Author: Louround

Translator: Deep Tide TechFlow

Despite the market developing at an extremely fast pace, some projects have remained consistent with the market phase over the years. This requires projects to have strong business development capabilities, innovation capabilities, and sources of income.

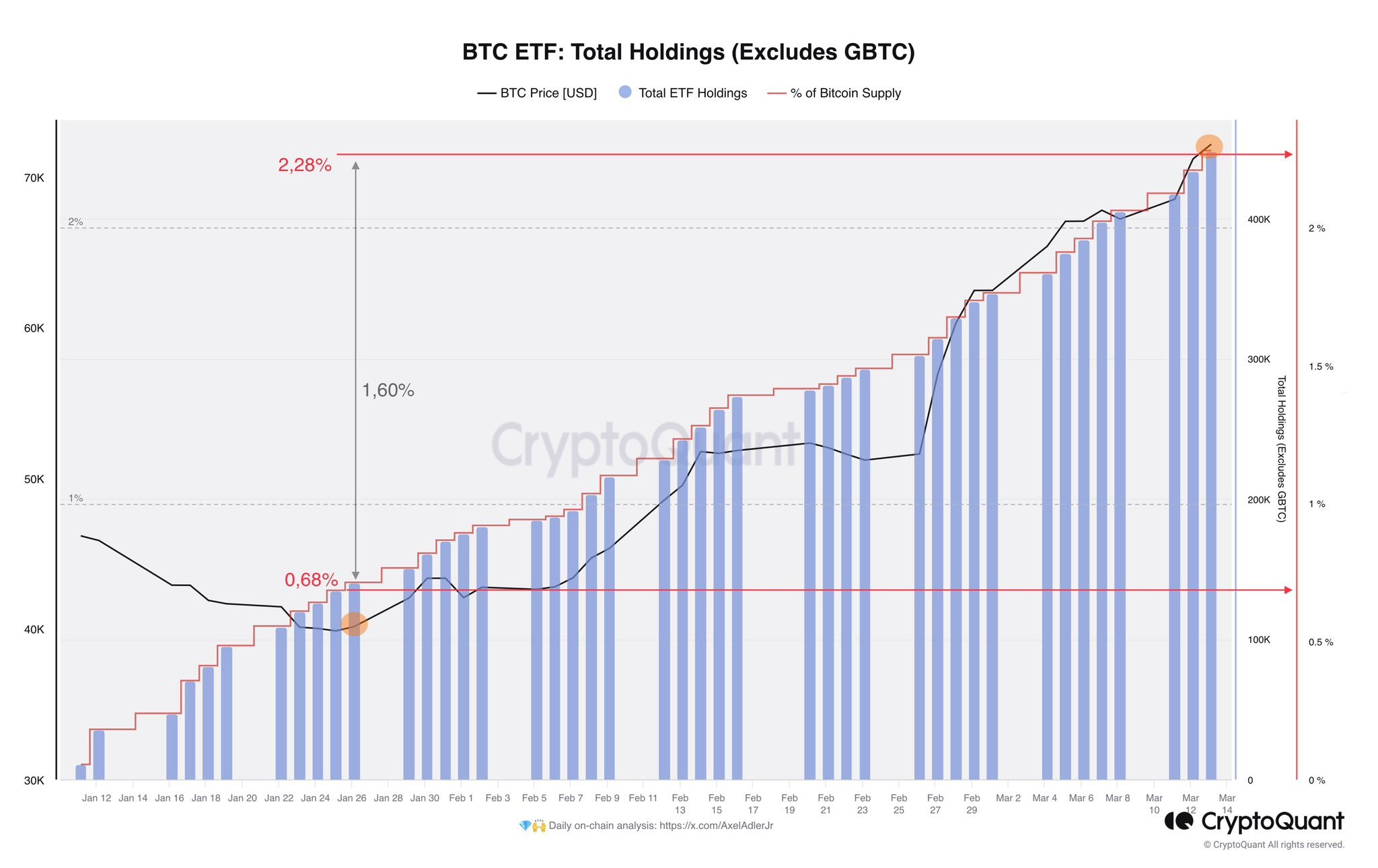

With the recent launch of Bitcoin ETF and a large influx of funds, institutions have purchased over 2% of the BTC supply, making the Bitcoin ecosystem one of the hottest topics in the market.

The Bitcoin ecosystem is continuously expanding, and participants are looking for ways to generate additional income from their holdings.

This is what Babylon hopes to achieve by becoming the EigenLayer for Bitcoin.

