Author: Deep Tide TechFlow

In the cryptocurrency circle, the endorsement carries immense value.

Whether it's conducting investment research or launching a project, players have always had an unspoken understanding: projects endorsed by major VCs often signify significant opportunities.

Due to the extreme information asymmetry in the industry, major VCs are to some extent regarded as "information filters" by the public. Projects endorsed by these VCs are seen as having been carefully selected by professionals using specialized knowledge, substantial funds, and valuable reputations. Following their lead, one can likely reap substantial benefits.

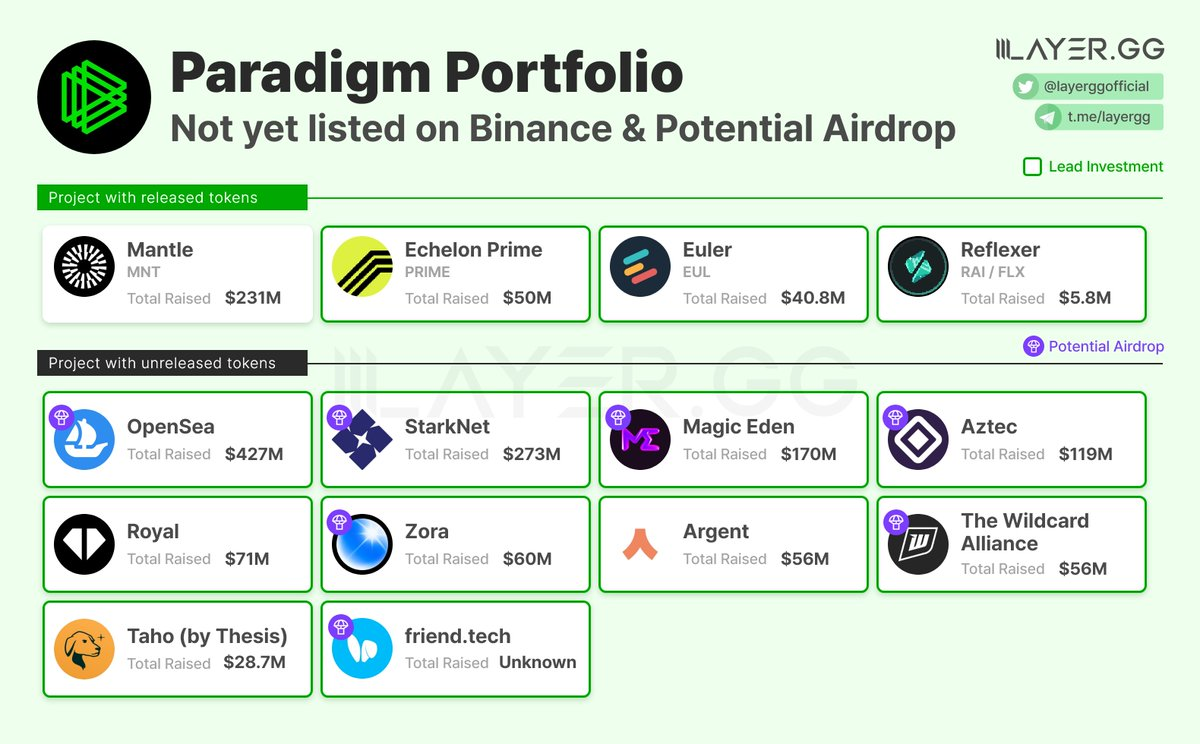

For example, Paradigm, a top VC in the crypto industry, has previously invested in Coinbase, Maker, Uniswap, and the once-prominent FTX, showcasing a keen eye for selecting projects.

During the previous bull market cycle, the saying "Paradigm leads, no small gains" was widely circulated.

However, recently, distancing oneself from Paradigm seems to have become a new unspoken agreement among retail investors.

Opening social media platforms, one can increasingly hear a strong sentiment that any project backed by Paradigm is to be avoided without exception.

Some have even mockingly commented that Paradigm's office is located in Shenzhen, and the projects it invests in exhibit a style reminiscent of Shenzhen's capital market, suggesting that the VC itself has gradually become adept at market manipulation but inept at actual business operations.

From being a benchmark for the industry to being avoided by everyone as the "master of manipulation," how did Paradigm fall from grace in the eyes of retail investors?

From Paradigm to "Puadigm"

The initial shift in sentiment can be traced back to FriendTech.

