In modular blockchain, the settlement layer holds the highest value.

Author: IMAJINL / Source

Translation: Plain Blockchain

1. Introduction

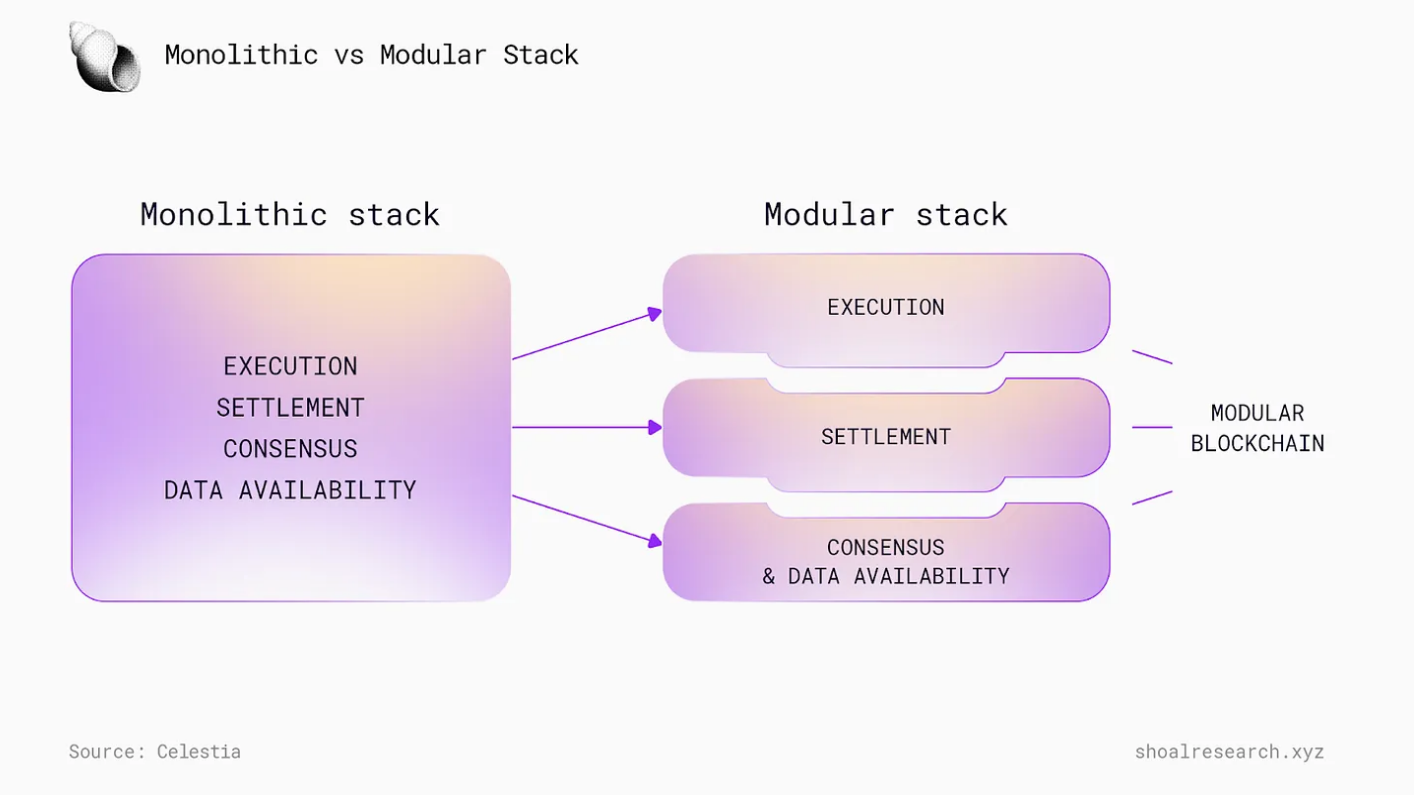

Modular blockchains have always been highly regarded, but one aspect is often overlooked, that is, they will fragmentize value. In a world where we only have a single massive blockchain, all value belongs to the ecosystem of this blockchain, but this is not the case with modular blockchains.

This is due to the inherent design of modular blockchains. The modularization related to core blockchain components (data availability and consensus; why these two components are put together will be discussed later in this article; execution and settlement) is specialized at different levels (doing what they do best), and the best levels of data availability and consensus, settlement, and execution are coupled into one blockchain, allowing end users to access better products at lower prices.

