Author: Biteye, Core Contributor Viee

The full text is about 3500 words, with an estimated reading time of 8 minutes.

According to DeFiLlama data, the trading volume of BSC DEX surpassed that of Ethereum DEX on March 10, winning the top spot.

At the same time, the price of BNB has increased by nearly 30% in the past week, and the trading volume has also significantly increased. Its performance since 2024 has been better than tokens of the same type, with the highest increase among exchange tokens and leading among native tokens of public chains.

As the native token of Binance Exchange and the fuel token of BNB Chain, such high popularity naturally sparked bullish sentiment in the market for BNB.

Why is BNB token considered the golden shovel of this bull market? What wealth secrets does this rise contain? Next, we will explore the huge potential and opportunities of BNB tokens.

Recent Increase in BNB

Recently, the price of BNB has surged again, breaking through 630 USDT in a short time, reaching a new high since December 2, 2021.

How strong is the upward trend of BNB? Since early March, it has risen by 50%, and the increase in the past 30 days has exceeded 80%.

Looking back at the last bull market, BNB once reached a historical high of 690.93 USDT, and then experienced price fluctuations between 2022 and 2023, maintaining a level of around 200-400 USDT. Currently, it is only 9% away from its all-time high.

This upward momentum implies that the market's concerns about the Binance regulatory events have decreased, and BNB has shown strong resilience after the turmoil, to a certain extent, rebuilding confidence.

In addition, Binance Launchpool (new coin mining) has also provided a key driving force for the rise of BNB.

Binance Launchpool

Binance Launchpool is a service provided by Binance Exchange, allowing users to obtain token rewards for new projects by staking cryptocurrencies. This section is also known as new coin mining.

This process is somewhat similar to staking mining, except that the mined tokens cannot be traded immediately, and may include high-quality potential projects. In other words, the exchange allows users to participate in upcoming new coins at a relatively low cost and risk.

There are various explanations for the rapid rise in BNB prices, and Binance Launchpool is an indispensable part. The mining rules are simple: users stake BNB and FDUSD to participate in mining and obtain new coin rewards. This empowers BNB through Binance Launchpool, directly impacting the core of the price increase.

For example, the launch of the on-chain derivatives exchange AEVO on March 6 brought significant momentum to the price of BNB.

In less than a week, BNB rose from 400 USDT to 500 USDT, attracting the attention and participation of a large number of investors.

Looking back, Binance has frequently launched 7 Launchpool projects in the first quarter, with the number of participants ranging from tens of thousands to hundreds of thousands. With such a large influx of demand, the price of BNB naturally continues to rise.

Launchpool Yield: Higher Returns for BNB

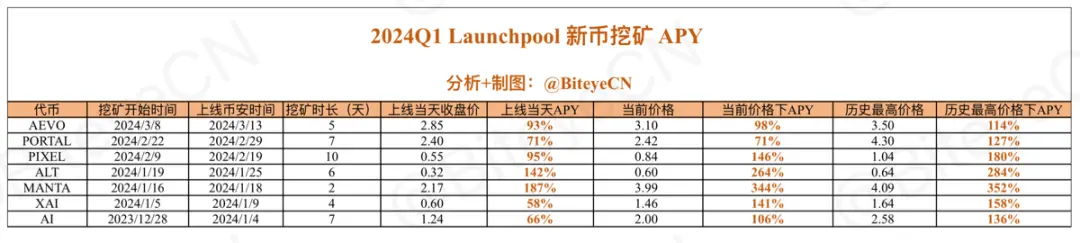

Currently, the staking currencies used in Launchpool to mine new tokens are BNB and mainstream stablecoins. Based on the staking data officially announced by Binance, Biteye calculated the annualized yield of the complete mining cycle of projects launched this quarter.

1) Participating in Launchpool is a relatively safe and high-yield mining method.