FriendTech (referred to as FT) sparked a social frenzy last year. While the promotion by FT's KOLs and the economic design of purchasing shares played a role, the real catalyst for further user influx was the news of Paradigm investing in FT's seed round.

With the subconscious belief that a project backed by a major VC must have potential, after the news was announced, FT's user activity and transaction fees noticeably increased for a period.

However, it was clear to everyone that the pursuit was for airdrops, not social interaction.

Later, everyone learned about the point system used by FT, where more active participation and purchasing of shares would result in more points, higher rankings, and eventually, at some point in the future, the points would be exchanged for token airdrops.

But this future, even now that SocialFi has cooled off, has yet to arrive.

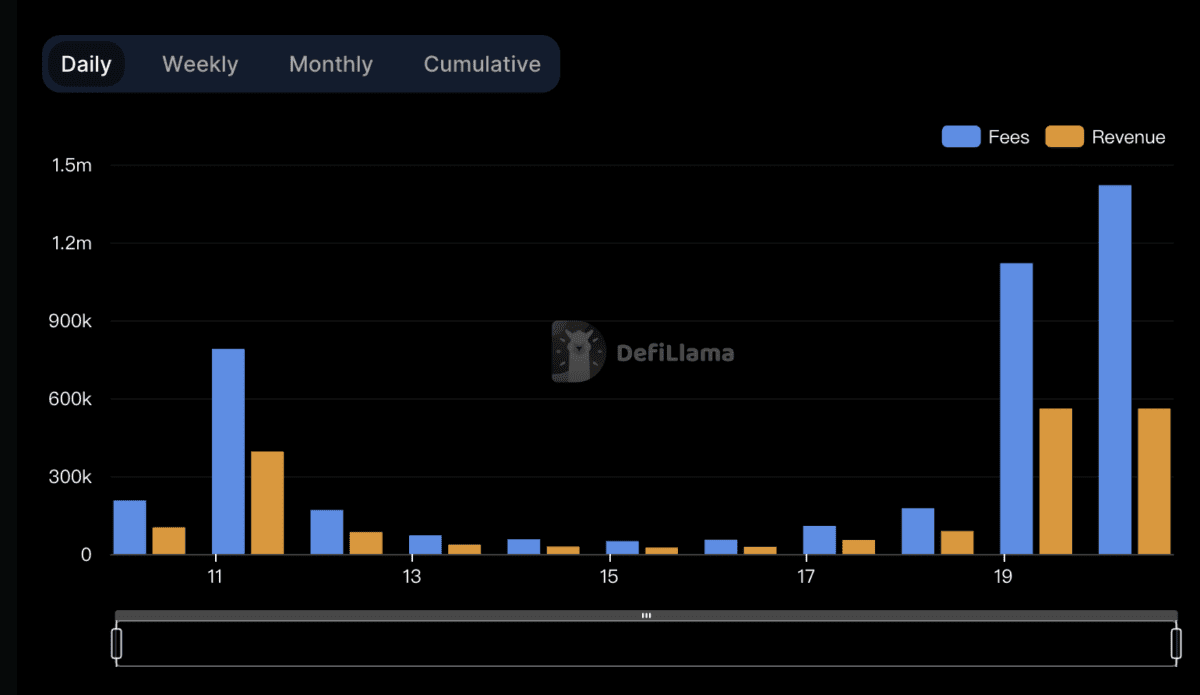

The cryptocurrency market experiences frequent shifts in hot trends, and this is particularly evident in social products. Subsequently, user activity sharply declined, and total value locked gradually decreased. Even if one continued to be active in FT, it became increasingly difficult to find someone to interact with.

As retail investors woke up from their dream, they began to realize that this was somewhat akin to pickup artistry (PUA).

Encouraging continuous investment, exerting continuous control, and dangling an unattainable carrot.

This feeling resurfaced with Paradigm's investment in Blast.

As the first L2 solution with inherent returns, the more TVL one contributed for a longer period, the more points one could earn, and the more enticing the future rewards would be… a familiar formula and taste.

Although Paradigm's research director had publicly expressed disapproval of certain execution strategies by Blast, and Pacman openly stated that Paradigm did not have control over Blast's go-to-market (GTM) listing strategy, it was difficult for players to dissociate Paradigm from the same PUA flavor.

