Compilation: Biscuit, RootData

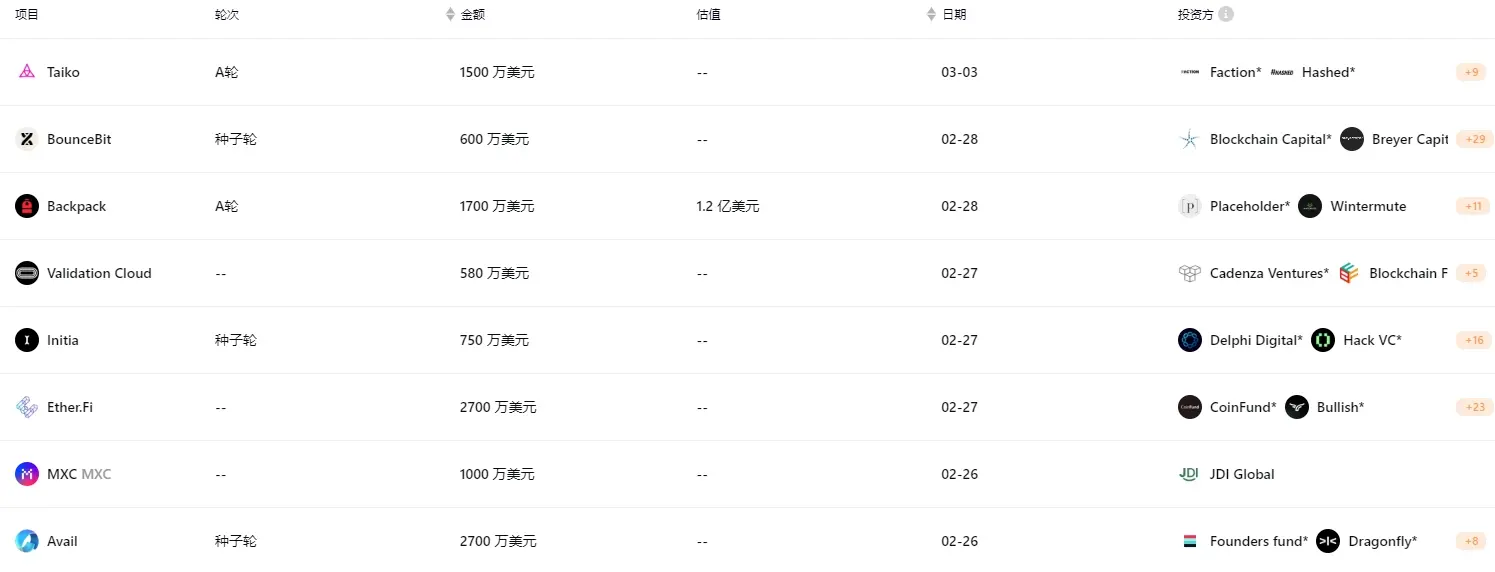

According to RootData's incomplete statistics, from February 26 to March 3, 2024, there were a total of 42 public financing events in the blockchain and crypto industry, with a total financing of approximately 160 million US dollars.

In terms of the distribution of projects, the financed projects are mainly distributed in the infrastructure and DeFi tracks. Popular projects include the ZK-EVM Layer 2 network Taiko, the cryptocurrency exchange Backpack, the full-chain Rollup network Initia, and the modular blockchain Avail, and so on.

(List of projects with financing exceeding 5 million US dollars last week, data source: Rootdata)

Last month, a total of 135 financing events were disclosed in the crypto market, with a total amount of approximately 700 million US dollars, an increase of 14.4% compared to the 118 times in January. The top three projects in terms of financing amount were the Ethereum re-staking protocol EigenLayer (100 million US dollars), Layer1 blockchain Flare Network (35 million US dollars), the liquidity staking protocol Ether.Fi (27 million US dollars), and the modular blockchain Avail (27 million US dollars). HashKey Capital was the most active investor in February, with a total of 7 disclosed investments.

