Author: Joyce, BlockBeats

Editor: Jack, BlockBeats

Since the beginning of the year, the AI sector has been very hot, with investment returns more eye-catching than other tracks. Old projects with AI concepts have been pulling up, and new projects that quickly bring high returns have emerged in droves. Among them, the Bittensor token TAO has risen from around $230 in January to around $700, tripling in value, while many subsequent small projects such as TaoPad (TPAD), AIT Protocol (AIT), OpSec (OPSEC), and others have seen multiples of growth exceeding TAO.

Bittensor has its own unique features. Its subnet mechanism outlines the blueprint of a "decentralized AI model incentive market," and the token price has grown 15 times in the past six months, making Bittensor a regular in VC research reports. However, in the eyes of the community, TAO seems not to be a worthwhile investment target for a simple reason: it's too expensive. Therefore, the recent emergence of Bittensor ecosystem projects has given investors more choices, and projects bearing the "Bittensor" name have shown very good returns in their early development.

BlockBeats found that the recent emergence of Bittensor ecosystem projects is becoming more "frothy." This kind of development is not surprising, but these projects are the first step for many users to invest in and understand Bittensor. This shift inevitably raises questions. From an investment value perspective, Bittensor's innovative subnet mechanism has led the community to see it as the "Ethereum of the AI industry," but for most investors, the current Bittensor seems to have become an AI meme new factory.

From one every three days to three every day: "TAO ecosystem" is everywhere

Starting with the recent projects, the trend of their token prices is the most direct signal, and it can be seen from the corresponding Twitter content the process of transformation of these projects.

In the article "A 20-fold increase in a weekend, the AI Summer of the crypto market is coming" two weeks ago, BlockBeats wrote that most of the AI new projects that appeared in the hot list of Ethereum two weeks ago were either decentralized infrastructure businesses such as GPU/CPU leasing or several Bittensor ecosystem projects with "TAO" in their names. The latter, with the selling point of the Bittensor ecosystem, quickly attracted community attention upon launch, with some tokens seeing a weekly increase of over ten times, and most projects quickly achieving a leap from zero to tens of millions of dollars in market value within two weeks.