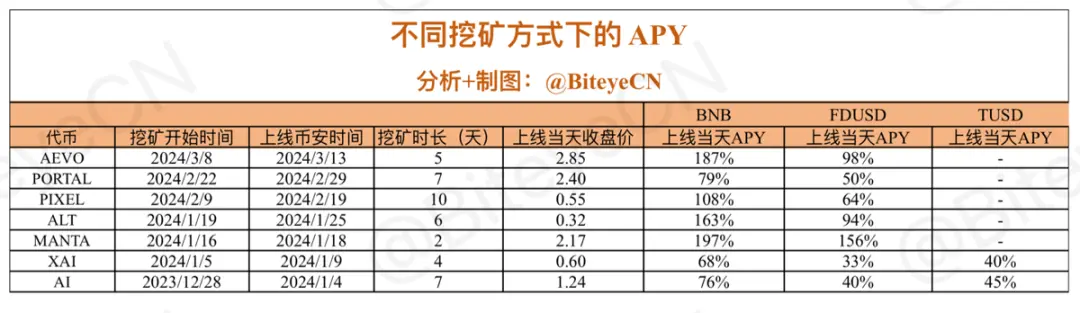

2) The mining yield of BNB is much higher than the other two stablecoins, almost equivalent to the sum of the two. Binance Launchpool can be said to be a "secure and high-yield financial lottery" tailored for BNB holders.

Why is this? Let's take a look at the historical performance yield of Launchpool below.

1) APY of new coin mining in Launchpool from 2024 Q1 to present

2) Comparison of mining yield using different tokens

Note: The reference time for the current price is March 13, 19:00 (UTC+8)

- Looking at the mining APY of the past 7 periods of Launchpool, the average yield brought by the performance on the day of the launch exceeds 100%, and the highest yield of MANTA reaches 186.92%.

If you gamble based on the historical highest price, the APY will double. And due to the generally short mining time, it greatly reduces the time users' funds are tied up. Therefore, participating in Launchpool can be considered a relatively safe and high-yield mining method.

- From the overall increase ratio above, the recent new coins launched on Binance Launchpool have almost all seen an increase ratio of around 200%, and the price of XAI was close to three times the closing price on the day of listing.

From the listed coins, it can be seen that there are many high-quality projects, which is also one of the important reasons for the subsequent rise in coin prices.

Most of the high-quality projects are issued through Launchpool, such as the highly anticipated on-chain derivatives trading platform AEVO, the dark horse in the chain game track Pixel, and the newcomer in the L3 game track Xai, all of which have very good fundamentals and a strong user base, and are also coins with potential for future development.

It can be said that the returns of new coin projects listed on Binance are all good.

- By comparing the mining yield of the three methods and calculating the yield brought by the performance on the day of listing, the mining yield of BNB is much higher than the other two stablecoins, almost equivalent to the sum of the two.

Imagine that when you hold 100 BNB during a bull market and stake it in the pool for mining with minimal operation, you will earn 1000u in 5-7 days, a solid gold shovel in a bull market.

Platform Development

BNB has the dual concept of "platform token + public chain token," and its value mainly depends on the fundamental situation of the exchange behind it, as the saying goes, "a good tree makes good shade."

This also conforms to a basic rule: the development of the platform directly affects the market performance of its token.

