Author's Note

Aptos is an L1 built around security and scalability, and its mainnet was launched in October 2022. The team behind Aptos originated from Meta's Diem and Novi projects, with co-founders Mo Shaikh and Avery Ching both being former executives at Novi, bringing extensive industry experience. Historically, Aptos has received approximately $400 million in funding from funds such as a16z, Multicoin Capital, Binance Labs, and Dragonfly. Aptos aims to become a public infrastructure that brings decentralized assets to billions of users. Since its launch, the team has been closely focused on this vision and has taken effective actions. The Aptos ecosystem is currently showing signs of prosperity, gathering the largest Move developer community and making significant breakthroughs in underlying technology. Its latest market value is $4.8 billion, ranking it in the top 30 of market value rankings.

This article will focus on some new features, new trends, and ecological development strategies of Aptos, exploring potential opportunities and suitable directions for development on Aptos.

Data Overview

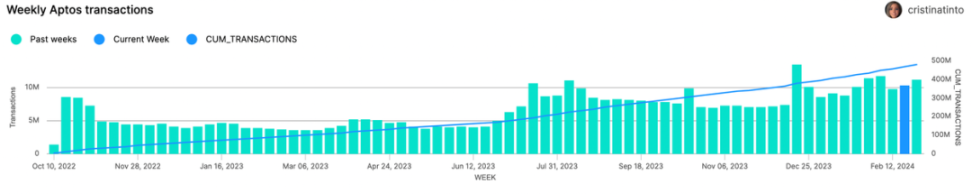

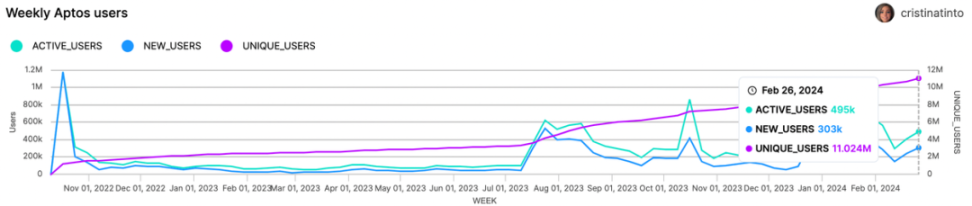

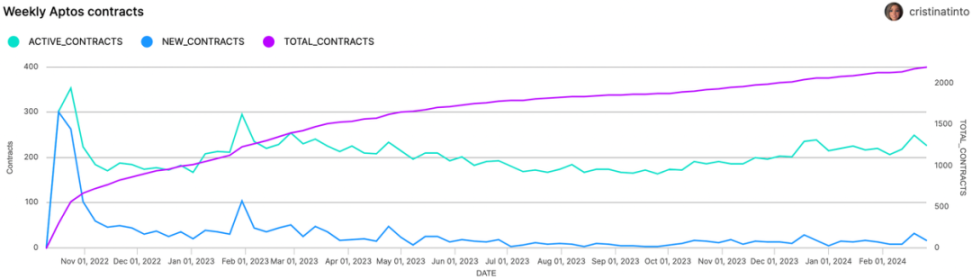

Aptos' current weekly trading volume is at 11.2 million, showing a significant increase compared to the same period last year, with a total trading volume of nearly 500 million. There are nearly 500,000 active users per week, with 300,000 new users in the week, and 17 new protocols added in the week, with approximately 230 active protocols.

