Author: Azuma, Odaily Planet Daily

The emotions surrounding the emerging token YES in the Blast ecosystem are quickly heating up.

Although it has been less than 48 hours since the token's inception, with the eye-catching narrative of "only rising and not falling," "circular leverage," and the "magical" aura of the former developer of Olympus DAO, along with the impressive opening performance, YES and its underlying Baseline have become the most watched project in the Blast ecosystem.

In the past day, you can see a large number of well-known KOLs discussing the mechanism design of YES on social media, such as NFT whale Machi, CEHV partner Adam Cochran, and Yearn core developer banteg, and so on.

So, what new gameplay does YES bring? Is the so-called "only rising and not falling" just a gimmick or does it really have some mechanism settings? Let's break it down one by one in the following article.

Before we start the article, we first need to clarify the basic positioning of YES and Baseline. In terms of positioning, Baseline is an automated liquidity management protocol built on Uniswap V3, while YES is the first token issued based on Baseline.

In simple terms, Baseline is the protocol, and the mechanism design we are discussing revolves around Baseline, while YES is the token (but not the governance token of Baseline), and the price changes we will discuss later are all based on YES.

Only Rising and Not Falling? It does not actually refer to the market price

Looking at the official documentation of Baseline, there is indeed a "only rising and not falling" price standard within the protocol, but it does not refer to the market price that users directly encounter, but rather refers to the protocol's ability to use its own liquidity to support the lowest price for all potential selling pressure — Baseline refers to this price as the "Baseline Value" (BLV).

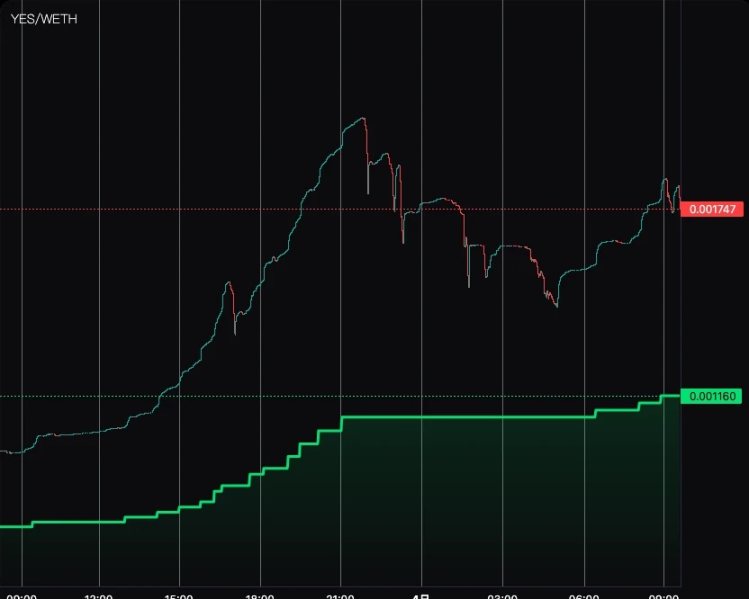

Taking the current price performance of YES as an example, its market price has experienced significant fluctuations within the first few hours after its inception, currently at 0.001747 WETH, but the "Baseline Value" (BLV) has been consistently rising, currently at 0.001160 WETH, indicating that there is actually a certain price distance between the two.

So, how is BLV determined? Where does the protocol's own liquidity come from?

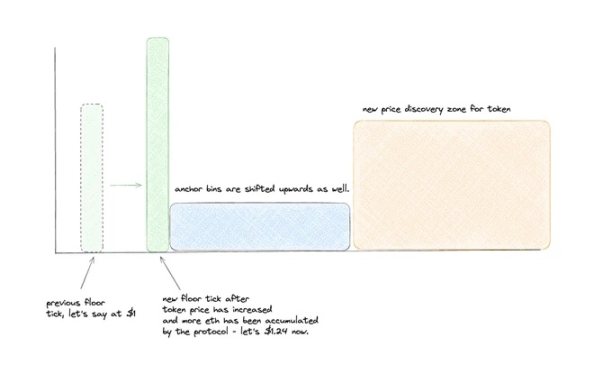

In the design of Baseline, when the tokens based on the protocol are issued, Baseline's market-making strategy will create three consecutive market-making ranges on Uniswap V3, with prices ranging from low to high, namely the "base position," "anchor position," and "discovery position."

- The "base position" is responsible for concentrating reserve liquidity within a relatively narrow price range, aiming to defend the token price when significant selling pressure arrives, and the lowest price that this range can defend is the corresponding token's BLV.

- The "anchor position" is responsible for distributing reserve liquidity within a relatively wide price range from BLV to the market price, providing sufficient liquidity for normal market trading activities.

- The "discovery position" is responsible for distributing new token liquidity within a very wide price range starting from the market price, aiming to facilitate price discovery and distribute new token supply to the market.

In short, the significance of the "base position" is to determine BLV, which is the protocol's ability to support the token's value; the significance of the "anchor position" is to facilitate smooth normal trading for users; and the "discovery position" is where new users can buy new tokens.