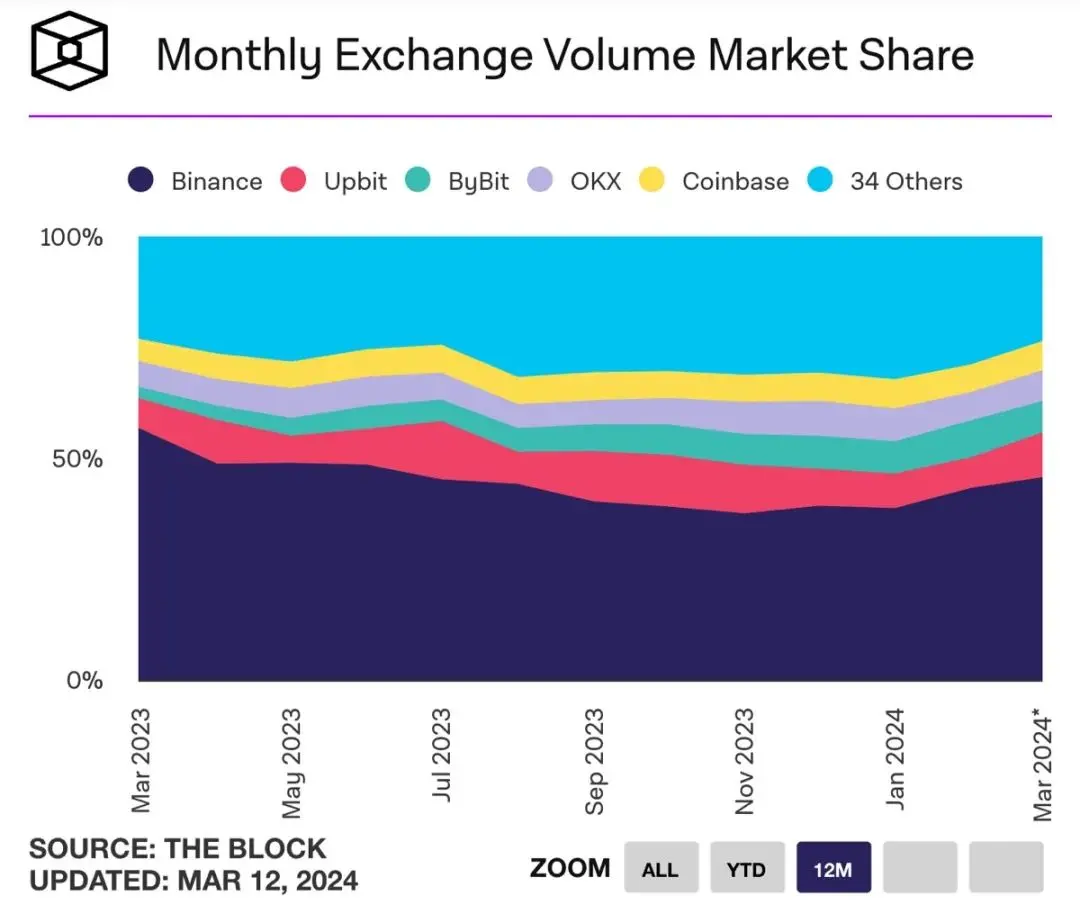

Market Share

From the performance of market share, despite the impact of recent events such as the FTX incident, Binance's market share has remained stable at around 50%, maintaining its position as the "top exchange."

As can be seen from the chart below, Binance's market share has been steadily increasing since Q1. In 2023, Binance attracted over 40 million new users, accumulating a total of 170 million registered users, an increase of nearly 30% from the end of the previous year.

Business Aspect

So, from a business perspective, what kind of empowerment can Binance, behind BNB, bring to it?

The answer is, the ceiling is high, and the imagination is great. Binance, as the world's largest cryptocurrency exchange, has not been limited to its own trading business in recent years, but has been striving to build a comprehensive cryptocurrency ecosystem.

First, Binance's investment at the exchange level can be described as "holding user needs in the palm of its hand," including upgrading Binance Square to retain more creators and active users. In the past year, the number of creators on Binance Square has increased from 1,200 to over 11,000, and the number of daily active users has increased from less than 700,000 to over 1.6 million.

High-frequency Launchpool projects allow users to achieve returns that surpass most financial products, leveraging the brand effect to benefit users and increase loyalty in a mutually beneficial way.

The introduction of copy trading functionality in October last year resulted in a weekly average trading volume of over $2 billion in three months, gradually resembling a social trading platform.