Specifically, the main benefits of the modular stack are reflected in users' access to cheaper and better block space (in this specialized sense, the total block space can expand exponentially; this will be detailed below; as more blockchains emerge, unlocking applications we haven't even thought of, just as broadband opened up social media), as well as better security. Application developers also do not need to worry too much about the ideal stack for them; they just need to plug and play, and then deploy their applications. Therefore, when the functions of all these core components are executed by different blockchains, where does the value really belong?

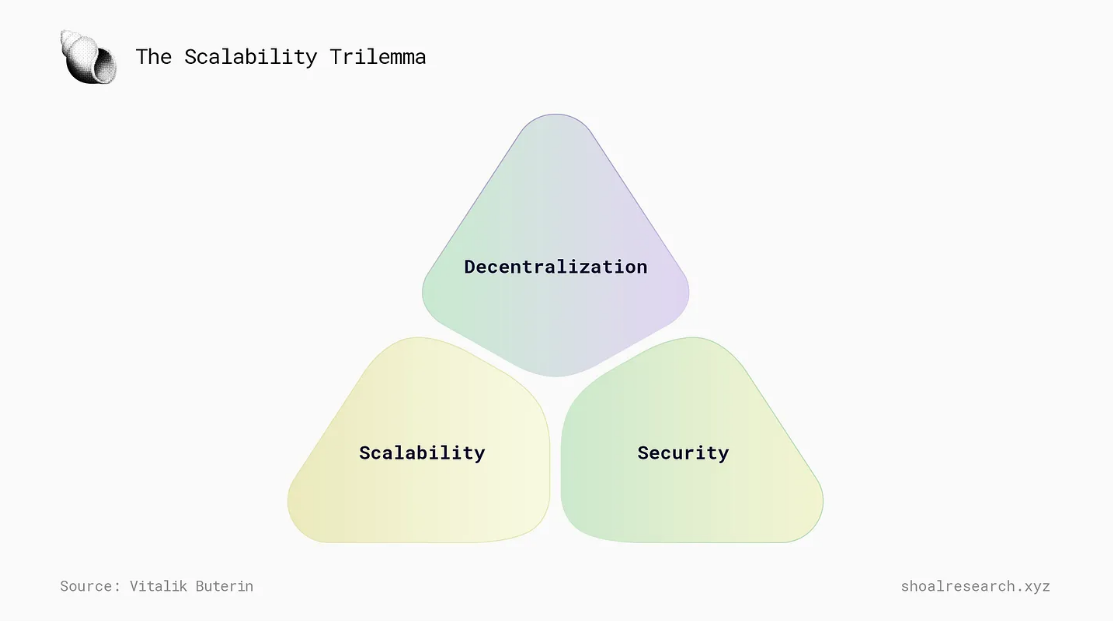

But before delving into this issue, let's gain a deeper understanding of modular blockchains. One important reason for the narrative of modular blockchains is that it will drive a paradigm shift in blockchain technology and Web 3.0 as a whole, as it allows us to expand bandwidth without compromising the attractive features of blockchain (censorship resistance, real-time and trust neutrality).

Essentially, through modular blockchains, we can weigh the pros and cons at different levels to achieve the best balance in the three dilemmas of blockchain (as mentioned above). Taking Ethereum as an example, through modular blockchains, Ethereum can be used as a settlement layer because it has the most validators and the most geographically distributed validator community (as well as many independent validators and overall less centralization, see here), and objectively, Ether is the best cryptocurrency after Bitcoin. But in reality, Ethereum is very suitable as a settlement layer, which would make it a place with normative bridging and dispute resolution functions (e.g., used for fraud/fault proofs).

Now, we are building different layers on Ethereum to address the scalability issue, similar to the practice in traditional finance (for example, services like Stripe or similar to PayPal are built on multiple financial layers, and banks typically use the Fedwire settlement system of the Federal Reserve at the base layer for settlement). Nic Carter explained this well in an interview with Lex Fridman (it is worth noting that traditional finance leverages the advantages of centralized databases in recording transfers, while blockchain is a distributed ledger that requires the cooperation of thousands of nodes to verify and add transaction records).

