How do you view the current state of the Bitcoin ecosystem and Bitcoin Magazine's definition of Layer2?

Interviewer: Wu Yue, Geek Web3

Guests: Kevin He, former Web3 technology leader at Huobi Group; Faust, founder of Geek Web3

The two guests discussed the current industry status of the Bitcoin ecosystem, their views on Bitcoin Magazine's definition of Layer2, and their own criteria for evaluating Bitcoin Layer2 in their minds. (Note: These remarks represent the personal opinions of the two guests and do not involve the values of Geek Web3 as a media organization itself)

Introduction: The beginning of 2024 can be described as the Warring States period of Bitcoin Layer2. In just a few months, at least 60 project teams claiming to be Layer2 have emerged in the Bitcoin ecosystem. Due to the lack of authoritative voices in this field, there is no clear and systematic judgment criteria for what should be considered as Layer2 and what should not.

This ambiguity and disorder provide absolute freedom for developers and entrepreneurial teams, but also allow various narratives to ride on concepts to spread unchecked.

(The text in the image is machine-translated from the original English text of Bitcoin Magazine)

In this chaotic and impetuous time, Bitcoin Magazine, relying on its relatively authoritative status as a media organization within the Bitcoin community, has put forward a simple set of standards for defining Bitcoin Layer2. It is not difficult to see that this standard has a strong "Bitcoin flavor," which is very different from the mainstream understanding of Layer2 in the Ethereum community. Bitcoin Magazine's main points mainly cover three aspects, including:

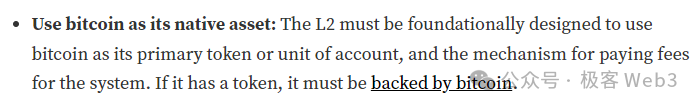

1. Using Bitcoin as its native asset: Bitcoin Magazine believes that Layer2 should use Bitcoin as its primary token or account unit (Native Token), as well as the measurement currency for gas fees.

If a Layer2 project issues its own tokens, they should be backed by Bitcoin. (This explanation is somewhat vague, and some people think that Bitcoin Magazine seems to be referring to assets like BRC-20).

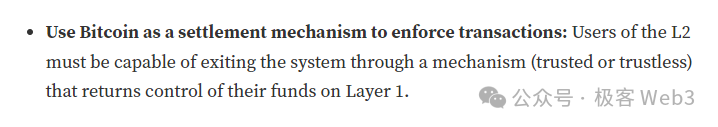

2. Using Bitcoin as a settlement layer: Layer2 must reserve an exit mechanism for users, allowing them to withdraw their assets back to Layer1. This withdrawal mechanism can be trustless, or it can exist with a certain level of trust assumption.

(It seems to be saying that there must be a bridging relationship between Layer2 and Layer1, or there must be a mapping relationship between assets in L1 and L2. The way of cross-chain bridging or asset withdrawal can be non-trustless, but they did not explicitly state what level of trustlessness should be achieved. According to this standard, protocols such as the Scripting Protocol or off-chain indexing protocols, and the original RGB protocol may not be categorized as Layer2.)

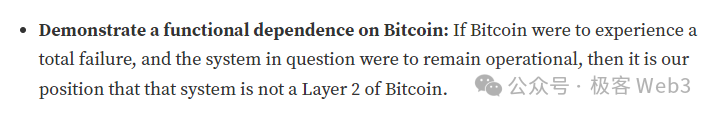

3. Dependence on Bitcoin: If Bitcoin completely fails, Layer2 should also be affected. If Layer1 shuts down, so-called "Layer2" should still be operational, then such a project is definitely not a Bitcoin Layer2.

In addition to the "three rules," Bitcoin Magazine also mentioned CounterParty and Ordinals, pointing out that asset protocols that are attached to Bitcoin and do not have independent blockchain structures do not belong to the category of Layer2; at the same time, some "parasitic layer" protocols do not meet certain conditions of Bitcoin Layer2.