Recently, Binance has launched Futures NEXT, allowing users to earn rewards by predicting tokens to be listed on Binance contracts. The NEXT Pool showcases a curated collection of potential listing tokens nominated by users.

Notably, in November last year, Binance introduced the Web3 wallet in its app, making it easier for users to switch between CeFi and DeFi without the need for cumbersome registration, just a simple one-click operation.

This update not only effectively lowers the entry barrier for new users into the Web3 ecosystem but also makes it more convenient for existing users to engage in on-chain operations.

In response to the strong user demand, Pionex officially launched the Binance Web3 wallet on February 1.

The most recent update on March 15 saw the completion of the integration of the Solana network into the Web3 wallet, allowing users to easily manage and trade Solana network tokens and access various dApps.

Undoubtedly, the exchange always occupies a core position in the Binance ecosystem, and Binance Labs, as the investment and incubation arm, plays a pivotal role.

Binance Labs, leveraging industry-leading resources and funding advantages, supports outstanding projects to accelerate their development, easing their burden of listing and liquidity building. This strategy has not only attracted high-quality projects and teams but also brought more users to Binance, achieving mutual benefits and driving the prosperity of the entire ecosystem.

In the past year, Binance Labs has mainly focused on the Web3 gaming, DeFi ecosystem, and ZKP (Zero-Knowledge Proof) fields, contributing numerous application scenarios and business models, providing users with more diverse product options.

In addition to the above sectors, it is well known that Binance's ecosystem expansion has also extended to public chains, forming a CeFi+DeFi closed loop.

BNB Chain has evolved into a comprehensive DeFi system with multiple chains, integrating computing, storage, and Layer 2 technology.

It is not just a single chain but a comprehensive "all-in-one" multi-chain development, becoming an undeniable presence in the DeFi field.

Based on the thriving BNB Smart Chain and the decentralized storage platform of BNB Greenfield, BNB Chain's ecosystem has seen significant gains.

At the same time, the introduction of low-cost trading opBNB based on Optimism technology has filled the gap in Layer 2, further significantly reducing the already low gas fees of BNB Smart Chain.

The BNB Chain 2023 Annual Report indicates that the daily active users surpassed 1 million in the past year, experiencing a substantial increase. On March 10, the trading volume of BSC DEX reached $24.74 billion, ranking first.

The daily trading volume of Ethereum DEX was $20.38 billion, ranking second, and the daily trading volume of Solana DEX was $13.61 billion, ranking third.

In the past quarter, BNB Chain has undergone updates in multiple directions:

Cheaper: The official plan is to double the speed of opBNB transactions and reduce gas fees by 10 times.

More comprehensive: The introduction of the One BNB concept aims to integrate BSC, opBNB, and Greenfield into a cohesive ecosystem, ensuring seamless interaction between decentralized computing and storage solutions.

More airdrops: On March 13, BNB Chain launched the "Airdrop Alliance Plan," issuing retroactive airdrops to BSC and opBNB users, aiming to reward the community for its support of BNB Chain, indicating the vigorous development of the on-chain ecosystem. As the current quarterly burn is tied to the total number of blocks produced by BNB Chain, the more active the on-chain ecosystem, the more anticipated the price increase.

It is foreseeable that a thriving multi-chain system will further become a significant force in the DeFi public chain.

Conclusion

In the Web3 field, Binance's business scope has expanded over the years, covering various aspects: from core exchange functions to cloud services, PoW mining pools, staking services, financial and payment solutions, and investment and incubation activities around Binance Labs.

At the same time, in the DeFi field, with the strong capabilities of BNB Chain, Binance has achieved coverage in almost every important area.

In conclusion, as the only vehicle in the Binance ecosystem for capturing value outside the platform token category, BNB, as the golden shovel, has also gained the imagination of the public chain coin ecosystem, reaping the dividends of Binance and BNB Chain development, with significant long-term value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。