We have adopted Rollup (and other scalable solutions, but Rollup is the main solution), which is specifically used for executing code (execution is basically running code in an execution environment, and the execution environment of Ethereum and Ethereum Rollup adopts the form of EVM). Therefore, there will be some trade-offs in decentralization and security (which is another separate topic). Rollup also requires data availability (here is a beginner's guide), and the resulting consensus, although these can be done by Ethereum, but can also be outsourced to blockchains specialized in this work like Celestia (you can learn about Celestia's high-level overview through this video).

A good example of a project embracing modularity is Eclipse, which uses Ethereum as the settlement layer, Celestia as the DA+ consensus layer, and uses SVM (Solana Virtual Machine) as its execution environment. SVM has attracted a lot of attention because it is one of the few multi-threaded virtual machines, allowing parallel processing (basically processing transactions in parallel), unlike the Ethereum virtual machine, which is single-threaded; therefore, sequential transactions are the norm and parallel processing is not possible.

2. Modularization or Monolithization?

Let me make one point clear, Ethereum itself is not a modular blockchain in this sense, it can independently perform all functions (data availability, consensus, execution, and settlement), but other blockchains and layers of modular stacks (such as Rollup and other execution layers) can utilize it for settlement and other functions, making Ethereum a part of another project's modular stack. This is the origin of the joke proposed by Jon Charb, who has written some amazing articles on Ethereum's roadmap and Ethereum Rollup. The understanding of this joke is that everything is a modular blockchain, and everything is a monolithic blockchain (completing all functions at the base layer, like Solana), depending on how you look at it. For example, if I build a Rollup on Solana, is Solana itself a monolithic blockchain or a modular blockchain? The same goes for Ethereum. Even Celestia can perform settlement, but if it is only used for data availability and consensus, then it is a modular blockchain—do you understand?

By embracing modular blockchains, you can have different blockchains that focus on their respective functions to meet the requirements of building "optimized" blockchains, as I explained above.

