Author: Severin & Ian, MT Capital

TL;DR

Berachain originated in 2021, with the founders inspired by the liquidity fragmentation between multiple chains and the ghost town effect of public chains, leading to the idea of creating a liquidity public chain. The Berachain community has a very distinct Ponzi culture, Meme culture, and NFT culture.

Berachain is a high-performance EVM-compatible public chain built on the liquidity proof of stake consensus. EVM compatibility allows Berachain to widely integrate the mature EVM ecosystem. The PoL consensus can directly incentivize on-chain liquidity through BGT emissions and bribery, helping Berachain to avoid the liquidity ghost town dilemma faced by existing public chains, promoting the prosperity of on-chain DeFi ecosystem and trading activities, allowing the public chain to gain protocol-level flexibility, and effectively incentivizing and guiding on-chain liquidity to promote the balanced development of the ecosystem, turning the public chain's upward spiral.

The ecological projects on Berachain are still in a very early stage of development. In addition to official components, the ecological projects on Berachain present three different development trends: (1) supplementing the long-tail market that cannot be reached around the official components; (2) innovating around the PoL mechanism, BGT, and bribery; (3) a large number of high-quality external projects are attracted to the Berachain ecosystem by the PoL mechanism.

From an investment perspective, we will focus on high-quality DeFi projects on Berachain and infrastructure that can innovate around Berachain's PoL mechanism, BGT mechanism, and bribery mechanism, and continue to pay attention to NFTFi protocols that combine NFT with DeFi and L2 based on Berachain and related infrastructure. (Related project parties are welcome to DM @0X_IanWu, @Severin0624 on Twitter)

Introduction

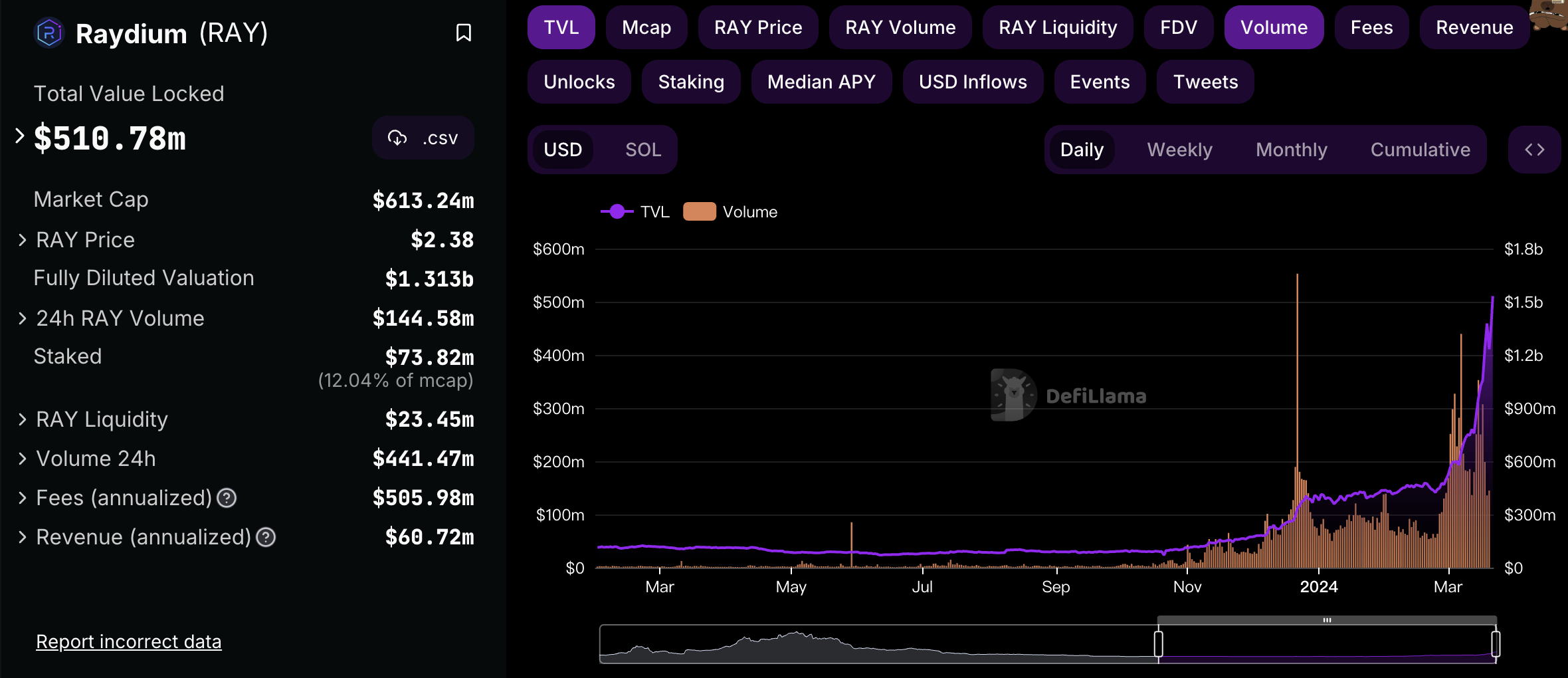

A recent interesting phenomenon is that the once proud Alt-L1 public chains are all starting to use Meme to grab the attention of the Crypto market. Just like Solana, the technical advantages of high TPS and low confirmation latency have finally been perceived by users in the surging Meme speculation wave, achieving a bountiful harvest of public opinion, funds, users, and traffic. Solana's Meme speculation wave not only brought a lot of attention and new users to Solana but also brought a lot of active trading and liquidity to Solana. The injection of liquidity funds also made Solana's Meme ecosystem more vibrant and further drove the prosperity of the entire Solana ecosystem. Especially, Solana's preferred DEX Raydium for Meme trading achieved a 246% monthly TVL growth. It can be seen that although technology is still the historical heritage of the blockchain iteration wave, technology is by no means the only key to measuring the future development of public chains. Market attention and liquidity represented by Meme may become the main battlefield of the new round of public chain competition.

source: https://defillama.com/protocol/raydium?events=false&volume=true

However, there is a public chain, Berachain, which has had Meme culture since its creation, allowing it to gather a large number of loyal community users in the bear market of Crypto despite the team's anonymity and lack of technical documentation. The name Bera itself is one of the most distinctive Crypto Meme cultures. The reason for naming it Bera is to pay tribute to the classic crypto old joke HODL, thus rewriting Bear as Bera. It also innovatively proposed the PoL mechanism, aiming to attract liquidity by rewarding tokens on the chain, avoiding the ghost town dilemma of existing public chains. In addition, it is EVM compatible, supporting seamless migration of developers and users in the EVM ecosystem. The combination of the three buffs quickly attracted millions of users to its test network and achieved a growth of a million active wallets in just 7.5 days.

source: https://twitter.com/berachain/status/1749522523895570700?ref=research.despread.io

As a public chain with its own technology, community, Meme culture, and liquidity, Berachain is expected to reshape the competitive landscape of existing public chains, break the ghost town dilemma of public chain liquidity, and become the superstar public chain of this bull market cycle.

Development History

Berachain Development History

The founders of Berachain are early anonymous DeFi players who started investing in Crypto projects in 2015, trading coins, and fully participating in DeFi Summer. Between 2021 and 2022, the founders also participated in the DeFi ecosystems of different chains and switched back and forth between different Alt-L1 chains, and were aware of the liquidity fragmentation between multiple chains and the ghost town effect of public chains. They found that public chains always overly rely on token incentive subsidies to attract TVL and liquidity. Once token emissions are exhausted, most public chains will gradually lose liquidity. They also found that PoS public chains also have some problems, with a large amount of value tokens being used for staking to ensure network security. Although the security of the network has increased, the cost of liquidity is also huge, and liquidity is the key to the active participation of DeFi and ecological protocols. Their rich experience in participating in the DeFi industry shaped their basic understanding of the ideal public chain model and laid the foundation for proposing the PoL mechanism.

About a year and a half ago, Smokey and another co-founder jokingly mentioned creating a smoking bear NFT Bong Beras. After the Bong Bears NFT was issued, it unexpectedly received a lot of attention and support from the community. Since the founders themselves were OGs who were early involved in major DeFi communities, most of the community members who came were also DeFi enthusiasts. Through exchanges with the community, the founders gradually had the idea of creating a liquidity public chain and started a vote in the community. Miraculously, despite never having done a public chain before, they unexpectedly received a lot of support from the community, and Berachain was born as a result.

Although the founding team has rich DeFi experience and precise market insights, developing a public chain still requires a lot of technical work. During the conversation, the Berachain team met the Polaris team, which focuses on EVM compatibility development. The two teams hit it off and together formed the core of the current Berachain. At this point, Berachain has basically taken shape. Technically, Berachain will use Polaris's technology to build a high-performance L1 based on Cosmos that is compatible with EVM. Mechanism-wise, Berachain will adopt the PoL mechanism to incentivize on-chain liquidity and promote the prosperity of the on-chain DeFi ecosystem.

Key Historical Milestones

- August 2021: Bong Bears NFT minting and issuance, laying the groundwork for the emergence of Berachain.

- October 2021: First rebase of Bong Bears NFT.

- November 2021: Berachain was first mentioned.

- March 2022: Olympus DAO OIP-87 proposal for seed round financing of Berachain approved, with Berachain receiving 0.5M in funding from Olympus at a valuation of 50M.

- April 2023: Berachain disclosed a 42M financing led by Polychain.

- January 2024: Berachain testnet release.

- March 2024: Berachain disclosed a financing round of over 69M led by Framework Ventures.

