Author: Kaori

Base's TVL saw a significant increase in March, benefiting from the recent meme frenzy. Base TVL surpassed 700 million USD yesterday, reaching a historical high of 7.43 billion USD at the time of writing. Backed by Coinbase, Base seems to be becoming a new growth point in the Ethereum ecosystem.

The increase in on-chain activities on Base has been questioned by the community, with concerns about the presence of bots and lack of genuine active users. However, the reality may be different, as no other chain needs genuine users and on-chain activity more than Base.

Launched in August last year, Base's protocol lead, Jesse Pollak, explicitly stated in a Bankless podcast that Base would not issue tokens and had no plans to do so. As the only chain created by the publicly listed cryptocurrency exchange Coinbase, Base's token issuance expectations are indeed low, thus requiring genuine user contributions to generate fee income for the entire ecosystem.

It is well known that the cryptocurrency market is a highly speculative and capital-efficient environment. So, why are users entering Base, and what is Base relying on to attract more users, and how much growth potential does Base have?

Base's Ecological Logic

The absence of token issuance expectations makes Base a unique presence in the Ethereum Layer 2 space. Periodically, Base seems to experience significant increases in TVL, bringing real income and traffic to the entire ecosystem. From the TVL trend chart, it can be seen that Base has experienced three significant increases in TVL since its launch.

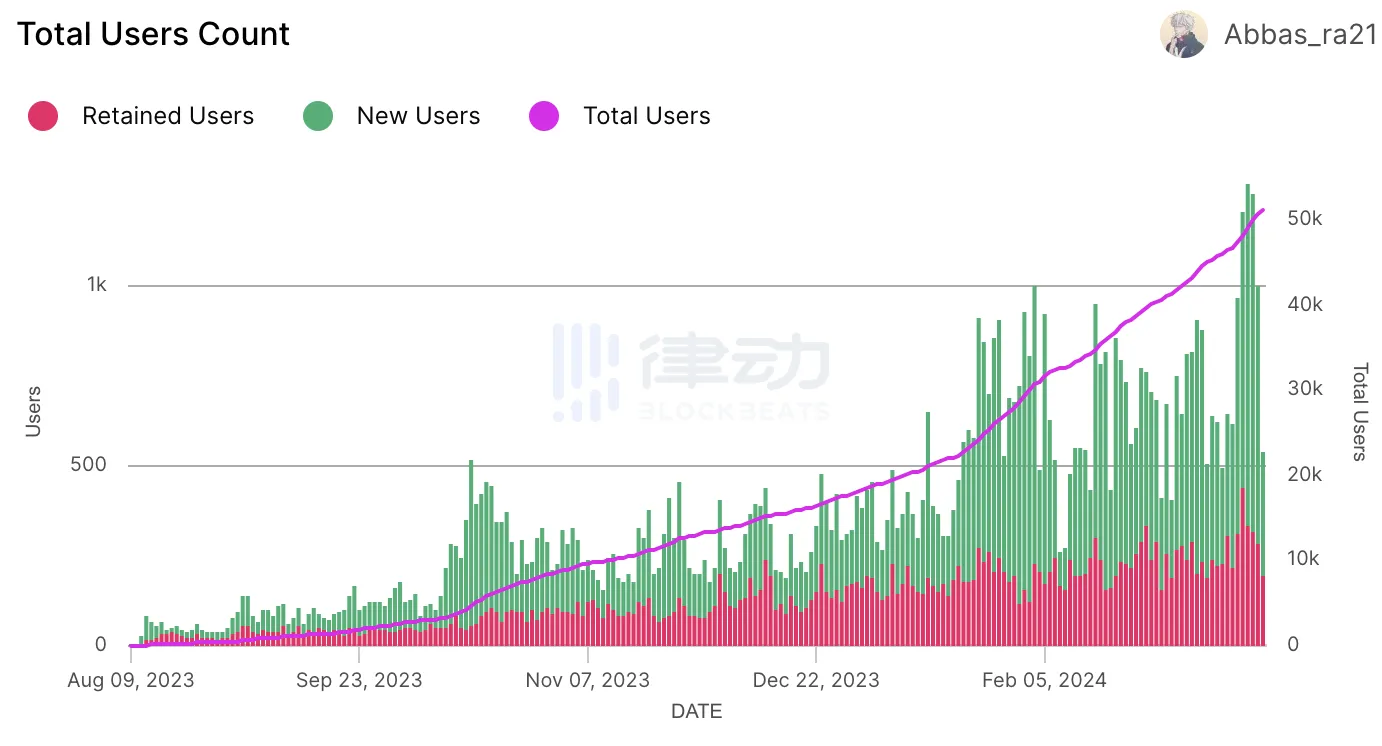

The first increase was driven by the social application Friend Tech, which single-handedly drove Base TVL to rise sharply. The second increase occurred in February this year, with the introduction of new features by the social protocol Farcaster, the community meme coin DEGEN, and a series of anticipated airdrops. The third increase occurred recently with the launch of Cancun upgrade, with Coinbase's support helping to increase on-chain liquidity for Base's DeFi projects, along with the synergistic effect of increased market capital inflows.