However, Bitcoin Magazine did not provide a clear explanation of which protocols belong to the so-called "parasitic layer" (which may include the RGB protocol). This also leaves everyone in suspense about the point that Bitcoin Magazine wants to convey.

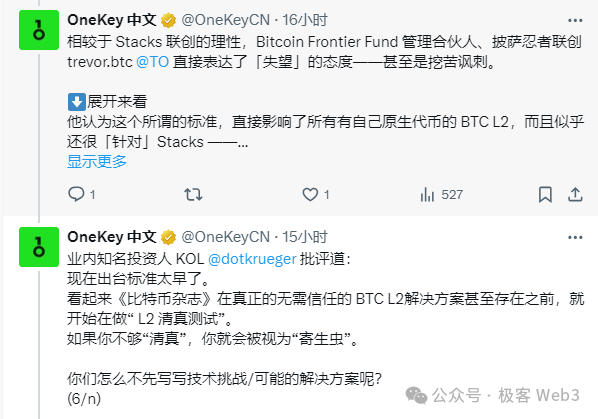

After the introduction of this standard by Bitcoin Magazine, it quickly sparked a lot of discussion, including the founder of the Stacks sidechain expressing his own views. Onekey's official Chinese account observed these influential Western KOLs, and it is obvious that people have mixed opinions about Bitcoin Magazine's views, and even the majority expressed opposition.

Setting aside the subjective positions of the public and the rationality of the above Layer2 definition standards, Bitcoin Magazine, as an influential media and research institution in the Bitcoin ecosystem, has taken a historic step—triggering a large amount of discussion on the definition standards of Bitcoin Layer2 in public, and sparking support or opposition from people with different positions.

It feels like in August 2023, when Dankrad of the Ethereum Foundation made a high-profile declaration on Twitter that "it's not considered Layer2 without using Ethereum as the DA layer." It is not surprising that the public discussion on the definition of Bitcoin Layer2 will become more intense in the future, until a majority of professionals reach a consensus.

Due to a strong interest in Bitcoin Layer2 and even modular blockchain technology narratives, Wu Yue, the Research Lead of Geek Web3, invited Kevin He, former Web3 technology leader at Huobi Group, and Faust, founder of Geek Web3, to conduct an online closed-door exchange. This article will summarize the results of this online exchange in text form to help everyone understand the definition standards of Bitcoin Layer2.

One

Of course, traders who are keen on trading and geeks who focus on technology have vastly different views on Bitcoin Layer2. Previously, some KOLs believed that exchanges also count as Bitcoin Layer2, and Sun Ge directly shouted: Tron is also a Bitcoin Layer2. Some KOLs believe that the evaluation criteria for Bitcoin Layer2 should be different from Ethereum Layer2, and even claim that Bitcoin Layer2 will surpass Ethereum Layer2, and then take this opportunity to promote a subjective theory.

These phenomena are just the tip of the iceberg in the current Bitcoin ecosystem. The phenomenon of setting standards and self-promotion is widespread among most people. Of course, all so-called "theories" will ultimately be judged by professionals, and currently, many statements about Bitcoin Layer2 are not logically reasonable.

In addition, there is also a clear gap between the Eastern and Western communities, especially among practitioners in Western communities, particularly in European and American countries, there has been direct and frequent communication, and the technical atmosphere is stronger than in the Eastern circle. More importantly, Bitcoin community OGs, the Ethereum Foundation, the Celestia Foundation, and other professional individuals or organizations have a huge influence in the West, much more than in the East, which largely contributes to the differences in values between the Eastern and Western communities.

In comparison, the Chinese community has formed a certain closed loop, with everyone minding their own business and busy with their own affairs, and has not yet formed a strong and influential organization or organizations with strong professionalism and promotional capabilities as a source of unified values, which brings both freedom and chaos.