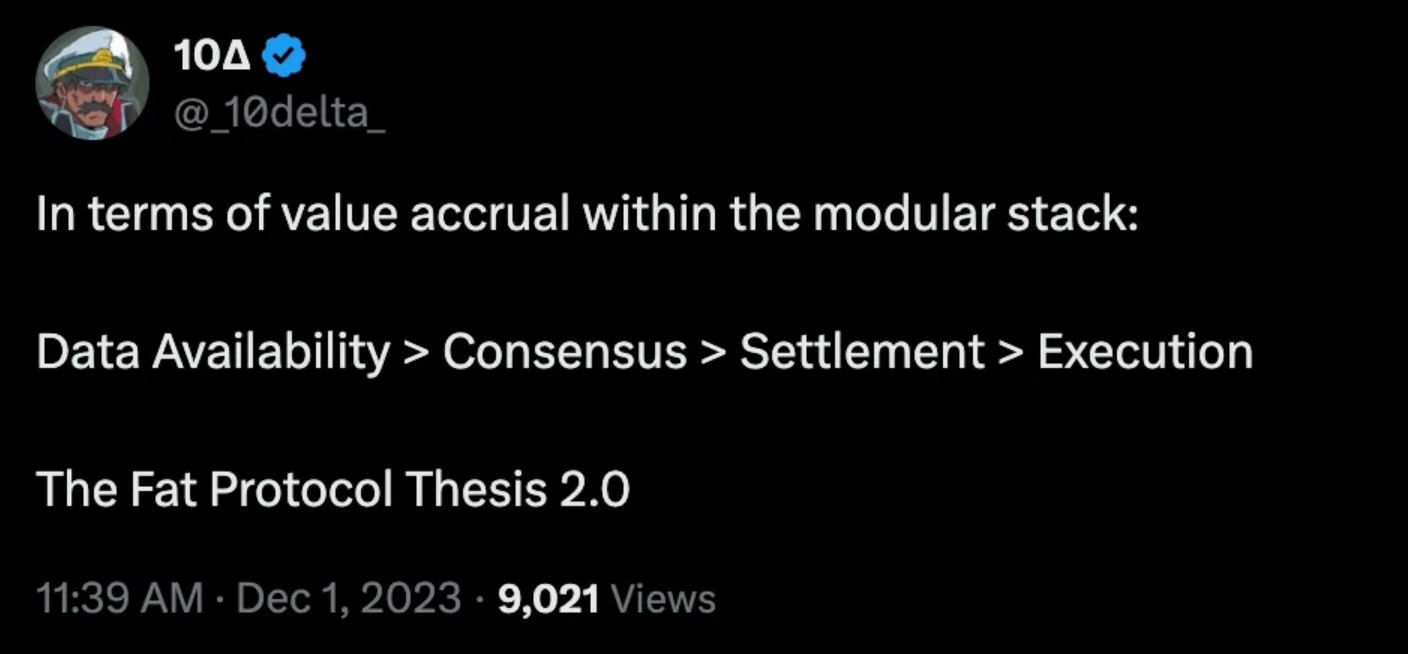

But this raises a question, which layer (data availability/DA, consensus, settlement, execution) will gain the most value (achieve the greatest value growth)?

This tweet sparked this article.

Based on this tweet, I have drawn the following conclusions and framework (spoiler alert: I disagree with this tweet).

To succinctly explain my thoughts:

1) To ensure the normal operation of the data availability (DA) layer, this layer needs to be prioritized. Therefore, in this modular stack, consensus and DA are not independent. Imagine creating proofs using available data on one chain, but this data is sorted differently on another chain, this would cause confusion.

