The only lesson that leeks have learned from the cycle is that they have not learned anything from history.

Before the high interest rates of Ethena, the heavy past of Luna-UST is just a thing of the past, returning to a game of who runs faster.

Even MakerDAO's DAI could not resist the temptation, changing its usual low-risk nesting with USDC and actively embracing the high returns of USDe.

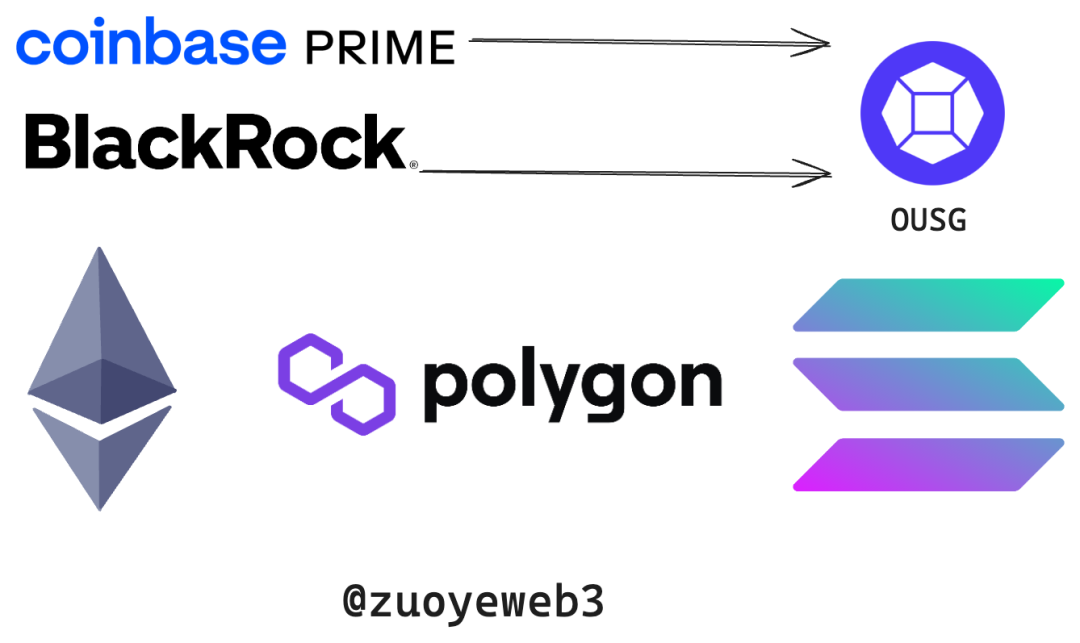

Although Ondo's USDY has been issued for less than three weeks, the TVL has increased from 100 million to 200 million, but it has also brought in the BUIDL fund established by BlackRock to resist risks and jointly expand and strengthen the RWA ecosystem.

As we can see, the above three are stablecoins, and they are also the latest developments in RWA—real-world assets on the chain, on-chain native arbitrage, and ultimately feeding back to real-world assets, forming three interconnected but independently operated small worlds.

New form of RWA

New form of RWA

Specifically, at this stage, RWA not only focuses on stablecoins, but also has the following new trends.

- Real-world assets priced in USD: Real assets focus on four major categories of assets priced in USD, including US bonds, USD, bonds, and compliant stablecoins. It is more accurate to say that it is the on-chain of USD-related assets rather than the on-chain of real-world assets.

- Dual-currency standard in the crypto world: The status of Bitcoin and Ethereum is generally recognized in the crypto world. Ethereum not only serves as the asset issuance chain, but ETH also plays a role equivalent to the "Bitcoin" reserve.

- Integration replaces reform: Traditional finance and exchanges have become the infrastructure for the operation of cryptocurrencies. The source of RWA is them, and the ultimate flow is also them. Even their existence is no longer a problem. Reality's gravity ultimately suppresses the dream's head.

From the tide of the US dollar to the ETH "base currency deflation-re-circulation" standard

In each bull and bear cycle, it starts with Bitcoin, then there is a large inflow of funds, such as exchanges, DeFi, or stablecoins, and then a liquidity crisis in a certain project appears, leading to a complete collapse.

