Title: 《But They Won’t Trap Me》

Author: MATTI

Translation: Deep Tide TechFlow

In hindsight, things may seem inevitable. Sometimes, the difference between inevitability and impossibility is very small, perhaps just a few weeks of price action. I want to explore this difference from the perspective of hindsight.

The forces of interaction between two stocks have formed a bull market in cryptocurrency. Resources (capital) flow from top to bottom, and products (creativity) flow from bottom to top. Combining capital with the right ideas will trigger innovation, or at least trigger imagination. At this point, exploration will turn into development.

I will share personal anecdotes from the past few years, and then discuss the differences between the exploration and development stages of the cycle. As a conclusion, I will summarize possible future scenarios and make personal comments.

Resources

In the field of cryptocurrency, we have experienced a rapid transition from extreme fear to extreme indifference and then to a high-expectation environment. All of this was completed in about 12 months. It can be said that the collective always lacks foresight, but the momentum of the group hinders individual decision-making.

After the extreme panic at the end of 2022, most investors were unwilling to invest capital, and some had completely given up on cryptocurrency. During the extreme indifference period in the summer of 2023, many people were unwilling to invest capital due to considerations of capital constraints, and the macroeconomic momentum painted a bleak outlook.

With the market rising at the end of 2023, driven by the tone of ETFs and top-down narratives such as Solana, the market soared. When talking to many peer investors in 2023, almost no one expressed optimism. Among those with resources, few actually deployed them.

In the field of cryptocurrency, whether in terms of liquidity or venture capital, many investors were caught off guard by the sudden bullish market, at least expecting another six months of winter. The prospect of a golden bull market almost happened overnight, and investors suddenly felt confused.

Those with liquidity are rushing to buy the tokens they should have bought a year ago, and those venture capitalists with resources are chasing the hottest stories—mainly L2 and artificial intelligence projects. We can judge by observing the following aspects:

Oversubscription

Limited to KOL/angel rounds

Intense price competition

Shares are quickly sold out

Those who felt over-allocated in December 2022 felt under-allocated in March 2024. The inflow of capital into liquidity funds accelerated at the end of 2023, followed by more capital demands from venture capital funds (a few still have disposable resources).

Based on my personal experience of raising venture capital cryptocurrency funds from mid-2023 to the present, it is almost impossible to find positively allocated LPs. In terms of mother funds (FoF), most funds are struggling to raise funds and delay capital deployment every quarter, while a few funds with resources have chosen larger companies.

In the summer of 2023, one of the partners of a large FoF expressed concern about writing a $500,000 check for each. Another FoF revealed in private conversations that they had communicated with about 100 cryptocurrency venture capital funds that raised funds in 2023 (I can't even say that many), but did not allocate to any of them. This is not just a phenomenon in cryptocurrency, as overall venture capital has dried up in various fields.

However, for cryptocurrency, in addition to the overall macro collapse, there is an additional micro crisis—FTX. Shortly before the collapse of FTX, I had a conversation with a US FoF, who said they had committed tens of millions of dollars to cryptocurrency managers, but the FoF itself would not be able to start financing until the end of 2022. I haven't heard that they have actually successfully financed. When cryptocurrency funds arrived, many LPs found themselves unable to fulfill their capital commitments.

The situation with FTX also delayed the entry of new capital into the cryptocurrency field, and many small and large family offices and funds eager to invest in cryptocurrency lost interest. Few investors are truly able to think independently, which is why we have both fanaticism and disillusionment.

However, compared to the situation of the cryptocurrency winter in 2018 and 2022/23, the confidence of traditional finance in cryptocurrency has greatly increased. In fact, before FTX, I talked to almost everyone in the traditional financial world, those who had not ventured into or marginally ventured into cryptocurrency all believed that cryptocurrency would stay. This was definitely not the case in 2018.

In conclusion, from my limited personal experience, venture capitalists and liquidity allocators have been marginalized by the rapid change in emotions. This means that a funnel has been created around existing narratives, and the market is accelerating.