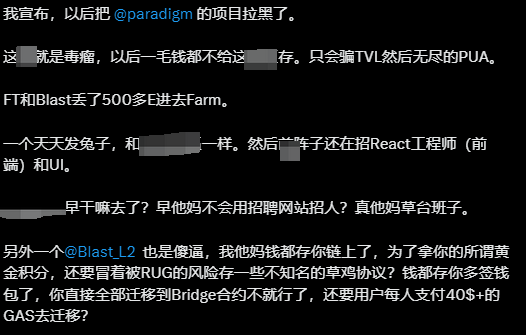

Not to mention Blast's further PUA point strategy after its mainnet launch, which left early participants who had staked a considerable amount of ETH in a difficult position, leading to feelings of frustration and anger reaching a peak:

Whether Paradigm was truly involved in designing strategies to absorb TVL in collaboration with the project team is no longer the main concern. What matters is the repeated PUA experience that projects backed by Paradigm have brought to retail investors, reinforcing the perception of the need to defend their rights:

Paradigm has become "PUAdigim." Once, having it meant having something to gain, but now it guarantees a lack of good outcomes.

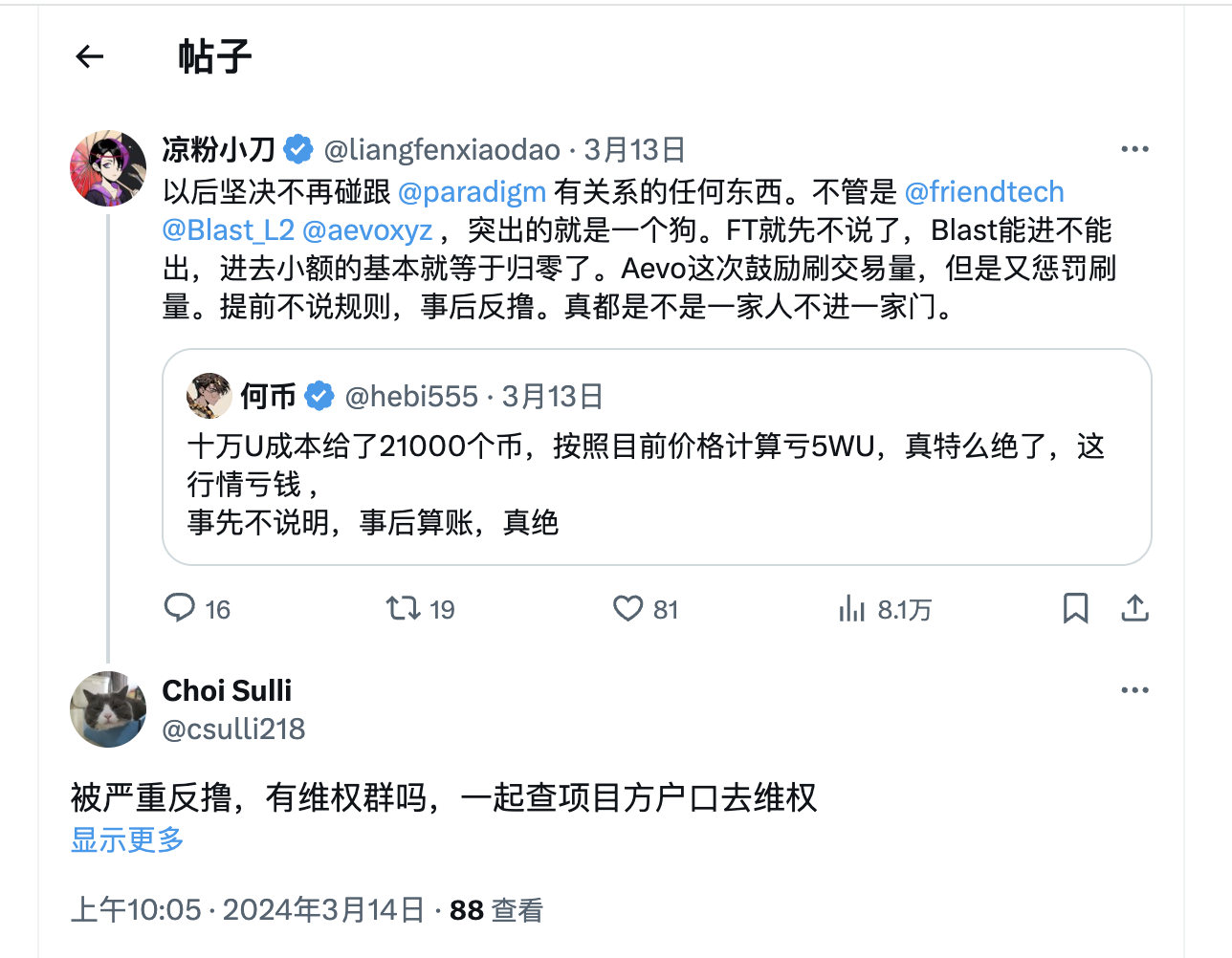

While the saying goes "three strikes and you're out," similar incidents have occurred recently with Aevo, where the greater the expectations, the greater the disappointment. The ambiguity surrounding wash trading activities further wounded the spirits of the "no small gains" enthusiasts seeking projects backed by Paradigm.

It's important to note that we still cannot confirm whether Paradigm reached a tacit agreement with the project teams. However, the longer the delay, the more unclear the rules, and the higher the opportunity cost, the greater the uncertainty, which is an undeniable fact.

What further complicates the situation for retail investors is that Paradigm's prestigious brand is still intact, leading to a significant chicken-and-egg effect:

If you don't participate, someone else will.

If you refrain from participating due to PUA troubles, there will undoubtedly be a slew of competitors celebrating, and the competitive pressure will be slightly alleviated. After all, the crypto market is never short of people willing to endure hardships for a free lunch, especially when they know that you won't partake, leaving them with a larger piece of the pie.

The tasteless food, yet the fear of others eating their fill.

Caught in a cycle of torment between potential returns and potential lack thereof, it becomes understandable why retail investors have turned their attention to Paradigm.

Long-termism, a Bitter Pill for Retail Investors

However, a tarnished reputation does not mean that Paradigm is entirely without merit.

Established in 2018, Paradigm's initial backers included endowments from Yale University, Harvard University, and Stanford University. Academia and researchers are not foolish enough to give money to an organization lacking investment capabilities.

The first $400 million fund launched by Paradigm was funded by Yale's endowment and has also invested in foundational DeFi projects like Uniswap and infrastructure giants like StarkWare.