source: flipside

Technological Iteration Path: Pursuing Dual Goals

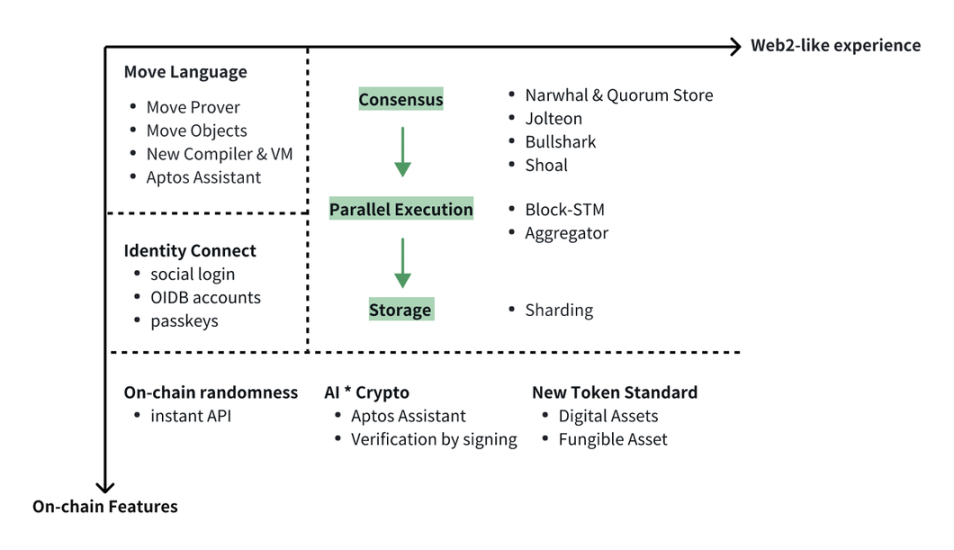

Aptos ultimately aims to accommodate billions of users similar to the internet and provide them with a Web2-like experience. In terms of the underlying technological architecture, it continues to launch new features with this ultimate goal in mind, aiming to achieve high TPS, low latency, and low cost. Another path is to make technical investments to achieve on-chain-specific experiences. We will look at Aptos' technological iteration focus from these two perspectives.

- Capable of Supporting High-Performance Experiences at Scale

Typical blockchain stacks usually consist of consensus, execution, and storage, each of which needs to be matched to achieve high performance. Aptos continuously makes hardcore iterations in engineering to optimize user experience, and its design is also very compatible with upgradability, with many upgrades being deployed after the mainnet launch.

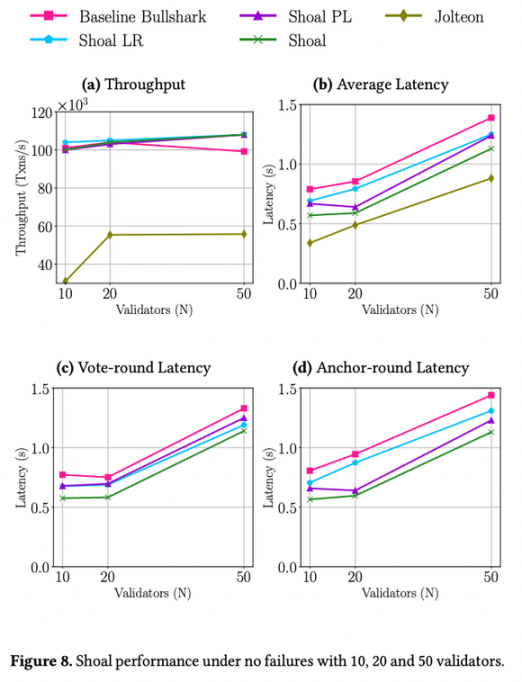

For example, in terms of consensus, Aptos initially adopted the Hotstuff BFT consensus (3500 TPS), followed by several iterations (Narwhal, Jolteon, Bullshark), and is about to implement the Shoal consensus, which significantly increases TPS. The breakthrough here comes from the realization that data propagation is the main bottleneck based on the leader's protocol. Therefore, Narwhal (based on DAG's Mempool protocol) separates data propagation from the core consensus logic and proposes an architecture where all validators can simultaneously propagate data. Jolteon and Bullshark each have their trade-offs in terms of TPS and latency characteristics, while Shoal achieves high TPS and low latency by introducing a pipeline and leader reputation. The pipeline introduces an anchor point in each round to reduce DAG sorting latency, and leader reputation ensures the association of the anchor point with the fastest validator.