These three increases also respectively demonstrate the unique developmental factors inherent in Base's genes compared to other Layer 2 solutions.

Focus on User Growth "VC Chain"

Do you remember the market frenzy brought about by Friend Tech last year? Although it may seem chaotic now, at that time the market was still in a bearish cycle, and the emergence of the social protocol Friend Tech on the Base chain was like a bolt from the blue.

From the initial product release in early August to mid-October, the Friend Tech protocol accumulated $21 million in revenue, with a peak daily revenue of about $1 million, far exceeding mainstream DeFi protocols or NFT markets at the time. By solving industry pain points through social viral sharing, Friend Tech took advantage of speculative effects to achieve a cold start, relying on rapid iteration and bundling with Paradigm to solidify development expectations, in addition to enhancing user stickiness through airdrop expectations. It can be said that Friend Tech provided a valuable product management lesson to the Web3 market at that time.

In this upward spiral, the early stage relied on invitation codes and well-known KOLs to drive social viral sharing, but the emergence of Paradigm was a key factor. A research report from Folius Ventures indicated that Friend.Tech refused to engage with any VC other than Paradigm, indicating a high degree of binding with Paradigm. But if we were to say who benefited the most from this SocialFi frenzy, I think it is undoubtedly Base.

In addition to Friend Tech, there are other projects on Base, such as FrenPets focusing on the electronic pet market, Unlongly, a Web3 live streaming platform, sound.xyz focusing on music collection, PartyDAO for fundraising, Zora for art collection, and Drakula, a Web3 TikTok, and many more.

After the smoke of Base memes cleared, many people asked what else is on Base. Jesse Pollak, the protocol lead of Base, listed a long string of project names, all of which are focused on serving consumer applications for Web3 users. Jesse stated that Base is currently brewing a trend called build2earn or "building influential new on-chain products and winning respect, appreciation, and economic rewards."

Behind these consumer applications are a group of well-known VC institutions in the cryptocurrency market, such as Paradigm, a16z, Multicoin, DragonFly, Variant Funds, and 1confirmation. These VC institutions have differentiated the Base ecosystem into two distinct characteristics based on their investment styles, one led by Paradigm with a "gambling culture" and the other centered around long-termism led by a16z. However, their goal is the same - to bring more genuine users to Base and create an active and prosperous on-chain ecosystem.

In contrast to the Friend Tech model, there is the long-term, low-key social protocol Farcaster. With a $30 million investment from VC firms such as a16z and 1confirmation, Farcaster was initially seen as the ceiling for decentralized social protocols. It did not rush to achieve user growth until February this year when it introduced the frames framework, which led to widespread breaking of barriers through articles from major institutions or KOLs, resulting in a historic high in DAU and a brief trading frenzy for Base.

Currently, Farcaster and its largest front-end protocol, Warpcast, have become the backyard of the Base ecosystem, with ecosystem assets represented by DEGEN becoming the main speculative targets on the Base chain. Although there is still a certain barrier to entry into Warpcast, the Base ecosystem, and even the Ethereum ecosystem, have established their own social circles and culture on it. This may seem somewhat elitist, but as projects continue to break barriers and a wider range of users adopt them, these "elites" seem to be compromising with the gambling culture.

Ecological Linkage and Interoperability with OP

The reason why Base is considered fortunate is not only because it has growth strategies crafted by VCs but also because of its strong collaboration with the Ethereum ecosystem. The most representative example is its participation in the OP superchain vision.

In August last year, Base and Optimism jointly announced a governance and revenue-sharing agreement, which stipulated different governance collaboration modes between Optimism and Base in the short and long term, as well as the economic interaction between the two parties. In other words, the two Ethereum Layer 2 chains, which were originally in competition, joined hands to build the ecosystem.

In addition to reaching a consensus on strategic directions, Base and OP have also had excellent cooperation in specific ecological project developments. Many people believe that since Base has so many consumer applications, perhaps no one is paying attention to DeFi, the core configuration of most blockchains. However, Base, with top resources, tells you that it can not only build genuine consumer application chains but also manage liquidity well and create excellent DeFi applications, all thanks to the synergistic effects brought about by ecological linkage.

