Investment Overview

Axelar is a cross-chain interoperability project.

In terms of team and funding, the Axelar team has a strong academic background and development capabilities, and has completed multiple rounds of financing, with a total funding amount of $113.8 million. Investors include Binance, Polychain Capital, Coinbase Ventures, Dragonfly Capital, and Crypto.com Capital. The project's current development is in good shape, with a noticeable increase in code submissions and the number of developers.

In terms of product and technology, Axelar is based on cross-chain technology and has introduced the concept of "Interchain" on top of cross-chain and multi-chain concepts. In this concept, all Web3 applications will have a unified development environment that accommodates various on-chain logics and supports users from multiple chains. In 2024, Axelar developed the Axelar Virtual Machine (AVM) based on CosmWasm and introduced tools such as Interchain Amplifier and Interchain Maestro, allowing Axelar to evolve from a cross-chain layer responsible for message and asset delivery to a cross-chain layer capable of programming and deploying smart contracts to perform more complex operations. To some extent, Axelar's Interchain concept is an upgrade to the concepts of cross-chain and multi-chain, with its core advantage lying in utilizing the Axelar network as a central interaction node within a multi-chain network. By developing and deploying applications within this central node and then expanding to other networks, efficiency can be greatly improved, costs reduced, and users can have a smoother experience. Therefore, Axelar's proposed Interchain solution has great potential in the future.

In terms of project development, Axelar is currently in good shape. In terms of data, the growth in GMP cross-chain message volume reflects the growth and improvement of the cross-chain ecosystem, while the number of active users has remained relatively stable, demonstrating the user stickiness of the Axelar ecosystem. In addition, the Axelar ecosystem is constantly expanding and is currently connected to 60 chains, interacting, cooperating, and integrating over 600 smart contracts, including leading projects in DeFi, public chains, and Layer 2 solutions. With the development of related projects in the ecosystem, Axelar is expected to achieve certain results in the future.

From a token economics perspective, the AXL token primarily serves as the network's utility token, playing roles in network consensus, governance, development, and payments. In the future, the AXL token will transition to deflation, further promoting the healthy development of the network.

From the perspective of the competitive landscape, the cross-chain interoperability sector in which Axelar operates is still in its growth stage. In the future, there will be significant growth potential with the development of public chain and DeFi sectors. In the competitive landscape, Axelar's proposed solutions and the Interchain concept give it a unique advantage in terms of scalability. If it can leverage this concept to attract enough projects to establish a thriving ecosystem, Axelar will have a significant competitive advantage in this sector.

1. Basic Overview

1.1 Project Introduction

Axelar is a cross-chain interoperability project, based on cross-chain technology, and has introduced the concept of "Interchain" on top of cross-chain and multi-chain concepts, aiming to provide a unified development environment for all Web3 applications. To this end, Axelar developed the Axelar Virtual Machine (AVM) in 2024 and introduced multiple development tools, allowing Axelar to evolve from a cross-chain layer responsible for message and asset delivery to a cross-chain layer capable of programming and deploying smart contracts to perform more complex operations.

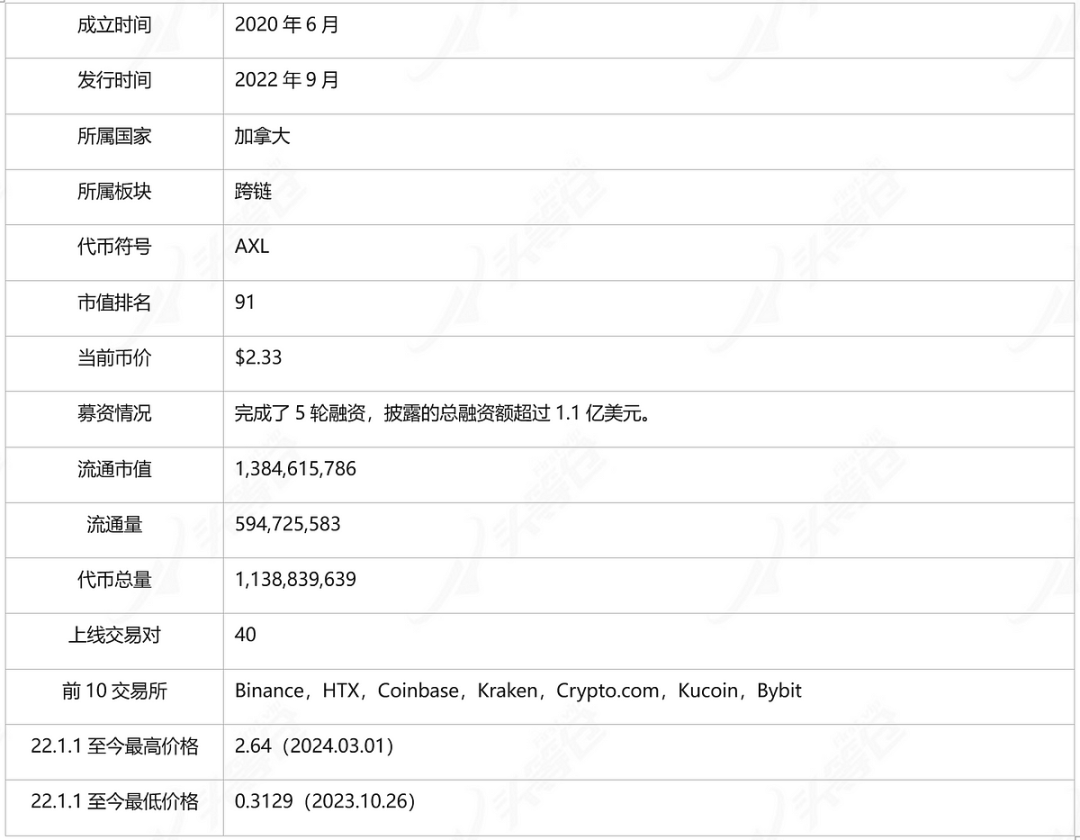

1.2 Basic Information [1]

2. Project Details

2.1 Team

Based on the available information, Axelar's development team, Interop Labs, is located in Canada, with an estimated total of around 50 employees. Currently, there are 33 employees on LinkedIn:

Sergey Gorbunov—Co-founder, holds a Bachelor's and Master's degree in Computer Science from the University of Toronto and a Ph.D. in Computer Science from the Massachusetts Institute of Technology. After graduating, he founded a company, StealthMine, which helps enterprises with data encryption. In 2018, Gorbunov joined Algorand as the Chief Cryptographer. In June 2020, Gorbunov co-founded Axelar.

Georgios Vlachos—Co-founder, holds a Bachelor's and Master's degree in Computer Science from the Massachusetts Institute of Technology. After graduating, he joined Algorand as the Head of Mathematics Research. In June 2020, Vlachos co-founded Axelar.

