Authors: Biscuit, RootData

Bitcoin reached a high near $69,000 in March, and the hot sale of Bitcoin ETF products may be the biggest factor affecting it. The influence of institutions on the crypto market is becoming increasingly important. Observing on-chain data may be a good way to formulate the best trading strategy based on institutional trends.

After DeFi Summer, on-chain infrastructure has developed rapidly, and on-chain activities are becoming more transparent. The holdings and transfers of whale addresses can have a significant impact on coin prices. Therefore, a large amount of trading value is hidden in these whale on-chain activities.

This article will delve into the on-chain holdings, covering well-known institutions, active market makers, and industry opinion leaders. Whether it's on RootData's project, institutions, or personal pages, users can easily view them with a single click. Of particular note is RootData's structured handling of data, extending from MakerDAO-related data to its founder Rune, or similar projects like Uniswap, and even a16z Crypto.

In addition, RootData has also launched a tracker feature, which tracks the dynamic addresses of on-chain entities in real time, covering tens of thousands of addresses such as exchanges, VCs, individuals, and project treasuries, and providing a higher level of on-chain readability through on-chain and off-chain data linkage.

What valuable coins do active whale institutions hold on-chain?

a16z Crypto

a16z Crypto is a specialized fund of Andreessen Horowitz (a16z) that focuses on investments in various stages of Web3. Its current fund management scale exceeds $7.6 billion.

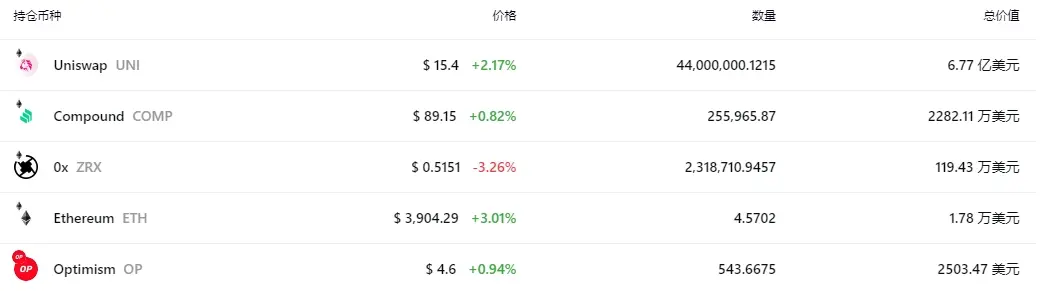

According to Rootdata's statistics of 26 a16z Crypto on-chain addresses, the largest position it holds is the UNI token, with approximately 44 million tokens (valued at $575 million), distributed across multiple addresses. Due to its large holding proportion, a16z was once embroiled in the Uniswap governance proposal controversy.

Paradigm

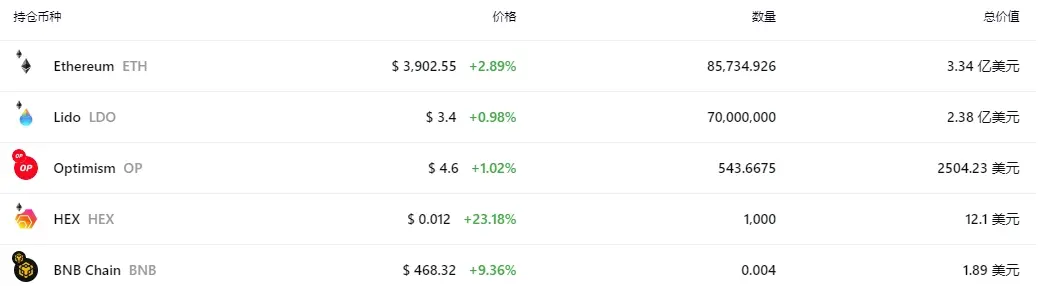

Paradigm is a research-oriented technology investment company. According to incomplete statistics, Paradigm's main on-chain holdings are approximately 85,734.9 ETH and 70 million LDO, with a total value of about $550 million.

