Author: jolestar

After the waterfall-like correction, there was a lot of wailing in the group, and the enthusiasm on the platform also calmed down. It's time to calmly review this bull market phase.

In this bull market, we have not yet seen a replicable application model, nor have we seen the boom of various projects like the ICOs in 2017 and the DeFi in 2020. Therefore, I have always believed that the real bull market has not yet arrived. However, there have been many attempts at new types of asset issuance models, such as new asset protocols on Bitcoin (Inscription, Atomicals, RGB/RGB++), various chain's inscription protocols, Meme Coins, graph coins, SFT, and others.

As a builder, I look at the problem from the perspective of whether there are opportunities to build applications. What are the insights from these attempts? I have summarized two points.

Preliminary validation of the CSV asset model

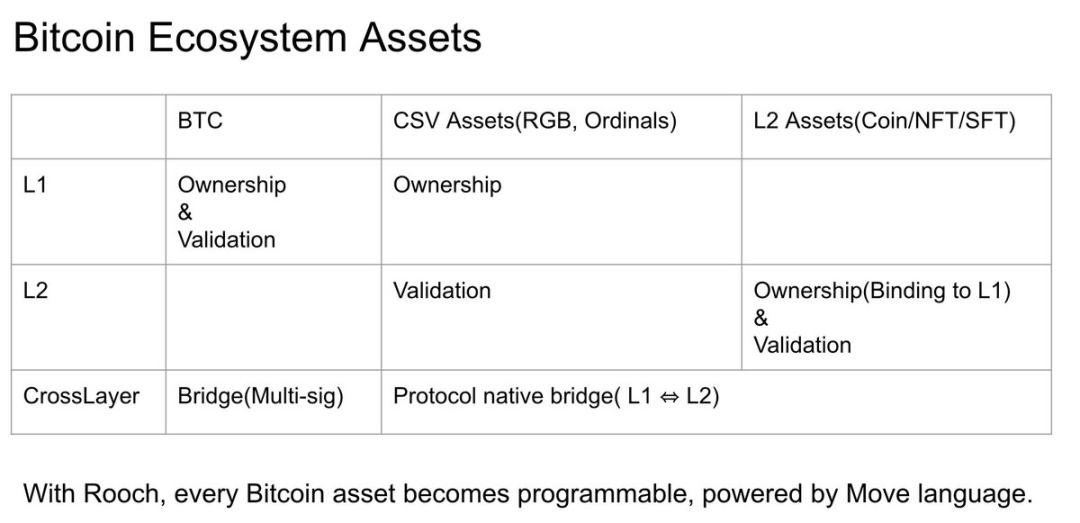

First, Bitcoin's Inscription has verified one point: the data definition of assets on the chain and the legality verification off the chain is feasible. It foreshadows a new way of asset issuance and expansion. All protocols derived from Bitcoin, including RGB/RGB++, and Atomicals, belong to this paradigm, which can be called a generalized client-side validation of assets. These assets are a type of asset between L1 and Offchain (L2), and they can define a bridge within a protocol to achieve the migration of assets from L1 to Offchain, including the preliminary verification of this transition mechanism by the RGB++ protocol. This ability foreshadows a way of blockchain expansion, which is the infrastructure for assets to overflow from Bitcoin to Offchain (including other public chains), thereby bringing prosperity to the entire blockchain ecosystem.

Here is a picture I shared at the Bitcoin Layer2 Conference organized by @BTCSCYLab in Hong Kong:

This model is different from Ethereum's ecological paradigm. The application scenarios of assets can no longer be limited to the smart contract environment provided by L1, but can be provided through the Offchain smart contract environment, removing the technical bottleneck for application development.

The application launch mode led by assets is being verified

If the technical bottleneck for building applications is overcome, another issue is how to launch applications. The traditional way is to build applications, attract users, and then issue assets. However, the new asset issuance model in this wave aims to verify the approach of assets first, building communities, and then constructing applications based on the community to provide usage scenarios for assets. This model has preliminarily attracted users and built communities, but the application launch still needs to be explored, and there are several challenges to be solved:

Fair distribution can easily attract users and reduce fraud, but how to solve the initial cost of building applications.

Building applications takes time, and assets with too high liquidity may not wait for the birth of the application. Therefore, it is more appropriate to initially issue low-liquidity assets, which can grow into high-liquidity assets, but how to seamlessly switch is a direction for exploration (ERC404, Movescriptions).

Although there are many challenges, the advantages of this model are also obvious:

Assets lead the way, and applications are derivatives of assets, rather than the other way around, so that the lifecycle of assets can exceed the lifecycle of applications.

Only with this model can there be combinable scenarios where the same asset is used in multiple applications, and this combinable capability is the most crucial point that distinguishes blockchain applications from Web2 applications.

In this model, application teams do not need to issue assets, but can directly benefit from providing scenarios for assets, thereby solving the compliance issues faced by Web2 application development teams.

The combination of the above two exploration directions will give rise to a large number of assets and applications. At that time, when everything blooms, it will be the real bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。