In the context of the fluctuating cryptocurrency market, DePINs has demonstrated stable and enduring development.

Author: Greythorn

Opening Remarks

DePINs is quietly leading a revolution. This movement is based on a simple logic: shifting from traditional, centralized methods to a more open, collaborative, and innovative model; it harnesses the appeal of cryptocurrency incentives to bring people together to collectively build and manage the infrastructure we all rely on.

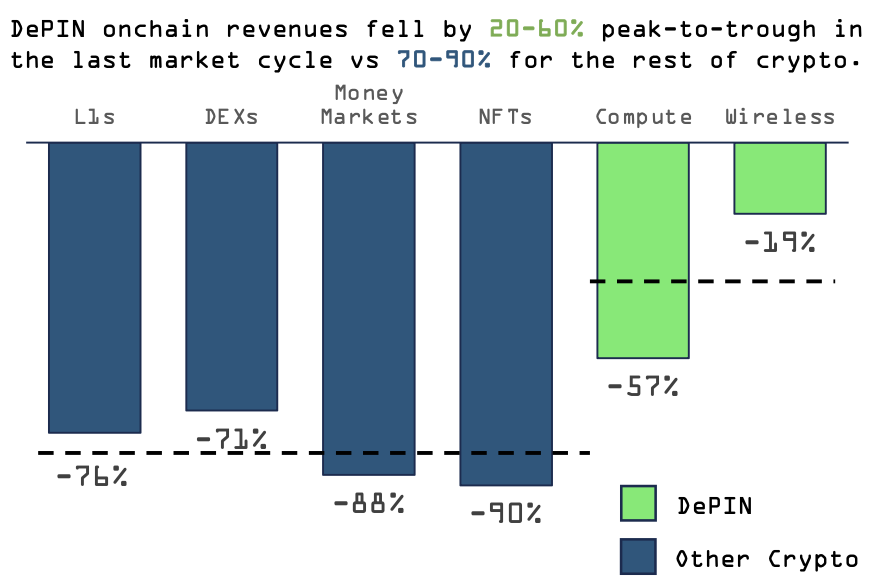

This research explores the DePINs track, and in the context of the fluctuating cryptocurrency market, DePINs has shown stable and enduring development. It is worth mentioning that the revenue model of DePINs has been proven to be based on practicality rather than speculation. While the overall cryptocurrency market has experienced a sharp decline of 70-90% in the past few years, DePINs' revenue has only decreased by 20-60% from its peak.

Source: Messari

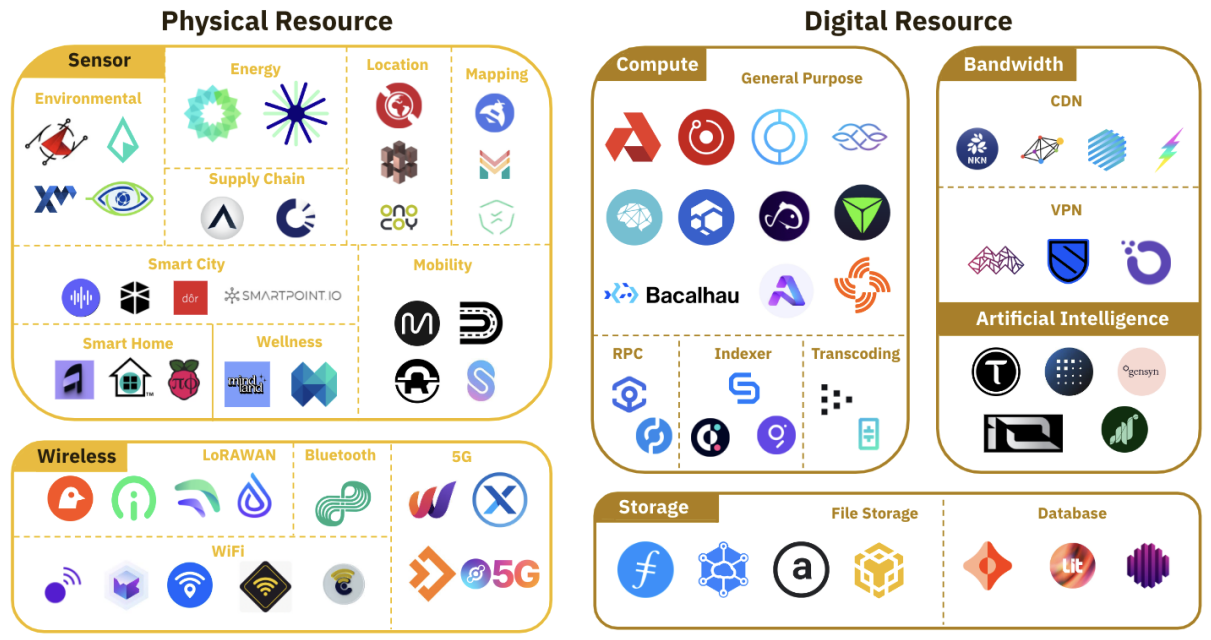

The concept of DePINs is very broad, spanning across 6 different sub-industries (computing, artificial intelligence, wireless, sensors, energy, and services). This decentralized model redefines our expectations for the development of physical infrastructure and future prospects.