Community Culture

Ponzi Culture

Berachain was initially launched by several old OGs who were involved in major DeFi projects. The founding team of Berachain does not reject, and even enjoys, Ponzi culture. Therefore, in the Berachain community, Ponzi is not avoided, and is even openly discussed. Berachain is also currently considered by the market to be the next Luna with a Ponzi model, although this analogy is not reasonable, it also reflects the cultural core of the Berachain community and the external recognition of the Berachain community culture.

Meme Culture

In addition to Ponzi, Berachain also naturally has Meme culture, as Berachain's origin comes from the smoking bear NFT Bong Bears, which has a very Meme-like image. The Bong Bears was initially an idea that originated from a joke among the founders and unexpectedly received a lot of attention and support from the community. In addition to Bong Bears, the name Bera itself is a part of Meme culture. The founders of Berachain, Smokey, even wear a Bera headgear to attend various formal events, actively spreading the Meme spirit. The Berachain community also loves to play with Meme culture. The official account deliberately misspells words, such as turning "Hello" into "Henlo". In other communities, you may often see "GM" and "GN", but in the Berachain community, you will see the highly Meme-personality "Ooga Booga" flooding the chat. From top to bottom, from the official to the community, Berachain is immersed in a highly distinctive Meme culture.

NFT Culture

As Berachain was born from NFT Collection, NFT has naturally become one of the most representative cultures of the public chain. When we talk about other public chains, we rarely associate them with symbolic NFTs other than Ethereum. But when talking about Berachain, the topic of Bong Bear NFT based on the Rebase mechanism cannot be bypassed. In addition to the NFTs issued by the founders, ecological projects on Berachain also issue their own NFT Collections, and the NFT Collections of different projects are all linked to the Bear theme. To some extent, for Berachain, NFTs are assets of equal importance to tokens. Compared to tokens alone, NFTs come with an additional layer of cultural attributes and community identity, giving the entire Berachain community stronger consensus and community stickiness. For example, despite the significant gains in the secondary market for the Bong Bear and Honey Comp NFT series, few users sell for profit, and the listing rate of NFTs is even less than 2%, which also reflects the strong community consensus under the Berachain NFT culture.

Conclusion

The unique cultural attributes of Berachain are also one of the identifiers that set Berachain apart from other public chains. We expect that Berachain's unique community culture will have the following impact on Berachain.

Stronger purchasing power and wealth effect compared to other public chains: The attractiveness of Ponzi culture for funds is self-evident. Berachain's native users from major DeFi and even Ponzi communities, as well as Berachain's preference for Ponzi, may give Berachain a stronger purchasing power compared to other public chains, making it the best soil for the survival of Ponzi projects.

Stronger traffic attention compared to other public chains: In this cycle, public chains have gradually realized that native Meme is the best marketing for public chains. From this perspective, Berachain, with its inherent Meme culture, self-deprecating Meme culture, and the ability to continuously propagate Meme culture, is more likely to attract more market attention and go viral compared to other public chains.

Stronger community cohesion compared to other public chains: Existing public chains are somewhat lacking a unified symbol as a spiritual consensus. But just as each country has its own national treasures as representatives and consensus, for Berachain, Bera is the best spiritual symbol and consensus for Berachain. Almost all NFT Collections on Berachain are created based on Bera as the basic carrier, and the spread of NFT culture will further bring community identity and enhance community stickiness. At the same time, cooperation and benefits based on NFT will also bring stronger ecological synergy and community cohesion to the Berachain ecosystem.

Berachain Technical Architecture

Berachain is a high-performance L1 public chain built on the Cosmos SDK with the CometBFT consensus engine and EVM compatibility. Building on the Cosmos SDK allows Berachain to seamlessly integrate with the Cosmos ecosystem and achieve horizontal expansion through the IBC module. Additionally, Berachain has independently developed the Polaris Ethereum module to provide EVM compatibility, enabling Berachain to better aggregate developers and users from the existing EVM ecosystem and provide a more familiar development and usage experience. Berachain aims to become a key node for unified EVM ecosystem liquidity and Cosmos ecosystem liquidity, creating the most powerful, fastest, and most liquid blockchain network in the multi-chain ecosystem.

Polaris Ethereum

Polaris Ethereum provides advanced EVM development experience for developers. In addition to providing basic EVM compatibility, Polaris Ethereum also provides developers with features such as creating stateful precompiled contract modules and supporting developers to customize opcodes, allowing developers to build more flexible and versatile smart contracts using Polaris Ethereum.

EVM Compatibility

The basic principle of Polaris is similar to running an additional Ethereum-equivalent virtual machine on the L1 main chain. By plugging and unplugging corresponding plugins such as Configuration plugin, State plugin, Gas plugin, Polaris can effectively input state transitions, thereby supporting the execution of Ethereum transactions for any type of L1 main chain smart contract.

Precompiles

Precompiles, also known as precompiled contracts, are a set of smart contracts with specific functions that are directly built into blockchain nodes rather than executed as bytecode in the EVM. Precompiled contracts can achieve more efficient state operations at a lower gas cost and provide additional functional logic. Polaris's support for precompiled contracts enables direct interaction with various Cosmos modules. Currently, the types of precompiled contracts on Berachain include BGT for redemption operations and Bribe for operations such as creating bribes and obtaining bribe fees.

Polaris EVM implementation also adds support for custom opcodes to enable more complex smart contracts.

Modularity and Interoperability

Polaris is a modular implementation of EVM, which can be easily integrated into any consensus engine. Each component of Polaris is developed as a unique package and comes with comprehensive testing documentation. Developers can use individual components of Polaris based on complete documentation, or combine multiple components as needed to create a personalized EVM integration. The modular implementation of Polaris for EVM integration can help developers significantly reduce the time cost of implementing their own EVM integration solutions.

Furthermore, the combination of Polaris Ethereum and Cosmos SDK enables interoperability with the Cosmos ecosystem in an EVM-compatible environment. By integrating multiple state precompiles on-chain, Polaris allows EVM users to execute native Cosmos operations, such as governance voting, validator delegation, and interact with other chains through IBC. This design not only preserves the native EVM experience but also achieves true interoperability between Cosmos and EVM, bringing Berachain closer to its vision of becoming the hub of liquidity for the EVM ecosystem and Cosmos ecosystem.

(Of course, since Polaris has not been tested in practice, the specific performance, traffic load, and EVM compatibility of Berachain after its mainnet launch are still to be observed.)

PoL Consensus

Why PoL is Needed

PoS is currently one of the most common consensus mechanisms. Although PoS has been tested for many years and has been confirmed by the market as an effective consensus mechanism that can balance network security, decentralization, and consensus efficiency, it also has some issues. For example, the security of a PoS network depends on the amount of assets staked in the network. The higher the value of staked assets, the lower the probability of the network being attacked. However, excessively high staked asset value also reduces the value of assets available for on-chain liquidity, which is not conducive to the prosperity of on-chain trading activities, especially in the 2021 and 2022 when liquidity staking has not been widely adopted. In addition, token incentives in PoS networks only flow to token stakers, meaning that PoS networks only incentivize staking activities, while activities that promote ecosystem prosperity such as providing liquidity for on-chain transactions do not receive sufficient incentive support from PoS networks. The existence of these two major problems ultimately led Berachain to abandon PoS consensus and propose PoL: Proof of Liquidity.

The core of PoL is to incentivize the prosperity of on-chain DeFi ecosystems, and one of the keys to DeFi is liquidity. Therefore, the core purpose of PoL is to incentivize sustainable deep liquidity on the chain.

PoL Mechanism

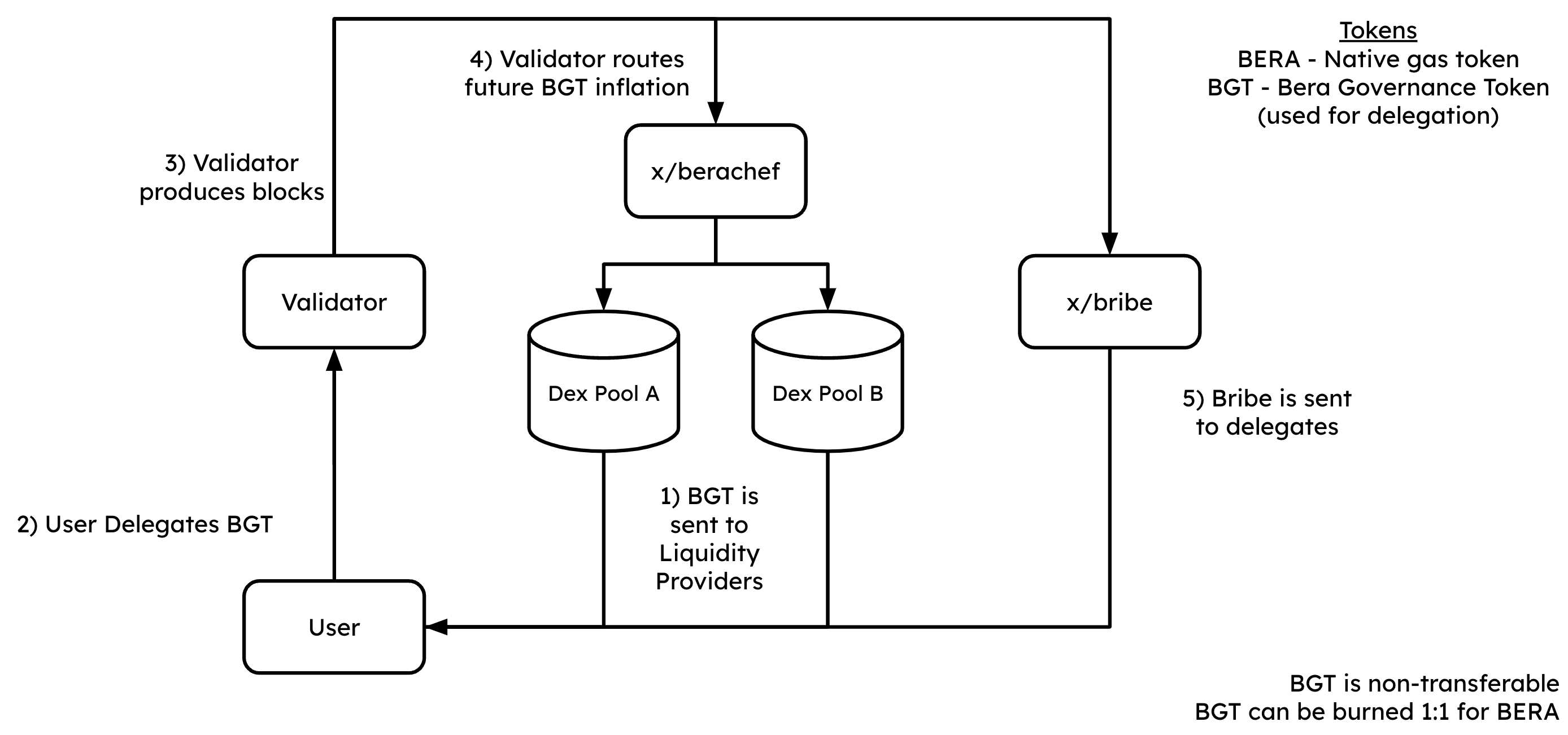

The specific mechanism of PoL is as follows:

