Author: SHANE NEAGLE

Translation: Luccy, Frost, BlockBeats

Editor's note:

As of March 14th, according to Farside Investors data, the cumulative net inflow of Bitcoin spot ETFs since their launch has reached 118.288 billion US dollars. Among them, IBIT has accumulated a net inflow of 120.278 billion US dollars; FBTC has accumulated a net inflow of 67.033 billion US dollars; GBTC has accumulated a net outflow of 114.026 billion US dollars.

In this bull market triggered by ETFs, the inflow of ETFs constantly affects the price trend of cryptocurrencies. In response to this, Shane Neagle, the editor-in-chief of The Tokenist, pointed out that higher trading volume generates higher liquidity, which can smooth out price fluctuations. In addition, from the perspectives of fund inflows and historical background, after 15 years of questioning and scrutiny, the credibility of Bitcoin has reached its peak and may become a safe-haven asset to replace gold. The original text is translated by BlockBeats as follows:

The approval of eleven Bitcoin ETFs has added new legitimacy to this groundbreaking cryptocurrency. With official recognition from the SEC, the barriers to institutional investment have been eliminated.

With this obstacle removed, financial advisors, mutual funds, pension funds, insurance companies, and retail investors can now easily gain exposure to Bitcoin without the need for direct custody. More importantly, the negative impressions of Bitcoin as "tulip mania," "poison," or "money laundering indicator" have been washed away.

Following an unprecedented bankruptcy wave in the cryptocurrency market in 2022, the price of Bitcoin returned to the level of $157,000 at the end of the year, equivalent to the level in November 2020. After the large-scale panic selling, Bitcoin gradually recovered in 2023 and reached the level of $45,000 at the beginning of 2024, which was first reached in February 2021.

With the fourth Bitcoin halving scheduled for April and the ETF setting new market dynamics, what can Bitcoin investors expect? To determine this, one must understand how Bitcoin ETFs have increased Bitcoin's trading volume and effectively stabilized its price fluctuations.

Understanding Bitcoin ETFs and Market Dynamics

Bitcoin itself symbolizes the democratization of currency. Unconstrained by central authorities such as the Federal Reserve System, Bitcoin ensures its limited supply of 21 million tokens cannot be tampered with through its decentralized mining network and currency policy determined by algorithms.

For Bitcoin (BTC) investors, this means they have access to an asset that does not naturally depreciate, in stark contrast to all existing fiat currencies in the world. This forms the basis of Bitcoin's value proposition.

ETFs provide another democratic avenue. The purpose of an ETF is to track asset prices, represented by shares, and unlike actively managed mutual funds, can be traded around the clock. The passive price tracking of ETFs ensures lower costs, making it an easily accessible investment tool.

Of course, custodians of Bitcoin, such as Coinbase, need to take sufficient cloud security measures to enhance investor confidence.

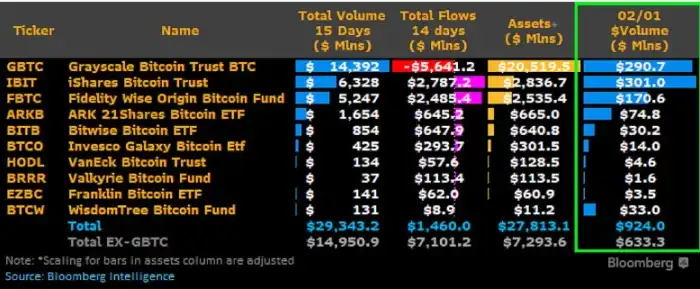

In the ETF space, Bitcoin ETFs have demonstrated a high demand for a decentralized asset resistant to dilution of centralization. In the past 15 days, they have generated a total trading volume of $293 billion, while selling pressure from the Grayscale Bitcoin Trust Fund (GBTC) reached $149 billion.

Image source: James Seyffart, Bloomberg Intelligence

This is not surprising. As the hype around Bitcoin ETFs drives up the price of Bitcoin, 88% of Bitcoin holders entered the profit zone in December 2023, eventually reaching 90% in February. As a result, GBTC investors began to cash out, exerting a selling pressure of $5.6 billion on the price of Bitcoin.