Specifically, DePIN covers 650+ projects, with the total market value of its liquid tokens exceeding $20 billion, coupled with an annualized on-chain income of approximately $15 million, fully demonstrating the industry's resilience and tangible value it brings.

Currently, the future of DePINs is continuously integrating with broad prospects such as ZK technology, on-chain artificial intelligence, and on-chain gaming. These developments showcase the industry's adaptability and its interest in using new technologies to create more efficient, collaborative infrastructure solutions.

Through this research, we aim to comprehensively analyze the DePIN ecosystem, exploring its current landscape, growth dynamics, and potential trajectory.

DePIN Overview

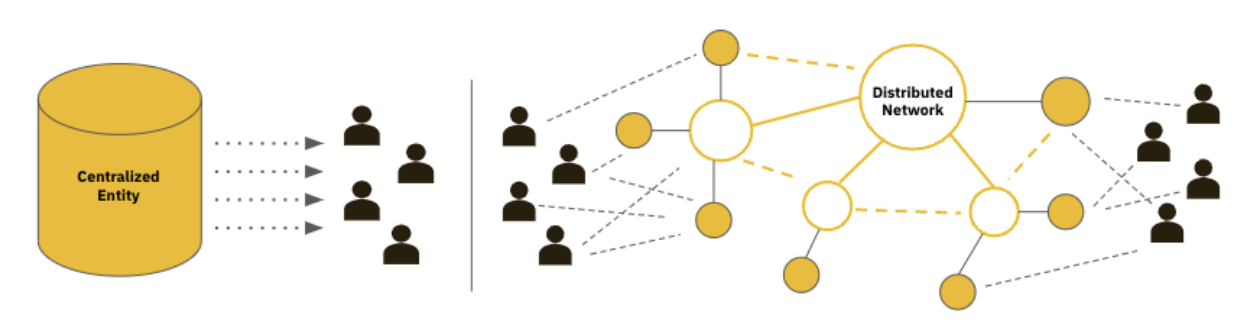

DePIN stands for Decentralised Physical Infrastructure Networks, which is a revolutionary approach that utilizes blockchain technology and cryptoeconomics to incentivize people to contribute resources to create transparent, decentralized, and verifiable infrastructure. These projects cover a range of areas, unified through a single model. Compared to traditional infrastructure, this model emphasizes community ownership and decentralized distributed systems, rather than centralized control.

Source: Binance Research

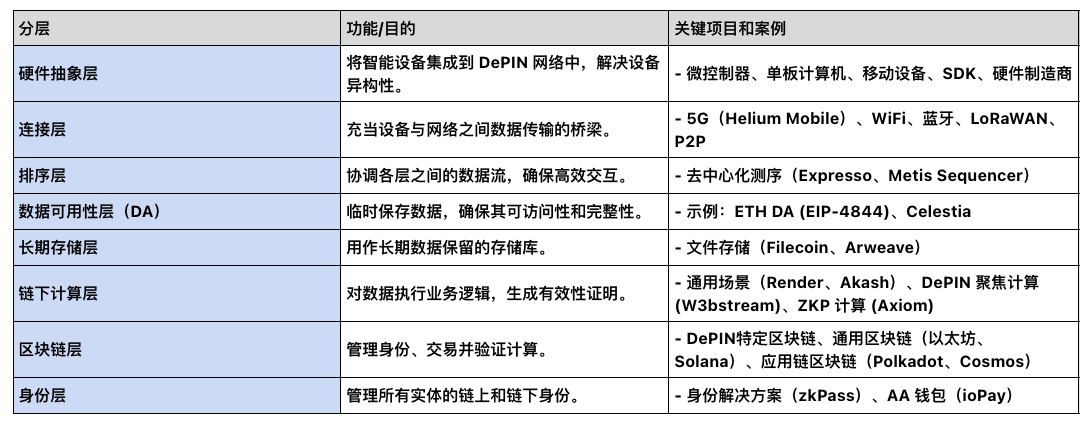

The technology behind DePIN projects adopts a layered, modular architecture, aimed at simplifying development and encouraging innovation by connecting the real world with blockchain. This setup allows independent development or updates of certain parts of projects, enabling developers to contribute more easily without needing to master the entire system.

Source: Greythorn Internal

DePIN plans to first define the resources they will provide, from storage and computing to bandwidth and hotspots. They rely on financial means to regulate behavior within the system, using reward mechanisms to encourage good behavior and punish bad behavior, and using tokens to encourage everyone to follow the rules.