Users who want to receive token incentives similar to those in PoS networks need to provide liquidity to specific liquidity pools on Berachain, and in return, Berachain will reward users with governance token BGT. It's important to note that in traditional PoS networks, the way to receive native token rewards is through staking, while in PoL networks, the way to receive native token rewards is by providing liquidity.

Similar to token staking in PoS, users can also delegate the BGT they receive to validator nodes, which will participate in network validation on behalf of the users.

Similar to PoS, validators will participate in block generation and construction based on the proportionate weight of the BGT they are delegated, and receive block generation rewards and block fees as incentives.

Unlike PoS, validators can vote on the future emission of BGT rewards in different liquidity pools. In PoS networks, stakers receive relatively fixed rewards. However, in PoL, the rewards for liquidity providers are dynamic and influenced by governance factors.

Finally, the new round of BGT will be dynamically emitted among different liquidity pools based on the voting results, and the BGT rewards will be distributed to liquidity providers, forming a closed loop.

source: What is Proof-of-Liquidity? | Berachain Docs

PoL vs PoS

The improvements of PoL over PoS are evident.

Firstly, PoL can directly incentivize on-chain liquidity, promoting the prosperity of on-chain DeFi ecosystems and trading activities. In a PoL network, the only way to receive token emission rewards is by providing liquidity. Therefore, the emission rewards of the network's native token will attract users to provide liquidity. Additionally, the higher the value of the network's native token, the greater the attractiveness of token emission rewards, leading to more users becoming LPs and deepening the network's liquidity. Furthermore, the persistence of liquidity incentives makes the liquidity of the PoL network more sustainable, unlike other PoS public chains that face the dilemma of a large withdrawal of liquidity once the airdrop incentives are completed.

Secondly, PoL gives public chains protocol-level flexibility, enabling more effective incentivization and guidance of on-chain liquidity, promoting the balanced development of the ecosystem. The PoL mechanism of public chains is similar to the protocol-level vetoken mechanism. Through governance modules, public chains can incentivize and guide specific assets and liquidity pools that were originally disordered. Its core purpose is very similar to the token subsidies that public chains provide to specific ecosystems, protocols, and assets, but the implementation is more elegant.

The PoL mechanism may provide higher security than PoS. The PoL mechanism has a potential positive feedback loop. In the PoL mechanism, users deepen the network's liquidity while providing liquidity and receiving network token emission rewards, which in turn provides a better user experience for DeFi users and promotes the prosperity of the network ecosystem. The improvement in the network's fundamentals will also to some extent be reflected in the token price, promoting the rise in token price. The rise in token price will further incentivize users to provide liquidity, capture network token emission, and form a closed-loop positive feedback loop. In this process, the increase in provided liquidity also means an increase in network security. Therefore, the PoL mechanism may provide higher security than PoS networks.

In summary, the PoL mechanism can effectively promote sustainable on-chain liquidity and the prosperity of the DeFi ecosystem through token emission rewards, breaking free from the over-reliance on airdrop marketing to attract users and liquidity, while also capturing higher security. The PoL mechanism also allows public chains to more flexibly incentivize the ecosystem, potentially driving a positive feedback loop of liquidity, token price, and ecosystem growth.

However, the PoL mechanism also has its corresponding drawbacks, as it only incentivizes liquidity and the most basic liquidity needs of DeFi. Although liquidity is the key to DeFi, it does not encompass all of DeFi. PoL cannot incentivize DeFi protocols with low liquidity needs. For example, a trading aggregator protocol may not have a very high TVL but can contribute a large amount of trading volume. However, under the PoL mechanism, Berachain cannot effectively incentivize such protocols. In addition, for non-DeFi tracks such as NFT and GameFi, PoL also struggles to provide balanced incentives. Therefore, the current version of PoL may be further optimized in the future development of Berachain to more evenly incentivize different DeFi protocols and the development of different cross-chain ecosystems.

Token Model

The token model of Berachain is different from other public chains. Berachain's token economy consists of three different tokens: governance token BGT, gas token BERA, and stablecoin HONEY.

Introduction to the Three-Token Model

BGT is positioned similarly to the governance token in PoS networks, with the difference being that BGT is set to be non-transferable. Additionally, the ways to obtain BGT are relatively limited. Currently, users can obtain BGT emission rewards by providing liquidity on BEX, borrowing HONEY, and providing HONEY in the bHONEY Vault on Berps. BGT can be used for governance participation, and users can delegate BGT to validators while receiving governance rewards and bribe rewards. Once validators participate in block production, users can also receive transaction fee rewards and gas fee rewards from Berachain's native applications BEX, Bend, and Berps within the block. BGT can also be converted 1:1 to Berachain's gas token BERA, but this process is one-way and irreversible, meaning users cannot convert BERA back to BGT at a 1:1 ratio.

BERA is positioned similarly to the native tokens in other public chains, mainly used for paying gas fees and block rewards. However, holding BERA tokens does not grant governance voting rights, as governance rights are allocated to BGT.

HONEY is positioned as the native stablecoin of Berachain, providing a stable trading medium for applications on Berachain. Users can mint HONEY by pledging USDC at a 1:1 ratio.

