Article: 0xEvan, Primev

Translator: Franci, ETHconomics Research Space

Proofreader: Jason, ETHconomics Research Space

Translator's Note

The previous articles we published were related to blob transactions themselves and the fee mechanism of 4844. In this article, the author simulates the potential of the blob market by backtesting data from the past year to explore how much data it can accommodate and whether it can meet the data availability requirements of rollups.

In addition to the supply and demand curve of the blob space affecting the blob market, the timing games of validators and the review of builders will also have some negative effects on this market. This article analyzes the potential delay of blob transaction broadcasting and demonstrates its impact on user experience and rollup data availability costs. It also proposes possible solutions—pre-confirming blob transactions.

Overall, this article provides a comprehensive analysis of the blob market, allowing readers to explore the landscape of the future blob space through the context of the article.

Main Text:

Special thanks to @terencechain for review, @BertKellerman for insights, and @ethpandaops for providing Holesky testnet data.

TL;DR

- Our research delves into the emerging EIP-4844 blob market, which operates similarly to EIP-1559's gas pricing mechanism. However, unlike type2 transactions, it does not have a direct fee mechanism for block builders to incentivize them to package blob transactions, which may lead to unstable blob transaction experiences and pose challenges for their inclusion in blocks.

- We note that while blob transactions have a large capacity (about 125 kB) and are cheaper than calldata of the same size, they significantly increase the size of Ethereum blocks. This also means that blob transactions bring incremental bidding power to the blocks.

- We demonstrate that the capacity of this new market can absorb the current data demand of rollups and reduce the gas cost of standard block space by 15-20%, unlocking lower-cost MEV opportunities.

- We observe that during periods of increased network activity, blob transactions may slow down block broadcasting by orders of magnitude in hundreds of milliseconds, which may lead block builders to review blobs to maintain competitive bidding in MEV-boost.

- We evaluate that "pre-confirming bids" can mitigate these challenges, and blob pre-confirmation can enhance the capabilities of EIP-4844, providing a better transaction experience for L2 users and a stable transaction packaging experience for rollups.

- We will conduct experiments on the Holesky testnet, collect data from block builders, and use MEV-commit to set up a relay as a blob pre-confirmation provider. We invite relevant participants from PBS to join the experiment.

Introduction

EIP-4844 introduces a blob market, expanding Ethereum's data availability. This emerging market uses a gas price mechanism similar to EIP-1559 to price and destroy the base gas fee of blobs. However, unlike type2 transactions, users in the blob market do not have a direct way to bid for builders to package their blobs as there is no priority fee design, making it difficult to accurately price the packaging fee for blobs. Additionally, blocks carrying blobs are expected to slow down in network broadcast speed because blobs are the largest type of Ethereum transactions. If builders accept many blobs in a block, they will face a higher risk of block reorganization. Therefore, assuming builders are rational actors at an economic level, they may choose to review blobs during MEV peak periods to maintain low latency in block construction.

We propose block building and MEV-boost data collection related to blobs, as well as an experiment using MEV-commit as a blob pre-confirmation provider, and invite participants from the community, including rollups, relays, block builders, and proposers. Our insights into blob-related behaviors in EIP-4844 indicate that L1 blob pre-confirmation can enhance the utility of the blob market, provide a better transaction experience for L2 users, offer reliable packaging experience for rollups under MEV conditions, and provide a more stable future for the rollup-centric Ethereum roadmap.