Christian Gorenflo—Head of Development Team, holds a Bachelor's degree in Physics from the Karlsruhe Institute of Technology and a Ph.D. in Computer Science from the University of Waterloo. After graduating, he joined Axelar's development team at Interop Labs as a blockchain engineer and was promoted to Head of Development Team in July 2023.

Milap Sheth—Head of Engineering Team, holds a Bachelor's degree in Computer Science from the University of Waterloo. After graduating, he worked in software development at a network security solutions company, ISARA. In July 2021, Sheth joined Interop Labs as the Head of Engineering Team.

Talal Ashraf—Head of DevOps Team, holds a Bachelor's degree in Electrical and Computer Engineering from the University of Toronto. After graduating, he joined the enterprise cloud service development company Symantec as a full-stack backend engineer. He then joined two software development companies, Flywheel and Pixlee, as a DevOps developer in 2019 and 2020, respectively. In August 2021, Ashraf joined Interop Labs as the Head of DevOps Team.

Overall, the development team members of the Axelar project have a good academic background, and the founders have previously participated in the research and development of the Algorand public chain, indicating that the project itself has good development capabilities.

2.2 Funding

Table 2-1 Axelar Financing Situation [2]

As of March 5, 2024, Axelar has completed a total of 5 rounds of financing, with a total funding amount of $113.8 million according to disclosed financing information. During the B round of financing, the project's total valuation reached $1 billion. Investors include Binance, Polychain Capital, Coinbase Ventures, Dragonfly Capital, and Crypto.com Capital. However, the most recent round of financing was completed on March 10, 2022, nearly two years ago. The actual financial situation of the project is currently unclear, but it is estimated that the project's funding is still relatively abundant as it is able to maintain its team size and continue with development and operational plans.

2.3 Code

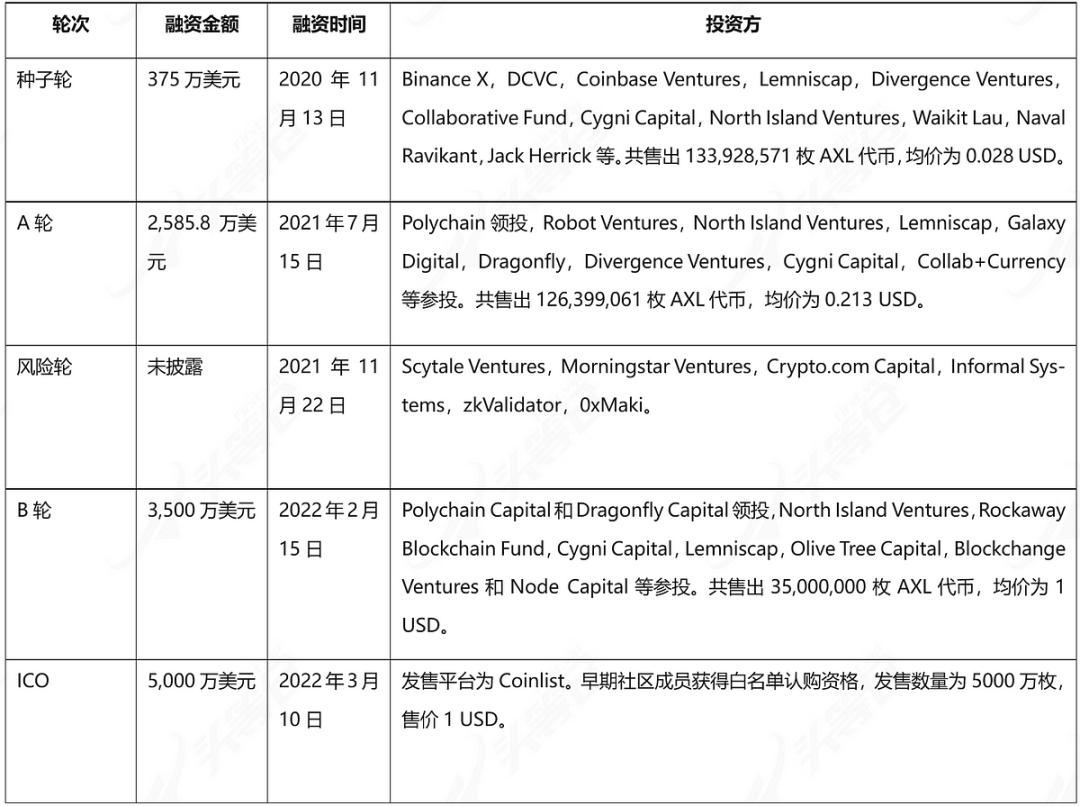

Figure 2-1 Axelar Code Submission Status [3]

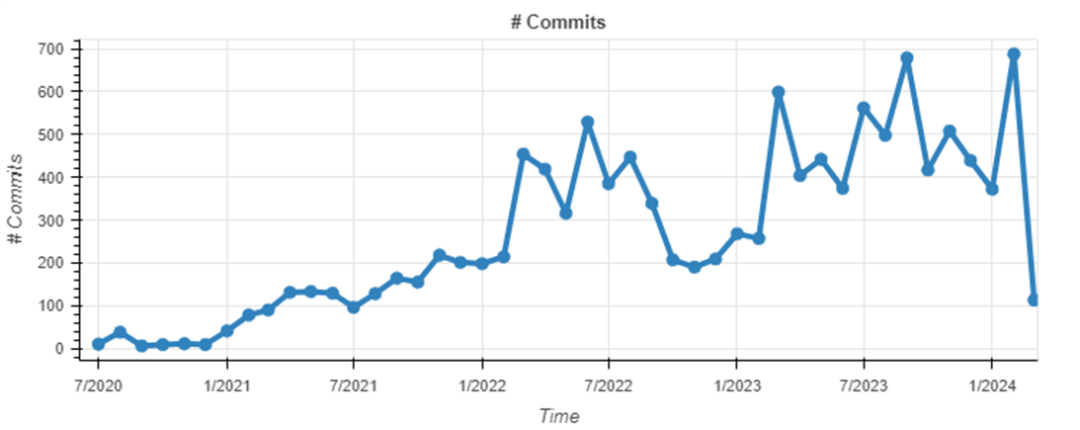

Figure 2-2 Axelar Code Contributors

Axelar's source code is open-source on GitHub. As of March 4, 2024, as shown in the above figures, Axelar's code is continuously being updated, with a total of 12,110 commits, and the number of developers has been consistently around 50 or more. Since entering 2023, both the code update volume and the number of developers for Axelar have shown a steady upward trend, indicating that the project's development is currently in good shape.

2.4 Product and Technology

Axelar is a cross-chain interoperability project developed using the Cosmos SDK, with cross-chain as its main core business.