Understanding the Three-Token Model

```

To understand the three-token model, we need to go back to Berachain's PoL mechanism. PoL incentivizes Berachain's liquidity by rewarding users with BGT tokens. Therefore, in order to achieve the desired liquidity incentive, BGT must have value to attract sufficient liquidity.

How can BGT's value be ensured? If, like other L1 chains, the native token is only used as a governance token, its value is difficult to guarantee. In this case, the token's value is weakly related to the fundamentals of the public chain, which is clearly not a reasonable path. There are two ways to ensure the value of BGT. First, BGT must have real value inflows or be able to show users the expected returns. Second, efforts should be made to ensure that users hold BGT rather than sell it. Based on these two approaches, a reexamination of Berachain's PoL and three-token model design will become clearer.

First, regarding the issue of preventing users from selling, Berachain's approach is simple: design BGT as a non-transferable governance token and introduce an additional gas token, BERA. If users want to sell BGT, they need to exchange BGT 1:1 for BERA, creating an additional barrier to delay the selling of BGT by users.

However, this approach is only a temporary solution. To make users believe that BGT has value, the most direct approach is to show users the benefits behind BGT. In this regard, Berachain provides two empowerment solutions. First, Berachain grants governance rights to BGT. This governance right is not for project development but directly related to BGT emission, i.e., governance rights over user earnings. The significance of governance rights is that every user must hold BGT and delegate it to those willing to vote for them in the liquidity pool they are mining in, in order to receive more BGT emission rewards. In a user-to-user PVP scenario, if one party chooses to mine and sell, it is clear that this party will expect to receive relatively fewer BGT emissions in the future, which is not conducive to maximizing their own earnings. From this perspective, by giving BGT income governance rights, Berachain can effectively delay the process of users mining and selling BGT, encouraging more users to hold BGT and seek higher future returns.

Second, not only Berachain, but the nodes themselves also empower BGT. Because a node's earnings come from ecosystem income and gas income from block production. In order to maximize their own interests, nodes must receive as much external BGT delegation as possible to increase their block production rate. To attract external BGT, nodes need to engage in bribery. There are many ways to bribe, such as sharing ecosystem income with users or offering high APY to exchange for BGT from users. The competition among nodes to maximize their own interests gradually evolves into the process of empowering BGT. The value of BGT is guaranteed by the protocol income and bribery income shared by the nodes, which further increases user confidence in holding BGT.

At this point, the relationship between the entire PoL mechanism and the three-token model becomes clearer. It is easy to understand why the official Berachain wants to control the DEX, Lending, and Perps trio. The reason is simple: as the three most powerful components for printing money, DEX, Lending, and Perps can enjoy huge gains from PoL, generating high protocol income. By transferring this part of the income to the hands of intermediary underwriting nodes, the nodes can empower BGT, providing the most real value guarantee for BGT. Imagine if there were no dividends from DEX, Lending, and Perps, wouldn't the value empowerment of BGT feel a bit like a castle in the air?

Furthermore, BGT and the entire Berachain ecosystem are mutually influential. The income of ecosystem projects is the most real value inflow behind BGT. If the Berachain ecosystem is not active enough, the value of BGT will not be well guaranteed, and users will tend to sell BGT. The decrease in the value of BGT will reduce Berachain's attractiveness to LPs, leading to the withdrawal of liquidity by users seeking higher-yield mining pools. This will further deteriorate the user experience of on-chain DeFi and reduce the activity of the ecosystem, leading to a negative spiral. Conversely, if the Berachain ecosystem is active enough and the protocol income from the official trio is high enough to be shared with users, BGT will receive more value guarantee, and users will be more willing to hold BGT. The increased attractiveness of BGT to users will attract more users to provide more liquidity, further driving the prosperity of the on-chain DeFi ecosystem and initiating a positive spiral. Rationally speaking, the start and stop of the spiral depend on the relationship between the delegation staking income of BGT and the current price of BGT. If the values of the two are close, the system will maintain overall stability. If the values of the two are significantly different, Berachain will easily enter an upward or downward spiral.