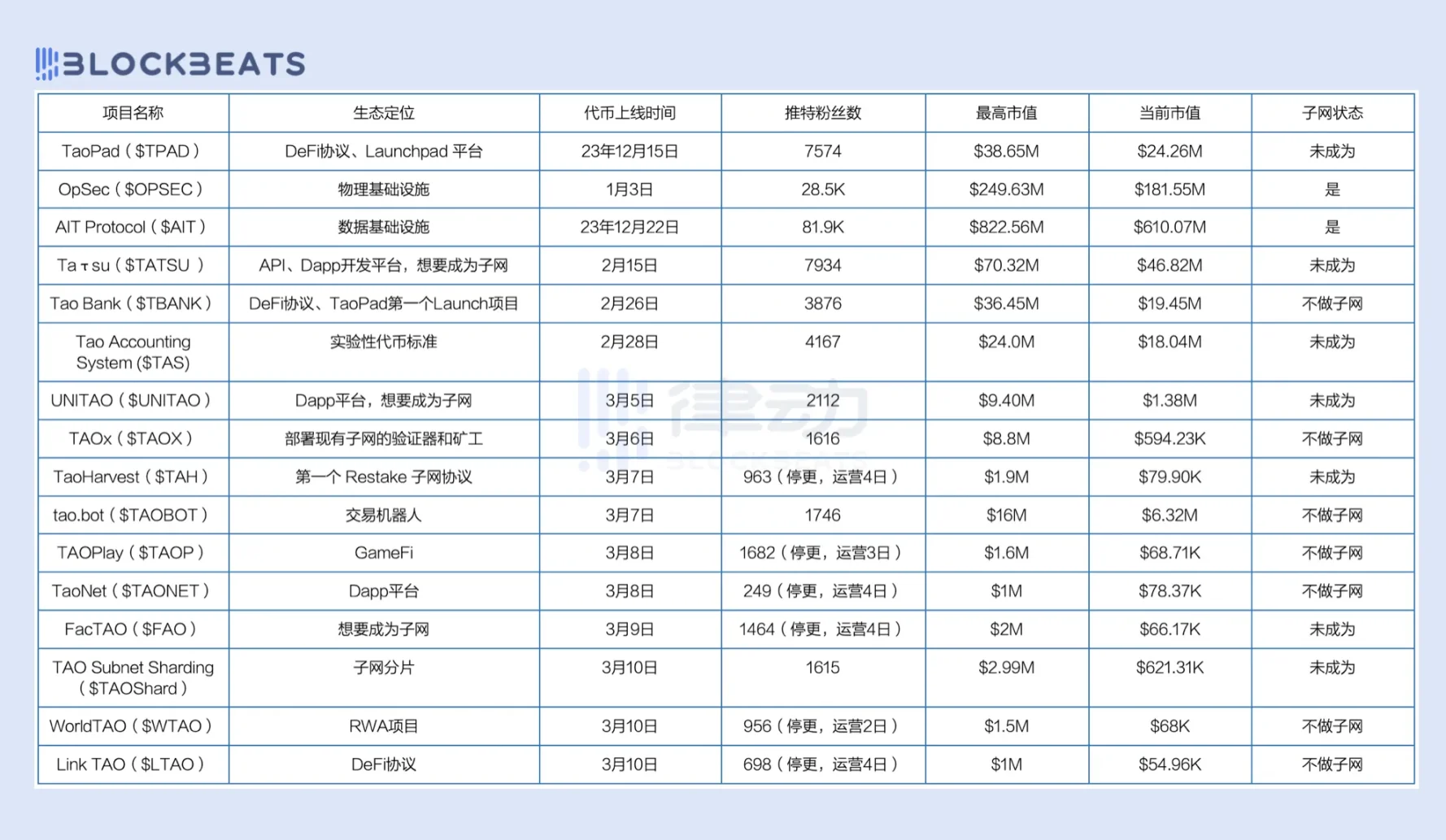

Some Bittensor ecosystem projects before March 10

First, there is Taτsu ($TATSU), Tao Bank ($TBANK), and Tao Accounting System ($TAS). These projects have not released team information, have not received official approval from Bittensor, and are not yet official subnets of Bittensor. However, with the name "Bittensor," the token prices can soar rapidly with just a bit of code or product front-end page release.

The token $TATSU of Taτsu completed a 50-fold increase from 0.2 USD at launch to 10 USD when the product page was released in two weeks. In early March, with the launch of the product "AI Conversation Assistant TaτsuASK," $TATSU broke through 70 USD on March 8, completing a splendid 35-fold turnaround from 3 USD to 70 USD in 15 days, riding the AI trend at the time.

Another project, Tao Bank, from the Bittensor ecosystem LaunchPad platform TaoPad, had an initial allocation price of 0.05 or 0.06 USD for the token $TBANK. After the team created liquidity pools for the TBANK/ETH trading pair, TBANK quickly rose to 0.3 USD upon launch and also made it to the Dexscreener hot list on the same day. On March 8, TBANK reached a high of 2.4 USD, with an 8-fold increase on the 12th. During this period, Tao Bank did the following: released the product front-end interface and announced the deployment of the token on Arbitrum.

Two days after TBANK went live, the token TAS of Tao Accounting System, positioned as "experimental token standard on Bittensor," also went live. Compared to the first two projects, "experimental token standard" had no product images to release, and in