I. Infrastructure

1. Polygon Modular Blockchain Project Avail Completes $27 Million Seed Round Financing, Led by Founders Fund and Dragonfly, with Seven X Participating

Polygon's modular blockchain project Avail announced the completion of a $27 million seed round financing, led by Founders Fund, a venture capital firm founded by Peter Thiel, and Dragonfly, with participation from SevenX Ventures, Figment.Nomad Capital, and several angel investors.

It is reported that Avail was spun off from Polygon in March 2023, led by Polygon co-founder Anurag Arjun. This round of financing will be used to develop three core products: its data availability solution (DA), Nexus, and Fusion. The first iteration of Nexus is expected to go live in 2024, while Fusion Security will be ready by 2025. (Source link)

2. Layer 1 Network Initia Completes $7.5 Million Financing, Led by Delphi Ventures

Layer 1 blockchain Initia completed a $7.5 million financing, with this round led by Delphi Ventures and Hack VC, and participation from Nascent, Figment Capital, Big Brain, A.Capital, and angel investors including anonymous crypto trader Cobie, DCF God, Split Capital co-founder Zaheer Ebtikar, Fiskantes, WSB Mod, and Celestia's COO.

It is reported that Initia is currently running on a closed testnet. Some projects have already built DeFi applications on the testnet and plan to officially launch after the incentive testnet, which is scheduled to go live in early April. Once any issues are resolved, the project will launch its mainnet, with preliminary plans to launch in the second quarter. (Source link)

3. Omni-Chain Ledger Protocol Cycle Network Announces First Million-Dollar Round of Financing, Led by Vertex Ventures

The trustless omni-chain ledger protocol Cycle Network announced the completion of a million-dollar first round of financing, with the specific amount not yet disclosed. Vertex Ventures under Temasek Holdings and Summer Ventures led the financing, with participation from LTP, Super Chain Capital, GSG Digital, and others.

It is reported that Cycle Network has launched a solution to address the interoperability issues in the blockchain field, introducing a trustless interaction method for blockchain through its innovative Omni-Distributed Ledger Technology (ODLT), solving the fragmentation problem of blockchain networks. (Source link)

4. Web3 Data Flow and Infrastructure Company Validation Cloud Completes $5.8 Million Financing, Led by Cadenza Ventures

Web3 data flow and infrastructure company Validation Cloud announced the completion of a $5.8 million first round of external financing, led by Cadenza Ventures, with participation from Blockchain Founders Fund, Bloccelerate, Blockwall, Side Door Ventures, Metamatic, GS Futures, and AP Capital.

Validation Cloud has built a proprietary system architecture, including several major breakthroughs for Web3. The result is a fast, scalable, and intelligent global platform that provides staking, node APIs, and data. (Source link)

5. Bitcoin Staking Chain BounceBit Completes $6 Million Seed Round Financing, Led by Blockchain Capital

The native Bitcoin staking chain BounceBit completed a $6 million seed round financing, with Blockchain Capital and Breyer Capital co-leading, and participation from CMS Holdings, Bankless Ventures, NGC Ventures, Matrixport Ventures, DeFiance Capital, OKX Ventures, HTX Ventures, and angel investors including Nathan McCauley, co-founder and CEO of Anchorage Digital, Ashwin Aiyappan, portfolio manager at Brevan Howard, and Calvin Liu, Chief Strategy Officer of EigenLayer.

According to crypto data platform RootData, BounceBit is a native BTC staking chain that ensures security through staking Bitcoin and BounceBit tokens. (Source link)

6. DePIN Company Geodnet Completes $3.5 Million Financing, Led by North Island Ventures

DePIN company Geodnet completed a $3.5 million financing, with this round led by North Island Ventures, and participation from Modular Capital, Road Capital, Tangent, and Reverie.

Geodnet is a community-based decentralized physical infrastructure network (DePIN), where anyone can connect to the network by installing and operating what is called "satellite miners." (Source link)

7. ZK Native Blockchain Protocol QED Completes $3 Million Financing, Led by Arrington Capital

ZK native blockchain protocol QED announced the completion of a $3 million financing, led by Arrington Capital, with participation from Starkware, Draper Dragon, Blockchain Builders Fund, Lbk Labs, Paper Ventures, Valhalla Capital, Edessa Capital, and Anagram Ltd., among other well-known venture capital firms and enterprises. QED aims to fundamentally change Bitcoin by combining the scalability of zero-knowledge (ZK) proofs with the liquidity and security of BTC.