Furthermore, GBTC investors took advantage of the lower fees of newly approved Bitcoin ETFs to transfer funds out of GBTC's relatively high 1.50% fee rate. Ultimately, BlackRock's iShares Bitcoin Trust (IBIT) with a 0.12% fee rate became the winner in trading volume, which will increase to 0.25% after a 12-month exemption period.

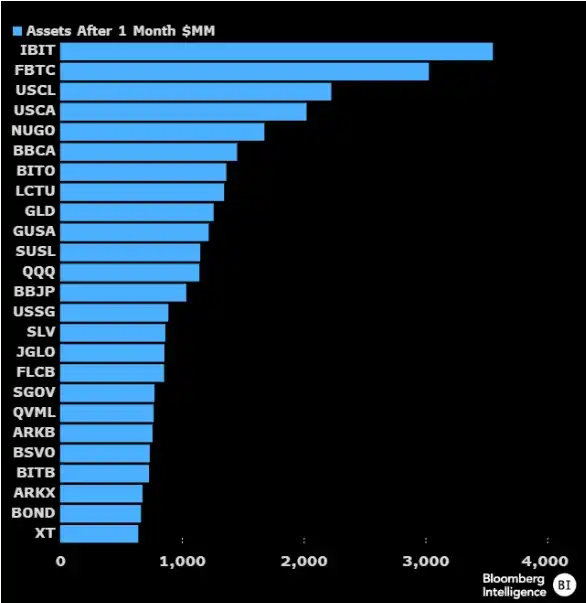

Placed in the broader context of the ETF space, IBIT and FBTC exceeded the iShares ESG Aware and Transition MSCI USA ETF (USCL) launched in June 2023 in terms of trading volume within a month.

Image source: Eric Balchunas, Bloomberg Intelligence

Given Bitcoin's history of attacks from the sustainability direction, this is particularly noteworthy. It is worth noting that due to environmental concerns, in May 2021, Elon Musk's tweet stating that Tesla would no longer accept Bitcoin payments led to a 12% drop in the price of Bitcoin.

According to Morningstar reports, in January, IBIT and FBTC ranked 8th and 10th in terms of net asset inflows among ETFs, with the top two spots being held by the iShares Core S&P 500 ETF (IVV). Approximately 10,000 Bitcoins flow into ETFs every day, indicating a significant demand for approximately 900 Bitcoins per day.

Looking ahead, with the weakening outflow pressure of GBTC funds and increasing inflow trends, the trend of funds flowing into Bitcoin ETFs stabilizing the price of BTC has taken shape.

Stability Mechanism

With 90% of Bitcoin holders entering the profit zone, the highest level since October 2021, selling pressure may come from many sources, including institutions, miners, and retail investors. The upward trend in the inflow of Bitcoin ETF funds serves as a defensive barrier against this, especially as another hype event, the upcoming fourth Bitcoin halving, approaches.

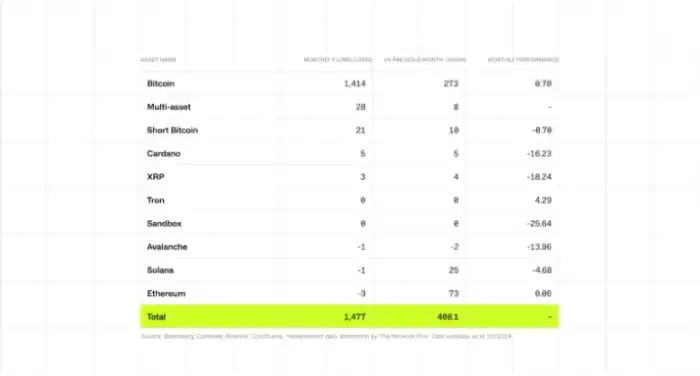

Higher trading volume generates higher liquidity, smoothing out price fluctuations. This is because larger trades between buyers and sellers can absorb temporary imbalances. In January, CoinShares' report showed that Bitcoin inflows reached $1.4 billion, compared to $7.2 billion from newly issued US funds, while outflows from GBTC reached $5.6 billion.