source: shoal paper

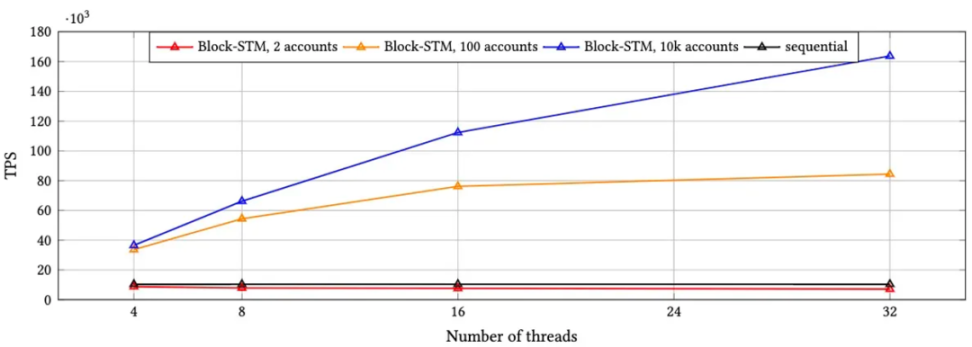

Parallel execution is also an important feature of Aptos. Block-STM is Aptos' parallel execution engine, based on optimistic concurrency and multi-version data structures, transforming the transaction processing from traditional sequential processing to speculative parallel processing, making blockchain transactions faster.

The performance of Block-STM largely depends on the workload, especially the number of read-write conflicts. In AIP-47, Aptos Labs proposed a new Move Feature called Aggregators. Its launch allows Aptos to execute smart contracts in parallel even in the presence of read-write conflicts, significantly improving the efficiency of limited asset minting (1M NFTs can be minted within 90 seconds). Aggregators are a very practical feature and are expected to be widely adopted.

Block-STM is also applied to other EVM/non-EVM chains, such as Polygon and Sei. In addition to Block-STM, the team is also developing new complementary technologies (such as sharding), hoping to further promote the development of scalable underlying architecture.

Combining the above technological iterations, Aptos continues to make breakthroughs in performance. Currently, Aptos has demonstrated a peak TPS of 30,000 and sub-second latency in experiments. However, the Aptos team believes that the future is far beyond this. CTO Avery Ching has stated on his Twitter that in Aptos' roadmap, both parallelism and scalability still have at least two orders of magnitude of optimization space (corresponding to 3M). LFG :)

In terms of the user experience, Aptos has also made optimizations. For example, with Identity Connect, users can log in to Web3 platforms using their social accounts. It has also recently introduced a method for signing transactions on L1: a passwordless access key that does not require setting a password and allows logging in through Touch ID or Face ID, making it more user-friendly (see AIP61 & AIP66).