Here, suppliers must deposit collateral to guarantee their services. If they perform poorly or behave improperly, they may risk losing their collateral, token rewards, and network access. Meanwhile, in this decentralized system, customers use the project's tokens to access services, such as AR for Arweave storage. These projects rely on suppliers, who provide basic services or hardware for network functionality, such as Filecoin or Helium.

Ecosystem

Over time, DePIN projects have experienced significant growth, evolving into a diverse field, with DePINscan identifying approximately 160 projects. The categorization of these projects varies based on the specific definition of DePIN projects. As shown in the image provided by Binance, the scope of this field includes Hivemapper (decentralized sensor networks), Akash, and Render (computing and digital resources), Bittensor (AI projects), Helium (wireless networks), as well as Arweave and Filecoin (decentralized storage solutions).

Source: Binance Research

Furthermore, over time, the largest DePINs are transitioning into platforms with various applications. Bittensor is a good example, hosting an increasing number of subnets, each dedicated to different regions.

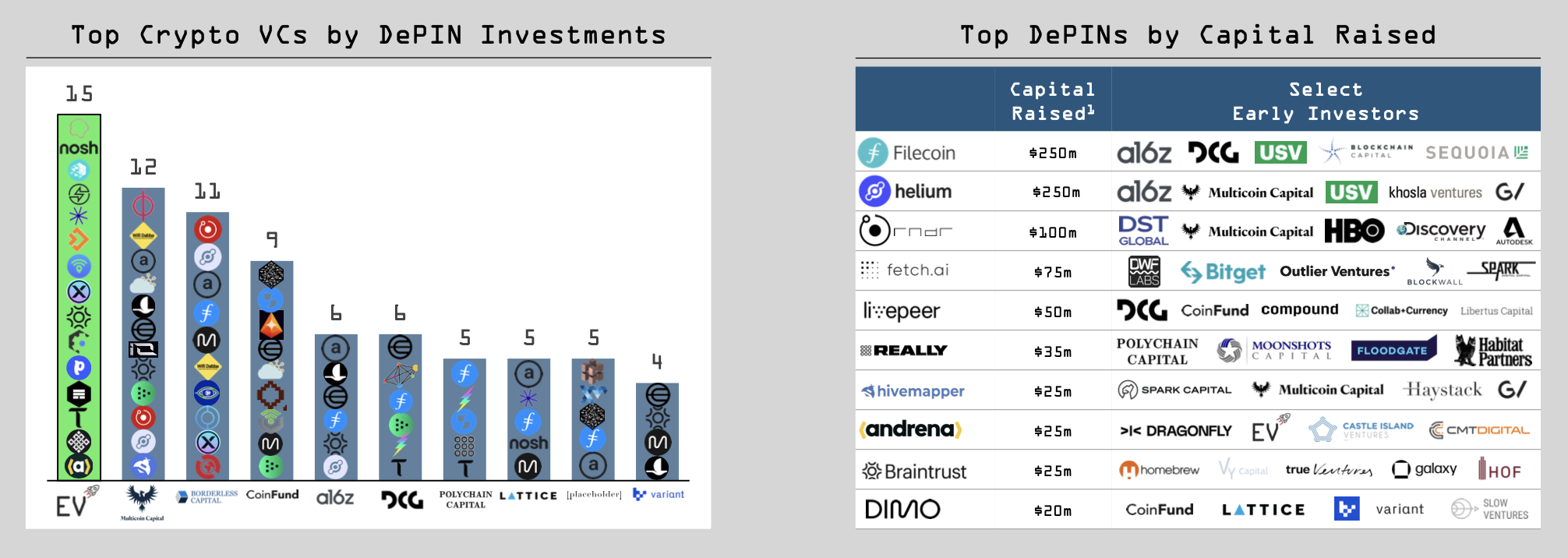

The DePIN ecosystem is rapidly expanding, and investors' interest is growing stronger. They have made multiple bets on DePIN, with the top 10 projects collectively raising about $1 billion. As the field matures, we expect some of these projects to begin gaining widespread adoption.

Source: Messari

In today's research, we will examine some case studies to analyze their unique value propositions and understand how their economic models operate.

Case Study 1: Exploring Decentralized Storage with Arweave

Value Proposition

Web3, based on decentralized networks, is the future of the internet. However, there are still many issues, such as the expensive and inefficient storage of large data files like images on blockchains such as Bitcoin or Ethereum. Blockchain is optimized for transactions, not for data storage, leading to high costs for simple tasks like storing Bored Ape Yacht Club images.