Of course, this kind of situation is inherently both good and bad, but when it comes to the technical understanding of Bitcoin Layer2, we can clearly feel the differences between the Eastern and Western communities. However, "technology is valuable, and creating wealth is also valuable." Technology is one aspect, and the wealth effect is another aspect. Since so many people can accept the Blast, I think that even if some Layer2 technologies are not sufficient, we cannot arbitrarily deny them. In the end, we need to see what value these projects can bring to the market and the entire industry.

Kevin He: Thank you for the question, the points Faust made are quite clear. I will add some personal opinions: the current Bitcoin ecosystem can be described as a hundred flowers blooming. As for Bitcoin Layer2, it is a stage of fierce competition and contention among heroes.

In the context of Bitcoin's continuous halving, the Bitcoin ecosystem has emerged. Various asset protocols based on Bitcoin have been launched, breaking the inherent concept that Bitcoin cannot easily issue assets, and assets have thus exploded. The prosperity of assets will inevitably give rise to application demand, and Bitcoin's special technical conditions (expensive and slow) urgently require BTC Layer2 to accommodate the application demand for these assets.

From a market perspective, several projects have been running fast, attracting the attention of both Eastern and Western communities. At the same time, from a technical point of view, the definition of Bitcoin's Layer2, or security standards, is still lacking and requires more ambitious individuals to push for the formation of consensus.

Two

2. Wu Yue: Thank you for the wonderful sharing from both of you. **What do you think about the recent widespread discussion of "Bitcoin Magazine's Three Rules for Bitcoin Layer2"? Do you think the standards proposed by Bitcoin Magazine are reasonable? Many people in the Western community seem to be critical of this.

Faust: Actually, the three major standards proposed by Bitcoin Magazine are not very precise, and some points are based on ideological perspectives rather than technical perspectives, and have not gained community consensus, making it difficult to serve as objective criteria for judging Layer2.

In my opinion, they originally wanted to propose some strict standards, but found that different Bitcoin Layer2s are very different, and it is difficult to quickly generalize a universal evaluation framework. They wanted to implement a custom standard at this current time, just a simple "three rules" (Bitcoin Magazine stated at the beginning of the article that their purpose in promoting standards is to resist some chaos in the Bitcoin ecosystem). But this simple and crude method may not objectively measure Bitcoin Layer2.

In this regard, the Ethereum Foundation's approach may be more rigorous. They are taking a technical approach, distinguishing different technical solutions, categorizing specific technical solutions such as state channels, Plasma, and Rollup as Layer2. Many people in the Ethereum community also include Validium and Optimium, outside of Rollup, in the Layer2 category.

This method of first classifying from a technical perspective is clearer and more focused. For example, state channels and Rollup differ greatly in their working mechanisms, and many features are not interchangeable. The Ethereum community first categorizes both as Layer2, and then proposes a series of evaluation criteria for Rollup as a subcategory. This method is more mature.

However, if you insist on defining the entire Layer2 track with a macro, universal indicator like Bitcoin Magazine, you will find it difficult to summarize a set of fine-grained universal methods. So, if it were up to me, I would first declare:

Which types of technologies, such as sidechains, sovereign Rollups, independent blockchains (ps: there is a difference between independent blockchains and sidechains), ZK Rollup, and OP Rollup, should be considered as Layer2, and then apply this to different sub-concept evaluations. Of course, if a set of evaluation criteria for Bitcoin Layer2 is not detailed enough and somewhat vague, it is not impossible, for example, I would be more inclined to evaluate from the perspective of security and functional expansion, as these are already mature evaluation methods with industry consensus.

The views proposed by Bitcoin Magazine have not been widely accepted by the industry and are mixed with strong ideological orientation, especially the first point: Layer2 must use Bitcoin as the native token. Even the Ethereum Foundation, which maintains the ETH price as one of its goals and has a centralizing tendency, does not dare to express it so bluntly. This may be because Bitcoin Magazine does not want to see too many teams rushing to issue coins, so they have proposed this point. However, in fact, even if Layer2 issues coins, it does not affect what its Native Token is, and the phrase "backed by bitcoin" is even more puzzling.