Based on Rootdata's statistics of 11 Paradigm on-chain addresses, the institution's on-chain activity has decreased over the past two years. In July of last year, Paradigm may have sold all MKR, realizing a profit of $17.16 million.

DeFiance Capital

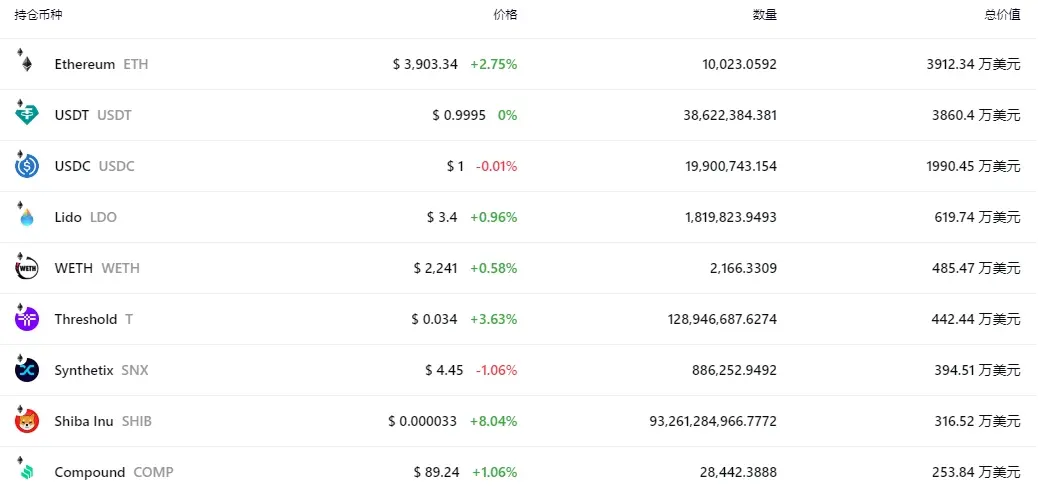

Defiance Capital was established in 2020 and is located in Singapore. It is a crypto asset fund focused on DeFi. According to The Block, DeFiance Capital completed a $100 million liquidity token fund closing in March 2023 and began investing.

Based on Rootdata's statistics of 15 DeFiance Capital on-chain addresses, the institution's largest on-chain holding is the PYUSD token, a stablecoin launched by the U.S. "Alipay" PayPal in collaboration with custodian company Paxos in August last year, with a market value of $230 million. DeFiance Capital's highest-value altcoin holding is LDO. Although DeFiance Capital has not publicly disclosed its financing for Lido, its founder Arthur has published his research views on Lido in a blog and has a long-term positive view on the LSD track.

Blockchain Capital

Blockchain Capital was established in 2013 with a mission to help entrepreneurs build world-class companies and projects based on blockchain technology. Blockchain Capital has launched multiple crypto funds, with payment giants PayPal and Visa being among the funding providers. Blockchain Capital focuses on investing in crypto startups in the infrastructure, gaming, DeFi, consumer, and social sectors.

Based on Rootdata's statistics of 9 Blockchain Capital on-chain addresses, the institution holds a total of 47,000 ETH (valued at approximately $181 million) in on-chain addresses, with the remaining positions mainly in DeFi category tokens, including UNI, AAVE, ENS, 1INCH, UMA, COW…

Pantera Capital

Since 2013, Pantera Capital has been investing in digital assets and blockchain companies, providing investors with comprehensive investment opportunities in this field. In January 2022, Pantera's new fund, Pantera Venture Fund IV, completed a $1 billion fundraising, with its memorandum stating that it will only participate in equity transactions and will not directly invest in tokens.

Pantera Capital led the seed and Series A financing of Ondo Finance, owning 313 million ONDO tokens (valued at approximately $157 million), accounting for 3.13% of the total circulation, but only 139 million tokens are currently in circulation, with the rest needing to be unlocked and released.

