Sui is not the only competitor in this niche market.

Written by: THOR AND MODERN EREMITE

Translated by: DeepTechFlow

In today's report, we will delve into the Sui ecosystem. Sui, created by MystenLabs, is hailed as the next generation blockchain, aiming to meet the growing demand for blockchain adoption. You may ask, who is adopting blockchain? The Web2 world is gradually finding its way and transitioning to the Web3 space, as it offers a new realm conquered through marketing, user acquisition, and network effects.

Areas related to mainstream usage, such as the metaverse, gaming, social layers, and even commerce, all require specific types of blockchains to meet their needs. We all remember how expensive Ethereum's costs can become whenever interest surges. Does anyone remember the over $150 million ETH gas fees burned during the Otherside NFT minting period? Indeed, this is why in the past few months, even during the last bull market, we have seen a demand for a fast and cheap Layer 1 blockchain network that will meet the upcoming mainstream adoption.

But what about Layer 2 ecosystems like Arbitrum or Optimism? Aren't they the solution to Ethereum's expensive gas fees?

Yes, but there is still much work to be done in L2 adoption, which is another topic for in-depth discussion. If we are to encounter significant demand from the traditional financial world, we must provide something here and now, and this is where a single-layer blockchain can take the lead.

Key Points of this Article

What is Sui, and why is it compared to Aptos?

Recent developments in the Sui ecosystem

Matters to pay attention to

Conclusion

Understanding Sui: The World of Parallel Chains

Sui is often compared to Aptos because both projects were released around the same time during the last bear market and are both related to Facebook's long-forgotten project Diem. The Diem project was mainly developed for handling lightweight payment traffic between a limited number of wallets, but it was suspended due to the public's premature acceptance of blockchain and the US government's disapproval of allowing giants like Facebook to introduce payment processing infrastructure. This is why both Sui and Aptos are Layer 1 based on proof of stake (PoS) consensus and both utilize parallel execution to meet the upcoming mainstream adoption needs. Despite many technical differences, such as differences in consensus mechanisms or data architecture, we will not delve into these differences as they are irrelevant to our discussion today.

However, it is relevant that both Aptos and Sui are seen as projects heavily influenced by venture capital, leading to a less welcoming atmosphere in the wider crypto world, which was noticeable in their early price actions after listing.

Another similarity is that both blockchains use the Move programming language; however, there are minor differences in the way the language is used. On one hand, Aptos adopts the usage of Move in Diem, while Sui decides to change some concepts and adopt an object-oriented approach, making it more suitable for large-scale adoption purposes, which is why it belongs to the growing trend of parallel L1 blockchains.

In the coming months, we will witness another round of L1 chain wars, which dominated the narrative during the 2020/21 cycle. However, this time, we will see new competitors entering the arena, namely Aptos, Sui, Sei, Solana, and the upcoming Monad. All of these are single-layer chains, they all support parallel execution, and they all aim to win market share in the same niche market.

Reverse Consensus: Recent Growth

As mentioned earlier, the price trend after the launch of Sui was not surprising, as the main trades taken by crypto Twitter were to open short positions and hold for months, which proved to be quite profitable. However, in October 2023, when Bitcoin began its ascent and finally broke the $30,000 mark, the bottom of SUI had formed and began its upward trajectory.

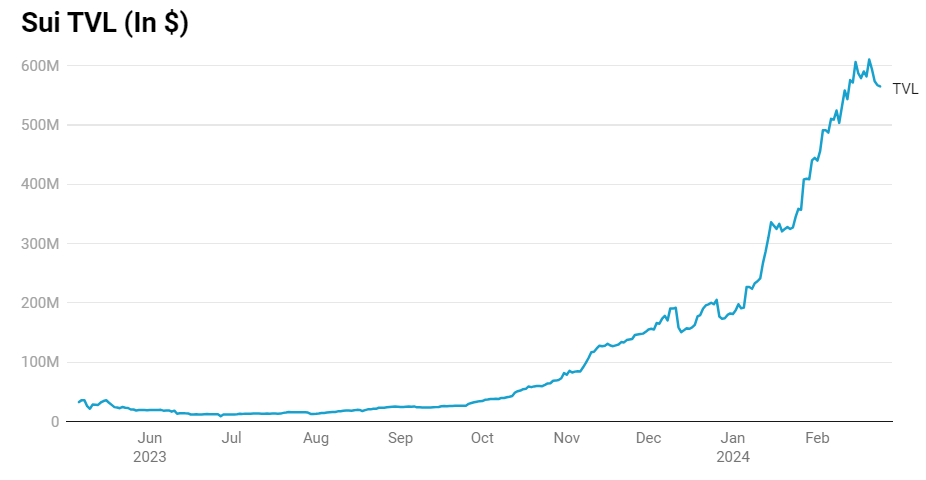

However, price was not the only thing that started to rise; TVL on Sui did too. From around $80 million in October 2023 to $567 million today, the Sui ecosystem has attracted more capital, but there is a question lurking here, how and with what?

