Author: Xiao Sa Team

In a recent article, the team led by Sa Jie has already introduced the background and consequences of the sentencing of Sam Bankman-Fried (referred to as SBF), the actual controller of FTX, for 25 years (interested partners can refer to "Xiao Sa Team | Breaking News! FTX's First Criminal Sentenced to 25 Years, the End of an Era"). With the "first criminal" being convicted and punished, the case has temporarily come to a close. For the vast majority of ordinary passersby, investors, and creditors, SBF's heavy sentence is more about "relief" and "spectating," while the most important matter concerning their own interests is how the FTX bankruptcy liquidation case will proceed, which will determine whether our claims can be effectively settled.

In addition, as the largest bankruptcy liquidation case in the world today and the first global bankruptcy liquidation case involving cryptocurrency assets, every move in this case will be closely watched by investors from various countries around the world. The handling of the bankruptcy of a giant multinational cryptocurrency enterprise will also become a landmark precedent of significant reference value for the global legal practice, influencing judicial practice for a long time to come.

After the FTX case occurred, Sa Jie's team has continuously received inquiries from Chinese creditors seeking legal advice. Since 2022, the case has undergone multiple claims, but due to significant controversies in the actual execution of the liquidation plan and the failure to complete the liquidation of FTX's bankruptcy assets in a short period of time, the path to creditors' settlement is long and distant. Now, the FTX liquidation entity and claims portal have been established and opened, and the settlement of creditors is about to begin. Today, Sa Jie's team has specially prepared this "FTX Claims Filing Guide" for everyone, to provide additional assistance on the road to safeguarding their rights.

Background and Overview of the FTX Case and Liquidation Team

For those unfamiliar with the FTX case, Sa Jie's team will first provide a brief introduction to the FTX case.

Before its bankruptcy, FTX, established in 2019, was a world-class top cryptocurrency exchange that could compete with the famous Binance. Its headquarters were located in the backyard of the United States, the Commonwealth of The Bahamas, with its main business concentrated in the United States. FTX was of significant scale, with hundreds of large affiliated companies and millions of customers worldwide. After completing Series C financing in 2022 (led by Sequoia, Temasek, SoftBank, Tiger, and others), its valuation had reached an astonishing $32 billion.

The collapse of FTX was rapid and irretrievable, fully embodying the "one day in the cryptocurrency world, one year in the human world" theorem. Initially, the well-known cryptocurrency media Coindesk released a report at the end of 2022, revealing that SBF controlled as much as 70% of the assets in Alameda Research, which were actually poorly liquid FTT tokens issued by FTX itself. Subsequently, Binance publicly announced the liquidation of a large amount of FTT tokens held, which caused market panic in the already depressed cryptocurrency industry. With everyone selling FTT, FTX could not continue, entering a death spiral.

After the collapse of FTX and its entry into bankruptcy proceedings, due to its registered office FTX Digital being in The Bahamas, while its main business was conducted in the United States through its subsidiary FTX Trading Ltd., FTX held a certain amount of bankruptcy assets in both of these jurisdictions. Therefore, on November 14, 2022, the Supreme Court of The Bahamas appointed PricewaterhouseCoopers' Bahamas office and two individuals in Hong Kong as the joint provisional liquidators to initiate the liquidation proceedings of FTX Digital in The Bahamas. Subsequently, the Delaware court in the United States placed FTX Trading Limited and its affiliated debtors (collectively referred to as the "Debtors") under bankruptcy proceedings in accordance with Chapter 11 of the U.S. Bankruptcy Code, and on February 15, 2023, recognized the provisional liquidation in The Bahamas through judicial procedures.