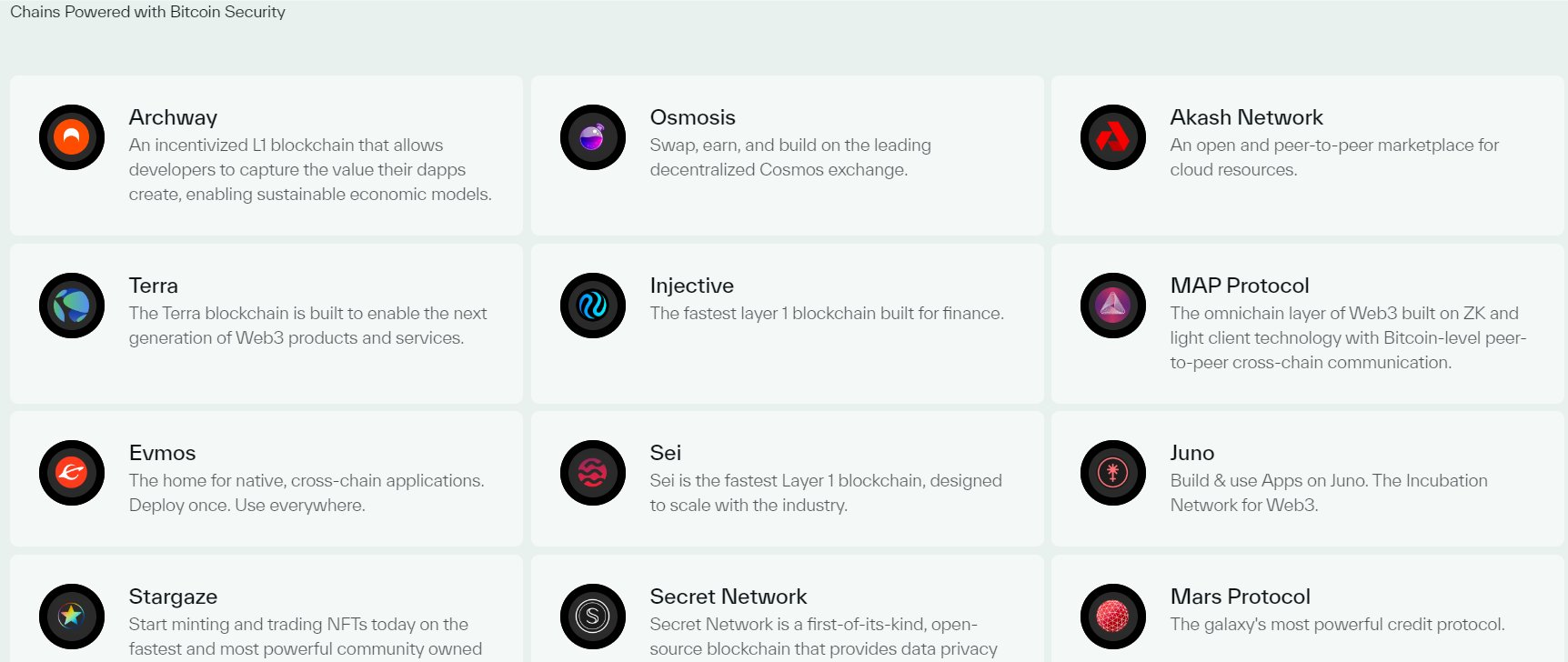

$BTC is staked and verified for proof of stake to earn additional income. Below are some chains that Babylon has already secured, providing a way for idle $BTC to generate income from their holdings.

Similar to EigenLayer, once you stake your $BTC, your funds will be locked in the short term and cannot be used.

This is where Ankr comes in as the primary BTC liquidity staking project, providing liquidity to holders while still earning staking rewards.

