services.

Source: @DoggfatherCrew

Participants in rune minting need to prepare BTC in wallets or platforms that support runes in advance. To prevent multiple proxy platforms from crashing on the day of launch and to avoid high trading costs on some platforms, participants are advised to choose multiple different proxy platforms in advance for easy switching.

In addition, Leonidas, the founder of Runestone, also advises users to split UTXOs in advance, which is akin to preparing loose change in advance to prevent transaction failures and high costs. (Refer to the UTXO splitting tutorial https://wizz.cash/btc/send). Platforms such as Unisat Wallet have also launched testnets, allowing users to practice in advance.

In addition to preparing proxy trading tools, for many participants, determining the target for minting or trading may be a bigger challenge.

Casey has personally revealed only the 0th rune out of the 0-9 runes he has determined, and he also revealed during a live broadcast that he will not reveal the remaining 9 runes in advance. The variety of rune types in pre-rune projects is also dazzling. Many testing platforms for minting already index hundreds of test tokens.

Various rune search and dashboard tools have also appeared on the market, such as SatScreener, a real-time token aggregator for runes and the Bitcoin ecosystem, and Runesmarketcap, which can help participants understand rune token information and filter by source, market value, type, and more.

While runes with meme-like characteristics harbor wealth myths, they also come with significant risks. The more FOMO there is in the market, the more cautious participants need to be.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。