just two days after going live, TAS experienced a large rise and fall. During this time, there were comments in the project's community questioning whether the team had failed to cancel the transaction tax as promised, and the team only tweeted that they would come back to launch the testnet after attending ETH Denver. In the comments section of this tweet, the majority were cooperation invitations from KOLs. TAS then achieved an over 8-fold increase in less than 4 days.

Starting from March, BlockBeats found that projects related to the Bittensor ecosystem have been appearing more frequently, but the project content and social media operations have become more casual, and their lifespan has become shorter. From March 5 to 10, ten projects with "TAO" in their names went live on Ethereum and appeared on the Dexscreener hot list.

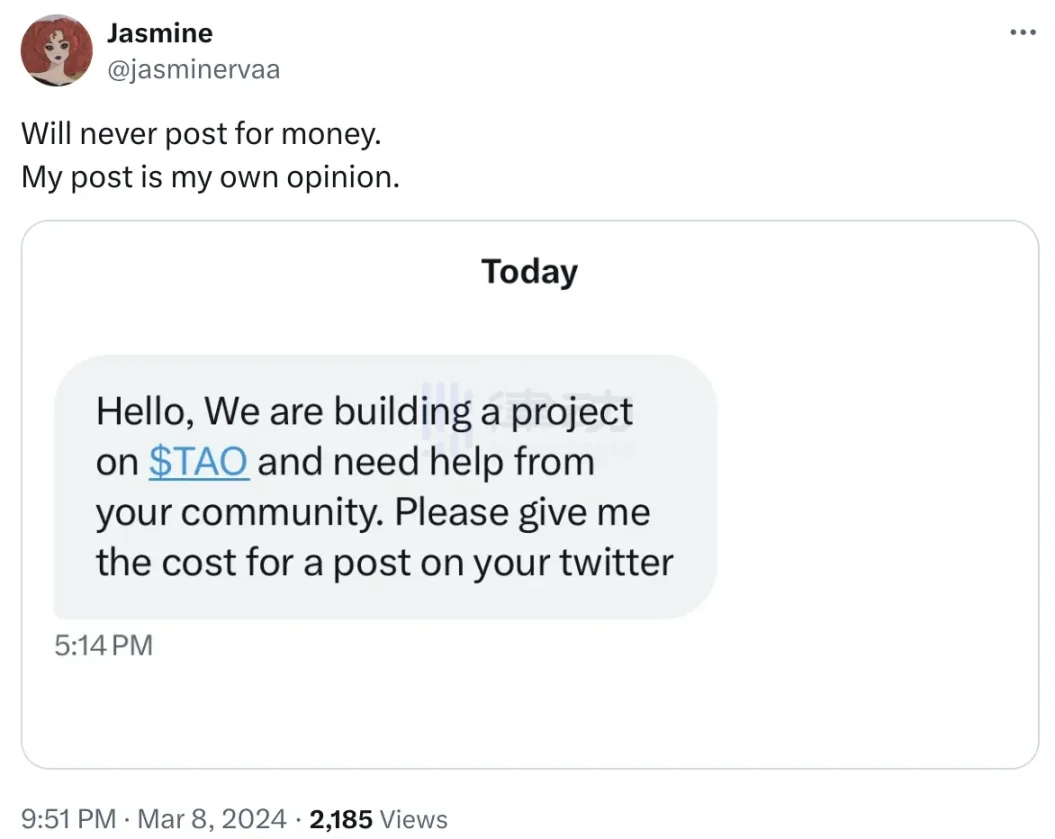

On March 5, the Dapp platform UNITAO, positioned in the Bittensor ecosystem, went live, with a 7-fold increase in 24 hours, and then dropped by 80% in the following week. TAOx had an even shorter life, with a 3-fold increase in four days, followed by a 90% drop in two days. After UNITAO and TAOx, eight Bittensor ecosystem projects emerged within four days, and most of these projects had a trading volume of less than 10 million. Tokens derived from "TAO" have experienced a transformation from potential value projects to riding the hot trend, and the trend of token prices is just the most direct reflection. Jasmine, a contributor to the Bittensor community ecosystem, once said that she had turned down offers to promote Bittensor-related projects.

