The expectation of BTC halving has triggered a noticeable shift in investor sentiment. For example, there has been a significant increase in interest in the crypto asset market among hedge fund clients of Goldman Sachs.

This renewed enthusiasm is not limited to speculative individual investors, but also extends to mature institutional investors.

Max Minton, the head of digital assets in the Asia-Pacific region at Goldman Sachs, stated that the approval of BTC ETF has reignited the interest of the company's clients. Many are either actively investing in the crypto asset market or exploring the potential to do so.

Minton added, "Last year was relatively quiet, but since the beginning of this year, we have seen an increase in client interest in onboarding, pipeline, and trading volume."

Goldman's current clients are primarily traditional hedge funds, which generate the majority of the profits.

Furthermore, Goldman is expanding its business scope to cover various clients, including asset management companies, its own banking clients, and certain companies specializing in digital assets.

Minton mentioned that clients are using crypto asset derivatives for speculative forecasting, increasing yields, and hedging.

Minton also pointed out that products related to BTC continue to be the most sought after by clients. However, depending on the potential approval of an Ethereum ETF in the United States, client interest in Ethereum-related products may change.

The upcoming BTC halving is also a reason for people to refocus on BTC.

This event is set to occur at the end of April, at which point the BTC mining reward will be halved, prompting miners to upgrade to more efficient technology to maintain profitability.

This once-in-four-years update is crucial for maintaining BTC's economic model, as the reward will decrease from the current 6.25 BTC to 3.125 BTC.

After the BTC halving in 2012, the market value soared by over 8000%. Similarly, after the halving in 2016, the value of BTC increased by over 1400%. Likewise, after the halving in 2020, the value of BTC rose by over 700%.

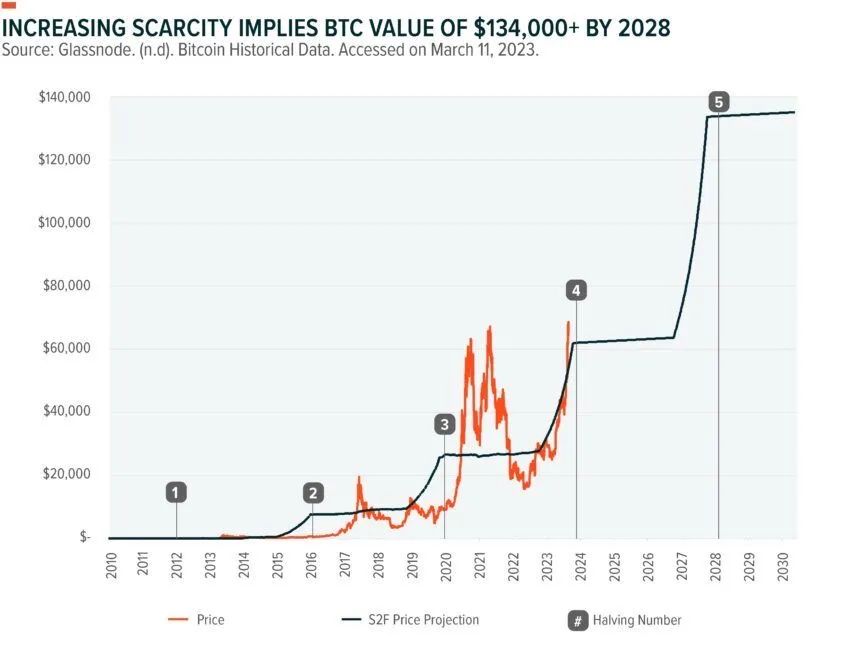

Although the Stock-to-Flow (S2F) model, typically applied to commodities like gold, has its flaws, it is a method for evaluating the value of BTC.

The S2F model has demonstrated historical correlation with BTC price fluctuations. As BTC becomes scarcer, experts expect its value to rise from the current price.

Pedro Palandrani, a researcher at Global X, stated, "BTC is about to experience another shake-up, and the next halving event may occur in April 2024. Historically, there is a correlation between halving events and subsequent BTC price increases."

"According to the S2F model, by 2028, the price of BTC could rise to over $130,000."

From trading to blockchain innovation, Goldman's involvement in the crypto asset market reflects a broader institutional recognition of digital assets.

As the halving approaches, the bank's positive stance on digital assets, coupled with the growing interest of its clients, represents a pivotal moment for the crypto asset market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。