2.4.1 Cross-Chain Layer

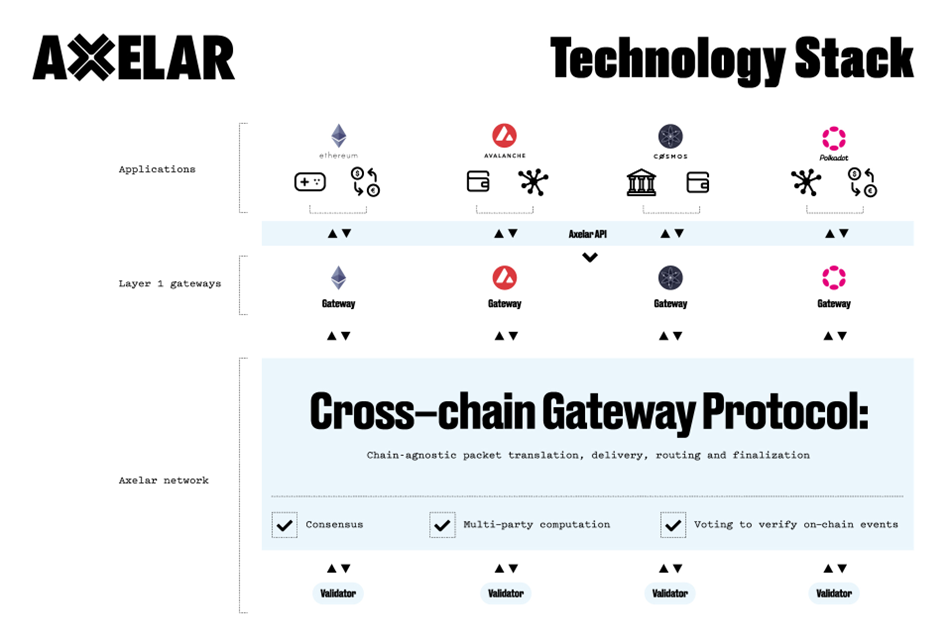

Figure 2-3 Axelar Technology Stack [4]

In the cross-chain solution, Axelar has chosen a "trinity" cross-chain layer with gateways as points, validators as lines, and the Axelar network as the surface. In this setup:

Gateways are mainly responsible for communication and cross-chain execution functions. On the source chain where the cross-chain transaction is initiated, the gateway is responsible for initiating the corresponding request. On the target chain where the cross-chain transaction is received, the gateway is responsible for receiving and executing the corresponding message to complete the cross-chain operation. On the EVM chain, the gateway exists in the form of a smart contract, while on Cosmos and other non-EVM chains, the gateway exists in the form of a Dapp. The control of the gateway's multi-signature keys is held jointly by all validators, and the share of the key held by each validator is determined by the amount of AXL tokens they have staked. The key only becomes effective when the share of the key submitted by the validating validator exceeds the threshold.

Users' cross-chain messages on each chain will first interact with the gateway. After receiving the message, the gateway will generate an event in the background, which will then be picked up by relays and submitted to the Axelar network for processing.

Validators are mainly responsible for message verification and network consensus. After cross-chain events are submitted to the Axelar network, validator nodes will start working by querying their RPC ports on the source chain node to check if they can observe the submitted events. After confirming the existence of the events, they will vote to approve the events as legitimate. The validators will then package these events into blocks and confirm these blocks through a proof-of-stake consensus mechanism.

The Axelar network is mainly responsible for processing all cross-chain requests and paying the corresponding gas fees. After the blocks are packaged and the cross-chain request messages are authorized, another group of relays will pick up these messages and periodically send them to the gateways on the target chain. During this process, Axelar needs to use tokens on the target chain to pay gas fees. To facilitate user usage and avoid the need to prepare tokens on the target chain and Axelar for gas fee payment, Axelar has created and deployed a smart contract called Gas Receiver. The Gas Receiver contract estimates the total gas fees required on the source chain, Axelar network, and target chain, and collects the native tokens on the source chain as gas fees from the user in one go. It then converts these native tokens into AXL, target chain tokens, and other required tokens to complete the gas fee payment for the user. During this process, the Gas Receiver generally collects more tokens than the actual payment amount and refunds the excess gas fees to the user's account after the transaction is completed.

Compared to common cross-chain bridges, Axelar's cross-chain layer as part of the Axelar network has many advantages in various aspects.

1) First, in terms of security, Axelar's security is ensured by multi-signature keys and the network consensus layer. When transmitting cross-chain information and executing cross-chain operations, a threshold number of validating nodes are required to confirm the authenticity of the message and submit the shared key before the gateway can take effect. Additionally, Axelar has added a rate-limiting function at the gateway level, imposing an upper limit on the number of transactions for each type of asset within a given time interval. Secondly, after all cross-chain events are packaged, they need to be confirmed through a delegated proof-of-stake (DPoS) consensus mechanism before new blocks can be generated. Furthermore, to mitigate the risk of voting power being concentrated in a few stakeholders due to different AXL staking shares, Axelar has introduced a "square voting" mechanism at the consensus layer. When validators vote, they receive one share of voting power for staking one unit of AXL token. However, if they need to receive two shares of voting power, they must stake the square of two, which is four units of AXL tokens, and so on. After introducing these two mechanisms, the decentralization of the network has been greatly improved. The existence of these two mechanisms ensures that Axelar has better security compared to common cross-chain bridges.

2) Secondly, in terms of scalability, Axelar, as a public chain, is capable of executing smart contracts. This means that Axelar can more conveniently, quickly, and cost-effectively integrate with other public chains and Dapps, and even act as a "cross-chain layer" in the concept of modular blockchains to help these projects complete cross-chain operations, while also effectively improving the user experience. For example, Axelar has released an API that can help integrated Dapps generate a one-time deposit address, which can receive cross-chain funds of any token from any wallet on any integrated chain, allowing users to have an interaction experience in the cross-chain process that is no less than that of centralized exchanges. Furthermore, by expanding the General Message Passing (GMP) functionality, Axelar can not only achieve asset cross-chain capabilities but also support complex cross-chain function calls and cross-chain state synchronization, greatly enhancing the scalability of Dapps collaborating with Axelar.

In addition, in 2023, Axelar introduced the concept of "Interchain" on top of the concepts of "Cross-chain" and "Multichain". In this concept, all Web3 applications will have a unified development environment that accommodates various logics on different chains and supports users from multiple chains, further realizing Axelar's ideal of full-stack interoperability. To achieve this, in 2024, Axelar developed the Axelar Virtual Machine (AVM) based on CosmWasm, allowing Axelar to evolve from a cross-chain layer responsible for message and asset transfer to a cross-chain layer capable of programming and deploying smart contracts to perform more complex operations.

