As we all know, after the JPEX and HOUNAX fraud cases, Hong Kong has been very cautious in regulating virtual asset trading platforms, covering both information disclosure and advertising to ensure the interests of investors, as if "once bitten by a snake, ten years afraid of well ropes," making every effort to protect investors' interests.

However, everyone in the industry knows that prevention is better than cure. With public awareness not improving, cryptocurrency circles are rife with phishing links, pyramid schemes among acquaintances, and account theft, making it not uncommon for exchanges to run away.

Just recently, another trading platform successfully absconded in Hong Kong, staging an "empty city" act, with the operation being even more outrageous, resorting to action rather than words—directly taking the money and running. On February 23, the Hong Kong-based cryptocurrency exchange BitForex disappeared from public view after withdrawing nearly $57 million from its hot wallet, and users could no longer log in to access their accounts.

This time, it seems that the regulatory authorities are once again late.

01. BitForex Runs Away, Staging an Empty City

On February 23, the Hong Kong-based cryptocurrency exchange BitForex suddenly suspended withdrawals. Prior to this, the platform had cited wallet and website maintenance as reasons for delaying user withdrawals. At the same time, before the exchange stopped processing transactions, blockchain detective ZachXBT detected an outflow of approximately $56.5 million in cryptocurrencies from three BitForex hot wallets.

On February 26, the exchange's website officially closed. Users were unable to log in to their accounts or load the webpage, and began seeking help on social media. However, BitForex's X platform account had not been updated since February 21, and multiple users posted messages on its official Telegram channel stating that they were unable to log in to their accounts and that their dashboards did not display any assets. The group has 23,413 members, with over 1,000 users currently online waiting for a response from the exchange. According to sources, one of the administrators of the BitForex Telegram channel, Hazel_BitForex, has deleted their personal account.

BitForex's official website is no longer accessible, image source: BitForex official website

Although the platform's official website is no longer accessible, public information can still be found on LinkedIn. BitForex is headquartered in Hong Kong, claims to have 6 million registered users, and has 51-200 employees. It has teams in Germany, Estonia, Singapore, Malaysia, the Philippines, and other countries. According to information from the Hong Kong Companies Registry, the company was registered in 2018 in the Kwai Fong area of the northern New Territories in Hong Kong. In fact, it had previously been active in mainland China under the Chinese name "币夫网" for a period of time before being regulated back to overseas regions. Several related business locations are also listed in the company's press releases. However, from the perspective of these business locations, the reality is summed up in four words—empty city.

In this regard, Callan Quinn, a reporter for DL News stationed in Hong Kong, visited the registered and business locations and found that unlike cryptocurrency companies that are densely registered in the city center or clustered in the Science Park and Cyberport, this company is located in the Dalian Ranks Industrial Area near the residential area of Kwai Fong Village, about 40 minutes from the city center by subway.

BitForex's registered location, image source: Callan Quinn

According to on-site staff at the registered location, the company mainly provides virtual addresses for mainland Chinese companies intending to establish offices in Hong Kong, and has already served thousands of companies, as indicated on the company's website. BitForex is just one of them. BitForex also lists the address of the company secretary at another location around the corner—on the second floor of the D/3 apartment building in the industrial complex, and unsurprisingly, no one is there.

The last relevant location is in the relatively bustling Mong Kok. Although it is difficult to enter due to the absence of residents, the letters and parcels scattered at the entrance of the office building correspond to different company names, indicating that this address is also just one of the virtual address services. Google Maps confirms this, showing that more than just BitForex uses this address.

The addresses are all false and forged, and the claimed hundreds of employees have long since disappeared, undoubtedly indicating that this is a premeditated scam. The suspension of withdrawals occurred one month after the resignation of the platform's CEO, Jason Luo, leading users to believe that this was the beginning of a run, as documents show that Jason is the company's sole shareholder and director, currently residing in Shenzhen.

In fact, regardless of the method of fraud, the platform has had problems before. Multiple financial regulatory agencies have issued warning statements about it. As early as October 2020, the Securities Commission of Malaysia (SC) included BitForex in its unauthorized warning list. In April 2023, the Financial Services Agency (FSA) of Japan also accused BitForex of violating the country's fund settlement law, and the Financial Conduct Authority of the United Kingdom also disclosed that BitForex had been operating in the country without being registered.

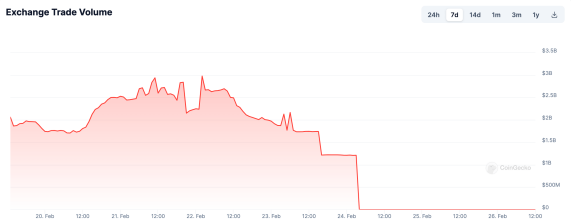

However, this does not seem to affect the platform's operation. After exiting the above-mentioned regions, in September 2023, BitForex claimed to be one of the world's leading cryptocurrency exchanges by market value, with a daily trading volume of approximately $2.6 billion. According to CoinGecko data, the exchange's trading volume dropped from $2.5 billion to $1 billion between February 22 and 24. There is currently no data institution recording and tracking the platform, but interestingly, as early as 2019, BitForex was exposed by Chainalysis for falsifying trading data, indicating that the platform's actual liquidity was only 1/800 of the reported trading volume, a falsification ratio that is astonishing.

Rapid decline in BitForex trading volume, source: CoinGecko

02. Overseas Coverage, Numerous Clues, and the Securities and Futures Commission Finally Issues a Statement

Regulation, as always, arrives late.