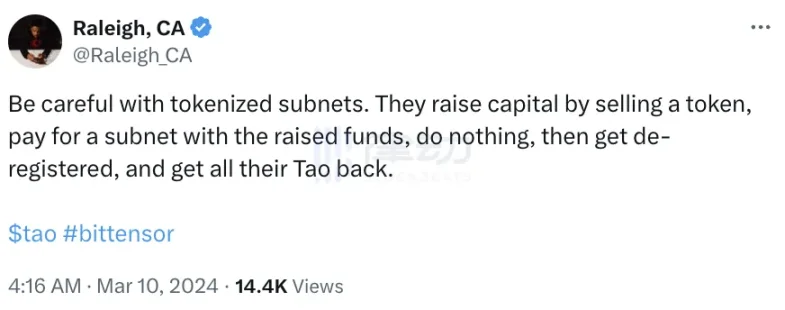

If they are all riding the hot trend, then for investors, is the grand and limitless potential of Bittensor only a branch of meme to buy into in the AI meme world? But unlike memes, "Don't touch Bittensor" is a more prudent choice when the trend is too high. Many people have realized this, "Be careful with tokenized subnets."

Bittensor ecosystem, limitless potential or unattainable heights?

As more similar projects emerge, the expectations for each project are also being diluted, and the lifespan of new projects is getting shorter. Moreover, after buying project tokens, regardless of whether they rise or fall, the team can receive transaction taxes, and the ultimate profit for holders depends on the integrity of the project team. In the past month, the emergence of project parties and investors has all relied on "proxy purchase/crowdfunding into Bittensor" to meet. Their goal is to participate in the Bittensor ecosystem and get a share of the $4 billion market value of the leading project in the AI sector.

For investors participating in these projects, after experiencing ups and downs, Bittensor may have gone from a "value halo" to a "cutting people's signboard." However, as the project stably holds the top position in the AI sector by market value, the potential value of Bittensor cannot be ignored. The contradiction arises largely from the difficulty of participating in the Bittensor ecosystem.

The Barrier of Liquidity

When it comes to supporting a project, the only things that can be done are to buy its tokens or participate in various gameplay within the project's ecosystem, but it seems that Bittensor does not welcome retail investors.

Currently, the ways for users to participate in the Bittensor ecosystem include: registering as a subnet, becoming a validator, becoming a miner, and buying TAO for staking. The first three can receive a daily allocation incentive of 7200 TAO from the Bittensor market, and only staking can yield a return of approximately 15% APY. To become one of the first three also requires staking TAO.

In terms of "holding TAO," it is not easy to purchase TAO, which is a non-EVM token. Bittensor is built on the Polkadot ecosystem, using its own independent Substrate-based L1 blockchain. Therefore, when conducting on-chain transactions, most mainstream wallets cannot purchase and hold TAO, and TAO can only be stored and managed through compatible wallets that support the Polkadot ecosystem.

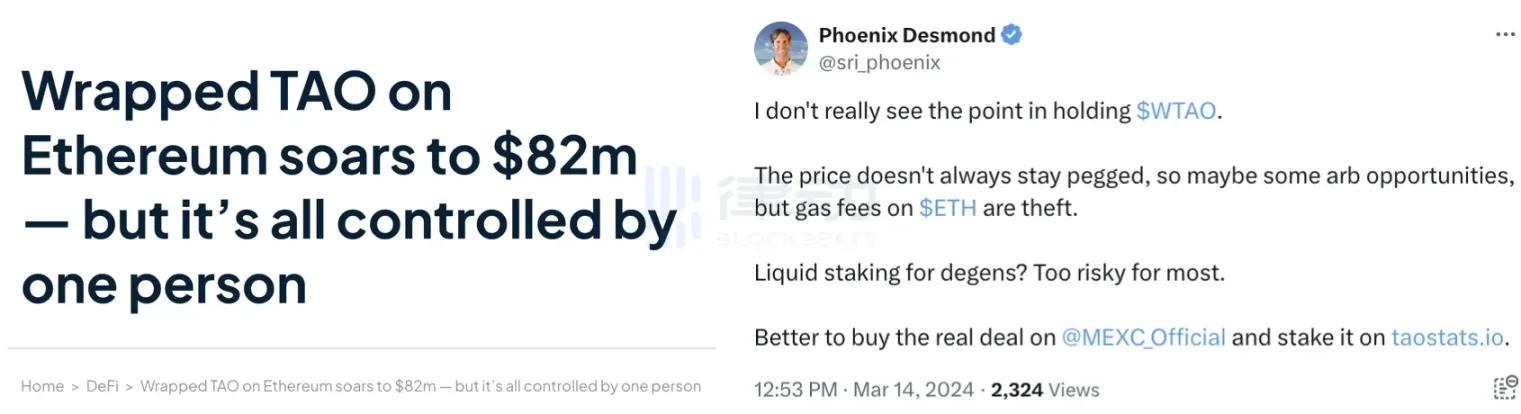

In addition, in recent months, the emergence of wTAO has largely solved the circulation and holding issues of TAO on Ethereum. However, according to dlnews, the developer behind Tao Bridge, which provides cross-chain services, is only one person known as CreativeBuilds, independent of Bittensor, and the project itself is closed source. In theory, holding wTAO carries the risk of the project team running away.