The catalyst for the bull market is the flow of funds into ETFs and liquid cryptocurrency funds, repricing the secondary market (which is already happening). In terms of the primary market, I expect resources to flow into cryptocurrency venture capital to increase in the second half of 2024, but mainly in 2025, thus driving the already competitive primary market.

Ideas

Due to the collapse of Luna and the plunge of FTX, the bear market quickly turned into a purge, with sellers quickly selling off, and those still in the game still feeling shocked. If they were to allocate assets, they would feel uneasy. The influx of founders has decreased, as many have turned their attention to the AI boom.

The narrative reset came quickly. The disillusionment period of cryptocurrency helped explore new ideas, select the best ideas, in order to be developed when the narrative turns to fanaticism. The exploration stage laid the foundation for the subsequent imitation race. Exploration is the search for the legendary "innovation trigger."

Throughout 2023, trading flows were most diverse, as there was no particularly strong narrative. There were some clusters, such as intent, ZK, rollup/L2, ordinals, and others, mainly in infrastructure.

Founders were actually forced to think for a while before exciting venture capitalists. At this point, both founders and investors are eager to explore. This is when cryptocurrency is at its most creative. The marginal improvement effect on popular things is not great, because there were not enough popular things during the bear market, and the excitement about things does not last long in the bear market.

With the market soaring at the end of 2023, the search for "innovation triggers" ended—the cards had been played. I believe that the "Overton Window" of this bull market has opened. However, this does not mean that the best-performing companies have emerged and are ready for investment.

(Editor's note: The Overton Window is a theory that describes the range of policies that most people can accept politically within a certain period of time.)

Uniswap may have been one of the most replicated products in the previous cycle, but the second most replicated product, the pioneer of DeFi 2.0, OlympusDAO, only appeared a few months after the DeFi summer. There is still room for innovation, but it must be done by leveraging existing narratives.

The most potential narratives we see today are:

Cryptocurrency AI/agents

Re-staking

Second layer

ZK

Infrastructure

DeSci

SocialFi/Web3 social

The above are fairly uncertain categories, more like tools for identifying the content people are building. Many products may be a combination of the above two or more categories. The winners will be those who master the traditional tools of user acquisition: yield and leverage. "Digital rise" is always the best user experience.