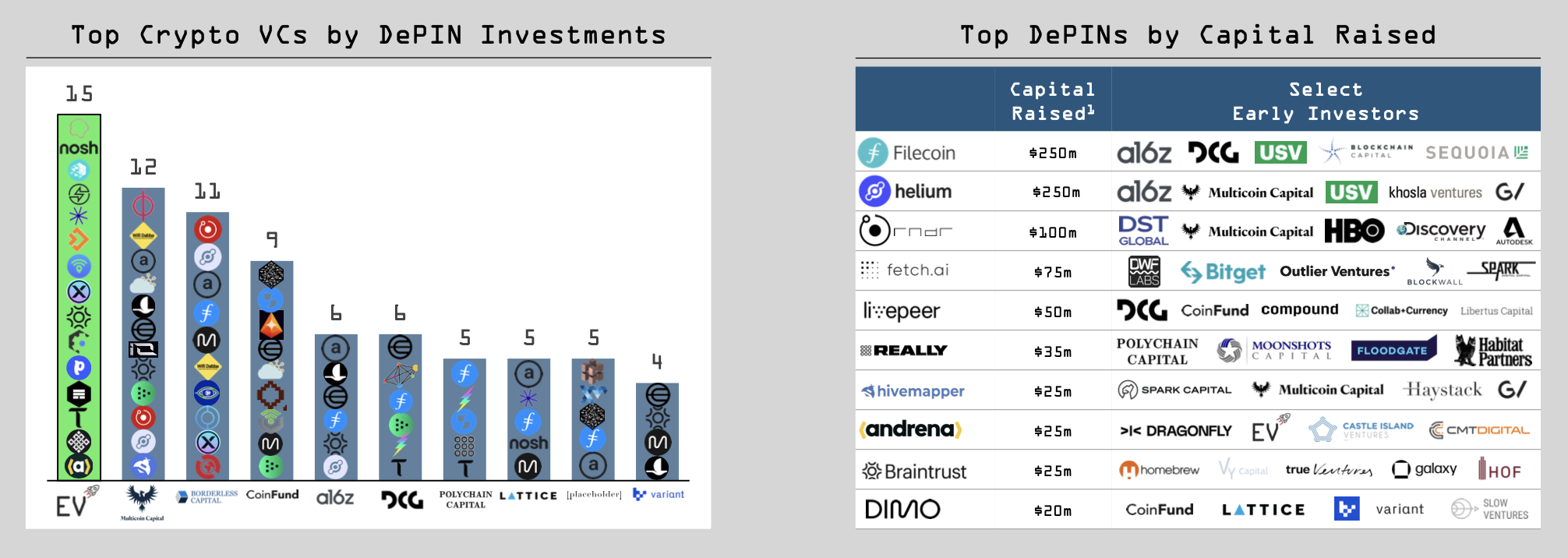

To avoid blockchain congestion and high costs, decentralized storage networks provide a cost-effective solution with similar security and accessibility to blockchain. Some NFT projects resort to centralized networks for storage, which poses risks of data tampering, loss, and potential censorship. The storage and decentralization of NFT data are crucial, as the value and background of NFTs are defined by metadata. If metadata is stored on centralized servers, there is a risk of alteration, potentially changing the appearance or value of NFTs.

Crypto Punks, known for its early development, sets security standards by storing all metadata and images directly on the blockchain, ensuring immutability and permanent access as long as Ethereum exists.

In contrast, MAYC stores NFT metadata on centralized servers and images on IPFS, making metadata susceptible to change and affecting the authenticity of NFTs.

dApps also face similar challenges, with some perceived as fully decentralized. However, while some (such as Uniswap and Aave) provide access through both centralized and decentralized networks, others rely entirely on centralized servers. Nevertheless, their interaction with smart contracts on decentralized blockchains still maintains the status of dApps.

Arweave Overview

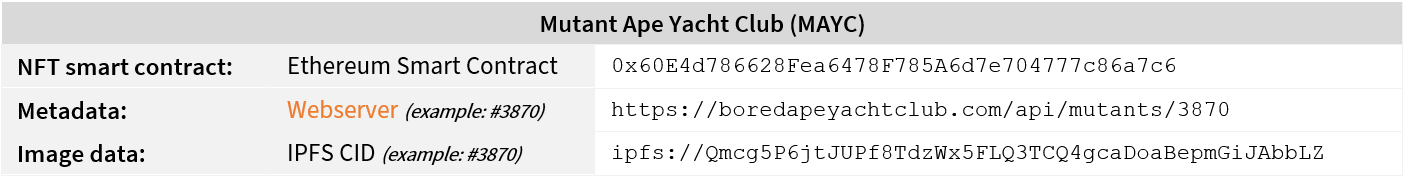

Arweave is an open-source platform for permanent data storage, charging a one-time fee. It consists of blockweave (a blockchain-like layer for data storage) and permaweb (a readable layer for permanent web content).

Supports smart contracts through SmartWeave, allowing local computation of contract states.

Transactions are conducted using its native token AR, including payment to miners for storage and network bandwidth costs.

Utilizes a unique consensus mechanism - Proof of Access (PoA), promoting long-term data storage and efficiency. PoA ensures data persistence by requiring miners to access previous blocks, creating a graph-like structure instead of a linear blockchain.

Provides content moderation tools, allowing node operators to filter out unwanted data.

Charges a one-time fee for permanent storage, with costs expected to decrease over time due to technological advancements.