- On-Chain Specific Features

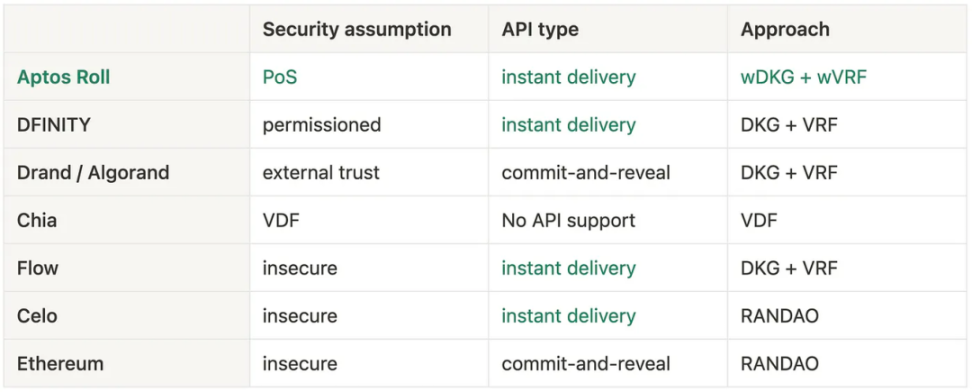

In addition to improving general features, the exploration of on-chain specific features is also an area of great interest for the Aptos team. Taking its latest on-chain randomness as an example, it innovatively uses weighted cryptographic schemes such as wPVSS, wDKG, and wVRF to solve the problem of expensive collaboration among validators in generating randomness, without requiring additional trust assumptions, relying solely on the security of the POS validator set. Compared to off-chain randomness, attackers must attack the chain to manipulate the randomness, making it more difficult. What's even more remarkable is that developers can call the API to generate random numbers at random, without waiting, making it suitable for scenarios that require quickly generating secure random numbers (such as games, lotteries, and social activities). Based on this, there may be many interesting use cases, and Aptos has specifically held hackathons to encourage exploration.

Roll with Move: Secure Instant Randomness on Aptos

In addition, the launch of the latest digital asset and fungible asset standard (AIP 21) aims to improve flexibility, efficiency, and composability. The iteration of token standards helps to better create, manage, and interact with assets on the blockchain, which is crucial for improving the user experience.

Digital assets (DA) are built on Move objects, rather than traditional account resources. Move objects allow various frameworks to share business logic and can add additional business logic through modular design. These features allow one Move object to own another Move object and achieve interoperability through shared core code. DA provides a standardized, flexible framework for non-fungible tokens, allowing seamless interaction with digital assets from different networks. There are many potential use cases, such as creating dynamic and composable NFTs (upgradable characters in games), allowing users to manage and trade digital assets more easily.

The Fungible Asset Standard (FA) is a core framework component in Aptos, used to tokenize different assets (such as in-game assets, tickets, tokenization of traditional assets, etc.), with traditional fungible coins being just a subset of FA. FA allows asset managers to have complete control over asset supply, enabling real-world assets to better meet regulatory requirements. The upcoming extension features of the Move VM will allow creators of fungible assets to add custom deposit, withdrawal, and balance functions without complex programming transactions, and due to Aptos' high TPS characteristics, deposits and withdrawals can be done at extremely fast speeds.

Ecological Development Opportunities: Building at the Right Time

Developing the ecosystem is a must for any public chain. In terms of strategic choices, Aptos shares some commonalities with other public chains, such as leading in DeFi, but also has its unique aspects, such as focusing on collaboration with Web2 giants, betting on RWA, and paying attention to emerging markets. Its high-performance characteristics also give it some unique application scenarios. In addition, Aptos also pays great attention to the potential combination of AI and blockchain. Considering that Aptos is still in the early stages of developing its ecosystem, there are many opportunities hidden within. In the following, we have selected a few key directions to explore.