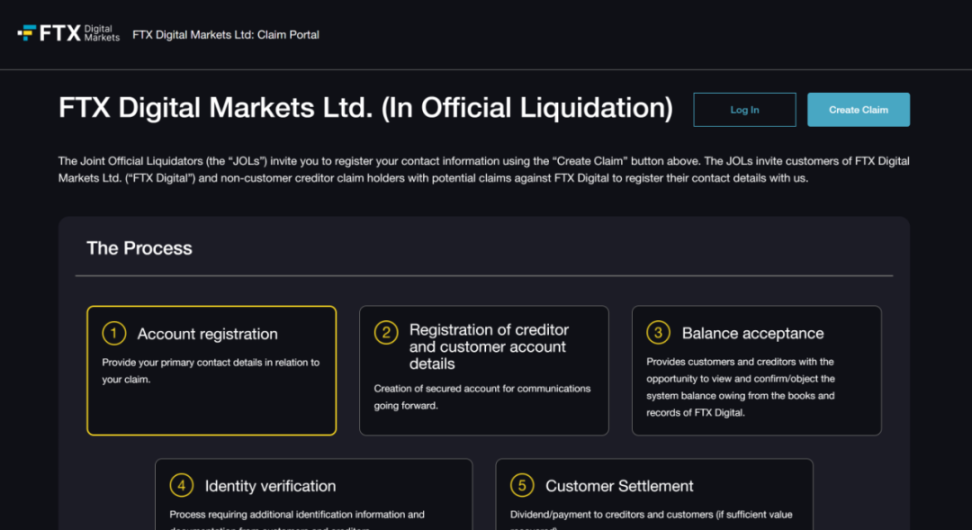

At the end of 2023, the Supreme Court of The Bahamas appointed the joint official liquidators (JOL) as the joint official liquidators for FTX Digital and its affiliated companies, using the legal entity "FTX Digital Markets Ltd" to liquidate FTX's assets and compensate creditors (this liquidation process is carried out in accordance with the provisions of the domestic law of The Bahamas on the liquidation of international business companies).

Currently, JOL has established a dedicated FTX claims filing website, where both customer and non-customer claims can be submitted, and the filing work needs to be completed by May 15, 2024.

FTX Claims Filing Guide

1. Access the FTX Claims Filing and Claims Portal and register your claim account

First, creditors need to access the FTX Claims Filing and Claims Portal website: https://digitalmarketsclaim.pwc.com/

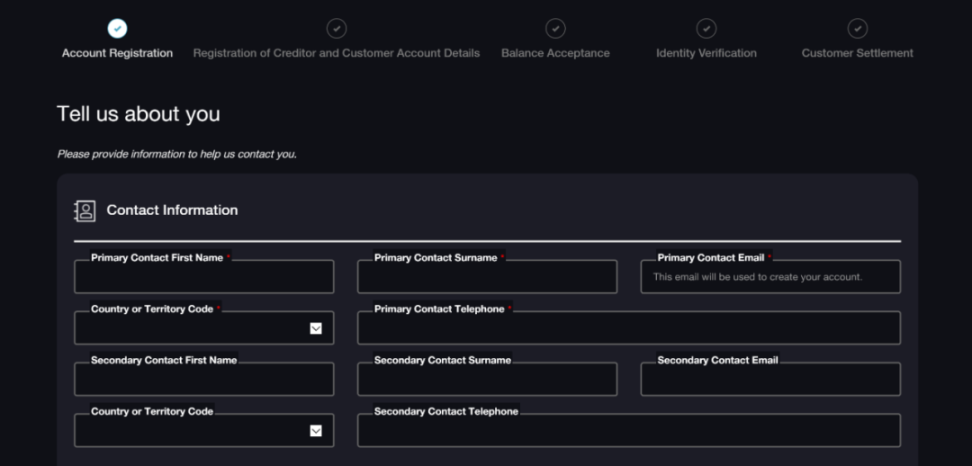

For first-time users, click on the blue box in the upper right corner to register a claim account. You will need to provide your name, email, country and region, and contact information. It is important to use a reliable email for registration, as a verification code will be sent to this email every time you log in. Any issues with the email may result in difficulties in logging in.