Miners are rewarded through transaction fees, inflationary token emissions, and donations.

Initially has 55 million AR tokens, with an additional 11 million from inflationary emissions, aiming for a total of 66 million AR tokens without a burn mechanism.

Arweave's design ensures data is permanently stored at predictable costs, achieving security and accessibility through decentralized technology.

Source: Arweave

Competitors

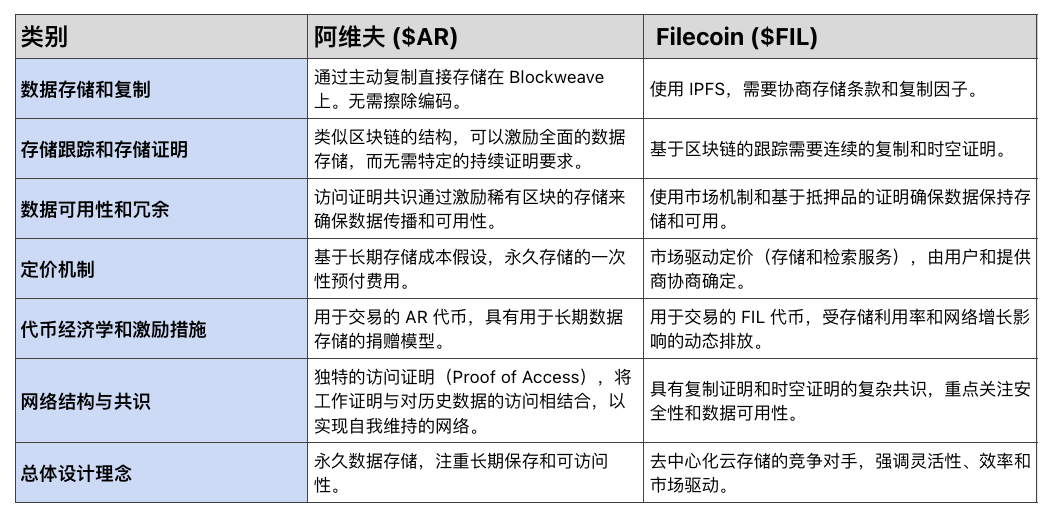

Filecoin ($FIL), Crust ($CRU), Sia ($SC), Storj ($STORJ), and Swarm ($BZZ) represent a range of decentralized storage projects, although this list is not exhaustive. With Filecoin becoming a significant competitor in this field, Greythorn's research team has compiled a comprehensive table to compare Arweave and Filecoin, highlighting their differences and features.

Source: Greythorn Internal

Another competitor that has recently caught our attention is GenesysGo, which utilizes Solana's blockchain to innovate cloud storage by combining speed with decentralization. Unlike Filecoin and similar decentralized storage projects, GenesysGo has introduced DAGGER, an innovative technology that ensures data integrity and fast access. This unique positioning in the Web3 ecosystem can meet the needs of computing, artificial intelligence, and data storage, providing a high-throughput solution that significantly reduces latency for data uploads and retrievals. Further research and validation are needed to fully understand its functionality and impact.