2.4.2 Axelar Virtual Machine (AVM)

As a Turing-complete virtual machine, AVM's significance lies not only in its ability to deploy smart contracts but also in fundamentally changing the traditional logic of Dapps implementing cross-chain functionality. For Dapp developers, applications developed on AVM inherently possess cross-chain functionality, without the need to integrate with other cross-chain projects afterwards. The cross-chain functionality is implemented by the lower-level blockchain, which is Axelar, and this is the concept of "Interchain" proposed by Axelar. In Axelar's own words, it is "Build once, run everywhere."

Specifically, by developing Dapps on AVM, DeFi projects will be able to trade or borrow using liquidity from multiple chains simultaneously; stablecoin projects will be able to expand their application space and provide users with a seamless experience across multiple chains; game projects can choose to issue the same asset or token on multiple chains; NFT projects can be integrated into cross-chain games or enjoy higher trading liquidity; wallet projects can access any blockchain to serve users; DAO projects can govern and act across multiple chains more easily and allocate assets more efficiently.

To help developers deploy their projects more efficiently and cost-effectively on AVM, Axelar has introduced two tools for developers to build applications: Interchain Amplifier and Interchain Maestro.

Interchain Amplifier is a tool for developers to connect to and use the Axelar network, primarily to help developers establish a connection to the Axelar network without permission and at a low cost. Developers only need to pay the cost of joining the Axelar network to enjoy the connection between Axelar and other ecosystems and networks, adding new functional attributes to enhance Dapp security and scalability, hence the name "Amplifier". Use cases include easily integrating components developed on Ethereum, such as ZK proof components, into Dapps on the Axelar network.

Interchain Maestro is a tool for developers to deploy and manage multi-chain Dapps. Developers can deploy their contracts on multiple chains through a simple process:

1) Specify the contract to be deployed, set the key parameters of the contract, and specify the chains involved.

2) Store the parameters and content on Axelar's smart contract and deploy the smart contract on the relevant chains.

3) Extend or clone these contracts to other chains.

4) When it is necessary to upgrade the Dapp, developers only need to initiate a transaction on Axelar to upgrade their contract code, and the upgrade of this code will be sent to other connected chains without the need to separately upgrade smart contracts on other chains.

Developers can greatly improve the efficiency of Dapp deployment and reduce the cost of Dapp deployment through Interchain Maestro. The important component Interchain TokenService in Interchain Maestro has been released to the mainnet. With this feature, projects can easily issue and manage interchain tokens and retain the cross-chain interchangeability of tokens and some custom functions during the cross-chain deployment process.

Through the deployment of AVM, Axelar can truly realize the concept of "Interchain" proposed by Axelar, thereby laying a solid foundation for the development of the Axelar ecosystem. To some extent, Axelar's Interchain concept is an upgrade to the concepts of cross-chain and multichain, with its core being the establishment of a central interaction node in a multi-chain network. By developing and deploying applications on this central node and then expanding to other networks, efficiency can be greatly improved, costs reduced, and users can have a smoother experience. Therefore, Axelar's proposed solution has great potential for the future.

3. Development

3.1 History

Table 3-1 Major Events of Axelar

3.2 Current Status

3.2.1 Operational Data

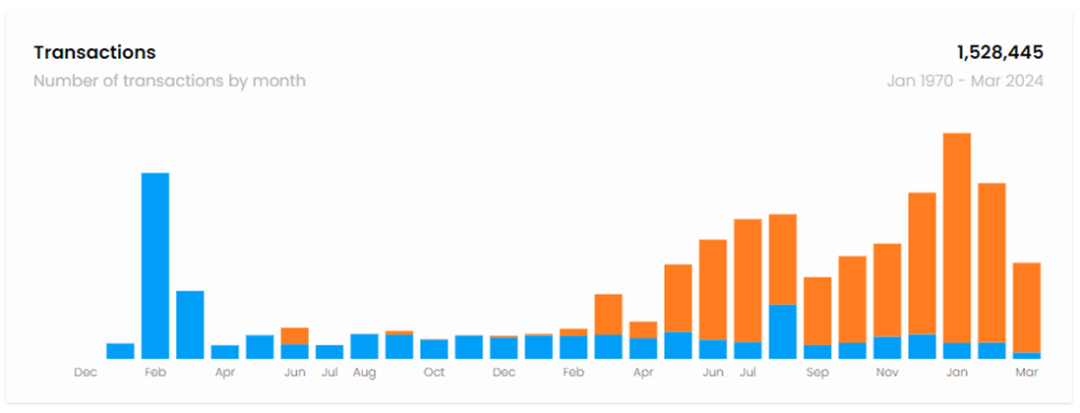

Figure 3-1 Axelar Transaction Volume [6]

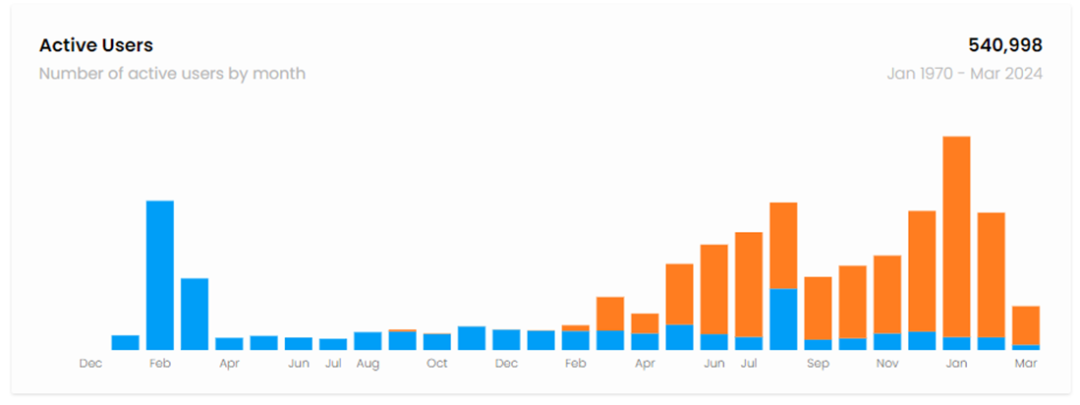

Figure 3-1 Number of Active Addresses on Axelar

According to Axelar's block explorer, as of 11:00 on March 11, 2024, a total of 1,528,445 transactions have been generated on Axelar, with 962,300 transactions, accounting for approximately 62.96%, being GMP (General Message Passing) transactions. GMP transactions are mainly used to call smart contracts on other chains connected by Axelar within a chain. The difference between GMP transactions and regular cross-chain transactions is that GMP transactions specify smart contracts as the target, while regular cross-chain transactions only transfer assets from an account on the source chain to an account on the target chain. Therefore, the rapid increase in the number of GMP transactions since 2023 reflects the continuous improvement and activity of Axelar's cross-chain ecosystem. In addition, since 2023, the number of active users on Axelar has also shown a significant increase and has remained relatively stable thereafter, demonstrating Axelar's strong user ecosystem stickiness.