Exploration and Exploitation

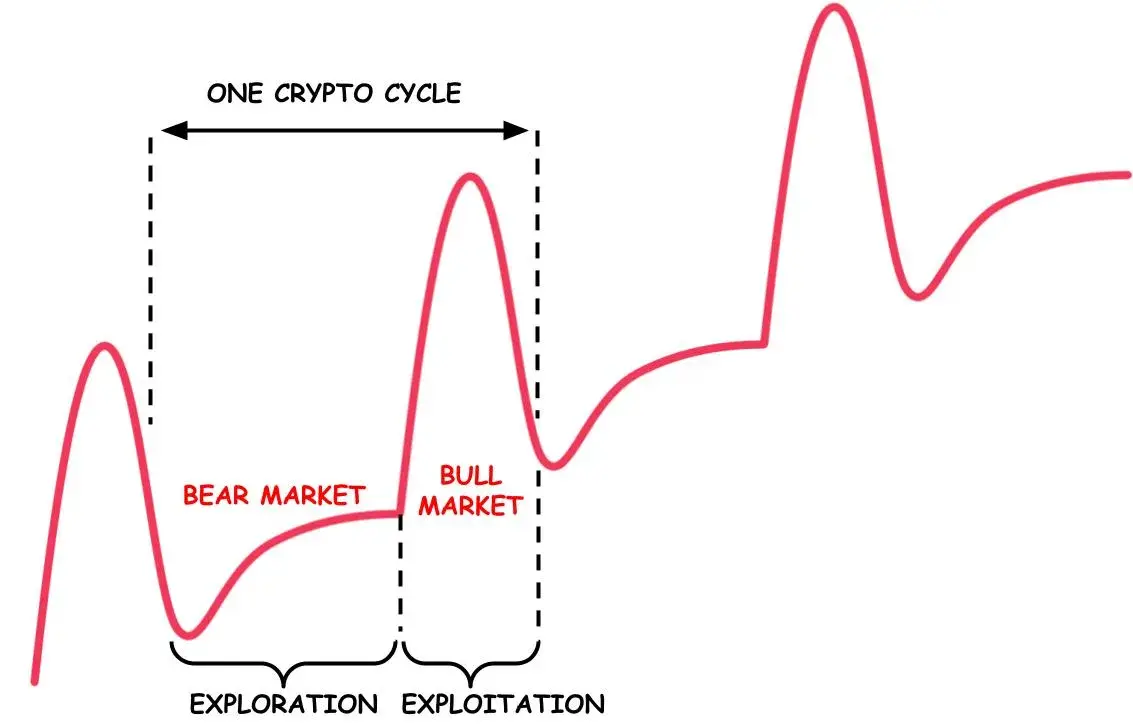

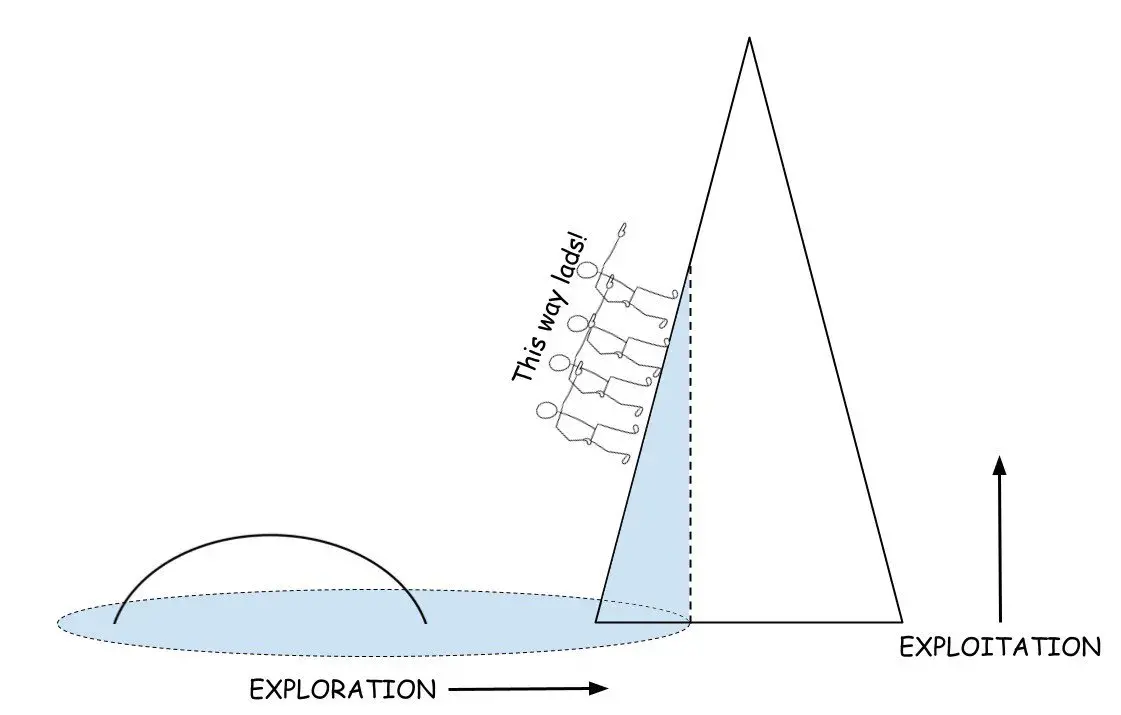

Let's briefly discuss the game theory of exploration/exploitation. The cryptocurrency cycle has two behaviors. One is that people are forced to come up with seemingly new things, and the other is that people exploit these new things through exaggerated narratives.