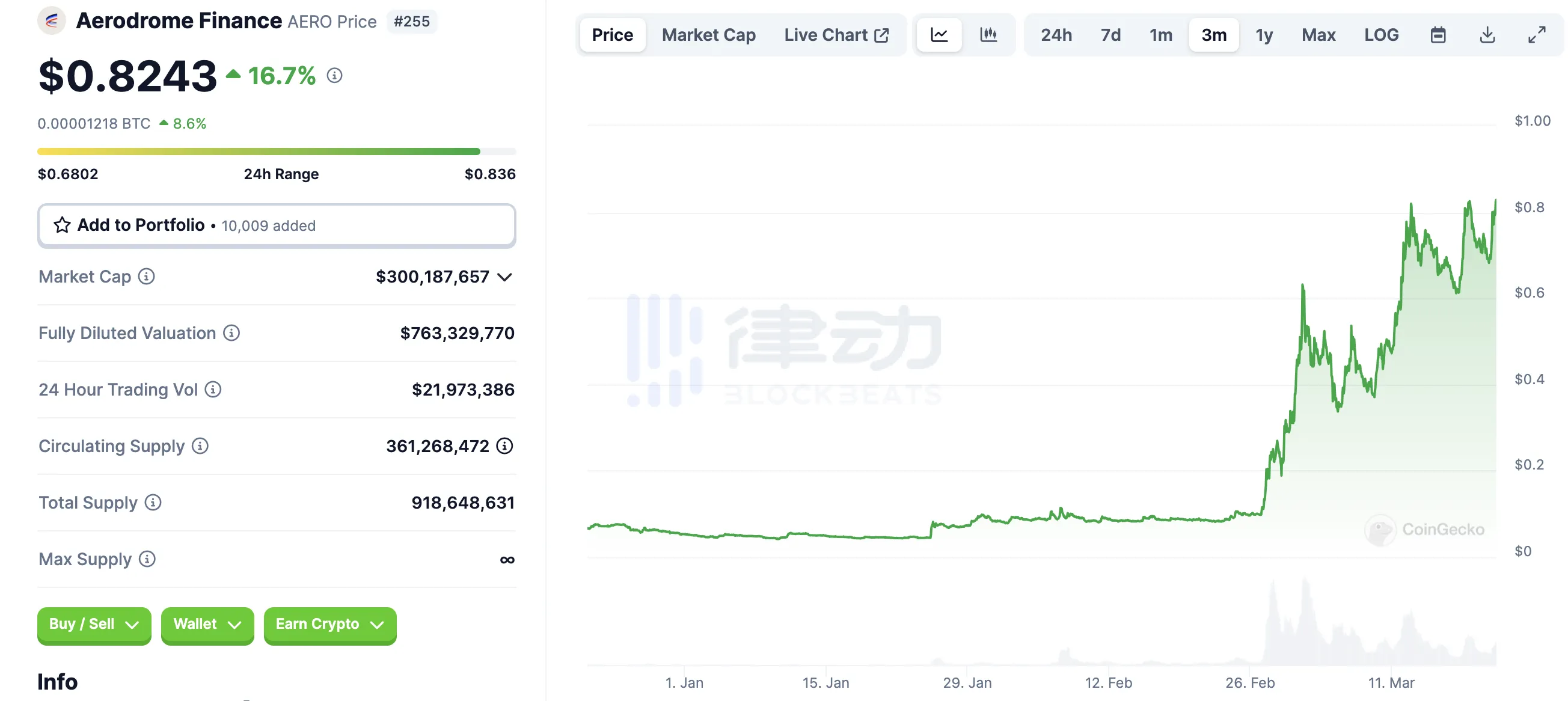

Currently, the liquidity protocol Aerodrome, deployed on Base by the leading protocol Velodrome Finance, dominates Base's TVL. Its native token is AERO, distributed to liquidity providers through emissions. After launching on Base at the end of August last year, it attracted nearly $2 billion in TVL within 24 hours, with its liquidity mining yield reaching nearly 1000% annually without compounding.

On January 25, Coinbase added Aerodrome Finance (AERO) to its listing roadmap. On February 27, Aerodrome announced an investment from the Base Ecosystem Fund led by Coinbase Ventures, with the specific amount undisclosed, and the investment made through the purchase of Aerodrome's native token AERO. At the time of writing, AERO had surged to over $0.83.

The series of actions from Coinbase's listing to investment have propelled Aerodrome, already the liquidity center of Base, to surge in price, with a monthly increase of nearly 700%. At the time of writing, Aerodrome's TVL reached $317 million, with trading fees totaling $14.52 million and over 33,000 active users.

Backed by Coinbase, a Big Tree Provides Shade

Coinbase is the key to Base's natural good fortune as a Layer 2 solution.