Understanding the Blob Market

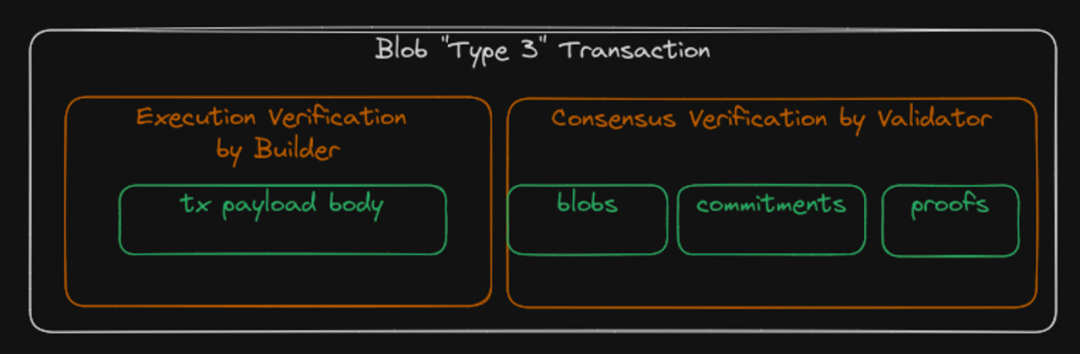

Blob Transactions

EIP-4844 introduces a type3 transaction (also known as a blob transaction). Transactions carrying blobs are similar to regular transactions but include blob data, KZG commitments, and proofs. Compared to standard Ethereum transactions, blobs are significantly larger (about 125 kB) and much cheaper than the equivalent calldata. The price of calldata is 16 gas per non-zero byte and variable in size, while the price of blob data is 1.04 gas per byte, with a maximum of 131,072 gas per blob.

Blob Gas Mechanism

The base gas pricing of blobs has a fee mechanism that reflects network congestion, similar to EIP-1559. The main difference is that the price of blob base gas varies based on the usage of blobs, while EIP-1559 is based on the utilization of gas in the previous block (the amount of gas used compared to the target gas amount). The target number of blobs is 3 (0.375 MB), and the maximum number per block is 6 (0.75 MB). The minimum value of blob base gas price is set to 1 wei.

When submitting a blob transaction, the sender submits maxfeeperblobgas as the highest price they are willing to pay for the blob base gas fee, and all of these fees will be destroyed. maxfeeperblobgas is similar to maxfeepergas in type0 and type2 transactions. If users want to submit additional fees to incentivize the packaging of their transactions, they will also submit maxpriorityfee. However, maxpriority_fee only covers the non-blob gas part of the transaction. This means that under this blob gas fee mechanism, users cannot directly submit blob packaging fees to builders.

(Editor's Note: For a more detailed analysis of the 4844 fee mechanism, our community has written a more detailed article, please see here)