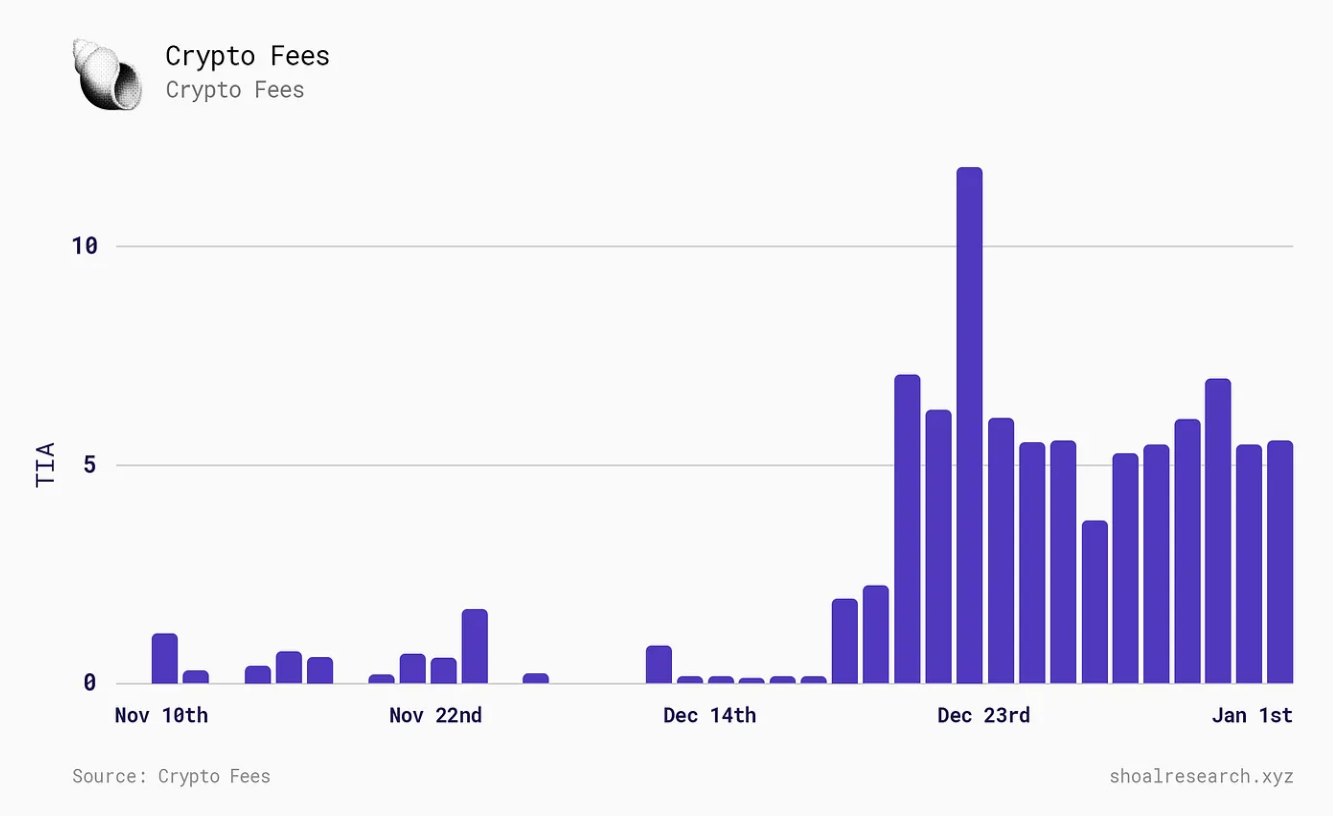

2) The execution layer (such as Arbitrum) has pricing power, while the data availability layer (such as Celestia) does not. This is because Celestia provides homogenized services (data availability), while execution layers like Arbitrum provide an execution environment for excellent cryptographic applications that cannot be found elsewhere. This is why Arbitrum can generate a large amount of revenue, while the fees for Celestia are negligible. Arbitrum has a monopoly on sorting, and therefore is closer to the end user. Although there may be changes in the future (such as adopting shared sorting), the Arbitrum protocol will still be the only entity that charges user fees. It is important to note that MEV and a portion of the fees will flow from the execution layer/rollup to the DA layer, as the execution environment will still write data to Celestia, etc. Please remember that if the DA layer captures most of the value, the rollup will charge users a lower fee than the cost of publishing/writing data to the DA layer. However, this is not the case.

Anatoly Yakovenko, the founder of Solana, provided a detailed explanation of this phenomenon on the Lightspeed podcast.

