Focus on the ToC scenario, as well as markets where similar hardware has not yet been widely adopted, revolutionary changes may occur.

Authors: Arnav Pagidyala, Harper Li, Jack Ratkovich, Jeffrey Hu, Junbo Yang, Stanley Wu, Sunny He, Xiao Xiao, Yerui Zhang, Zeqing Guo

As one of the most active Crypto VCs, HashKey Capital regularly analyzes and organizes various Web3 tracks internally.

On the occasion of the 2024 New Year, we will release our internal track judgment and understanding of "open source" as our contribution to the industry.

ZK

In 2023, the ZK track expanded from previous scalability and cross-chain scenarios to more application scenarios, further differentiating into different tracks.

zkEVM

In terms of zkEVM, there have been some developments in aspects such as type0, type1, and type2. In terms of categories, type0 is completely equivalent to Ethereum, but still faces technical challenges such as block speed, deployment, and verification state due to its emphasis on equivalence; type1 has made improvements and compromises based on the EVM, and currently has the most prominent overall application experience and opcode compatibility; type2 and others have already launched their mainnets and are developing their respective application ecosystems.

The specific project situations vary and require analysis based on the development roadmap of each project, such as Polygon's CDK, StarkNet's full-chain games, etc.

zkVM

The main technical route in the zkVM field is zkWASM, which has a more scalable architecture, so its application direction is to collaborate with exchanges to create high-performance DEX. The main projects in the zkWASM field include Delphinus Labs, ICME, wasm0, etc.

In the direction of RISC V architecture, RISC0 is being explored, which is more friendly to front-end languages and back-end hardware compared to WASM, but potential issues lie in efficiency and proof time. The application scenarios are also expanding, such as Reth simulating the Ethereum execution environment, the execution environment of FHE, Bitcoin Rollup, etc.

There is also zkLLVM. Recently, a Type-1 zkEVM was launched based on this technology, and zkLLVM can quickly compile high-level languages into zkSNARK circuits.

ZK Mining

In the ZK Mining field, the efficiency of GPUs and FPGAs is currently similar, but GPUs are more expensive, FPGAs are more like prototype verification, and the ASIC scenario may gradually differentiate, such as special-purpose ASIC chips, the demand for additional FHE, etc.

In addition, there is a noticeable increase in Prover DAOs, and computing power is a core competitive advantage, so mining teams that establish Prover DAOs will have a significant competitive edge.

ZK Middleware

ZK middleware can include scenarios such as zkBridge, zkPoS, ZK Coprocessor, zkML, and zk trusted computing for verifiable computation. The scenario of ZK Coprocessor is relatively clear, and most projects have reached the testing phase; the zkML track is still quite active, and there is already some differentiation in the progress and competition of various projects. In addition, a new track of ZK proof sharing has emerged (sending proofs to a network, and after batch processing, sharing the income).

MEV

Mainly focus on the early stage of the transaction supply chain, i.e., the intent stage.

The next-generation DEX design and infrastructure improvements for LVR and LP will attract more capital.

If private auctions/trading pools can operate effectively, they will greatly improve the transaction supply chain. The development of FHE, MPC, and ZKPs is worth paying attention to.

Currently, most systems use centralized relays, licensed solvers, and trusted builders. However, we believe that the ultimate goal of the track is permissionless to achieve the most competitive market.

MEV supply chains will undergo changes in APS, document execution, PEPC, etc.

OFA

Order Flow Auctions (OFA) began to rise in 2023. High-value transactions will no longer flow to public trading pools but to OFA, providing users with feedback on the value they create. From RFQ auctions to block space aggregators, there are various OFA implementation schemes to meet various needs for price discovery and execution quality. Looking ahead, it is estimated that more and more ETH transactions will be conducted through OFA.

Blockbuilder

As seen through relayscan, the builder market is concentrated in a few companies, some of which are high-frequency trading companies serving their own trading needs. In the future, with the reduction in CEX/DEX arbitrage volume, the advantage of high-frequency trading may also diminish.