On March 4, after more than a week of suspended withdrawals, the Securities and Futures Commission of Hong Kong (SFC) issued a public notice warning the public to beware of a virtual asset trading platform operating under the name BitForex, which is suspected of engaging in virtual asset fraud. BitForex is not licensed by the SFC, nor has it applied to the SFC for a license to operate a virtual asset trading platform in Hong Kong. The SFC has included it on the list of suspicious virtual asset trading platforms.

At the same time, the SFC once again warned investors to beware of the risks of buying and selling virtual assets on unregulated virtual asset trading platforms. If the platform ceases operations, closes, is hacked, or if any assets are misappropriated, investors may lose all the investments they hold on the platform.

List of suspicious platforms by the SFC, source: Securities and Futures Commission of Hong Kong

But before that, the SFC listed 14 suspicious virtual asset trading platforms, and BitForex was not on that list. On February 29, the SFC announced the deadline for virtual asset trading platform license applications, with 21 platforms submitting application materials. According to regulations, exchanges that did not apply for a license by that date must cease operations in Hong Kong by May 31, 2024, and operating without a license is a criminal offense. Perhaps this was also the final straw that broke the camel's back for BitForex.

Compared to previous scams that targeted Hong Kong residents more, looking at the statements on X platform, the disappearance of this trading platform seems to involve more overseas groups, with many overseas individuals initiating Telegram groups for victims to voice their grievances and track the situation. Further investigation revealed frequent mentions of the OMI token.

Multiple overseas OMI holders on X platform inquiring about BitForex, source: X platform

According to the official website, OMI is the ecological currency of ECOMI, a trading platform based on blockchain NFT and digital collectibles. The token is only listed on four exchanges: OKX, BitForex, Gate, and AscendEx, with BitForex being the main gathering place. Data shows that the exchange holds 7% of the total OMI supply. Therefore, the closure of this exchange significantly affects OMI holders, and the pursuit of this on X platform is also the most intense. However, in terms of the token price, it seems to have been unaffected, currently at $0.001083, up 29.20% in the past 7 days. However, compared to its peak of $0.008, it has clearly dropped significantly.

After the incident, the official account of ECOMI on X platform immediately responded, stating that they had begun trying to contact the local government and actively reaching out to the exchange, but no updates were available. Some holders believe that the organization may be associated with the exchange, as it placed most of its market value and ecosystem on BitForex. Some also claim that the authorities are intervening and conducting an investigation, as the OMI-related project closed its Telegram group after the incident and made personnel adjustments. However, based on current information, there seems to be no direct evidence linking the organization to the exchange's absconding, and the SFC did not mention the related project.

Coincidentally, Atom Asset (AAX), a Hong Kong exchange that closed in 2022, has also recently shown some activity. According to the Beosin team's tracking, after 426 days of silence, the AAX exchange wallet began to show activity, transferring large amounts of funds totaling $74 million to other addresses in batches, attempting to evade detection and monitoring by AML tools. AAX was once one of the largest cryptocurrency exchanges in Hong Kong. Although former CEO Thor Chan and board member Leung Ho-ming were arrested by the Hong Kong police in 2022 for fraud, the founder's identity remains unknown, and they are in a fugitive state with access to user funds worth HK$230 million (US$29.41 million) and the private keys to the exchange's wallets. Due to the coincidental nature of these events, some speculate that the founders of the two exchanges may be related, but this is mostly speculation and lacks substantial evidence.

03. Regulatory Issues? Or the Worst Outcome?

The occurrence of these events has once again put cryptocurrency and the SFC in the spotlight.

But from a factual perspective, in terms of financial regulation, Hong Kong is already at a globally leading level, and regarding cryptocurrency regulation, due to the strict licensing and limited investment options, "Asia Weekly" has even published an article stating that Hong Kong's overly conservative regulation hinders innovation and flexibility.

Secondly, as a securities regulatory agency, the SFC is inherently unable to intervene in investigations before the occurrence of fraudulent activities, and it does not have the authority to do so. It can only issue warnings in the form of statements or cooperate with law enforcement actions after receiving complaints. Hong Kong, as a globally renowned financial hub, has an excellent and relaxed business environment open to all enterprises. Many offshore institutions register here, and it would be as difficult as finding a needle in a haystack to investigate each one. From another perspective, it is clear that the people of Hong Kong do not have sufficient knowledge of the cryptocurrency field. The fact that a platform with a history of information discrepancies claims to have 6 million customers, whether the data is true or not, is still unbelievable. Perhaps it is precisely because of the information gap that this scam has covered many overseas groups.

Of course, this is not to say that the SFC is without responsibility. A suspicious exchange has been operating for nearly 6 years, and several institutions have reported on it and made statements, and financial regulatory authorities in other regions have also issued warnings, but the regulatory response itself has been non-existent, reflecting Hong Kong's excessive tolerance and regulatory neglect.

In terms of impact, this platform incident is far less far-reaching than the JPEX incident, and it is still difficult to track the follow-up actions. Whether the new founders can be found and whether the embezzled funds can be recovered are still major question marks. The worst outcome may be just another unsolved case and another harsh lesson for investors in the harsh reality.

References:

Callan Quinn: My search for a Hong Kong crypto exchange that disappeared with $57m led to an empty office in a strip mall;

Gaurav Roy: BitForex Disappears Without a Trace—Website Vanishes, Investors Left in Limbo

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。