But this cycle is different. On the one hand, off-exchange funds have brought in 60 billion yuan of ETF funds, improving the previous cycle of USD interest rate cuts and hikes, which would cause a "tide" of USD shortages worldwide. Bitcoin has played the role of a reservoir, effectively alleviating this harm. Of course, the reservoir still has more than 10 times the expansion space.

Summary point 1: Bitcoin has duality, it is not only a real asset, but also a crypto asset.

There are two development paths for this reservoir. One is to continue to increase the capacity of Bitcoin, and the other is to seek more ETF products, such as Ethereum.

On the other hand, Ethereum's staking system has created an "ETH base currency deflation-re-circulation" mechanism within the market. Using ETH as the pricing asset, even if the assets issued through staking (LSDfi) and re-staking (LRTfi) eventually collapse, the staking income of ETH itself will not decrease. During the bull market, with a huge increase in usage, the value of ETH will increase due to deflation.

Summary point 2: As long as one can survive the bull and bear markets, it is possible to profit from both long and short positions, making up for losses in the bear market during the bull market.

Now, shifting the focus, if something is equivalent to the US dollar, with a permanent 1:1 anchoring, and uses a composite standard of gold and silver (BTC+ETH) as the reserve, and seamlessly integrates with exchanges, can this RWA model of USDe survive the bull and bear markets?

Summary point 3: Do not resist centralized exchanges, but use them as a source of profit.

We cannot predict the future, we can only assume the future based on the past, and give our own opinions. USDe is likely to collapse, but if the bull market lasts long enough, it may decline steadily and eventually become insignificant. If the price of ETH collapses sharply, then USDe will also collapse rapidly.

Based on the above three points, let's explain why this conclusion is drawn for USDe.

Principle of USDe

Principle of USDe

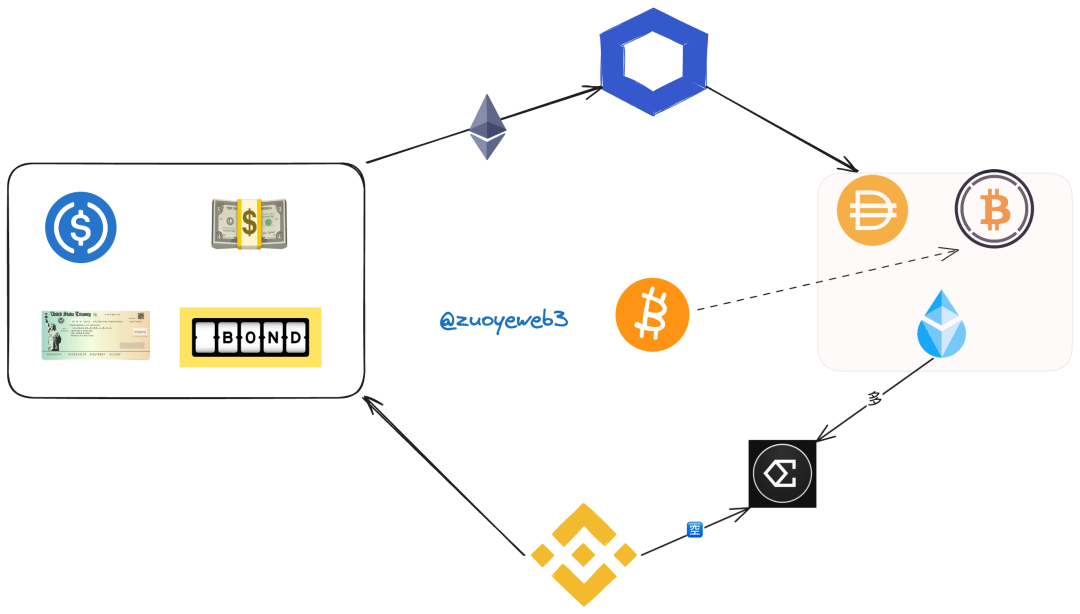

The issuance of USDe is linked to the long and short positions of ETH. According to AC's theory, spot trading is like perpetual contracts with no leverage, or 1x leverage. Buying is going long, and selling is going short.