Berachain Ecosystem

Although Berachain was born in 2021, due to the continuous optimization and design of its core mechanism, and the fact that its related documents have not been publicly disclosed, the Berachain ecosystem has not yet formed a very complete project ecosystem. Even due to the late release of Berachain's related documents, most community projects were established after January 2024, and the Berachain ecosystem is still in a very early stage.

Official Ecosystem

The official ecosystem of Berachain is the most important foundational component of the Berachain ecosystem. According to the founder, in order to avoid meaningless vampire attacks among DEX, Lending, Perps, and similar protocols, the official decision is to provide DEX, Lending, and Perps products directly. Combined with the analysis above, DEX, Lending, and Perps are also the main source of income for the Berachain ecosystem. The official control of these three components is beneficial for better benefits to BGT holders, providing more sources of value for BGT, and driving the positive spiral of Berachain's upward movement.

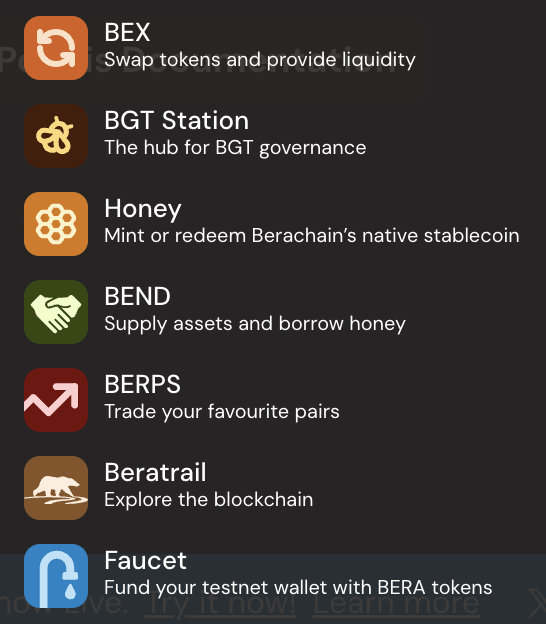

In addition to BEX, BEND, and BERPS, the official also provides the BGT Station management platform based on BGT delegation governance, the platform for minting and redeeming the native stablecoin HONEY, the Berachain blockchain browser Beratrail, and the testnet faucet.

source: https://www.berachain.com/

DeFi Ecosystem

Infrared

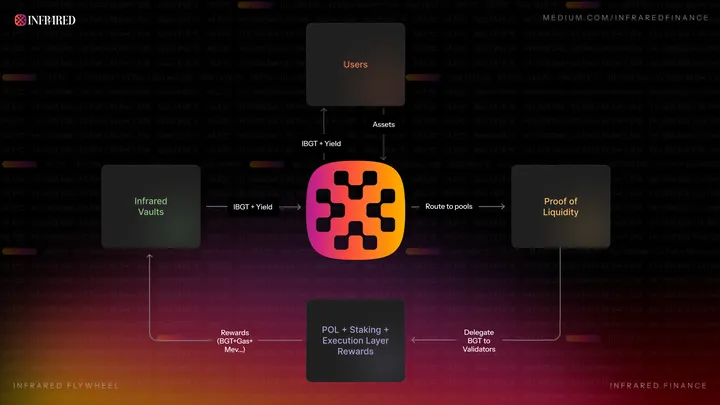

Infrared is the PoS and LSD protocol on Berachain, and it disclosed a seed round financing of 2.5 million led by Synergis, with participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, and other institutions in January 2024. Infrared cleverly transforms Berachain's PoL into a more familiar PoS for the market and users, and further enhances the efficiency of fund utilization by issuing staked liquidity certificates. Infrared captures BGT emissions from Berachain by receiving users' liquidity assets and providing liquidity. Subsequently, Infrared will give users liquidity certificates iBGT and staking certificates siBGT as a mapping of BGT. Users can enjoy the corresponding BGT income and also use iBGT and siBGT to further participate in other DeFi ecosystems on Berachain. Infrared is expected to become the Lido on Berachain and expand its own iBGT ecosystem.

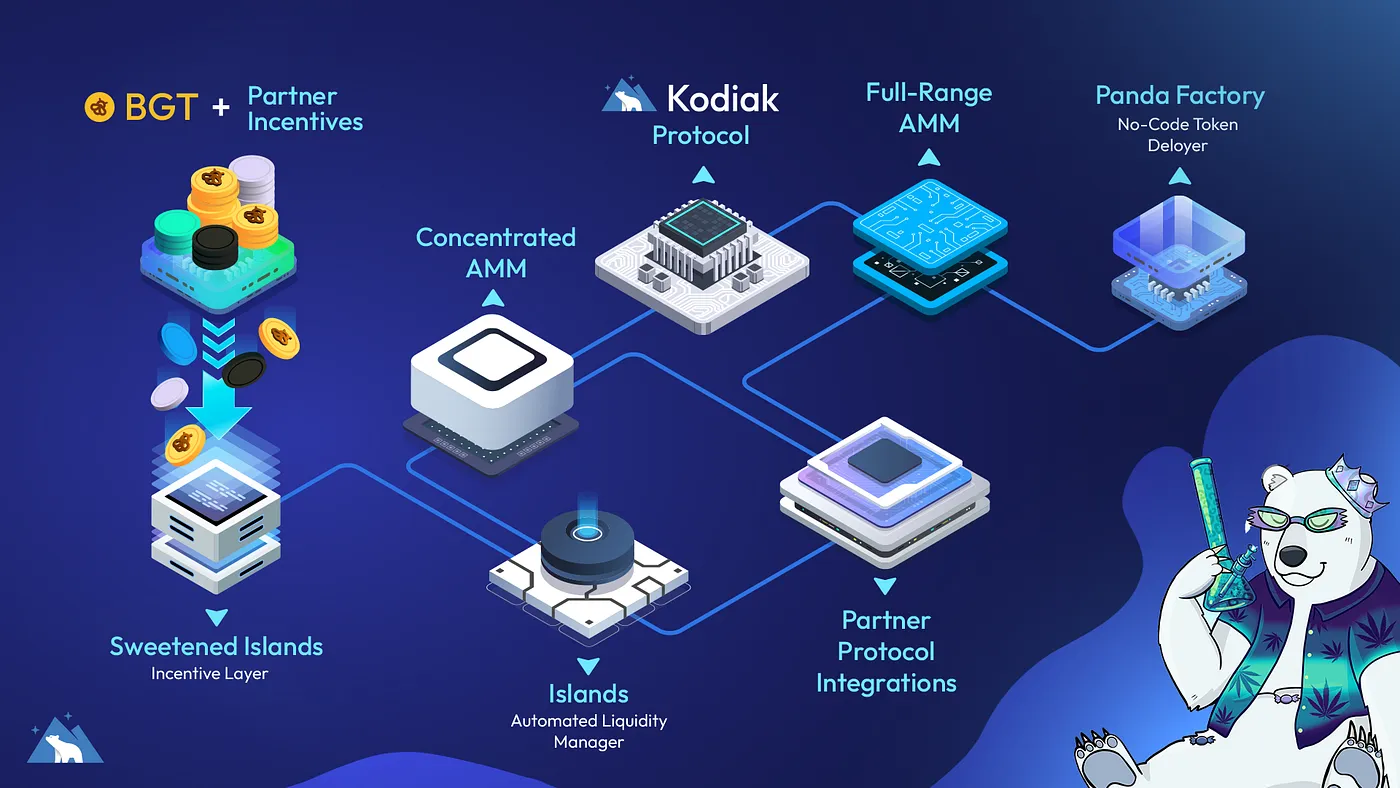

Kodiak

Kodiak is the only DEX project incubated by Berachain's Build-a-Bera accelerator program and disclosed a seed round financing of 2 million led by Build A Bera, Amber Group, Shima Capital, DAO5, and other institutions in February 2024.

Kodiak aims to be a comprehensive liquidity platform on Berachain, providing DEX, automated liquidity management, and no-code token deployment services for users on Berachain. Although both are DEX, Kodiak's positioning does not conflict with the official DEX. Kodiak aims to provide users with trading services for long-tail assets on Berachain, and it can also provide liquidity providers with automated liquidity management solutions, eliminating the hassle of LP actively managing liquidity. In addition, Kodiak also provides a no-code token deployment solution, supporting developers in quickly deploying and issuing tokens. It can be said that Kodiak provides a full set of service processes from token deployment, issuance, to trading, and liquidity management solutions.

source: https://medium.com/@KodiakFi/introducing-kodiak-berachains-native-liquidity-hub-63c3e7749b30

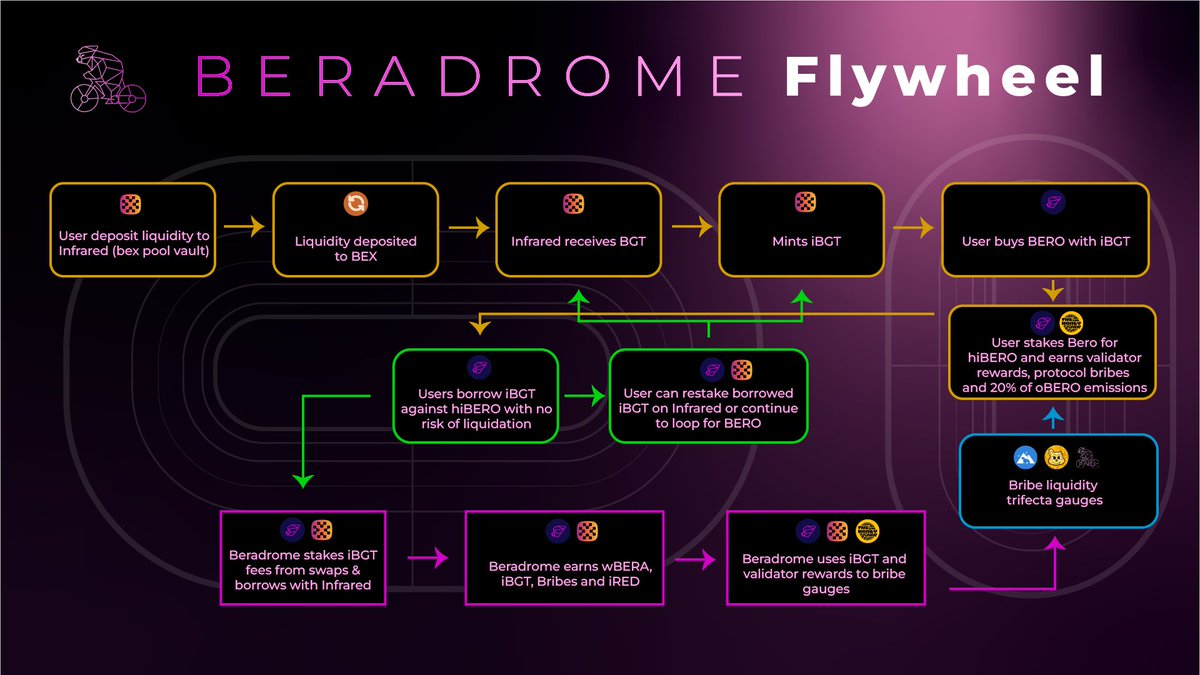

Beradrome

Beradrome aims to be the DEX and Restaking liquidity market on Berachain, bringing Solidly's gameplay into the Berachain ecosystem through the ve(3,3) token economics design. Users holding iBGT can use Beradrome to purchase and stake BERO, capturing validator rewards, protocol bribery rewards, and oBERO emissions on the Beradrome platform while obtaining hiBERO certificates. At the same time, users can use hiBERO for collateralized borrowing of iBGT without liquidation risk, further enhancing fund utilization efficiency and amplifying returns.

source: https://twitter.com/beradrome

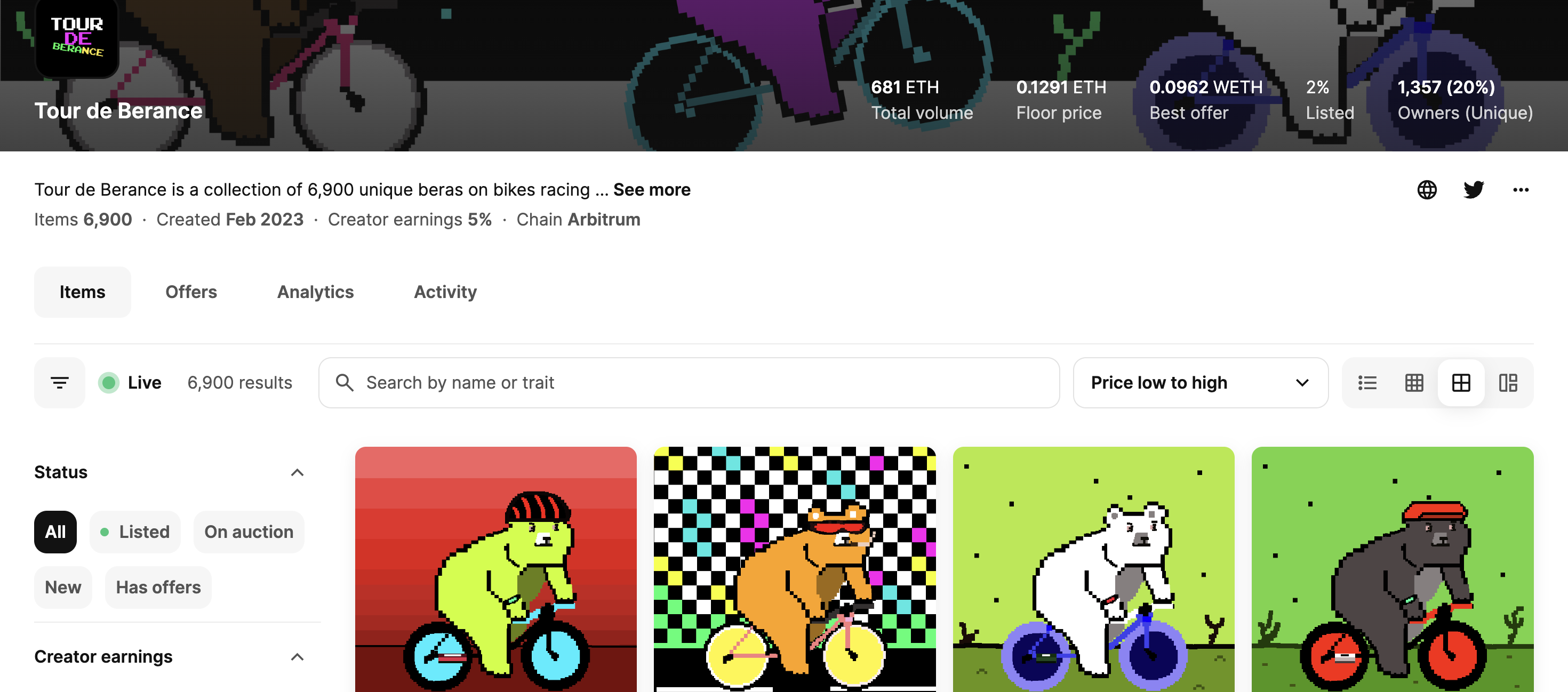

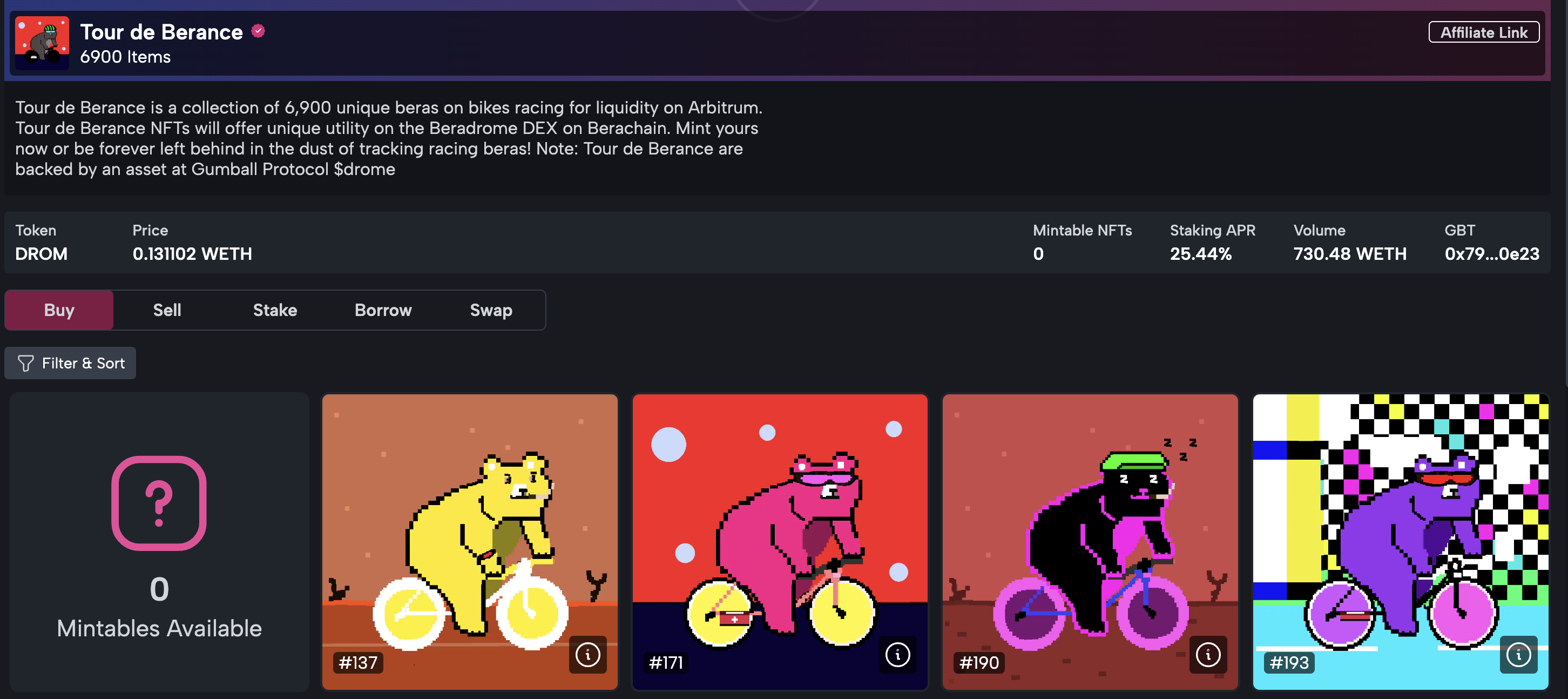

It is worth noting that Beradrome has partnered with The Honey Jar, and the two will operate a validator node on the BeraChain. In addition, Beradrome has also launched its NFT Collection Tour de Berance, where NFT holders can receive higher hiBERO allocation rights and voting rights.

source: https://opensea.io/collection/tour-de-berance

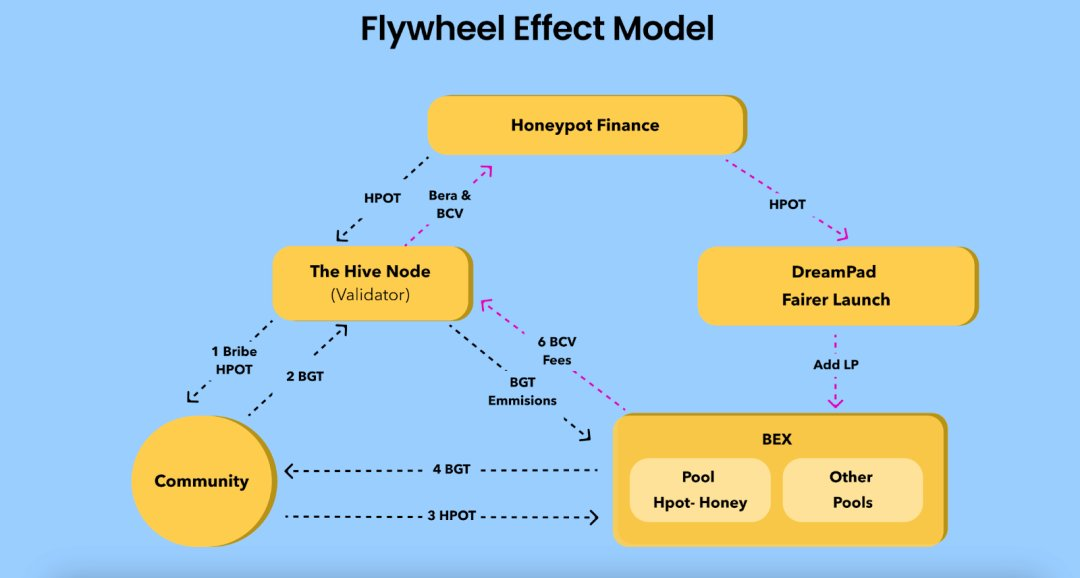

HoneyPot Finance