One recent reason might be the speculation about the upcoming Wormhole airdrop, which has driven the use of bridges and increased TVL across chains. Needless to say, once the airdrop snapshot is taken, this liquidity will not stay there, but the recent surge in TVL and how much it is related to the Wormhole speculation is still a mystery.

So, how about the DeFi ecosystem on Sui? Now, we see some major DeFi protocols offering liquidity re-staking (NAVI), lending (Scallop), DEX, and Perps (Cetus and BlueFin), building the core infrastructure of a growing ecosystem. Further deepening this idea, we can say that incentivizing DeFi protocols can be a way to attract users and liquidity; however, this must be done in sync with attracting developers who will build various dApps and protocols. It is also worth mentioning that BlueFin recently partnered with Elixir, a protocol aimed at increasing the liquidity of DEX order books. This led to a roughly 50% surge in BlueFin's TVL, from nearly $9 million to $13.1 million today. It is difficult to say whether this is the beginning of cross-chain integration or a single event of Elixir's influence diffusion, so it is worth closely monitoring further integrations that may occur in the Sui ecosystem in the near future.

In terms of attracting users and stirring emotions, there is another selling point that can be a trump card for Sui, the lack of ecosystem projects' tokens. If a crypto project can do a marketing trick, it is to use an upcoming airdrop as an incentive for using the project, and it is even better if the airdrop activity spreads across the entire ecosystem, which is entirely possible on Sui.

Most importantly, we have also seen the launch of Stardust, which brings wallet-as-a-service infrastructure aimed at attracting GameFi builders who will utilize all the features Sui provides. On top of this, we see an interesting collaboration between MystenLabs (the creator of Sui) and Team Liquid (one of the most well-known esports teams in Europe). In other words, Sui is trying to enter the GameFi world, but why are we seeing this shift?

It must be said that in the fiercely competitive parallel L1, each ecosystem must find its own niche market to attract users and TVL, rather than vying for the same overly generic audience. Solana seems to have found its selling point in the crypto culture through its NFTs and memecoins, while Sui seems not to replicate others' success stories but to continue forward, attempting to attract GameFi users, thanks to its object-oriented Move language and user experience, which is far better than what we see on StarkNet.

Facing the Future: Potential Issues

While all of this may sound overly positive and promising, we should not forget to consider all the risks involved and the upcoming unlocks that may affect the SUI token price.

As mentioned earlier, since hitting a bottom at $0.36 in October 2023, the price of SUI has been steadily rising and has almost doubled since the beginning of 2024, nearly reaching the $2 mark, but the narrative speed in the parallel ecosystem has slowed down. This indicates that there is indeed an opportunity to make money for those who are adventurous enough to explore the ecosystem and bet on their projects and meme coins, as a rising price is always a good incentive. However, the situation for Sui is not as straightforward.

The most prominent DeFi projects we mentioned earlier, such as BlueFin, Aftermath, or Scallop, apart from Cetus, do not have their own tokens, which may lead to airdrop speculation in the future. However, at the moment, it severely limits the attractiveness of the ecosystem, as there are no tokens worth speculating or investing in.

The most obvious example could be the meme coins on Solana, which have generated multiple small cycles with brief cooling-off periods in between. During these cooling-off periods, the broader market has time to turn to other trends, which are usually related to meme coins on different chains, and Sui has such a trend as well. The most anticipated meme coin on Sui, with the code $FUD, followed the then-popular trend of dog-themed coins. However, there was almost nothing to offer in terms of price action, as interest waned and liquidity quickly left after the initial surge.

What seemed to be a promising way to attract liquidity to the ecosystem turned out to be extremely short-lived, as the liquidity disappeared just a few hours after launch. Additionally, it is worth noting that the number of token buyers and sellers can be negligible, around 150 people for the top four meme coins. Needless to say, this interest is almost non-existent, as even on the waning Solana chain, we see thousands of market participants every day.