source: Aptos Allday

DeFi/RWA: The Beginning of Spring

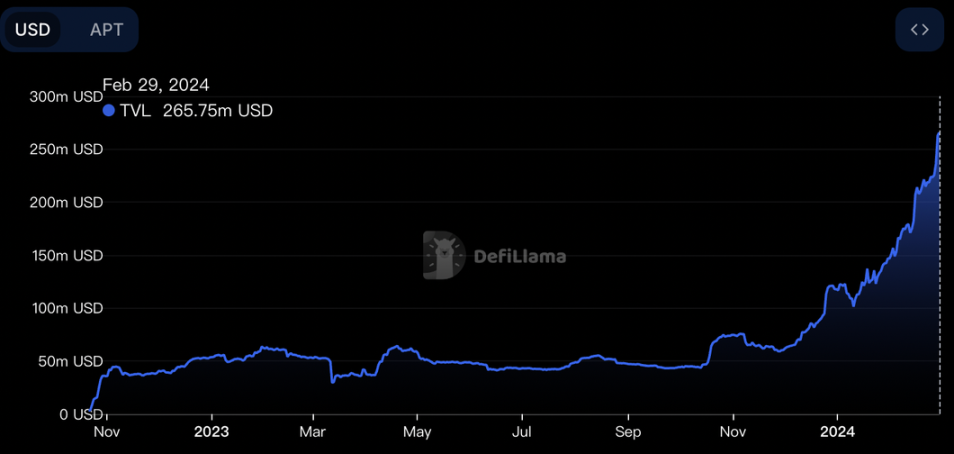

Aptos' overall TVL is currently at the $265 million level, entering a fast growth lane since the end of 2023. The ecosystem already includes various forms of DeFi protocols and assets, including DEX, lending protocols, liquidity staking, stablecoins, and leading the way are @ThalaLabs, @AmnisFinance, and @AriesMarkets.

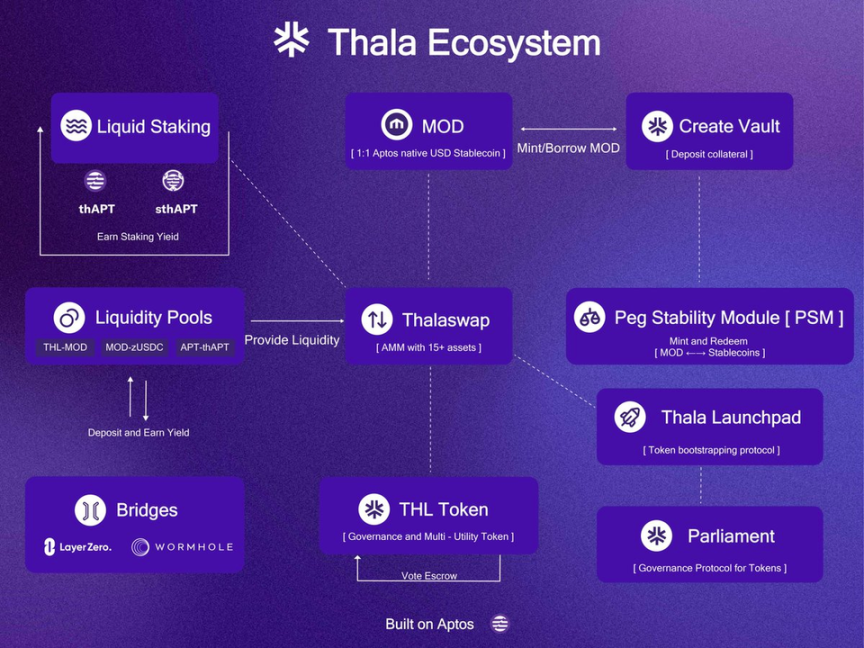

Taking ThalaLabs as an example, it has established a strategic partnership with Aptos, launching in the form of a DeFi super app, contributing 67% of Aptos' TVL. Its core revolves around two key products: MOD (over-collateralized stablecoin) and Thala Swap (AMM, aiming to become the core liquidity layer of Aptos), as well as liquidity staking, Launchpad, and other business categories.

Thala's native token is $THL, with 35% allocated to the community to incentivize the development of the Thala ecosystem and introduce more liquidity. In the third quarter of 2023, Thala and Aptos jointly established the $1 million Thala Foundry to incentivize native DeFi protocols on Aptos, providing funding of $50,000 to $250,000. The first supported project is the lending protocol @EchelonMarket, which adopts the latest fungible asset standard and aims to become a full-chain liquidity market, with a TGE scheduled for Q2. Considering that Thala's founder Adam previously worked at @paraficapital and has extensive financial experience, we can see that Aptos hopes to efficiently build the DeFi ecosystem infrastructure through Thala.

Thala has lived up to expectations, with trading volume now exceeding $200 million. In the liquidity staking design, stakeholders can achieve higher returns through a dual-token model similar to Frax (thAPT/sthAPT). Despite being launched only in March, the staked amount has already exceeded 5 million APT. With more APT unlocking and DeFi integration, Thala's LST business still has a lot of room for growth.