Blob Market Capacity

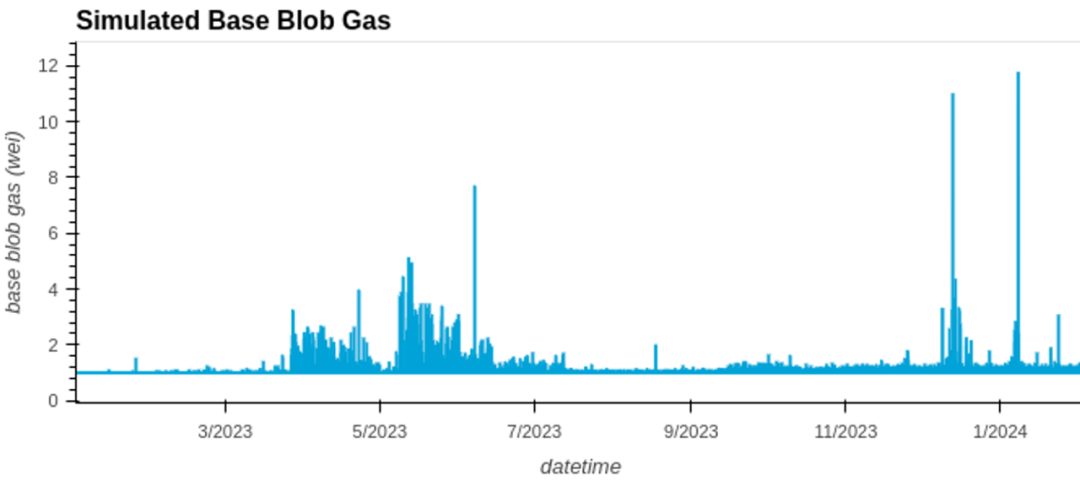

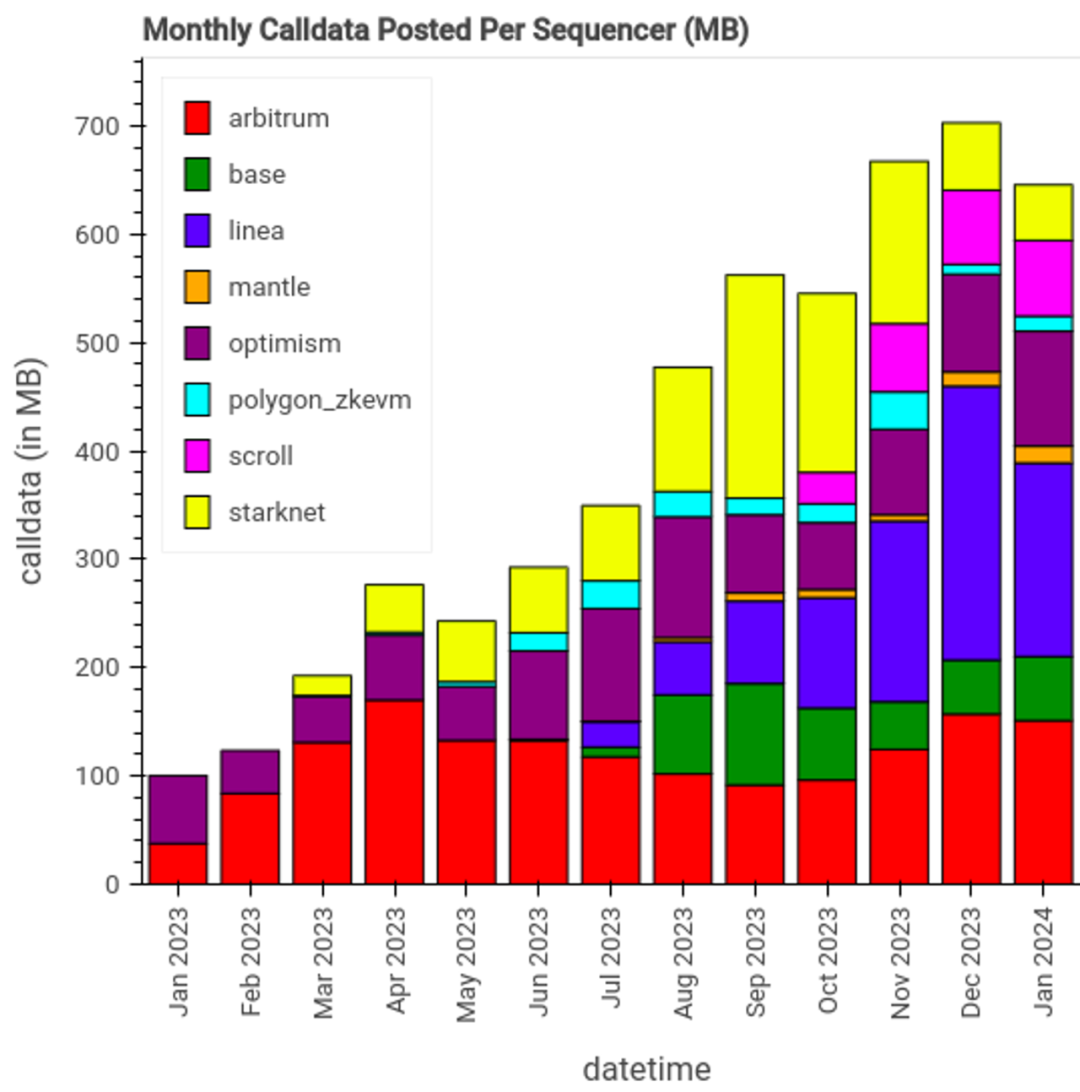

In this section, we backtested the historical interaction activity of the rollup network from January 2023 to January 2024 to demonstrate the capacity of the blob market. We focused on the most active rollups on Ethereum and used historical data to simulate a real-time blob market. Of course, this market is actively growing, and blobs have not yet been launched on the mainnet. This article uses the entire 2023 historical data to simulate its potential.

Based on the historical calldata activity of rollups, simulated usage in the block space of type3 transactions, we can see that the blob market prices can easily absorb all the capacity of rollups without causing the blob market prices to exceed the minimum blob base gas value (i.e., 1 wei).

Figure: base blob gas per block

Figure: base blob gas per block

Despite rollups releasing more data to Ethereum, most blocks still remain below the target blob quantity, ensuring that the blob gas price remains at a low level.