Subnet Universe and the "Bittensor War"

In October 2023, Bittensor passed the Revolution upgrade, marking an important milestone in the development of Bittensor. The Revolution upgrade introduced the concept of "Subnet," where anyone can create subnets specifically for certain types of applications and define their independent incentive mechanisms.

According to TAO's token economics, 7200 TAO (equivalent to approximately $5.04 million at $700 per TAO) will be mined daily, and this portion of TAO will be allocated by the ROOT network to 32 subnets and their miners and validators.

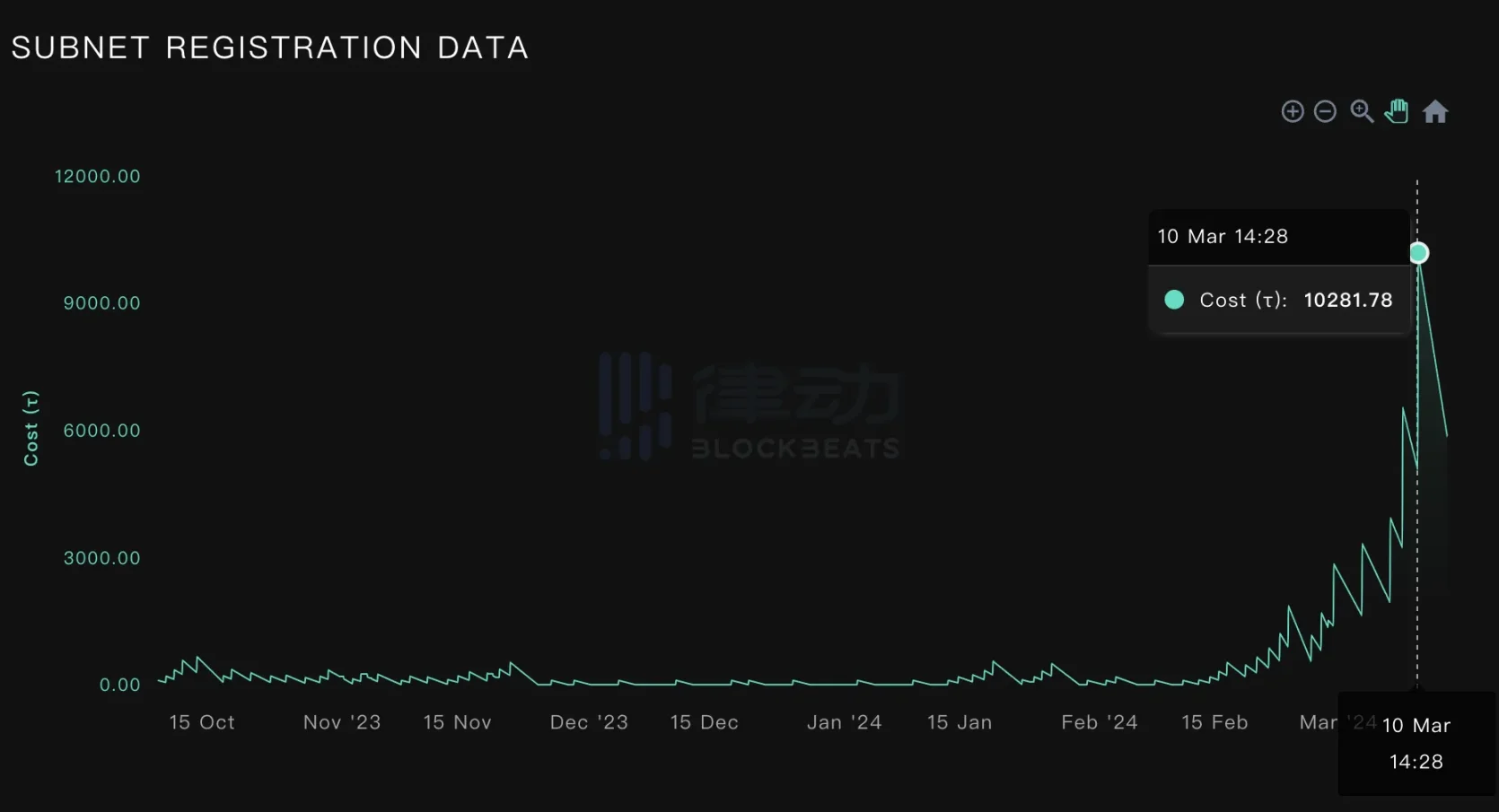

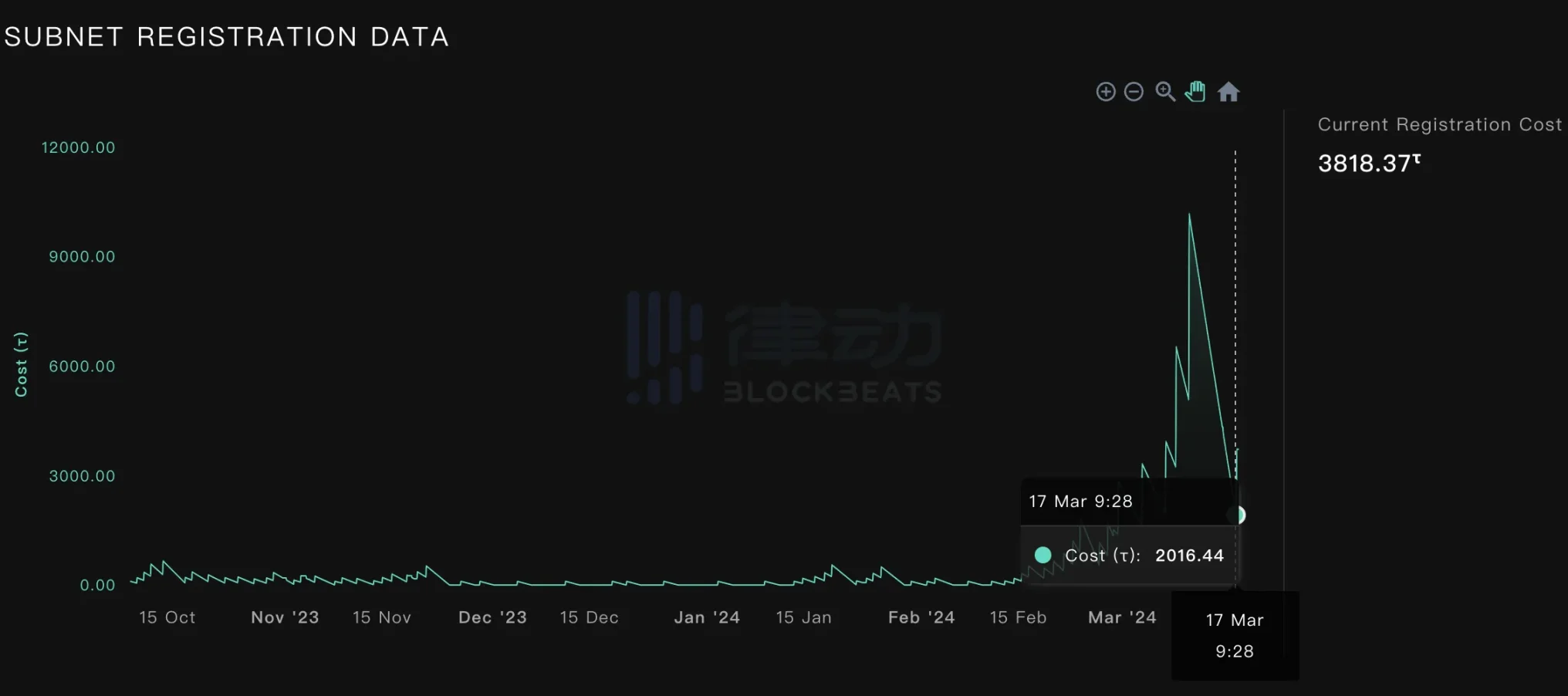

Competition for subnets on Bittensor is fierce. In January, the registration threshold for creating a subnet was less than 200 TAO. In the past three months, the cost of registering a subnet has skyrocketed, reaching 10,281 TAO on March 10, over $7 million. If we include the token's own price increase, the cost of registering a subnet has increased by a hundredfold in nearly three months.

Successfully registering a subnet does not guarantee a stable income. The rising cost of subnet registration means that there are more projects registering subnets. Once they have enough registration fees, these projects will release testnets and deploy and modulate their own incentive mechanisms on the test chain. Among the 32 subnets, new subnets will have a 7-day "protected immunity period." After seven days, the subnet with the lowest token allocation will face the risk of being deregistered and replaced by the testnet when the testnet meets the requirements.

To become a validator or miner, in addition to staking TAO, one must also follow the specific requirements and deployment process outlined by the chosen subnet on GitHub. Only the top 64 ranked validators in all subnets will be granted a validator license and marked as active participants.

The daily TAO rewards for validators and miners are based on their respective contributions and are determined by a fixed formula: INCENTIVE * (EMISSION * 0.41) + DIVIDENDS * (EMISSION * 0.41), where EMISSION represents the share of TAO minted by the subnet, and DIVIDENDS represents the percentage weight of all validators in the subnet. Of the total daily allocation, 82% is evenly distributed among validators and miners, and the remaining 18% belongs to the subnet owner.