It is worth mentioning that founder Mo recently mentioned on Twitter that he met with ten large asset management institutions to discuss opportunities, with one of the key focuses being RWA. He recently announced a strategic partnership with Ondo Finance to natively introduce tokenized US Treasury bonds USDY onto the Aptos chain, initially through Thala Labs. In addition to launching USDY in AMM pools, Thala also plans to include it in the MOD collateral whitelist, increasing its utility and composability.

Aptos has its unique performance, supporting large-scale transactions, security, low cost, and low latency, aiming to create an experience close to CEX. Based on these features, some innovative derivative protocols, such as Merkle Trade (perp DEX, with a cumulative trading volume of $20 billion), Econia (dynamic parallel on-chain order book), Mirage Protocol (synthetic assets and perps DEX) are also being built on Aptos and have gained significant growth potential. Opportunities in structured products are also worth exploring. All these protocols will contribute to the prosperity of Aptos' unique DeFi ecosystem.

Social/Game: Still in the Early Stages

In the gaming field, Aptos has already established partnerships with some large game projects/studios, such as ReadyGG (with 2000 games in the ecosystem), Stan (mainly targeting the Indian gaming market), and others. Taking Supervillain Labs, which recently received investment from Aptos, as an example, its team comes from METAPIXEL and is a top Korean game studio specifically built on Aptos. In addition to investment, Aptos also provides support in game distribution and listing strategies. In the upcoming Supervillain: Idle RPG, Supervillain will integrate well-known NFT projects in the Aptos ecosystem, such as AptosMonkeys, Aptomingos, Bruh_Bears, etc. Furthermore, Aptos has also collaborated with NBCUniversal to create an interactive web game called Free Renfield.

It is evident that Aptos is very good at establishing large-scale partnerships, and in the early stages of building vertical ecosystems, it often adopts a high-profile strategy to attract attention. However, for the ecosystem to achieve long-term healthy development, it also needs to grow some vibrant applications from the bottom up. Considering Aptos' characteristics, such as fast transactions, low gas fees, etc., it is very suitable for interactive games. Additionally, Aptos is compatible with other chains such as Ethereum and Binance, allowing assets to be transferred across chains, providing more flexibility in asset trading and composability. With these features in mind, and considering that there is currently no full-chain game layout on Aptos, there may be opportunities for in-depth exploration in this area.

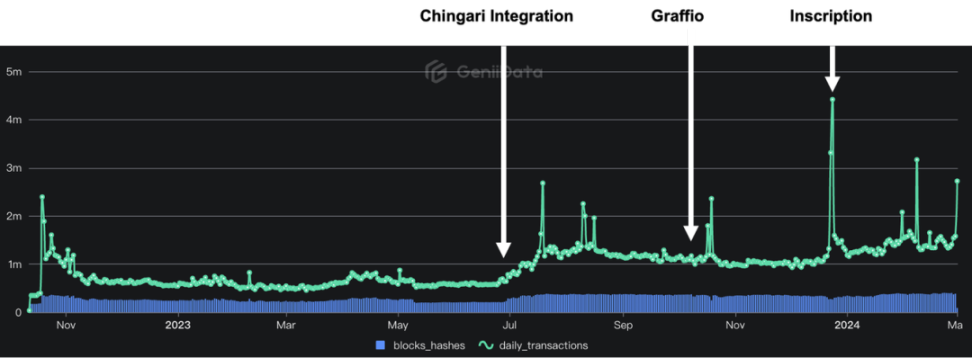

The social sector is currently relatively quiet. The peak trading volumes in history came from the integration of Chingari and the launch of Graffio. Chingari is an Indian on-chain social app with over 1 million downloads on the Google Store. Users can earn GARI tokens through interaction and content creation, which can be used for tipping, purchasing virtual gifts, etc. Users can also earn additional income through staking and participate in governance. Chingari has brought significant incremental users and trading volume to Aptos, and Aptos' high performance is sufficient to handle this sudden growth. Graffio was launched to celebrate Aptos' first anniversary, inviting community members to participate in a collaborative art creation on a canvas within 24 hours, with a total of 605,000 unique wallet addresses participating.