The total inflow of Bitcoin is $1.4 billion, accounting for 96% of the total inflow in the United States. Image source: CoinShares

At the same time, large financial institutions are setting new liquidity benchmarks. As of February 6th, Fidelity Canada established a 1% Bitcoin allocation in its All-in-One Conservative ETF fund. Given its "conservative" name, this indicates that non-conservative funds in the future will have a higher proportion of Bitcoin allocation.

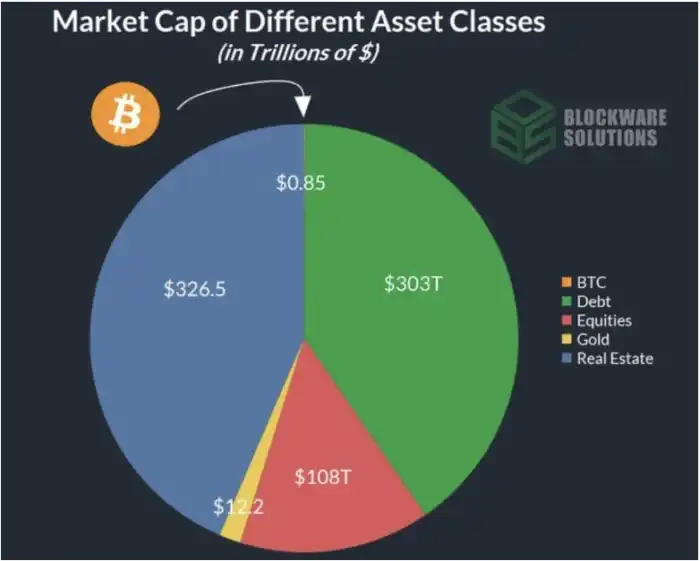

Ultimately, if Bitcoin occupies 1% of the $749.2 trillion in various asset classes, Bitcoin's market value could grow to $74 trillion, pushing the price of Bitcoin to $400,000.

Bitcoin's current market value is in the range of $85 billion to $90 billion. Image source: Blockware Solutions

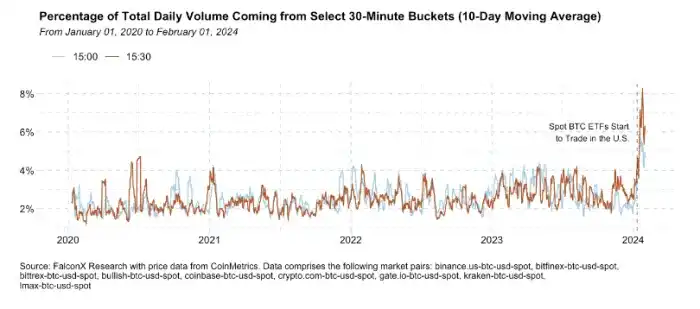

Given that Bitcoin ETFs provide a consistent and transparent market price reference point, large-scale transactions have reduced the potential impact of miner selling on the market, according to FalconX research. The daily total volume has significantly increased, rising from an average of 5% to the range of 10% to 13%.

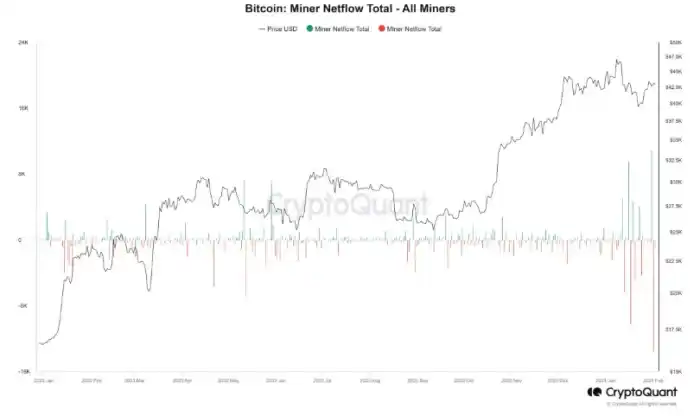

In other words, the new market system triggered by Bitcoin ETFs is reducing overall market volatility. So far, Bitcoin miners have been a major price-suppressing factor on the liquidity side of the equation. In Bitfinex's latest weekly on-chain report, miner wallets were responsible for the outflow of 10,200 Bitcoins.