QED aims to address many of the current shortcomings of Web3, including challenges faced in building on blockchain, scalability issues, and poor user experience. As the world's first horizontally scalable blockchain, it benefits from more network nodes to increase throughput and allows any Web2 developer to write QED smart contracts using popular programming languages such as Javascript and Python. (Source link)

8. DePIN Project MXC Announces $10 Million Financing, Led by JDI Ventures

Tokenized asset issuance company Open Asset completed a 2.3 billion Korean won (approximately $1.916 million) seed round financing, with participation from Hana Ventures, Korea Investment Partners, and Mashup Ventures.

Open Asset is advancing a solution that enables financial institutions to adopt blockchain and trade tokenized assets, and is involved in the tokenized securities issuance infrastructure construction project "Korea Investment ST Friends" of the Korean Investment Securities. (Source link)

9. Layer1 Blockchain 5ireChain Receives Million-Dollar Investment from Gotbit Hedge Fund

Hedge fund Gotbit Hedge Fund announced a million-dollar investment in Layer1 blockchain 5ireChain. The latter will use this round of financing to deepen ecosystem innovation. Previously, 5ireChain announced the launch of a $10 million funding program "5ireGrantsProgram," focusing on projects in the areas of multi-chain, EVM compatibility, and real-world assets (RWA). The program will provide up to $100,000 in funding support for participating projects starting from March 1. (Source link)

10. L2 Network Taiko Completes $15 Million Series A Financing, Led by Hashed

二、CeFi

1. Crypto Exchange Backpack Completes $17 Million Series A Financing at a Valuation of $120 Million, Led by Placeholder VC

Crypto exchange Backpack completed a $17 million Series A financing at a valuation of $120 million, led by Placeholder VC, with participation from Wintermute, Robot Ventures, Selini Capital, and Amber Group.

Backpack, headquartered in Dubai, also offers a cryptocurrency wallet and an NFT series called Mad Lads. The company's CEO and co-founder, Armani Ferrante, is an early employee of Alameda Research. Another co-founder, Can Sun, is a former legal counsel for FTX. Among the company's 40 employees, five were former FTX employees. (Source link)

2. Institutional Staking Platform ContributionDAO Completes $2.8 Million Seed Round Financing, Led by KXVC

Institutional staking platform ContributionDAO announced the completion of a $2.8 million seed round financing, led by KXVC, the venture capital arm of Thailand's largest commercial bank, KBank, with participation from Axelar, Monad, Connext, and other angel investors. The new funds will be used to develop new institutional staking solutions and help the project expand into the Southeast Asia blockchain market.

Additionally, ContributionDAO is building a community infrastructure suite, ProofSquare.xyz, which provides smart automation and virtual assistants to help manage global communities. (Source link)

二、DeFi

1. Liquidity Re-Staking Protocol ether.fi Completes $27 Million Financing, Led by Bullish and CoinFund

Liquidity re-staking protocol ether.fi announced the completion of a $27 million financing, with this round led by Bullish and CoinFund, and participation from Amber Group, BanklessVC, OKX Ventures, Selini Capital, Consensys, Foresight Ventures, and Relayer Capital. (Source link)

2. DEX Project Ring Protocol Completes Pre-Seed Round Financing, with Participation from Manifold Trading

DEX project Ring Protocol announced the completion of pre-seed round financing, with participation from Manifold Trading, Continue Capital, Synergiscap, mox Capital, CL207, DefiSquared, and Bored Chili.

Ring Protocol is the winning project in the Layer2 network Blast ecosystem application competition BIG BANG, and its Ring Swap allows liquidity providers to earn swap fees and yields by staking underlying assets and/or RWA. (Source link)

3. DeFi Protocol Zest Protocol Completes First Round of Financing, Led by Youbi Capital

DeFi protocol Zest Protocol completes its first round of financing and will launch on the Blast mainnet. This round of financing is led by Youbi Capital, with the specific amount undisclosed.

