Author: Biteye, Core Contributor Dobby

*The full text is about 4500 words, with an estimated reading time of 6 minutes

BOME and SLERF have ended their crazy surge, and the market has once again experienced and witnessed another round of "gold rush" for wealth. Although the heat of MEME has not completely subsided, the market has temporarily regained some calm.

In addition to marveling at the gains and returns of "one day in the currency circle, one year in traditional finance," many "old leeks" are discussing a question: "Why did MEME coins exert their strength so early in this cycle?" Judging from the rotation of sectors in the past few cycles, when the heat of a new concept and narrative reaches its peak, accompanied by the relay of MEME coins, the flowers wither, marking the prelude to the end of the bull market. However, in this cycle, the order of sector rotation seems to have been rearranged, and MEME coins did not follow the routine, becoming the main theme in the middle of this cycle.

In the theory of "value investment," MEME coins and Dogecoin have always been marginalized, even in the bubble-filled currency circle. In fact, many people do not understand what MEME is, let alone the difference between MEME coins and Dogecoin.

From DogeCoin's dog pattern to today's inscriptions, MEME has become a unique cultural symbol and means of communication in the currency circle. So, how did these seemingly ridiculous and even absurd cultural elements gain such a significant position in the crypto world? This article will explore the relationship between MEME and blockchain, as well as its impact on cryptocurrency culture.

01 MEME is Genetic

1.1 The Origin of the MEME Concept

Whenever the birth and origin of MEME are mentioned, Richard Dawkins is definitely an unavoidable figure.

In 1976, Richard Dawkins first proposed the concept of MEME in his groundbreaking work "The Selfish Gene." In the final chapter of "The Selfish Gene," Richard Dawkins introduced the concept of "MEME," defining it as a unit of cultural transmission, similar to genes in biological inheritance. MEMEs can be melodies, ideas, fashion styles, language habits, technologies, or any other cultural phenomena that spread through imitation from one person to another, thus replicating themselves in human culture. The success and survival of MEMEs, like genes, depend on their precision of replication, persistence, and their "attractiveness" or utility to the host.

In simpler terms, MEMEs can be a meme, a joke, an emoji, and so on, forming a subculture after widespread dissemination. MEME coins are a way of valorizing this subcultural value.

With the rise of the Internet and social media, MEME has become an important part of global cultural exchange, spreading rapidly and widely beyond Richard Dawkins' original intention. Today, with its humor and irony, MEME not only rapidly disseminates entertainment and information but also plays an important role in shaping public opinion and cultural phenomena, especially in the field of cryptocurrency and blockchain technology, where the influence of MEME is particularly significant.

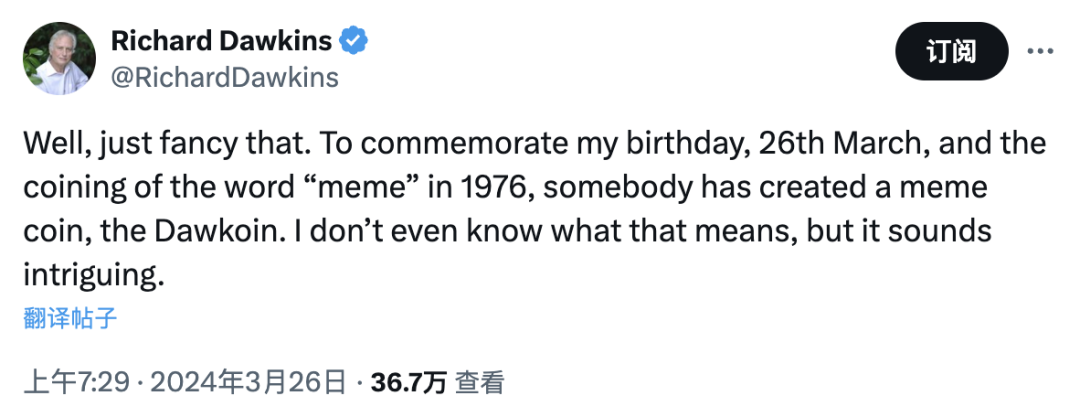

It is worth mentioning that to commemorate Dawkin's birthday on March 26, the community specially launched a MEME coin called "Dawkoin." Dawkin shared this news on social media without showing resistance or displeasure.

1.2 Is Bitcoin the Earliest MEME?

"In a sense, all cryptocurrencies have MEME content, but the content varies, with over 50% being the norm," according to the recent opinion of the earliest batch of media Blue Fox Notes in the blockchain industry. On a scale of 0-100, MEME content represented by pepe and doge is over 99.9%; AI has 90% MEME content; BTC L2 has 80% MEME content; and DeFi has 30-50% MEME content.