Daily TransactionsSource: GeniiData

In addition, social applications within the ecosystem include Aptos' native TowneSquare, Kade Network, each with its own unique features. TowneSquare is a new type of information flow content platform and community that allows direct NFT sales on the feed and introduces a set of P2P features, supporting wallet-to-wallet DM, social payments, etc. The team behind it has also built a social graph called Cred, which can derive rich use cases such as targeted advertising from this on-chain behavioral database. Kade has features similar to Friend Tech, such as closed communities and encrypted message delivery. Kade is supported by Aptos and Overmind. Overmind is a developer Quest platform where developers can earn rewards by completing coding challenges, and it also has cooperation with Aptos Foundation.

From Chingari and Graffio, we can intuitively feel the power of social applications in driving ecosystem activity and introducing new user layers. To achieve the goal of onboarding billions of users, the prosperity of the social ecosystem is almost a necessary condition. Whether specific use cases combining on-chain features are widely adopted remains to be seen. Developers can leverage some of Aptos' features, such as On-chain Randomness, to build unique and fun scenarios on the chain. Aptos' high TPS and high performance will then have ample room to play. Consumer demand will also provide clearer directions for technological iterations.

AI/Mobile: Emerging

Aptos' AI field is still in a very early stage of development, but it is an area that it is very focused on. Neil, the strategic head of Aptos Labs, mentioned on Twitter that "Aptos 2024 = Move + DeFi/RWA + AI" and revealed that Google Gemini is also paying attention to the combination of Move and AI.

Recently, it announced a major collaboration with Microsoft to integrate AI with the Aptos blockchain and launched the Aptos Assistant, based on Azure OpenAI, to help developers build on Aptos, providing guidance for the process of creating smart contracts, making development more accessible. Due to the integration of RAG, LLM, semantic search techniques, and high-quality content, it can provide more accurate and conversational content compared to general-purpose AI.

On the consumer application level, Aptos Labs has launched an experimental Q&A app called Find Out, where users can ask questions anonymously and earn on-chain points by selecting the most popular answers through an on-chain voting system. Find Out is a solution developed by the Microsoft AI Co-Innovation Lab that can answer unlimited questions.

There are many opportunities worth exploring in the AI field, depending on the natural entry points. For example, considering that AI reduces the cost of content production infinitely, leading to an explosion in content production, it also brings challenges such as content identity verification and whether to authorize content for model training. Immutable and censorship-resistant on-chain proof may be a solution. Other experiments include SwapGPT, which is building an AI-driven DeFi aggregator to find the best trading paths using AI.

Recently, io.net announced a $30 million financing for building a decentralized GPU network, and Aptos Labs is prominently featured in the investor list. To some extent, this indicates that Aptos is deepening its layout in the AI field.

In addition, Aptos places great emphasis on emerging markets. It recently announced a partnership with Jambo to enter the markets in Africa, Southeast Asia, Latin America, etc., in the form of mobile hardware. Jambo aims to become a Web3 super app for Africa, selling phones for $99 preloaded with the Aptos Petra wallet and related applications. Preloading has proven to be an efficient customer acquisition method in the era of mobile internet, and whether it can be reused and achieve large-scale onboarding in the blockchain era remains to be seen.

Ecological Incentive Plan: Community First

The development of the ecosystem also requires clever pushers, especially in the early stages, it needs to attract developers to build the ecosystem with its own characteristics combined with certain incentives, and when the ecosystem grows to a certain extent and the user side becomes active, it begins to have greater attractiveness and centripetal force, and more developers will actively come to build. It can be seen that the core is to capture developers and users in various ways, leverage each other, and enter a positive cycle of development.