Case Study 2: Decentralized GPU Computing with Render Network

Value Proposition

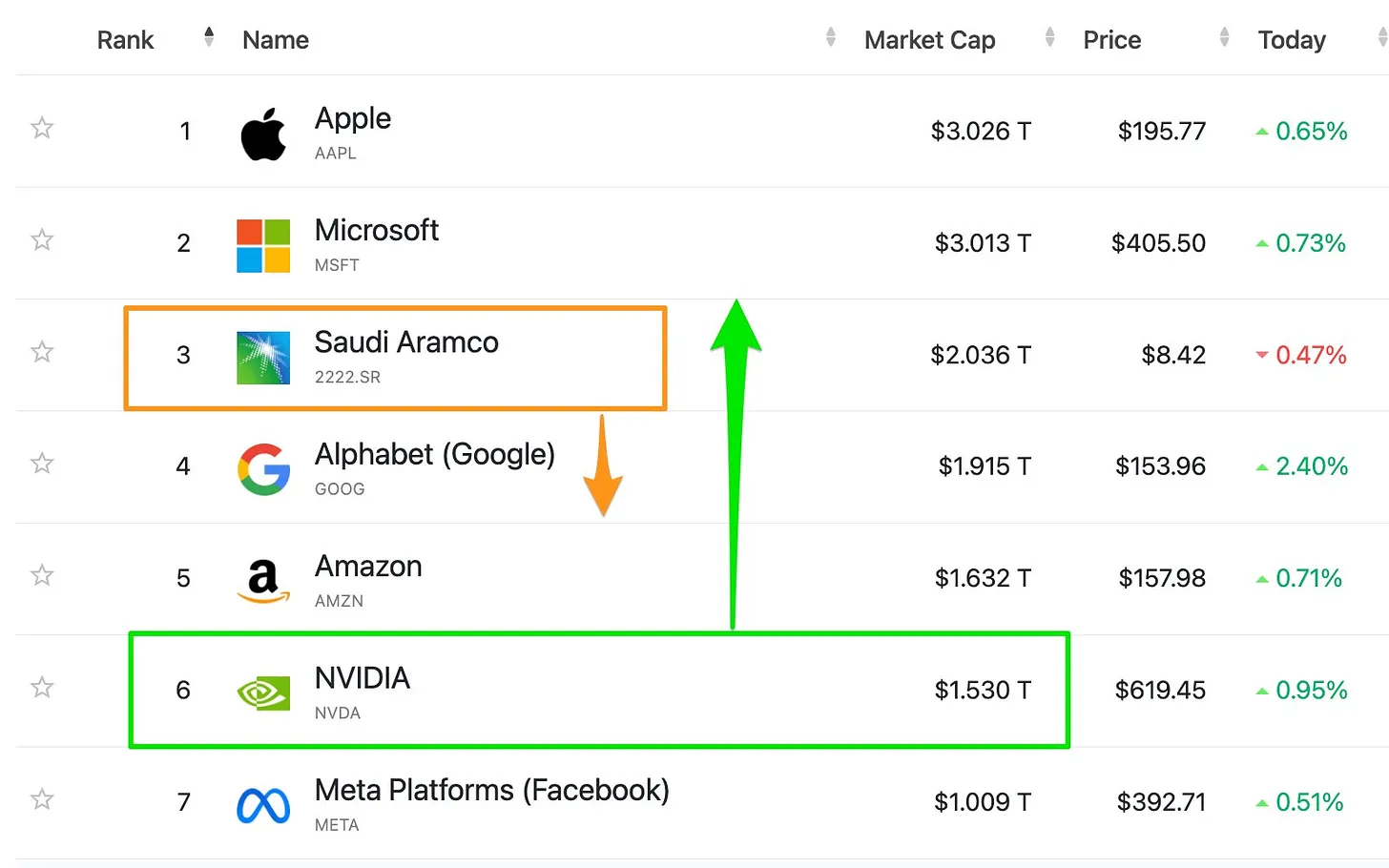

Render Network is changing the GPU market to meet the growing demands of modern media, artificial intelligence, and cloud computing. As the value of GPUs approaches that of leading oil companies, GPU computing has become crucial in today's digital world.

Source: Rentoshi Tokamoto

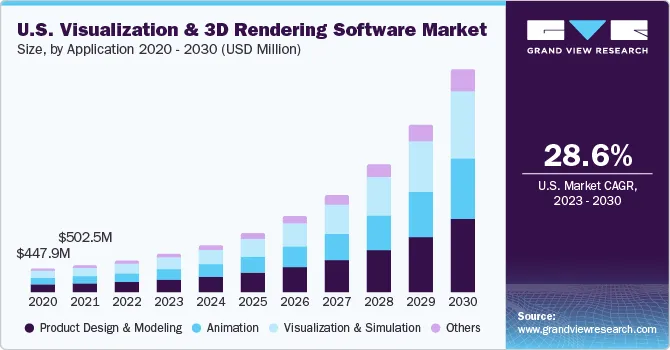

As the market rapidly expands, Render Network is at the forefront, providing decentralized GPU computing for various purposes, from media production to scientific research. Render Network integrates artificial intelligence, enhancing digital creativity and efficiency, catering to the evolving AI industry.

Source: Grand View Research

As a leader in the decentralized computing market, Render Network stands out with its extensive GPU network and strategic partnerships, ensuring a strong competitive position. It has gained support from numerous providers by competing in the open market. Simultaneously, it makes cloud computing more accessible and efficient for developers, driving the decentralization of power from giants like Amazon Web Services and Google Cloud. This approach not only diversifies the choice of computing resources but also positions Render Network as a key player in the digital and AI revolution era.

Render Network Overview

Render acts as a decentralized marketplace, connecting GPU owners with creators in need of rendering capabilities, facilitated by the RNDR token for secure transactions.

Allows GPU owners to earn money by contributing idle computing power and optimizing global GPU infrastructure.

Supports a wide range of projects, including digital art, dynamic graphics, architectural visualization, and scientific simulations.

Dual-layer structure:

Off-chain Rendering Network: Comprising creators, node operators, and suppliers, with node operators providing necessary GPU capabilities.

Blockchain Layer: Manages transactions using RENDER tokens and escrow contracts to ensure transparency and integrity.

OctaneRender: Render's flagship product, offering advanced rendering technology, including machine learning optimization and significant speed improvements.

Render services are crucial for product design, architecture, and scientific research, becoming increasingly important with the expansion of the metaverse.

Collaborations with Io.net to enhance computing capabilities and with FedML to advance decentralized machine learning demonstrate Render Network's commitment to broadening its computing applications.

Tokenomics:

Utility token: RNDR token, based on ERC-20, facilitating Render transactions, with a circulating supply of 376 million RNDR and a maximum supply of 536 million RNDR.