Relay

The relay market faces two fundamental issues: (1) market concentration in a few companies, namely BloXroute and Flashbots; (2) lack of incentive mechanisms for relays.

In the future, we expect to see the rapid development and implementation of optimistic relays and proposals for relay incentives.

AA

The AA (Account Abstraction) track can mainly be divided into two categories: smart contract wallets and modular services.

In the smart contract wallet area, companies in the AA wallet track have already established a similar pattern to the entire wallet track. It is becoming increasingly difficult to gain traffic based solely on functionality, and instead, the focus is on wallet factory.

In the area of modular services, Bundler and Paymaster are two essential functions that these infrastructure providers must offer, and in fact, these two services have become standard services.

Current track trends include:

Most of the infrastructure has been built, and the development is relatively stable at present. From the data of the entire track, it has entered a fast-growing trajectory, with user wallet numbers increasing since June, and as of November, there have been over 6 million Userops and approximately 200K MAU.

The development of L2 in the AA track is better than L1, and the EF is considering providing native support for L2.

The problem of DApps not supporting AA is still severe, and there are also issues with implementing cross-chain and cross-Rollup accounts, which require new solutions to be proposed.

Private mempools will converge with MEV and intent, optimizing the user experience.

Intents

After receiving attention this year, Intents has developed rapidly, although it faces issues such as malicious solvers and trust in order flow. However, there are feasible solutions to these issues.

For Intents to develop better, it must consider issues such as order flow and user acquisition. Therefore, from an architectural and business perspective, Intents are well suited to be combined with the architectures of MEV and AA. For example, Builders and Searchers are best suited to play the roles of matching and solving.

Telegram Bot is likely to evolve towards Intents, and their advantage in order flow gives them considerable bargaining power with builders and SUAVE, a bargaining power that may even exceed that of wallets with larger volumes.

DA

There are not many participants in the DA (Data Abstraction) track, apart from Ethereum, the main ones include Celestia, Eigenlayer, and Avail, and the progress of the projects varies. There is a clear winner-takes-all effect, leaving little opportunity for the long tail. The overall valuation level of the DA track has been raised with the launch of Celestia and the rise in prices. However, DA is essentially a B2B business, and the income of DA projects is closely related to the quantity and quality of ecosystem projects.

From a customer perspective, releasing DA on Ethereum is the safest and most expensive solution. After the protodanksharding, the fees on Ethereum have significantly decreased, so large Rollup projects still choose Ethereum as the DA layer. Currently, the clients of DA projects, apart from EigenDA, are mainly from the Cosmos ecosystem and RaaS projects. EigenDA has a unique positioning, indirectly related to Ethereum, and may be able to attract some middle ground clients. Additionally, there are some early-stage DA projects and DA projects targeting specific scenarios, such as Bitcoin DA, which may gain a decent market share in niche areas.

Rollup Frameworks & RaaS

The rollup market is already saturated and awaits new developments. Currently, there are at least 30 RaaS projects supported by VCs and infrastructure providers entering the market. It is necessary to understand which use cases have been successful in RaaS and which interoperability solutions can be effective.

Some L2/L3 frameworks (such as OP Stacks) have received a lot of public goods funding and developer adoption.

Specific applications, such as DePIN, may use custom execution environments to utilize Ethereum rollup.

Additionally, there are many new technologies related to rollup, such as Risc0 Zeth/other projects that can change the way rollup verification states are handled without relying on validators or sync committees. When used with primitives like ZKP and MPC, FHE rollup can provide fully universal privacy DeFi, and more.