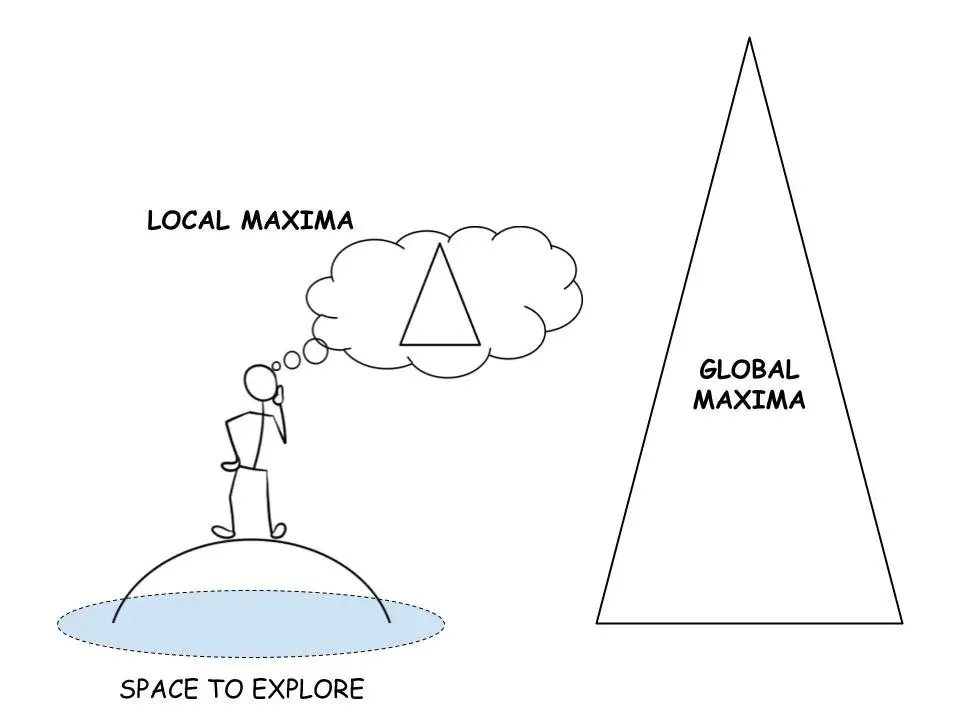

In the bear market, we are stuck in a local maximum. As the old narratives have collapsed and cannot further support the market, founders are forced to explore, and investors are unwilling to follow. The "innovation trigger" is the foothills of the new global maximum. This becomes the goal of exploration, around which new narratives can be constructed.

As previous ideas hit a dead end, founders are back to square one, expanding the space for exploration. As prices continue to fall or stagnate, the motivation to abandon the security of old narratives and explore larger potential novelty areas grows.