3.2.2 Ecosystem Projects

As a cross-chain layer capable of programming and deploying smart contracts to perform more complex operations, Axelar's ecosystem includes both other connected chains and Dapps developed on top of it.

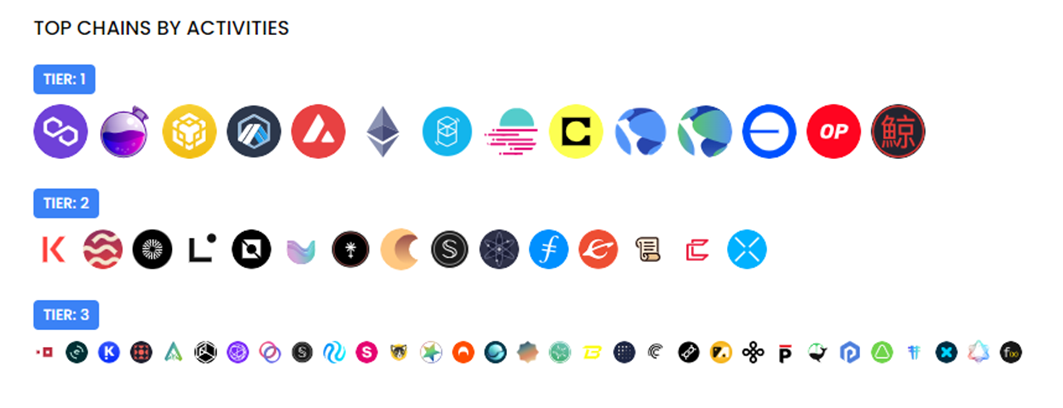

Figure 3-2 Axelar Cross-Chain Public Chain Ecosystem

Currently, there are 60 chains connected to Axelar, and these chains can be divided into 3 levels based on the level of user and Dapp interaction activity.

T1 level public chains include: Polygon, Osmosis, BNBChain, Arbitrum, Avalanche, Ethereum, Fantom, Moonbeam, Celo, Terra Classic, Terra, Base, Optimism, Kujira.

T2 level public chains include: Kava, Sei, Mantle, Linea, Neutron, Umee, Juno, Crescent, Secret-SNIP, Cosmos, Filecoin, Evmos, Scroll, Comdex, XPLA.

Among them, there are approximately 290,330 transactions initiated from Polygon, accounting for about 19.00%, approximately 189,880 transactions initiated from BNBChain, accounting for about 12.42%, approximately 166,120 transactions initiated from Osmosis, accounting for about 10.87%, approximately 151,400 transactions initiated from Arbitrum, accounting for about 9.91%, and approximately 135,840 transactions initiated from Avalanche, accounting for about 8.89%. It can be seen that the participation of various public chains in the Axelar cross-chain ecosystem is relatively decentralized, and there is no heavy reliance on a particular public chain, indicating a healthy overall development situation.

As of March 11, 2024, there are 635 Dapps deployed or preparing to be deployed on Axelar [7].

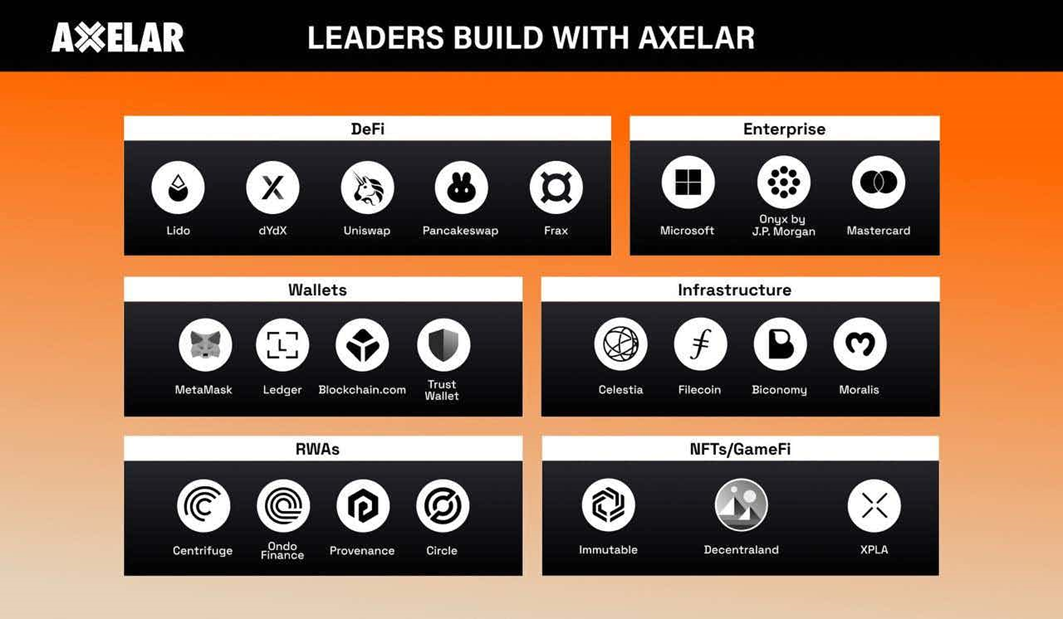

Figure 3-3 Some Projects in the Axelar Ecosystem [8]

The deployed projects include wallet projects such as MetaMask, Trust Wallet, Keplr; infrastructure projects such as Biconomy; game projects such as Decentraland; DeFi projects such as dYdX, Lido, PancakeSwap, SushiSwap, QuickSwap, KyberSwap.

In addition, there are also projects integrated or collaborating with Axelar, including Uniswap, Ripple, Immutable, Frax Finance, Vertex, OndoFinance, Fantom, Band Protocol, Sommelier, Filecoin, Umee, Polygon, Sui, Circle, and others.

Currently, the projects related to the Axelar ecosystem are mainly focused on DeFi and public chains, which are closely related to Axelar's cross-chain nature. With the future prosperity of the DeFi and public chain ecosystems, Axelar has good development potential.

3.2.3 Social Media Scale

Table 3-2 Axelar Social Media Data

As of March 11, 2024, Axelar's social media platforms have a large number of followers but relatively low interaction. The community has a large number of members, but the level of activity is average, and the discussions mainly revolve around issues encountered in project interactions. The governance forum has an average level of activity, and the discussions mainly focus on future project technical upgrades and development direction.

3.3 Future

According to Axelar's roadmap announced on January 30, 2024, Axelar's future development will revolve around AVM, including the following sub-items:

1) Develop AVM as an open-source tool development platform for various Dapps.

2) Use Interchain Amplifier to achieve permissionless connections to any chain and extend potential network effects to hundreds of blockchains, including Ethereum Layer2.

