Author: Andrew Throuvalas, Decrypt

Translation: Jordan, PANews

On the evening of March 12th, according to an S-1 application file disclosed by the U.S. Securities and Exchange Commission, the cryptocurrency asset management giant Grayscale has applied to register a brand new mini version of its Bitcoin trust fund product: Grayscale Bitcoin Mini Trust, with the stock code "BTC". According to the application file, if the mini GBTC obtains regulatory approval, it will be listed on the New York Stock Exchange and operate independently from GBTC.

Why is Grayscale launching a "new version of GBTC"?

In the ETF industry, it is not uncommon to issue mini versions of flagship trust funds. However, according to a source close to Grayscale, the difference with GBTC is that the new fund Grayscale Bitcoin Mini Trust is created through a spin-off, which means that Grayscale needs to automatically transfer a portion of GBTC shares to Grayscale Bitcoin Mini Trust.

Currently, the S-1 file disclosed by the U.S. Securities and Exchange Commission does not reveal the proportion of shares allocated by Grayscale, but it is reported that GBTC is expected to supplement the detailed information on the split terms and conditions in the subsequent 14C application form. In addition, Grayscale also stated that it has not yet sought the consent, authorization, approval, or agency of GBTC shareholders for the split, and GBTC shareholders do not need to pay any consideration, exchange, or relinquish existing GBTC shares or take any other action to receive the shares allocated on the mini GBTC distribution date.

So, why would Grayscale choose to launch a "mini Bitcoin trust" product more than two months after the spot Bitcoin ETF GBTC obtained approval from the U.S. Securities and Exchange Commission?

First, the "mini Bitcoin trust" Grayscale Bitcoin Mini Trust may make Grayscale more competitive in terms of fees. In fact, the realization of capital gains is one of the reasons why GBTC shareholders are connected to existing products, as the fees for Grayscale GBTC are relatively high compared to those of competing products.