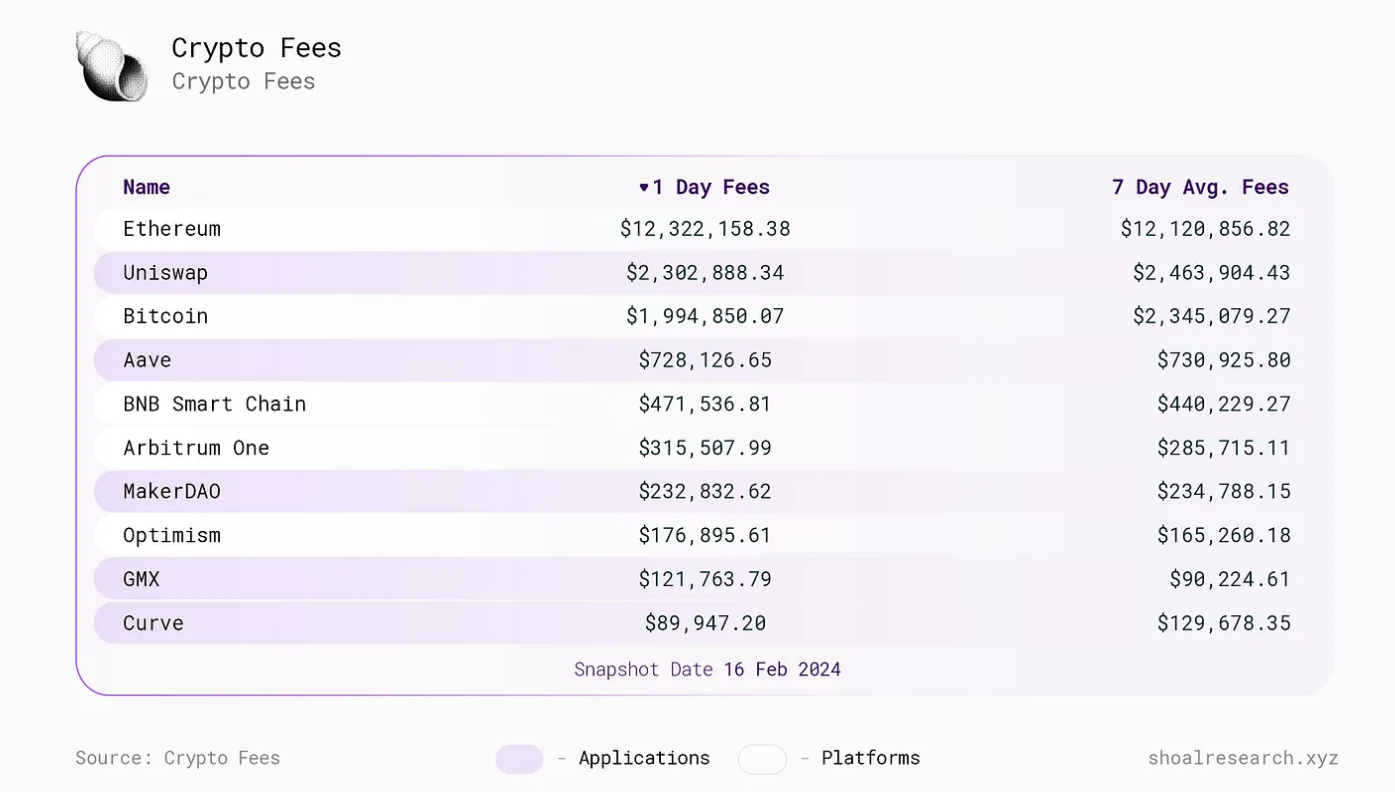

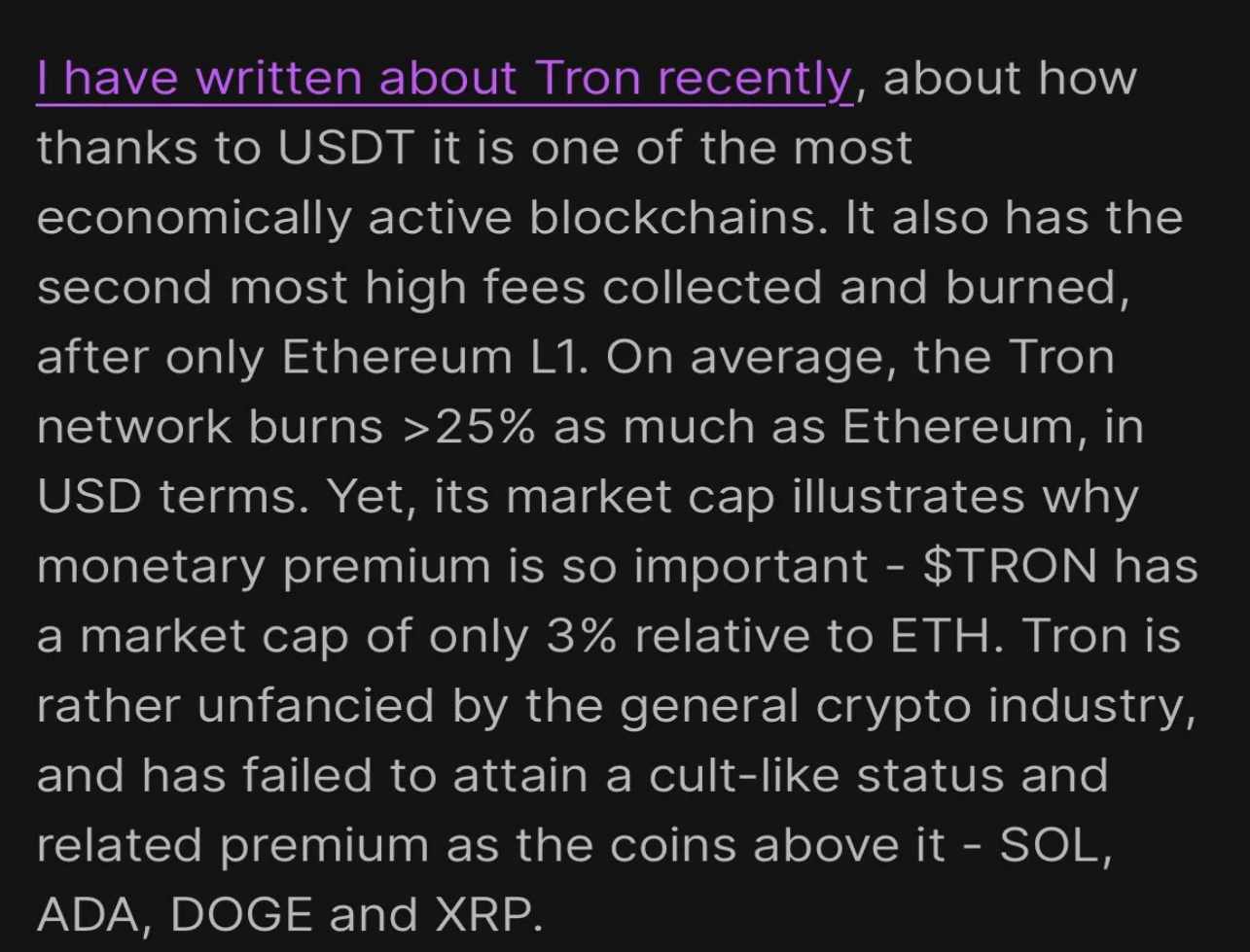

3) The settlement layer is more valuable than the DA+ consensus layer (and the execution layer, which I would argue), simply because the settlement layer is secured by the most funds/similar currency-like cryptographic assets, just like the current most reliable neutral settlement layer Ethereum, which is secured by ETH. Compared to the settlement layer (used only for bridging and dispute resolution, and therefore sometimes receiving block headers from the DA+ consensus layer), the DA+ consensus layer will inevitably have more activity/transaction volume flowing through it. But despite the settlement layer "doing less," the assets of the settlement layer are still more valuable. Just look at the situation with $TRX and $ETH; the former has a larger blockchain transaction volume and burns more native tokens, while Ethereum's transaction volume and burning of native tokens are relatively smaller, but its value is much lower than $ETH—why? Specifically, currency premium.

In simple terms, currency premium is a multiple of an asset's trading value relative to its fundamentals/basic utility, due to its "currency-like" properties. Gold is a good example, as it is not widely used in the production process in the economy, and yes, it looks pretty, but most of its value comes from its hard currency properties—this is the key issue. Thanks to Polynya for contributing this viewpoint, his expression is better than mine, as shown below.

Translation: Recently, I wrote an article about Tron, discussing how it is one of the most active blockchains due to the existence of USDT. It also has the second-highest fee collection and burn volume, just behind Ethereum L1. On average, the value destroyed on the Tron network is equivalent to over 25% of Ethereum's value in USD terms. However, Tron's market value is only equivalent to 3% of Ethereum's market value, which highlights the importance of currency premium. Unlike other popular coins like SOLADA, DOGE, and XRP, Tron is not popular in the entire cryptocurrency industry and has not received a corresponding premium.

So, what is our conclusion now?

I believe: the most valuable part of the stack is the settlement layer, followed by the execution layer, and then the DA+ consensus layer, for the reasons mentioned above (which is why I did not differentiate between DA and consensus).

My argument can be summarized as follows: the settlement layer is the most valuable because of the currency premium it carries, while the execution layer is more valuable than the DA+ consensus layer because the latter provides fiercely competitive homogenized services, and the cost (and therefore the income of the DA+ consensus layer) will tend towards zero, while the former (execution layer) can build network effects at a faster pace and consolidate them through large-scale liquidity! They are also closer to the users and not in a fee competition!