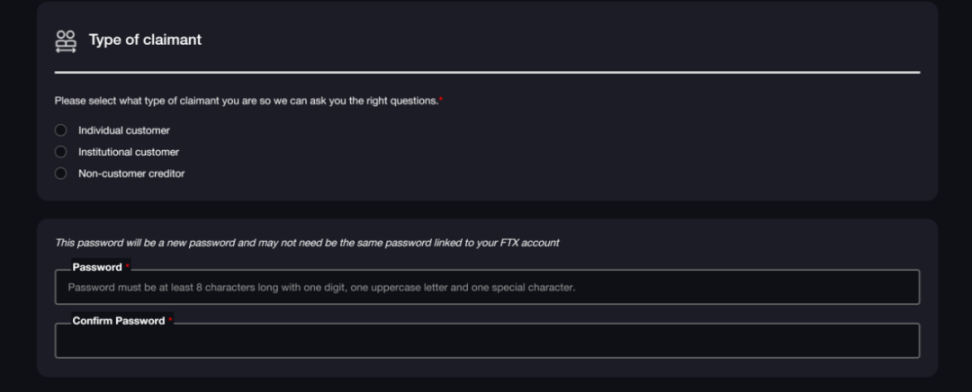

In addition, users need to correctly select the type of claimant, with three options: "Individual customer," "Institutional customer," and "Non-customer creditor." If you are a user of the FTX exchange and have registered and used the FTX platform for cryptocurrency asset trading in your own name, select "Individual customer." If you have registered an account with a legal entity, such as a company, select "Institutional customer." If you have not been a customer of FTX and have not used the FTX platform, but have a creditor-debtor relationship with FTX or its affiliated companies for other reasons (such as employees hired by FTX, suppliers providing products to FTX, etc.), select "Non-customer creditor."

The registration process on this website is relatively lenient, and even when selecting "Institutional customer" or "Non-customer creditor," the registration process does not require the registrant to provide relevant documents such as proof of identity for authorized representatives.

2. Registration of detailed information for creditors and customer accounts

In this section, it is important to note the type of claim you have. If you are an individual or institutional customer as mentioned earlier, you can directly submit your account registration information on the application page of this website (for natural persons, you will need to provide your name, date of birth, phone number, address, country or region of residence, occupation, nationality, ID number, etc.). This will allow you to associate your claim account with your FTX account, and after association, you can also view your account status.

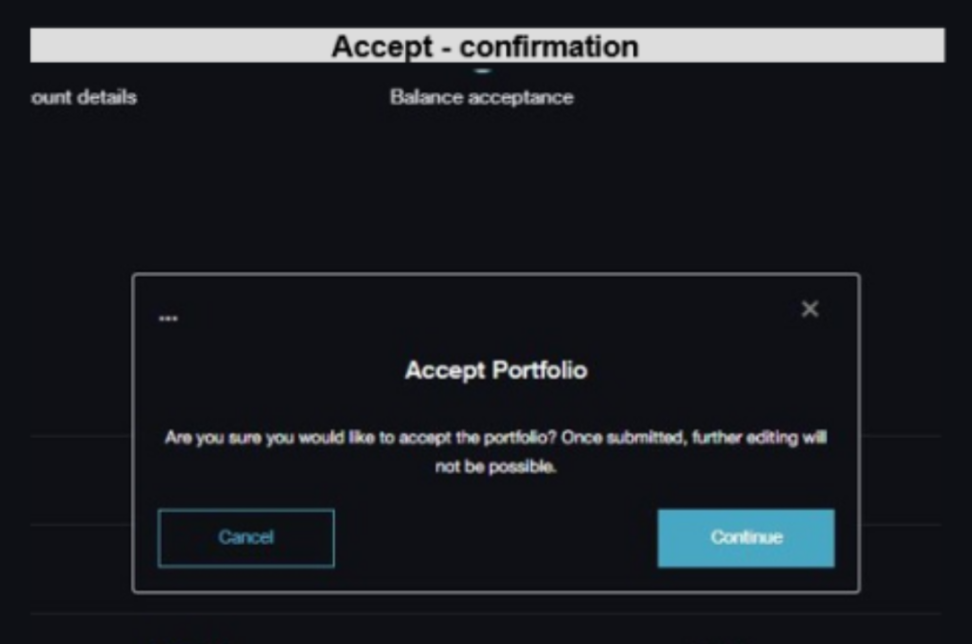

After completing the account association, the website will redirect to the creditor balance confirmation page. It is crucial to carefully check and verify whether the balance and assets displayed on this page are consistent with the assets in your FTX account. If they are consistent, you can click the blue button to confirm, and these assets will become the claims you submit for the claims process.