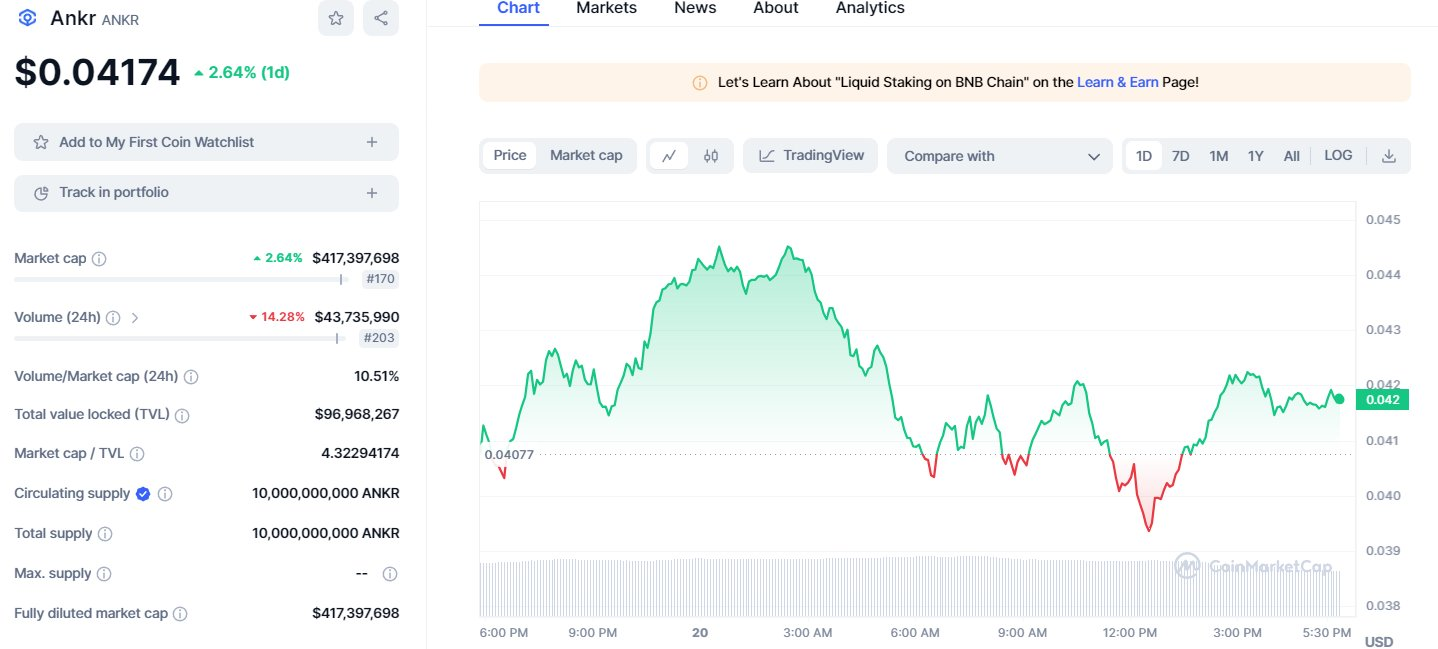

You may be familiar with Lido, but did you know that Ankr (currently with a TVL of $100 million) was the first protocol to launch ETH liquidity staking in December 2020?

They provide the most reliable RPC and have over 6 years of experience in the industry, leading in the RaaS field.

Well, this is just the beginning. Although their FDV is only 1/10 of AltLayer's, Ankr's goal is not just the RaaS narrative.

Ankr announced an exclusive partnership with Babylon in their latest tweet.

Ankr will provide BTC's LST (liquidity staking tokens) for the chains secured by Babylon, which will then be issued on the chain, providing additional liquidity for the chain and security.

Soon, it will become a leader in the field. To truly understand this event, let's make some assumptions.

Babylon is the EigenLayer for Bitcoin, currently with a TVL of $6.4 billion.

This only accounts for a tiny fraction of the Bitcoin market value, meaning more idle capital will take the opportunity to stake in Babylon and generate income.

As mentioned earlier, Ankr is the first LST for $BTC in the market, similar to Kelp DAO, ether.fi, and Puffer Finance for $ETH.

You may have seen that ether.fi recently launched their token, currently with an FDV of $4.2 billion.

Lido's FDV is $3.2 billion.

Guess what Ankr's current FDV is? Only $419 million.

Yes, the trading price of Bitcoin's Lido is 1/8 of Lido's, and 1/10 of Etherfi's.

Imagine, if in addition to this, they will also lead the RaaS narrative, but only trade at 1/10 of AltLayer and Dymension's market value.

Ankr also leverages the DePIN narrative, as they provide decentralized computing power and data availability through the network. Furthermore, this further increases the use case and distribution of the $ANKR token.

If we pay more attention to the details, Ankr attended the Nvidia conference and has recently had many discussions around AI.

Why is the Rollup As A Service project so focused on artificial intelligence?

I'll let your imagination do the work, but you currently have one of the most asymmetric bets in the market:

- 6 years of experience

- The first ETH LST

- BTC's Lido

- RaaS leader

- DePIN narrative

- Artificial intelligence

In conclusion, I believe Ankr is a project and token worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。