Let's not forget that "paradigm" itself means "a typical example." In selecting business models, Paradigm's investment portfolio includes creative projects that represent a departure from the current market norms.

This was the case with Friend Tech, Blast, and Aevo, all of which were projects that differed from the prevailing offerings in the market.

When top VCs lean towards finding projects that can bring about a paradigm shift, it inevitably signifies that these projects have the potential to change certain operational models or industry formats.

However, the time it takes for this potential to materialize may indeed be quite long.

Long enough for retail investors to lament the PUA, point-earning, accelerated rewards, and referral mechanisms.

If the focus is on the long-term development of the project, there will inevitably be marketing strategies aimed at playing the long game and aiming for big wins. The aforementioned tactics are just a part of the strategy from the perspective of VCs and project incubation, and it naturally makes sense.

But retail investors detest the four words "long-termism."

In the realm of crypto interests, no one will continue to unconditionally support a project for the long term without reaping any interim benefits. All support without tangible rewards is futile.

Moderate PUA may be acceptable, but continuous PUA is shameful, and this is the true consensus among retail investors.

"Just because I can't benefit from it, does it mean it's not good?"

Finally, it's important to clarify that:

Paradigm may be the ceiling of the crypto investment world, but it may not necessarily be the ceiling for your personal investments.

The goal of VCs is not and will not be to ensure the success of your personal investments. There is sometimes a contradiction between investing in a good project and how much profit you can actually derive from it, such as the PUA experience you are currently going through.

VCs are inherently involved in venture capital, so how can you guarantee that you will succeed by following their lead?

Even if a project succeeds, you may not necessarily benefit from it. But if you assert that a particular VC is rubbish just because you can't benefit from it, that may also be unfair.

Today, Paradigm is the target of PUA-related emotions, but which VC will be the subject of hatred tomorrow? Criticizing all crypto VCs and staying away from all PUA projects will not increase your profits.

Consider the runes and fair launches—VCs also haven't benefited. Different roles in the crypto world have their own ways of gaining profits.

As some KOLs have said, abandon worship, question authority, and think independently.

Not being led by the nose and finding your own way to benefit is the beginning of dispelling the allure of the crypto world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。