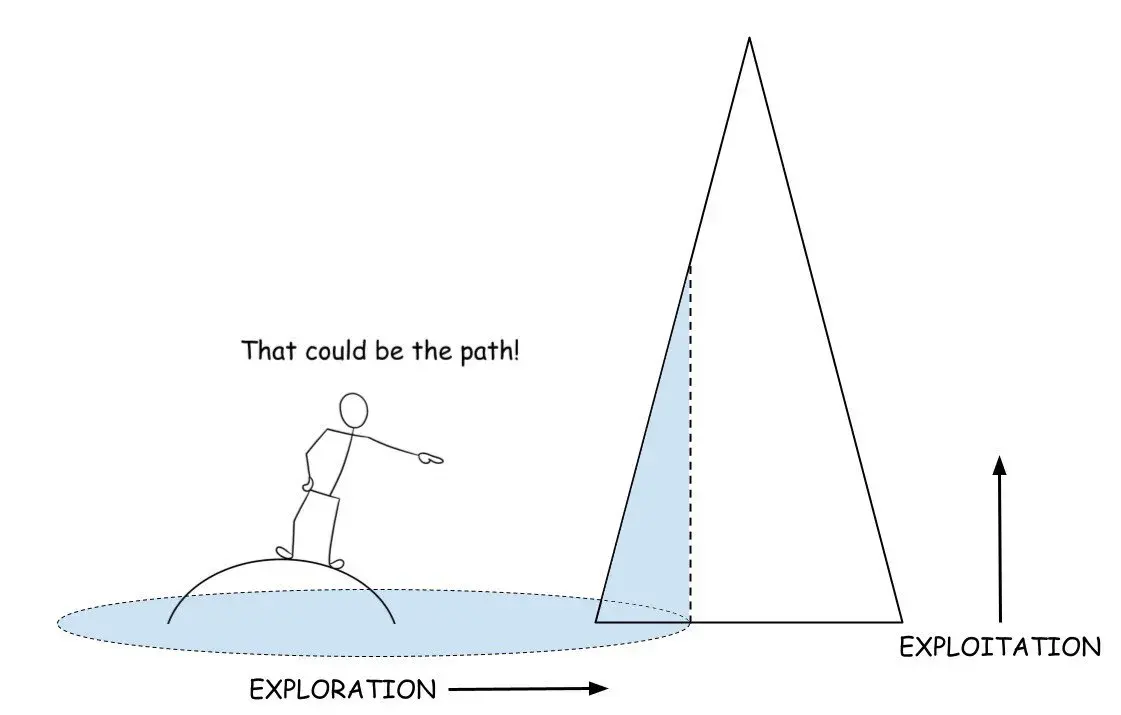

At some point, explorers set their sights on the foothills that could become the new global maximum. Typically, the formation of foothills is a function of novelty and price recovery. Although this may be more of a correlation than a causation—it is enough to start climbing and form an overall narrative.

The ascent signals the end of the exploration stage, and we have established a base camp and begun to exploit the market's momentum. At this point, the reflexive relationship between novelty and price behavior begins to push the global maximum higher. Price becomes the leading indicator of adoption.

As of March 2024, it seems that we have found the foothills, and everyone is scrambling to climb the new peaks because it seems to offer better returns than further exploration.

What's Next?

The exploration stage has ended, and considering that most investors are passive, they will not waste time exploring, but will double down because they have to make up for what they have lost. Each round of financing is starting to be oversubscribed, indicating that investors are in full exploitation mode.

2024 is similar to 2020 and 2016, mostly a year of internal speculation. The active retail base in cryptocurrency is higher than in 2020, which means we are starting from a higher starting point. Although there has been little innovation in the past two years, we are now leveraging resources.

Developers focus on resources, while explorers focus on ideas. There is a subtle difference between being an investor and "engaging in investment" (investor vs allocator).

Development strategies are also a function of scale. Most funds with abundant resources only engage in development, as innovation or exploration does not require as much capital as competing on the development axis. There is much more dumb money than outsiders believe and insiders admit.

Considering that during any frenzy, a large amount of capital is looking for scarce talent, many will compromise to achieve their deployment goals. Or as Hobart and Huber put it: "While talent is scarce, the demand for dupes is always met through a great deal of fraud." Expectations are exaggerated, founders are incentivized to get involved in a resource war, subsidizing the returns of exotic species.

