According to the current Telegram's global 800 million users, the current global advertising revenue of Telegram is about 45.6 billion US dollars. Based on this data, the data that can be transacted on the Toncoin chain is about 22.8 billion US dollars per year.

By Frank, PANews

On February 28th, Telegram founder Pavel Durov announced on his personal Telegram channel that starting next month, Telegram channel owners will be able to receive financial rewards from their work. He stated that currently, Telegram broadcast channels generate 1 trillion views per month, but only 10% of the views are monetized through Telegram Ads, which is a promotion tool designed with privacy in mind. In March, the Telegram advertising platform will officially open to all advertisers in nearly a hundred new countries. The owners of channels in these countries will start receiving 50% of the revenue generated by Telegram from displaying ads on their channels. To ensure fast and secure advertising payments and withdrawals, the TON blockchain will be specifically used, and advertising will be sold through Toncoin and shared with channel owners.

Once this news was released, the TON token surged, with a short-term increase of up to 38%, reaching a peak price of $2.95. However, after 4 hours, the TON price experienced a significant decline, with a maximum drop of 25%, reaching a low of $2.2, almost returning to the level before the surge. What specific benefits will this change bring to the TON chain? Or is it another short-term market stimulus?

An increase of 20 billion in advertising revenue without dividends is good for now

Perhaps it is the lukewarm reception that has led Telegram founder Pavel Durov to repeatedly provide blood transfusions to TON through partnerships. So, in terms of the cooperation introduced this time, how much actual impact does it have on TON?

In this key information, Pavel Durov mentioned that Telegram broadcast channels generate 1 trillion views per month, but only 10% of the views are monetized through Telegram Ads. With the new advertising plan introduced in March, channel owners will receive 50% of the advertising revenue, which will be transacted through Toncoin.

PANews found in the official Telegram advertiser's description that the current CPM (cost per thousand impressions) for Telegram is as low as 2 euros. Based on Pavel Durov's mentioned monthly view count of 1 trillion and 10% of the advertising view count, the advertising playback volume is about 1 billion times. Based on the lowest CPM value, Telegram's minimum monthly advertising revenue is about 200 million euros, and the total revenue for channel owners is at least about 100 million euros per month.

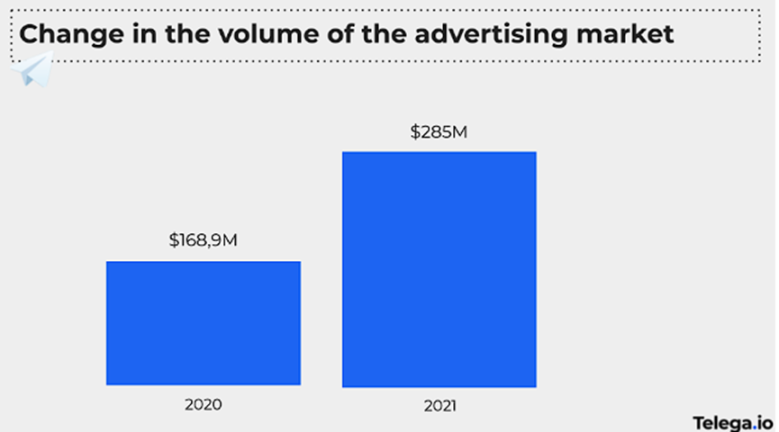

Another report also basically verifies this data. According to a report from Telega.io, the largest advertising trading market for the Russian-speaking segment of Telegram, in 2021, the Russian Telegram user community exceeded 50 million, and the annual advertising revenue in the Russian-speaking market reached 285 million US dollars. Based on the current Telegram's global 800 million users, the current global advertising revenue of Telegram is about 45.6 billion US dollars. According to this data, the data transacted on the Toncoin chain is about 22.8 billion US dollars per year.

However, it is worth noting that this income is not shared with TON token holders, but is transacted on the chain in the form of TON. Therefore, this news is very different from the dividend distribution proposed by Uniswap some time ago. However, based on the current on-chain data of TON, even if only transactions of this scale are conducted on the chain, it will still elevate the overall activity of the chain.

Currently, Telega.io shows that there are 4,351 channel owners who are verified advertising space providers in the market, and there are only about 70,000 active advertisers. Therefore, in terms of user growth, the potential impact may not be significant. However, the assets deposited by Telegram through advertising fees on Toncoin have become a concern for the community.