Cosmos

In the future, the Cosmos Hub will continue to strengthen its position in the ecosystem in various aspects. For example, Partially Secured Staking (PSS) can allow some validators to provide cross-chain shared security (ICS) more flexibly, without requiring all Cosmos Hub validators to join, reducing the pressure on many validators and making it easier to promote. On the other hand, the Cosmos Hub plans to enable multi-hop IBC to improve user experience. In terms of protocol implementation, there are plans to add features such as Megablocks and Atomic IBC to provide atomic cross-chain transactions, which can form a unified MEV market, similar to the shared sequencer and SUAVE in the Ethereum ecosystem.

In the Cosmos ecosystem, the development route of application chains has been somewhat influenced by L2 and other development frameworks, leading to a decrease in the number of new projects. However, due to its highly customizable underlying framework, it is flexible and can be customized as the mainstream narrative evolves, finding corresponding modifications for public chain targets.

Security

Projects in the security track have made progress at various levels, including tools and protocols at various levels, such as on-chain detection and interception, on-chain tracking tools, manual auditing and bounty services, development environment tools, various technical methodologies (such as fuzz testing), and more.

Each tool is better suited to detect specific vulnerability categories and has specific methods for checking vulnerabilities in smart contracts (static analysis, symbolic execution, fuzz testing, etc.). However, the combination of tools is still difficult to replace a complete audit.

In addition to the different positioning mentioned above, the dimensions to consider for projects can also include maintenance and update speed, size of the vulnerability database, carriers, actual needs of partners, and more.

AI

The current direction of the combination of Crypto and AI mainly includes underlying computing power infrastructure, training based on specific data sources, chat tools, data labeling platforms, and more.

Projects in the underlying computing power infrastructure and computing network fields have innovations at different points, but are generally in the early stages and need to consider future sustainable business expansion paths beyond creating different types of agents.

Data labeling platforms transform traditional manual labeling businesses into web3 forms, and the ability to obtain orders is crucial. Additionally, because low-threshold data labeling is likely to be easily replaced by AI in the future, there is a need to focus on providing tools for high-value, high-threshold data and obtaining more orders.

Furthermore, many new projects combining AI are developing ToC chat tools, and more.

As a Crypto fund, we will focus more on ZKML, projects with a data advantage in the crypto vertical, or ToC products closely integrated with AI, rather than basic infrastructure such as large language models that we are not good at.

DeFi

A change in 2023 may be that many investors will need actual yield products, such as those from LSDfi or RWA, rather than emission-based yield. Additionally, due to significant regulatory pressure on centralized exchanges and the need for assets to find liquidity, DEX has a great opportunity, especially with the possibility of high-performance applications on L2. It is important to focus on DEX opportunities on L2.

On the other hand, projects that enable non-crypto native users (including institutions) to access Web3 yield have a huge opportunity. Projects that can abstract on-chain elements and provide a secure environment for non-crypto native users will attract a large amount of capital.

Specifically, according to Messari's report, perpetual DEX fees generated by well-known projects such as dYdX, GMX, Drift, and Jupiter account for the highest proportion in various sub-tracks.

Liquidity staking continues to grow in 2023. Nearly 22% of all ETH is staked, with Lido accounting for around 32% of the ETH staking market share (at the time of writing). Liquidity staking tokens are still the largest DeFi track, with a TVL of $20 billion.