Zest Protocol is launching DeFi products on the Blast Layer2 platform, aiming to provide a high-yield collateralized stablecoin solution. It separates Blast ETH's yield and price volatility in a special way and introduces two innovative products: zUSD (a stablecoin providing leverage yield on Blast ETH) and mirrorETH (an on-chain leveraged Ethereum derivative with no funding fees).

Additionally, Zest Protocol will open the Genesis Pool for pre-staking on the Blast mainnet today, where users will receive Blast rewards, Blast Points, and Zest Points. (Source link)

4. Lending Protocol Scallop Raises $3 Million, Led by THE CMS and 6MV

Sui ecosystem lending protocol Scallop announced the completion of a $3 million strategic financing on social media, with joint leadership from THE CMS and 6MV, and participation from KuCoin Labs, 7UpDAO, Side Door Ventures, Oak Grove Ventures, Signum Capital, Blockchain Founders Fund, Cypher Capital Group, Mysten Labs, and Kyros Ventures.

Scallop is the currency market of the Sui ecosystem. By emphasizing institutional-grade quality, enhanced composability, and strong security, Scallop aims to build a dynamic currency market, offering high-yield lending, low-cost lending, AMM, and asset management tools on a unified platform, and providing SDKs for professional traders. (Source link)

三、Gaming

1. Web3 Gaming User-Generated Content Company PlayMakers Completes $1.5 Million Financing, Led by RockawayX

Gaming

1. Web3 gaming user-generated content startup PlayMakers announced the completion of a $1.5 million Pre-Seed round of financing, led by RockawayX, with major angel investors including Sébastien Borget, Vincent Hart de Keating, and Hugues Ouvard participating.

PlayMakers provides developers with a seamless and easy-to-implement solution to collect, plan, and integrate player creations, turning players into creators in Web3 games. (Source link)

2. NFT gaming company READYgg completes a $4 million financing round, with participation from Delphi Digital and others.

NFT infrastructure startup READYgg announced the completion of a $4 million financing round, with participation from Delphi Digital, NeoTokyo, Merit Circle, Momentum6, Purechain Capital, and others. The valuation has not been disclosed. READYgg CEO David Bennahum stated that the new funds will be used to help expand the startup's business development to cover more regions worldwide.

READYgg provides developers with tools to implement NFTs, cryptocurrency wallets, and other technologies in games. The company also plans to launch its own RDYX token later this year to reward early users, provide governance rights to holders, and enable cross-platform and cross-game transactions within the ecosystem. (Source link)

3. NFT gaming and entertainment platform Imaginary Ones completes a new round of financing, with participation from Animoca Brands and others.

NFT project Imaginary Ones announced the completion of a new round of financing, with participation from Cypher Capital Group, Animoca Brands, MH Ventures, Illuminati Capital, Andromeda Capital, and others.

Imaginary Ones aims to accelerate efforts to become a leading WEB3 entertainment group, focusing on games, content, and merchandise. (Source link)

AI

1. AI-focused blockchain platform Talus Network completes a $3 million financing round, led by Polychain Capital.

The AI-focused decentralized blockchain platform Talus Network completed a $3 million Series A financing round, led by Polychain Capital, with participation from dao5, Hash3, TRGC, WAGMI Ventures, Inception Capital, as well as angel investors from major tech and blockchain companies such as NVIDIA, IBM, Blue7, Symbolic Capital, and Render Network, contributing to the team's mission to democratize AI on the blockchain.

Talus Network is an innovative blockchain platform focused on decentralized artificial intelligence. The network leverages the powerful capabilities of Move, emphasizing security, speed, and enhanced developer experience. By nurturing a diverse ecosystem of intelligent agents for decentralized applications, Talus Network aims to empower users with power in a fair and accessible manner. (Source link)

Tools

1. Web3 tax company Haven Intelligence Systems launches a Pre-Seed round of financing at a valuation of $5 million.

Web3 tax software startup Haven Intelligence Systems launched a Pre-Seed round of financing at a valuation of $5 million. The company has already reached its target cap of $2 million in financing. The company's "Keeper" Web3 tax solution aims to address the complexity of crypto transactions and help users accurately and efficiently fulfill their crypto tax obligations. (Source link)

2. Anti-witch network Humanity Protocol completes strategic financing, with participation from Hashed and others.

Humanity Protocol completed strategic financing, with participation from Hashed, CMCC, Cypher Capital, Foresight Ventures, Mechanism Capital, and over 20 other institutions. The specific amount of financing has not been disclosed.