Transition to Solana: RNDR initially existed on the Ethereum blockchain but has transitioned to new SPL tokens based on RNP-006. This allows for broader application support by leveraging the blockchain's low-cost, high-throughput capabilities.

Economic model: Introduces Burn Mint Equilibrium (BME) to achieve economic stability through fiat-to-RENDER conversions and token burn mechanisms to balance rendering costs and token supply.

Competitors

Akash Network is a pioneering force in decentralized cloud computing, primarily focused on AI applications. It operates as an open-source GPU network, enabling developers to deploy containerized applications by providing access to a global pool of spare computing resources. Akash's model is often likened to "Airbnb for server hosting," creating a marketplace for excess computing leasing and computing resource, including CPU, GPU, memory, and storage.

As of early 2024, Akash has a significant amount of resources and has seen a surge in activity, especially due to the development of AI and increased demand for high-performance GPUs. Active leasing volume has more than doubled since early 2023.

Source: Binance Research

Akash vs. Render Network:

Model Differences: Unlike Akash's decentralized cloud infrastructure model, Render operates on a Platform as a Service (PaaS) model, focusing on Render's functionalities. Render provides a hosting platform, simplifying infrastructure management for developers.

Strategic Positioning: Akash focuses on a wide range of computing needs, with a specific emphasis on AI, while Render integrates AI and metaverse applications, giving the project a unique advantage in these areas.

In summary, Akash Network promotes a decentralized approach to cloud computing, providing an alternative to traditional cloud services through its peer-to-peer marketplace. It contrasts sharply with Render's specialized services, demonstrating the diverse potential of decentralized networks in meeting different market needs and technological advancements.

Case Study 3: Achieving Decentralized Wireless Network with Helium

Value Proposition

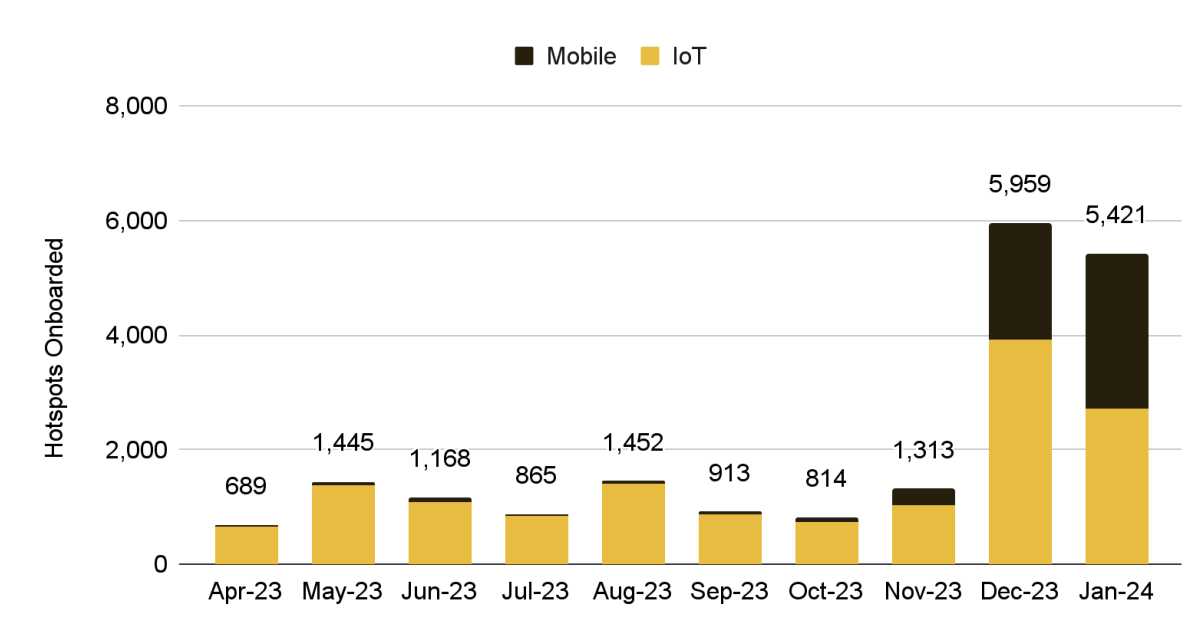

Helium is a groundbreaking project in the decentralized wireless infrastructure space, focused on enhancing connectivity for IoT and mobile devices globally. Helium was launched in 2019, initially introducing the Helium Hotspot product aimed at providing wireless access to IoT devices. This is just the beginning, as Helium will expand into the 5G space to meet the growing demand for higher bandwidth and lower latency mobile connections.

Since then, the number of new Helium hotspots has continued to increase, especially in recent months.