Gaming & Entertainment

Studio

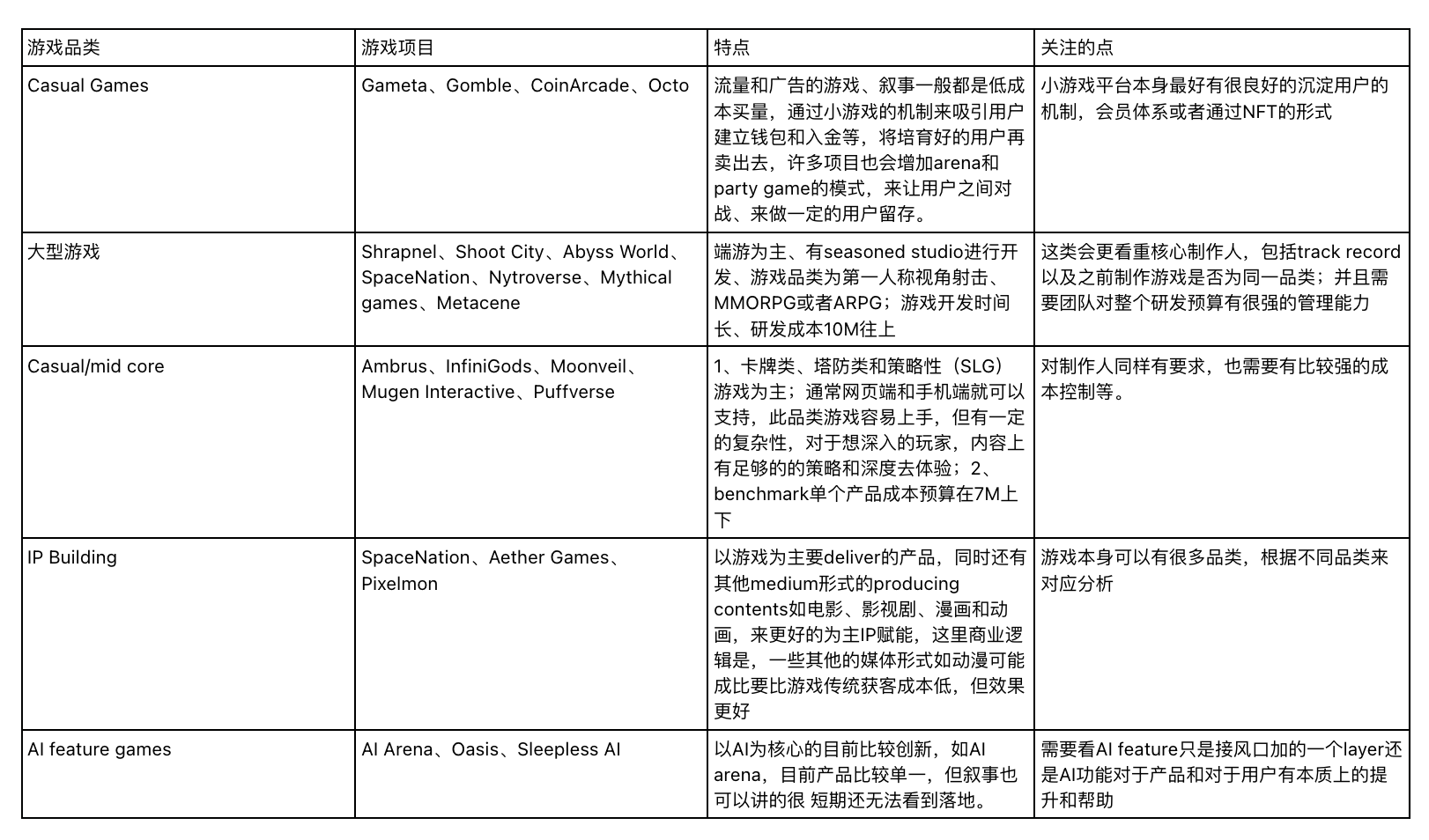

Studio projects have different characteristics and points of focus based on their own categories, as shown in the table below:

The overall gaming track can be summarized into the above categories. The overall game quality and team professionalism have significantly improved compared to the previous period. We continue to look forward to studios entering web3, with mature experience in developing and operating products, and a continuous pursuit of founders who are strong in learning, sensitive to crypto, community-oriented, and willing to speak out. In terms of Web3, because there is a short history of blockchain games and not much mature experience to draw from, we will focus more on whether the team's ideas and approach align with web3 and their learning speed, rather than having extensive web3 experience.