Currently, rollups like Optimism and Arbitrum pay over 90% of the costs (actually paid by users) for DA costs (this discussion of the Bell Curve expands on what I said), and hope to minimize them. Therefore, they may turn to Celestia for DA (and therefore also consensus), significantly reducing costs (and therefore also significantly reducing their income) (currently, the cost of using Celestia's data for Rollup is very low; if Arbitrum were to write data to Celestia today as it does on Ethereum, it would only cost a few thousand dollars—Dan Smith has done good research on this).

But users do not care about paying tiny fee differences between different rollups! I don't care about paying $0.01 on Rollup A for a swap, and $0.007 on Rollup B for a swap, because I don't swap often, and moving my assets to another Rollup is a barrier and involves security risks! But for rollups, they are actually profit-seeking businesses and need to publish thousands of megabytes of data to the DA layer, and these "increments" in costs are very important to them, as they add up. Essentially, rollups are price elastic, but their users are not to a large extent.

3. Conclusion

From "fat protocols" to "fat applications," modeling value accrual in the blockchain space is not a new endeavor. The emergence of modularity introduces new components to the public blockchain space, and therefore new economic and value dynamics. Modular blockchains represent a paradigm shift in the blockchain stack—from building a fully integrated network that can serve all four blockchain functions at the base layer, to building networks using specialized layers to efficiently perform these functions.

To reiterate, I believe the settlement layer is the most valuable component in the stack, supported by the currency premium of its underlying assets. The execution layer follows closely. However, while the DA+ consensus layer provides necessary functions, it faces increasingly fierce competition and declining income potential due to its homogenized nature.

In short, the value accrual in the modular stack is as follows:

Settlement layer > Execution layer > DA + Consensus layer

The purpose of this communication is purely educational and should not be construed as investment advice, legal advice, a solicitation to buy or sell any assets, or a recommendation to make any financial decisions. Please consult professionals and conduct your own research.

Source: Pionex

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。