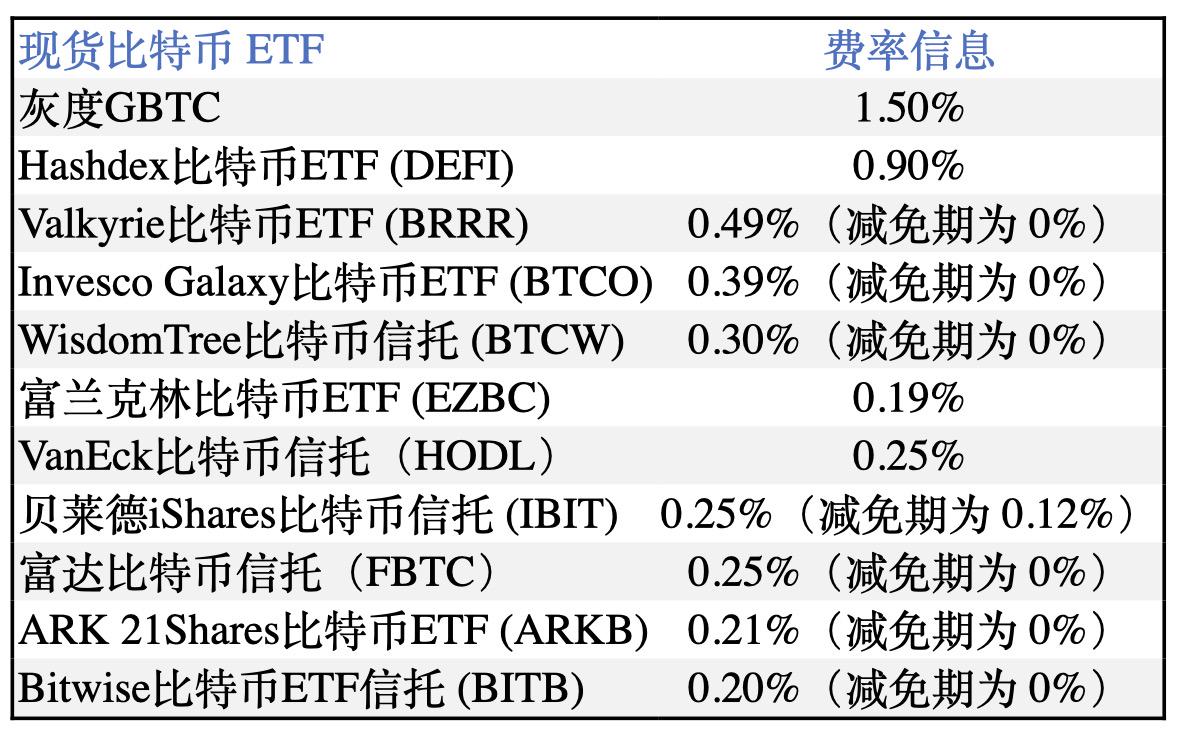

If the current rates provided by GBTC are considered, it is indeed difficult to compete with some low-cost spot Bitcoin ETFs in the market. Although Grayscale has transformed GBTC from a closed-end Bitcoin fund to an ETF, as shown in the table above, the 1.5% fee rate is the highest among similar products (before converting to a spot Bitcoin ETF, GBTC's rate was as high as 2%), while Franklin EZBC's rate is as low as 0.19%, and Bitwise's BITB is as low as 0.2%. For registered investment advisors (RIA) companies and brokers preparing to recommend Bitcoin ETF products to clients, fees may be a decisive factor in their product selection, so providing a cheaper alternative to GBTC makes sense.

Although Grayscale has not disclosed the fee information for the "mini trust," considering the current market environment, this figure should not be too high.

Another potential reason for Grayscale's application to launch the "mini trust" is tax issues. Since the approval of the Bitcoin ETF, investors in Grayscale's Bitcoin trust fund have been shifting to ETFs, and the tax implications of such moves may vary greatly depending on the investors' positions.

For investors holding GBTC in U.S. retirement accounts, although all of these securities are proxies for Bitcoin, they are held by traditional brokers, which means that transferring any of them to a new ETF in a retirement account will be tax-free. However, for investors holding GBTC in taxable accounts, the situation is different, and whether they will be taxed will depend on whether their positions are unrealized gains or losses. If investors have unrealized gains, selling the investment to invest in an ETF will trigger taxable gains, which means that the capital available for reinvestment in the ETF is effectively diluted by taxes.

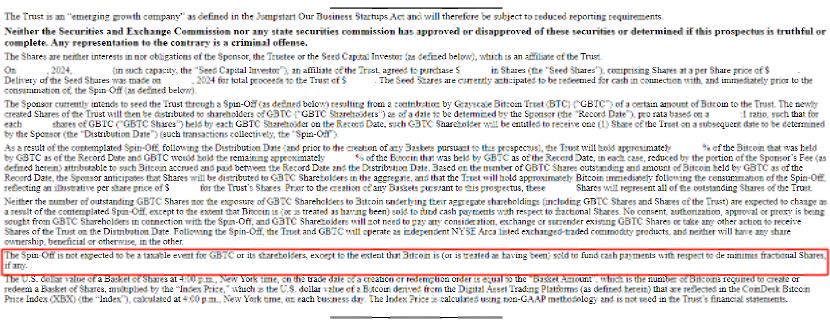

In order to allow investors to reasonably avoid taxes, Grayscale has indicated in the S-1 file submitted to the U.S. Securities and Exchange Commission: "The split mini trust will not be a taxable event for GBTC and its shareholders."