Dragonfly

Dragonfly is a globally leading investment institution focused on crypto technology, collaborating with crypto technology founders in all development stages from seed rounds to Series D and liquidity tokens. As of now, Dragonfly has launched 3 funds, raising a total of $950 million.

According to Rootdata's statistics of 7 Dragonfly on-chain addresses, the institution's total on-chain holdings are approximately $57 million. In 2021, Dragonfly led the investment in Frax Finance, holding 2.36% of the FRAX tokens on-chain (valued at approximately $18.45 million). Its managing partner, Haseeb, previously ventured into stablecoin direction.

Market Makers

Wintermute

Wintermute specializes in high-frequency algorithmic trading and market-making services, providing liquidity algorithms to most cryptocurrency exchanges and trading platforms, and supporting traditional financial institutions to enter the cryptocurrency market.

Based on Rootdata's statistics of 34 Wintermute on-chain addresses, Wintermute's total on-chain balance is approximately $352 million, with the largest position being the OP token, approximately 12.73 million tokens (valued at approximately $60 million).

Jump Trading

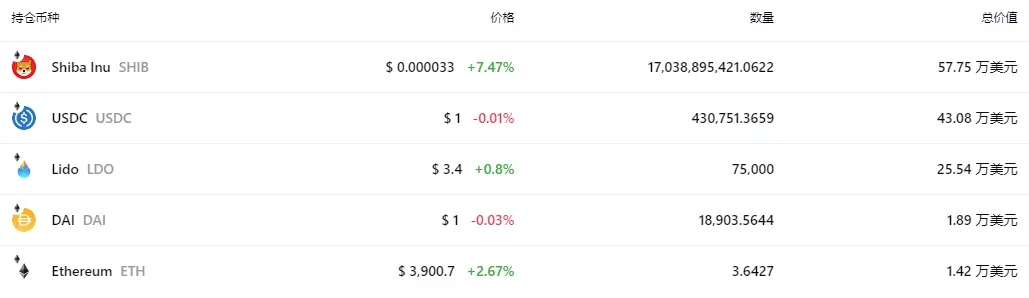

Jump Trading started from the Chicago Mercantile Exchange (CME) trading pool and gradually grew into a research-oriented quantitative trading company. According to Rootdata's statistics of 34 Jump Trading on-chain addresses, Jump Trading holds multiple tokens on-chain, with a total value of approximately $135 million, with the highest proportion being ETH (approximately $35 million), as well as tokens such as SHIB and LINA.

DWF Labs

DWF Labs provides market-making, secondary market investment, early-stage investment, and over-the-counter (OTC) trading services for Web3 companies, as well as token listing and consulting services. DWF Labs was a shining star in the last bear market but also got caught in the debate of "crypto savior or super scythe."