So, can Bitcoin also be considered the earliest MEME?

We all know that in January 2009, Satoshi Nakamoto invented the Bitcoin system on a small server in Helsinki, Finland, and mined the first block, also known as the "genesis block," which marked the debut of the initial 50 bitcoins. Technically, Bitcoin is the key to opening the door to blockchain, relying on technologies that have matured over nearly half a century, such as cryptography, distributed storage, and consensus mechanisms.

However, when people mention Bitcoin today, they will not only discuss its technical algorithms. As the first successful cryptocurrency, Bitcoin's philosophical implications, its anonymous creator Satoshi Nakamoto, and its spirit of challenging the traditional financial system have endowed it with a meaning beyond technology.

So, from this perspective, Bitcoin itself is the earliest MEME, representing the pursuit of power, freedom, and systemic change. This symbolic significance transcends its function as a currency, becoming a symbol of culture and social movement.

Some also say that MEME coins are part of the "attention economy," and the better the MEME coin can attract attention, the better the MEME. After 15 years of development, following its historic high breaking $71,000, Bitcoin's market value has soared to $1.398 trillion, surpassing silver ($1.379 trillion) and ranking as the eighth largest asset globally. Bitcoin's share of the total cryptocurrency market value has reached 49.8%, firmly establishing its dominant position in the crypto industry.

With the approval of Bitcoin ETFs and the rise of the Bitcoin ecosystem earlier this year, more and more traders and investors are "returning to basics," refocusing attention and liquidity on the Bitcoin ecosystem.

Bitcoin is the most attention-grabbing token in the crypto industry. From this perspective, isn't Bitcoin also a MEME?

1.3 Inscriptions and NFTs: Derivatives of MEME

Since MEME can be seen as a manifestation of genes, MEME will definitely undergo differentiation. This can also be found in the theoretical basis of MEME's origin in Richard Dawkins' "The Selfish Gene": the similarity in the transmission and evolution mechanisms of MEME and genes, both being transmitted through the replication process, experiencing selection pressure, and undergoing mutations under certain conditions.

Looking back at the leading MEME coins in the currency circle, DogeCoin was initially created as a lighthearted concept of Bitcoin, with the popular "Doge" MEME (a picture of a dog named Shiba Inu accompanied by inner monologue-style text) as its symbol. Its founders did not expect this joke-based currency to be "favored" by Musk and eventually become the largest market value MEME coin today.

After twelve years in the crypto industry, there is already a set of established logic. After creating new concepts and narratives, project parties embrace and bundle with VC institutions, "brushing" and hyping up airdrops, and then making various moves to attract secondary buyers. In this wave of bull market, only TIA and SOL are considered good projects in the eyes of the "old leeks" — with a team, good VCs, Binance listing, and expectations for speculation in the race.

While all of this should continue according to common sense, the MEME track has undergone a series of mutations and derivatives, giving birth to inscriptions as a "disruptor." The appearance and popularity of all "inscriptions" in the Bitcoin ecosystem came as a complete surprise.

Since its inception, "inscriptions" have naturally carried the community spirit of "fair launch" and "first is first," which happens to be the slogan of MEME. Since its birth in March, prejudice has closely accompanied the Bitcoin ecosystem, but it seems to have never given up convincing everyone: "If you have prejudice, then let the Bitcoin ecosystem rise until you have no prejudice."

The cost of one ORDI (1 ORDI includes 1000 coins) was between $2 and $3. Based on the current price of $60 per ORDI, the current price of one ORDI is $60,000. After a year, if it has not been sold, based on the current price, this is an investment with an increase of over 20,000 times.

And inscriptions are not the first mutation and derivative of MEME. The diversity of MEME is also evident in the NFT track. As the biggest new narrative in the last cycle, NFT has also experienced a bull and bear cycle. The NFT leader BAYC once fell below 13 ETH, not to mention the current situation of many NFT artists without capital support, who are also looking for various ways out.

From the recent popularity of BOME and SLERF, it can be seen that MEME coins bring cultural value to holders, which to some extent can also benefit the liquidity of NFTs. Although the forms presented are different, the cultural attributes spread by NFTs and MEME coins are essentially the same.

In addition to this more widespread form of derivation, we can also see a series of cultural derivations in some more specific MEMEs, such as Pepe the Frog.

This image was originally just a character in a webcomic by cartoonist Matt Furie in 2005, but it later evolved into a widely recognized MEME symbol on the internet. Unlike MEMEs with clear author backgrounds, Pepe the Frog has gathered a community of countless anonymous artists who have created various Pepe images, playing diverse roles in different cultural contexts and social media platforms.