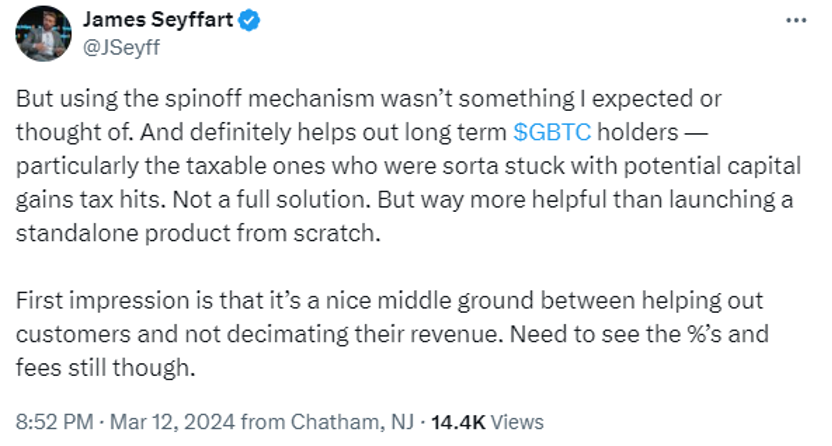

Bloomberg ETF analyst James Seyffar bluntly stated that Grayscale's application for the mini trust is to help long-term holders avoid taxes, and it can almost be certain that the mini trust will benefit long-term GBTC holders, especially those who have been hit by potential capital gains taxes and had to pay taxes previously. This is a good middle ground that helps clients find a position between reducing income and selling.

Can the "mini trust" curb the outflow of GBTC funds?

Since converting to a spot Bitcoin ETF on January 11th, GBTC investors have redeemed approximately 229,000 BTC (worth over $10 billion), and the fund has not recorded a single-day net inflow. In comparison, Grayscale's biggest competitors BlackRock and Fidelity's spot Bitcoin ETFs have accumulated 204,000 BTC and 128,000 BTC, respectively.

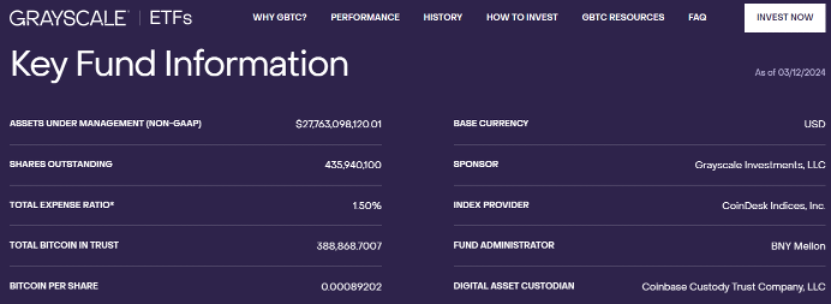

According to official data from Grayscale, as of March 12th, GBTC's Bitcoin holdings have dropped below the 400,000 BTC mark to 388,868.7007 BTC, and the number of circulating shares has also decreased to below 500 million. However, thanks to the rebound in the cryptocurrency market, especially with Bitcoin rising to the $70,000 range, GBTC's assets under management (non-GAAP) still remain in the range of $27-28 billion, making it the largest product of its kind in terms of scale.

However, it is worth noting that Grayscale's market dominance has begun to show signs of weakening. At the close of trading last Friday, Grayscale GBTC's total trading volume in spot Bitcoin ETFs fell below 20% for the first time, while the combined trading volume of BlackRock and Fidelity's ETFs rose to 69% (with BlackRock's IBIT trading volume accounting for nearly 47%)—when spot Bitcoin ETFs began trading in January, Grayscale GBTC absorbed about half of the trading activity, which seems to indicate that as GBTC's selling activity gradually weakens, early investors have begun to shift to other competing products after redeeming funds.

At present, the launch of Grayscale Bitcoin Mini Trust may be able to somewhat slow down the outflow of GBTC funds, but the effect may be limited. On the one hand, Grayscale needs to face the challenge of numerous competitors in the market to prevent existing clients from transferring to other products; on the other hand, Grayscale also needs to attract new investors. Even if Grayscale Bitcoin Mini Trust obtains regulatory approval for listing, it remains to be seen whether this product will offer investors greater and more attractive incentives in terms of taxes and fees. Let's wait and see!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。