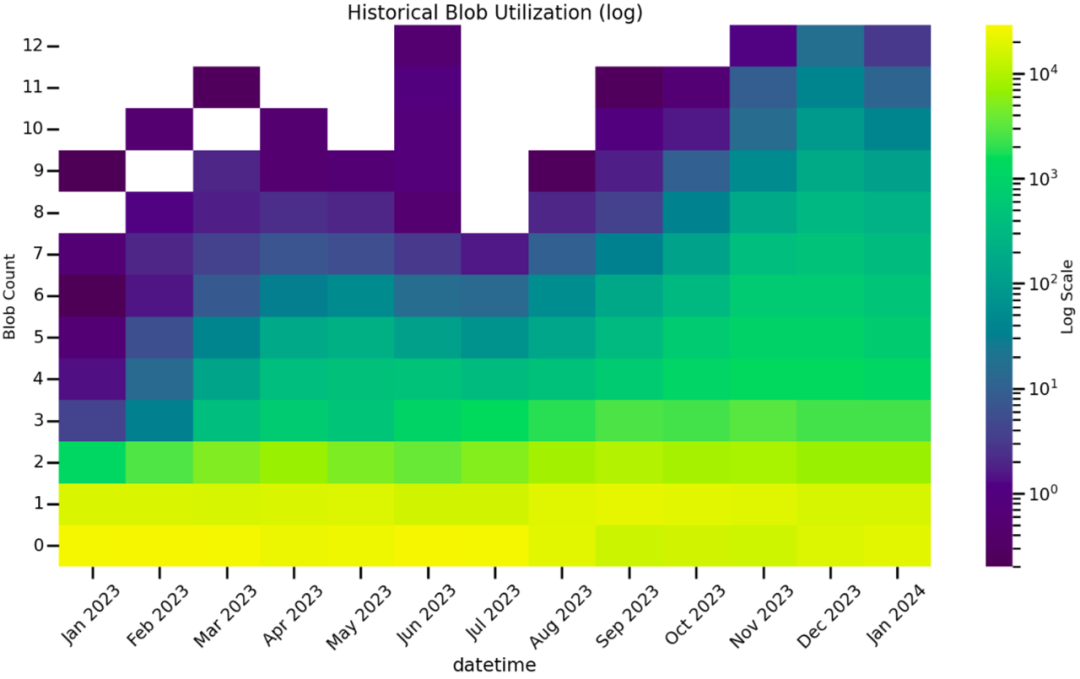

Figure: The lighter the color, the more frequently blocks with a specific number of blobs are built

Figure: The lighter the color, the more frequently blocks with a specific number of blobs are built

This means that the calldata expenses in the blob market will be lower (calldata consumes 16 gas per byte, while blob consumes 1 gas per byte), and the gas price will also be lower (calldata gas price is in the gwei range, while blob gas price is in the wei range), saving two layers of additional costs for rollups.

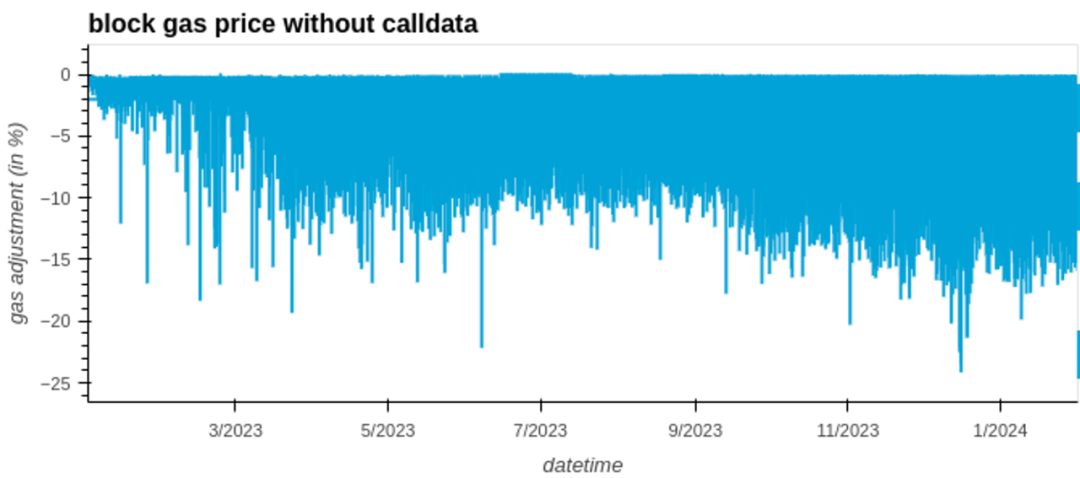

The blob market not only can easily absorb the current data availability needs of rollups but also allows the non-blob market to release more block space, reducing gas expenses by more than 15-20%. The reduction in gas expenses correspondingly increases the bidding power of users/searchers, builders, and validators, unlocking new MEV opportunities that were previously excluded due to high prices before EIP-4844.