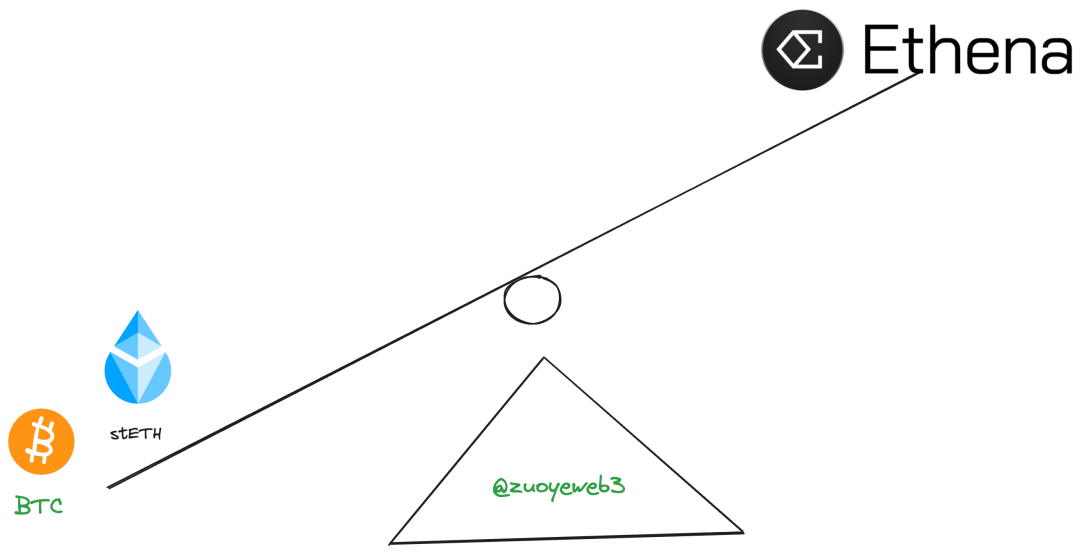

The Delta neutrality of USDe can also be understood in a similar way, that is, the collateral is stETH and BTC, which is equivalent to going long. At the same time, the corresponding short position is bought on the exchange, one positive and one negative, so-called neutrality and risk hedging, that's it.

There are two sources of income here. stETH itself has a return of around 4%, and secondly, going short will receive the fee rate given by the long position. When combined, during the bull market, the price of ETH will continue to rise, and the return rate in USDe terms will be unreasonably high.

So, risks come along with it. If the price of ETH falls, as mentioned earlier, the return in terms of U will not only disappear, but there will even be a need to pay the long position fee rate on the exchange, leading to insolvency and an instant collapse.

But the opportunity here is that even if the price of ETH falls, the ETH-based returns of stETH still exist. As long as one can survive until the bull market, one can still sell ETH for profit, as long as people believe in this and do not withdraw their assets.

During the bull market, everything is easy. For assets such as BTC/ETH, exchanges need short positions to maintain liquidity to a certain extent. In addition, they are very skilled in techniques such as pulling the network cable and inserting the needle, and are unlikely to care too much.

But as we can see, instead of saying that USDe is anchored to ETH derivatives for pricing, it is more dependent on the operation of exchanges. The exchange itself is a black box, and this is not a problem that can be solved by accessing the oracle. Moreover, the people who support USDe by paying the fee rates, do not know how the exchanges will respond.

USDe is indeed very creative, and I can't help but write about it in the middle of the article. Next is the new business model of Ondo and the speculation about where MakerDAO's DAI will go.

In particular, Ondo is more like tokenizing assets such as US bonds, but it represents the comprehensive dollarization and "virtualization" of RWA-linked asset types, meaning that physical assets such as real estate and other currencies are no longer the main direction for the future.

From the real to the virtual, ascending to happiness

From the real to the virtual, ascending to happiness

MakerDAO represents the struggle of on-chain protocols. The direct purchase of national debt through proposals by MakerDAO is still vivid, but the road of RWA has become more bewildering. Whether it should go on-chain, or bring native assets off-chain, or combine the two, perhaps the train of thought still needs time to verify.