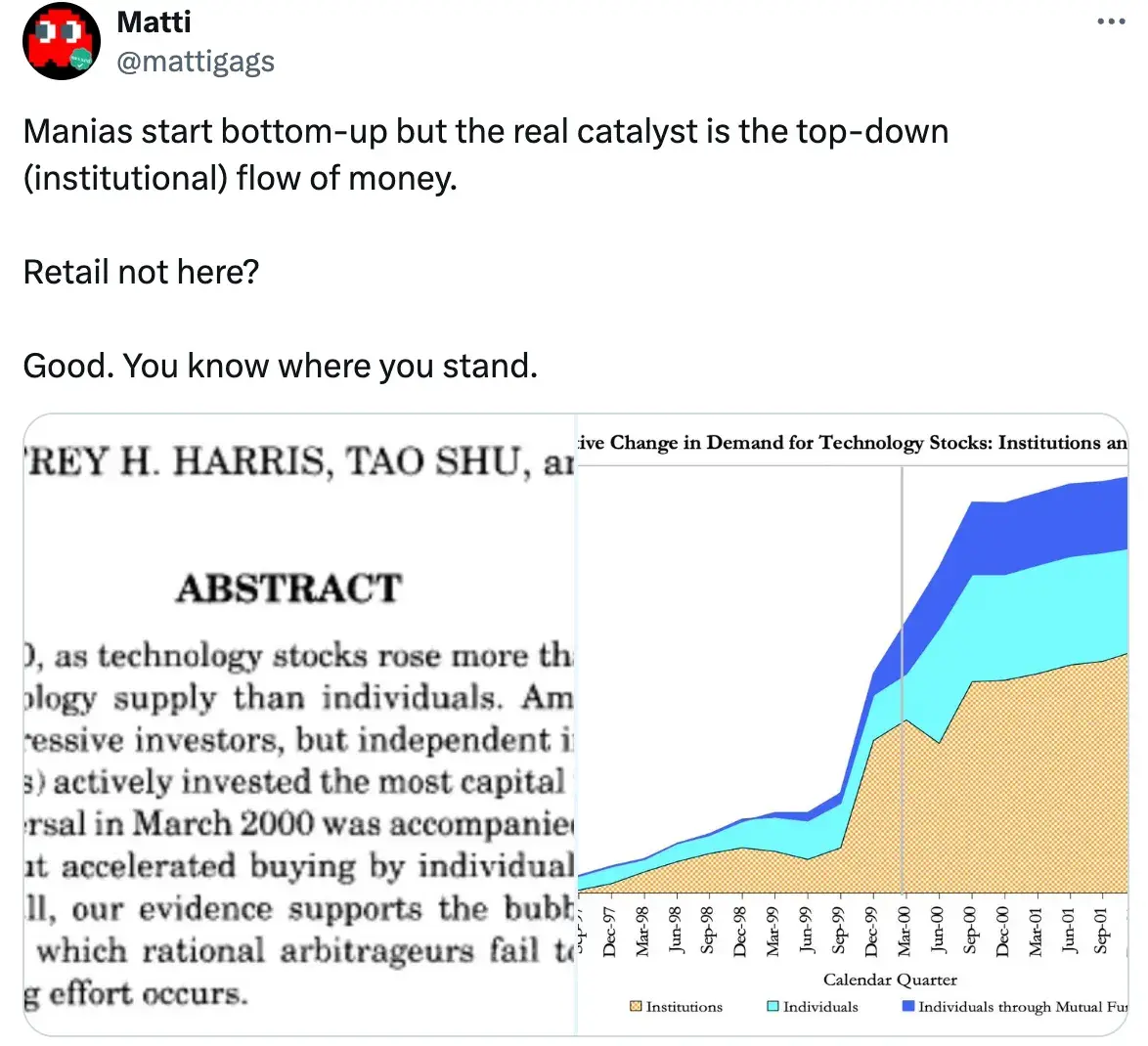

As the VC financing machine has started to operate, the top-down flow of capital will gradually increase. Early internal rounds of competition mean that insiders and institutional funds will support the market before a large influx of retail. In addition, the retail industry is not a homogeneous group, but a wave of adoption within a cycle.

Those who were most afraid are turning into fearless bulls. But this is just the other side of insecurity. Remember, insecurity is the mother of greed, and there is a lot of insecurity in the market today.

The fact is, there has not been much innovation in cryptocurrency in the past two years, so it is difficult to see this bull market as an independent phenomenon from the previous one. Thematically, it seems to be a continuation of the previous cycle, but on a larger scale, as yield arbitrage becomes more profitable, and with the opening of ETFs, the doors of institutions have also opened.

For an out-of-control frenzy, the trigger of imagination is more effective than the trigger of innovation. Reflexivity is once again unleashed, and most people in the space are supporting kayfabe. The role of credit has not yet been fully realized in this cycle.

A few months ago, I wrote in an investor letter:

Each cryptocurrency cycle often ends in destruction due to the excess of its fundamental principles. 2017 was destroyed by the excessive frenzy of ICOs, and 2021 was destroyed by the excessive leverage of the DeFi narrative; the fundamental principle of each frenzy is the imitative competition for immediate wealth.

This rise began with the top-down flow of institutional capital. There are no truly shining new things. The foundation of the potential upcoming frenzy is the inflow of institutional funds (and credit?) and the price trend itself. Will this cycle be destroyed by the overexposure of institutions? Let's wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。