Figure: The impact of EIP-4844 on standard block space (based on 2023 data)

Figure: The impact of EIP-4844 on standard block space (based on 2023 data)

Rollup Needs More Data Availability

Rollups significantly impact the use of gas in blocks and are the largest gas users in the current Ethereum block space. In 2023, rollups stored a record amount of transaction data on Ethereum, as shown in the following figure:

Figure: Record high calldata stored on Ethereum

Figure: Record high calldata stored on Ethereum

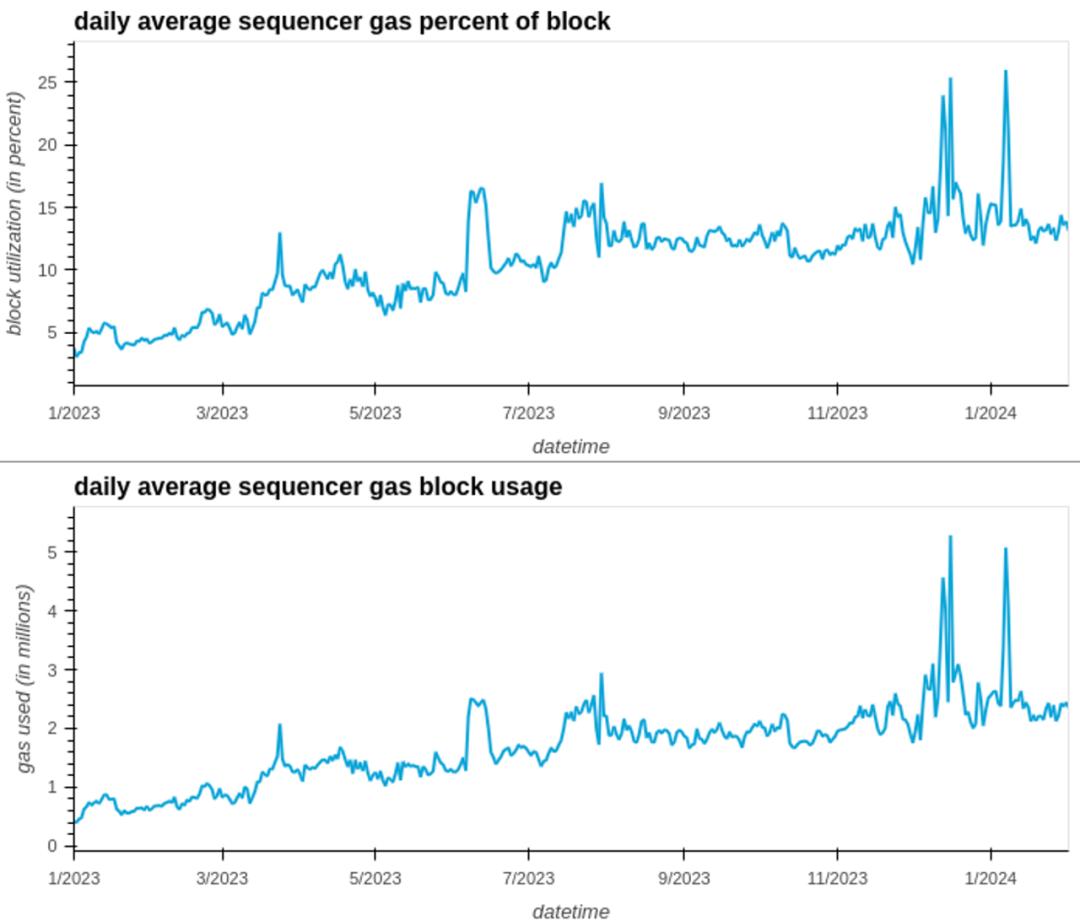

The daily average chart below shows that rollups began to account for over 15% of the gas in each block they were in, directly affecting the usage prices of other users.