As mentioned earlier, Coinbase is the best trading venue for tokens deployed by some projects on Base, demonstrating the mutual benefits of being backed by a big tree. It's not just about the flow from Base to centralized exchanges (CEX), but also from Coinbase to Base, which is worth paying attention to.

Recently, Coinbase launched a new smart wallet with the core feature Magic Spend, allowing users to "instantly" transfer funds on-chain. When signing transactions/making payments, users can choose to withdraw funds from their Coinbase account, with the funds only being withdrawn at the time of the transaction/payment. In addition to having funds in their Coinbase account, users do not need to perform any other operations or download wallet extensions or bridge assets manually.

The smart wallet further removes barriers between on-chain and off-chain, and Base is undoubtedly the chain that benefits most from this. This not only lays the foundation for Base to attract users and funds on a large scale but also expands the potential adoption of existing consumer applications on Base.

In addition to empowering the Base ecosystem, Coinbase's compliance management also reduces risks for Base in the longer term.

On March 19, Coinbase CEO Brian Armstrong stated, "Authorities claim that cryptocurrencies have no practical use other than speculation and illegal activities. However, 400 million people worldwide (including over 50 million Americans) have purchased cryptocurrencies, and third-party data shows that illegal activities account for less than 0.5% of transaction volume." Armstrong, as the CEO of a CEX, often speaks not only for Coinbase but also for Base, or to legitimize the cryptocurrency market.

Notable Investment Targets

With support from various VCs and Coinbase, Base is undoubtedly set to become the most densely populated Alpha in the Ethereum ecosystem. Due to Coinbase's compliance attributes, Base has the innate attribute of not issuing tokens, which also means that if users want to speculate on Base assets, they can only focus on Base's ecosystem projects.

Aerodrome, as mentioned earlier, saw its native token surge from $0.04 to $0.8 after being listed on Coinbase, a 1900% increase. There are many other projects in the Base ecosystem, and the community is also increasing its expectations for their listing on Coinbase.

Moonwell (WELL)

Moonwell is an open lending protocol deployed on Base, synchronized with the Base mainnet. On February 15, Moonwell launched a tool called "USDC Anywhere," allowing individuals to lend Circle's USDC stablecoin to Moonwell through various Ethereum networks. The tool supports detecting USDC in users' wallets on networks such as Arbitrum, Avalanche, Base, Ethereum, Optimism, and Polygon, and uses Circle's cross-chain protocol to transfer stablecoins to the platform without manually bridging assets, allowing users to send USDC in the Ethereum ecosystem using their digital assets on Moonwell.

As the Base ecosystem heats up, Moonwell's user base is also gradually growing. Its native token WELL is currently priced at $0.032, with a 333% increase in the last 30 days.

Avantis

On February 4, the oracle-based synthetic derivatives protocol Avantis completed its mainnet launch on Base, allowing users to trade cryptocurrencies and real-world assets with leverage.

In September 2023, Avantis Labs completed a $4 million seed round of financing, led by Pantera Capital, with participation from Founders Fund, Coinbase's Base Ecosystem Fund, and Modular Capital.

Currently, Avantis has not issued tokens and launched a trading volume reward on March 12.

Infusion

Infusion is a new AMM protocol on Base, launched on March 15, and is a rising star in the Base liquidity protocol. The Infusion Protocol solidifies on-chain liquidity through a new time-lock component called Timefuse. When liquidity is "time-fused," most fees are allocated to liquidity providers, and the liquidity is locked for a period of time, incentivizing the long-term stability needed for DeFi.

The Infusion Protocol is a community-driven project, with contributors and advisors from various DeFi and infrastructure projects, including 1inch, Pendle Finance, Harmony, LI.FI, and Thorchain.

Infusion has not issued tokens at this time.

BSX

BSX is an emerging DEX on Base, one of six crypto projects in which Coinbase Ventures' Base Ecosystem Fund made its first round of investment. It uses a non-custodial system with "off-chain execution and on-chain settlement" and will also support commodity and forex trading in the future.

BSX is currently in the public testnet phase and will launch its mainnet at the end of the month.

Drakula

On March 14, the social app Drakula.app announced the launch of the on-chain short video social app Drakula on social platforms. Users can earn 250 BLOOD points by logging in with Farcaster and can also earn points by publishing and watching short videos, with creators earning commission income from each token transaction. In addition, Drakula has partnered with Degen, using DEGEN as the primary trading token, with Degen providing Drakula with a grant of 10 million DEGEN tokens.

In the project's official introduction, the project team stated that this is a social project invested in by Paradigm and DragonFly. Considering the previous frenzy surrounding Friend Tech, it may be worth looking forward to Drakula's performance in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。