Dividing the trend, how to deal with the barbarians

After discussing the composite standard system of BTC/ETH, the massive entry of off-exchange funds is not all positive. Traditional financial giants such as BlackRock and Franklin Templeton have assets that are more than ten times the market value of Bitcoin, but at least they have the confidence to resist SEC regulation and have a continuous supply of ammunition. The situation of the three countries has already formed.

- Traditional financial giants: Opening up new battlefields, not only staying at the stage of futures/spot ETFs, hoping to enter the on-chain market and conduct more innovative combination experiments;

- RWA project parties: Starting from the perspective of crypto, they hope to cooperate with traditional financial giants, aiming to become a mainstream financial investment choice through compliant shell borrowing, rather than confronting regulatory authorities. Or rather, confrontation is a superficial posture, and the core is to seek recognition;

- Regulatory authorities: Trying to block, if they cannot block, they seek control. OFAC controls Ethereum nodes, the SEC controls the definition of "securities," and Congress and the Federal Reserve mainly focus on stablecoins and exchanges. Money laundering and illegal securities issuance are the most commonly used means.

From the perspective of Bitcoin and Ethereum, regulation has effectively been relaxed. The approval of an ETH spot ETF is only a matter of time. However, for smaller projects, they do not have the ability to confront regulation alone. They are committed to traditional financial giants and actively implement measures such as KYC/AML, hoping to reduce outsiders' stereotypical impressions of them as financial disruptors and instead package themselves as innovators within the existing system.

In other words, anything related to real-world assets is difficult. The gravity of reality is too heavy. Simply put, the route of RWA can be divided into three stages:

- Eastern "chain reform frenzy," where everything can be put on the chain, emphasizing traceability and recordability. For example, Pionex is such a project, but in the end, it's all a mess.

- Western "tokenization," where physical and virtual assets are tokenized and put on the chain. For example, the real estate project RealT is the most typical, followed by lending products such as Maple and Centrifuge.

- Subsequently, there is the current trend of putting USD financial assets on the chain, as well as the integration and development trend of native assets of BTC/ETH and the existing financial system.

The above is my personal opinion. In the classification of RWA.XYZ, it is divided into lending, US bonds, stablecoins, and real estate. I still insist on my point of view that this round of RWA is only divided into USD-related assets on the chain, BTC/ETH off-chain, with stablecoins as the main issuance method, and lending as a supplementary development path.

However, there will be constraints from three parties: the desire for control from CeFi, the malicious impulse of CEX, and the regulation (SEC).

Taking Ondo as an example, it has issued two main products, OUSG based on US bonds and interest-bearing stablecoin USDY. The types of future products will be further updated, and their mechanisms are similar. They all follow the path of registering entities, four major audits, bank/institutional custody, and investing in USD assets, to take effect. I won't go into further detail.

OUSG components

OUSG components

Taking OUSG as an example, its main asset composition is BlackRock's short-term Treasury ETF product. However, Ondo is deeply integrated with BlackRock and will continue to promote cooperation with BlackRock's RWA product BUIDL, which is the most typical demonstration of dual integration.

Furthermore, it can directly help old money manage money, such as Compound's founder's Superstate directly purchasing US bond products and then tokenizing and issuing them. The process may be dull, but the core represents the birth of a group of Old Money in the crypto world. They have already passed the age of high risk and high returns and are ready to bring ashore the plundered gold, silver, and jewels for a peaceful life.

But the continuous influx of new forces does not want to give up directly. For example, MakerDAO's DAI is already prepared to embrace the high returns of USDe, with an initial investment of 600 million DAI, which can be recharged up to 1 billion USD. Not only can DeFi do arbitrage, but stablecoins can also become another type of stablecoin. It must be noted that the essence of USDe is not a dollar equivalent, but an ETH volatility equivalent.

The crypto world's response to the vast real-world assets still seems somewhat immature. Compared to the trillions of dollars managed by asset management giants, a TVL of hundreds of millions or billions is simply insignificant. The more important question is whether we consider RWA to be an important form of asset in the future, at least as mainstream as ETFs, or is it just a one-sided view within the crypto community, where the token hype is good, but the aftermath is a mess.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。