Source: Binance Research

Helium's primary value proposition comes from its decentralized approach to wireless networking, enabling broad coverage without the significant site acquisition costs typically associated with traditional telecom infrastructure. By leveraging user-operated nodes, Helium democratizes the provision of wireless services, allowing participants to earn tokens in exchange for contributing to the network's expansion and efficiency. This model not only reduces operational costs but also promotes a community-driven approach to improving wireless accessibility.

Helium Overview

Token ecosystem:

HNT: Helium's native token, crucial for network operations, including creating "data credits" for data transactions. Hotspot hosts can exchange HNT for network tokens (e.g., IOT, MOBILE).

IOT: Helium's IoT network protocol token, mined by LoRaWAN hotspots through data transmission and coverage proof.

MOBILE: Helium's 5G network protocol token, rewarded to contributors providing 5G wireless coverage and verifying network operations.

Network participants:

Devices: Send and receive data from the internet using WHIP-compatible hardware, with data stored on the blockchain.

Miners: Provide network coverage through hotspots, participate in Proof of Coverage, and earn tokens based on network contributions and service quality.

Routers: Purchase encrypted data from miners and ensure its proper delivery, acting as endpoints for data encryption.

Key technologies and protocols:

Proof of Coverage: Economically verifies miners' wireless network coverage.

Consensus Protocol: Combines asynchronous Byzantine fault tolerance with Proof of Coverage for network governance.

WHIP: An open-source, low-power wide-area network protocol.

Proof-of-Location: Allows devices to verify their location using network intelligence without satellite hardware.

Migration to Solana:

- Helium migrated to Solana last year to leverage its scalability, low transaction costs, and high-performance capabilities, enhancing network resilience and supporting more complex algorithms.

Tokenomics:

Halving cycle every 2 years, with a maximum supply cap of 223 million HNT, and approximately 160.88 million tokens currently in circulation (72.14%).

Token utility: HNT is used for network participation rewards, data transmission, creating Data Credits (DC), and network security staking.

Competitors

While not in the blockchain space, The Things Network (TTN) has emerged as a significant competitor to Helium, especially in densely populated urban environments. Launched in 2015, TTN stands out through its open-source software foundation, with a concept similar to Helium's approach.

In contrast to Helium's model, which includes hardware provision, TTN focuses on providing software solutions and comprehensive documentation to help individuals build their own LoRaWAN networks. The driving motivation behind adopting TTN is not primarily for economic gain but more for seeking practical solutions beneficial to users or their clients.

Conclusion

In concluding the exploration of DePIN, we have discovered a track full of potential but also significant challenges. DePIN plays a role in enhancing traditional infrastructure through the sharing economy, indicating a critical shift in digital infrastructure development. Efforts to integrate DePIN with Web2 interfaces are expected to significantly improve user accessibility, promoting broader adoption by making blockchain technology more user-friendly.

The development of DePIN's token economy, especially in connection with the DeFi ecosystem, foreshadows an interesting future where the practicality of blockchain will surpass simple transactions. However, challenges such as token price volatility, profit-driven user engagement, and weak consensus remain obstacles to widespread adoption. Addressing these issues will require a reliable economic model and strong community participation.

With the maturation of the DePIN industry, significant growth is expected, especially in Asia. Messari indicates that Asia is expected to be a major catalyst for this growth, with several top DePIN projects expected to emerge in the region between 2024 and 2025. The success of DePIN initiatives will depend on their ability to provide tangible benefits and address the complexity of the digital infrastructure landscape.

Source: Messari

Today's article only touched on a fraction of the emerging projects in the DePIN field. We encourage further exploration as new opportunities arise. For those looking to familiarize themselves with the field, DePINscan may be a good starting point.

If you found this article interesting, Greythorn invites you to visit our website for more information. You can also explore our previous research here.

Disclaimer

This presentation was prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be considered as general information and not investment advice or financial advice. It is not an advertisement, solicitation, or offer to buy or sell any financial instruments or participate in any specific trading strategy. When preparing this document, Greythorn did not take into account the investment objectives, financial situation, or specific needs of any recipient receiving or reading this document. Before making any investment decision, recipients of this presentation should consider their individual circumstances and seek professional advice from their accountant, lawyer, or other professional advisors. This presentation contains statements, opinions, forecasts, predictions, and other materials (forward-looking statements) based on various assumptions. Greythorn is not obligated to update the information. These assumptions may prove to be correct or incorrect. Greythorn, its directors, employees, agents, advisors, or any other persons specified in this presentation make no representations about the accuracy or likelihood of any forward-looking statements or the assumptions on which they are based. Greythorn and its directors, employees, agents, and advisors do not provide any guarantees, representations, or warranties regarding the accuracy, completeness, or reliability of the information contained in this presentation. To the extent permitted by law, Greythorn and its directors, employees, agents, and advisors are not liable for any loss, claims, damages, costs, or expenses arising from or related to the information contained in this presentation. This presentation is the property of Greythorn. Acceptance of this presentation implies the recipient's agreement to keep its contents confidential and not to copy, provide, transmit, or disclose any information related to its contents without written consent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。