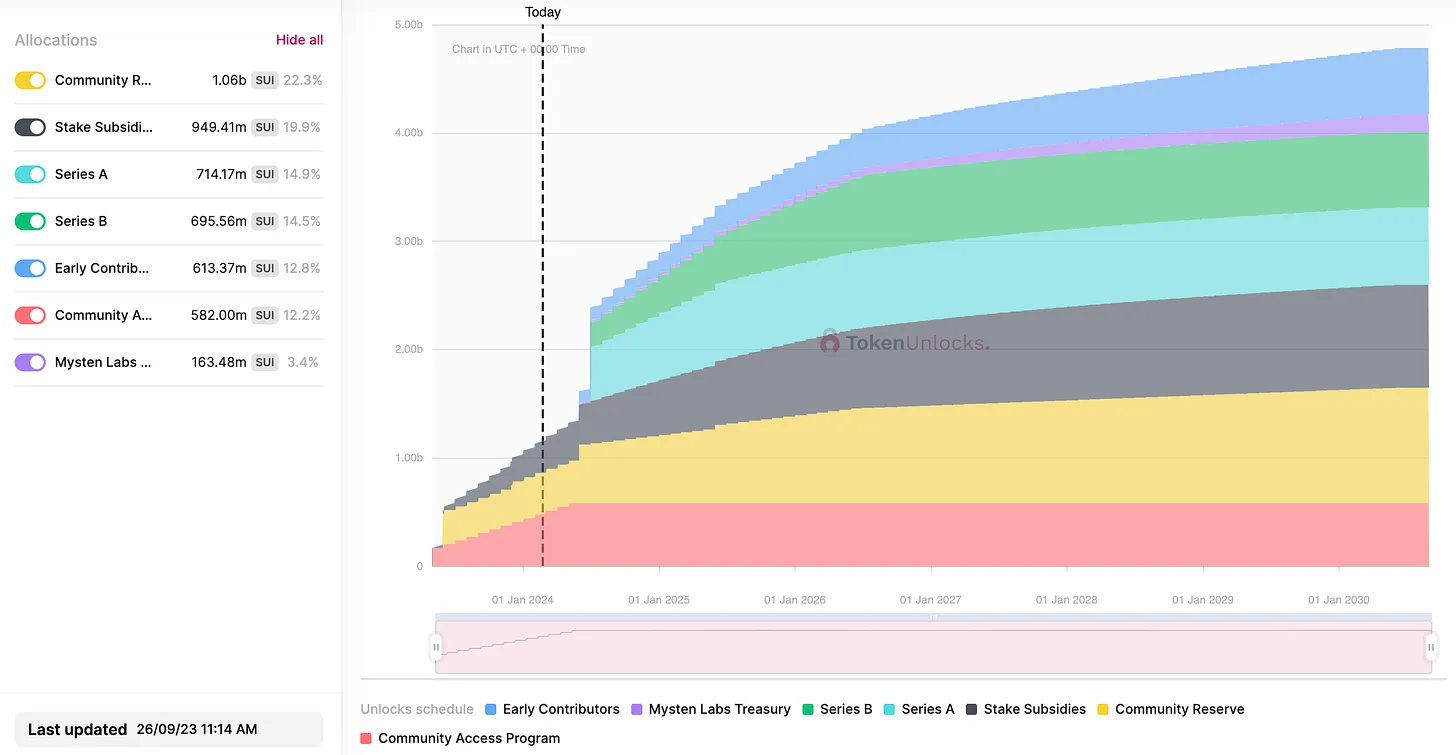

There is also something imminent in the ecosystem, and that is the unlocking schedule. The monthly unlock is set at 0.65% of the maximum supply, equivalent to approximately 5.5% of the current market value or $110 million. These are rough estimates, as the price of $SUI is fluctuating, and the percentage of market value and dollar value are also changing. While the monthly supply seems to have been absorbed by the market, the upcoming supply release in May could severely impact the price.

On May 3rd, the supply of Sui will increase by 8.27%, approximately $1.4 billion in USD, accounting for about 71% of the current market value. It is difficult to predict how the market will react to such a large-scale unlock. However, we may see the gradual establishment of a so-called "liquidity cushion," which will to some extent offset the released supply, as is often the case with $DYDX unlocks. On the other hand, considering the relatively low interest in the Sui ecosystem at the moment, it may be challenging to attract enough liquidity to build such a secure buffer, and the market will begin pricing in the unlock a few weeks before it occurs.

While predicting the future is impossible, observing the market and the ratio of SUI's trading volume to market value can tell the story of how the market is attempting to cope with the upcoming unlock.

Conclusion

The next few months and years may see explosive growth in blockchain adoption not only among mainstream users but also among Web2 brands, as we have already seen this trend emerge during the 2021 metaverse frenzy. With all this in mind, there is an urgent need for a fast and cheap blockchain that can accommodate millions of users exploring emerging frontiers and the numerous dApps that will follow.

Sui is not the only competitor in this niche market; there are also strong competitors like Solana, Aptos, Sei, and the upcoming Monad, all vying for market share. Additionally, we will see rapid development in the L2 ecosystem, which will provide similar functionalities and, combined with Ethereum's overall strength and network effects, may become solid competitors vying for market share in the same niche market as Sui.

The theme of the previous cycle was the war between alternative L1s. This time, we will see a similar scenario play out. However, what we will see is not the L1 ecosystems, but the battle between L1 sub-projects and single-layer chains, vying to become the preferred place for "mainstream-oriented" dApps.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。