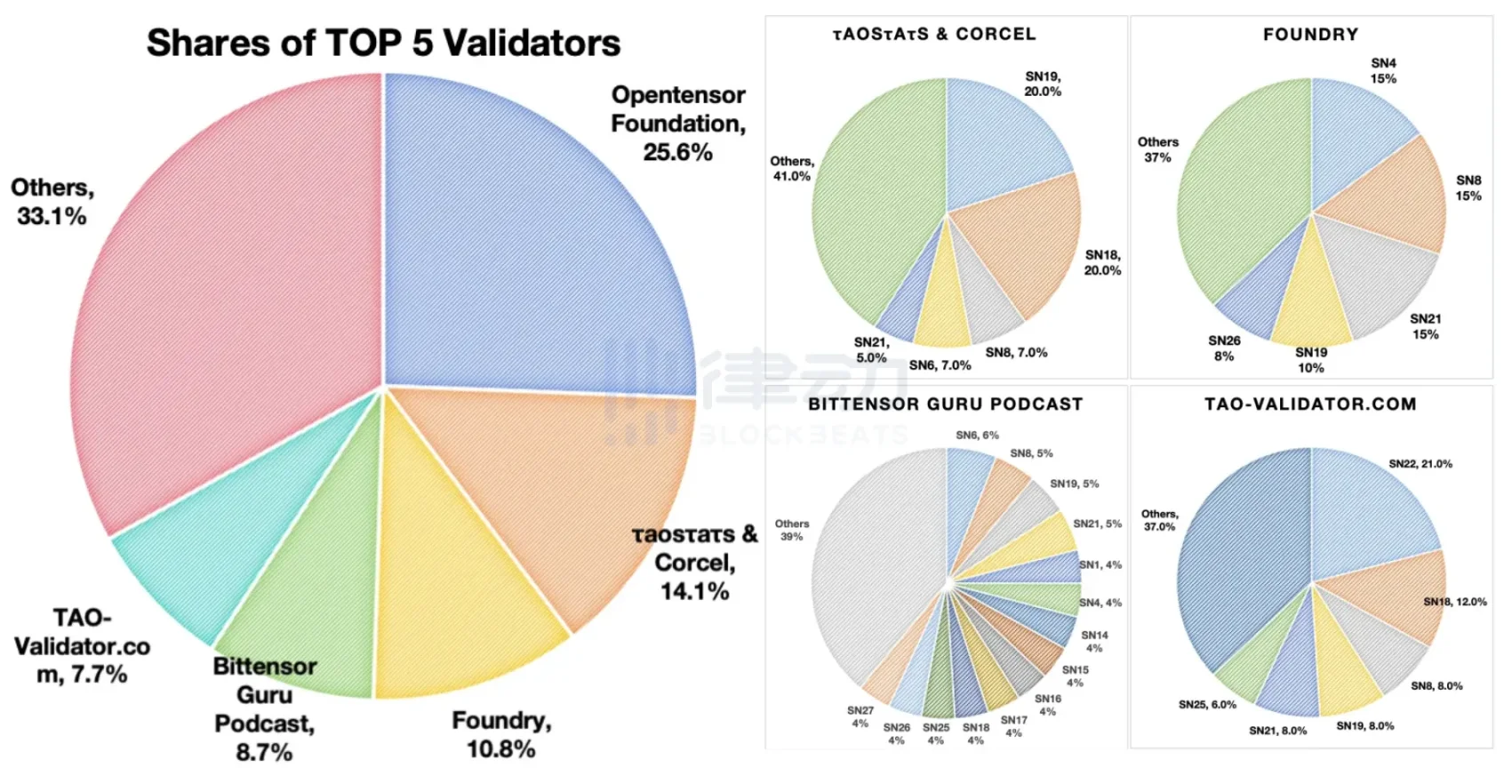

The Emission also has its own calculation formula, and its value is related to the validator's staked amount and the subnet score. According to research by the 0xai organization, the top 5 validators control over 65% of the staked TAO.

Source: 0xai, among the top five Validators, τaosτaτs & Corcel, Foundry, and TAO-Validator.com all show significant bias.

