To be honest, I am not surprised at all that the Bitcoin spot ETF in Hong Kong has been approved, but the approval of the Ethereum spot ETF this time is a bit of a surprise to me.

Hong Kong's future depends on cryptocurrency, right? I have said before that the Hong Kong government has been having a hard time recently. This time, approving both Bitcoin and Ethereum spot ETFs at once also shows a certain amount of courage.

01. If Ethereum can have an ETF, what about other tokens?

Whether in the United States or other regions in the world, it is generally believed that Bitcoin is not a security.

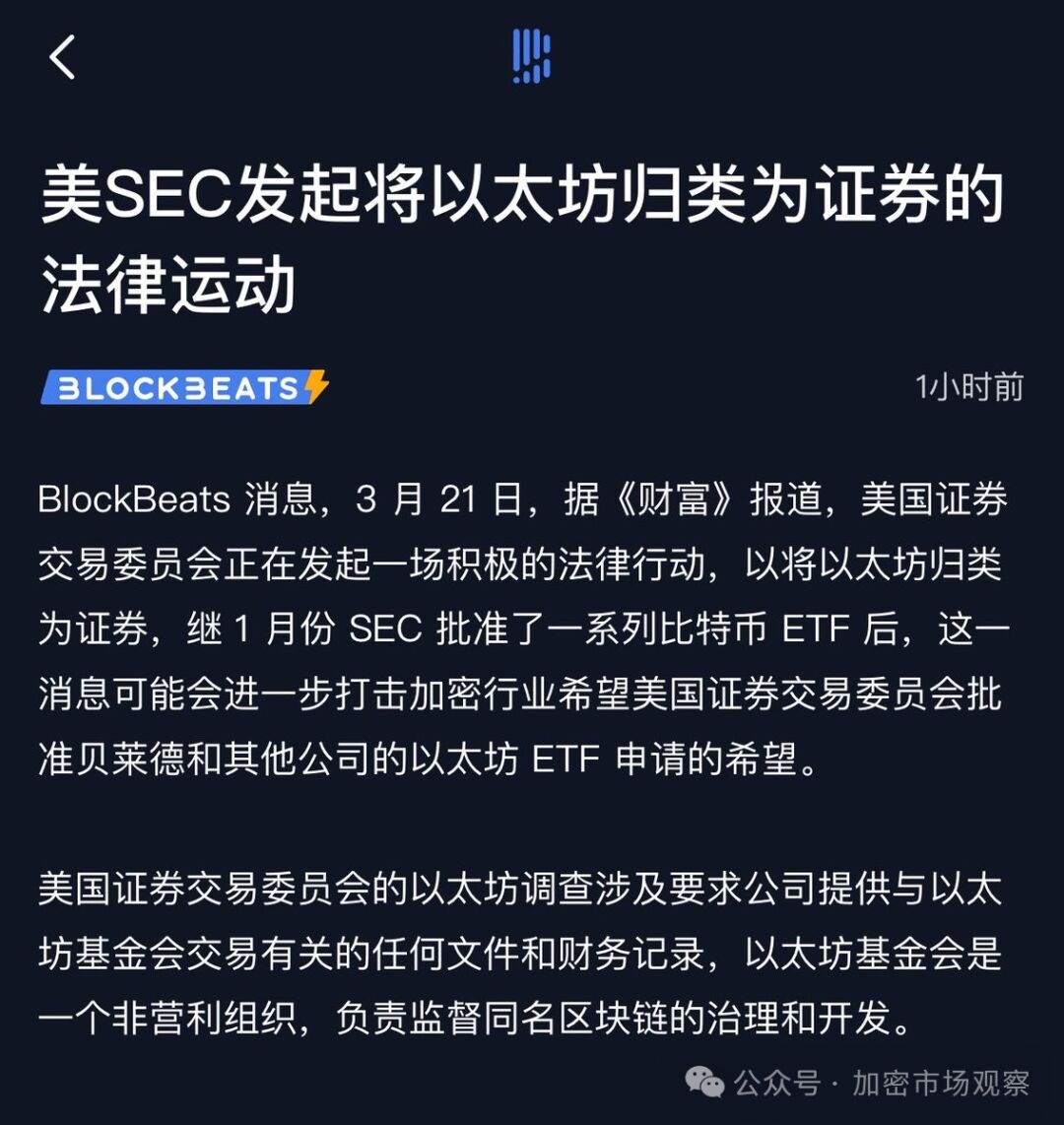

But there is still much controversy over whether Ethereum is considered one.

This is also the main reason for the slow progress of the Ethereum ETF in the United States.

In the United States, the SEC only has jurisdiction over securities, so it is entirely possible to "set aside disputes and develop together."

If a cryptocurrency is a security, it can be regulated by the SEC; if it is not a security, can it still be regulated through the ETF model?

The Securities and Futures Commission of Hong Kong has deeply understood this logic, so it boldly approved the Ethereum ETF.

Following this logic, it won't be long before more types of encrypted ETFs are available.

After all, Ethereum is currently facing internal and external challenges, with ecosystems like Cosmos/Solana gaining momentum externally, and various L2 public chains vying for power internally.

I don't know how much help it would be for Vitalik Buterin to personally promote the Ethereum spot ETF in Hong Kong, but for Hong Kong, which operates under the common law framework, it will be difficult to refuse ETFs for other public chain tokens in the future.

02. Hong Kong is still good at creating channels

With a total population of only a few million, Hong Kong can hardly survive on the local market alone.

But to be honest, I actually quite like Hong Kong's strategy of launching encrypted ETFs.

Due to jurisdictional issues in the United States, it is estimated that there will still be disputes within the next three years. Currently, for institutions looking to invest in cryptocurrency, there are two options:

1) Open an account with a compliant exchange.

2) Purchase through encrypted ETFs.

The first method may seem simple, but in practice, it is quite complex for institutions:

- Many institutions still do not trust exchanges, especially given that even prominent exchanges like FTX have only been around for less than two years and have had scandals.

- People in institutions are lazy; they may be willing to learn about it, but the operational threshold is still quite high.

The second method through ETFs is different. It is still a familiar platform, familiar upstream and downstream, but with a different underlying asset.

That's how magical the world is~

Hong Kong should leverage its institutional advantages and launch ETFs for mainstream cryptocurrencies as soon as possible, and may even allow fund managers to create their own combinations.

Under the current rules in Hong Kong, making money is not just about ETF management fees; downstream licensed and compliant exchanges may also rely on this to expand their business.

03. It has nothing to do with ordinary mainlanders

For those in mainland China, don't think too much about it. As retail investors, you should be aware of your status.

You should ask yourself:

1) Can you buy US/Hong Kong stocks?

2) Can you buy the US Bitcoin spot ETF?

3) Can you open an account with a compliant exchange in Hong Kong?

Of course, I believe many of my readers can do all three of the above, but generally, such people do not need ETFs to allocate encrypted assets.

However, for those who have not even opened accounts with exchanges like Binance/OKX in the past, or have not even opened US/Hong Kong stock accounts, and are now fantasizing about freely allocating encrypted assets after the approval of Hong Kong ETFs, you really have quite an imagination.

Although Hong Kong is our window to the outside world, it mainly hopes to attract foreign money and export Chinese goods or services.

You could say it's like a semiconductor channel~

Author's Bio:

Partner at Cutie Labs, self-operated IP encryption beauty

1783DAO Core Builder

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。