Author: Jack Inabinet, Bankless

Translation: Baishui, Golden Finance

Toncoin (TON) continued to rise this month, soaring 50% from its low point in April, refreshing its previous all-time high, and becoming one of the top ten cryptocurrencies by market value! What catalysts are driving TON's outstanding performance?

The Open Network (TON) was initially created by the popular messaging app Telegram in 2018, aiming to be a competitor to Ethereum. However, after the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the company, it abandoned TON in 2020. This was because the company raised $1.7 billion from private placements and argued that it was an unregistered security.

Subsequently, a group of independent developers established NewTON (now known as the TON Foundation) and gained control of the project's domain and code repository in 2021. Later in the same year, they launched The Open Network and distributed TON.

Although TON has been on an upward trend in the cryptocurrency market since September, its relative stagnation caused its value to fall by 70% compared to BTC. However, TON made a strong comeback in March, rising by over 170% in just the past five weeks!

Source: TradingView

After Telegram announced in September last year that they were developing a crypto wallet on The Open Network, TON experienced a brief period of strength, but it wasn't until last month that market participants seriously digested the impact of this partnership.

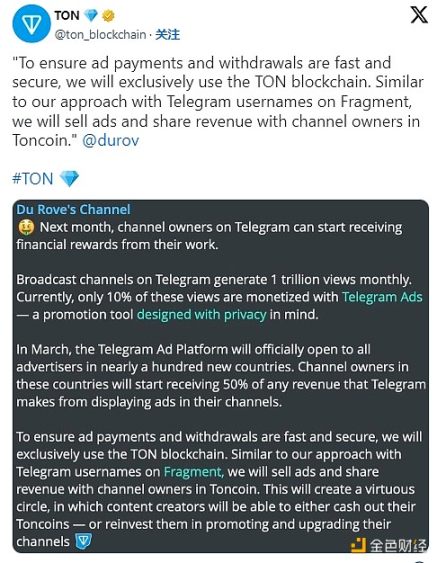

On March 31, Telegram announced that it would allow users to purchase advertisements using Toncoin and share 50% of the advertising revenue from channel monetization through TON distribution with creators.

In addition to Telegram's attempt to inject utility into its application with Toncoin, the decentralized TON Foundation is also working to promote the use of the chain itself.

Their Open Alliance campaign began on April 1, distributing 30 million TON to applications and users (valued at $204 million at current prices), and using an additional 1 million TON to incentivize users to join HumanCode (the chain's leading identity proofing primitive).

The net impact of all these plans has been very positive not only for the price but also for various on-chain metrics; compared to early March, the number of wallets on The Open Network has doubled, and TVL has increased sixfold!

Although the on-chain application scenarios for TON are still in the early stages compared to more mature EVM chains and L1 leaders like Solana, the market is pricing TON's success favorably, recognizing its close ties to Telegram and the real-world utility behind Toncoin, making it more advantageous compared to assets from other cryptocurrency investments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。