According to Electric Capital's statistics, the number of active developers on Aptos last month is around 500, with a cumulative code commit count exceeding 5 million, making it the largest Move developer community at present.

Attracting Developers

Aptos has various grant and support programs, including the Aptos Grant Program, Aptos Artist Grants Program, The Registry, Aptos Collective, etc., each serving different purposes. In October last year, Aptos announced that it had distributed over $6 million in grants. In vertical fields, Aptos also has specific support strategies, such as the DeFi-exclusive Grant program in collaboration with Thala mentioned earlier.

In addition to grants, hosting hackathons is also a key strategy for Aptos to attract developers, and its World Tour hackathon series has been held in Singapore, Hong Kong, Seoul, Tokyo, Amsterdam, and other locations. The Asia-Pacific region is a key focus for Aptos.

Furthermore, considering that the number of Web3 developers accounts for only a small fraction of the overall developer population (20k VS 20M), expanding the increment is also important. On one hand, Aptos is iterating to lower the barrier to entry with tools such as Aptos Assistant, co-pilot, and on the other hand, it is also establishing more diverse collaborations. Taking its collaboration with Chingari as an example, they jointly launched the GARI Academy, starting from the education source to help Indian developers and students build dApps on Aptos, and will also hold offline events to promote it.

Attracting Users

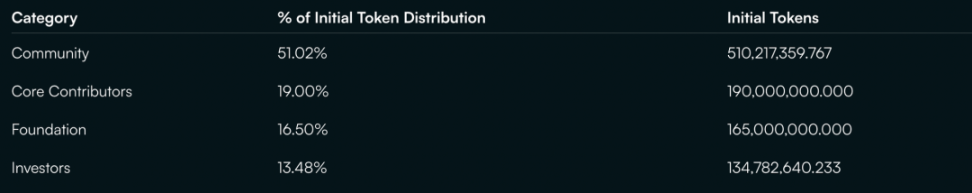

Token incentives are an important means for Web3 projects to attract users and complete cold starts, and how to effectively distribute them is the key. A striking point about Aptos is that it has allocated as much as 51% (510 million APT) of the tokens to the community. The majority of these tokens (410 million, ~80%) are held by the Aptos Foundation, with a small portion (100 million) in the hands of Aptos Lab. Approximately 1/4 (130 million) of the tokens have been initially unlocked to support ecosystem projects, community growth, etc., and the remaining tokens are expected to be linearly unlocked on a monthly basis over 10 years, demonstrating its long-term development determination.

The first airdrop on Aptos occurred in 2022, distributing 23,454,750 APT, mainly to incentivize users who participated in the testnet. This also means that Aptos' community incentive budget is still very ample. Adam, the founder of Thala, revealed on Twitter that the second airdrop is imminent, and the goal of Thala Foundry is to create second-order liquidity for the Aptos network.

The eve of an airdrop often heralds active user interaction, and although there may be some suspicion of false prosperity to some extent, the new increment it brings to the ecosystem is real. Especially for developers, this is undoubtedly a very good timing to attract users.

Conclusion

The competition among public chains is becoming increasingly intense, and each chain needs to find its own irreplaceability and differentiated ecological strategy to survive and develop. Built on the Move language, Aptos has security and scalability, and is making rapid progress in underlying technology development, with a constant stream of AIPs. On one hand, it hopes to create a smooth experience close to Web2, and on the other hand, it is actively exploring unique on-chain use cases. In terms of ecological strategy, it has chosen to focus on DeFi, RWA, AI, and other tracks, which also align with its high performance and low-cost characteristics.

2024 is a crucial year for Aptos to put its philosophy into practice and win the competitive advantage in the ecosystem. With the upcoming second airdrop, ample token incentive budget, new possible scenarios opened up by continuous technical iterations, and the strengthening attractiveness of the DeFi ecosystem for liquidity, Aptos still has many cards to play. For builders, there is a lot of open ground for construction on Aptos, which is worth judging and exploring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。