If there are objections to the assets associated with your FTX account, you will need to further provide materials to JOL through the Dispute Portfolio dispute process to file a claim for your own debt. In this part of the process, the Sa Jie team recommends consulting professionals to prepare materials that meet the requirements for filing a dispute claim, especially for non-customer creditors, who need to submit qualified debt evidence and proof of debt to file a claim. This part of the work is more professional and requires judgment from professionals familiar with Chinese, American, and Bahamian bankruptcy laws.

In addition, for the assigned FTX bankruptcy claims, complete proof of assignment is required to file a claim. For example, if Sa Jie's team members purchased someone else's FTX bankruptcy claim on Xclaim, they need to submit specific evidence of the right to the assigned claim to file the claim. If there are guarantees on the claims being filed, the related guarantee evidence should also be submitted as part of the claim materials to prevent the guarantees from becoming invalid due to failure to file in a timely manner.

Finally, after submitting the above materials, a normal KYC procedure (a verification process based on anti-money laundering compliance requirements) will complete the filing of the claim for the partners.

Do I need to file again if I have already filed for bankruptcy claims on KROLL?

As mentioned earlier, the bankruptcy case of FTX Trading Ltd. in the United States has been accepted by the Delaware court, and the well-known bankruptcy management company KROLL is responsible for registering the bankruptcy claims. Due to the faster pace of actions in the United States, many investors who suffered losses in the FTX case have already filed for bankruptcy claims on KROLL. So, do partners who have already filed need to file again in The Bahamas?

First, we need to understand the legal consequences of filing on both platforms: if a bankruptcy claim has already been filed on KROLL, filing again on the designated FTX bankruptcy claims portal in The Bahamas will automatically result in two legal consequences:

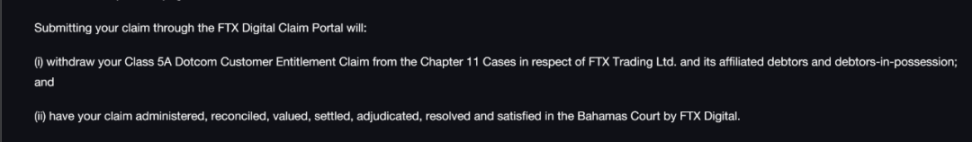

It will be considered as withdrawing the creditor's bankruptcy claim and claim against FTX Trading Ltd. and its affiliated companies and debtors under the U.S. Bankruptcy Code.

The bankruptcy claims will be transferred to the jurisdiction of the Bahamian court, and the claims and requests for settlement of the creditors will be governed, verified, valued, settled, adjudicated, resolved, and paid in accordance with Bahamian law.

Secondly, we need to understand that in the FTX bankruptcy case, the United States and The Bahamas have reached a preliminary consensus on the liquidation of the bankruptcy estate: after the completion of the liquidation, it will be treated as a single property for distribution. Therefore, the release of the FTX Digital-based bankruptcy claims in The Bahamas actually gives creditors the freedom to choose the jurisdiction and use of the law, but it will not result in substantial unfairness in the process of repayment for creditors in The Bahamas or the United States.

This choice will not increase or decrease the liquidation property, but such legal application and the choice of judicial authorities will more affect whether the bankruptcy claims of FTX-related creditors will be recognized, the size of the recognition ratio, the filing of objections, and rulings, which also concern the vital interests of the creditors. Therefore, the Sa Jie team recommends that partners consult a professional legal team before making a choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。