3) Expand the use cases of Interchain Tokens and extend their availability on all connected chains.

4) Add a gas burning mechanism to the AXL token to achieve deflation and protect the Axelar network.

5) Integrate different consensus mechanisms from various chains, including Solana, Stellar, and chains based on Move, such as Aptos and Sui.

6) Improve the gas pricing mechanism and increase the accuracy of cross-chain gas estimation services on the Axelar network.

Summary:

In terms of project development, Axelar is currently in a good development situation. In terms of data, the growth in the number of GMP cross-chain messages reflects the growth and improvement of the cross-chain ecosystem. Additionally, the number of active users has remained relatively stable, demonstrating the user stickiness of the Axelar ecosystem. Furthermore, the Axelar ecosystem continues to expand, with 60 connected chains and over 600 smart contracts for interaction, collaboration, and integration, including leading projects in DeFi, public chains, and Layer 2. With the development of ecosystem-related projects in the future, Axelar is expected to achieve significant results.

4. Economic Model

4.1 Supply

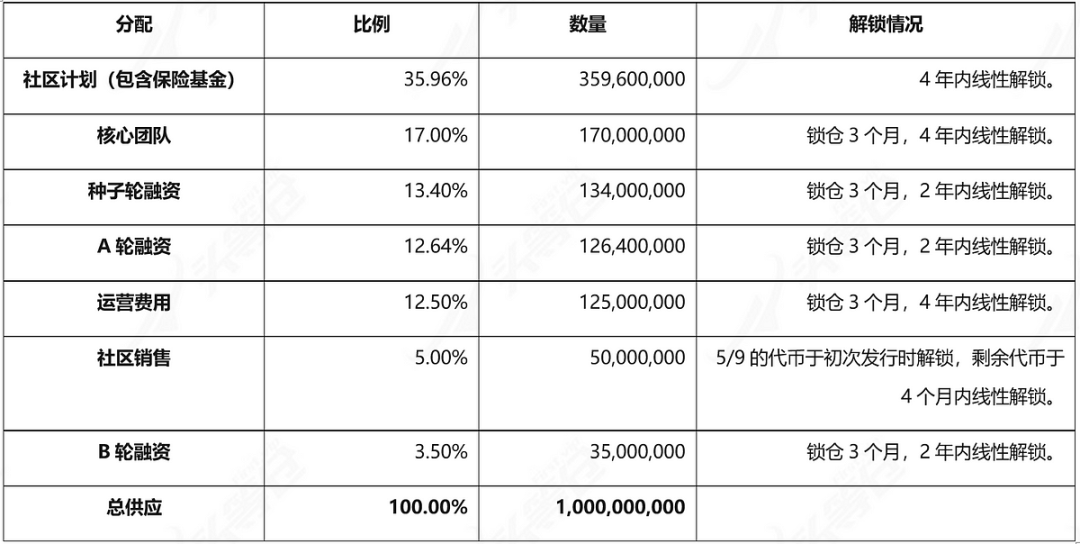

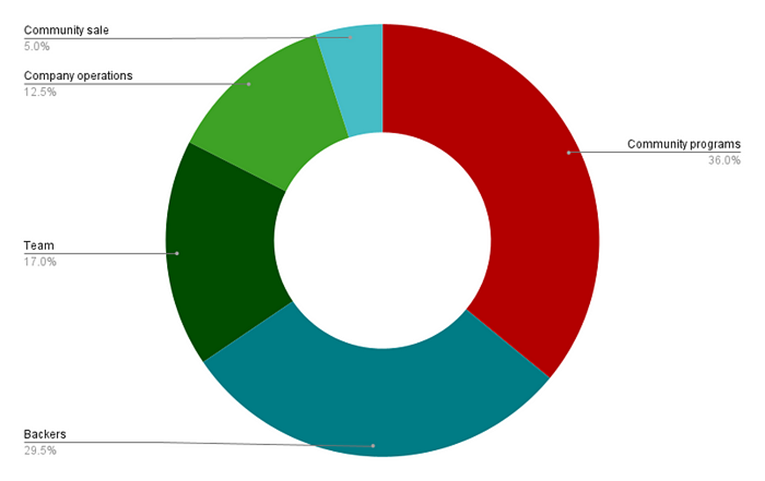

4.1.1 AXL Token Distribution [9]

AXL is the project token of Axelar, which was launched on the mainnet in September 2022 with an initial supply of 1,000,000,000 tokens. New AXL tokens are issued through inflation. As of March 5, 2024, the total supply of AXL tokens is 1,137,455,595, with a circulating supply of 587,380,415.

Table 4-1 Initial Distribution of AXL Tokens [10]

Figure 4-1 Initial Distribution of AXL Tokens

Figure 4-2 AXL Token Distribution Stack Chart

In the initial distribution of 1 billion AXL tokens, the team and financing each accounted for about 30%, while the community and ecosystem accounted for about 40%, which is relatively reasonable. As of March 5, 2024, nearly 452 million tokens have been unlocked from the initial issuance of 1 billion tokens.

In terms of token issuance, AXL tokens currently use an inflationary model, with a base inflation rate of 1% plus an additional 0.3% inflation rate for each externally supported blockchain (EVM chain) (0.75% before December 5, 2023). With 20 externally supported blockchains, the current inflation rate is 7% (14.5% before December 5, 2023).

To promote the healthy development of the network, Axelar plans to change AXL tokens from inflationary to deflationary by implementing a gas burning plan. Axelar currently charges approximately 0.2 AXL tokens for processing a cross-chain message. If Axelar processes approximately 100,000 transactions per day, it will collect about 104 million AXL tokens in a year. By burning these AXL tokens used as gas fees, Axelar can offset up to 10% of the inflation rate, achieving token deflation.

Although the proposal has been approved, the plan to deploy AXL as the network gas token and implement burning has not yet been deployed on the mainnet, which will be one of Axelar's key focuses in the coming year.

4.2 Demand

As the native token of the Axelar network, AXL token serves several functions:

1) It serves as the basis for DPoS network consensus and as the block reward for validator nodes.

2) It is used as a governance token for voting on governance proposals, including network parameters, protocol marketing, development, and technical upgrades.

3) It is used to pay transaction fees on the network and will become the primary gas fee in the Axelar network ecosystem in the future.

4) It is used to reward ecosystem participants and community contributors.

4.2.1 Network Nodes

The Axelar network uses the Tendermint consensus algorithm for DPoS network consensus. Currently, there are 75 fixed validator nodes, and the top 75 nodes by token staking can register as validators. The number of validators can be adjusted through governance in the future.

Validators on the Axelar network need to first configure nodes on the chosen external chains and then submit the RPC endpoints of the external chains to Axelar validator nodes. They also need to register as maintainers of these external chains to submit the states of these external chains for voting at any time, which requires a certain level of operational threshold.