According to the official documentation, Baseline consolidates the source of its own liquidity for BLV from protocol revenue, which comes from three aspects: first, through the fee mechanism of Uniswap V3 pools, where 1% is extracted from user buys and sells as revenue; second, when adjusting the market-making range through a function called "shift" (as detailed in the next paragraph), a portion of reserve liquidity is deducted; and third, revenue from the built-in lending module (which will be mentioned in the next part).

As protocol revenue accumulates, Baseline continuously invests these revenues into the "base position" and "anchor position" for market-making, thereby continuously enhancing the protocol's ability to absorb selling pressure. At this point, Baseline will execute a function called "shift" to readjust its three layers of market-making ranges when the token price rises to a specific threshold — the "base position" will rise (BLV will increase), and the "anchor position" and "discovery position" will also be adjusted upwards.

Corresponding to the actual trend of YES as shown in the above figure, we can see that its BLV gradually rises in a step-like manner, indicating that Baseline has triggered the shift function, which has raised the BLV by adjusting the "base position."

Built-in Lending: The Magic of "Stepping on the Left Foot and the Right Foot"

In addition to the market-making aspect of the support design, another key design of Baseline is the built-in lending module.

If the innovation of BLV determines the lower limit of tokens such as YES, the built-in lending may have a more direct impact on the upper limit of token prices.

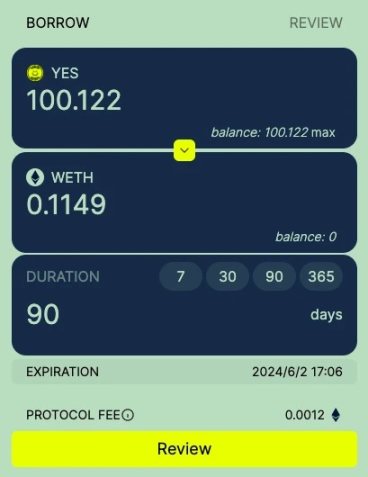

According to Baseline's official documentation, the protocol allows token holders to use Baseline tokens as collateral to borrow assets. Since Baseline can guarantee the "Baseline Value" of each token, the protocol allows holders to borrow with a relatively high capital utilization efficiency and without setting a liquidation mechanism.

Taking the example of borrowing YES in the figure below, Baseline allows users to borrow ETH using YES as collateral; the loan term is in days and can be any number of days; in addition to paying a one-time fee of 0.01095% per day when opening a lending position (as mentioned earlier as protocol revenue), users do not need to bear any other interest costs; lending positions do not face liquidation risk, and if there is a default, only the YES used as collateral will be destroyed.

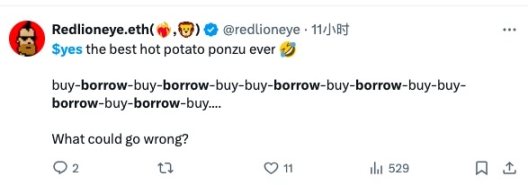

As for what can be done after borrowing WETH, Baseline even directly mentioned in the documentation's use case column that the borrowed WETH can be used to purchase tokens (YES) again, to achieve leverage cycling and expand one's position by increasing capital utilization efficiency.

Perhaps because there is no need to worry about the risk of the position itself, a large number of users have already chosen to execute the above operation mode, which has created a large number of buy orders for YES out of thin air, continuously raising its market price performance, and the protocol has also raised the BLV of YES through accumulated fee income.

So, the "stepping on the left foot and the right foot" technique is beginning to take shape.

Was the Protocol Hacked?

Regarding Baseline, some of the community's doubts stem from the fact that its predecessor, Jimbos Protocol, lost 4048 ETH due to a hacker attack in May last year, when the price was approximately $7.5 million.

Afterwards, although Jimbos Protocol claimed to have cooperated with law enforcement to try to arrest the attacker and offered a high reward of about $800,000 to the community, the hacker ultimately transferred all the stolen funds to Tornado.cash in September last year.

As a result, despite Baseline announcing the completion of a third-party security audit by Trust Security, many community members still have doubts about its security status.

Can You Still Get on the YES Train?

Considering the current situation, the FOMO sentiment surrounding YES is quite intense.

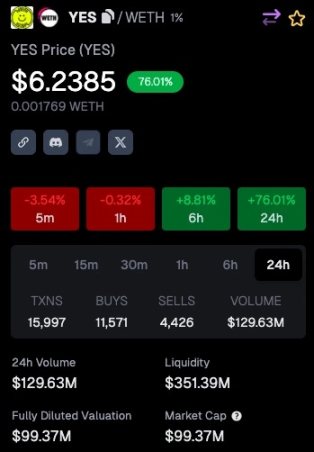

Real-time data from Gecko Terminal shows that YES is currently at $6.2385, with a 24-hour increase of 76.01%, corresponding to a market value of $99.37 million.

The Baseline official website shows that the current BLV of YES is at 0.00116 WETH, approximately $4.1, which means the current market price has a premium of about 52% over BLV.

Considering Baseline's tiered market-making mechanism, in the absence of concentrated selling, there will be a certain distance between the "base position" and the "discovery position," so it is not surprising that the market price has a certain premium over BLV.

As for whether you can still enter, we will not provide any investment advice. For users who are willing to believe in the new contract quality of Baseline and are interested in trying its mechanism, please be sure to pay attention to risk control and DYOR (Do Your Own Research).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。