Similar to Infrared's concept, HoneyPot Finance also provides a staking solution for BGT that transforms Berachain's PoL into a more familiar PoS for users. Unlike Infrared's approach of absorbing users' liquidity assets and providing users with iBGT liquidity certificates, HoneyPot Finance uses platform token bribery to receive users' delegated BGT and incentivizes users to use the bribery platform token to provide liquidity in exchange for BGT emissions through income governance, forming a PoS. In addition, HoneyPot Finance has launched a fair launchpad for long-tail assets and a Batch AMM model optimized for long-tail asset trading, aiming to become the liquidity infrastructure for long-tail asset issuance and trading on Berachain.

source: https://docs.honeypotfinance.xyz/v/zh-cn/overview/map

In addition to the above-mentioned DeFi protocols, there are still a number of high-quality protocols under construction in the Berachain ecosystem that have not yet disclosed product details, such as:

- The Gummi protocol, which supports any currency market on Berachain

- The Wakalah protocol for commodities and RWA on Berachain

- The Exponents protocol, an oracle-free derivative platform on Berachain

- The IVX 0DTE options AMM platform

- The OOGA BOOGA DEX trading aggregator

- The Smilee Finance options protocol, which offers up to 1000x leverage, non-liquidation, and impermanent loss

- The Shogun intent-based order flow aggregator and modular intelligent liquidity routing platform

- The D^2 Finance 100% on-chain non-custodial multi-strategy hedge fund protocol

- …

NFT Ecosystem

NFT Collection

Bong Bears

Berachain originated from the Bong Bears NFT Collection. On August 27, 2021, three anonymous founders of Berachain issued the Bong Bears NFT Collection, consisting of 100 uniquely designed bears. The subscription process was different from other NFTs, with each NFT priced at 0.069 ETH, and buyers could view specific bears on OpenSea before subscribing.

Bong Bears NFT also introduced the concept of Rebase NFT and subsequently rebased four different NFT Collections: Boo Bears, Baby Bears, Band Bears, and Bit Bears.

The early high user stickiness of the Bong Bears community allowed the prices of Bong Bears NFT to soar even without Berachain disclosing any related information. The price gradually rose from 0.069 ETH to over 50 ETH. With the disclosure of Berachain's financing information, holding Bong Bears NFT was seen as the optimal choice for receiving Berachain airdrops. As a result, the listing rate of Bong Bears NFT quickly declined, and it has now reached a state of having value but no market, with a floor price of 200 ETH.

source: "Proof of Liquidity" Project Berachain Launches Public Testnet, Artio (investingcube.com)

The Honey Jar

In addition to the official Bong Bears NFT Collection, the most popular NFT Collection and community on Berachain is The Honey Jar. The Honey Jar is the traffic entrance of the Berachain ecosystem and has been helping to operate online and offline activities related to Berachain and its own community even before Berachain publicly disclosed PR. The Honey Jar not only serves as the traffic entrance of the Berachain ecosystem but also educates users in the Berachain ecosystem. Additionally, The Honey Jar, as a community, also operates incubation and cooperation with other projects in the Berachain ecosystem.

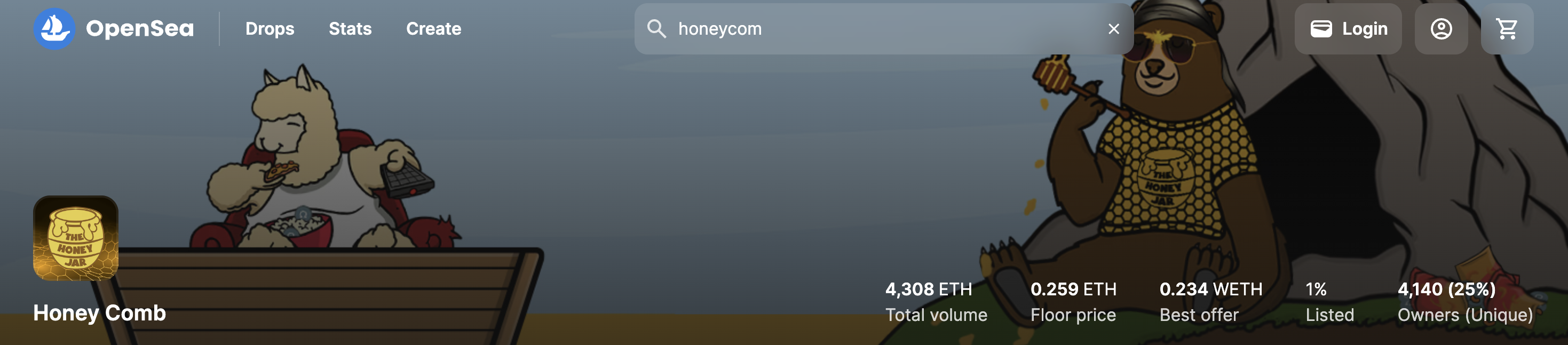

The Honey Jar has also launched its own NFT series, Honey Comb NFT. As a core community NFT project of Berachain, holding Honey Comb NFT can enjoy additional benefits brought by The Honey Jar's partners, such as NFT whitelist minting opportunities and additional mining yield enhancements. Currently, the trading volume of Honey Comb NFT on OpenSea has reached 4.3k ETH, with a floor price of approximately 0.25 ETH and a listing rate of only 1%, reflecting the high user stickiness of The Honey Jar community.

source: https://opensea.io/collection/honey-comb-2

NFT Protocol

Goldilocks

Goldilocks is a comprehensive DeFi + NFTFi platform on Berachain, providing NFT-based lending services to users on Berachain. The distinctive features of Goldilocks NFT lending services are: (1) The floor price of NFT Collections is determined by the governance token LOCKS holders' vote, without relying on oracle price feeds. (2) NFT loans are priced in iBGT, and users can provide BGT to the lending pool and receive the liquidity certificate GiBGT. Users can enjoy lending interest income and also use GiBGT to further participate in other Berachain ecosystems.

Kingdomly

Kingdomly aims to be the native OpenSea of Berachain. For C-end users, Kingdomly provides NFT minting, sales, trading, and leasing services. For B-end users, Kingdomly supports the rapid deployment of NFT Collections and seamless NFT issuance. Kingdomly has partnered with Honeypot Finance to issue the Honeypot Finance Genesis NFT.

Protecc