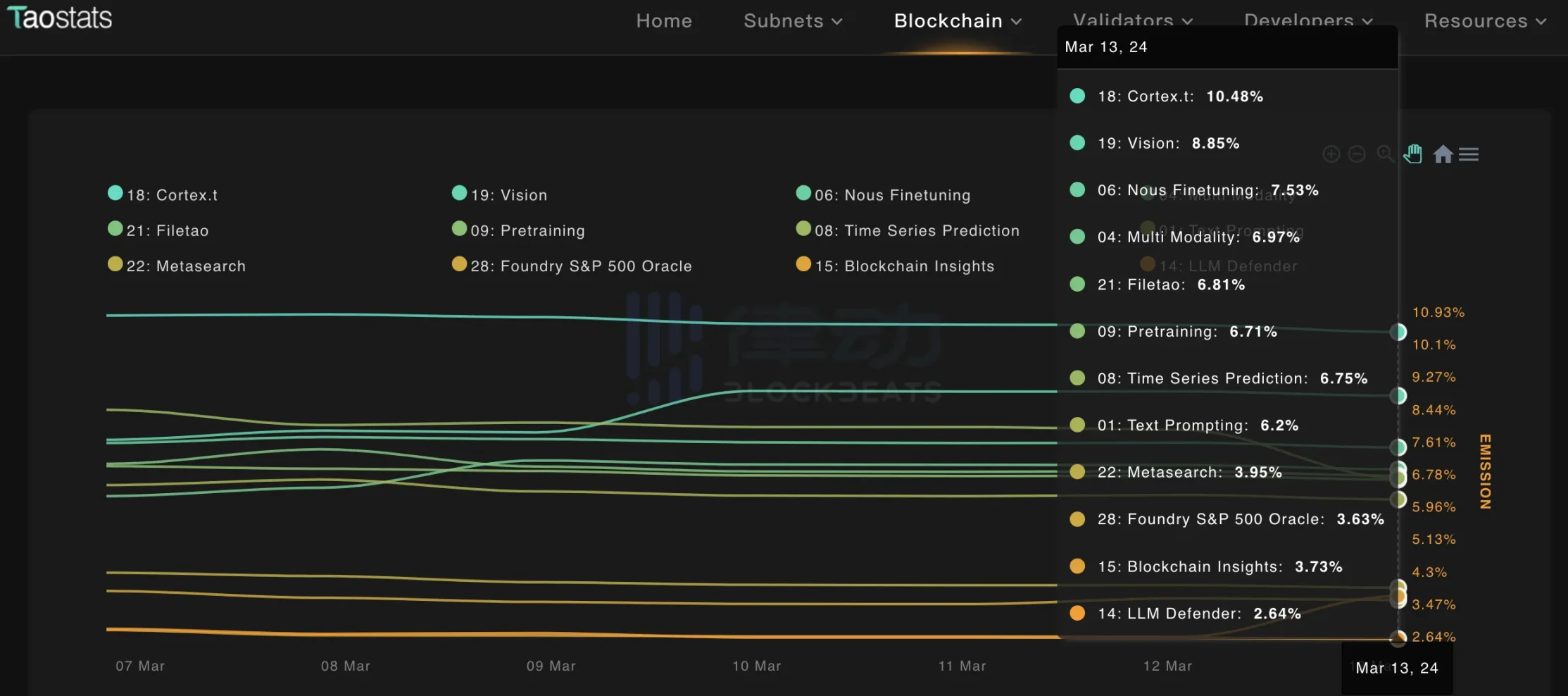

According to data from taosat, as of the time of writing, the subnet 18Cortex. has a stable share of around 10% of the daily emitted 7200 TAO, while the subnet 19 Vision has seen its share increase from 7.96% to 8.85% in the past week, and correspondingly, the incentives allocated to the subnet 08 Time Series Prediction have decreased from 8.49% to 6.75%.

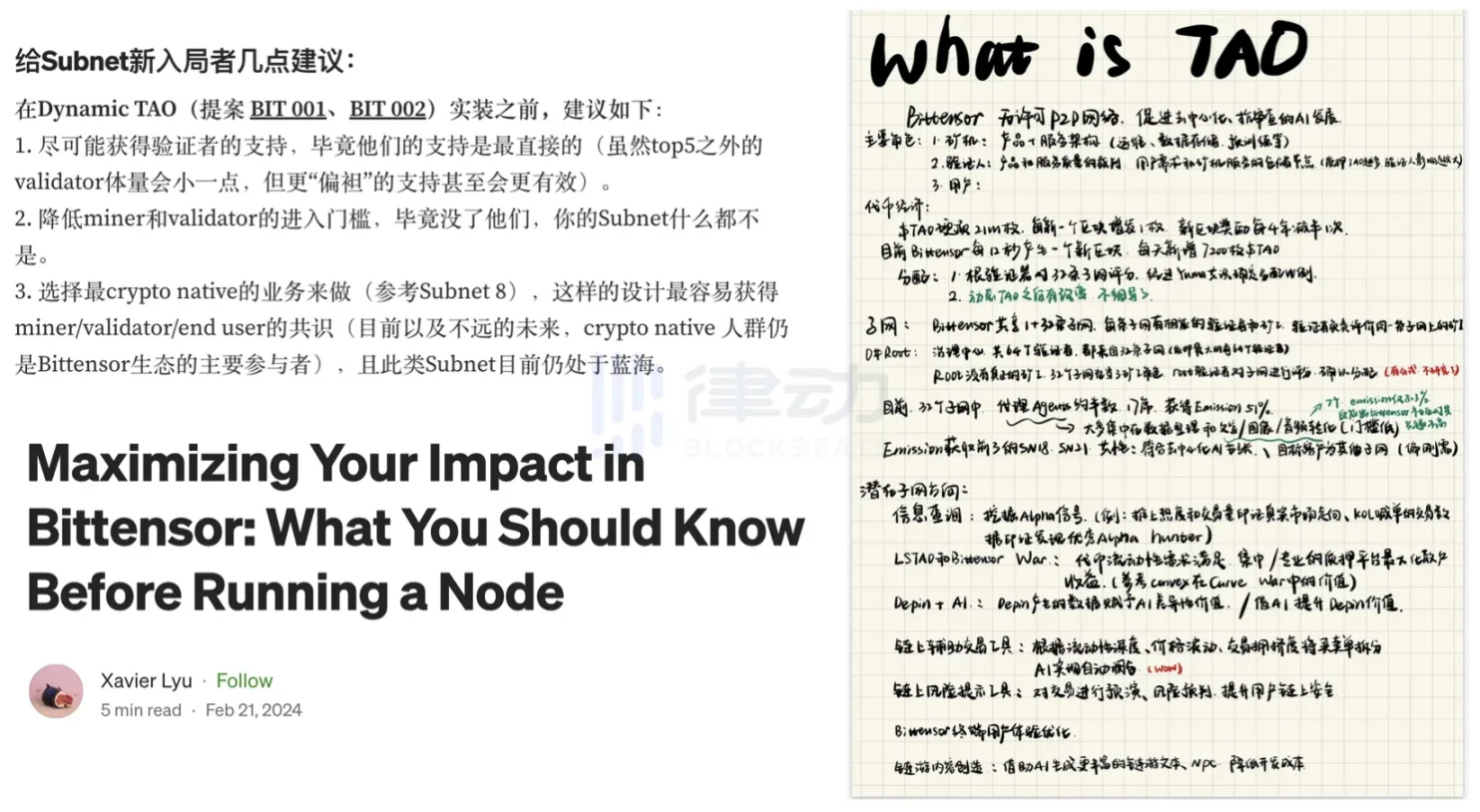

In the eyes of the Bittensor community, the high threshold for subnets and intense competition can drive the continuous development of the Bittensor ecosystem. There are many widely circulated "subnet strategies" on social platforms. As for the liquidity issue, the community believes that protocols that provide deployment nodes or staking will compete in user profit sharing, leading to the "Bittensor War."