This could further deteriorate in the event of a black swan event and increased demand. In December 2023, the surge in transactions due to the inscription craze caused the sequencer of Arbitrum to be offline for about an hour. When the Arbitrum sequencer resumed operation and began to release the backlog of saved state data, the sequencer immediately monopolized the entire block space, causing gas prices to soar to over 140 gwei, consuming over 90% of the gas in most blocks, rendering the network unavailable to most users for several hours.

In the next section, we will discuss how timing games and review may affect this market, even in the absence of such a surge in demand.

Challenges Faced by the Blob Market: Review

Broadcast of Blob Transactions

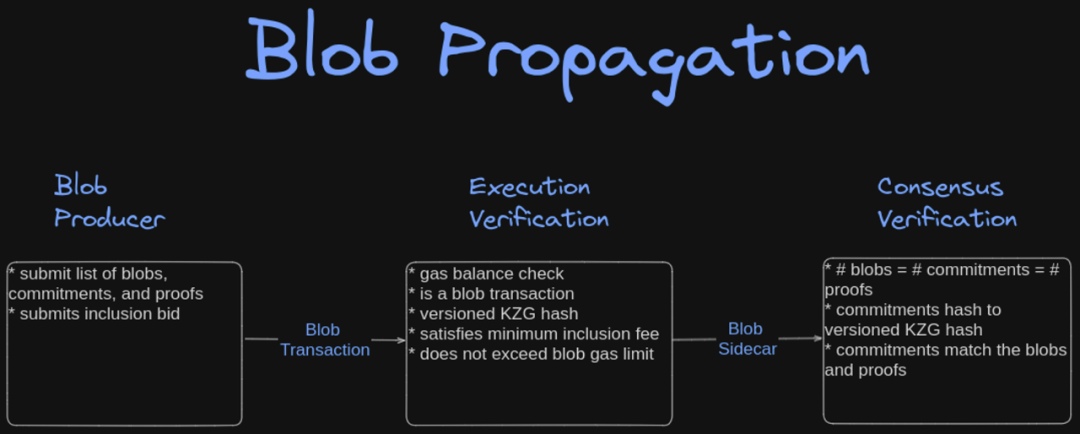

EIP-4844 increases the bandwidth demand of each beacon block by approximately 0.75 MB, 42m gas, to accommodate up to 6 additional blobs in each beacon block. Unlike calldata, which is permanently stored, blobs have a short duration in beacon nodes (as of February 2024, 18 days) to keep the growth of network archives under control.

In addition, blob transactions have two network representations—for block builders, it is a blob transaction, and for validators, it is a blob sidecar. The design of the blob sidecar is for forward compatibility.

Blobs must first be broadcast through the execution layer and then broadcast to the consensus layer. This means that builders (not validators) have the final say in packaging blobs. Proposers can only exclude blob transactions dynamically in mev-boost based on the invalidity of commitments/proofs.

Figure: Execution verification by builders, consensus verification by validators

Figure: Execution verification by builders, consensus verification by validators

Perspective of Block Builders

Recent research on validators' "timing games" emphasizes that delay optimization can strategically maximize node operators' profits by delaying block proposals. The authors explain that this is harmful to the health of the chain. Blob transactions further complicate this game by adding different amounts of delay (when blob sidecar is broadcast).

Blob transactions are the largest possible transaction size type. Because of this, blocks carrying these transactions propagate slowly, making block builders less competitive in winning MEV-boost bids. As a result, this incentivizes block builders to temporarily or even indefinitely review blobs so that they can submit MEV bids at a higher frequency.

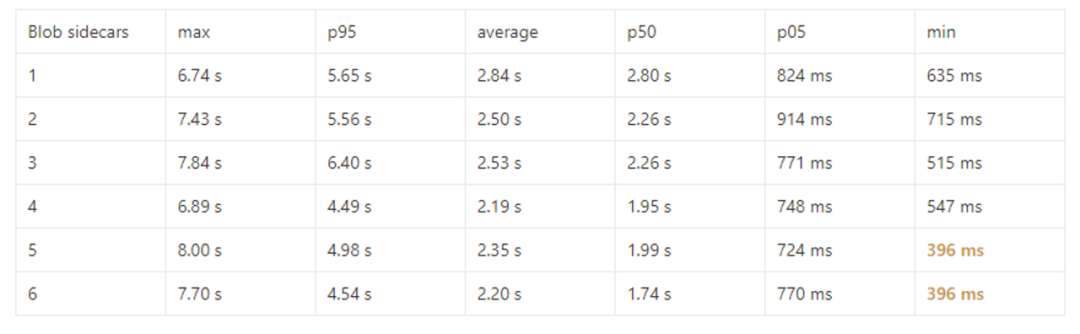

The ethpanda team has been testing real-world delays using Xatu on the testnet. They set up observers in multiple locations globally (NYC, FRA, BLR, SYD) and used different Ethereum consensus clients (Prysm, Nimbus, Lodestar, and Lighthouse) to measure real-world delays. The Holesky Blob data snapshot on February 20, 2024, shows a significant amount of delay throughout the MEV pipeline.