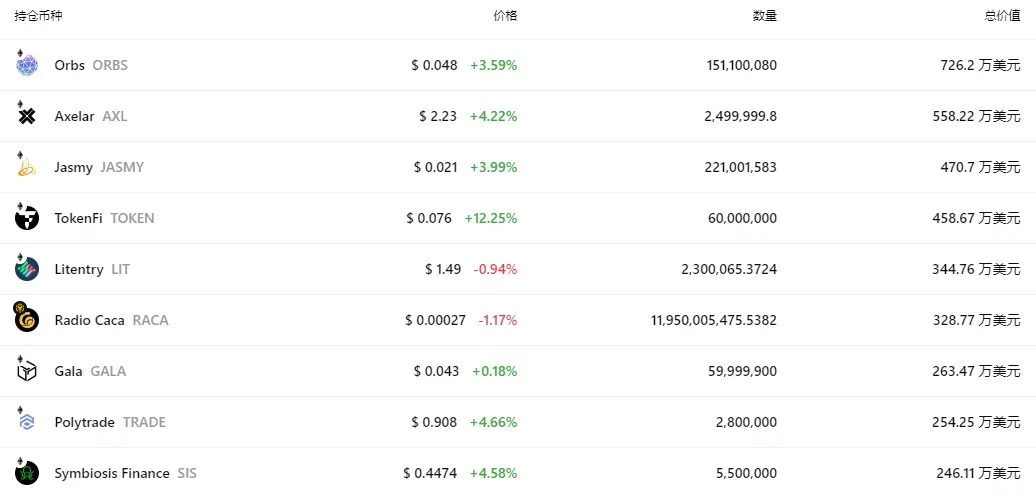

According to Rootdata's statistics of 12 DWF Labs on-chain addresses, DWF Labs currently holds assets worth nearly $55 million on-chain, distributed across over 130 tokens, with the largest position being 151 million ORBS tokens, valued at approximately $6.89 million.

Personal Addresses

According to RootData's incomplete statistics, Ethereum co-founder Vitalik Buterin owns 6 on-chain addresses, holding a total of approximately $1.1 billion in crypto assets, with the vast majority being ETH.

MakerDAO co-founder Rune Christensen purchased SHIB on March 1st and 4th and immediately gained a large amount of profit. After BTC reached $69,000, this address made multiple purchases of MKR. Could this be the next trading signal? Currently, Rune holds approximately $3 million in assets on-chain, with the largest position being MKR (valued at approximately $1.31 million).

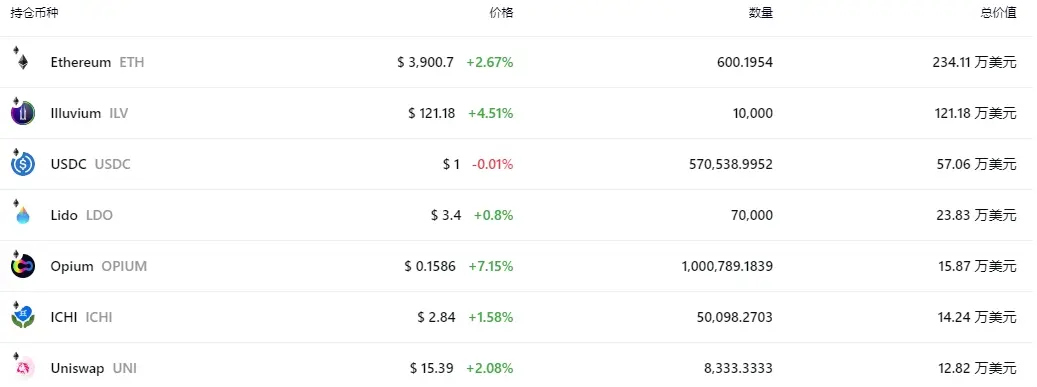

1inch co-founder Anton Bukov is also a skilled on-chain trader, having made multiple high buys and low sells of tokens such as ETH and UNI. Currently, the total value of his personal address holdings is approximately $5 million, mainly in tokens such as ETH, ILV, and LDO.

Conclusion

According to RootData's incomplete statistics, top institutions such as a16z, Paradigm, and Blockchain Capital, apart from Grayscale, are the main whales in on-chain holdings. The long-term holdings of LDO, CRV, RBN, AAVE, OP, and other tokens are also the position choices of several other institutions. Some venture capital institutions have opened up new crypto narratives, such as Ondo, led by Pantera Capital, shining in the RWA field.

Due to space limitations, users can search and track valuable addresses on RootData using the method in this article. For example, when the AI track is hot, users can find Sam Altman's investments in Filecoin, Arkham, and other crypto projects through personal relationships, and can also pre-emptively invest in alpha returns. When the meme track erupts, which institutions or celebrities have already purchased or hold Meme tokens?

At the same time, RootData has launched the first double points activity, from March 4th to 10th, Beijing time. Users can earn double points on the platform by collecting projects, providing content feedback, submitting projects, and creating public collections. To complement the recent wallet tracking feature, RootData has also added the method of binding wallets to earn points, and all wallet users can receive equivalent airdrops of points, for example, NFT exchanges and minting, to reward users who have made outstanding contributions to RootData.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。