This is consistent with the approximately 10,000 Bitcoins flowing into Bitcoin ETFs, leading to a relatively stable price level. Another potential stabilizing mechanism is options, as miners reinvest and upgrade mining equipment ahead of the fourth halving.

Although the US SEC has not yet approved options on Bitcoin ETFs for spot trading, this development will further enhance the liquidity of ETFs. After all, a wider range of hedging investment strategies will increase bilateral liquidity in trading.

As a forward-looking indicator, implied volatility in options trading can measure market sentiment. But with the launch of BTC ETFs, we will inevitably see a more mature market and are more likely to see more stable pricing of options and derivative contracts.

Analysis of Fund Inflows and Market Sentiment

As of February 9, 2024, the Grayscale Bitcoin Trust ETF (GBTC) holds 468,786 BTC. Last week, the price of BTC rose by 8.6% to $46,200. Consistent with previous predictions, this suggests that BTC selling may spread across multiple rebounds after the fourth halving.

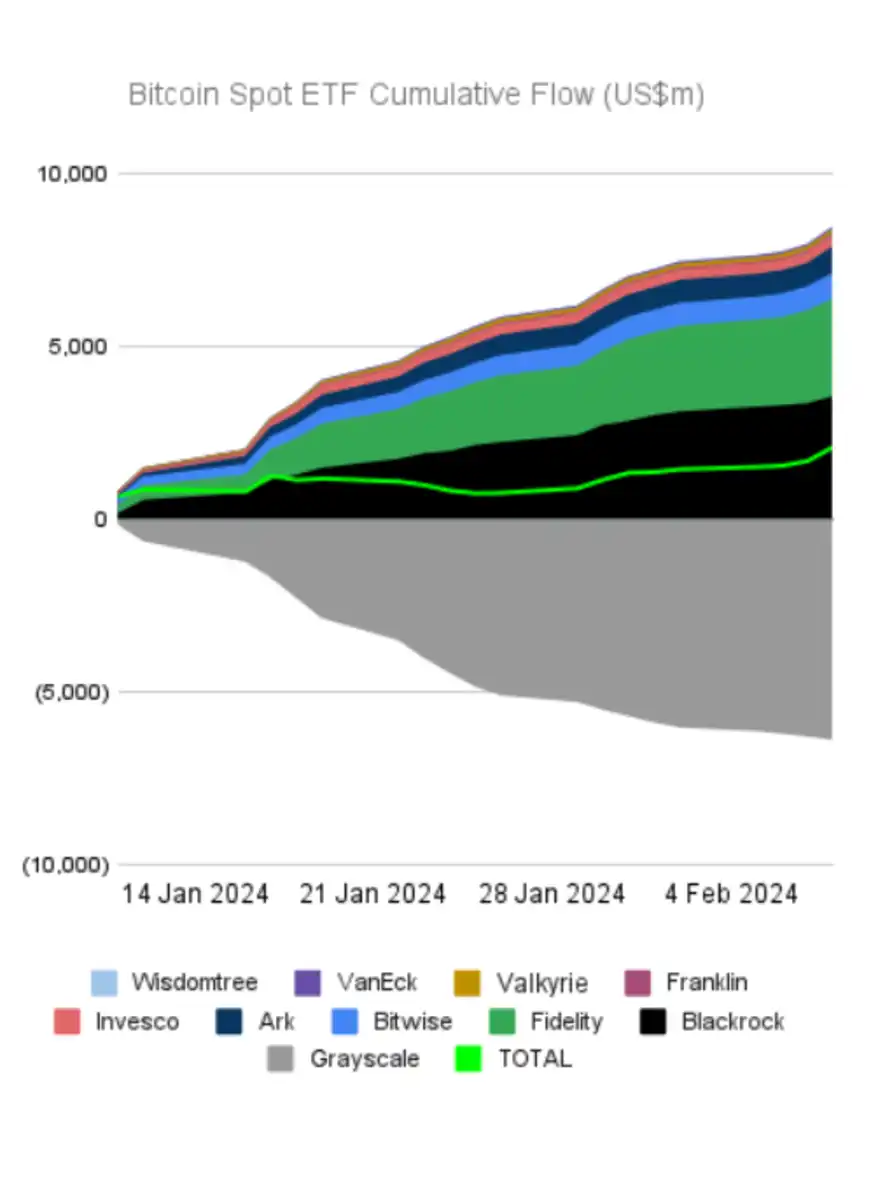

According to the latest data provided by Farside Investors, as of February 8, 2024, Bitcoin ETFs have accumulated inflows of $403 million, totaling $2.1 billion, while the total outflow of GBTC is $6.3 billion.