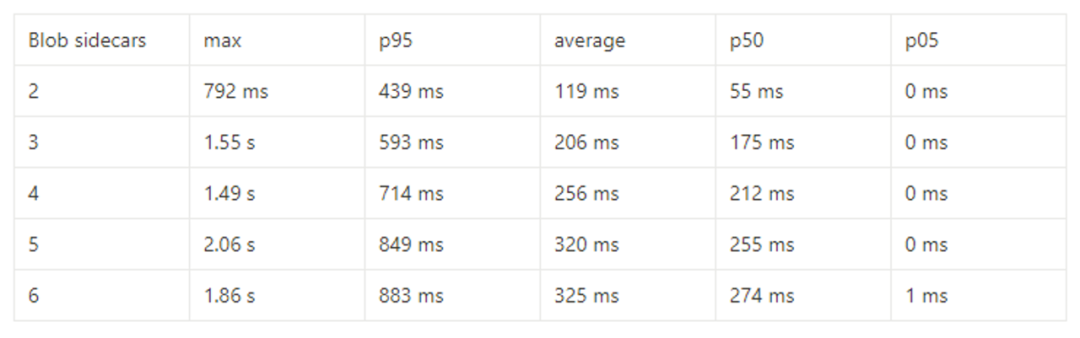

After winning the MEV-boost bidding auction, proposers must wait for the broadcast of the blob sidecar before they can verify the blobs packaged in the block. The table below shows that in a sample of 800 blob sidecars, the shortest time for the broadcast of a single blob sidecar is approximately 400 milliseconds.

Figure 1. Blob Broadcast Time vs. Number of Blobs Contained in a Single Slot

Figure: The small data volume is one of the reasons for some counterintuitive observations described in this dataset

Figure: The small data volume is one of the reasons for some counterintuitive observations described in this dataset

The table below shows the delay difference when waiting for more blob sidecars to arrive. The 50th percentile (p50) in the table indicates that the delay difference between blocks carrying 2 blobs and blocks carrying 6 blobs is approximately 225 milliseconds.

Figure 2. Time difference between the first and last arriving blob sidecars in the total number of blob sidecars grouped by block

This delay in blob broadcasting will bring additional block reorganization risk to block builders, as they fill their blocks with blobs but receive minimal economic benefits. Builders may choose to exclude/review blob transactions to avoid potential reorganization. If a block contains a large amount of MEV, economically rational builders need to appropriately compensate for this risk through the rollup network.

This delay in blob broadcasting will bring additional block reorganization risk to block builders, as they fill their blocks with blobs but receive minimal economic benefits. Builders may choose to exclude/review blob transactions to avoid potential reorganization. If a block contains a large amount of MEV, economically rational builders need to appropriately compensate for this risk through the rollup network.

User Experience in Blob Market Bidding

In a paper on validator timing games, it is pointed out that in the late stage of the MEV-boost bidding process, larger bids are associated with larger blocks. As bids and gas prices increase, a larger share of ETH will be destroyed in subsequent slots. If the base fee increases while MEV extraction remains constant, builders' bidding space for future income will decrease.

Translator's note:

(Value inflow: MEV + fees

Value outflow: destroyed ETH + Proposer's PriorityFee + tip from builder to Proposer + builder's own income)

In other words, the more destroyed, the less given to the proposer.

In the expected blob market, the capacity exceeds current demand. The destroyed blob base fee will remain at a very small level, in the tens or hundreds of wei. Understanding this is crucial for rollups: even if they pay enough base fee, their blob transactions may not be packaged. A low blob market base fee means that blob transactions need to bid many times higher to incentivize builders to package such transactions. In this case, blob transactions will have to be resubmitted at a higher cost, resulting in a poor user experience.