In conclusion, my personal stance is very clear: the standards proposed should be based on technical perspectives as much as possible, with less pure ideological influence. In this regard, the Ethereum community's L2BEAT has done a good job. They conduct scientific evaluations from the perspectives of resistance to censorship, reliability of DA implementation, verification methods for state transitions, and control of Rollup contracts. This set of standards can be slightly modified and applied to many modular blockchain modules in the Celestia ecosystem, and of course, can also evaluate the security of Bitcoin Layer2.

But if, like Bitcoin Magazine, you define Layer2 from an ideological perspective, it is too subjective. This is like evaluating which political system is better between the United States and the Soviet Union, and it can easily evolve into mutual labeling by people with different political views. But if you start from a technical perspective to judge everything, it will be much easier.

I think it is better to first focus on areas with less controversy and easier to reach consensus, such as evaluating the security risks and functional completeness of Layer2, and evaluating the hidden dangers of different asset protocols. From these perspectives, the evaluation will be more objective and rigorous. Attempting to define from an ideological perspective is not something that Bitcoin Magazine or anyone else or any organization should do (except for Satoshi Nakamoto).

Interestingly, the CEO of Bitcoin Magazine mentioned that they plan to recruit an employee from L2BEAT to study the evaluation methods of Bitcoin Layer2. I estimate that they will soon cite some of the work results from L2BEAT.

Kevin He: First of all, I want to express my great appreciation for the courage and responsibility of the editors of Bitcoin Magazine in proposing and implementing standards in this era of great controversy. It is inevitable that this will attract criticism, and it will also require a lot of effort to implement. However, a healthy community inevitably needs someone to do this, just like we tried to promote discussions on classification standards and security standards in the community several months ago.

Secondly, returning to the standard itself, personally, I believe that:

1) It is based on the innovation of Ordinals and BitVM (without these two innovations, the Bitcoin ecosystem might still be stagnant)

2) I personally believe it belongs to a relatively broad standard (making a great effort to unite as many forces as possible)

3) I personally believe it lacks discussion on more essential security standards (i.e., the underlying principles of why these three standards are necessary)

Considering that we have had quite a bit of thinking and discussion in this area before, mainly focused on the Chinese-speaking community, we will now promote our draft to a wider audience and welcome more forces (including Bitcoin Magazine) to join us in building and promoting consensus on classification and security standards in the community.

Three

3. Wu Yue: The sharing from both of you has been excellent. Now, I would like to ask the most crucial question: How do you think objective evaluation criteria for Bitcoin Layer2 should be defined?

Faust: As mentioned earlier, it is first necessary to start from a technical perspective, focusing on security, the completeness of Layer2's functionality, and other technical aspects, and to avoid starting from subjective ideological perspectives, and to refer more to industry-consensus points, and to avoid inventing new concepts and ideas. Bitcoin Layer2 is essentially an extension of modular blockchains and state channels, as well as derivative off-chain asset protocols. As long as we follow the existing research conclusions about these three elements, it will be sufficient.

Elements that have not been included in the evaluation criteria for Layer2 by industry predecessors must have their reasons for not being included. We should avoid these minefields and try to follow the path that previous pioneers have already taken, rather than forcibly opening up new paths in marshy areas, as doing so will only lead to deeper entanglement.

Kevin He: I believe that in order to promote this set of standards, we need to adhere to at least 2 basic points:

1) Respect Bitcoin's traditions and incorporate the latest developments (such as Ordinals/BitVM)

2) Absorb the exploration and implementation experience of other ecosystems in Layer2 (such as Ethereum Layer2)

Based on these two basic points, we need to form several universal/objective/security-focused standard definitions, undergo thorough discussions, and ultimately form community consensus. All theoretical frameworks need to go through several discussions and revisions before they can gradually take shape. For the establishment of standards for Bitcoin Layer2, it may still require a lot of exploration by many individuals and organizations. Ultimately, the market will gradually select the most reasonable standards that can be accepted by the majority of professionals and even common-sense individuals. This process needs to be left to the free choice of the market in order to know the final answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。