This round of financing will be used to accelerate the development and deployment of Humanity Protocol, improve its scalability, efficiency, and user accessibility, and prepare for the upcoming testnet. (Source link)

3. On-chain data analysis platform Octav announces a $4 million strategic financing.

On-chain data analysis platform Octav announced a $4 million strategic financing led by high-net-worth individuals in the crypto space, with specific participants not disclosed. This investment will be used to expand the marketing team and accelerate the decentralization and open data processes.

According to the crypto data platform RootData, Octav announced the completion of a $2.65 million seed round financing in September last year, with institutional investors including Nascent, Polymorphic Capital, Parallel Studio, and individual investors such as Markc Zeller, Aave's strategic lead, and 0xMaki, former CEO of Sushiswap. (Source link)

1. Web3 traffic aggregation marketing platform LinkTo completes seed round financing, with participation from Adaverse and other institutions

Web3 traffic aggregation marketing platform LinkTo announced the successful completion of seed round financing, with investment institutions including Adaverse, Ruby Capital, Warrior Wealth Fund, BitValue Capital, and Block Infinity Limited.

LinkTo is dedicated to addressing the core challenges of advertising and marketing in the current Web3 ecosystem, including improving advertising efficiency, ensuring marketing transparency, and optimizing user engagement. By introducing advanced traffic injection technology and AI algorithms, LinkTo aims to provide a platform for brands and advertisers to accurately target and effectively reach their desired audience, while ensuring data security and user privacy. (Source link)

2. Singapore Web3 development tool company BuildBear Labs secures $1.9 million in financing

Singapore Web3 development tool company BuildBear Labs has secured $1.9 million in financing, led by Superscrypt, Tribe Capital, and 1kx, with participation from Iterative, Plug-N-Play, and angel investors Kris Kaczor and Ken Fromm.

The company plans to use this funding to accelerate the development of its flagship platform, providing developers with testing and validation solutions to create secure decentralized applications. BuildBear Labs offers a platform specifically for dApp development and testing, enabling developers to create custom private testnet sandboxes on multiple EVM and EVM-compatible blockchain networks. Its key features include a private faucet for unlimited local and ERC20 token minting, allowing developers to efficiently build and test dApps. (Source link)

3. Decentralized reputation protocol development team Karma3 Labs completes $4.5 million in financing, with participation from HashKey

The development team of the decentralized reputation protocol OpenRank, Karma3 Labs, announced the completion of a $4.5 million financing round, led by Galaxy and IDEO CoLab Ventures, with participation from Spartan, SevenX, HashKey, Flybridge, Delta Fund, Draper Dragon, and Compa Capital.

OpenRank aims to enhance user trust in Web3 primarily through ratings and recommendations. The new funds will be used to drive product adoption and help launch the initial version of the protocol for developer use. (Source link)

4. Cryptographic security company Silence Laboratories completes $4.1 million in new financing, with Pi Ventures leading

According to Techcrunch, cryptographic security startup Silence Laboratories announced the completion of a $4.1 million new financing round, with Pi Ventures and Kira Studio co-leading with angel investors. The recent financing brings the total funding of the company to $6 million. The company will use this funding to expand the team and strengthen research and development channels.

Silence Laboratories is a startup that builds infrastructure using multi-party computation (MPC) to help enterprises protect data privacy and security. The company offers two products using MPC technology: Silent Shard and Silent Compute. Silent Shard, audited by security audit firm Trail of Bits, enables enterprises and users to limit the risk of exposing sensitive private keys and implement advanced authorization rules. Silent Compute allows enterprises to collaboratively process information without revealing their private data to third parties. (Source link)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。