Figure 4-3 Validator Node Share [13]

Each node will receive block rewards during the block consensus process. The expected APR of block rewards for each validator node is currently between 5% and 10%, depending on the number of nodes deployed on external chains, with actual APRs around 9%. Axelar network users can stake their AXL tokens with the corresponding validator nodes to share the block rewards they receive. Additionally, unstaking requires 7 days to complete.

Currently, the validator node with the highest AXL share is ValidatorREX, accounting for approximately 7.52% of the share, and the top ten validator nodes account for approximately 34.31% of the share. The top three validator nodes almost do not participate in protocol governance. Therefore, although the number of validator nodes on Axelar is relatively small, there is still a certain level of decentralization.

Summary:

From the perspective of token economics, the design of AXL tokens is moderate, mainly used as an application token in the network, serving functions such as network consensus, governance, development, and payment. In the future, AXL tokens will transition to deflation, further promoting the healthy development of the network.

5. Track

5.1 Track Overview

Axelar, as a cross-chain layer capable of message and asset cross-chain interoperability, can be classified into the cross-chain interoperability track.

In the past, the cross-chain track was generally understood to refer to projects that perform asset cross-chain operations. However, with the introduction of information transmission solutions, the cross-chain interoperability track has emerged. Cross-chain interoperability, as the name suggests, aims to achieve mutual operations between multiple chains, such as users being able to complete operations on Chain A with Chain B. This completion depends on the interaction of data on different chains, including asset, chain state, and contract invocation information. To some extent, cross-chain interoperability and sidechains have certain similarities. Both emphasize achieving interoperability between the main chain and sidechains, that is, sharing of assets and information. The difference lies in the fact that cross-chain interoperability projects strive to achieve an interoperable network, where once connected to the main chain, all other chains connected to the network theoretically become "sidechains" of the main chain.

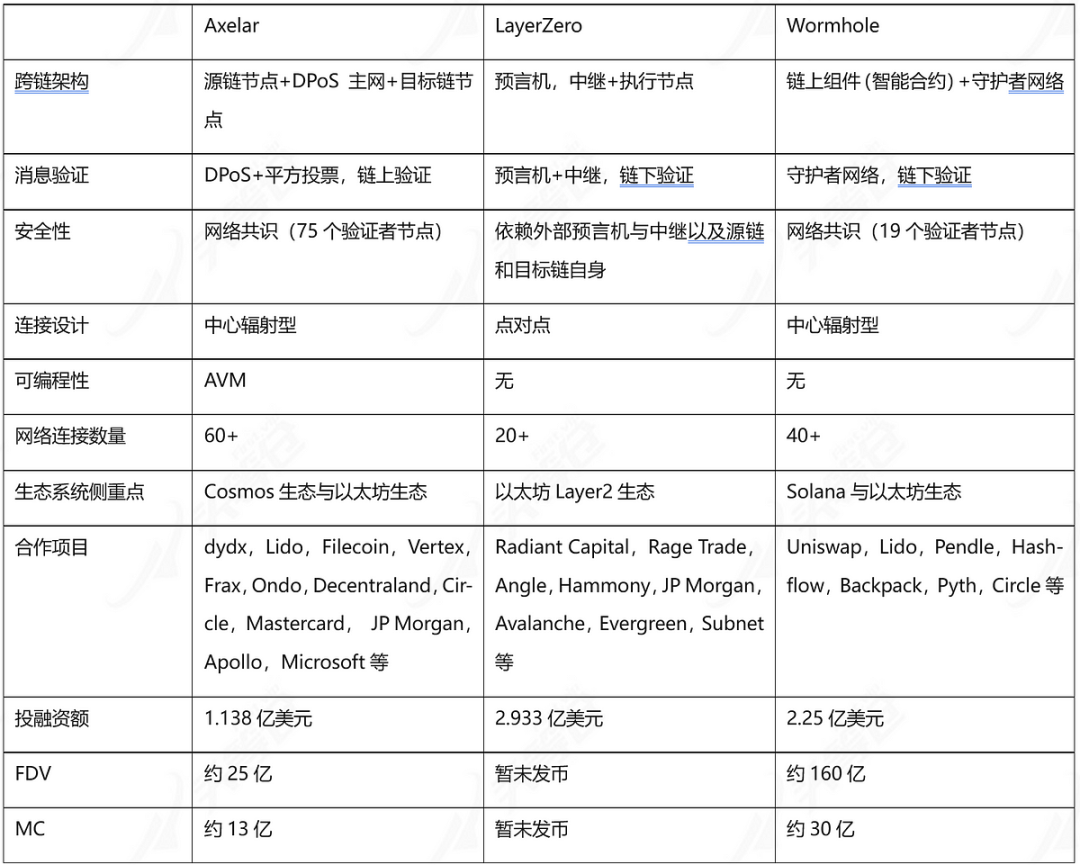

Currently, there are not many projects in the cross-chain interoperability track, and the overall development of the track is still in its growth stage, with significant potential for future development. In the following competitive comparison, we will select LayerZero and Wormhole as competitors to Axelar and compare the implementation solutions of the three to a certain extent.

5.2 Competitive Comparison

5.2.1 LayerZero

LayerZero is a full-chain interoperability protocol.

In terms of team and funding, LayerZero's team has rich development experience, and team members have a long history of cooperation, resulting in high cohesion. The project has completed multiple rounds of financing, with a total financing amount of $293.3 million, with investors including Binance Labs, Delphi Digital, A16z, Sequoia Capital, Coinbase Ventures, and other prominent capital firms.

In terms of product and technology, LayerZero focuses on achieving "lightweight" data transmission, so it chooses to use oracles and relay networks to complete data transmission. When a user completes an operation at the endpoint of the source chain in LayerZero, the oracle, as an external component, forwards the block headers of the transactions on the source chain to the target chain, while the relay obtains the transaction proofs on the source chain and transmits them to the target chain. This approach has three benefits:

1) Reduced the cost of information transmission. Because LayerZero does not need to run its own nodes on each chain and outsources the function of information verification, and the oracle only sends information to the target chain unidirectionally, it also avoids the cost of interaction with validation nodes.

2) Ensured security. By separating and independently performing the functions of the oracle and relay, and allowing the information transmitted by both to be mutually verified, the threat to the network from the oracle or relay acting alone is reduced.

3) Increased scalability. Because the oracle and relay are only responsible for transmitting information, all verification is completed on the respective source and target chains, so the speed and throughput of transactions will depend entirely on the properties of the two chains.

In January 2024, LayerZero launched the V2 version, which separated message verification and execution into two independent stages. Developers can set different security configurations according to their needs and carry out independent execution, thereby gaining more autonomy and enhancing the programmability of the protocol.

From a token economics perspective, although LayerZero has not yet issued tokens, the team has released some information in its official documentation code, indicating that LayerZero's tokens are expected to be used for functions such as gas payments in the future.