The evolution of Pepe the Frog demonstrates a unique phenomenon in MEME culture: how a single image can give rise to a large and diverse cultural ecosystem. This cultural derivation is not just a simple act of replicating the original image, but a process involving creative reconstruction and cultural reinterpretation.

02 The Flowing Narrative of the Currency Circle, the Ironclad MEME Culture

In delving into the essence of MEME and its relationship with blockchain, we find that the two have jointly constructed a unique cultural and emotional ecosystem in the crypto world. Blockchain is not only a technological innovation but also a huge emotional arena, while MEME is not just an entertaining meme but also plays an important role in shaping market narratives, attracting community participation, and driving the value of cryptocurrencies in the blockchain industry.

2.1 The Currency Circle is a Magnifying Glass for Emotions and Narratives

Where there are people, there is a community, and where there is a community, there are emotions.

The currency circle is not only a gathering place for capital but also an amplified emotional pressure cooker with crazy bubbles and fluctuating candlestick charts. As an emerging technology and financial field, blockchain has magnified the influence of these basic human emotions, affecting market dynamics and investment decisions.

MEME naturally has the role of conveying emotions. From enthusiasm to panic, in a humorous, ironic, and even exaggerated form, MEME can quickly spread among communities, evoke emotional resonance, and thus influence the direction of the market.

In a short period, a successful MEME can attract a lot of attention and discussion, thereby driving investor buying behavior and causing short-term price increases. This phenomenon is particularly common in the crypto market, where market sentiment often significantly affects price fluctuations.

Yuval Noah Harari once said in "Sapiens: A Brief History of Humankind" that humans initially communicated interpersonal information through "gossip" and ways to get to know each other by talking about others, thus establishing stable and close interpersonal organizations.

Later, people formed a common imagination through "storytelling" to build more universal trust, such as religion, nation, currency, companies, and so on. Similarly, individuals in the crypto community can also form a strong group identity and goal through shared MEMEs and narratives.

This trust based on shared imagination is the key factor for MEME to generate prices in the currency circle and the reason why it can attract a large number of currency circle investors and users to participate.

2.2 MEME Doesn't Need Public Chains, Public Chains Need MEME

From BTC to Solana, and then to TON and Base chains, every hot public chain needs MEME coins and encourages or even creates MEME culture.

The most representative example is Anatoly, the co-founder of Solana. On the day of last year's Solana Community Summit, which coincided with Halloween, Anatoly appeared in a green dinosaur costume, becoming the most unique and eye-catching presence at the summit. Standing in front of the audience, Anatoly introduced himself, saying, "I'm Anatoly, and I'm a silly dragon." After saying this, Anatoly smiled shyly, and the audience at the entire venue was amused.

The rest of the story is well known. "Silly" became the hottest MEME coin at that time, and the community rediscovered that trading on Solana was really smooth, and the "Ethereum killer" returned to the community's sight as "selected by SBF."

After Solana, it was discovered that it is feasible for public chains to build brand identity and community cohesion through MEME. A strong community built around a specific MEME can effectively promote projects, attract new users, and enhance the market position of the project.

Now, we can also see that TON and Base chains are eager to get a share of the liquidity in MEME coins. TVL has reached new highs, on-chain activity and trading volume have also experienced exponential growth, and the TON Foundation has publicly announced the recruitment of a person in charge of the MEMECOIN ecosystem.

2.3 Have We Finally Dispelled All Kinds of Concepts?

A recent joke goes: "When VCs see concepts like zk+DEPIN+rollup+ai stacked together, they can't help but be excited." The background of this joke also makes us think: have we really gained a deep understanding and dispelled the charm of various concepts in the cryptocurrency field?

The continued popularity of MEME, like a mockery of the games played by the so-called core circles, not only questions the technology itself but also deeply criticizes the blind enthusiasm of the entire cryptocurrency market for new technologies and the neglect of their substantive applications.

"I can't understand it anyway, so I might as well speculate on MEME." The old leeks in the community seem powerless, and the new leeks are even more clueless. Under the rapidly iterating narratives of the currency circle, MEME culture has remained strong. The rapid listing of BOME on Binance has "breached the defense" of many crypto projects. After years of hard work, they have not been able to list, but BOME did it in three days.

Returning to the frequent questions in the community: "Is the end of blockchain MEME?" or "Value investment is dead, long live MEME?" Although these questions seem absolute and even extreme, it must be admitted that the biggest role of blockchain in the past decade is still speculative trading, which may be a fact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。