Protecc is a comprehensive NFTFi platform. Protecc aims to be a one-stop NFT trading market, providing NFT AMM for traders to trade at any time, NFT OTC and bulk trading platforms, supporting whale trading, providing NFT automatic yield strategy vaults to help users earn automatic income, and offering cross-chain NFT trading robots, among other products.

Gumball Protocol

Gumball Protocol is an innovative NFT Launchpad and AMM protocol. In Gumball Protocol, each NFT Collection is backed by corresponding tokens and underlying assets for users to trade NFTs in a timely manner. By combining fragmented NFT assets with underlying assets to form liquidity trading pairs, Gumball Protocol supports users' immediate buying and selling needs for NFT trading.

source: https://www.gumball.fi/collections/arbi/0x794075aef95d9bd7e5cfd0ea8a1e68493b7e0e23/buy

GameFi Ecosystem

BeraTone

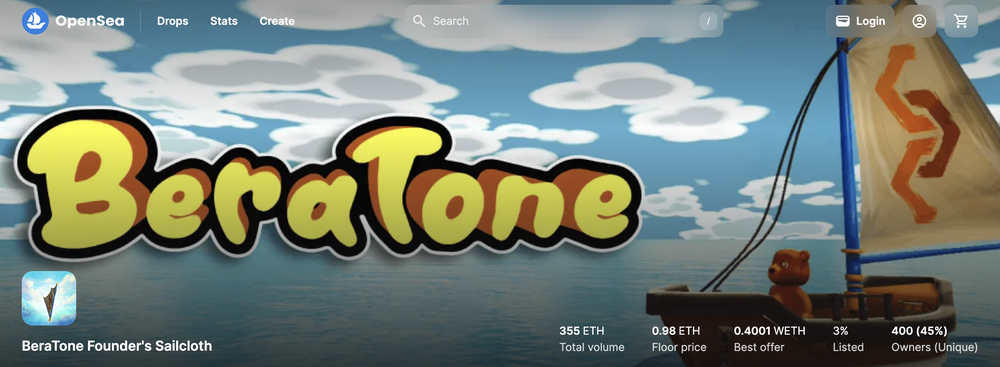

BeraTone is a multiplayer online open-world role-playing game inspired by "Animal Crossing" with farming as its core. Each player has their own piece of land, allowing them to freely customize and expand it. Players can engage in activities such as crop planting, resource collection, animal husbandry, and trading with other farmers. BeraTone is also a continuously evolving virtual world constructed with 3D aesthetics, allowing players to explore the rich virtual world, interact with various characters, complete tasks, level up, solve different game puzzles, and gradually unveil the mystery of BeraTone.

BeraTone also released its Genesis NFT, BeraTone Founder’s Sailcloth, in January 2024, with a minting price of 0.1E. The current floor price is close to 1E, with a total trading volume of 355E and a listing rate of only 3%. Although BeraTone has not been released, the strong performance of its NFT in the secondary market reflects the market's high expectations for BeraTone as a BAB incubation project.

source: https://opensea.io/collection/beratone-founders-sailcloth

Beramonium

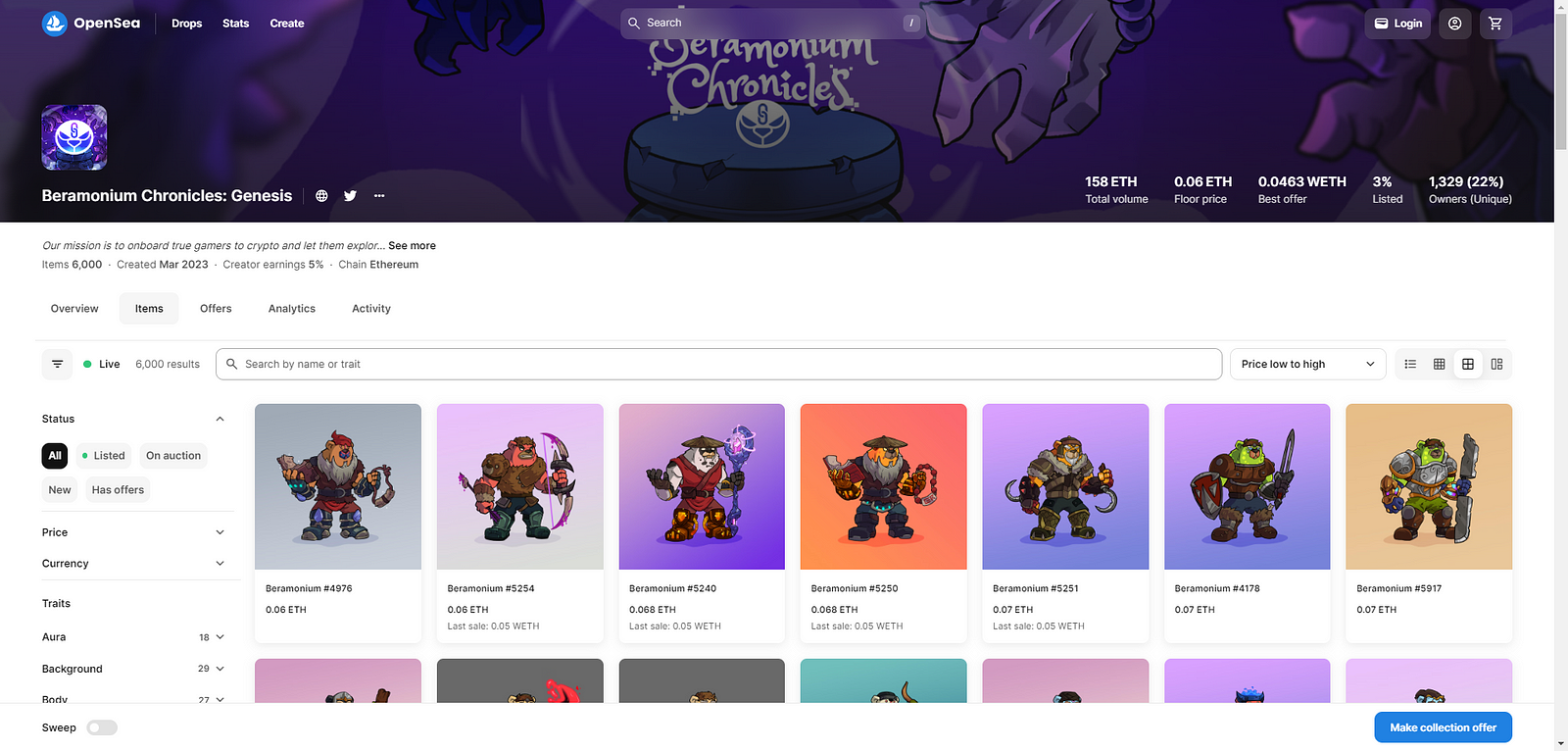

Beramonium is an ARPG blockchain game on Berachain. They have released an action role-playing game called Gemhunters. In this game, players can let their Beramium Genesis beras explore dungeons, challenge bosses, and complete tasks to obtain gems, which can be exchanged for NFTs from other well-known Berachain projects, such as Honey Combs and Beradoges. Currently, the floor price of Beramonium's Genesis character NFT is approximately 0.06 ETH, with a total trading volume of 158 ETH and a listing rate of only 3%. The overall game community is very active.

source: https://opensea.io/collection/beramonium-chronicles-genesis

Meme

BabyBera

BabyBera aims to be an ecosystem on Berachain that combines NFT, Yield Farming, and Meme Coin. BabyBera will be released in three stages: NFT issuance, followed by Yield Farming, and finally the issuance of $BBBERA Meme Coin. All $BBBERA will be distributed as liquidity mining rewards during the Yield Farming phase to ensure that BabyBera users are loyal Degen users with extremely high stickiness, aiming to realize the vision of making $BBBERA the leading Meme Coin on Berachain.

BeraDoge

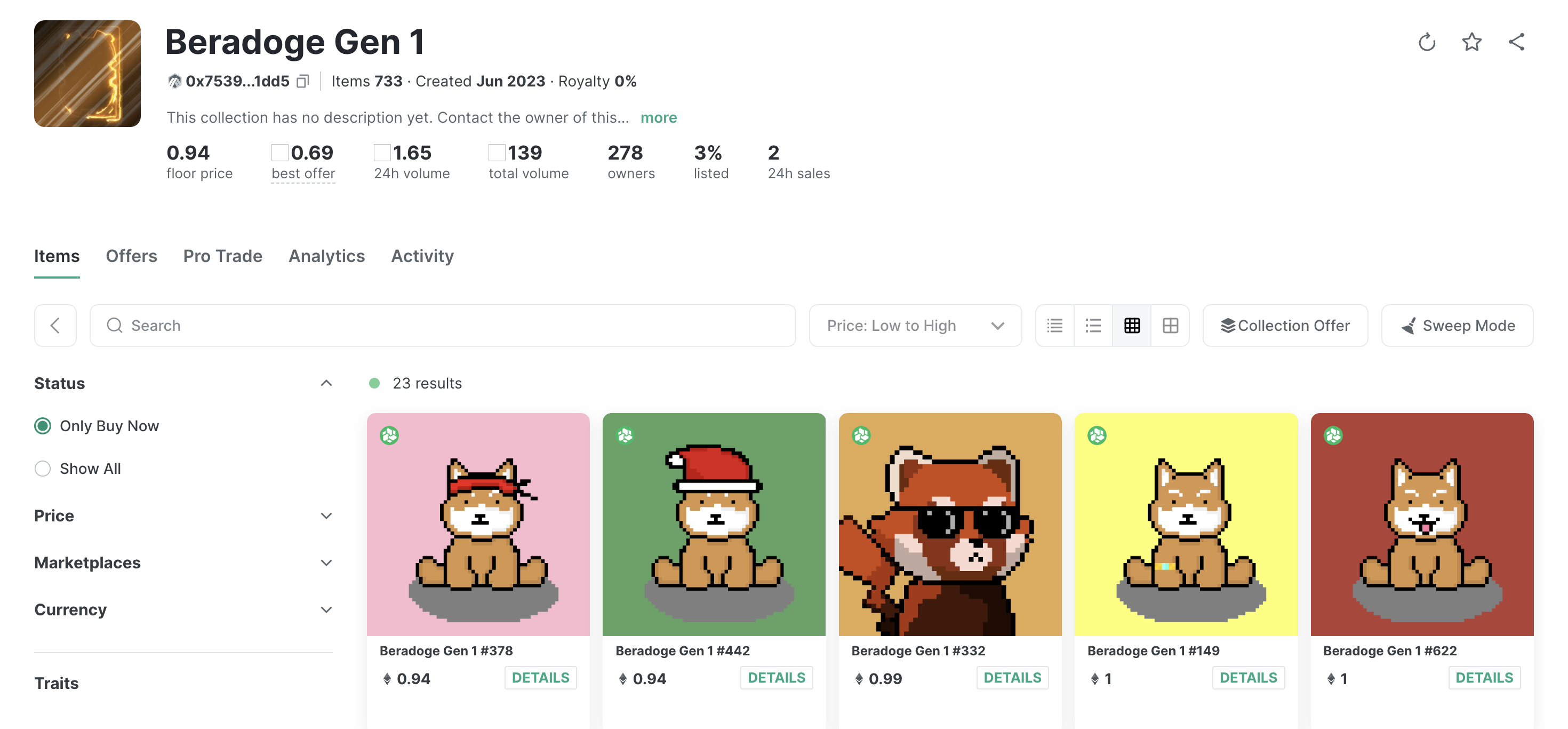

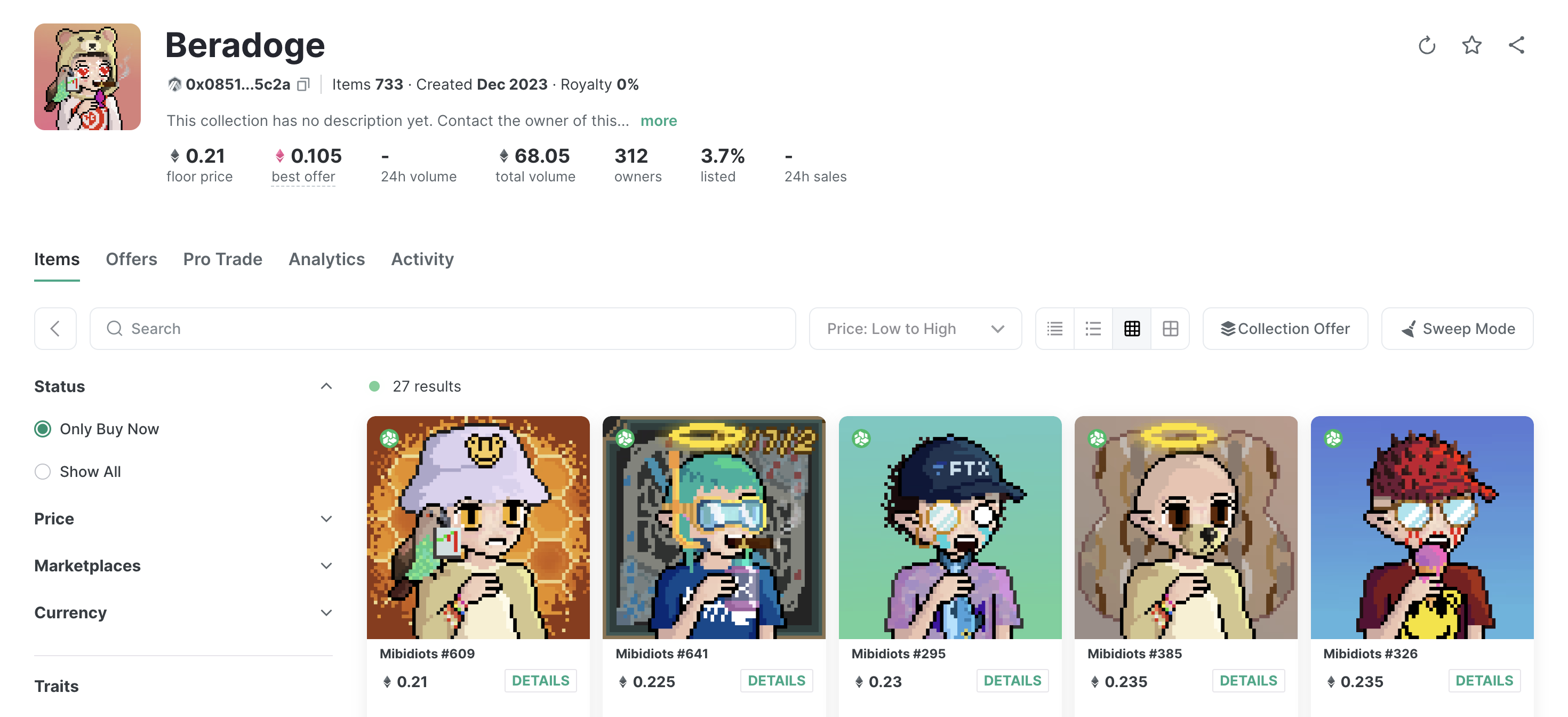

BeraDoge is another major Meme project on Berachain. The project has two NFT collections, Beradoge Gen 1 and Mibidiots. Holding NFTs from these two collections will be promised "a bunch of useless stuff" or "a bunch of useless BDOGE." There are also rumors that BeraDoge will issue its own DeFi platform.

source: https://element.market/collections/beradoge-d51393

Ecosystem Summary

Currently, official components are still one of the most important infrastructure in the Berachain ecosystem. In addition to official components, the DeFi ecosystem on Berachain presents three different development trends:

(1) Supplementing the long-tail market that official components cannot reach; (2) Innovating around the PoL mechanism, BGT, and bribery; (3) Many high-quality DeFi projects are attracted to the Berachain ecosystem by the PoL mechanism.

As of now, in the DeFi ecosystem on Berachain, as the official components have done the most basic but crucial DEX, Lending, and Perps components, there are no longer a large number of homogeneous projects continuing to reinvent the wheel and play vampire attacks. On the contrary, the existence of official components forces DeFi projects to explore actual points of innovation and strive for excellence on the basis of existing business.

At this stage, in terms of project quality, projects incubated by the Build A Bear incubator have relatively higher quality, followed by external high-quality projects introduced by Berachain. The quality of native community projects on Berachain is slightly uneven and slightly inferior.

As mentioned earlier, because Berachain itself has a built-in NFT culture, platforms for NFT issuance and management, as well as liquidity protocols, will be extremely important components of Berachain.

Currently, the game and Meme ecosystems on Berachain are still in the very early stages of development.