Subnet strategies in the Bittensor community. Top left: @0xai_devi; Bottom left: @xavi3rlu; Right: @Richmelon8

Certainly, Bittensor has indeed attracted many participants focused on AI technology. Subnet 18Cortex comes from the open-source AI research organization Nous Research, and Subnet 9's performance is said to surpass OpenAI's GPT2 large model. Bittensor has received much recognition for empowering AI with Web3. Vitalik once used Bittensor as a case study to explain how to use cryptographic incentive mechanisms to create better AI products without relying entirely on cryptographic technology when analyzing the combination of AI and Crypto.

Vitalik mentioned Bittensor in his writing

However, at least for the present and the foreseeable future, the Web3 market is pursuing better capital utilization. Tom Shaughnessy of Delphi Ventures, when introducing Bittensor, stated, "I believe the key to the Bittensor system is how the demand for subnets translates into the demand for subnet tokens."

The "success" of Bittensor lies in its subnet mechanism. The closed ecosystem, intense competition, and high entry barriers can filter and bring together enough outstanding participants, with the potential to produce better models. In a sense, Bittensor has chosen a relatively practical path for the combination of AI and Crypto.

Many projects in the AI sector are currently being questioned for decentralization for the sake of decentralization. AI is a very cutting-edge field with high technological density, and traditional Web2 giants with strong resources are still thriving. What can Web3 achieve in terms of results?

The decentralized incentive market built by Bittensor, ideally, can allow teams dedicated to researching AI technology to receive sufficient material incentives based on their capabilities. Through the "AI Lego" approach, Bittensor has envisioned a product concept for "AI solving productivity, and Web3 solving production relations," and it is still operating normally.

However, the production and application of AI models take a long time to yield results, which is also why the crypto field has not been optimistic about AI x crypto in previous years. For the crypto market that seeks capital efficiency, attracting liquidity is more important. The Bittensor ecosystem often makes Web3 natives feel "difficult to understand," with settings such as miners and validators, staking mechanisms, and the TAO token designed to attract more AI developers to ideally produce better AI models and products. There are many different subnets in the Bittensor ecosystem, but the progress of subnets often only concerns validators and miners. Investors who hold TAO but are not familiar with AI products seem to only be able to imagine the future of Bittensor in a "mysterious and impressive" way.

The previously mentioned "Dogecoin projects" were hyped up by retail investors who were keen on Bittensor but didn't know where to start. After the hype died down, has Bittensor become closer to the crypto community?

Where are the opportunities for TAO?

Firstly, regarding the future growth space for TAO, "believers" of Bittensor and community observers have completely different understandings. On one hand, observers believe that its price has surged 15 times in the past six months, and its market value has reached $4 billion, with limited upside potential. However, the Bittensor community believes that 87% of the circulating TAO is currently staked, meaning that the actual circulating supply only accounts for a small portion of the current market value, indicating that there is still significant growth potential for TAO.

Additionally, the attractiveness of Bittensor cannot be denied. If one still wants to find quick and high returns in the Bittensor ecosystem, looking for projects related to the Bittensor ecosystem that can directly issue tokens is still a viable option. Although "having a big name guarantees success" is no longer possible, new gameplay and marketing methods will still attract attention.

For example, the project Tao Ceti (ceti), which went live on March 11, was endorsed by the founder on the day of its launch, and its founder, Dennis Jarvis, is the former CEO of Bitcoin.com. Despite the project's website not yet having an introduction and token economics, ceti still achieved a surprising 15-fold increase in the first three days after launch.

On the other hand, Bittensor has also made efforts to improve its ecosystem. In January, the Bittensor Foundation Opentensor Foundation submitted a network upgrade proposal called Dynamic TAO (BIT001), which improved the staking mechanism and TAO block reward distribution rules of the Bittensor network, enhancing the power of TAO holders to participate in Bittensor block reward distribution. Most importantly, this proposal introduced the "dual-token mechanism."

According to Taonews, the dual-token mechanism means that after the proposal is passed, the tokens in the Bittensor ecosystem will include TAO and new subnet tokens, and TAO and subnet tokens can be traded. The value of subnets will no longer be solely related to validators and miners, embracing market factors, which also means lowering the barrier for "speculative" behavior. The Bittensor ecosystem will be more dynamic, but also more complex.

As of the time of writing, the B1T1 proposal is still in the discussion stage. This weekend, the subnet registration threshold of Bittensor dropped from 10,281 TAO to a minimum of 2016 TAO. Each time a project registers a subnet, the registration cost doubles, and if no one registers, the price will halve linearly within four days. This seems to indicate a slight easing of the subnet competition in the Bittensor ecosystem.

The Opentensor Foundation announced on social media the release of the Bittensor roadmap this Thursday. The NVIDIA conference is currently underway, and a new wave of AI hype is also on the way. Several projects are gearing up, and only time will tell what role Bittensor will play in it.

References:

"Wrapped TAO on Ethereum soars to $82m—but it's all controlled by one person," by Tim Craig, Ryan Celaj

"Maximizing Your Impact in Bittensor: What You Should Know Before Running a Node," by Xavier Lyu

"Bittensor's New Tokenecon Empowers Subnet AI Competition," by Tom Shaughnessy, Guest Author (Delphi Ventures)

"BIT1 Unveiled: Steering Bittensor Towards a Revolutionary Dual-Token Ecosystem," by tao.news

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。