Image source: Farside Investors

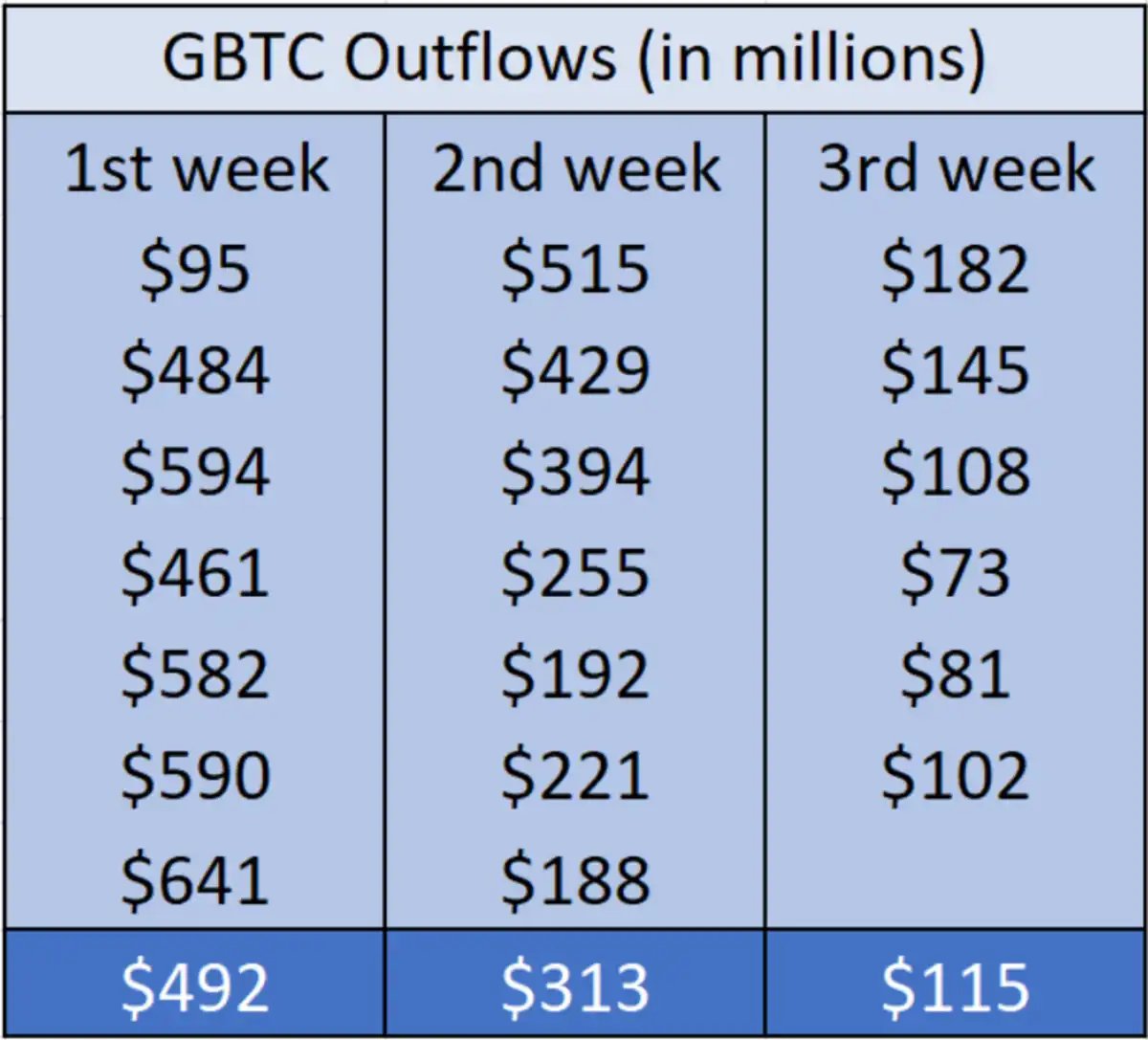

From January 11, 2024, to February 8, 2024, the outflow of GBTC gradually decreased. In the first week, their average outflow was $492 million. In the second week, the average outflow of GBTC was $313 million, and in the third week, the average outflow was $115 million.

Image source: Bitcoin Magazine

On a weekly basis, this means that the selling pressure decreased by 36% from the first week to the second week and by 63% from the second week to the third week.

As of February 9, 2024, with the unfolding of GBTC FUD, the cryptocurrency fear and greed index reached 72, rising to the "greed" level. Looking back to January 12, 2024, on the second day of the approval of Bitcoin ETFs, the fear and greed index was 71.