In the future, we will continue to focus on UGC. Currently, web 2 UGC has centralized issues that cannot be resolved. In addition to providing tools for users to create content, UGC should also provide a completely transparent reward mechanism and freedom of asset trading. Decentralization is a good way to solve these issues and provide additional value. We are optimistic about teams with web2 creator resources, introducing these creators to web3 UGC platforms through transparency and higher returns.

Game UA

Summarizing the projects in the Game UA category, they all focus on building user profiles, combining on-chain, off-chain, and social dimensions, and are divided into customer acquisition (Carv) and operational strategy (Helika) directions. However, all customer acquisition platforms often face retention challenges, but the value of player data increases with the growth of user numbers. If applications with large-scale adoption are expected, game data analysis can capture some of this value.

Extending to game distribution platforms, those that focus on core game products that can bring in a large number of users will determine whether the distribution business can succeed, rather than relying solely on infrastructure and tools as the core products did in the previous period.

User/Fan engagement

The project mainly involves the entertainment, sports events, and film and television-related industries. According to the cooperation relationship with IP holders, it can be roughly divided into two forms: direct operation by IP holders and cooperative operation through IP authorization. The IP cooperation form puts less pressure on platform operations, but its effectiveness depends on how much resources the IP holders provide. Direct operation by IP holders involves heavier operations, but it usually better integrates IP events/content with end products and can grant users more ancillary rights through NFTs, potentially leading to better fan incentives and feedback. Additionally, through tracking and observation of several projects, it has been observed that platforms with a certain existing community base (such as Karate combat) find it easier to convert existing users into IP fans, compared to starting from scratch and targeting IP-based fan communities for fan engagement. The focus will be on targets with high IP value, users/audiences/fan communities overlapping with gaming/betting profiles, and direct cooperation with IP.

Institutional Service

The institutional service track can be divided into the following sub-tracks:

● Trading/Brokerage Services: Including exchanges, liquidity providers, brokers/traders, clearing/settlement, etc.

● Asset Management: Including fund management, high-frequency trading, arbitrage, custody, etc.

● Banking/Payment: Including payment processors/deposits/withdrawals, issuing cards, banking-related services, etc.

● Other Services: Including trading technology providers, etc.

The overall trend of this track includes:

● The institutional service track is expected to continue to maintain stable growth in the coming years.

● Compliance is an important trend in the institutional service track, and companies are actively engaged in compliance construction.

● The responsibilities of various service providers are becoming increasingly clear, with each participant in the track focusing on their core responsibilities, mutual checks and balances in niche areas, and supervision, which is conducive to a more honest and efficient market operation.

● The market share of PB service companies is expected to gradually increase. It is worth continuing to pay attention to the areas they provide, which are currently blank in the crypto field but mature in traditional fields (ECNs, fully regulated clearing house, cross-margin capabilities).

● During the ETF application window, native crypto service companies will face challenges from traditional financial companies, and the demand for compliant-level products will further increase, reshaping the market landscape.

● Europe is a hotspot for the development of the institutional service track, and emerging markets such as South America also have certain potential.

Bitcoin

Although Bitcoin has recently received attention due to Taproot, the on-chain of Bitcoin is not a globally shared state, and the entire concept (state, accounts, computational model) of Bitcoin is very different from Ethereum. Therefore, in the medium to long term, the construction of Bitcoin infrastructure and applications needs to be approached with a different mindset.

In this regard, it is worth paying attention to Taproot Assets, Rollup, Lightning Network, etc. Additionally, new technology routes such as Statechain are also worth tracking.

Sidechains

Sidechain technology routes, including Stacks, have long dominated the mainstream narrative of Bitcoin's second-layer network because of their relatively small technical burden (can be implemented directly off-chain) and high programmability, making it easy to achieve a good ecological effect. However, it will mainly depend on cross-chain and anchoring to the main chain, and may be attracted by other new technology routes that can bring more traffic and attention.