In order to address concerns that Telegram's excessive holding of Toncoin due to the specialized sale of TON advertising may have a detrimental impact on the decentralized ecosystem, Pavel Durov has proposed a solution. To limit the share of TON held by Telegram to about 10% of the supply, they plan to sell the excess TON holdings to long-term investors at a price lower than the market price, but with a lock-up and attribution plan of 1 to 4 years. This can lock up freely circulating TON, stabilize the ecosystem, and reduce volatility. In addition, Telegram has also set up a new email address for investors with large amounts (over $1 million) to express their interest.

Telegram's rocky road in encryption

When it comes to TON, most people may think of Telegram's official encryption plan, the TON public chain. However, the current TON is essentially not a blockchain directly controlled by Telegram.

As early as 2019, Telegram attempted to launch the "Telegram Open Network" (TON) blockchain network. TON is a multi-purpose blockchain platform designed to provide higher speed and scalability than Bitcoin or Ethereum to support global payments and decentralized applications. However, this project was canceled after a series of legal battles with the U.S. Securities and Exchange Commission (SEC).

The TON project was originally planned to be promoted by Telegram. After settling with the SEC, Telegram announced that it would no longer participate in the TON project. Subsequently, the community and other developer teams decided to continue the project and launched several branch projects based on TON, such as Free TON (later renamed Everscale) and TONcoin. These projects inherited the technical vision of TON and aimed to create a high-performance blockchain platform, but they no longer have direct contact with Telegram. The current TON public chain that we are familiar with, named The Open Network, is the most mature public chain project that has grown after Telegram's official encryption plan was aborted. Although TON is not directly related to Telegram, the official Telegram and founder Pavel Durov have supported the project multiple times in recent years and emphasized the business connection between Telegram and TON.

In December 2022, Telegram announced that users can purchase anonymous numbers on the Fragment blockchain by paying with Toncoin. Stimulated by the news, TON rose 30% from $1.84 to $2.4, and the price briefly reached $2.8. Although Fragment's trading volume exceeded $5000 in the following month, TON's market performance did not remain strong, but instead continued to decline to a low of $0.96 as the crypto bear market progressed.

With 800 million users, eager to build the world's largest public chain

In the official introduction of TON, it is written: As of 2022, the TON blockchain is still one of the few truly scalable blockchain projects. Therefore, it is still the most advanced blockchain project, capable of executing millions, and even tens of millions of truly Turing-complete smart contract transactions per second when necessary in the future.

In its official performance comparison with other public chains, the TON chain seems to be able to outperform Ethereum and Solana in all aspects.

In 2023, Steve Yun, the president of the TON Foundation, revealed in a speech that their goal is to attract 30% of Telegram's users to join TON by 2028. It is expected that TON will have 500 million active users by 2028.

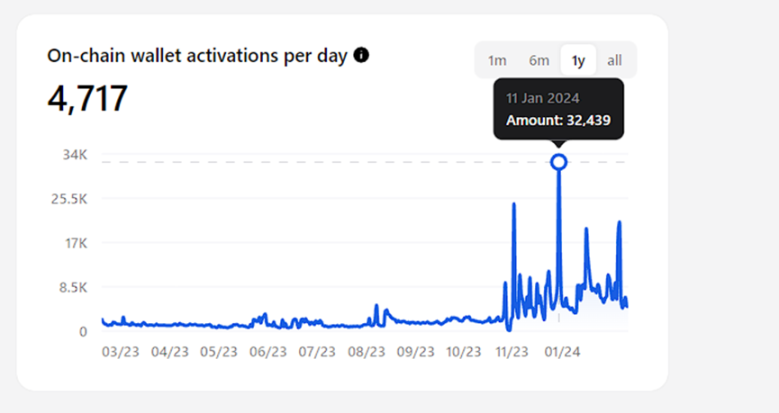

Although the goal is ambitious and backed by the strong support of Telegram with its 800 million users, the current progress of TON seems to be less than ideal. As of March 1, 2024, there are approximately 1.56 million wallets activated on the TON chain, with a peak daily active user count of 32,439. In comparison, Ethereum has approximately 110 million of these data.

Overall, Telegram, as a product with strong Web3.0 genes, is widely recognized in the industry. Especially as more and more Telegram bots and encryption tools grow and thrive on Telegram. As one of the world's largest social platforms, Telegram also has the potential to become the king of the encryption industry. However, in the current context of its somewhat superficial partnership with TON, market performance may be the best feedback.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。