Investment Opportunities

Focus on High-Quality DeFi Protocols on Berachain

Berachain's PoL mechanism will generate significant attraction for high-quality DeFi protocols. Additionally, there are fewer vampire attacks on Berachain, allowing leading DeFi protocols to enjoy greater exposure to traffic in their respective sub-sectors, leading to higher TVL, traffic, and user support. More concentrated liquidity will also further improve the protocol's user experience. We expect the network effect to be more pronounced on Berachain, and leading protocols in sub-sectors are likely to receive higher valuation premiums. Therefore, early participation in high-quality leading DeFi projects in sub-sectors is undoubtedly the best choice to enjoy the market premium on Berachain.

Focus on Innovative Infrastructure around Berachain's PoL Mechanism, BGT Mechanism, and Bribery Mechanism

The most significant difference between Berachain and other public chains lies in its innovative PoL mechanism and three-token model. Apart from replicating gameplay found on other public chains, some projects on Berachain will inevitably innovate at the infrastructure level in adapting to the PoL mechanism and the three-token model. The direction of innovation can either emulate Infrared, transforming the less familiar PoL into the more widely known PoS, allowing their liquidity certificate tokens to gain greater market adoption from the start. Alternatively, innovation can start from the BGT mechanism and bribery mechanism, focusing on the delegation, revenue, and bribery rights of users at the token model level, combined with Berachain's bribery mechanism to bring more combinable gameplay. Innovative infrastructure-level innovations around Berachain's PoL mechanism and three-token model are expected to create a moat for the protocol's ecosystem and shape its ecological barrier.

Favor NFTFi Ecosystems that Combine NFTs with DeFi on Berachain

Unlike other public chains, NFTs are also an important part of liquidity on Berachain. How to release liquidity around NFTs and integrate NFT gameplay with DeFi gameplay on Berachain is also one of the themes worth exploring. Although NFTFi protocols on other chains have not made a big impact, NFTFi protocols on Berachain are expected to capture sufficient liquidity and have a greater chance of development. The revenue strategies and revenue treasury derived from NFTFi protocols can also be combined with mechanisms such as node bribery, making NFTFi protocols more flexible.

Favor L2 Solutions and Related Infrastructure Based on Berachain

The popularity of the Berachain testnet to a certain extent reflects the market's strong expectations for Berachain. With the launch of the Berachain mainnet, supported by the PoL mechanism, Berachain is expected to replicate the prosperity of Ethereum's DeFi Summer. Although Berachain is positioned as a high-performance L1 public chain, it also has scalability needs in the face of massive traffic and high-frequency on-chain interactions. Once Berachain starts its positive feedback loop, the rise in BGT prices will also drive up Berachain's interaction gas fees. Therefore, Berachain also needs to reduce costs and increase efficiency. In conclusion, we expect that some of the super DeFi applications on Berachain and applications with high-frequency interaction needs, such as GameFi and SocialFi, will develop their own L2 solutions based on Berachain for scalability. Based on this logic, we will continue to favor and focus on the L2 solutions and related infrastructure ecosystem based on Berachain.

Summary

Liquidity has always been the most important topic in the crypto space. All tokens, grants, and points ultimately exist to compete for users and liquidity. Without liquidity as a foundation, even the most complete ecosystems and infrastructure are just castles in the air.

Berachain is poised to break the liquidity dilemma of public chains, siphoning liquidity from other public chains and becoming the hub of liquidity for the EVM and Cosmos ecosystems through its innovative PoL consensus mechanism and three-token model. Solidified liquidity will not only provide financial support to Berachain but also bring in more developers, users, and market attention. Berachain is expected to become the new infrastructure that carries massive crypto liquidity, making liquidity, maker DeFi great again!

Reference

Welcome to Polaris Ethereum – Polaris Ethereum Docs (berachain.dev)

Berachain — The Convergence of a Strong Community and Experimental Endeavors | DeSpread Reports

Berachain - Innovating the Approach to L1 Building | blocmates.

Berachain: Building Sticky Liquidity - by Pavel Paramonov (shoal.gg)

https://twitter.com/berachain/status/1749522523895570700?ref=research.despread.io

https://twitter.com/burstingbagel/status/1565705660888596481

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。