Layer2

Many so-called Bitcoin Layer2 projects still resemble a sidechain form from the core technical principles, but have built a complete framework for execution, settlement, verification/challenge, and DA based on Ethereum's technical model. The differences in current Bitcoin Layer2 projects mainly lie in the different technology stacks chosen at various levels, such as the use of Cosmos SDK, OP Stack, Polygon zkEVM, Taiko, etc. for the execution layer. Some third-party projects have already implemented the DA layer, and there are also self-implementations. Additionally, there is usually a "account abstraction" layer or integration of multi-chain wallets to support both Ethereum and Bitcoin address formats for user convenience.

Client Verification

Client verification technologies, including RGB and Taproot Assets, can achieve asset issuance and transactions with minimal on-chain footprint, and are worth continued attention.

Lightning Network

Lightning Labs plans to launch stablecoins and other assets on Taproot Assets next year. Additionally, the promotion of native asset yield products by Liquidity Service Providers (LSP) is also worth looking forward to.

BRC20 Type

BRC20 assets heavily depend on specific infrastructure, such as indexers, and it is worth paying attention to this infrastructure and new asset types such as ARC20, but the technical implementation risks need to be considered.

DLC

Although DLC was proposed early, it has been difficult to promote due to limited demand. With the large-scale expansion of the ecosystem, the application of DLC technology may become more widespread, especially after collaborating with some oracles. However, attention should be paid to the centralization risks introduced in the implementation process of DLC.

DePIN

DePIN is a track that is easily scalable in a bull market. Similar to gaming, DePIN is also a track that is easy to convert traditional users, and therefore, it has received industry attention. DePIN has several key elements: 1) decentralization and gameplay/mechanism, which are the lifelines of DePIN, and investment in DePIN projects needs to consider the mechanism first. 2) timing, good mechanisms need to be accompanied by good timing. Projects launched early in the bull market are definitely easier to acquire users, so the team needs to be sensitive to the web3 market. 3) industry fundamentals, the type of hardware chosen by the project, and the characteristics of the user base may determine the success or failure of the project. The following is a classification based on the type of hardware:

Focus on ToC scenarios and markets where similar hardware is not yet widespread, revolutionary changes may occur: For hardware used frequently in ToC (such as wearable devices), the gameplay and mechanism of Web3 actually provide project teams with a better and more efficient crowdfunding channel, reducing barriers for both users and merchants. In the world of DePIN, because of clear token incentives, users will be more motivated to purchase hardware (quick return on investment), and merchants can even presell before production. With flexible cash flow, merchants can focus on fundamentals, such as enriching the software ecosystem, integrating with other hardware, and empowering tokens in the ecosystem. Especially for underdeveloped areas, without DePIN, certain hardware may never be purchased, but early participation in mining speculation may lead to widespread adoption of real hardware on a large scale.

Caution in improving hardware: For ToC placement or low-frequency but essential hardware (such as routers), with a large user base and holdings, DePIN can be an opportunity to improve the experience. In theory, DePIN reallocates resources and demands between suppliers and users, achieving a more reasonable unit economic benefit and making user services cheaper. However, there are also challenges: 1) whether it can achieve decentralization that surpasses centralized solutions technically, such as many decentralized computing or storage solutions, which may be more expensive and less efficient than centralized solutions; 2) whether it infringes on the interests of centralized giants. The large user base and holdings mean that this direction has many major players, who have accumulated years of user, brand, and financial resources. If the DePIN solution cannot have a revolutionary breakthrough in fundamentals or cannot unite forces beyond the influence of major brands, it will be difficult to compete with web2 competitors.

Wait and see unique mining machine directions: For other low-frequency use, and even optional hardware in daily life, or even specialized mining machines purchased for mining, DePIN may bring short-term returns, but may not necessarily create user stickiness. It is not ruled out that DePIN has really cultivated new user habits, but there is a certain degree of uncertainty and it is difficult to predict. Each project needs to be analyzed specifically.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。