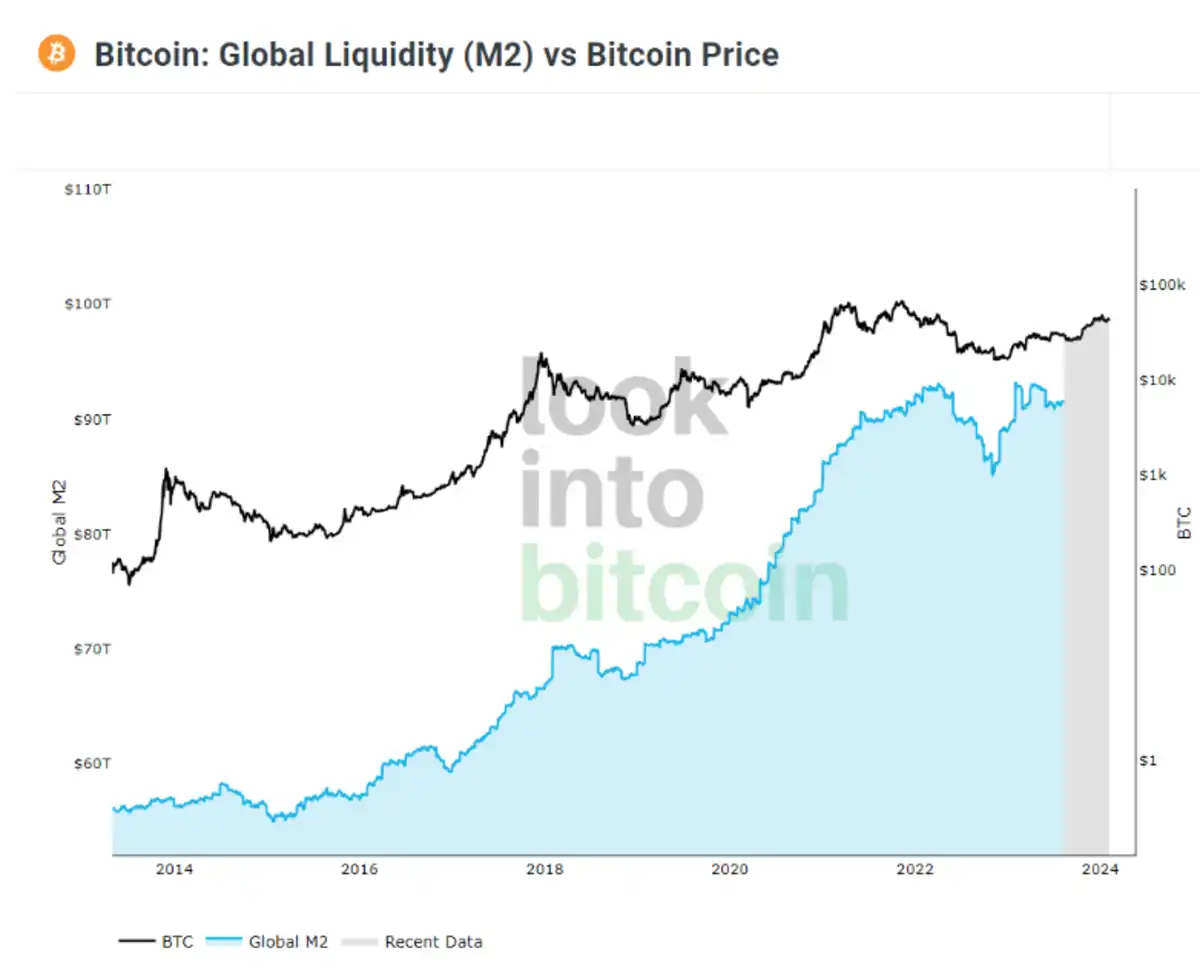

Looking ahead, it is worth noting that the price of Bitcoin depends on global liquidity. After all, it was the Fed's interest rate hike in March 2022 that led to a large number of cryptocurrency bankruptcies, ultimately resulting in the collapse of FTX. The current federal funds futures expect this cycle to end in May or June of this year.

Furthermore, the Fed is unlikely to change its course of printing money. In this scenario, the price of Bitcoin may follow suit.

The M2 money supply measures how much available currency is in an economy. Image source: LookIntoBitcoin.com

Considering that $34 trillion is a relatively large national debt, and federal spending continues to exceed income, Bitcoin positions itself as a safe-haven asset, a currency waiting for capital to flow into its limited supply of 21 million tokens.

Historical Background and Future Impact

Gold Bullion Securities (GBS) is a similar safe-haven asset to Bitcoin, as the first gold ETF was listed on the Australian Securities Exchange (ASX) in March 2003. In 2004, SPDR Gold Shares (GLD) was listed on the New York Stock Exchange (NYSE).

From November 18, 2004, within a week, the total net assets of GLD rose from $114,920,000 to $1,456,602,906. By the end of December, this number dropped to $1,327,960,347.

Although not adjusted for inflation, this may indicate that the market sentiment for Bitcoin is better than that for gold. Bitcoin is digital, based on a globally distributed proof-of-work mining network, and its digitization means it is portable.