Furthermore, due to the lack of a packaging fee mechanism (such as blob priority gas fee) in the initial blob market under EIP-4844, this further exacerbates the user experience issue, as rollups cannot directly compete for the space to package blob transactions.

Let's look at an example transaction, assuming a blob base gas fee of 10 wei, to calculate the cost of blob with the same data volume. It should be noted that this example assumes a valid packaging bidding mechanism that can bid for blob space.

?Please see the example transaction:

Calldata - 129,998 bytes (129429 nonzero bytes) ~ 2,094,140 gas used at 10.56 gwei (10.55 gwei base price + .01 gwei Priority Fee) = .022 ETH

Blob-128,000bytes~131,072gasusedat1gwei(10weibaseprice+.99999999gweipriorityfee)=0.000131072ETH

The conclusion drawn from the calculation is that if rollups use the blob market, they can submit bids that are 100 times higher due to the lower blob base fee, while saving more than 150 times the cost. The lower blob base fee allows rollups to provide more competitive bids while saving expenses. Packaging costs need to be as competitive as the existing MEV opportunities in the block to compensate for the potential reorganization risk faced by builders, so even bidding 100 times higher may not be enough. This is without blob pre-commitment.

Implementing Blob Pre-Commitment through mev-commit

In this timing game, the main role of blob pre-commitment is to make some pre-committed blobs available in the MEV pipeline. Through mev-commit, each pre-commitment provider makes their own commitment to the transactions. Then, the provider can authorize this data to other participants (such as block builders, relayers, sequencers). The pre-committed data available to other participants in the MEV pipeline allows block builders to send matching execution loads in parallel. This concept can be used to create a pre-committed list of blob packaging or to coordinate the construction of type3 block space by relayers.

Because block builders know about pre-committed blobs in advance, they can build blocks with future blobs before their slot begins. This approach provides a basis for pricing and lays the foundation for building a strong futures market. This market will provide a more reliable transaction packaging experience for rollups and stabilize block space prices. Additionally, the pre-commitment bidding of mev-commit provides rollups with a more reliable price discovery mechanism, as rollups can update their pre-commitment bids in real-time without resubmitting the entire blob transaction.

Finally, bundling blobs and using the pre-commitment bidding mechanism can enable rollups to form alliances. Pre-commitment bidding can be applied to bundled blob transactions or aggregated blobs, allowing rollups to share bidding capabilities and packaging space, helping to promote stability and continued development of the Ethereum blob market.

Conclusion

In summary, our research indicates that the economics of rollups are improving, and the emergence of new markets requires consideration of more factors, including timing games and the impact of the lack of a fee mechanism. It is too early to enter the solution stage for the issues we have emphasized, but since mev-commit has been activated on the Holesky testnet, we can easily experiment with PBS behavioral entities. Primev will collect relevant data on the impact of blobs on block builder and proposer delays and hopes to understand potential behavioral patterns.

While economics and user experience are the primary drivers for pre-commitment Type2 transactions, under EIP-4844, the transaction packaging experience, reliability, and stability of rollups and the rollup-centric Ethereum ecosystem will become important reasons for pre-committing blobs. We will also attempt to use blob pre-commitment relayers, which can leverage blob pre-commitment and coordinate with block builders to improve the broadcast delay of blob sidecars on the Holesky testnet. We invite the community to participate in this experiment, as it may provide potential solutions for the entire community.

Related Resources

EIP-4844 Economics #1: In-depth EIP-4844 Fee Mechanism

https://ethconomicsresearchspace.substack.com/p/4844-economics-series-1-cn

The cost of artificial latency in the PBS context

https://arxiv.org/pdf/2312.09654.pdf

Timing Games: Implications and Possible Mitigations

https://ethresear.ch/t/timing-games-implications-and-possible-mitigations/17612

STRUCTURAL ADVANTAGES FOR INTEGRATED BUILDERS IN MEV-BOOST

https://arxiv.org/pdf/2311.09083.pdf

Validator Timing Game Post EIP4844

https://ethresear.ch/t/validator-timing-game-post-eip4844/18129?u=murat

Historical data of rollup network from January 2023 to January 2024

https://github.com/Evan-Kim2028/ethereum_block_explorer/tree/master/panel

What is mev-commit

https://docs.primev.xyz/concepts/overview/introduction

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。