Author: A FOX

Translation: DeepTechFlow

Abstract:

- On Tuesday, March 5th, Bitcoin reached a historical high of $69,000, briefly surpassing the record set on November 7, 2021, and then fell back.

- It is unprecedented to reach ATH before the halving (i.e., 45 days later), which may be due to the surge in demand for Bitcoin ETFs.

- After the halving, there will be a supply shock, coupled with high demand from ETFs, and we are likely to see parabolic growth in a short period of time.

- This earlier-than-expected high growth may also indicate that the end of the bull market will come earlier than expected, possibly in early 2025 instead of the end of 2025.

Main Text

Bitcoin's price has reached a new historical high of $69,000!

Although this situation was short-lived as it has already fallen back, Bitcoin has reached this milestone even before the halving.

For Bitcoin and the broader cryptocurrency space, this is an unprecedented historic moment in itself, so let's analyze this and see what will happen next.

Bitcoin's Historical High

On March 5, 2024, we saw the price of Bitcoin surpass its previous all-time high (ATH) of $69,000 on November 7, 2021! Although this situation was very brief, it quickly fell back to $58,000, stabilizing at around $64,000 a few hours later.

Bitcoin's previous ATH was reached during the peak of the last bull market, when Bitcoin became a hot topic and it seemed like it would continue to rise forever, as always happens in a bull market.

In the chart above, you can see the ATH peaks of about $1,200 in 2013, about $19,000 in 2017, and about $69,000 in 2021. Each of these peaks aligns with Bitcoin's 4-year cycle.

Now we are once again in the bull market phase of a new cycle, with Bitcoin rapidly surpassing the previous highs of the bull market and preparing to enter a price discovery mode, stabilizing above the new ATH.

However, this time is different as it has surpassed the previous ATH before the Bitcoin halving, which is still about 45 days away!

As shown in the chart, in all previous cycles, Bitcoin experienced this aggressive upward climb in the months after the halving, not before.

Halving

Historically, the halving has been a major driver for pushing the price of Bitcoin to rise above the old ATH and enter a price discovery phase to find a new ATH.

This involves many complex market dynamics, but the most prominent reason is that the halving leads to a 50% reduction in the new Bitcoin supply per block, immediately altering the balance of demand and supply.

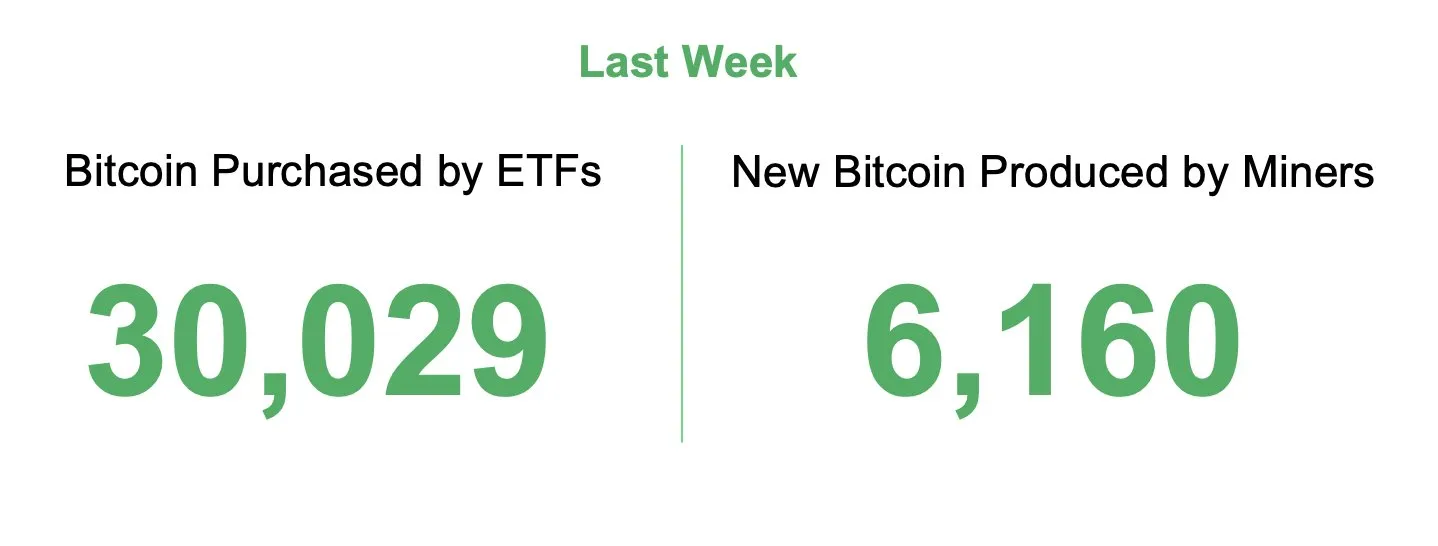

The most likely reason for this unprecedented situation this time is Bitcoin ETFs, which created a huge demand for Bitcoin after their launch in January, surpassing the supply. As you can see below, the amount of Bitcoin purchased by ETFs last week was 5 times the miner output!

In about 45 days, we will have another halving, and then the number of Bitcoins mined per block will decrease from 6.25 to 3.125, i.e., from about 900 Bitcoins per day to 450 Bitcoins, or from 6,000 to 3,000 Bitcoins per week!

Just as Bitcoin ETFs led to a significant increase in demand, the halving will lead to a significant decrease in supply. Bitcoin will experience another unprecedented moment, while dealing with this huge demand and supply shock!

What Might Happen Next

Simply put, the surge in demand for ETFs and the decrease in supply due to the halving are likely to cause a rapid increase in the price of Bitcoin.

In the past, when Bitcoin broke the previous all-time high, it took only 10 to 18 days to double in price.

Given the current conditions, it is very likely that Bitcoin will once again experience a parabolic growth cycle, which will also drive the entire market upwards.

If we see this doubling, then by mid-year, the price of Bitcoin will reach around $140,000!

Of course, it is difficult to determine whether the price of Bitcoin will double again in such a short time, but in any case, a significant price increase is likely.

Looking ahead, Bitcoin's 4-year cycle historically has 3 years of upward movement, followed by 1 year of decline. Since the collapse of LUNA in 2022, we have experienced about 1 year of decline, followed by 1 year of growth in 2023, so we can expect about 2 more years of upward movement in this cycle.

Under normal circumstances, we expect the 3-year bull market cycle to end around the fourth quarter of 2025.

However, in fact, we have already reached the peak before the halving, and the upcoming demand and supply shock will drive up prices, and cryptocurrency inflows and outflows are easier than ever, which means things may be different.

I think we may see the following situation: the frenzy stage of the bull market comes early, the BTC ATH peak also comes early, so the inevitable decline will also come early, possibly in the first or second quarter of 2025.

But this does not constitute financial advice, anything is possible. The only thing that is certain is to fasten your seatbelt and make sure you are on board, as this will be a spectacular year!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。