In 1933, President Roosevelt issued Executive Order 6102, requiring citizens to sell gold bullion. Unlike Bitcoin, new gold veins are frequently discovered, but Bitcoin's supply is limited.

In addition to these fundamentals, options on Bitcoin ETFs have not yet been introduced. Standard Chartered Bank analysts expect the size of Bitcoin ETFs to reach $50 to $100 billion by the end of 2024. Furthermore, large companies have not followed MicroStrategy's lead in converting stock sales into depreciating assets.

Even a 1% BTC allocation in mutual funds could lead to a surge in BTC prices. For example, Advisors Preferred Trust indirectly allocates 15% of its range to Bitcoin exposure through futures contracts and BTC ETFs. The Bitcoin allocation in mutual funds is likely to drive up the price of Bitcoin.

Conclusion

After 15 years of doubt and slander, Bitcoin has reached the peak of credibility. The first wave of sound money believers ensured that its blockchain would not disappear into coding history.

With confidence in Bitcoin, so far, Bitcoin investors have formed two waves. The approval of Bitcoin ETFs may be a milestone for the third wave. Central banks around the world continue to weaken people's confidence in cryptocurrencies, as governments cannot control themselves and can only indulge in spending.

With so much noise introduced into the exchange of value, Bitcoin represents a return to the roots of sound currency. Its appeal lies in its digitization, born from physical proof-of-work. Unless the US government takes extreme action to disrupt institutional risk exposure, Bitcoin may replace gold as a traditional safe-haven asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。