In terms of project development, LayerZero is currently in good shape, especially since March 2024, there has been a significant increase in user usage. The ecosystem already supports interoperability with over 20 chains, with the most transactions originating from Arbitrum, Optimism, Polygon, Avalanche, Binance, Fantom, and Ethereum. The number of integrated and cooperating Dapps has reached 95 and is still increasing.

5.2.2 Wormhole

Wormhole is a general message passing protocol.

In terms of team and funding, Wormhole originated from a collaboration between Solana and Certus.One, initially established as a cross-chain bridge between Ethereum and Solana. Therefore, it has rich development experience. In November 2023, Wormhole completed a $225 million financing at a valuation of $2.5 billion and established a new company, Wormhole Labs, responsible for the development of the new protocol.

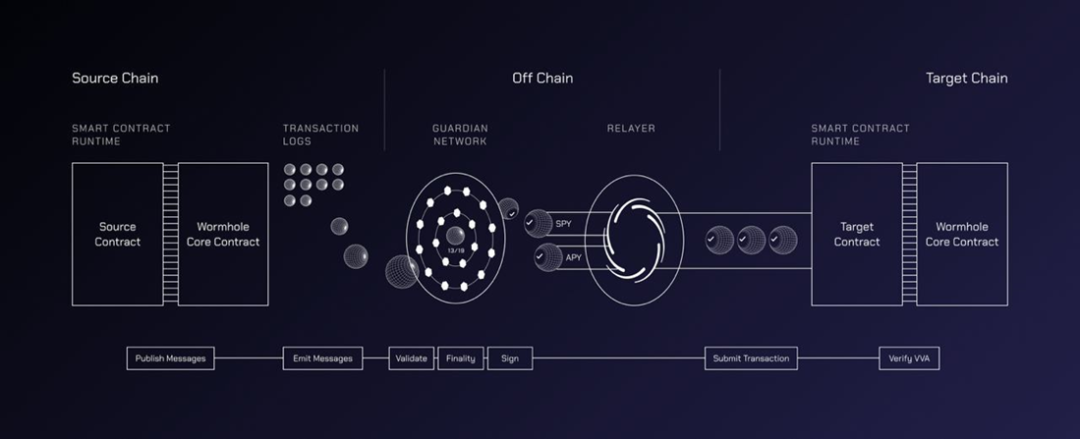

Figure 5-1 Wormhole Architecture [14]

In terms of product and technology, Wormhole's implementation is relatively straightforward. The overall architecture consists of on-chain and off-chain components.

The on-chain components mainly include the emitter, Wormhole core contract, and transaction logs.

The emitter contains smart contracts such as the xAsset contract (which converts ordinary tokens into xAssets and bridges them), the relay contract (which allows cross-chain applications to send messages to specific blockchain smart contracts through a decentralized universal cross-chain relay network), and the Worm Router contract (which allows developers to create smart contracts for Dapps as cross-chain applications), responsible for calling the core contract to send messages.

The Wormhole core contract is the contract that interacts with off-chain components and is mainly responsible for message verification and confirmation.

Transaction logs are specific logs on the blockchain that allow off-chain components to observe messages sent by the core components.

The off-chain components mainly consist of guardian nodes and the message transmission network.

The guardian nodes consist of 19 guardians who hold Verifiable Action Approvals (VAA) multi-signatures. They each run a full node on each connected chain, specifically monitoring any messages from the core contract. Once two-thirds or more of the guardians verify and sign a message, the verified message is relayed to the target chain, where it is processed and completes the cross-chain transaction.

Wormhole uses an external verification solution, which has the advantage of being fast and cost-effective, and can quickly expand to multiple chains. However, it sacrifices a certain level of security, as it relies on a few validating nodes and carries a certain level of centralization risk.

From a token economics perspective, Wormhole's token will mainly be used for the future development of the project and ecosystem, and will have certain governance functions. However, the connection between the W token and the project's development is not strong enough to fully share the dividends of the project's development or to empower the project further.

In terms of project development, Wormhole is currently in good shape. Although it experienced a period of low activity for over a year after the FTX incident, it has regained some vitality since mid-2023. The network connected by Wormhole (including validation networks) exceeds 40. In terms of transaction volume, the main transactions on Wormhole come from Ethereum, Solana, Sui, and Arbitrum. Currently, there are over 100 Dapps integrated and cooperating with Wormhole, and the number is still increasing.

Competition Summary

Table 5-1 Competitive Analysis of Axelar, LayerZero, and Wormhole [15]

After comparing with LayerZero and Wormhole, we can see that Axelar's architecture is less efficient than LayerZero's due to the need for node validation and network consensus. In terms of security, both LayerZero and Axelar have their merits. LayerZero simplifies the process of cross-chain information interaction and is not responsible for information verification. In the absence of collusion between the oracle and relay, the security of cross-chain transactions is ensured by the source and target chains themselves. Axelar relies on network consensus to ensure cross-chain security. Axelar's architecture is similar to Wormhole's, but compared to Wormhole, Axelar has a larger number of validator nodes, making it more decentralized.

However, as a cross-chain layer that can execute more complex operations and deploy smart contracts, Axelar has a unique advantage in terms of scalability. Its proposed concept of inter-chain interaction can further lay the foundation for the development of the ecosystem. From a token economics perspective, the integration of AXL tokens with Axelar is undoubtedly more closely linked. After the application of the new token economic model, it can bring new empowerment to the project's development. In terms of specific project development, we can see that LayerZero's focus is on interaction between Ethereum Layer 2 ecosystems, Wormhole's focus is on interaction between the Solana and Ethereum ecosystems, and Axelar's focus is on interaction between the Ethereum and Cosmos ecosystems. The three projects present a competitive yet complementary situation. This means that the current market competition environment is still in a blue ocean, and the cross-chain interoperability track will have broader market growth potential in the future, as the development of the public chain and DeFi tracks continues.

In summary, we are optimistic about Axelar's competitive potential in the cross-chain interoperability track in the future.

Conclusion

From the perspective of the track, Axelar's position in the cross-chain interoperability track is still in the growth stage, and there is great growth potential in the future as the public chain and DeFi tracks develop. In the competition within the track, Axelar's proposed solution and inter-chain concept give it a unique advantage in terms of scalability. If it can attract enough projects to build a thriving ecosystem based on this concept, Axelar will have a significant competitive advantage in this track.

6. Risks

1) Code security risk: Despite multiple audits, Axelar still has the potential for system risks and vulnerabilities. Additionally, the cross-chain track is a prime target for hacker attacks, so users need to be more vigilant.

2) Market competition risk: Currently, Axelar has many strong competitors.

3) Centralization risk: Axelar currently only has 75 network nodes, still posing a certain degree of centralization risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。